Market Overview

The Global Proteomics Market size is expected to reach a value of USD 27.0 billion in 2024, and it is further anticipated to reach a market value of USD 92.8 billion by 2033 at a CAGR of 14.7%.

The global proteomics market is characterized by steady growth, fueled by technological advancements, a deepened understanding of complex biological processes, and an increasing emphasis on personalized medicine. Key factors influencing market size include robust research and development activities, substantial funding, and the widespread adoption of proteomics across diverse applications. Significant technological progress, particularly in

mass spectrometry, chromatography, and bioinformatics, has been vital in shaping the proteomics landscape, continually enhancing the capabilities and applications of these technologies. Proteomics finds applications across various sectors, such as clinical diagnostics, drug discovery, biomarker discovery, and personalized medicine. Its versatility contributes to widespread adoption in academic research, pharmaceuticals, biotechnology, and clinical laboratories.

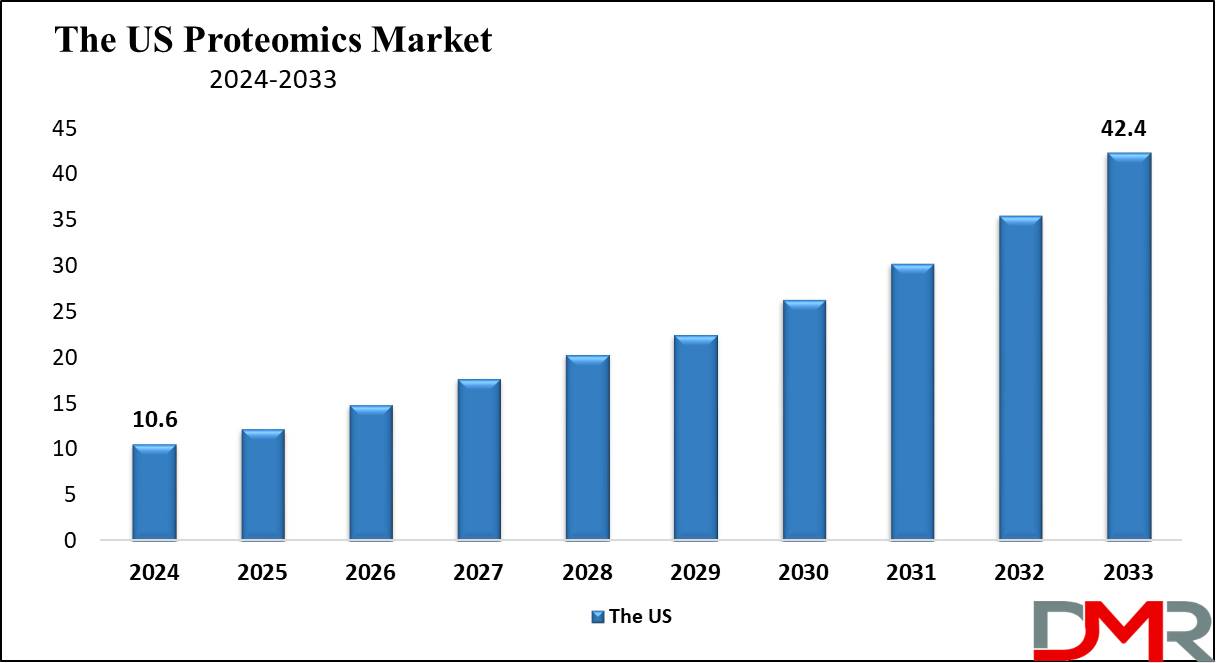

The US Proteomics Market

The US proteomics market focuses on identifying, characterizing, and understanding proteins and their activities. This area of proteomics has been receiving increasing attention because of the importance of diseases, new drug development, and even theragnostic.

The market size is expected to be valued at USD 10.7 billion in 2024, with a compound annual growth rate (CAGR) of 14.2% during the forecast period. The bulk of the global industry is being fueled by major players like Caprion Proteomics Inc. and many others by employing advanced technologies and undertaking research and development in proteomics.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

- In 2024, the US proteomics market had the highest market share captured by pharmaceutical and biotechnology industries by using proteomics in the manufacture of drugs and precision medicine. The market is likely to advance since proteomics investment is set to receive more private funding and nano proteomics technologies are integrated into the market.

- The major players in the global proteomics market were the US which possessed strong healthcare facilities high investment in terms of research and development and high capabilities to accept modern technologies in the field of proteomics.

Key Takeaways

- Market Size: The Global Proteomics Market size is expected to reach a value of USD 92.8 billion by 2033 from a base value of USD 27.0 billion in 2024 at a CAGR of 14.7%.

- By Product Segment Analysis: In the context of products, reagents, and consumables is expected to exert a vital and dominant role in the proteomics market as it holds 69.1% of the market share in 2024.

- By Technology Segment Analysis: Spectroscopy is projected to hold a prominent position among various technologies in the global proteomics market in 2024.

- By Application Segment Analysis: Based on application, clinical diagnostics is projected to dominate this segment as it holds 52.9% of the market share in 2024.

- Regional Analysis: North America is projected to hold a dominant position in the global proteomics market as it contains 47.3% of the market share in 2024.

Use Cases

- Drug Discovery and Development: Proteomics aids in identifying new drug objectives, understanding drug mechanisms, and optimizing drug efficacy and safety, enhancing pharmaceutical research and development processes.

- Disease Diagnosis: Proteomics is pivotal in discovering biomarkers for early ailment detection, enabling customized treatment plans and enhancing affected person outcomes in clinical settings.

- Agricultural Biotechnology: The study of plant proteins through proteomics helps in developing disease-resistant crops, enhancing crop yield and quality, and ensuring food security.

- Nutritional Research: Proteomics helps in analyzing the protein content and functionality in foods, leading to the development of fortified foods and supplements that cater to specific health needs.

Market Dynamic

Trends

Technological Advancements

It has been observed that the constant advancements in mass spectrometers, bioinformatics, and nano proteomics are fueling the market with better tools for protein analysis. These developments have made it possible to determine the numbers of proteins as well as others and as a result, analyze multiple interactions in various biological processes more effectively. For example, new techniques of mass spectrometry have demonstrated high sensitivity and have been faster than previous approaches; this, consequently, allows larger-scale proteomic data analysis. On the same note, the bioinformatics data analysis tools are enhanced and this enables for easy integration of data streams and improved analysis.

Integration with AI and Machine Learning

AI and machine learning are being incorporated into proteomics by improving data analysis and predictive models as well as intellectual and personalized medicine strategies. In proteomics, they are in a position to analyze huge data streams, find structures, and make conclusions that will be unlikely for an individual to come up with. For example, machine learning will detect biomarkers that could alert doctors of the diseases and the evolution of the disease and AI will help the doctors to map out the suitable treatment plan for a given patient according to their proteomic signature.

Growth Drivers

Rising Incidence of Chronic Diseases

Chronic diseases including cancer and diabetes have become more common, and this is giving rise to proteomics because understanding these diseases and designing proper therapies is more intimate. Proteomics also helps to find out the proteins or biomarkers relating to the diseases for the development of new diagnostic markers and treatments. For instance, proteomics is diligently used in cancer research to identify biomarkers for tumors and to deconstruct the processes behind tumor formation and progression. Thus, this knowledge is critical for the formulation of treatment approaches and enhancing the quality of patient care.

Increased Research Funding

Large funding from governments and other private companies in proteomics research and development avenues is boosting its growth by allowing further research to be undertaken. Current funding from governmental agencies, research foundations, and private investors is enabling the creation of new proteomic tools and performing extensive proteomic research. For example, such projects as the Human Proteome Project, which is also dedicated to the identification of the whole set of proteins in humans, are quite informative concerning human biology and diseases.

Growth Opportunities

Expansion in Emerging Markets

These indicate that the proteomics market size is expected to expand significantly in emerging markets by the reason of rising healthcare expenditure and enhanced infrastructure. There are many growing healthcare industries all over the world especially in the Asia-Pacific, Latin America, and the Middle East, because of increased healthcare costs and better medical infrastructure. These regions offer proteomics companies the potential to boost their companies’ market share and help meet the increasing global need for better diagnostic and therapeutic technologies.

Personalized Medicine

Increasing awareness of biomarkers is projected to fuel the market demand as proteomics offers key data for the biochemistry of specific proteins to design medical treatment according to a person’s needs. Custom care is the practice of administering treatment to a patient according to the patient’s genetic makeup, and this reduces side effects and increases the effectiveness of treatment. In this approach, proteomics proves vital in establishing protein biomarkers that are useful in prognosticating a patient’s reaction to particular treatments.

Restraints

High Costs

The proteomics instruments and technologies can be very expensive and this acts as a great hindrance as they are extremely expensive to obtain especially in developing countries and other places with little funding. Some of the techniques employed in newer proteomics technologies like mass spectrometers and bioinformatics tools are expensive, and thus not easily accessible to small-scale laboratories and regions in development. Second, other compliance costs are included in the operation and maintenance of these instruments, and also requirement of professional staff increases the costs.

Complex Data Analysis

Proteomics data analysis is rather complex, so the methods used to work with such data need to be highly developed and complex, which results in difficulties in data interpretation and integration with other types of biological information. Comprehensively, proteomics offers big and intricate data that require proper assessment to obtain valuable outputs. This process is quite complex and utilizes state-of-the-art bioinformatics tools and analysts who can manage and analyze the data. The absence of protocols, as well as the system’s incompatibility with other data platforms, through which proteomics technologies should be linked, hinders analysis and prevents the integration from becoming widespread.

Research Scope and Analysis

By Product

In the context of products, reagents, and consumables is expected to play a vital and dominant role in the proteomics market as it holds 69.1% of the market share in 2024 and is further projected to show subsequent growth in the upcoming period of 2024 to 2033. The market for reagents and consumables is rather important for daily laboratory research since it offers significant support in sample preparation, protein extraction, and purification of proteomics applications.

Since proteomic analysis employs various methods such as mass spectrometry, 2-D gel electrophoresis, and HPLC, the need for proteomic reagents differs according to the type of method used, owing to the extensive proteomics market. Subsequently, constant progress and enhanced technologies in proteomics heavily impact the generation of superior reagents, which determines the overall outcome of subsequent analyses.

In addition, the utilization of reagents and consumables are easily affordable, cost-efficient, and flexible hence are well adopted in both academic and small-scale research laboratories where efficiency plus costs are major key factors taken into consideration. This last section focused on standardization and quality control and their relevance to daily laboratory operations, the strategic importance of reagents and consumables only reemphasizes them as the fundamental backbone for successful proteomics and reliable outcomes across various applications.

By Technology

Spectroscopy is expected to hold a prominent position among various technologies in the proteomics market, and its dominance in this segment can be attributed to several key factors. Spectroscopy techniques, particularly mass spectrometry, offer high sensitivity and resolution in the analysis of proteins. The ability to detect and resolve complex protein mixtures with precision is crucial for identifying and characterizing proteins, making spectroscopy a preferred choice in proteomics research. Spectroscopy enables quantitative analysis of proteins, providing information about their abundance in a given sample.

This quantitative aspect is essential for understanding changes in protein expression levels under different conditions, such as in disease states or response to treatments. Spectroscopy techniques, including mass spectrometry, are versatile in protein identification. They allow researchers to analyze proteins in a wide range of sample types, from simple protein mixtures to complex biological samples like blood or tissues. This versatility contributes to the widespread application of spectroscopy in proteomics. Ongoing advancements in mass spectrometry, a key spectroscopy technique, have significantly improved its performance in terms of speed, sensitivity, and accuracy.

These improvements make mass spectrometry an increasingly powerful tool for proteomics research, contributing to its dominance in the field. Spectroscopy, especially techniques like nuclear magnetic resonance (NMR) spectroscopy, plays a vital role in protein structural analysis. Understanding the three-dimensional structure of proteins is essential for elucidating their functions and interactions, making spectroscopy indispensable in structural proteomics.

By Application

Based on application, clinical diagnostics is expected to dominate this segment as it holds 52.9% of the market share in 2024 and is expected to show subsequent growth in the forthcoming period of 2024 to 2033. During the forecast period, hospitals had the highest proportion of the proteomics market as they play a critical diagnostic and treatment point in the healthcare field. The increasing use of proteomics technologies in disease diagnostics, prognostics, and therapy suggesting a suitable treatment approach for the patients also fuels the market for hospitals.

Integration of proteomics in hospitals helps in the early diagnosis of a disease based on the arrival of biomarkers and helps improve patient results. Moreover, hospitals possess a rich patient population base, which makes them accredited for extensive proteomics funding and resources. Thus, proteomics gives prominence to precise medicine aiming at the molecular targeting of patients according to their protein level. Moreover, it is common practice for hospitals to partner with research institutions and the pharmaceutical industry by providing their facilities for clinical proteomics and translational research carried out in clinics. Altogether, all these aspects point to the fact that hospitals remain the key players in the proteomics market, thus underlining its function of moving healthcare forward with the help of proteomics.

By End User

In clinical diagnostics, it is suggested that proteomics plays a major role in the identification of disease biomarkers based on the ability of the field to analyze proteins in biological samples for diagnosing, predicting, as well as monitoring disease status. The emergence of the field of individualized medicine only emphasizes the significance of proteomics in making clinical decisions regarding applying certain treatments through genetic profiles.

In the diagnostics of cancer, enzymes of proteomics, especially mass spectrometry, increase the opportunities for precise tumor sample analysis and thus, the rates of appropriate cancer diagnosis. Understanding proteomics is helpful in the diagnosis of inflection diseases for individual proteins which are characteristics of the pathogens with a short time for detection of the infectious agents. The application of proteomics to neurological disorders adds knowledge through the biomarker’s identification of cerebrospinal fluid and brain tissue for early diagnosis and tracking of the disease.

Cardiac diagnostics are seen to allow for the identification of biomarkers that help in early diagnosis and accurate care strategies. Recent developments in mass spectrometry and bioinformatics improve proteomics functions, convert molecular discoveries into therapies, and obtain essential regulatory certifications.

The Proteomics Market Report is segmented on the basis of the following

By Product

- Reagents & Consumables

- Antibodies and Antigens

- Buffers and Solvents

- Enzymes

- Kits and Assays

- Instruments

- Mass Spectrometers

- Chromatography Systems

- Microarray Instruments

- Electrophoresis Systems

- Spectroscopy Instruments

- Services

- Protein Identification and Characterization

- Quantitative Proteomics

- Post-translational Modifications (PTMs) Analysis

- Bioinformatics Analysis

By Technology

- Spectroscopy

- Mass Spectrometry

- NMR Spectroscopy

- CD Spectroscopy

- Microarray Instruments

- X-Ray Crystallography

- Chromatography

- HPLC Chromatography

- Ion Chromatography

- Affinity Chromatography

- Superficial Chromatography

- Electrophoresis

- Gel Electrophoresis

- Capillary Electrophoresis

- Protein Fractionation Systems

- Surface Plasma Resonance System

By Application

- Clinical Diagnostics

- Biomarker Discovery and Validation

- Diagnostic Assays

- Personalized Medicine

- Drug Discovery

- Target Identification and Validation

- Lead Compound Screening

- Mechanism of Action Studies

- Toxicology Studies

- Other Application

By End User

- Hospitals

- Clinical Laboratories

- Pharmaceutical & Biotechnology Companies

- Academic Research Laboratories

- Other End Users

Regional Analysis

North America has been projected to hold a dominant position in the global proteomics market as it holds 47.3% of the market share in 2024 and is expected to show subsequent growth in the forthcoming period of 2024 to 2033.

This dominance can be attributed to a combination of key factors. The region, particularly the United States, serves as a major hub for life sciences and biotechnology research and development. The well-developed healthcare system in the region has encouraged the flow of proteomics technologies in clinical and research environments. Increased funding in proteomics research and development by public and private organizations are contributing factors to the growth and development of proteomics technology. Possible threats posed by large vendors and extensive market research and innovative products of the North American market leaders like Caprion Proteomics Inc. have put the region in a better position.

Further, there is a more pronounced rate of chronic diseases in North America and to address them, there is a requirement for better diagnostic and therapeutic techniques which again leads to an increase in demand for proteomics. The continued implementation of personalized medicine and precision healthcare in the region is in sync with the proteomics’ ability hence promoting the market. In addition, active industry gaps, and partnerships between academic as well as research organizations and firms in North America fuel proteomics research, thus boosting the market over the forecast period.

The presence of numerous academic institutions, research centers, and leading biotech companies is driving innovation and advancements in proteomics technologies. Notably, major industry players such as Thermo Fisher Scientific, Agilent Technologies, Waters Corporation, and Bio-Rad Laboratories are headquartered in North America, significantly contributing to the region's market influence. A robust funding environment, strong collaboration between academia and industry, an advanced healthcare infrastructure supporting the adoption of proteomics technologies, and early access to cutting-edge technologies further bolster North America's leadership in the field.

The region's regulatory support, exemplified by the United States Food and Drug Administration (FDA), provides a framework for the approval and adoption of proteomics-based diagnostics and therapeutics, attracting investment and fostering market growth. While North America remains a key player, it is essential to acknowledge the rising prominence of other regions, including Europe and Asia-Pacific, which are actively advancing in proteomics research. The global landscape is anticipated to evolve with widespread investments and developments in this field.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

To sum up one can state that current global proteomics market has a wide variety of companies ranging from large established proteomics companies and numerous new entrants committed to the further development of proteomic technologies. Agilent Technologies, Thermo Fisher Scientific, Waters Corporation, Bruker Corporation, PerkinElmer, and Bio-Rad Laboratories are some of the companies that significantly impact this field with various types of mass spectrometers and chromatography systems that analyze proteins.

Additionally, Danaher Corporation, through its subsidiary SCIEX, is recognized for mass spectrometry and analytical technologies in proteomics. In the realm of emerging and niche players, Biognosys, SomaLogic, Proteome Sciences, Evotec, and Newomics bring innovation to the market, specializing in mass spectrometry-based solutions, protein biomarker discovery, and microfluidic-based platforms for proteomics. The industry is marked by ongoing technological advancements and collaborative efforts between companies and research institutions to address challenges in protein analysis.

Some of the prominent players in the Global Proteomics Market are

- Thermo Fisher Scientific Inc.

- Alumna Incorporated

- Creative proteomics

- GE Healthcare

- Illumina Inc.

- Agilent Technologies Inc.

- Bio - Rad Laboratories Inc.

- GE Healthcare

- Bruker Corporation

- F. Hoffmann-La Roche Ltd.

- Promega Corp.

- Merck KGaA.

- Danahery

- Other Key Players

Recent Developments

- In June 2024, Caprion Proteomics Inc announced the launch of a new proteomics platform integrating AI for enhanced biomarker discovery and disease diagnostics.

- In May 2024, Thermo Fisher Scientific secured a USD 50 million investment in a public-private partnership aimed at advancing nano proteomics research and development.

- In April 2024, Merck & Co. and academic research laboratories established a major collaboration to accelerate proteomics-based drug discovery and development.

- In March 2024, Agilent Technologies introduced new advancements in mass spectrometry, providing more accurate and rapid protein analysis, boosting the market.

- In February 2024, A study by Pfizer highlighted the role of proteomics in understanding protein mechanisms in Alzheimer's disease, opening new avenues for treatment.

- In January 2024, Bruker Corporation introduced innovative bioinformatics tools designed to streamline data analysis and integration in proteomics research.

- In December 2023, Private funding for proteomics research reached a new high, with venture capital firms investing in start-ups focused on proteomics technologies, including those by Quantum-Si.

- In November 2023, Bio-Rad Laboratories announced a breakthrough in proteomics, revealing new biomarkers for early cancer detection, showcasing the potential of proteomics in clinical outcomes.

- In February 2023, Waters Corporation acquired Wyatt Technology, which improved the portfolio of separation and detection, which provides customers with an unmatched set of analytical solutions across a wide range of applications.

- In October 2022, Agilent Technologies Inc. and CMP Scientific Corporation entered into a co-marketing agreement to provide an integrated capillary electrophoresis-mass spectrometry solution for the life science and pharmaceutical industries.

- In August 2022, Bruker Corporation launched the new nanoElute 2 nano-LC, of MetaboScape and TASQ 2023 software supporting fluxomics, and of latest advances in PaSER intelligent acquisition to enhance research in protein-protein interactions (PPIs) and metaproteomics applications.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 27.0 Bn |

| Forecast Value (2033) |

USD 92.8 Bn |

| CAGR (2024-2033) |

14.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Reagents & Consumables, Instruments and Services), By Technology (Spectroscopy, Microarray Instruments, X-ray crystallography, Chromatography, Electrophoresis, Protein Fractionation Systems, and Surface Plasma Resonance System), By Application (Clinical Diagnostics, Drug Discovery, and Other Application), By End User (Hospitals, Clinical Laboratories, Pharmaceutical & Biotechnology Companies, Academic Research Laboratories, and Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Thermo Fisher Scientific Inc., Alumna Incorporated, Creative Proteomics, GE Healthcare, Illumina Inc., Agilent Technologies Inc., Bio-Rad Laboratories Inc., GE Healthcare, Bruker Corporation, F. Hoffmann-La Roche Ltd., Promega Corp., Merck KGaA., Danahery, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

How big is the Global Proteomics Market?

▾ The Global Proteomics Market size is estimated to have a value of USD 27.0 billion in 2024 and is

expected to reach USD 92.8 billion by the end of 2033.

Which region accounted for the largest Global Proteomics Market?

▾ North America is expected to be hold largest market share for the Global Proteomics Market with a

share of about 47.3% in 2024.

Who are the key players in the Global Proteomics Market?

▾ Some of the major key players in the Global Proteomics Market are Pix4D, NavVis, Intel Corp, and many

others.

What is the growth rate in the Global Proteomics Market?

▾ The market is growing at a CAGR of 14.7 percent over the forecasted period.