Market Overview

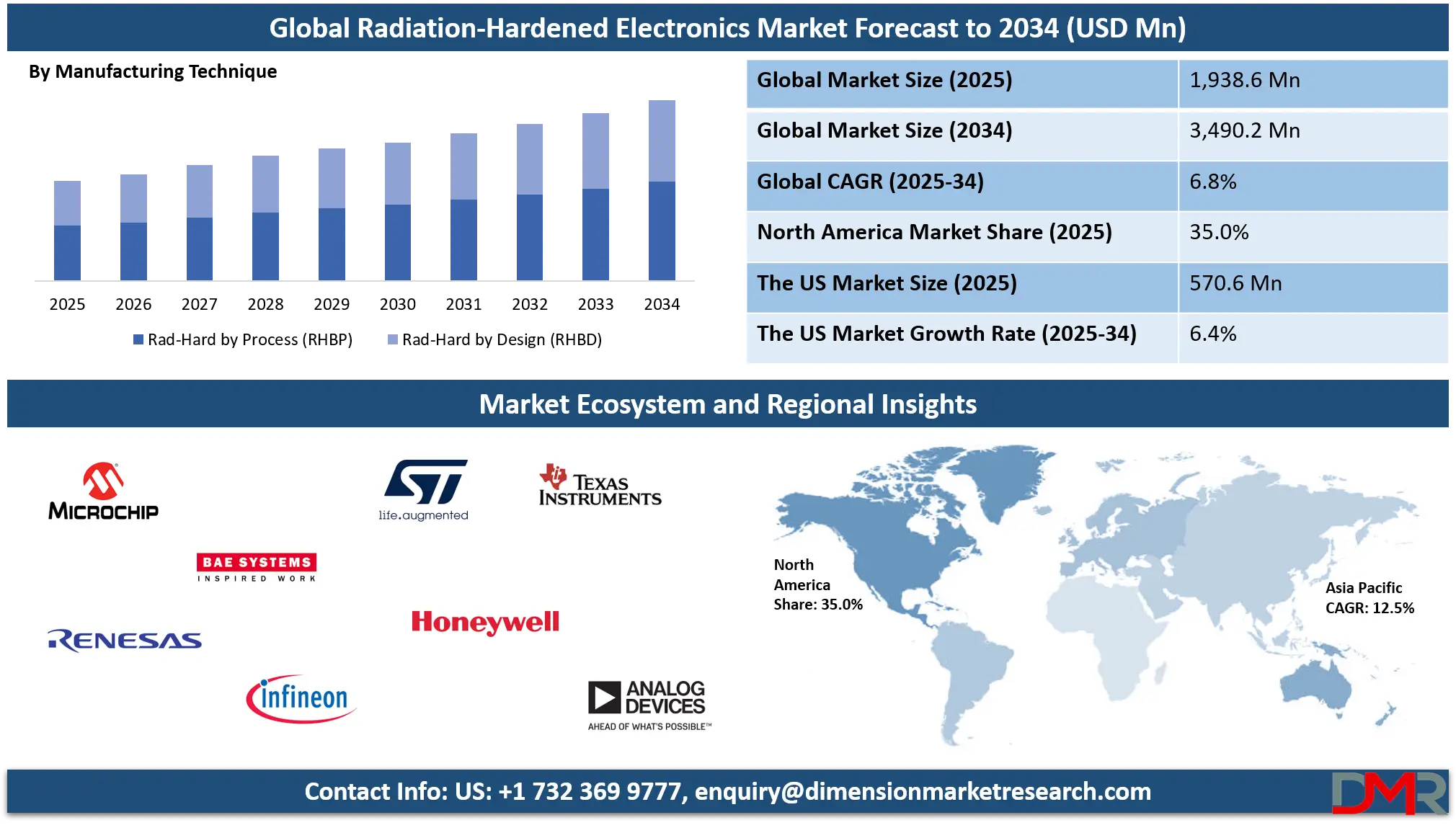

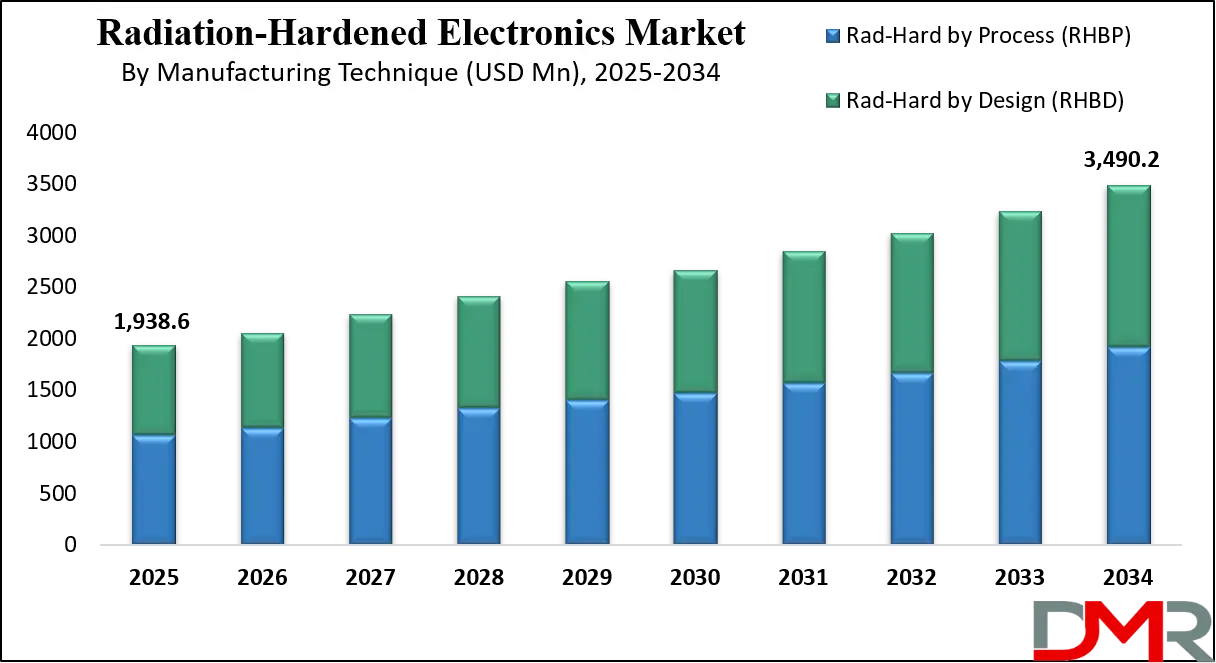

The global radiation-hardened electronics market is projected to reach USD 1,938.6 million in 2025 and is expected to grow to USD 3,490.2 million by 2034, registering a CAGR of 6.8%. This growth reflects rising demand for resilient semiconductors in satellites, aerospace and defense, nuclear energy, and medical imaging applications, supported by advancements in silicon carbide and gallium nitride technologies as well as growing adoption of commercial off the shelf solutions.

Radiation-hardened electronics are highly specialized electronic components engineered to endure intense radiation environments without performance degradation. Unlike conventional semiconductors that fail when exposed to cosmic rays, gamma rays, or energetic particles, these components incorporate robust design methodologies, shielding approaches, and material innovations that enable sustained reliability in hostile conditions.

By utilizing techniques such as radiation hardening by process and by design along with advanced semiconductor materials including silicon carbide and gallium nitride, these devices resist total ionizing dose accumulation, displacement damage, and single event effects. Their resilience makes them essential in satellites, defense systems, nuclear facilities, and medical equipment, where failure is not an option.

The global radiation-hardened electronics market is a dynamic sector that supports critical applications across space exploration, military modernization, nuclear power safety, and advanced healthcare technologies. It includes integrated circuits, memory modules, power devices, and programmable logic components designed to perform consistently in environments with high radiation exposure.

The growing number of low earth orbit satellite launches, defense communication upgrades, and nuclear plant automation is fueling demand for these reliable systems, while continuous innovation in materials science and manufacturing processes is expanding their capabilities.

This market is also shaped by strategic government investments, international space collaborations, and rising private sector participation in commercial satellite programs. As industries seek cost efficiency, there is an growing adoption of commercial off the shelf solutions enhanced for radiation tolerance alongside purpose built custom hardened devices for high assurance missions.

Regional markets such as North America and Europe dominate due to strong aerospace and defense sectors, while Asia Pacific is emerging rapidly with expanding space and nuclear energy projects. With advancing technologies and evolving mission requirements, the global landscape of radiation-hardened electronics is set for steady and transformative growth.

The US Radiation-Hardened Electronics Market

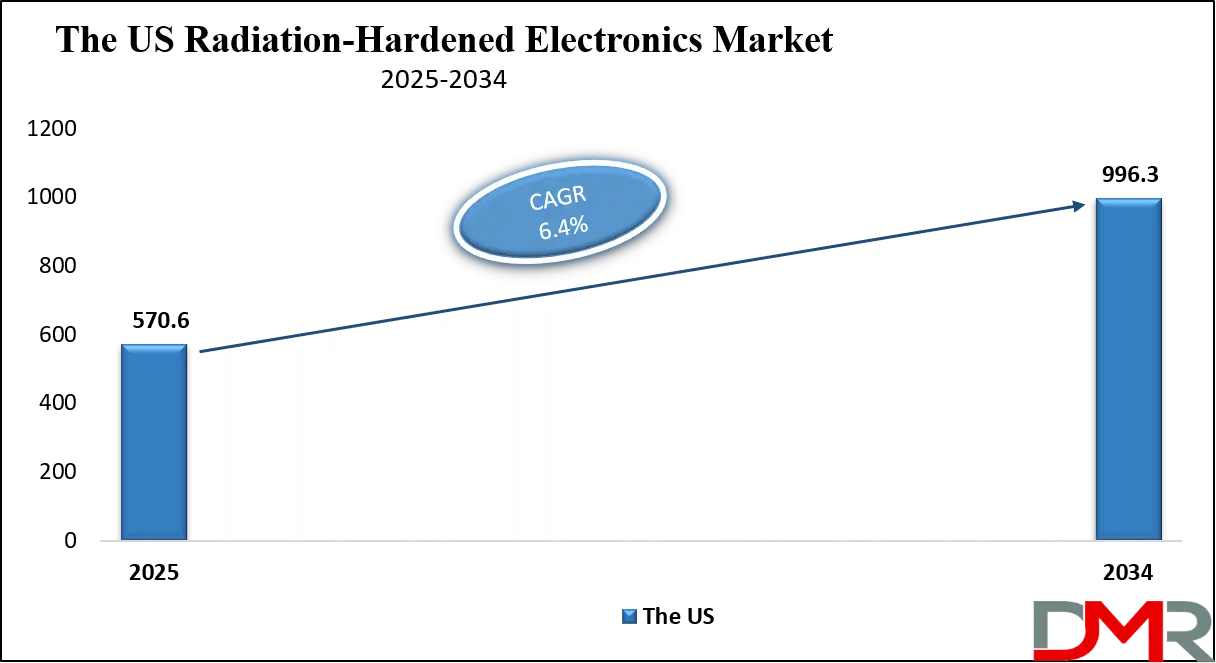

The U.S. radiation-hardened electronics market size is projected to be valued at USD 570.6 million by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 996.3 million in 2034 at a CAGR of 6.4%.

The United States radiation hardened electronics market plays a leading role in shaping global demand due to its strong presence in aerospace, defense, and space exploration programs. The country invests heavily in developing advanced semiconductors that can withstand extreme radiation environments encountered in low earth orbit, geostationary satellites, deep space missions, and nuclear facilities. With agencies such as NASA, the Department of Defense, and the Department of Energy driving procurement, U.S. manufacturers focus on producing integrated circuits, power management devices, memory chips, and field programmable gate arrays that deliver long term reliability under total ionizing dose and single event effects.

The presence of established industry leaders, robust R&D infrastructure, and strategic government funding ensures consistent innovation in process hardening, design hardening, and the use of advanced materials like silicon carbide and gallium nitride to meet mission critical requirements.

The U.S. market is further strengthened by collaborations between defense contractors, semiconductor companies, and space technology firms to develop cost effective yet highly reliable solutions. Rising deployment of satellite constellations for communication, surveillance, and navigation systems is accelerating the demand for radiation tolerant commercial off the shelf components, while national security initiatives continue to prioritize custom built fully qualified rad hard devices.

Additionally, growing investments in nuclear power modernization and the adoption of advanced diagnostic equipment in the medical sector contribute to expanding market opportunities. As private space enterprises increase launch activities and government programs emphasize resilience in electronic systems, the U.S. radiation hardened electronics market is expected to maintain its dominance with steady growth supported by innovation, policy backing, and a mature supply chain ecosystem.

Europe Radiation-Hardened Electronics Market

The Europe radiation-hardened electronics market is projected to reach USD 562.1 million in 2025, reflecting a steady growth trajectory driven by strong aerospace, defense, and space exploration initiatives in the region. Countries such as France, Germany, and the United Kingdom are heavily investing in satellite programs, defense modernization, and nuclear infrastructure upgrades, which are boosting demand for radiation-tolerant integrated circuits, memory devices, and power management components.

The presence of established semiconductor manufacturers and advanced research facilities further supports the development and deployment of resilient electronic systems capable of withstanding cosmic rays, solar radiation, and high-energy particle impacts in mission-critical applications. The market’s growth in Europe is also influenced by the adoption of commercial off-the-shelf radiation-hardened solutions, which reduce development costs and shorten project timelines for both government and private sector initiatives.

Additionally, ongoing innovation in semiconductor materials such as silicon carbide and gallium nitride is enhancing the performance and reliability of components used in satellites, defense electronics, and nuclear plants. With a projected CAGR of 4.1%, the European market is expected to maintain steady expansion, driven by growing collaboration between aerospace companies, defense contractors, and research institutions aiming to advance radiation-hardened technology and support long-term strategic applications.

Japan Radiation-Hardened Electronics Market

The radiation-hardened electronics market in Japan is projected to reach USD 66.9 million in 2025, reflecting steady growth driven by the country’s expanding space programs, defense modernization, and technological advancements in nuclear energy infrastructure. Japanese companies are increasingly investing in satellites, aerospace electronics, and mission-critical defense systems, which require highly reliable integrated circuits, memory modules, and power management devices capable of withstanding high levels of cosmic and ionizing radiation.

The presence of advanced semiconductor manufacturing facilities and ongoing research in materials like silicon carbide and gallium nitride further supports the development of resilient electronic components tailored to Japan’s high-precision aerospace and defense applications.

Japan’s market growth is also fueled by government initiatives to promote innovation in space exploration and defense technology, alongside rising adoption of commercial off-the-shelf radiation-hardened solutions for cost-effective deployment. With a projected CAGR of 4.5%, the market is expected to expand steadily as companies focus on enhancing the reliability and performance of rad-hard systems in satellites, defense platforms, and nuclear monitoring equipment. Strategic collaborations between semiconductor manufacturers, aerospace organizations, and research institutions are anticipated to drive innovation and strengthen Japan’s position in the global radiation-hardened electronics landscape.

Global Radiation-Hardened Electronics Market: Key Takeaways

- Market Value: The global radiation-hardened electronics market size is expected to reach a value of USD 3,490.2 million by 2034 from a base value of USD 1,938.6 million in 2025 at a CAGR of 6.8%.

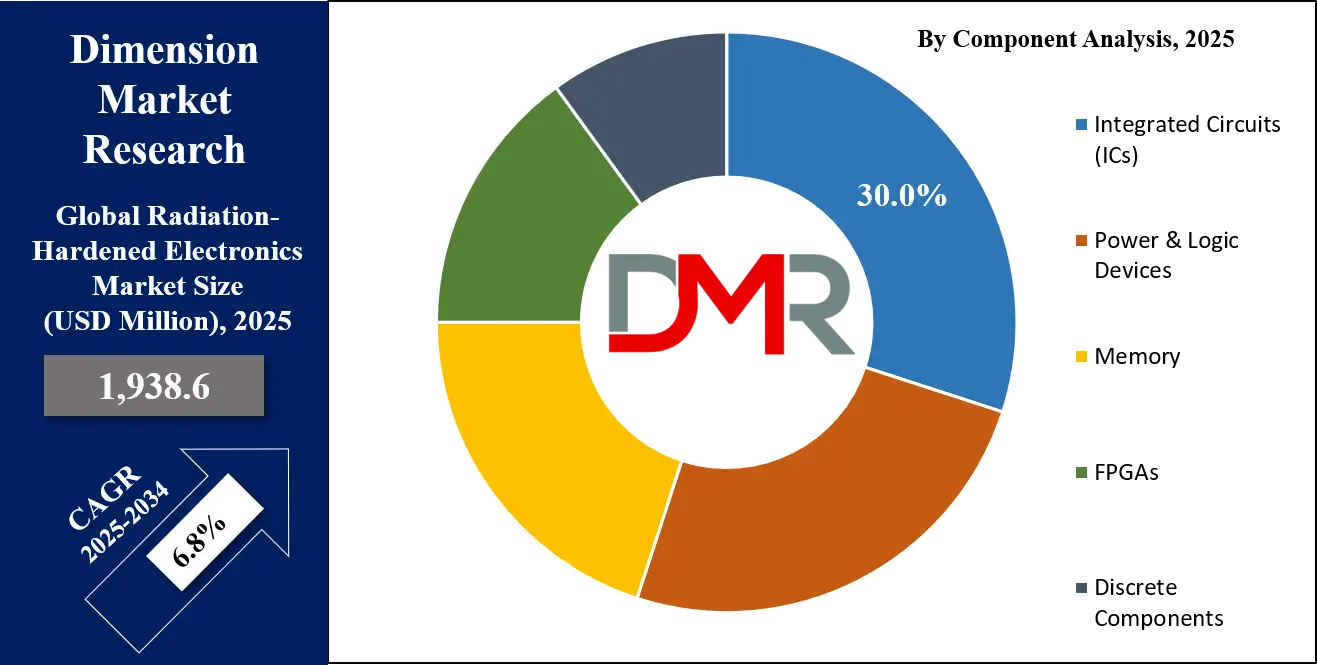

- By Component Segment Analysis: Integrated Circuits (ICs) are anticipated to dominate the component segment, capturing 30.0% of the total market share in 2025.

- By Manufacturing Technique Segment Analysis: Rad-Hard by Process (RHBP) is expected to maintain its dominance in the manufacturing technique segment, capturing 55.0% of the total market share in 2025.

- By Semiconductor Material Segment Analysis: Silicon (Si) will dominate the semiconductor material segment, capturing 60.0% of the market share in 2025.

- By Radiation Level Segment Analysis: TID (Total Ionizing Dose) will account for the maximum share in the radiation level segment, capturing 65.0% of the total market value.

- By Application Segment Analysis: Space applications will dominate the application segment, capturing 51.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global radiation-hardened electronics market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global radiation-hardened electronics market include Microchip Technology Inc., BAE Systems Plc, Renesas Electronics Corporation, Infineon Technologies AG, STMicroelectronics, Honeywell International Inc., Texas Instruments Incorporated, Analog Devices Inc., Xilinx Inc. (AMD), Teledyne Technologies Inc., and Others.

Global Radiation-Hardened Electronics Market: Use Cases

- Satellite Communication and Navigation Systems: Radiation hardened electronics ensure reliable performance of satellites in low earth and geostationary orbits where cosmic rays and solar flares can damage conventional semiconductors. Rad hard ICs, memory, and power devices support GPS, broadband constellations, and Earth observation satellites. Growing adoption of silicon carbide and gallium nitride materials is extending mission life and lowering costs in global satellite programs.

- Defense and Military Avionics: Military aircraft, UAVs, and defense communication systems depend on rad hard microprocessors, FPGAs, and analog devices to withstand high altitude radiation and single event effects. These components enable secure radar, electronic warfare, and command systems. With rising defense modernization, custom built fully qualified rad hard devices remain a priority for mission critical aerospace and defense applications.

- Nuclear Power Plant Control and Safety Systems: In nuclear energy, radiation hardened sensors, ICs, and power devices protect reactor monitoring and safety systems from ionizing radiation. They deliver stable performance, reduce downtime, and enhance plant safety compliance. As nuclear infrastructure is upgraded globally, the demand for radiation tolerant electronics in control and safety instrumentation continues to expand.

- Medical Imaging and Radiation Therapy Equipment: Medical imaging systems such as CT and MRI scanners, along with radiation therapy equipment, integrate rad hard components to maintain accuracy and patient safety in radiation heavy environments. Memory chips, controllers, and sensors designed for radiation tolerance improve reliability in life saving diagnostic and treatment devices. Growing healthcare demand is boosting adoption of these resilient technologies.

Impact of Artificial Intelligence on Radiation-Hardened Electronics Market

Artificial intelligence is reshaping the radiation hardened electronics market by enabling smarter design, testing, and deployment of resilient components for space, defense, and nuclear applications. AI powered simulation tools allow engineers to model single event effects and total ionizing dose impacts with greater accuracy, reducing development cycles and cost. In satellite constellations and deep space missions, AI integrated with rad hard processors enhances autonomous navigation, fault detection, and predictive maintenance.

Moreover, AI driven analytics improve yield in semiconductor fabrication of radiation tolerant ICs, microcontrollers, and FPGAs, accelerating innovation and supporting mission critical reliability across aerospace, military, and healthcare sectors.

Global Radiation-Hardened Electronics Market: Stats & Facts

U.S. Department of Defense (DoD) & NASA

- The U.S. Department of Defense allocated over USD 1.5 billion in 2023 for the development and procurement of radiation-hardened electronics for military satellite systems.

- NASA's Artemis program has earmarked approximately USD 200 million for radiation-hardened components to ensure the longevity and reliability of lunar exploration missions.

- NASA's Jet Propulsion Laboratory (JPL) reported that over 70% of its spaceborne electronics are radiation-hardened to withstand the harsh environments of deep space.

- The U.S. Air Force's Space and Missile Systems Center has identified radiation-hardened microelectronics as a critical technology area, with ongoing investments exceeding USD 300 million annually.

European Space Agency (ESA) & European Commission

- The European Space Agency (ESA) has funded over €150 million in radiation-hardened electronics research through its Advanced Research in Telecommunications Systems (ARTES) program since 2018.

- The European Commission's Horizon 2020 program allocated €50 million in 2020 for the development of radiation-hardened components for space applications.

- ESA's Cosmic Vision program includes a dedicated work package on radiation-hardened electronics, with a budget of €30 million over five years.

- The European Space Agency has partnered with over 20 European universities and research institutions to advance radiation-hardened semiconductor technologies.

Japan Aerospace Exploration Agency (JAXA) & Japanese Government

- JAXA's Hayabusa2 mission utilized over 50 radiation-hardened components to ensure the spacecraft's functionality during its seven-year journey to the asteroid Ryugu.

- The Japanese government has committed ¥10 billion (approximately USD 90 million) in 2022 for the development of radiation-hardened electronics for future lunar and Mars missions.

- JAXA's collaboration with the Japan Atomic Energy Agency (JAEA) focuses on developing radiation-hardened electronics for both space and nuclear applications.

- The Japanese Ministry of Defense has initiated a project to develop radiation-hardened electronics for military satellites, with an estimated budget of ¥5 billion (approximately USD 45 million).

Global Radiation-Hardened Electronics Market: Market Dynamics

Global Radiation-Hardened Electronics Market: Driving Factors

Expansion of Satellite and Space Missions

The rising number of satellite launches for communication, navigation, and earth observation is significantly driving the demand for radiation hardened electronics. With private space companies and government agencies investing heavily in satellite constellations, there is a growing requirement for robust semiconductors, memory chips, and processors that can withstand solar radiation, cosmic rays, and harsh orbital conditions. These components ensure reliable performance of spacecraft systems, from power management to onboard computing, making them critical in modern space exploration and defense-grade satellite infrastructure.

Advancements in Semiconductor Materials

The development of wide bandgap materials such as silicon carbide and gallium nitride has become a major growth driver in the radiation hardened electronics industry. These advanced semiconductors offer superior efficiency, higher thermal stability, and greater resistance to radiation effects compared to traditional silicon-based devices. Their integration into power management systems, microcontrollers, and integrated circuits enhances resilience in aerospace and defense electronics, nuclear facilities, and medical imaging equipment, enabling long-term reliability and reducing maintenance costs.

Global Radiation-Hardened Electronics Market: Restraints

High Development and Testing Costs

The production of radiation tolerant integrated circuits, FPGAs, and memory devices involves complex design processes, expensive materials, and extensive radiation testing, which increases overall manufacturing costs. These high costs pose a challenge for small and medium enterprises seeking to enter the market and restrict wider adoption in cost-sensitive industries. Additionally, stringent qualification standards for aerospace and defense applications further slowdown product commercialization.

Limited Availability of Skilled Expertise

Designing and manufacturing rad-hard electronics requires specialized expertise in radiation physics, semiconductor design, and aerospace-grade certification. The shortage of trained engineers and R&D specialists with deep knowledge in this niche domain hampers large-scale production and innovation. This skill gap limits the speed at which new radiation resistant components can be introduced, creating dependency on a small pool of global suppliers.

Global Radiation-Hardened Electronics Market: Opportunities

Rising Demand in Nuclear Energy and Defense Sectors

Growing investments in nuclear energy infrastructure and modernization of defense equipment present a strong opportunity for the radiation hardened electronics market. Nuclear reactors require highly reliable rad-hard systems for monitoring, control, and safety applications, while military systems such as radar, missile guidance, and secure communication networks depend on robust electronics to ensure mission-critical performance in radiation-prone environments. This dual demand expands the scope of rad-hard technologies beyond aerospace and space industries.

Integration of AI and Edge Computing

The integration of artificial intelligence and edge computing in radiation hardened systems offers a transformative opportunity. Rad-hard processors combined with AI algorithms can support autonomous spacecraft operations, predictive maintenance in defense systems, and real-time decision-making in nuclear plants. This convergence improves operational efficiency, reduces reliance on ground control, and opens new avenues for innovation in satellite communications, medical diagnostics, and industrial automation.

Global Radiation-Hardened Electronics Market: Trends

Adoption of COTS-Based Rad-Hard Components

A growing trend in the industry is the use of commercial off-the-shelf (COTS) electronics modified for radiation tolerance. This approach reduces costs and shortens development timelines compared to fully custom rad-hard solutions. With advancements in shielding technologies and design techniques, COTS-based solutions are increasingly being deployed in low-earth orbit satellites, unmanned aerial vehicles, and industrial control systems, making radiation resistant electronics more accessible across industries.

Miniaturization and System-on-Chip Integration

The push towards miniaturized, high-performance electronics is shaping the radiation hardened market, with growing adoption of system-on-chip (SoC) architectures. These integrated designs combine processing, memory, and power management into compact, resilient devices suitable for small satellites, drones, and portable defense electronics. The trend supports higher computing power in smaller footprints, enhancing efficiency while maintaining durability in radiation-heavy environments.

Global Radiation-Hardened Electronics Market: Research Scope and Analysis

By Component Analysis

In the component segment of the radiation hardened electronics market, integrated circuits (ICs) are projected to dominate with a 30.0% market share in 2025. Their leadership stems from their indispensable role in processing, memory control, and signal management within mission-critical applications such as satellites, military spacecraft, and nuclear monitoring systems.

ICs designed with radiation tolerant features are capable of withstanding total ionizing dose effects and single event upsets, ensuring system reliability in high-radiation zones like outer space and defense battlefields. The growing demand for miniaturized, high-performance electronics in satellite constellations and advanced defense systems further cements the importance of ICs, as they provide the performance and resilience necessary for extended operations in harsh conditions.

On the other hand, power and linear devices also hold significant importance in this market by delivering reliable energy regulation and efficient power management across systems exposed to radiation. These components are vital in stabilizing voltage levels, protecting against sudden surges, and ensuring the smooth functioning of spacecraft subsystems, nuclear control frameworks, and advanced radar systems. With the growing complexity of aerospace and defense missions, power and linear devices enable consistent performance and extend the lifespan of sensitive equipment.

Their role in safeguarding system integrity under extreme radiation makes them an indispensable part of the radiation hardened electronics ecosystem, complementing the dominance of integrated circuits.

By Manufacturing Technique Analysis

In the manufacturing technique segment, Rad-Hard by Process (RHBP) is expected to lead with 55.0% of the total market share in 2025, reflecting its widespread adoption in aerospace, defense, and satellite applications. This approach involves modifying the semiconductor manufacturing process itself, such as using specialized materials, insulating substrates, and hardened fabrication techniques, to enhance resistance against radiation effects.

RHBP components are widely preferred in space programs and nuclear facilities where long-term reliability is essential, as they offer higher durability and can endure extreme levels of total ionizing dose and single event effects. Their dominance is further strengthened by their proven track record in mission-critical systems where performance failures are unacceptable.

Rad-Hard by Design (RHBD) also plays a crucial role in this market by focusing on circuit-level innovations rather than material-level modifications. RHBD uses design strategies such as error correction codes, redundancy techniques, and fault-tolerant architectures to improve resilience against radiation without heavily relying on costly process alterations.

This method is gaining popularity in low-earth orbit satellites and defense electronics where cost-efficiency, flexibility, and faster development cycles are key requirements. By integrating intelligent design practices, RHBD provides a balance of performance and affordability, making it an attractive option for industries seeking radiation tolerance without the high expenses associated with specialized fabrication processes.

By Semiconductor Material Analysis

In the semiconductor material segment, silicon is projected to dominate with 60.0% of the market share in 2025, owing to its wide availability, established fabrication infrastructure, and proven reliability in radiation hardened applications. Silicon-based components are extensively used in satellites, defense electronics, and nuclear systems because they offer a cost-effective balance of performance, scalability, and radiation resistance.

The maturity of silicon manufacturing processes also ensures consistent quality and large-scale production, making it the preferred choice for integrated circuits, memory devices, and power management components deployed in mission-critical environments. Its dominance is further supported by continuous enhancements in silicon processing that extend its resilience to radiation exposure.

Gallium nitride, on the other hand, is emerging as a highly promising material in the radiation hardened electronics market due to its superior electrical properties and wide bandgap characteristics. GaN devices offer higher power efficiency, faster switching speeds, and greater thermal stability compared to traditional silicon-based systems, making them especially valuable in advanced radar systems, high-frequency communication satellites, and aerospace defense platforms.

Their inherent ability to withstand harsh environments and extreme radiation conditions positions them as a key enabler of next-generation applications. Although GaN currently represents a smaller share of the market, its growing adoption in high-performance and power-intensive applications highlights its potential to reshape the future of rad-hard semiconductor technologies.

By Radiation Level Analysis

In the radiation level segment, Total Ionizing Dose (TID) is expected to account for the largest share at 65.0% of the total market value, reflecting its critical importance in assessing long-term exposure effects on electronic components. TID measures the cumulative radiation absorbed by semiconductors over time, which can degrade performance, alter electrical characteristics, and potentially cause permanent failures in integrated circuits, memory devices, and power management systems.

This makes TID-hardened electronics essential for satellites, deep space missions, nuclear reactors, and defense systems where prolonged radiation exposure is unavoidable. Manufacturers focus on designing and testing components to withstand high TID levels to ensure mission-critical reliability and longevity in harsh operational environments.

Single Event Effects (SEE), on the other hand, address the impact of individual high-energy particles striking sensitive regions of semiconductor devices, which can cause transient disruptions, bit flips, or system crashes. SEE-hardened components are particularly important in applications such as aerospace avionics, defense communication networks, and high-altitude satellites, where exposure to cosmic rays and energetic particles is frequent.

Techniques like redundancy, error correction codes, and radiation-tolerant circuit design are employed to mitigate SEE, ensuring stable system operation even under sporadic but potentially disruptive radiation events. Together with TID protection, SEE mitigation forms a comprehensive approach to maintaining the integrity and reliability of radiation hardened electronics.

By Application Analysis

In the application segment, space is projected to dominate with 51.0% of the market share in 2025, driven by the surge in satellite launches, deep space exploration missions, and growing demand for satellite constellations supporting communication, navigation, and earth observation. Radiation hardened electronics are critical for spacecraft as they ensure reliable operation in environments with high levels of cosmic radiation and solar particle events.

These components safeguard onboard systems such as navigation controls, communication modules, and power management circuits, enabling satellites and space probes to function effectively over extended lifespans. The expansion of commercial space activities alongside government-led exploration initiatives further fuels the reliance on radiation tolerant integrated circuits, memory devices, and power components.

Aerospace and defense also represent a significant segment of the radiation hardened electronics market, with applications ranging from avionics and radar systems to missile guidance and secure communication platforms. Military systems are often deployed in radiation-prone environments where electronic reliability is crucial to mission success and safety.

Radiation hardened semiconductors in these systems ensure consistent performance under nuclear conditions, electromagnetic interference, and other hostile operational scenarios. In modern defense strategies, these components are integral to enhancing survivability, maintaining secure communications, and supporting advanced tactical capabilities, which underscores their vital role alongside the dominant space applications.

The Radiation-Hardened Electronics Market Report is segmented on the basis of the following:

By Component

- Integrated Circuits (ICs)

- Power & License Devices

- Memory

- FPGAs

- Discrete Components

By Manufacturing Technique

- Rad-Hard by Process (RHBP)

- Rad-Hard by Design (RHBD)

By Semiconductor Material

- Silicon

- Gallium Nitride (GaN)

- Silicon Carbide (SiC)

By Radiation Level

- TID (Total Ionizing Dose)

- SEE (Single Event Effects)

By Application

- Space

- Aerospace & Defense

- Nuclear Plants

- Medical

- Industrial

Global Radiation-Hardened Electronics Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global radiation-hardened electronics market with a 35.0% share of total revenue in 2025, driven by strong aerospace, defense, and space exploration activities in the region. The presence of major government agencies, defense contractors, and private space enterprises fuels demand for radiation tolerant integrated circuits, memory devices, power management systems, and field programmable gate arrays.

Investments in satellite constellations, deep space missions, military avionics, and nuclear infrastructure further support market growth, while advanced research facilities and a mature semiconductor industry ensure continuous innovation in silicon, silicon carbide, and gallium nitride technologies for mission-critical applications.

Region with significant growth

The Asia-Pacific region is witnessing significant growth in the radiation-hardened electronics market, driven by expanding space programs, defense modernization, and growing investments in nuclear energy infrastructure. Countries such as China, Japan, South Korea, and India are accelerating satellite launches, developing advanced military electronics, and upgrading critical nuclear systems, which fuels demand for radiation tolerant semiconductors, integrated circuits, memory devices, and power management components.

Additionally, rising adoption of commercial off-the-shelf rad-hard solutions, intergated with government support for aerospace and defense technology initiatives, is creating new opportunities for manufacturers and accelerating regional market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Radiation-Hardened Electronics Market: Competitive Landscape

The global radiation-hardened electronics market is characterized by a competitive landscape featuring several prominent players. Companies such as Microchip Technology Inc., BAE Systems, Renesas Electronics Corporation, Infineon Technologies AG, STMicroelectronics, Honeywell International Inc., Texas Instruments Incorporated, Analog Devices, Inc., Xilinx, Inc. (AMD), Teledyne Technologies Inc., TTM Technologies, Inc., Cobham Advanced Electronic Solutions, Data Device Corporation (DDC), Micropac Industries Inc., Vorago Technologies, Maxwell Technologies, Inc., Mercury Systems, Inc., CAES Systems, Microelectronics Research & Development Corporation, and GSI Technology, Inc. are actively involved in the development and production of radiation-hardened components.

These companies manufacture a wide range of products including integrated circuits, power management devices, memory modules, and field-programmable gate arrays, catering to aerospace, defense, nuclear energy, and space exploration applications. Their ongoing research and development efforts focus on improving performance, reliability, and cost-effectiveness to meet the stringent requirements of high-radiation environments.

Some of the prominent players in the global radiation-hardened electronics market are:

- Microchip Technology Inc.

- BAE Systems Plc

- Renesas Electronics Corporation

- Infineon Technologies AG

- STMicroelectronics

- Honeywell International Inc.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Xilinx, Inc. (AMD)

- Teledyne Technologies Inc.

- TTM Technologies, Inc.

- Cobham Advanced Electronic Solutions

- Data Device Corporation (DDC)

- Micropac Industries Inc.

- Vorago Technologies

- Maxwell Technologies, Inc.

- Mercury Systems, Inc.

- CAES Systems / CAES

- Microelectronics Research & Development Corporation

- GSI Technology, Inc.

- Other Key Players

Global Radiation-Hardened Electronics Market: Recent Developments

- May 2025: Infineon Technologies launched new radiation-hardened GaN transistors, including one of the first DLA JANS certified GaN devices, enhancing performance and reliability in space applications.

- April 2025: Magics secured €5.7 million in funding to accelerate the development of radiation-hardened integrated circuits (ICs) and expand its commercial footprint in both the space and nuclear sectors.

- January 2024: Mercury Systems introduced the first-ever DDR4 memory device qualified for space applications, marking a significant milestone in radiation-hardened memory technology.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,938.6 Mn |

| Forecast Value (2034) |

USD 3,490.2 Mn |

| CAGR (2025–2034) |

6.8% |

| The US Market Size (2025) |

USD 570.6 Mn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Integrated Circuits, Power & License Devices, Memory, FPGAs, Discrete Components), By Manufacturing Technique (Rad-Hard by Process, Rad-Hard by Design), By Semiconductor Material (Silicon, Gallium Nitride, Silicon Carbide), By Radiation Level (TID, SEE), and By Application (Space, Aerospace & Defense, Nuclear Plants, Medical, Industrial) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microchip Technology Inc., BAE Systems Plc, Renesas Electronics Corporation, Infineon Technologies AG, STMicroelectronics, Honeywell International Inc., Texas Instruments Incorporated, Analog Devices Inc., Xilinx Inc. (AMD), Teledyne Technologies Inc., and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global radiation-hardened electronics market size is estimated to have a value of USD 1,938.6 million in 2025 and is expected to reach USD 3,490.2 million by the end of 2034.

The US radiation-hardened electronics market is projected to be valued at USD 570.6 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 996.3 million in 2034 at a CAGR of 6.4%.

North America is expected to have the largest market share in the global radiation-hardened electronics market, with a share of about 35.0% in 2025.

Some of the major key players in the global radiation-hardened electronics market are Microchip Technology Inc., BAE Systems Plc, Renesas Electronics Corporation, Infineon Technologies AG, STMicroelectronics, Honeywell International Inc., Texas Instruments Incorporated, Analog Devices Inc., Xilinx Inc. (AMD), Teledyne Technologies Inc., and Others.

The market is growing at a CAGR of 6.8 percent over the forecasted period.