Market Overview

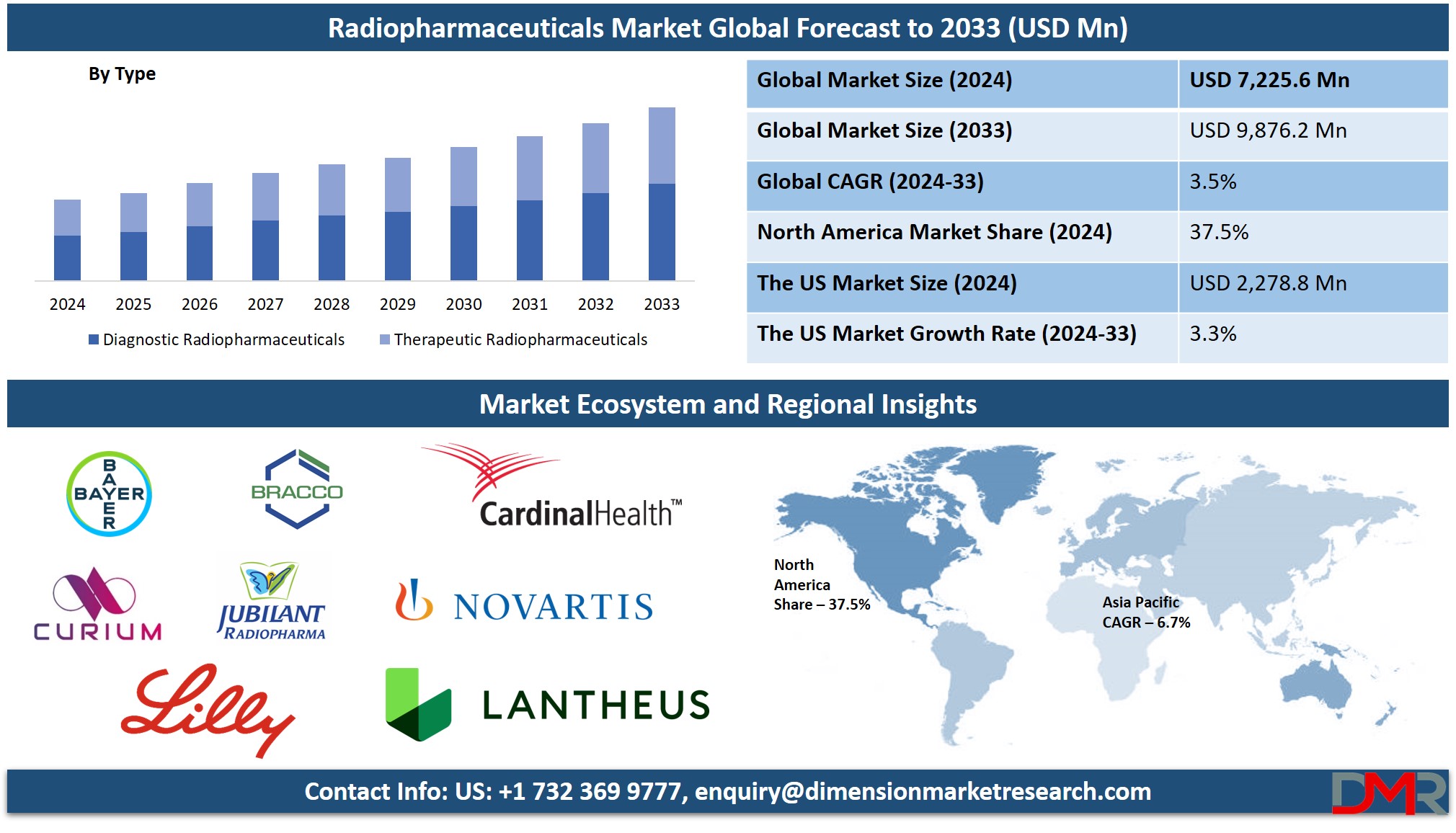

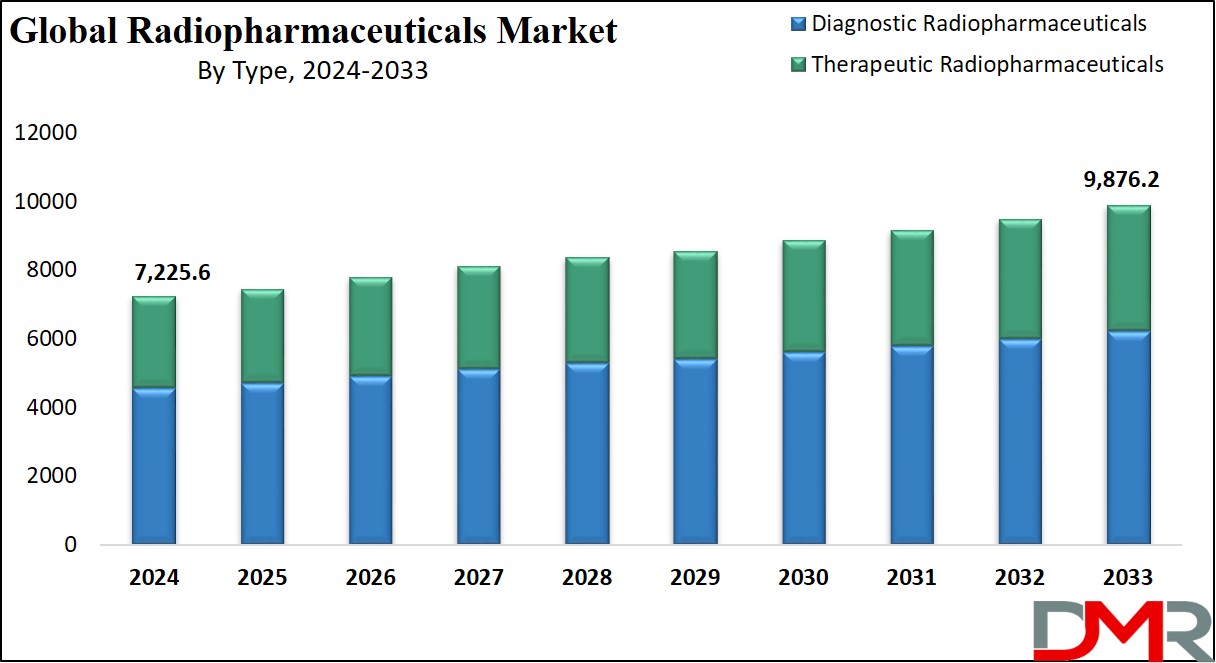

The Global

Radiopharmaceuticals Market size is expected to reach a

value of USD 7,225.6 million in 2024, and it is further anticipated to reach a market

value of USD 9,876.2 million by 2033 at a

CAGR of 3.5%.

The radiopharmaceuticals market is growing dramatically due to increased demand for nuclear medicines for diagnosis and treatment of diseases, particularly cancer and cardiovascular diseases. Radiopharmaceuticals are the radioactive compounds applicable in both diagnostics and treatment and have a vital role in non-invasive medical imaging. Major isotopes such as Technetium-99m, Fluorine-18, and Iodine-131 are extensively employed in the diagnosis of heart disease, cancer, and neurological disorders.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Also, among the therapeutic radiopharmaceuticals, Lutetium-177 is highly used in the treatment of tumors targeted mainly at cancers of the prostate and neuroendocrine tumors. Driving factors for the market size of radiopharmaceuticals include the prevalence of chronic diseases, advanced technologies in the manufacture of radiopharmaceuticals, and a rise in nuclear medicine procedures across different regions of the world.

Moreover, R&D activities are continuously being carried out to develop new radioisotopes with better-directed therapies that could act as boosting factors for this market. The market further has grown on the grounds of a growing focus on personalized medicine with theranostics, which is the combination of diagnostic and therapeutic applications, thereby extending the use of radiopharmaceuticals in precision healthcare.

The strong healthcare infrastructure, high prevalence of chronic diseases, and key players presently keep North America at the top with the highest share in this market. Overall, increasing demand for diagnosis and treatment, a higher incidence of various chronic diseases, and the improvement of technology in radiopharmaceuticals all create strong stimuli to develop this market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Radiopharmaceuticals Market

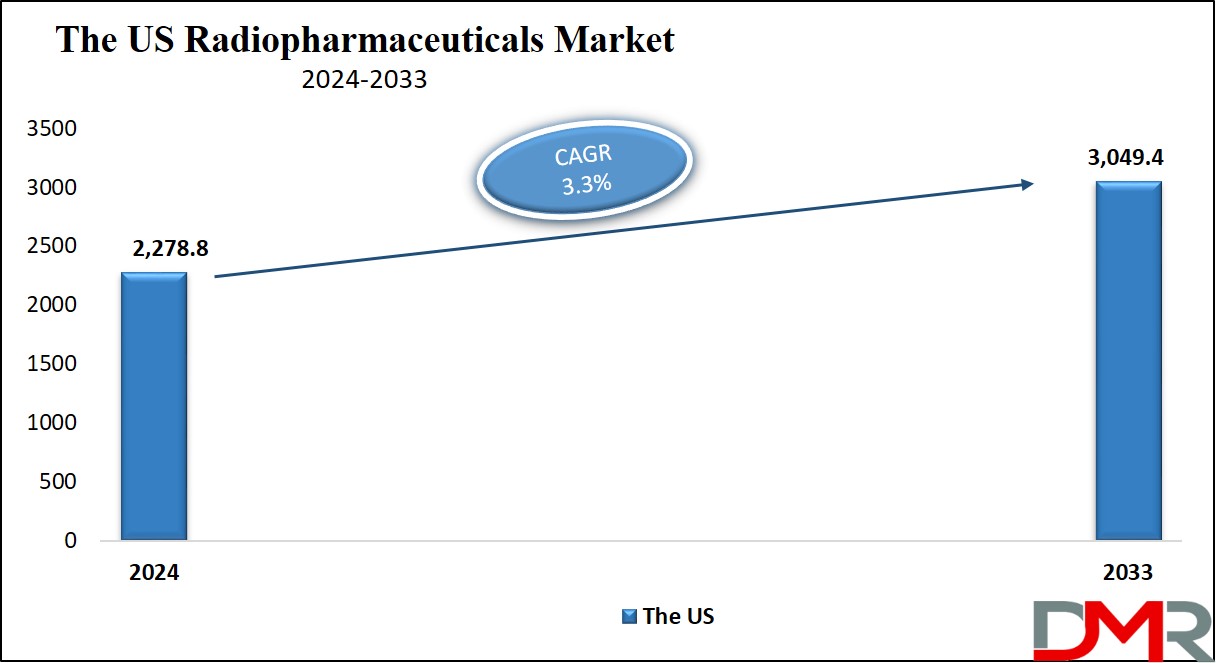

The

US Radiopharmaceuticals Market is projected to be

valued at USD 2,278.8 million in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 3,049.4 million in 2033 at a

CAGR of 3.3%.

The US radiopharmaceutical market is one of the largest and most developed markets in the world, which occupies a leading position in the global market. This will establish a scope for a steady increase in the market size in the US since there is continued incidence of chronic diseases such as cancer and cardiovascular diseases which require better solutions for diagnosis and treatment. Some important market trends include an increase in the use of therapeutic radiopharmaceuticals in many targeted therapies for cancer such as Lutetium-177 for prostate cancer.

New radiopharmaceutical development including the integration of the radiopharmaceuticals into precision medicine strategies has fueled the call for radiopharmaceuticals. Furthermore, the United States is the location of origin for developing new technologies in nuclear medicine in both PET and SPECT modalities. The highly developed healthcare sector with regular R&D activities has enabled the U.S. to retain the top position in the global radiopharmaceutical market.

Besides this, the increasing budget for cancer-related research and a growing number of

clinical trials for new radiopharmaceuticals are the factors that fuel the growth of the market. The prominent market players that take the largest market share of the U.S. are collapsed with GE Healthcare Cardinal Health and Lantheus Holdings Ac Corp; key players invest significantly in research and development to provide new radiopharmaceuticals.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Key Takeaways

- Global Market Value: The Global Radiopharmaceuticals Market size is estimated to have a value of USD 7,225.6 million in 2024 and is expected to reach USD 9,876.2 million by the end of 2033.

- The US Market Value: The US Radiopharmaceuticals Market is projected to be valued at USD 3,049.4 million in 2033 from a base value of USD 2,278.8 million in 2024 at a CAGR of 3.3%.

- By Type Segment Analysis: Diagnostic radiopharmaceuticals are anticipated to dominate this segment with 63.1% of the market share in 2024.

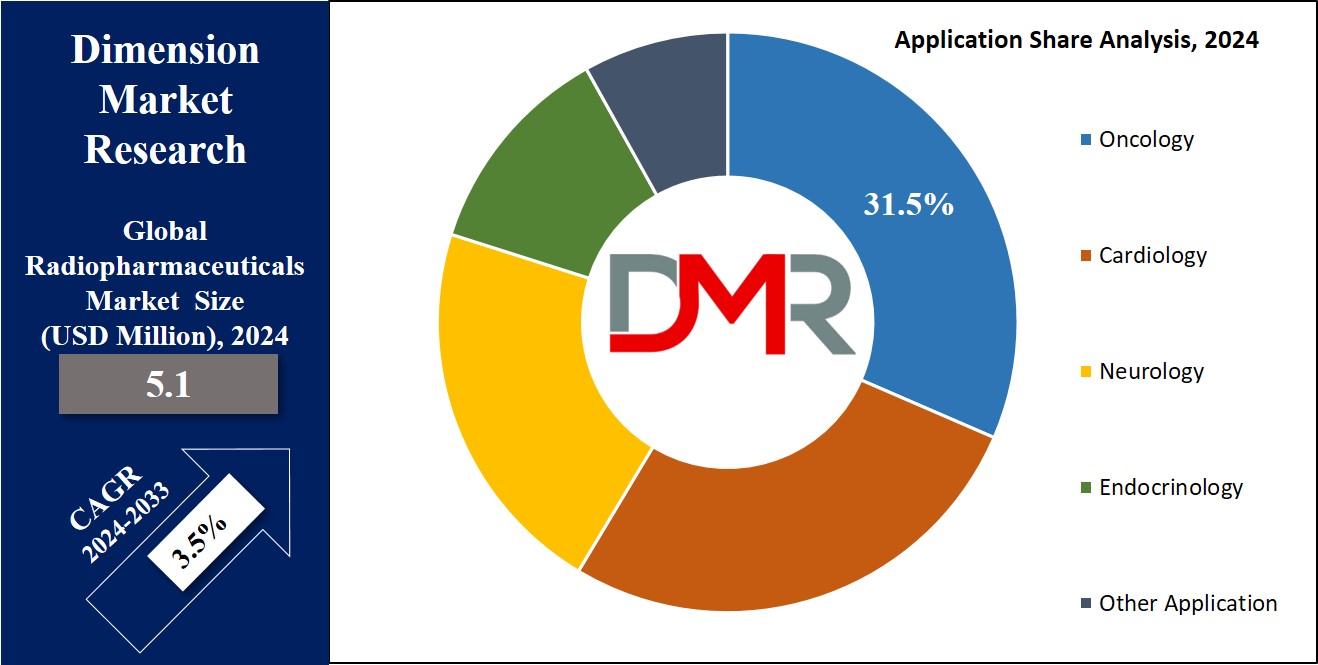

- By Application Segment Analysis: Oncology is expected to dominate the application segment in this market as it hold 31.5% of the market share in 2024.

- Regional Analysis: North America is expected to have the largest market share in the Global Radiopharmaceuticals Market with a share of about 37.5% in 2024.

- Key Players: Some of the major key players in the Global Radiopharmaceuticals Market are Bayer AG, Bracco Imaging S.p.A., Cardinal Health, Inc., Eli Lilly and Company (Eli Lilly), Curium Pharma, Lantheus Oldings Inc., Novartis AG, and many others.

- Global Growth Rate: The market is growing at a CAGR of 3.5 percent over the forecasted period.

Use Cases

- Cancer Diagnosis and Treatment: Fluorine-18 enables PET imaging for early diagnosis of cancer while enabling treatment by acting specifically on certain types of cancers using Lutetium-177.

- Cardiology: Technetium-99m is utilized in SPECT imaging and is helpful in studying the efficiency of heart contractions or signs of coronary artery disease with the aid of myocardial perfusion scans.

- Neurological Imaging: Inconclusive Al & Parkinson neurological disorders & Multiple Sclerosis, PET Tracers including Fluorine-18 derivatives diagnose brain activity and pathologies.

- Thyroid Disorders: Iodine-131 is used for the diagnosis and treatment of thyroid diseases, including noninvasive imaging and molecular therapy for hyperthyroidism and thyroid malignant diseases.

Market Dynamic

Trends

Rise of TheranosticsAnother trend in the market of radiopharmaceuticals is theranostics – the convergence of diagnostic and therapeutic devices. Such an approach enables individual changes in treatment plans even though the same radiopharmaceutical is used for both diagnosis and therapy of diseases such as cancer. For example, Lutetium-177 works for both diagnosis of prostate cancer tumors and treatment of it. The concept of theranostics is growing rapidly since it opens the opportunity for a more personalized, less toxic treatment of cancers, and hence generates the need for new theranostic radiopharmaceuticals around the world.

Advancements in Imaging Technology

Technological improvement of appliances like positron emission tomography (PET) and single-photon emission computed tomography (SPECT) compounds the requirement for radiopharmaceuticals. However, new imaging hybridization technologies such as PET/CT, and SPECT/CT that give historical findings with improved anatomical and functional information have increased the demand for the development of better radiopharmaceuticals for these systems also is required.

Growth Drivers

Increasing Prevalence of Chronic Diseases

Global incidence of chronic diseases like cancer, cardiovascular diseases, and neurological diseases is also considered to be a major growth factor for the radiopharmaceutical market. These conditions must therefore be diagnosable with high precision as well as be treatable by means of reliable remedies, and both of these are made available by radiopharmaceuticals. For example, rising cancer incidences across are driving the PET and SPECT market demand where Fluorine-18 and Technetium-99m are key radiopharmaceuticals.

Government Initiatives and Investments

Major funding is being made by governments across the globe by investing in nuclear medicine and in healthcare systems and facilities mainly in North American and European countries. Governments are offering faster clearance for new radiopharmaceuticals, and healthcare systems around the world increasingly incorporate nuclear medicine services. Such favorable measures accompanying enhanced investments in research and development of nuclear medicine applications are also primarily boosting the growth of the radiopharmaceuticals marketplace.

Growth Opportunities

Emerging Markets in Asia-Pacific

Currently, the Asia-Pacific region is most promising for the radiopharmaceutical market due to the constantly developing healthcare sector and increasing demand for nuclear medicines. Nuclear medicine facilities are being developed in countries like India and China; more diagnostic and therapeutic services are being added. Furthermore, the growth in rates of chronic diseases in these areas is also fueling the growth in the radiopharmaceuticals market in Asia-Pacific which presents a growth opportunity for international players looking to enter the market.

Expansion of Therapeutic Radiopharmaceuticals

Chronic disease management through therapeutic radiopharmaceuticals switching from diagnostic applications is offering new growth prospects. The use of Lutetium-177 and Yttrium-90 in the management of cancer through targeted therapy is the new frontier in the treatment of cancer having minimal side effects and invasiveness. Simultaneously with the shift towards therapeutic applications, new radiopharmaceuticals are predicted to appear in the market, hence the growth of the therapeutic segment.

Restraints

High Cost of Radiopharmaceuticals

A major problem currently facing the radiopharmaceuticals market is the high cost of the products in question to the consumer. Radioisotope production is an expensive process that involves the use of technologies such as cyclotrons and Nuclear reactors making radiopharmaceuticals expensive. Also, there are specialized healthcare facilities and legal requirements that increase costs and thereby reduce the feasibility and availability of these products, especially in the lowest and middle-income countries.

Stringent Regulatory Requirements

Radiopharmaceuticals are ready by involving strict regulatory rules because the elements in them are radioactive. Observing these regulations can be quite difficult especially because they have high safety measures and a strict standard of quality. Getting regulatory clearances from authorities such as the U.S Food and Drug Administration and the European Medicines Agency may take time, meaning that the organization may take longer to introduce new products into the market a factor that will limit growth.

Research Scope and Analysis

By Radioisotope

The radioisotopes market is dominated mainly by the fluorine-18 derivatives since they are used in positron-emission tomography, primarily diagnostics of tumors and neurological studies. Fluorine-18 is an officially and commonly used isotope during a PET scan. The main compound used is F-18 fluorodeoxyglucose, which detects metabolic activity within malignant cells. Due to its short half-life of 110 minutes, it is suitable for clinical imaging studies because this enables the completion of imaging studies in a relatively short time to minimize the radiation exposure to the patient.

The good-resolution image shows that the fluorine-18 derivatives have a property of positron emission and hence assist in the early detection of cancer and several other diseases, thereby improving the disease outcome. These radiopharmaceuticals are not limited to cancer applications but increasingly find their application in neurological symptoms, such as Alzheimer's disease, and even in cardiology to ascertain the diseases of the heart.

Fluorine-18-based PET imaging is gaining attention from several parts of the world due to the rising incidence of several chronic diseases including cancer and cardiovascular diseases among others. Fluorine-18 has also been found highly suitable for automated radiopharmaceutical production; hence, it has more reasonable pricing and productive output boosting its dominance in the radiopharmaceutical market.

By Type

Radiopharmaceuticals used for diagnostic purposes will continue to dominate the type segment in the radiopharmaceuticals market, accounting for 63.1% market share in the year 2024, as it constitutes the leading segment in the type segment of the radiopharmaceuticals market since it also has wide applications in various nuclear medicine imaging techniques such as SPECT scans. Such radiopharmaceuticals have important applications in the diagnosis of a wide range of diseases, including cancers, cardiovascular conditions, and neurological disorders. This is used to visualize internal organs and their functionalities and aMnormalities for the doctors.

The growing prevalence, worldwide, of chronic diseases that involve early diagnosis and monitoring by advanced diagnostic techniques has made this one of the major drivers for the demand for diagnostic radiopharmaceuticals. Radiopharmaceuticals such as Technetium-99m and Fluorine-18 view internal metabolic and physiological processes in real-time. Non-invasive diagnostic modalities succeed in making these radiopharmaceuticals a must for clinical use, especially in oncology and cardiology.

On the other hand, technological advancement in nuclear medicine has considerably improved diagnostic precision and accuracy, therefore increasing the adoption rate for diagnostic radiopharmaceuticals. Secondly, the trend of shifting toward non-invasive diagnostic procedures, besides the availability of diagnostic radiopharmaceuticals at imaging centers and hospitals, has kept diagnostic radiopharmaceuticals at the forefront of the global radiopharmaceutical market.

By Source

The dominant share in the radiopharmaceutical market goes to cyclotrons, carriers of the main technology for producing short-life radioisotopes, especially for PET imaging, among which is Fluorine-18. Installation in hospitals of different types of accelerators will enable the manufacturing on-site of life-critical radiopharmaceutical products due to their extremely short half-life and hence reduce transportation issues and ensure on-time availability of the product for diagnosis.

The major advantages of cyclotrons are their capacity to produce a wide range of radioisotopes: Gallium-68, Carbon-11, and Nitrogen-13, which are required in various PET scans of oncology, cardiology, and neurology. Their flexibility and efficiency in producing radioisotopes make them irreplaceable in nuclear medicine. The driving forces involve increasing demand for Fluorine-18-based PET imaging. Increase in investments made by the government and private sectors in health development infrastructure increased installations of cyclotrons around the world, the majority of them located in North America and Europe.

Additionally, cyclotrons make radioisotopes friendlier to the environment, as there is no need for a nuclear reactor necessary premises for sustainability in healthcare. Major market players, such as Ion Beam Applications (IBA) and Siemens Healthineers, are at the forefront of the development of advanced cyclotron technologies, further strengthening their leading positions in the radiopharmaceutical market.

By Application

The application segment will continue to be dominated by oncology in the radiopharmaceuticals market, accounting for 31.5% market share in 2024. This is because the high demand for the diagnostic imaging of therapeutic intervention in cancer care creates the lead of market share by oncology in the application segment. The global burden of cancer has increased tremendously in the past few decades, with millions of new cases diagnosed every year.

3Thus, there is an emerging need for state-of-the-art imaging technologies such as PET and SPECT in the early detection and monitoring of tumors. The main radiopharmaceuticals used in the PET scan include Fluorine-18 (FDG), which, due to its great role in monitoring metabolic activity in cancerous cells, is of immense importance in diagnosis, staging, and treatment planning. A recent trend toward developing so-called theranostics integration of diagnostic and therapeutic use in one single radiopharmaceutical changed the face of cancer care.

The turn the tide has taken regarding the therapeutic radiopharmaceuticals in the circles of Lu-177 and I-131 includes the treatment of cancers, selected of course, which include but are not limited to prostate cancer and thyroid cancer, respectively. The important point is that these cancers can be cured with this modality with much fewer side effects. This has given a strong boost to the clinical outcomes of the patients whose oncology dominates this segment.

Also, the continuous development of nuclear

oncology through research and development promises to continue to augment the share of new radiopharmaceuticals, adding even more to the higher effectiveness in diagnostics and treatments of cancer. As cancer comprises the maximum share of applications, oncology would also continue to dominate the application segment in the future as well in the radiopharmaceuticals market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End-User

Hospitals are anticipated to dominate the end-user segment in the radiopharmaceuticals market with the highest market share in 2024. Among end-users, the radiopharmaceuticals market is dominated by hospitals, as they are primary end-users of such products in the course of advanced diagnosis and therapeutic procedures. Radiopharmaceuticals remain important in nuclear medicine departments of hospitals owing to diagnostic tests such as positron emission tomography and single-photon emission computed tomography.

These tests are crucial for the diagnosis of various diseases, including cancer, cardiovascular diseases, and neurological conditions. Also, the readiness at the hospital centers of special equipment and professionals specialized in handling such equipment make radiopharmaceuticals the greatest consumers at the hospital level. The treated cases are further more complex, involving therapeutic radiopharmaceuticals such as Iodine-131 for thyroid cancer or lutetium-177 for the therapy of advanced prostate cancer.

This class of therapy is provided only in a hospital setting due to several factors that include special care, monitoring, and even regulatory protocols for dealing with radioactive drugs. Besides, hospitals are always the first point of contact for patients needing nuclear medicine services, as they offer a wide range of diagnostic services under one roof for conditions requiring radiology and nuclear medicine imaging. The demand for radiopharmaceuticals in hospitals is further increased by the rise in

chronic diseases and a growing need for timely and proper diagnosis.

The Radiopharmaceuticals Market Report is segmented on the basis of the following

By Radioisotope

- Fluorine-18 Derivatives

- Fluorine-18 Fludeoxyglucose (FDG)

- Fluorine-18 Sodium Fluoride

- Fluorine-18 Sodium Flucicovine

- Fluorine-18 Sodium Florbetapir

- Fluorine-18 Sodium Flurbetaben

- Others

- Technetium-99

- Lutetium (Lu) 177

- Gallium-68

- Zirconium 89

- 11C-choline

- 14C-urea

- Other Radioisotope

By Type

- Diagnostic Radiopharmaceuticals

- SPECT Radiopharmaceuticals

- PET Radiopharmaceuticals

- Standalone PET Systems

- Hybrid PET/CT

- Hybrid PET/MRI

- Therapeutic Radiopharmaceuticals

- Alpha Emitters

- Beta Emitters

- Others

By Source

- Cyclotrons

- Nuclear Reactors

- Generators

By Application

- Oncology

- Cardiology

- Neurology

- Endocrinology

- Other Application

By End User

- Hospitals

- Medical Imaging centers

- Cancer Research Institute

- Other End User

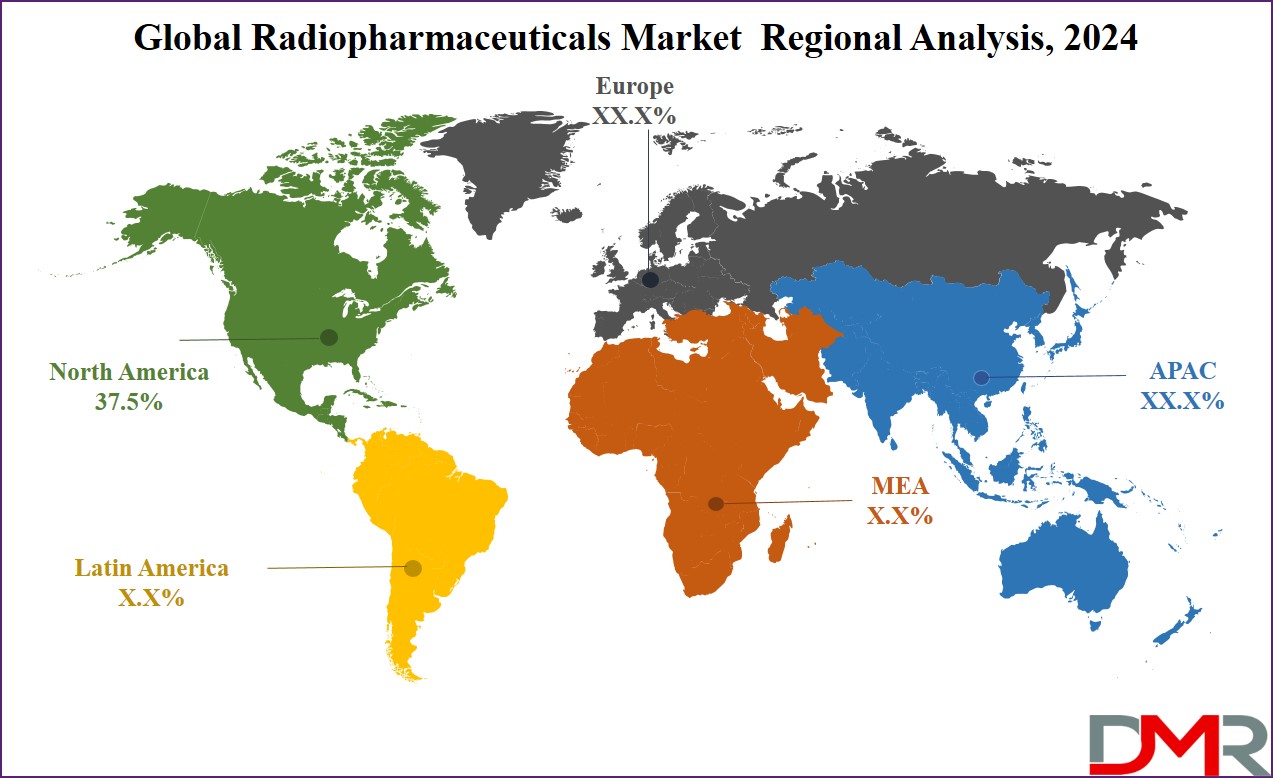

Regional Analysis

North America is projected to dominate the global radiopharmaceuticals market as it

holds 37.5% of market share in 2024. North America holds the major market share of the global radiopharmaceuticals market mainly due to superior healthcare facilities and enhanced utilization of nuclear medicine products.

The region is very dominant because of the tremendous market for diagnostic and therapeutic applications of radiopharmaceuticals especially in the United States where there is ample research and development center for nuclear medicine applications. Chronic diseases such as cancers, cardiovascular disorders, and neurological disorders have become more common in North America implying the need for state-of-the-art diagnostic imaging and treatment solutions. Radiopharmaceuticals are used in PET and SPECT scans to diagnose fresh cases of cancer and other chronic diseases, which are the key reasons for the region’s market share.

In addition, opportunities in North America are vast for radiopharmaceuticals as governments and private investors have invested a lot in its research and production. FDA is advancing in the support of new molecular agents, helping create positive conditions for the introduction and market expansion of radiopharmaceuticals. Moreover, important market players such as GE Healthcare, Cardinal Health, and Lantheus Holding add more strength to the region in the global market. To meet the requirements of the increasing consumption of nuclear medicine in the region, these companies are increasing investments in research and development and expanding the range of radiopharmaceutical products.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The market for radiopharmaceuticals is highly competitive, and it is witnessed by the existing key players who are interested in controlling the largest possible market share. The competition in the market characteristics arises from new product development, cooperation strategies, and ongoing research and development for product diversification. Companies like Ion Beam Applications (IBA), GE Healthcare, Siemens Healthineers, Cardinal Health, and Lantheus Holdings are the major players in this market.

These companies are mainly relying on growth strategies that involve the creation of new radiopharmaceuticals for diagnostic techniques and cures. For example, GE Healthcare was a leading player in imaging radiopharmaceutical and IBA has a dominant market for cyclotrons that are used for the generation of radioisotopes.

In the same regard, the market has been shaped by cooperation and affiliation arrangements in a big way. You’ve seen how companies are partnering with research institutions and pharmaceutical firms to further radiopharmaceutical science. For example, Siemens Healthineers has worked with some of the renowned university educational facilities to create innovation that is radiopharmaceutical cancer therapy. Moreover, these key players are increasing their operations in geographical locations across the developing world, especially in the Asia-Pacific region that has the development of healthcare facilities.

Some of the prominent players in the Global Radiopharmaceuticals Market are

- Bayer AG

- Bracco Imaging S.p.A.

- Cardinal Health, Inc.

- Eli Lilly and Company (Eli Lilly)

- Curium Pharma

- Lantheus Holdings, Inc.

- Novartis AG

- Nordion (Canada) Inc.

- Jubilant Radiopharma

- Other Key Players

Recent Developments

- September 2024: Ion Beam Applications (IBA) announced the launch of a new compact cyclotron for radioisotope production, aimed at improving the availability of radiopharmaceuticals for cancer diagnosis and therapy.

- August 2024: GE Healthcare introduced a new line of theranostic radiopharmaceuticals designed for precision cancer therapy, enhancing their oncology product portfolio.

- June 2024: Siemens Healthineers partnered with Harvard Medical School to advance research in nuclear medicine imaging and the development of novel radiopharmaceuticals.

- April 2024: Cardinal Health expanded its nuclear pharmacy network in the U.S., enhancing its distribution capabilities for radiopharmaceuticals.

- March 2024: Lantheus Holdings received FDA approval for a new radiopharmaceutical targeting prostate cancer, increasing its presence in the oncology segment.

- January 2024: IBA opened a new manufacturing facility in India for the production of medical isotopes, aimed at meeting the growing demand for radiopharmaceuticals in the Asia-Pacific region.

- November 2023: Cardinal Health entered into a collaboration with Pfizer to develop radiopharmaceuticals for the diagnosis of neurological disorders, expanding its therapeutic applications.