As per the Tavus Ready to Drink Premixes Market report, RTDs in the U.S. have seen remarkable growth, expanding their volume share from less than 3% of the total U.S. beverage alcohol market in 2012 to nearly 12% by 2022, surpassing the wine category. This surge was primarily driven by the hard seltzer segment.

Between 2018 and 2021, the super-premium RTD segment led with a CAGR of +71%, outperforming premium (+48%), standard (+39%), and value (+19%). Packaging preferences also highlight a shift, with 47% of consumers favoring glass over metal cans (36%), despite supply chain constraints limiting material options for brand owners.

Also, rising disposable earnings, mainly in emerging economies like China, South Korea, India, and Thailand are contributing to market growth, as customers increasingly opt for top-class RTD products. Additionally, there is a growing fashion towards more healthy and more sustainable RTD options, prompting producers to incorporate herbal components and green packaging answers. Overall, the global RTD premixes marketplace offers a dynamic panorama with ample opportunities for boom and innovation, driven by the aid of evolving consumer alternatives and market dynamics.

The ready-to-drink (RTD) premixes market is buzzing with activity as major events and deals reshape the landscape. Recent mergers and acquisitions, such as global beverage giants acquiring innovative RTD startups, highlight the sector's rapid growth and appeal. Events like the World Beverage Innovation Awards are recognizing cutting-edge RTD offerings that blend convenience with premium flavors.

Additionally, partnerships between alcohol and non-alcohol brands are expanding product lines, targeting health-conscious and younger demographics. This surge in strategic deals and events reflects the booming demand for RTD premixes, driven by evolving consumer preferences for on-the-go beverages. The growing popularity of

Non-alcoholic Beverages is also influencing this trend, as consumers increasingly seek flavorful, low-calorie, and mindful drinking alternatives that align with modern lifestyle and wellness choices.

Key Takeaways

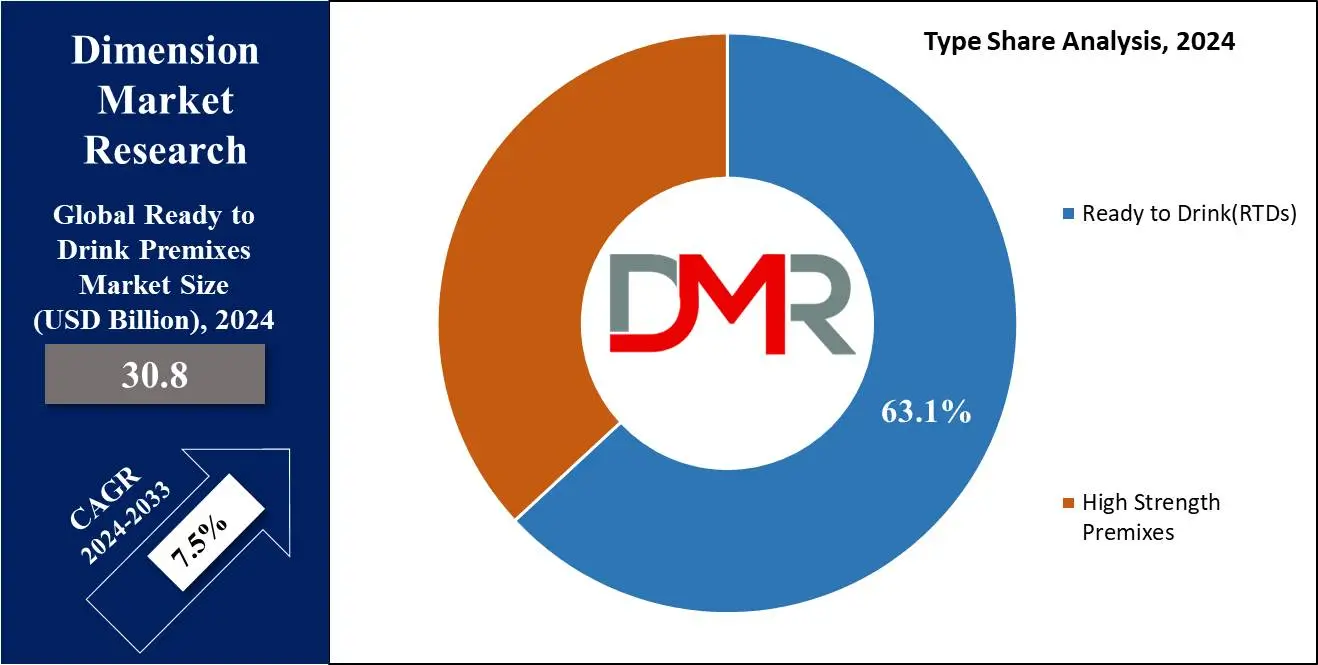

- Market Value: The global ready-to-drink premixes market is projected to reach a market value of USD 32.9 billion in 2025, in comparison to USD 58.9 billion in 2033 at a CAGR of 7.5%.

- Market Definition: Ready-to-drink (RTD) premixes are beverages that come pre-mixed and are ready for consumption without requiring any additional preparation or effort.

- Product Segment Analysis: Alcoholic beverages are expected to exert their dominance in this segment with highest market value by the end of 2024.

- Type Segment Review: Ready-to-drink is expected to dominate the global ready to drink premixes market with 63.1% market value in 2024.

- Distribution Channel Analysis: The offline distribution channel is projected to command this market with 68.8% market share in 2024.

- Growth Factors: Convenience, modern life-style, expanding distribution channels, product innovation and rising disposable incomes is driving the need for top rate and sustainable options drive increase inside the global RTD premixes market.

- Regional Preview: North America is predicted to dominate the global ready-to-drink premixes market with 37.2% of market share in 2024.

Use Cases

- Convenience: Ready-to-drink drinks provide instant energy, perfect for busy lives, on-the-go activities, and casual socializing without preparation.

- Outdoor Events: RTDs are ideal for outdoor events such as picnics, beach walks, sports activities, and more, providing hassle-free hydration and enjoyment.

- Travel: Flexible packaging makes RTDs travel-friendly for hiking, flying, and camping, and provides a refreshing alternative without the need for hybridization.

- Social events: RTDs facilitate entertaining by offering a variety of pre-mixed cocktails and drinks, effortlessly catering to different tastes and occasions.

- Workplace: Ready-to-drink products are popular in workplaces for employee benefits, conferences, and corporate events, providing convenience and comfort without compromising productivity.

Ready to Drinks Premixes Market Dynamic

The global prepared-to-drink (RTD) premixes market is driven using several dynamic factors. The converting customer lifestyles, characterized by way of accelerated urbanization and busy schedules, drive demand for convenient beverage alternatives. This trend is similarly amplified with the aid of the growing desire for on-the-go consumption and the choice of novel flavors and useful components.

Moreover, increasing distribution channels, such as supermarkets, convenience stores, and online structures, enhance accessibility and availability of RTD premixes, contributing to marketplace increase.

Innovation performs a vital role, with organizations that specialize in product development, packaging, and marketing strategies to differentiate themselves and capture a significant market proportion. Additionally, the competitive landscape drives continuous improvements in high-quality, branding, and pricing strategies amongst key players.

Regulatory factors, including labeling necessities and health guidelines, also affect market dynamics, shaping product formulations and advertising processes. Furthermore, sustainability worries spark the adoption of eco-friendly packaging and components, aligning with consumer preferences for environmentally conscious products. Overall, these interconnected dynamics drive the evolution and expansion of the global ready-to-drink premixes market.

Ready to Drink Premixes Market Research Scope and Analysis

By Product Type

Alcoholic beverages are expected to dominate the global ready-to-drink premix market in the product segment with the highest market share by the end of 2024. Alcoholic liquids dominate the product type segment of the ready-to-drink (RTD) premixes market due to numerous key elements. This dominance can be accredited to its sizable cultural acceptance and consumption of alcoholic beverages throughout many areas and demographics, making them inherently popular among consumers.

This cultural inclination towards alcohol intake drives a sizable need for alcoholic RTD alternatives. Additionally, alcoholic RTD premixes offer customers the benefit of taking part in their preferred alcoholic drinks without the hassle of blending elements or touring a bar, making them incredibly appealing for numerous social activities and settings. Moreover, alcoholic RTDs frequently are available in a huge range of flavors and variations, catering to numerous flavor alternatives and permitting consumers to explore new and revolutionary alternatives in the class.

Furthermore, the alcoholic RTD segment benefits from significant marketing and branding efforts by the most important players, which help to attract consumer attention and loyalty. Overall, the mixture of cultural reputation, comfort, range, and advertising efforts contributes to the dominance of alcoholic drinks inside the RTD premixes market's product type segment, a trend also observed in the broader

Whiskey Market.

By Type

Ready-to-drink (RTDs) are projected to dominate the global ready-to-drink premix market with 63.1% of the market share in 2024. In the type segment, Ready-to-Drink takes the lead because these drinks offer convenience, and usability, and appeal to many consumers in different demographics. The centralization is primarily motivated by some main reasons. Firstly, the fact that RTDs are ready to drink, making them an instant consumption option without any additional preparation or mixing, is one of the main features that address the needs of consumers who are constantly on the go or who are seeking convenience.

Additionally, among the RTDs, there exists a wide sort of RTD options that include spirit-based ones, wine-based others, and even malt-based drinks, providing consumers with the advantage of having so many options to choose from depending on their taste preferences and occasions. Moreover, RTDs are most of the time marketed as convenient and delicious substitutes for alcoholic beverages.

Such a category of products obviously will positively influence the attractiveness of their customers who might feel satisfied without compromising on the quality of their drinks. Besides that, the RTD category expands its distribution channels consisting of supermarkets, liquor stores, and duty-free shops. This makes it all the more possible a lead the segment with a bigger market share.

By Distribution Channel

Offline channels are anticipated to dominate the global ready-to-drink premix market in the context of distribution channels with 68.8% of the market share in 2024. The offline retail channel enjoys the leading position in the distribution channel segment of ready-to-drink premixes based on certain strong reasons. In the first place, with offline channels, consumers can use their sense of sight, physical touch, or smell for a product, so they may trust and be confident about their buying decisions as a result.

Apart from that, such channels offer RTD (ready-to-drink) options which can be used in different consumer preferences ranging from occasions that promote convenience and choice. Furthermore, supermarkets & hypermarket chains most often take advantage of their significantly sized distribution infrastructure and economies of scale by bargaining for lower prices with manufacturers, which leads to reasonable prices for the clients.

Next, liquor specialist stores are intended to provide expertise and personalized advice, distinguishing them from others who simply serve the masses but offer premium RTDs for select customers. For one, duty-free stores take advantage of their strategic destinations in airports and travel nodes, and as such, they attract both local and foreign travelers who need to make easy and duty-free purchases.

Even though it is more convenient to shop online, a huge part of premium ready-to-drink premixes is bought offline because it is preferred to go to shops and stores where there is a huge choice, a lot of experts, and a special shopping experience with other consumers who buy premium products.

The Ready to Drink Premixes Market Report is segmented based on the following:

By Product Type

- Alcoholic Beverages

- Non-alcoholic Beverages

By Type

- Ready to Drink(RTDs)

- Spirit Based RTD

- Wine Based RTD

- Malt Based RTD

- High-Strength Premixes

By Distribution Channel