Market Overview

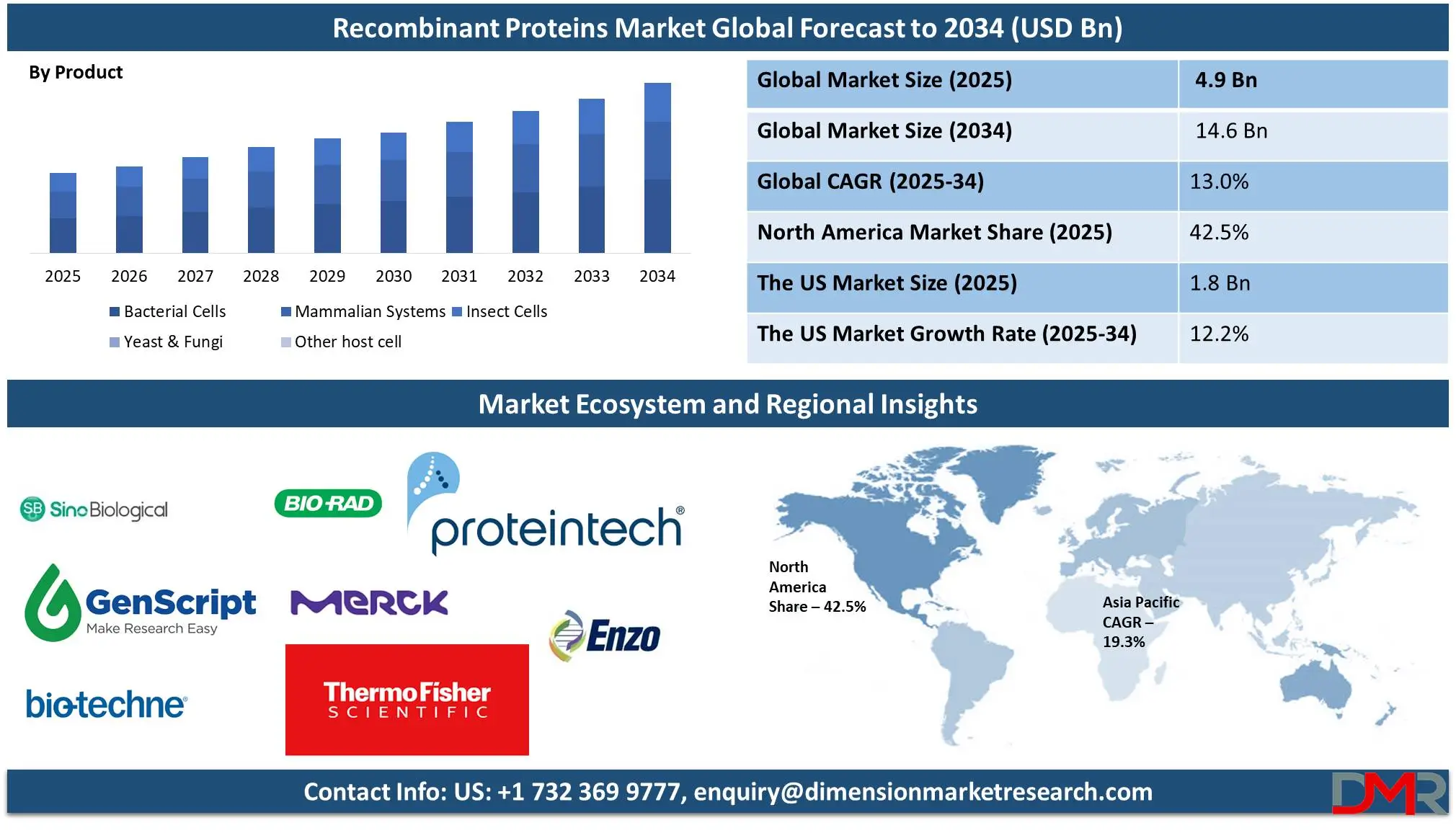

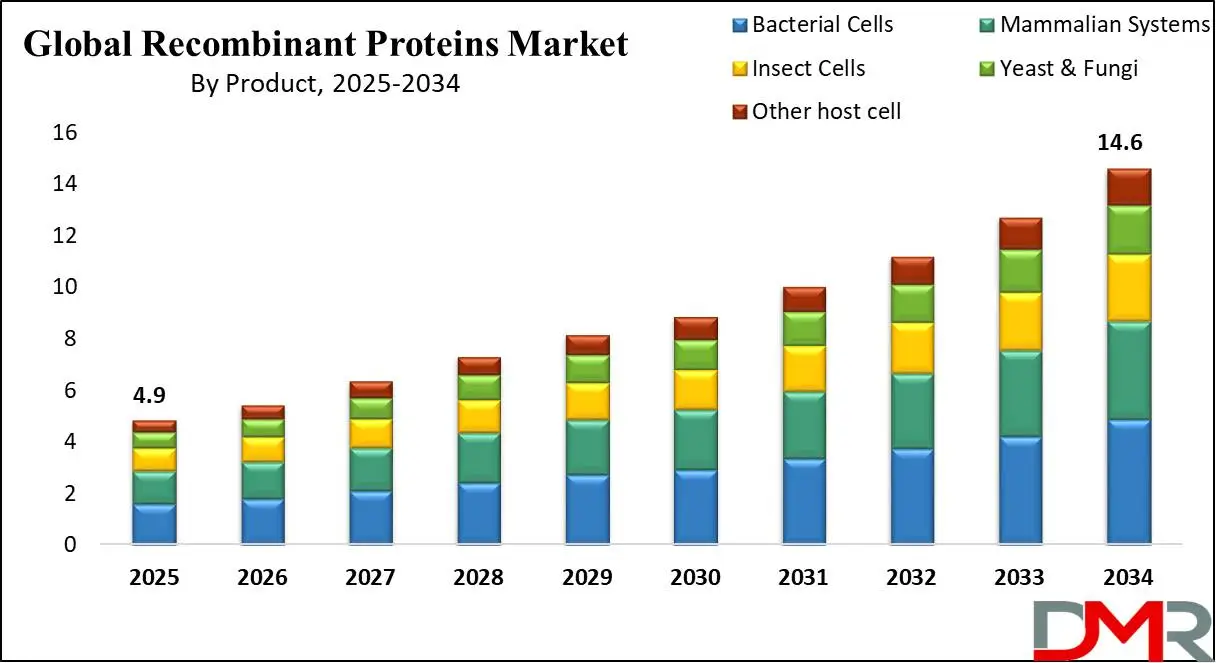

The Global

Recombinant Proteins Market size is estimated at

USD 4.9 billion in 2025 and is expected to reach

USD 14.6 billion by 2034, at a

CAGR of 13.0% during the forecast period of 2025 to 2034.

Recombinant proteins are proteins engineered through recombinant DNA technology, where specific genes encoding the desired protein are inserted into host cells, such as bacteria, yeast, or mammalian cells. These hosts are cultured to produce the target protein, which is then purified for various applications.

This technology enables the large-scale production of proteins with high purity and precision. Recombinant proteins play a crucial role in medicine, including the development of vaccines, insulin, and monoclonal antibodies. They are also widely used in research for studying protein functions and in industries like agriculture and biotechnology for enzyme production and crop improvement.

In recent news, the focus on personalized medicine has highlighted the critical role of recombinant proteins. Pharmaceutical companies are heavily investing in targeted biologics and antibody-based therapies to address complex diseases. The rise of biosimilars is also creating opportunities for affordable treatments for chronic conditions such as cancer, diabetes, and autoimmune disorders.

The demand for recombinant proteins is growing in academic and research settings due to their importance in understanding disease mechanisms, protein interactions, and drug discovery. Their pivotal role during the COVID-19 pandemic, particularly in vaccine development and diagnostic assays, has further boosted their adoption and underlined their significance in modern science.

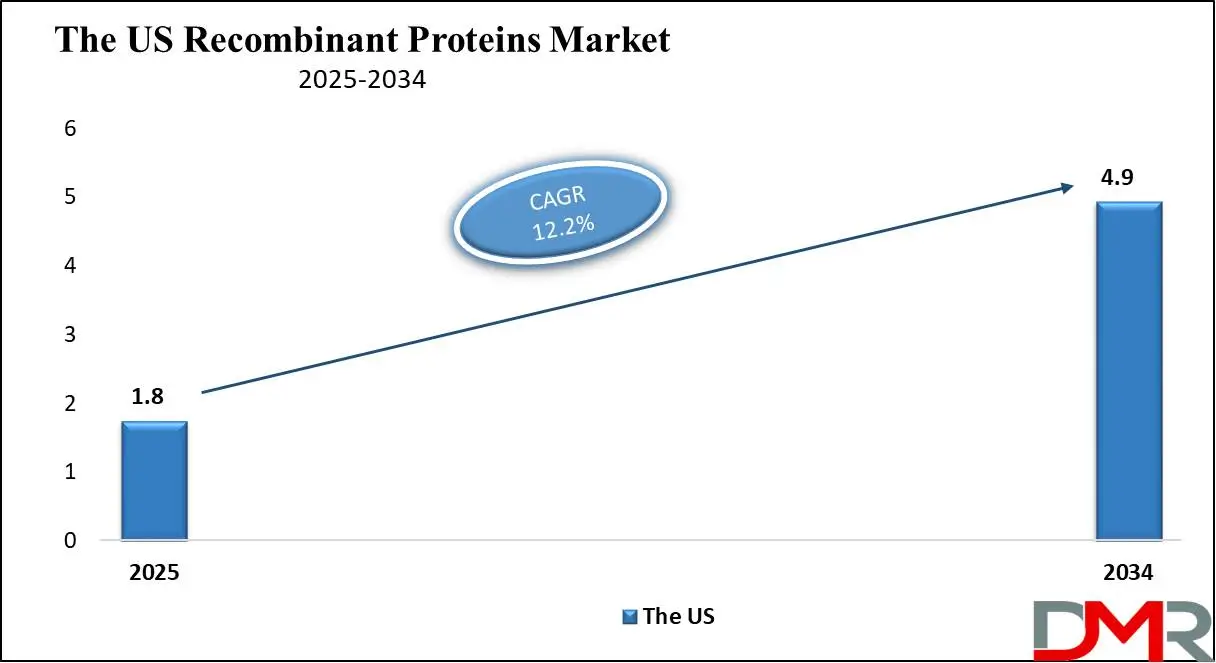

The US Recombinant Proteins Market

The US Recombinant Proteins market is projected to be valued at USD 1.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 4.9 billion in 2034 at a CAGR of 12.2%.

The US recombinant protein market is driven by increased demand in academic and research settings for studying disease mechanisms, protein interactions, and drug discovery. The COVID-19 pandemic accelerated adoption, highlighting recombinant proteins' critical role in vaccine development and diagnostic assays. Continuous advancements in biotechnology, the rising prevalence of chronic diseases, and government funding further bolster market growth.

The US recombinant protein market is experiencing a growing focus on personalized medicine and precision therapies, alongside an increasing use of cell-based assays. Innovations in production technologies are advancing the industry, while artificial intelligence is being integrated into protein design. Additionally, sustainable, plant-based protein expression systems and collaborations between academia and biotech firms are driving significant innovation.

Key Takeaways

- Market Growth: The global Recombinant Proteins market is anticipated to expand by USD 9.2 billion, achieving a CAGR of 13.0% from 2026 to 2034.

- Product Analysis: Growth factors and chemokines are predicted to dominate the global market based on product by the end of 2025.

- Host Cell Analysis: Bacteria cells are predicted to dominate the global market based on host cells by the end of 2025.

- Application Analysis: Drug discovery and development are projected to dominate the global market with the highest revenue share by 2025 in terms of application.

- End User Analysis: Pharmaceutical and biopharmaceutical companies are likely to lead the market based on end users with the largest revenue share by 2025.

- Regional Analysis: North America is projected to dominate the global Recombinant Proteins market, holding a market share of 42.5% by 2025.

Use Cases

- Therapeutic Applications: Recombinant proteins are widely used in medicine to treat various diseases. For instance, recombinant human insulin is essential for managing diabetes. Monoclonal antibodies, such as trastuzumab and adalimumab, are used to treat cancers, autoimmune diseases, and infections.

- Research and Diagnostics: In research, recombinant proteins enable scientists to study the structure, function, and interactions of proteins. They are also employed as antigens in diagnostic tests for diseases such as COVID-19, HIV, and hepatitis.

- Industrial Biotechnology: Recombinant proteins are essential in various industrial processes. Enzymes like amylases and proteases are used in the production of detergents, food processing, and biofuels.

- Vaccine Development: Recombinant proteins are pivotal in the development of vaccines. Protein-based vaccines, such as those for hepatitis B and HPV, rely on recombinant proteins as antigens.

Stats & Facts

- The recombinant proteins market has witnessed remarkable growth, with over 30% of therapeutic drugs approved by regulatory authorities in recent years relying on recombinant protein technology. Approximately 80% of all biologics in development utilize recombinant proteins, underscoring their critical role in drug discovery and manufacturing processes across pharmaceuticals, biotechnology, and clinical research sectors.

- Globally, more than 1,200 recombinant protein-based drugs are currently in clinical trials, with over 50% targeting oncology and chronic diseases. Additionally, recombinant proteins constitute nearly 70% of proteins used in diagnostics and vaccine production, playing a pivotal role in developing novel and precision healthcare solutions for various medical conditions.

- As the International Diabetes Federation reported, an estimated 537 million individuals aged 20 to 79 had diabetes in 2021, with projections indicating that this number will rise to 643 million by 2030 and reach 783 million by 2045. This substantial increase in the diabetic population highlights the urgent need for innovative therapeutic solutions, including recombinant proteins.

Market Dynamic

Driving Factors

Increased R&D Spend and Funding

Pharmaceutical and biotechnological firms' increasing R&D expenses and funding have had a direct effect on the expansion of the recombinant protein market. Companies investing more in research and development is leading to novel therapies being created quickly; such as protein-based drugs used to treat complex conditions like cancer, autoimmune disorders, and infectious disease. Through continuous investments into biopharmaceuticals, the discovery of novel recombinant proteins drives market expansion while meeting rising consumer demands for targeted, potency, and safer therapeutic options.

Rising Demand for Biopharmaceuticals

Recombinant protein therapy has emerged as a primary driver in today's biopharmaceuticals market, particularly its expansion globally. Recombinant proteins offer increased potency, specificity, and reduced side effects when compared with traditional small molecule drugs; making them highly effective in treating diseases including autoimmune conditions, bleeding disorders (hemophilia in particular), and cancer. Both healthcare providers and patients increasingly prefer them due to their higher therapeutic index and ability to target specific pathways with specific outcomes leading to improved patient outcomes which has propelled the global expansion of this segment within biopharmaceuticals overall.

Restraints

High Production Costs

Recombinant protein markets within Recombinant Proteins suffer a substantial setback due to high production costs associated with manufacturing processes. These processes involve complex steps like cell culture, fermentation, and protein purification which require considerable resources and costly equipment. Additionally, specialized media is often needed and facilities for large-scale production must meet high quality standards - these costly production expenses make recombinant proteins prohibitively expensive which limits affordability and accessibility, potentially slowing market expansion especially among price-sensitive segments of this sector.

Bioprocessing Efficiency Issues

Current bioprocessing strategies present one of the primary obstacles in producing recombinant proteins for Recombinant protein products. Producing therapeutic and prophylactic recombinant proteins requires complex processes and cutting-edge technologies for maximum production efficiency, in particular cell culture and fermentation operations that may incur inefficiencies that extend production timelines while decreasing yields. Innovation of efficient bioprocessing methods is vital to cutting costs and expanding scalability; yet doing it on an industrial scale remains difficult, which further restricts use of recombinant proteins as Recombinant protein supplements.

Opportunities

Development of Enhanced Protein Supplements

Gene Editing Technologies like CRISPR-Cas9 enable precise modification of genetic codes within host organisms used for protein expression, leading to highly optimized recombinant proteins with enhanced stability, bioavailability, and functionality. Many sports create enhanced protein supplements tailored specifically towards muscle recovery, growth, and athletic performance which cater specifically to certain dietary needs like plant-based or allergen-free options, etc.

Customized Nutrition Solutions

By manipulating host cell genomes, recombinant proteins can be tailored with specific functional attributes for faster absorption rates, higher amino acid content, or integration of bioactive compounds. Such innovations open opportunities for personalized Recombinant Proteins products tailored specifically towards meeting individual performance or recovery goals and needs; athletes could potentially take advantage of protein supplements designed to optimize metabolic profiles or meet sports demands that offer them a competitive edge within an increasingly dynamic Recombinant Proteins market.

Trends

Increased Demand for Insulin and Other Diabetes Therapeutics

Global diabetes rates have seen their rates skyrocket, creating an unprecedented surge in global diabetes therapeutic demand, particularly insulin and other recombinant proteins used for managing this illness. With more diabetic patients ever becoming diabetic themselves, new effective and accessible therapies must emerge that address complex needs while controlling blood sugar levels more effectively - this trend fuelling market growth as pharmaceutical companies innovate advanced personalized diabetes solutions in response to this growing need.

Advances in Recombinant Protein Development

Diabetes' growing prevalence has spurred advances in recombinant protein development as companies strive to enhance therapeutic efficacy. Researchers are making strides toward optimizing the quality, potency, and specificity of recombinant proteins; innovations include novel insulin formulations as well as long-acting biologics with sustained therapeutic benefits; advancements such as protein engineering such as biosimilar and personalized therapies are meeting patient demand more precisely while positioning companies at the forefront of diabetes care through these advances in treatment development. These developments place companies at the forefront of the market for developing recombinant proteins market for diabetes care companies are leading this revolution.

Research Scope and Analysis

By Product

Growth factors and chemokines have emerged as market leaders due to their central roles in various therapeutic and research applications, particularly cancer research, HIV/AIDS, COVID-19 immunology research, and neuroscience applications. Their widespread usage across cancer treatment, HIV/AIDS research, COVID-19 immunology research as well as regenerative medicine applications fuel market expansion - along with rising funding of cancer research studies themselves and rising therapeutic need.

Recombinant protein products manufactured specifically for therapeutic applications also aid their popularity on this front. Antibodies have seen remarkable expansion due to their crucial diagnostic applications. Recombinant antibodies have long been sought-after for their specificity and sensitivity in detecting biomarkers associated with the disease as well as specific antigens related to them assays like ELISA, western blotting, and immunohistochemistry use antibodies extensively as diagnostic tools in cancer, infection, and autoimmune disorder diagnoses thus further increasing demand across healthcare and research industries alike.

By Host Cell

Bacteria cells are predicted to dominate the recombinant proteins market based on host cells with the highest revenue share as they are their easily manipulateable genome and well-established genetic characteristics that allow precise manipulation for protein expression. Bacteria systems such as Escherichia coli (E. coli) offer lower costs compared to mammalian and insect cell-based production processes, making them an attractive solution for large-scale production.

Bacteria are ideal bioproduction systems due to their fast growth rates and ease of culture in simple media environments; producing large yields of recombinant proteins within short timeframes with ease of genetic modification and high scalability, thus furthering their appeal. Bacterial systems can produce an array of recombinant proteins for various applications, including enzymes, vaccines, and therapeutic proteins; making them highly versatile.

Mammalian systems represent another dominant segment within the market for recombinant protein production - though more expensive and complex compared to their bacterial counterparts they often prefer producing complex proteins requiring posttranslational modifications such as glycosylation for production purposes.

By Application

Drug discovery and development are predicted to be the top application of the recombinant proteins market with the highest revenue share in 2025 because it plays a crucial role in discovering novel compounds and pharmaceutical innovations. Recombinant proteins play an invaluable role in targeting disease-associated proteins and modulating protein-protein interactions to enable novel therapeutics such as biologics, vaccines, and cell or gene therapy to be developed.

These proteins offer exceptional specificity and efficiency during drug development processes, speeding the discovery of effective treatments for complex diseases. Biopharmaceutical production represents the second-largest segment within the recombinant proteins market.

Recombinant proteins have gained dominance due to increasing demand for biologics and biosimilars that rely on them as key manufacturing processes, with their ability to boost efficiency while upholding quality making them indispensable tools in scaling therapeutic solutions.

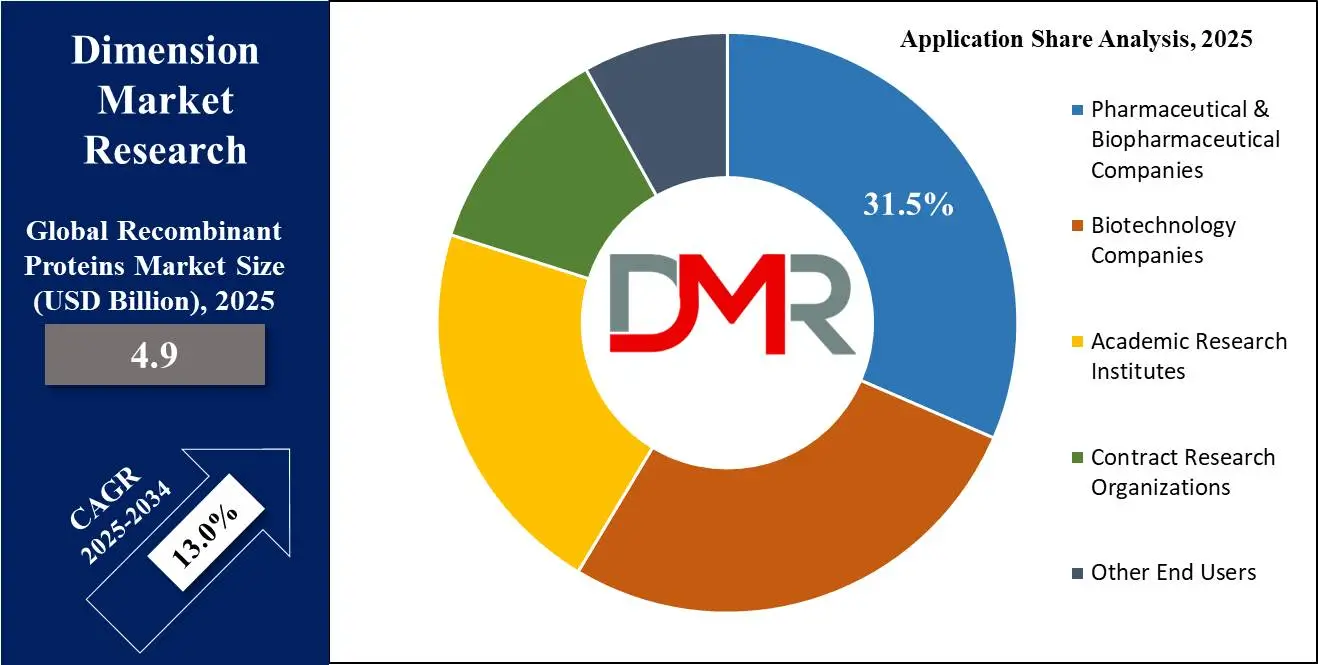

By End User

Pharmaceutical and biopharmaceutical companies are expected to dominate the recombinant proteins market with a 40.2% market share by 2025. The dominance of these companies is due to their focus on biologics & biosimilars which has led to substantial investments in research and development, creating product pipelines, innovative technologies, and bioprocessing tools designed to meet market demand for their offerings.

Rising competition, diverse applications of recombinant proteins across end-user markets as well as their capacity for commercializing production ensure they lead the industry. Biotechnology companies represent another of the key segments in the recombinant proteins market.

Biotech firms play an essential part in driving early-stage research and driving innovation through expertise in molecular biology and protein engineering to produce novel recombinant protein products, thus making a critical contribution towards market expansion and driving innovation forward. Their value to innovation, as well as application, reinforces their position within this competitive field.

The Recombinant Protein Market Report is segmented based on the following:

By Product

- Growth Factors and Chemokines

- Interferons (IFNs)

- Interleukins (ILs)

- Other growth factors & chemokines

- Immune Response Proteins

- Structural Proteins

- Membrane Proteins

- Kinase Proteins

- Regulatory Proteins

- Recombinant Metabolic Enzymes

- Adhesion Molecules and Receptors

- Other Recombinant Proteins

By Host Cell

- Bacterial Cells

- Mammalian Systems

- Insect Cells

- Yeast & Fungi

- Other host cell

By Application

- Drug Discovery & Development

- Biologics

- Vaccines

- Cell & Gene Therapy

- Biopharmaceutical Production

- Research

- Academic Research

- Biotechnology Research

- Diagnostics

- Other Applications

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Biotechnology Companies

- Academic Research Institutes

- Contract Research Organizations

- Other End Users

Regional Analysis

North America is likely to dominate the recombinant protein market with a

revenue share of 42.5% in 2025, driven by robust research spending, advanced healthcare infrastructure, and the presence of several significant market players. The region’s well-established healthcare systems and strong support for research and development (R&D) enable rapid advancements in proteomics and genomics, key fields underlying the recombinant protein market.

Chronic and infectious diseases are prevalent in North America, creating a high demand for effective treatments such as recombinant protein therapies. These proteins are extensively tested and proven for managing various disorders, making them a preferred choice for addressing the rising healthcare challenges. Furthermore, government funding opportunities and favorable policies support innovation and development in the biotechnology and pharmaceutical industries, ensuring continued growth and leadership in the market.

Additionally, the presence of prominent market players accelerates product development and commercialization, enhancing North America’s market dominance. The ongoing initiatives in research, particularly in proteomics and genomics, alongside growing R&D expenditure, reinforce the region’s position as a leader in the recombinant protein market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The leading companies in the recombinant proteins market are actively working on developing and launching innovative products, as well as implementing strategic initiatives to strengthen their market position. These key players focus on growth by prioritizing technological advancements and innovations in production methods. They make significant investments in research and development to improve expression systems and purification processes, which enhance product yield and quality.

By forming strategic alliances with biopharmaceutical firms and research organizations, they expand their product applications and enter new markets. Additionally, these companies prioritize regulatory compliance and quality assurance to establish trust and credibility within the industry. They also focus on emerging markets by adapting their products to meet local healthcare demands and making advanced therapeutic solutions more accessible.

Some of the prominent players in the global recombinant proteins market are:

- Sino Biological, Inc.

- Bio-Techne

- GenScript

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Thermo Fisher Scientific

- Proteintech Group, Inc.

- Enzo Life Sciences, Inc.

- Abnova Corporation

- RayBiotech Life Inc.

- STEMCELL Technologies Inc.

- Other Key Players

Recent Developments

- In September 2024, ScaleReady and Bio-Techne Corporation unveiled the launch of G-Rex optimized ProPak™ GMP Cytokines, specifically designed for efficient closed system manufacturing in cell and gene-modified cell therapies.

- In March 2024, Proteintech announced the opening of a new, state-of-the-art facility in the UK, significantly larger than its previous location, with expanded spaces for research, development, production, logistics, and administration.

- In August 2023, Danaher Corporation confirmed a definitive agreement to acquire Abcam Plc. Danaher will purchase all outstanding shares of Abcam for USD 24.00 each, with the total acquisition valued at approximately USD 5.7 billion, including debt and net of acquired cash.

- In January 2023, Thermo Fisher Scientific Inc. completed the acquisition of PeproTech, enhancing its biosciences business to better serve pharmaceutical and biotech sectors by adding complementary capabilities to its existing offerings.

- In October 2023, Proteintech introduced multi-rAb recombinant secondary antibodies, advancing its product range with a new generation of secondary antibodies.

- In February 2022, GenScript opened a manufacturing facility in Singapore, dedicated to highly automated protein and gene preparation services. The new site strengthens the company's protein and gene platforms and supports rapid, high-quality production for new vaccine and therapeutic developments, reinforcing its presence in the Asia Pacific region.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 4.9 Bn |

| Forecast Value (2033) |

USD 14.6 Bn |

| CAGR (2024-2033) |

13.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Growth Factors and Chemokines, Immune Response Proteins, Structural Proteins, Membrane Proteins, Kinase Proteins, Regulatory Proteins, Recombinant Metabolic Enzymes, Adhesion Molecules and Receptors, and Other Recombinant Proteins), By Host Cell (Bacterial Cells, Mammalian Systems, Insect Cell, Yeast & Fungi, and Other host cell), By Application (Drug Discovery & Development, Biopharmaceutical Production, Research, Diagnostics, and Other Applications), By End User (Pharmaceutical & Biopharmaceutical Companies, Biotechnology Companies, Academic Research Institutes, Contract Research Organizations, and Other End Users) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Sino Biological, Inc., Bio-Techne, GenScript, Bio-Rad Laboratories, Inc., Merck KGaA, Thermo Fisher Scientific, Proteintech Group, Inc., Enzo Life Sciences, Inc., Abnova Corporation, RayBiotech Life Inc., STEMCELL Technologies Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Recombinant Proteins Market size is estimated to have a value of USD 4.9 billion in 2024 and is expected to reach USD 14.6 billion by the end of 2033.

North America is expected to be the largest market share for the Global Recombinant Proteins Market with a share of about 42.5% in 2024.

Some of the major key players in the Global Recombinant protein market are Thermo Fisher Scientific, Bio-Rad Laboratories, Inc., GenScript, and many others.

The market is growing at a CAGR of 13.0 percent over the forecasted period.

The US Recombinant Proteins Market size is estimated to have a value of USD 1.8 billion in 2024 and is expected to reach USD 4.9 billion by the end of 2033.