Market Overview

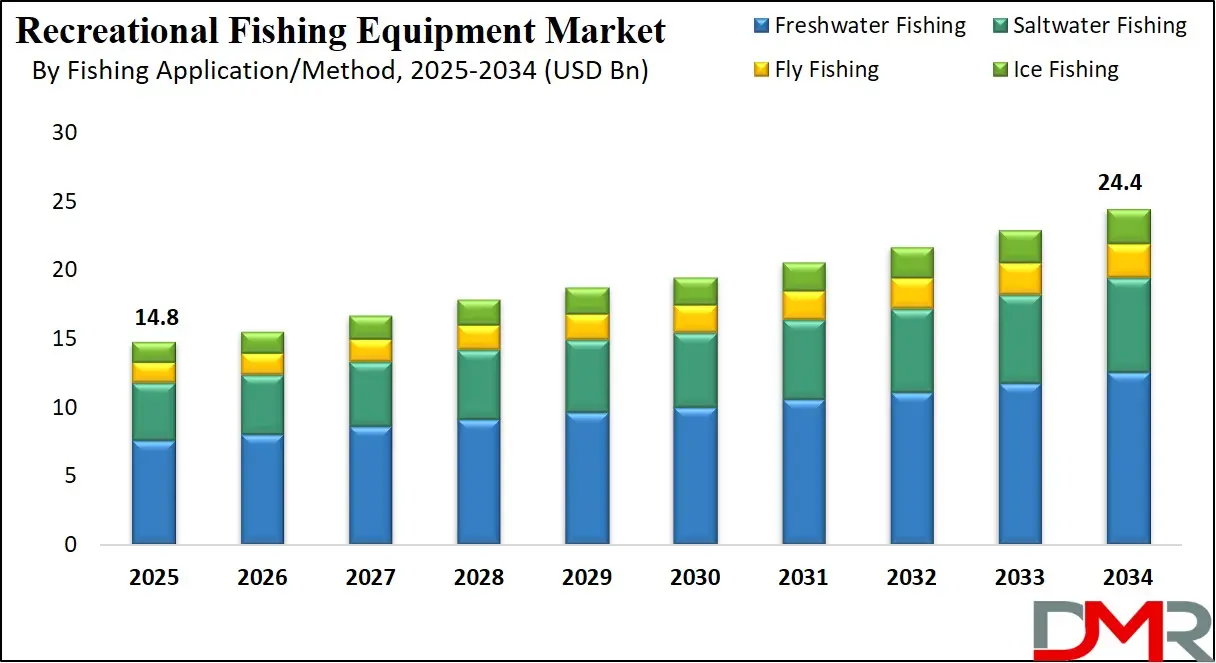

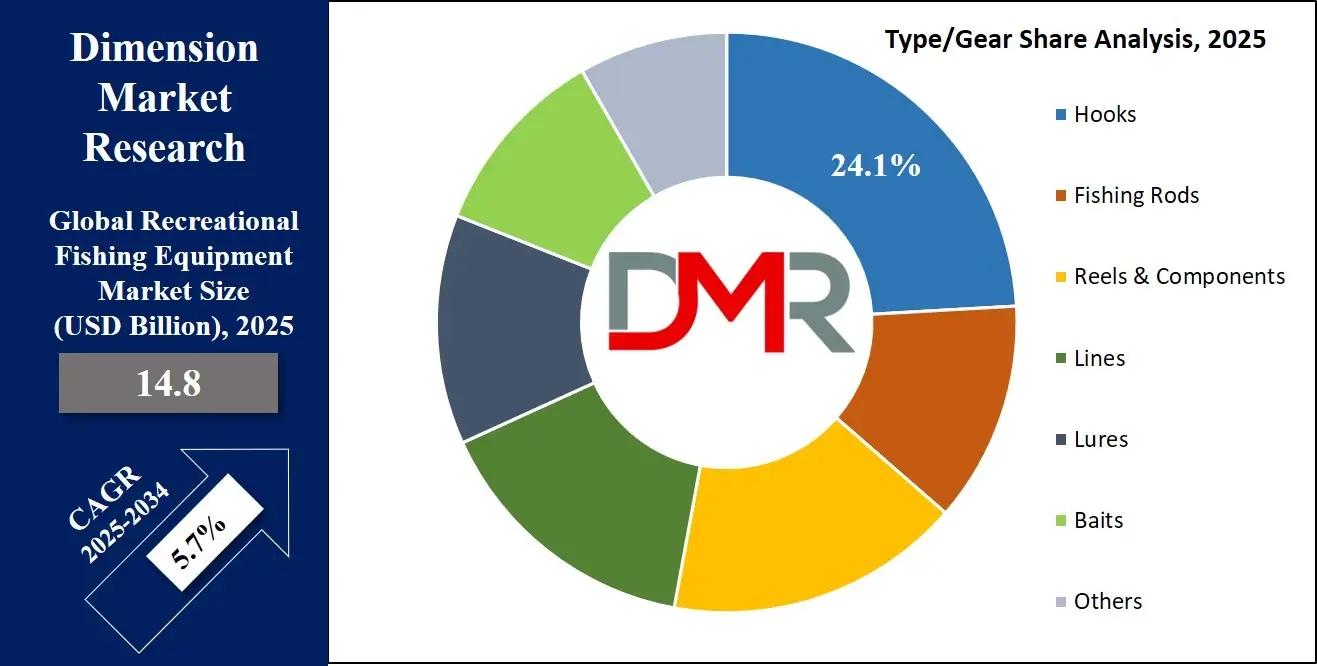

The Global Recreational Fishing Equipment Market is projected to reach USD 14.8 billion in 2025 and grow at a compound annual growth rate of 5.7% from there until 2034 to reach a value of USD 24.4 billion.

The global recreational fishing equipment market is witnessing steady expansion, driven by increasing interest in outdoor leisure and sport fishing. The market is fueled by greater access to water bodies, rising tourism, growing urbanization, and higher disposable incomes. This trend is especially notable across North America and parts of the Asia-Pacific region. Angling continues to gain traction across age groups, especially with a shift toward wellness, nature activities, and digital disconnection.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A prominent trend reshaping the market is the integration of smart technology. Products like digital fish finders, electric reels, and app-enabled fishing guides are transforming how both hobbyists and seasoned anglers engage with the sport. Simultaneously, there’s increasing demand for eco-friendly tackle such as lead-free sinkers, biodegradable baits, and recycled line spools. Lightweight, portable, and modular kits are also appealing to urban anglers and travelers with limited storage or transport options.

Significant opportunities exist in emerging regions, particularly in Southeast Asia, Latin America, and inland Africa, where freshwater bodies are plentiful but recreational fishing infrastructure remains underdeveloped. The growth of online retail, angling-focused social media influencers, and increased female participation are unlocking new demographics. Conservation-focused initiatives such as artificial reef deployment and community-led fish restocking also contribute to the long-term sustainability of the industry.

Restraints include seasonal dependency, strict environmental regulations, and volatile input costs for synthetic and carbon-based materials. Disruptions in global logistics have also impacted inventory availability for key products like rods, reels, and electronics. Despite these hurdles, prospects remain strong, with innovation, sustainability, and experiential fishing experiences leading future growth. As recreational fishing evolves into a lifestyle hobby for wellness, sport, and exploration, the market is expected to gain depth and value in the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Recreational Fishing Equipment Market

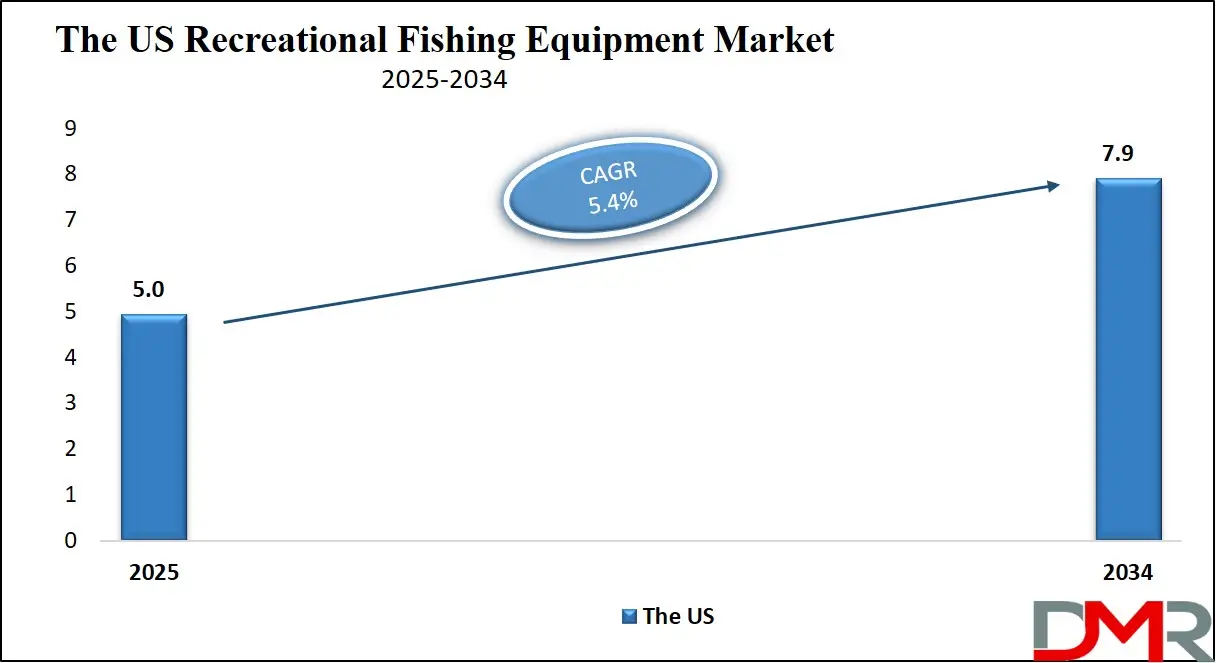

The US Recreational Fishing Equipment Market is projected to reach USD 5.0 billion in 2025 at a compound annual growth rate of 5.4% over its forecast period.

The U.S. remains the largest market for recreational fishing equipment, backed by widespread participation, high consumer spending, and well-established retail and licensing systems. According to the U.S. Fish and Wildlife Service’s most recent National Survey of Fishing, Hunting, and Wildlife-Associated Recreation, over 54.7 million Americans engaged in recreational fishing in recent years, contributing billions to the national economy through gear, licensing, and travel expenditures. Freshwater fishing is the most practiced, with bass and trout among the top targeted species.

The U.S. Census Bureau notes that the country’s expansive network of inland lakes, rivers, and coastal zones makes it uniquely suited for both freshwater and saltwater fishing. More than 12 million licensed anglers were recorded by state wildlife agencies across the country, indicating consistent and organized recreational engagement. States like Florida, Texas, and Minnesota lead in participation rates, with strong fishing tourism bolstered by favorable weather and event calendars.

Youth and family fishing programs promoted by agencies such as TakeMeFishing.org and the Recreational Boating & Fishing Foundation (RBFF) have successfully increased participation among women and younger demographics. The presence of dedicated infrastructure public boat ramps, national parks, stocked ponds further enhances access. Moreover, U.S. Department of the Interior programs support aquatic habitat restoration and species conservation, which in turn sustain fish populations vital to angling activities.

These structural, demographic, and environmental advantages make the U.S. a long-term growth engine for fishing gear manufacturers, especially for rods, reels, and smart fish-finding electronics designed for professional and casual use alike.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Recreational Fishing Equipment Market

The Europe Recreational Fishing Equipment Market is estimated to be valued at USD 2.2 billion in 2025 and is further anticipated to reach USD 3.4 billion by 2034 at a CAGR of 5.0%.

Europe’s recreational fishing equipment market, accounting for roughly 15% of global share, benefits from strong cultural heritage, environmental regulations, and widespread public access to aquatic environments. According to the European Anglers Alliance (EAA), more than 25 million Europeans participate in recreational fishing annually, particularly across countries like Germany, France, Sweden, and the United Kingdom. These figures underscore angling's significance as both a cultural pastime and a conservation-oriented outdoor activity.

European Commission data supports the sector’s social and economic value, noting that recreational fisheries contribute significantly to rural employment, eco-tourism, and water ecosystem awareness. The continent’s dense network of rivers, lakes, and marine zones like the North Sea, Baltic, and Mediterranean enables a wide range of freshwater and saltwater fishing. Urban canal and riverbank fishing are increasingly popular in metropolitan areas.

Environmental agencies across Europe enforce stringent fishing regulations, including seasonal limits, species protection, and gear restrictions. These frameworks have elevated the demand for sustainable fishing gear, such as barbless hooks, biodegradable baits, and carbon-neutral tackle boxes. The EU Biodiversity Strategy and Common Fisheries Policy both indirectly benefit the market by ensuring fish stock management and aquatic habitat restoration.

Public investment in conservation and angling access infrastructure like walkways, piers, and managed fishery lakes further expands recreational fishing opportunities. Local clubs and angling associations also play a vital role in youth education and competitive fishing events. These factors, coupled with growing digital integration and tourism rebound post-pandemic, are expected to drive moderate but sustainable growth in the European fishing gear market over the next decade.

The Japan Recreational Fishing Equipment Market

The Japan Recreational Fishing Equipment Market is projected to be valued at USD 888.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,401.4 million in 2034 at a CAGR of 5.2%.

Japan holds a unique position in the global recreational fishing equipment market due to its deep-rooted fishing culture, high product quality standards, and abundant coastal geography. With more than 6,800 islands and a long tradition of both marine and freshwater fishing, recreational angling is widely practiced across Japan’s rural and urban communities. The Ministry of Agriculture, Forestry and Fisheries (MAFF) notes that over 7 million people in Japan engage in some form of recreational fishing annually.

The country’s extensive coastline and access to rich marine biodiversity support activities such as shore casting, boat fishing, squid fishing, and fly fishing. Popular fish species include horse mackerel, flounder, sea bream, and squid. Public piers, sea parks, and freshwater reservoirs are commonly stocked and managed by local governments to encourage angling tourism and weekend recreational use.

Japan’s demographic trends show a high interest in leisure among the aging population, with fishing being a low-impact, socially enriching outdoor activity. Local municipalities and prefectural governments support angling festivals, community clubs, and shoreline cleanups. Educational institutions also include fishing in outdoor curricula and summer camp programs, fostering early adoption.

High-quality domestic brands like Shimano and Daiwa have set global benchmarks for precision reels, rods, and line technology, positioning Japan as both a consumer and innovator in the market. Additionally, the Ministry of Environment supports marine protection zones and fish stock preservation, ensuring long-term ecological stability for recreational anglers. Japan’s balance of innovation, accessibility, and conservation makes it a key hub for premium recreational fishing gear.

Global Recreational Fishing Equipment Market: Key Takeaways

- Global Market Size Insights: The Global Recreational Fishing Equipment Market size is estimated to have a value of USD 14.8 billion in 2025 and is expected to reach USD 24.4 billion by the end of 2034.

- The Global Market Growth Rate:The market is growing at a CAGR of 5.7 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Recreational Fishing Equipment Market is projected to be valued at USD 5.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.9 billion in 2034 at a CAGR of 5.4%.

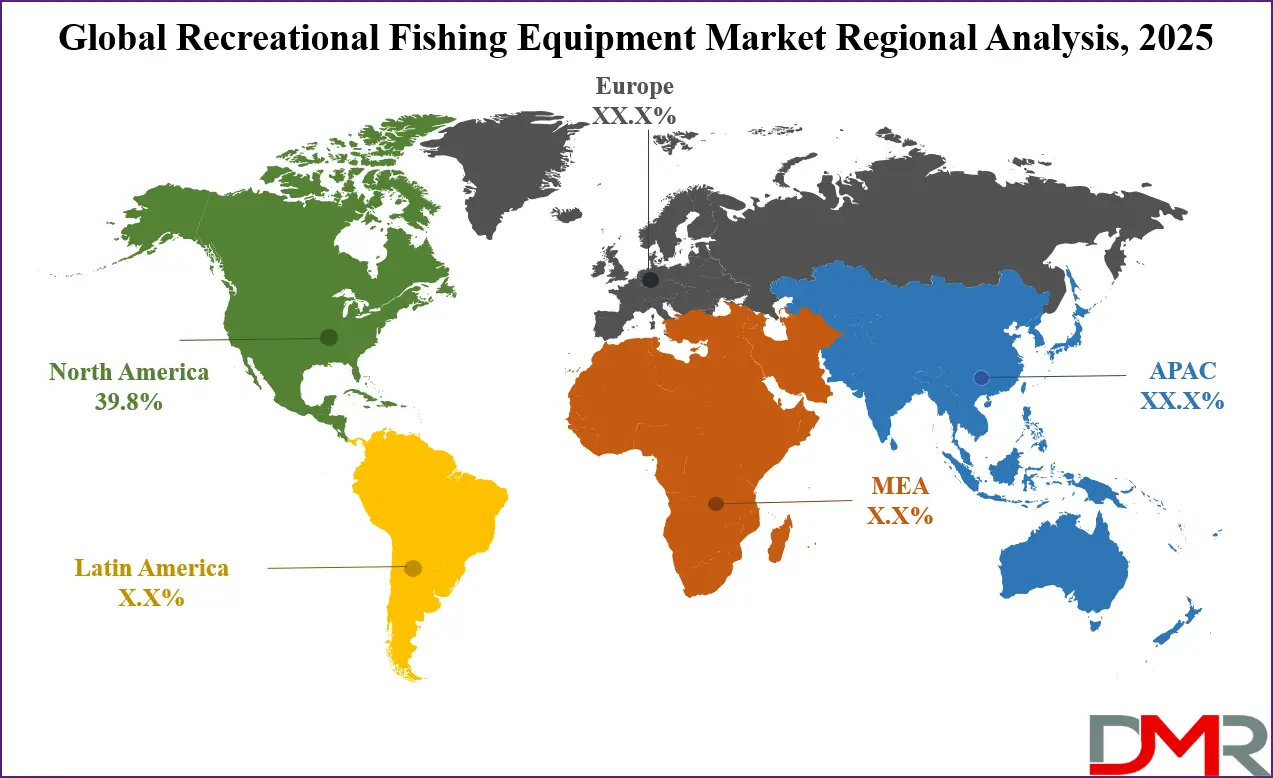

- Regional Insights: North America is expected to have the largest market share in the Global Recreational Fishing Equipment Market with a share of about 39.8% in 2025.

- Key Players: Some of the major key players in the Global Recreational Fishing Equipment Market are Shimano Inc., Pure Fishing, Inc., Daiwa Corporation, Rapala VMC Corporation, Johnson Outdoors Inc., , and many others.

Global Recreational Fishing Equipment Market: Use Cases

- Bass Fishing Tournaments: Anglers in the U.S. use premium rods, baitcasting reels, and sonar devices to compete in professional bass tournaments, driving demand for high-performance equipment with fast-action sensitivity and drag precision.

- Urban Family Fishing Events: Cities host family-friendly fishing days using simple rod-and-reel combos, biodegradable bait, and stocked ponds to promote beginner participation, youth education, and sustainable community recreation.

- Fly Fishing in European Rivers: Recreational fly fishers in the UK and Germany use specialized rods, waders, and artificial flies to target trout and salmon in regulated freshwater ecosystems, fostering eco-tourism and conservation.

- Kayak Fishing in Australia: Outdoor enthusiasts outfit fishing kayaks with rod holders, tackle crates, and GPS fish finders to access remote saltwater zones along Australian coasts, blending sport fishing with exploration.

- Ice Fishing in Nordic Countries: Anglers in Finland and Sweden drill holes in frozen lakes to use compact ice rods, insulated gear, and digital sonar, turning sub-zero environments into vibrant seasonal fishing experiences.

Global Recreational Fishing Equipment Market: Stats & Facts

U.S. Fish and Wildlife Service (FWS):

- Over 52.4 million Americans participated in recreational fishing in 2022.

- Freshwater fishing attracted 41.8 million participants; saltwater fishing drew 13.8 million.

- Recreational anglers spent more than USD 49.8 billion on fishing-related expenses in the U.S. in 2022.

- Fishing participation among women rose by 4.4% between 2020 and 2022.

- Youth (ages 6–17) accounted for 13.4 million fishing participants in 2022.

NOAA (National Oceanic and Atmospheric Administration):

- U.S. marine recreational anglers caught approximately 950 million fish in 2022.

- 66% of those fish were released alive, highlighting the growing catch-and-release trend.

- The Atlantic and Gulf coasts saw the highest saltwater fishing activity.

- Recreational fishing contributes over USD 37 billion to the U.S. GDP annually.

- Over 472,000 U.S. jobs are supported directly or indirectly by recreational saltwater fishing.

European Anglers Alliance (EAA):

- Europe has 25 million recreational fishers, representing nearly 5.5% of the EU population.

- Germany, France, and the UK have the highest number of licensed anglers.

- Recreational sea fishing in Europe supports over 100,000 jobs.

- Catch-and-release practices are now common in more than 60% of freshwater fishing activities across Europe.

Japan Ministry of Agriculture, Forestry and Fisheries (MAFF):

- Japan had over 9 million recreational anglers as of 2021.

- Shore-based fishing is the most common method among recreational fishers in Japan.

- The Japanese government has launched national programs to promote eco-friendly angling tourism.

- Local fishing cooperatives oversee over 3,000 fishing spots dedicated to recreational fishing.

Recreational Boating & Fishing Foundation (RBFF):

- The number of first-time fishing participants in the U.S. reached 4.1 million in 2022.

- Over 90% of participants cited fishing as a great way to relieve stress and connect with nature.

- Hispanic fishing participation increased by 7.7% year-over-year.

- Families with children represent 35% of total U.S. fishing outings annually.

- Bank fishing is the most popular form, accounting for 45% of trips.

Australian Fisheries Management Authority (AFMA):

- Over 3.5 million Australians participate in recreational fishing annually.

- Recreational fishers in Australia contribute over AUD 2.5 billion to the economy.

- Boat-based fishing accounts for around 55% of total catch volumes.

- State licensing schemes help manage access and fund habitat restoration projects.

- Youth fishing clinics hosted nationwide attract over 50,000 participants yearly.

Global Recreational Fishing Equipment Market: Market Dynamic

Driving Factors in the Global Recreational Fishing Equipment Market

Rising Outdoor Participation Post-Pandemic

The aftermath of the COVID-19 pandemic led to a global resurgence in outdoor and nature-based recreational activities, including fishing. Fishing provided a safe, socially distanced way to enjoy leisure, reduce stress, and reconnect with nature especially during lockdowns and periods of limited indoor access. According to the U.S. Fish and Wildlife Service, fishing participation increased significantly between 2020 and 2022, with over 50 million Americans casting a line annually. Similar upward trends were observed across Europe, Japan, and Australia. This surge in participation triggered higher demand for rods, reels, tackle boxes, lures, and outdoor accessories.

Families, youth groups, and first-time fishers formed a new wave of consumers. Industry stakeholders, including sporting goods stores and e-commerce platforms, capitalized by offering beginner kits and educational content. The broader societal focus on wellness and unplugged lifestyles further bolsters the driver. Fishing has become not just a hobby but a therapeutic and lifestyle choice for millions globally, creating sustained demand for quality and affordable fishing gear across demographics.

Government Support and Licensing Infrastructure

Public policies and institutional support continue to be vital drivers of the recreational fishing equipment market. Many countries offer affordable fishing licenses, implement conservation programs, and fund fishing events and public education campaigns to promote the sport. In the U.S., excise taxes on fishing gear and licenses directly fund conservation and fishery restoration through the Sport Fish Restoration Program. In Europe, state agencies collaborate with fishing federations to promote angling tourism, while in Japan, local fishing cooperatives manage well-regulated fishing zones and infrastructure.

These frameworks ensure stock sustainability while stimulating regional economies. Several governments also invest in maintaining water bodies, artificial fish habitats, and designated fishing parks, which improves access and attractiveness for new and seasoned anglers alike.

Additionally, youth-focused campaigns and national "Free Fishing Days" help increase early exposure and participation. Such support not only strengthens market demand but also fosters a responsible, long-term ecosystem where the growth of fishing equipment sales correlates directly with expanded access and regulated angling experiences.

Restraints in the Global Recreational Fishing Equipment Market

Environmental Regulations and Fishing Restrictions

Environmental concerns and the corresponding tightening of fishing regulations pose significant restraints on the recreational fishing equipment market. Governments and environmental bodies are increasingly restricting fishing seasons, species targeting, and the use of specific gear types to preserve biodiversity and marine ecosystems. For instance, bans on lead-based tackle due to toxicity, catch limits to protect overfished species, and no-fishing zones in sensitive habitats directly affect consumer demand and product categories.

These regulations, although crucial for sustainability, often result in reduced product turnover or inventory obsolescence. Manufacturers must frequently adapt to shifting compliance standards, which can inflate production costs. Additionally, fish stock depletion in certain popular angling locations leads to reduced visitation and sales. New conservation laws can discourage novice anglers due to complexity and perceived difficulty, affecting new customer acquisition.

High Equipment Costs and Limited Access in Emerging Economies

Despite rising interest in recreational fishing globally, affordability remains a key barrier in many developing markets. Quality rods, reels, sonar devices, and branded tackle can be prohibitively expensive for large segments of potential users in countries across Africa, South Asia, and Latin America. Import duties, supply chain challenges, and limited local manufacturing raise retail prices further. Additionally, access to fishing spots, proper licensing, and knowledge resources are often lacking in rural or underserved regions. This disparity creates a significant market gap, limiting penetration and growth scalability.

The perception of fishing as a sport for affluent individuals deters mass adoption in several price-sensitive regions. Moreover, traditional subsistence fishing often replaces recreational use in many communities, reducing the need for advanced equipment. While affordable or second-hand gear options exist, they often lack durability and features required by modern enthusiasts. Bridging this accessibility gap will require coordinated efforts between governments, NGOs, and private players to democratize fishing and make gear more inclusive and economically viable.

Opportunities in the Global Recreational Fishing Equipment Market

Expansion of Recreational Fishing Tourism Globally

Recreational fishing tourism is an emerging frontier offering lucrative growth opportunities for the equipment market. With scenic water bodies, coastal getaways, and exotic rivers being marketed as angling destinations, international and domestic travel packages centered on fishing experiences are proliferating. Countries such as New Zealand, Canada, Brazil, and parts of Africa have gained traction for hosting sport fishing expeditions, often attracting high-income travelers willing to invest in premium gear.

This global tourism expansion boosts the demand for portable rods, travel kits, weatherproof gear, protective clothing, and high-performance reels. The hospitality sector is also collaborating with tackle brands to offer equipment rentals and guided fishing trips, increasing brand exposure. Regions with rich biodiversity and underexploited fishing spots represent untapped potential. These developments are particularly important in the context of post-pandemic revenge travel and experience-based tourism.

E-commerce Penetration and Direct-to-Consumer Sales

The digitalization of retail has opened expansive opportunities for the recreational fishing equipment market. Online platforms now serve as major distribution channels for rods, reels, bait, and accessories, reaching urban and rural consumers alike. From Amazon to niche angling sites, e-commerce enables easy price comparisons, product reviews, and quick delivery, especially in regions where physical stores are scarce.

Direct-to-consumer (D2C) brand models are flourishing as well, offering personalized gear, subscription boxes, and online customization. Social media marketing and influencer endorsements have further enhanced brand visibility and consumer engagement, particularly among millennials and Gen Z audiences. Emerging markets in Asia, Latin America, and Eastern Europe are witnessing strong e-commerce growth, enabling global access to premium and budget-friendly equipment alike. During COVID-19, the convenience and safety of online ordering accelerated digital sales, and the momentum continues post-pandemic.

Trends in the Global Recreational Fishing Equipment Market

Technological Advancement in Smart Fishing Gear

The market is experiencing a notable shift toward smart, tech-enabled fishing equipment. Anglers are increasingly adopting sonar fish finders, GPS-enabled rods, digital bite alarms, and smart reels with built-in Bluetooth and tracking features. These innovations enhance catch rates and provide real-time data analytics, offering an improved user experience even for amateur fishers. The integration of IoT in fishing gear supports location scouting, weather monitoring, and underwater imaging, leading to greater user engagement. Companies are also releasing app-connected tools for remote control and data sync, appealing to younger, tech-savvy demographics.

This growing demand for digitized angling gear is transforming fishing into a more analytical and data-driven recreational sport. The trend is especially prominent in North America, Europe, and Japan, where high disposable incomes and hobbyist culture intersect with rising interest in technology. As sustainability becomes a concern, smart gear is also aiding responsible fishing practices by alerting users about overfishing or endangered species zones, thus aligning technology with conservation goals.

Sustainable and Eco-Friendly Equipment Demand

Environmental consciousness is influencing consumer preferences in the recreational fishing equipment market. Anglers are increasingly seeking biodegradable fishing lines, non-lead sinkers, barbless hooks, and reusable bait containers that reduce ecological damage. Governments and fishing associations are reinforcing these trends by promoting gear that minimizes harm to aquatic life and ecosystems. For instance, several U.S. states and European countries have placed bans on lead-based tackle due to toxicity in water bodies. In response, manufacturers are innovating with non-toxic alternatives like tin, tungsten, and steel. Sustainable packaging, recycled rod materials, and solar-powered accessories are becoming more mainstream.

This trend is further supported by eco-label certifications that help consumers identify environmentally responsible products. Social media and fishing forums have amplified awareness, encouraging peer influence and community-wide adoption. The convergence of environmental responsibility with product innovation is pushing companies to redefine their value propositions. Consequently, sustainable product lines are not only becoming a necessity but also a competitive differentiator in the global recreational fishing gear market.

Global Recreational Fishing Equipment Market: Research Scope and Analysis

By Type/Gear Analysis

Fishing rods is projected to continue to dominate the type/gear segment of the recreational fishing equipment market due to their irreplaceable role in all fishing styles freshwater, saltwater, fly, and ice fishing. Unlike hooks or reels that are often used interchangeably or upgraded periodically, rods are foundational and are typically the first purchase for both novice and experienced anglers. Technological innovation in materials, such as carbon fiber, fiberglass, and composite blends, has drastically enhanced durability, sensitivity, and casting accuracy. These advances attract premium buyers, while affordable models continue to appeal to entry-level hobbyists.

The increasing availability of technique-specific rods, such as telescopic rods for travel or fast-action rods for sport fishing, also expands consumer choice and spending per angler. In markets like the U.S. and Japan, anglers often own multiple rods for various conditions, boosting volume demand. Additionally, fishing rod manufacturers focus heavily on ergonomics, lightweight designs, and customizable grip options, catering to a wide spectrum of users, including children, seniors, and women.

The rising popularity of adventure tourism and angling as a social sport is further driving demand for fishing rods globally. Branded collaborations with influencers and local tournaments also contribute to growth by creating aspirational value around rod performance. Fishing rods dominate the type segment because they are central to both performance and the angler’s identity, encouraging repeat purchases, seasonal upgrades, and equipment diversification none of which is as pronounced with other gear components.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Fishing Application/Method Analysis

Freshwater fishing is poised to dominates the application segment of the recreational fishing equipment market primarily due to its accessibility, low barrier to entry, and global distribution of freshwater bodies. Lakes, ponds, rivers, and reservoirs exist in abundance across North America, Europe, and parts of Asia-Pacific, enabling year-round freshwater angling in both urban and rural settings. As most fishing beginners start in freshwater environments, this method enjoys a broad user base, from children and casual weekend fishers to serious hobbyists.

Freshwater fishing also allows greater versatility in techniques such as spinning, baitcasting, jigging, and float fishing resulting in demand for a diverse range of gear including rods, reels, lures, and bait types. The equipment required is generally more affordable and portable than that used for saltwater or fly fishing, making it accessible to a wide demographic. This inclusivity fuels repeat purchases and interest in product upgrades.

Government agencies and wildlife departments also actively promote freshwater fishing through licensing programs, conservation efforts, and community engagement activities. For example, U.S. states like Minnesota, Michigan, and Wisconsin have extensive lake networks and provide incentives to boost angling tourism. Moreover, the catch-and-release model in many freshwater settings encourages ethical fishing practices while still sustaining tackle and accessory sales.

Freshwater fishing’s low entry cost, extensive reach, and diversity of fishing opportunities ensure it remains the dominant application method, contributing significantly to equipment sales, licensing revenues, and regional outdoor recreation economies worldwide.

By Distribution Channel Analysis

Specialty and sporting-goods stores is poised to dominate the distribution channel for recreational fishing equipment due to their in-depth product range, professional guidance, and community-centric customer service. These outlets such as Bass Pro Shops, Cabela’s, Dick’s Sporting Goods, and region-specific independent retailers are widely trusted by both amateur and seasoned anglers. Their physical presence allows buyers to physically inspect gear such as rods, reels, and apparel, test grip and weight, and receive real-time advice based on local fishing conditions.

One of the key strengths of this channel lies in tailored recommendations, which are essential for new buyers who may not fully understand product specifications. Many stores also organize workshops, fishing tournaments, and gear demonstration days, which foster strong brand loyalty. In contrast to online retailers, these stores provide instant gratification with immediate product availability and fewer post-purchase returns due to the hands-on buying experience.

Specialty retailers often stock exclusive gear or regionally adapted products that cater to the specific needs of local ecosystems, fish species, and regulations. In-store services such as reel spooling, rod repair, and custom lure design add further value to the shopping experience. Moreover, these stores often partner with leading brands for promotional events and loyalty programs, increasing footfall and repeat purchases.

As a result, despite the convenience of e-commerce, specialty/sporting-goods stores maintain their lead in this segment by offering personalized service, community connection, and product authenticity that online-only channels struggle to replicate.

The Global Recreational Fishing Equipment Market Report is segmented on the basis of the following:

By Type/Gear

- Hooks

- Fishing Rods

- Reels & Components

- Spools

- Drag Systems

- Electric Reels

- Lines

- Monofilament

- Braided

- Fluorocarbon

- Lures

- Crankbaits

- Jigs

- Soft Plastics

- Baits

- Others

By Fishing Application / Method

- Freshwater Fishing

- Saltwater Fishing

- Fly Fishing

- Ice Fishing

By Distribution Channel

- Online Retail

- Specialty / Sporting‑Goods Stores

- Department Stores / Hypermarkets

- Catalog & Rental Services

Impact of Artificial Intelligence in the Global Recreational Fishing Equipment Market

- Smart Fish-Finding Technology: AI-enabled sonar and fish finder systems now offer real-time fish detection by learning fish behaviors, water temperatures, and movement patterns. These systems, integrated into boats or mobile devices, help anglers locate fish with far greater accuracy than traditional sonar, enhancing catch rates and user satisfaction.

- Predictive Fishing Forecasting: AI models analyze historical catch data, weather conditions, lunar cycles, and water parameters to generate fishing forecasts. Apps and smart devices can now recommend the best fishing times, locations, and bait choices, empowering recreational fishers with data-driven decision-making.

- AI-Based Equipment Customization: AI tools help brands personalize fishing rods, reels, and tackle based on user preferences, grip strength, and style. This leads to better ergonomics and performance, especially in e-commerce channels where virtual fittings and recommendations improve customer experience and reduce returns.

- Autonomous Drones & Watercraft: AI-powered fishing drones and autonomous boats are being used to scout fishing areas, drop bait with precision, and record underwater activity. These systems expand accessibility and appeal to tech-savvy and younger fishing enthusiasts.

- Inventory Optimization for Retailers: AI algorithms optimize inventory and supply chains for distributors and online retailers, ensuring faster restocking of popular gear and predicting seasonal demand shifts. This enhances availability and reduces stock-outs and overstocking.

- Enhanced Training & Simulation Tools: AI-based fishing simulators provide immersive, realistic training experiences for novice anglers. Using haptic feedback and behavioral learning, these systems mimic fishing conditions, helping new entrants gain confidence before engaging in real-world fishing.4

Global Recreational Fishing Equipment Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global recreational fishing equipment market with 39.8% of the total revenue by the end of 2025, owing to its deep-rooted fishing culture, expansive water bodies, and high consumer spending on outdoor recreation. The U.S., in particular, is home to a large base of licensed anglers over 50 million according to the U.S. Fish and Wildlife Service which fuels continuous demand for fishing rods, reels, tackle, and accessories. States like Florida, Minnesota, Texas, and Michigan are well-known fishing destinations with abundant lakes, rivers, and coastal access. These regions drive robust seasonal sales and host frequent local and national fishing tournaments that promote the adoption of premium gear.

The region also benefits from well-developed retail infrastructure. Established players such as Bass Pro Shops, Cabela’s, and Dick’s Sporting Goods offer specialized in-store experiences and curated product selections that increase customer engagement and repeat sales. Moreover, the rise in eco-tourism, recreational boating, and angler education programs supported by state governments and non-profits have reinforced the cultural importance of fishing as a family and leisure activity.

Technological innovation is another key factor. North American brands lead in introducing smart fishing gear such as sonar fish finders, GPS-integrated reels, and app-connected rod sensors. These advancements attract hobbyists and tech-savvy consumers alike.

Additionally, North America enjoys a mature e-commerce ecosystem, making gear widely accessible even in remote locations. The region's strong regulatory frameworks and conservation programs also maintain fish stock health, ensuring sustainable fishing experiences and long-term equipment demand. All these factors make North America the dominant region in the global market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Asia Pacific is poised to witnessing the fastest growth in the recreational fishing equipment market, driven by a combination of rising disposable incomes, growing urban stress levels, and expanding coastal and freshwater fishing opportunities. Countries such as China, Japan, South Korea, and Australia are at the forefront of this surge, with emerging economies like India, Vietnam, and Indonesia rapidly catching up.

A significant factor behind the region’s high CAGR is the increasing adoption of recreational fishing as a wellness and tourism activity. In densely populated urban centers, fishing is gaining popularity as a relaxing, weekend getaway pursuit. Governments and tourism boards across APAC are investing in recreational infrastructure including fishing parks, coastal docks, and lakeside resorts, especially in Southeast Asia. This is catalyzing the sale of fishing rods, reels, bait, and wearables tailored to both beginners and experienced anglers.

Japan and South Korea are innovation hubs in fishing gear manufacturing, known for high-quality reels, carbon fiber rods, and lure designs. These countries not only contribute to local consumption but also serve as export leaders across the global market, reinforcing regional growth. Additionally, the rise of e-commerce platforms like Rakuten, Shopee, and Alibaba has made a wide variety of equipment accessible to rural and remote buyers at competitive prices.

Youth engagement is also on the rise, spurred by social media fishing influencers and YouTube channels showcasing fishing as a lifestyle. Combined with rapid urbanization and improving logistics infrastructure, these trends are propelling Asia Pacific’s recreational fishing equipment market at the highest CAGR globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Recreational Fishing Equipment Market: Competitive Landscape

The global recreational fishing equipment market is highly competitive, characterized by a mix of multinational corporations, regional manufacturers, and niche premium brands. Key players include Shimano Inc., Pure Fishing, Inc., Daiwa Corporation, Rapala VMC Corporation, G. Loomis, and Okuma Fishing Tackle Corp. These companies dominate through extensive product portfolios, global distribution networks, and continuous innovation in gear design and materials.

Shimano and Daiwa, based in Japan, lead in precision-engineered reels and rods, benefiting from decades of R&D and a reputation for quality. They compete heavily in both developed and emerging markets by offering models tailored to skill level and fishing method. Pure Fishing, a U.S.-based conglomerate with brands like Abu Garcia, Berkley, and PENN, leverages strong branding and strategic acquisitions to enhance its global footprint.

Rapala VMC specializes in fishing lures and accessories, maintaining dominance through design innovation and geographic expansion. Regional players, particularly in China and South Korea, offer cost-competitive alternatives, intensifying price-based competition, especially online.

Companies are increasingly focused on sustainability by introducing eco-friendly packaging, biodegradable lures, and compliance with local fishing regulations. Additionally, partnerships with tourism boards and outdoor retailers help brands increase visibility and trust among new users.

E-commerce strategies, influencer marketing, and mobile app integration (for smart rods and tackle boxes) are becoming essential to remain competitive. While the market is fragmented, leading players maintain their edge through product performance, customer experience, and brand loyalty.

Some of the prominent players in the Global Recreational Fishing Equipment Market are:

- Shimano Inc.

- Pure Fishing, Inc.

- Daiwa Corporation

- Rapala VMC Corporation

- Johnson Outdoors Inc.

- Zebco Brands

- Okuma Fishing Tackle Co., Ltd.

- St. Croix Rods

- G. Loomis, Inc.

- Eagle Claw Fishing Tackle Co.

- Berkley

- Penn Fishing

- KastKing

- Abu Garcia

- Pflueger

- Tica Fishing Tackle

- 13 Fishing

- Piscifun

- Hardy

- Orvis Company, Inc.

- Other Key Players

Recent Developments in the Global Recreational Fishing Equipment Market

- February 2025: CenSea acquired Ocean Garden’s portfolio to enhance its fishing gear reach and expand its aquaculture distribution network, aligning with its strategy of strengthening its position in global seafood equipment and supply chain integration.

- February 2025: Yumbah Aquaculture announced a proposed merger with Clean Seas Seafood, reflecting ongoing consolidation within aquaculture-based fisheries equipment sectors to increase scalability, streamline operations, and improve supply chain control in premium fish farming.

- January 2025: Mowi completed the acquisition of Nova Sea to boost its fisheries dominance and increase vertical integration across seafood logistics and gear supply chains, improving operational synergies and expanding its influence in gear-linked aquaculture equipment markets.

- December 2024: Aquaship and Intership acquired FSV in a strategic move to bolster capabilities in industrial fisheries support vessels, directly influencing marine logistics infrastructure and the demand for specialized fishing and aquaculture equipment.

- October 2024: The 16th Weihai Fishing Gear Expo took place October 12–14, showcasing rods, reels, hooks, boats, and accessories. Over 1,400 exhibitors and 3,000 buyers participated, underlining strong global demand for recreational and commercial fishing equipment.

- September 2024: The China (Yantai) Deep Sea Aquaculture and Marine Fisheries Equipment Expo, held September 5–7, featured 20,000 sqm of exhibitions focused on deep-sea fishing gear, aquaculture machinery, and fostering industry-academia innovation across marine technology segments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.8 Bn |

| Forecast Value (2034) |

USD 24.4 Bn |

| CAGR (2025–2034) |

5.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 5.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type/Gear (Hooks, Fishing Rods, Reels & Components, Lines, Lures, Baits, and Others), By Fishing Application/Method (Freshwater Fishing, Saltwater Fishing, Fly Fishing, and Ice Fishing), By Distribution Channel (Online Retail, Specialty/Sporting-Goods Stores, Department Stores/Hypermarkets, and Catalog & Rental Services |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Shimano Inc., Pure Fishing, Inc., Daiwa Corporation, Rapala VMC Corporation, Johnson Outdoors Inc., Zebco Brands, Okuma Fishing Tackle Co., Ltd., St. Croix Rods, G. Loomis, Inc., Eagle Claw Fishing Tackle Co., Berkley, Penn Fishing, KastKing, Abu Garcia, Pflueger, Tica Fishing Tackle, 13 Fishing, Piscifun, Hardy, Orvis Company, Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Recreational Fishing Equipment Market?

▾ The Global Recreational Fishing Equipment Market size is estimated to have a value of USD 14.8 billion in 2025 and is expected to reach USD 24.4 billion by the end of 2034.

What is the growth rate in the Global Recreational Fishing Equipment Market in 2025?

▾ The market is growing at a CAGR of 5.7 percent over the forecasted period of 2025.

The market is growing at a CAGR of 5.7 percent over the forecasted period of 2025.

▾ The US Recreational Fishing Equipment Market is projected to be valued at USD 5.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.9 billion in 2034 at a CAGR of 5.4%.

Which region accounted for the largest Global Recreational Fishing Equipment Market?

▾ North America is expected to have the largest market share in the Global Recreational Fishing Equipment Market with a share of about 39.8% in 2025.

Who are the key players in the Global Recreational Fishing Equipment Market?

▾ Some of the major key players in the Global Recreational Fishing Equipment Market are Shimano Inc., Pure Fishing, Inc., Daiwa Corporation, Rapala VMC Corporation, Johnson Outdoors Inc., , and many others.