Market Overview

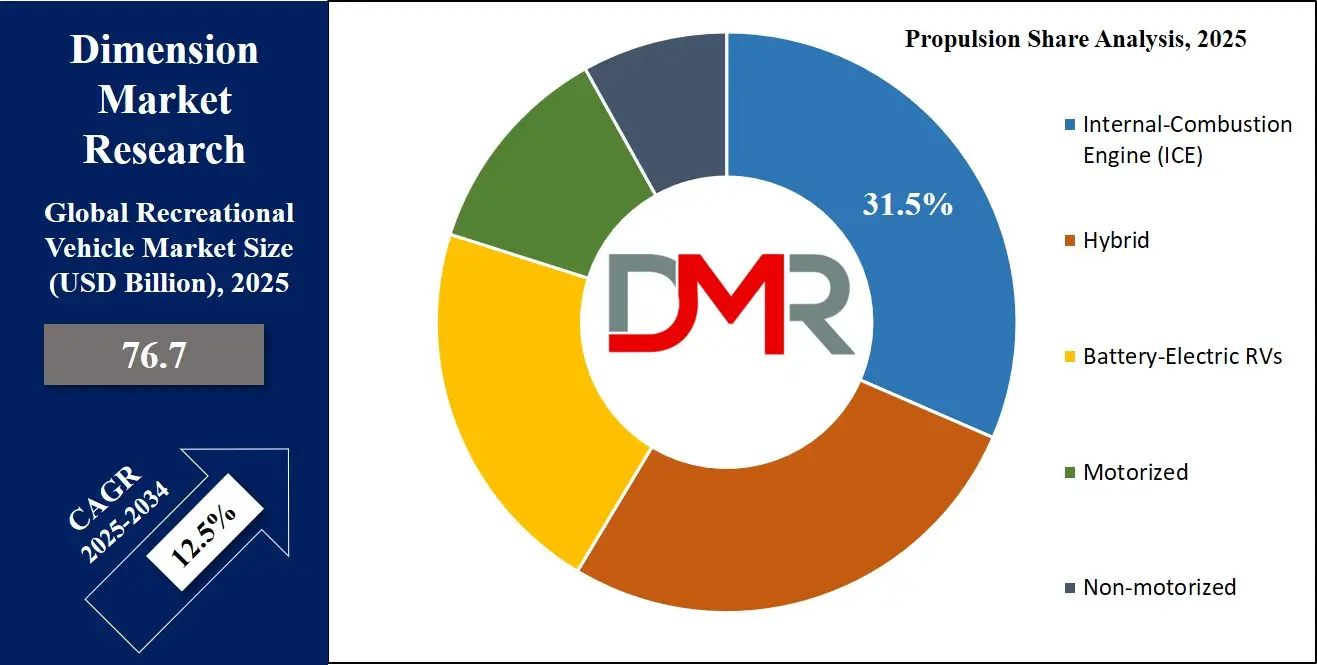

The Global Recreational Vehicle Market is projected to reach USD 76.7 billion in 2025 and grow at a compound annual growth rate of 12.5% from there until 2034 to reach a value of USD 220.6 billion.

The global recreational vehicle market is experiencing sustained momentum, driven by evolving consumer lifestyles, increased leisure travel, and a rising preference for mobile living. The market is poised for substantial expansion, reflecting strong demand and widespread adoption of recreational vehicles across both developed and emerging regions. Growth is fueled by technological innovations such as the integration of solar energy systems, lithium-ion battery packs, and advanced smart connectivity features. The rising prevalence of remote work and the growing digital nomad community are redefining travel habits, as individuals and families increasingly prioritize flexibility and immersive outdoor experiences.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Emerging economies throughout Asia-Pacific are witnessing growing RV adoption, supported by improved infrastructure, rising income levels, and expanding tourism development. North America continues to dominate with a well-established RV culture and vast geographic mobility. Europe is gaining traction with energy-efficient, compact motorhomes that align with its carbon neutrality and environmental goals. The momentum is further propelled by heightened interest in domestic travel and staycations.

Opportunities are emerging in the development of electric and hybrid recreational vehicles, driven by environmental mandates, green energy incentives, and expanding charging networks. Moreover, digital rental platforms are democratizing access to RVs, attracting a younger and more diverse user base while supporting shared economy models.

Challenges do exist in the form of high initial purchase costs, regulatory licensing variations, and underdeveloped EV infrastructure in certain areas. Fluctuations in fuel prices and seasonal usage trends also pose constraints. Nonetheless, the long-term outlook remains optimistic as innovation, personalization, and sustainability continue to shape the future of recreational mobility.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Recreational Vehicle Market

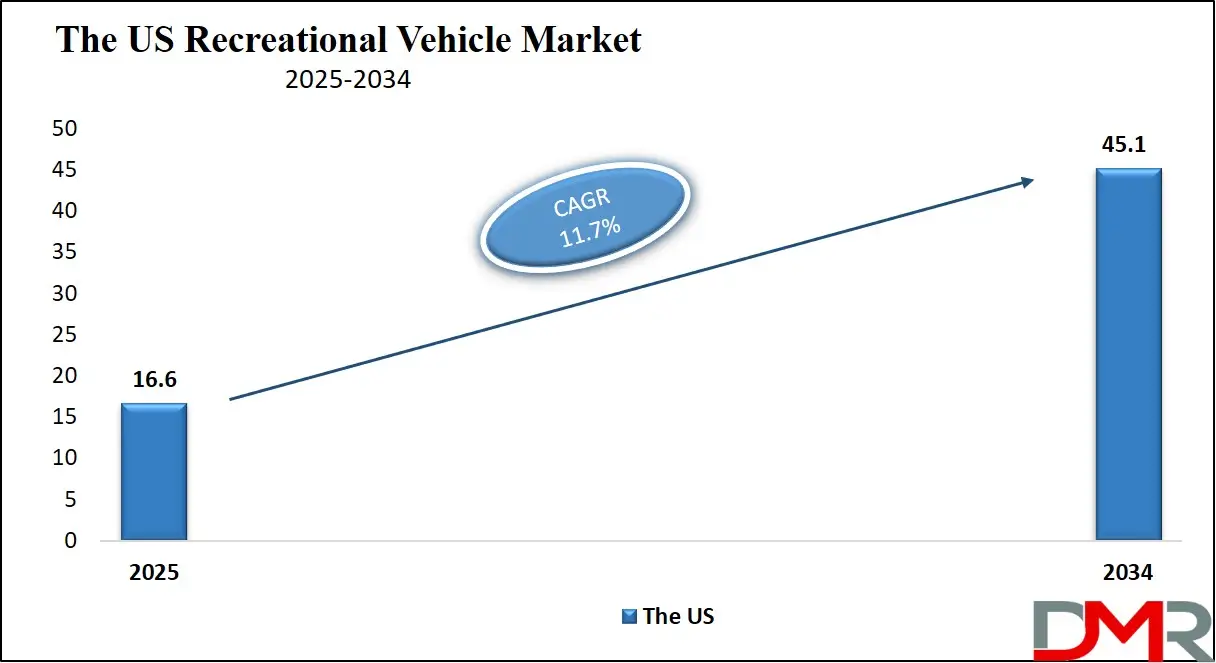

The US Recreational Vehicle Market is projected to reach USD 16.6 billion in 2025 at a compound annual growth rate of 11.7% over its forecast period.

The U.S. recreational vehicle market is one of the most established globally, underpinned by a robust travel culture, expansive highways, and a deep-rooted tradition of road-based exploration. According to data from the U.S. Census Bureau and the Bureau of Economic Analysis, over 11 million U.S. households owned an RV as of recent counts. The Federal Highway Administration reports that America has more than 4 million miles of navigable roadways, providing a perfect foundation for domestic RV travel. The National Park Service recorded over 325 million visits to U.S. national parks in a single year, reinforcing the role of RVs in enabling outdoor recreation.

The demographic landscape supports continued growth. Baby Boomers, many of whom are entering retirement with solid savings, are a key consumer segment, while Millennials and Gen Z are increasingly embracing RV travel as a lifestyle choice. According to the U.S. Department of Housing and Urban Development, many states are expanding RV-friendly infrastructure and campgrounds to meet rising demand.

Policy shifts also contribute. Several states offer tax incentives or exemptions for RV purchases or eco-friendly conversions, helping consumers offset initial acquisition costs. The U.S. Department of Energy’s push toward electrification is fostering development in electric RVs and associated infrastructure.

However, rising interest rates and inflation may temper purchasing power in the short term. Nonetheless, the industry is adapting through financing options, rental fleets, and innovative vehicle formats. As the market matures, RVs are no longer just seasonal vehicles but are evolving into mobile habitats for work, leisure, and lifestyle.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Recreational Vehicle Market

The Europe Recreational Vehicle Market is estimated to be valued at USD 11.5 billion in 2025 and is further anticipated to reach USD 29.4 billion by 2034 at a CAGR of 11.0%.

Europe’s recreational vehicle market has witnessed a significant transformation, driven by shifting travel behavior, rising environmental awareness, and enhanced cross-border tourism within the Schengen Area. According to Eurostat, domestic tourism in Europe continues to outpace international travel, making RVs an attractive mode of transport for intra-EU mobility. The European Environment Agency notes a strong policy shift toward low-emission travel, encouraging the development and adoption of electric and hybrid motorhomes.

Germany, France, and the United Kingdom represent the largest RV markets in the region, with countries like the Netherlands, Sweden, and Italy showing rapid adoption. The Federal Statistical Office of Germany reports that over 70,000 new motorhomes were registered annually in recent years, signifying strong consumer uptake. Moreover, the European Commission supports eco-tourism and rural development programs, which often include RV-accessible camping areas and infrastructure projects.

A unique demographic advantage in Europe is the aging yet active population. Seniors in Western Europe are increasingly mobile, health-conscious, and financially independent, making them prime consumers of mid- to high-end RV models. At the same time, younger families and digital freelancers are drawn to the affordability and flexibility of campervans and compact trailers.

Despite these positive trends, Europe’s RV market faces challenges such as limited urban parking space, strict emission standards, and the need for uniform pan-European licensing regulations. However, continued investment in green technologies, lightweight design, and cross-border digital services is expected to mitigate these issues. As camping culture modernizes, RVs in Europe are evolving into sustainable and versatile mobility solutions.

The Japan Recreational Vehicle Market

The Japan Recreational Vehicle Market is projected to be valued at USD 4.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 12.7 billion in 2034 at a CAGR of 12.0%.

Japan’s recreational vehicle market is emerging as a niche yet rapidly growing segment, buoyed by its unique geography, rising domestic travel trends, and aging population. According to Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT), the nation has over 1.2 million registered campgrounds and roadside rest areas (Michi-no-Eki), creating a nationwide support network for RV travel. Domestic tourism is increasingly prioritized, as seen in data from the Japan National Tourism Organization, which shows a strong rebound in domestic overnight stays post-pandemic.

The demographic structure of Japan favors RV adoption among both seniors and younger tech-savvy travelers. With over 28% of the population aged 65 or older, according to the Statistics Bureau of Japan, RVs are appealing as mobile comfort zones that allow safe, self-contained travel. Simultaneously, urban dwellers in their 30s and 40s are using camper vans as weekend escape vehicles, avoiding crowded transit hubs.

Cultural preferences also play a role. The concept of "shachuhaku" or car-based overnight stay is gaining popularity, and municipalities are responding by expanding RV-parking-friendly zones. Furthermore, Japanese manufacturers are innovating with space-saving designs, hybrid drivetrains, and ultra-compact builds suitable for narrow roads and urban environments.

Nevertheless, space constraints in cities, limited awareness compared to Western markets, and high vehicle ownership costs remain barriers. However, government-led tourism revitalization programs and environmental initiatives are beginning to address these issues. Japan’s RV market is poised to grow steadily, blending traditional values with a modern, minimalist take on mobile living.

Global Recreational Vehicle Market: Key Takeaways

- Global Market Size Insights: The Global Recreational Vehicle Market size is estimated to have a value of USD 76.7 billion in 2025 and is expected to reach USD 220.6 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Recreational Vehicle Market is projected to be valued at USD 16.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 45.1 billion in 2034 at a CAGR of 11.7%.

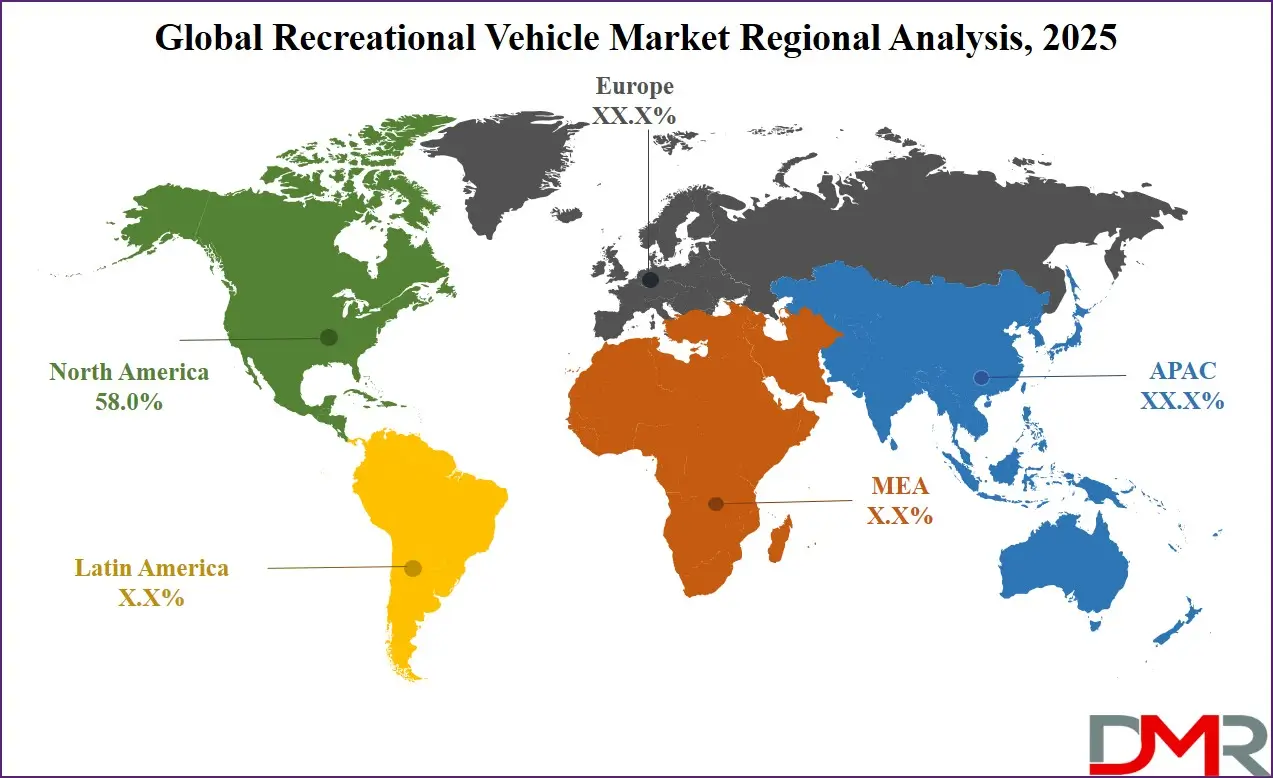

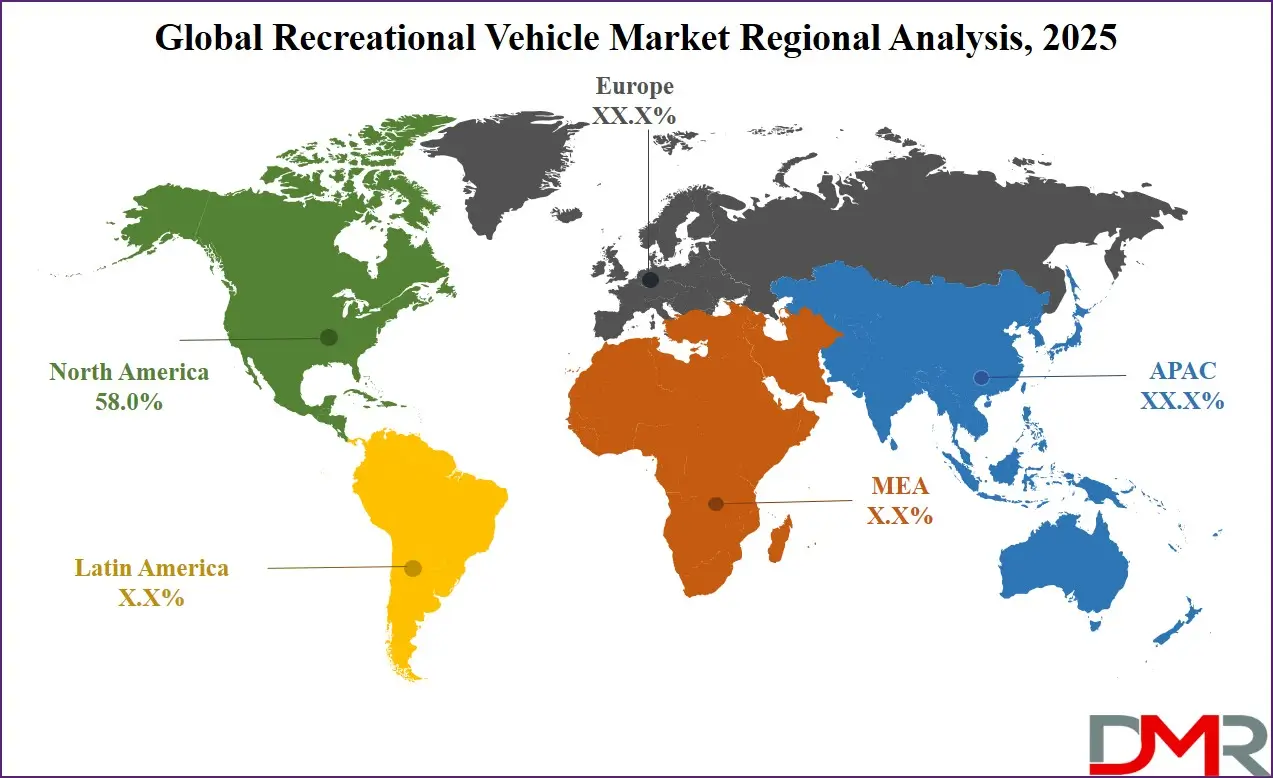

- Regional Insights: North America is expected to have the largest market share in the Global Recreational Vehicle Market with a share of about 58.0% in 2025.

- Key Players: Some of the major key players in the Global Recreational Vehicle Market are Thor Industries, Forest River, Winnebago, REV Group, Trigano, Knaus Tabbert, Jayco, Grand Design RV, Keystone RV, Airstream, Hymer, Bürstner, and many others.

Global Recreational Vehicle Market: Use Cases

- Remote Work and Digital Nomadism: Recreational vehicles offer mobile offices equipped with Wi-Fi, solar power, and ergonomic workspaces, enabling professionals to work from anywhere. This appeals to digital nomads and freelancers who prefer flexible, scenic, and affordable living and working conditions without sacrificing connectivity or productivity.

- Adventure and Off-Grid Travel: RVs are ideal for off-grid camping, overlanding, and wilderness travel. Equipped with all-terrain tires, solar panels, water tanks, and kitchenettes, they support self-sufficient living. Enthusiasts use them to explore national parks, mountains, and remote trails, embracing freedom from traditional accommodations and structured itineraries.

- Family Leisure and Road Trips: Families use recreational vehicles to facilitate safe, affordable vacations with customizable itineraries. RVs serve as a mobile home base, providing convenience, reduced travel costs, and bonding experiences through extended road trips. They are popular for visiting landmarks, amusement parks, and coastal drives.

- Temporary Housing and Disaster Relief: Governments and aid agencies deploy RVs for emergency housing during natural disasters or housing crises. They serve as immediate shelters with essential utilities for displaced families or workers, particularly in regions affected by wildfires, hurricanes, or construction labor shortages.

- Mobile Healthcare and Outreach Services: Customized RVs are used as mobile clinics for rural healthcare, vaccinations, diagnostics, and community outreach. These units bring medical services to underserved areas, reducing access disparities. Nonprofits, hospitals, and governments use them for health education, screenings, and on-site consultations.

Global Recreational Vehicle Market: Stats & Facts

U.S. Census Bureau

- 11.2 million U.S. households owned an RV as of 2021.

- Over 1 million Americans live full-time in RVs.

- The U.S. manufactured nearly 600,000 RVs in 2021.

- Indiana accounts for over 80% of U.S. RV production, with Elkhart County known as the "RV Capital of the World."

U.S. National Park Service (NPS)

- Over 4.8 million RVs entered U.S. national parks in 2023.

- Yellowstone, Grand Canyon, and Yosemite are among the top RV destinations.

- RVs accounted for 23% of overnight stays at NPS campgrounds.

Federal Highway Administration (FHWA)

- The U.S. has over 4 million miles of public roads, contributing to strong RV travel networks.

- More than 16,000 public and private RV parks and campgrounds are connected to federal highways.

Kampgrounds of America (KOA) – Industry Body

- 38 million Americans took an RV camping trip in 2023.

- 51% of RV users say access to nature and outdoor recreation is their top reason for RV travel.

- 45% of Gen Z and Millennials expressed interest in future RV ownership.

U.S. Department of Energy (DOE)

- Over 85% of new RVs use energy-efficient LED lighting.

- More than 1,500 public EV charging stations are accessible to RV travelers with towable EVs or hybrid motorhomes.

- Solar panels are now integrated into over 30% of newly manufactured RVs.

U.S. Environmental Protection Agency (EPA)

- RV idling contributes to over 6 million metric tons of CO₂ annually.

- Initiatives are underway to encourage low-emission RV technology adoption.

- Over 12,000 RVs were retrofitted for better fuel efficiency under the EPA Clean Diesel programs.

RV Industry Association (RVIA) – Regulatory Body

- 56% of RV owners travel more than 200 miles on average per trip.

- The RV industry supports over 680,000 jobs in the U.S.

- RV-related manufacturing generates more than $140 billion in annual economic impact.

- Over 60% of new RV purchases are by first-time buyers.

Canadian Recreational Vehicle Association (CRVA)

- Over 2.1 million Canadian households own an RV.

- Canada has over 4,000 registered campgrounds suitable for RVs.

- RV sales rose by 17% in Ontario and British Columbia in 2022.

European Caravan Federation (ECF)

- Germany leads Europe in RV registrations with over 1.6 million vehicles.

- France and the UK follow with 600,000+ and 400,000+ RVs respectively.

- Electric and hybrid RVs account for nearly 8% of new registrations in Europe.

Japan Recreational Vehicle Association (JRVA)

- Japan had over 140,000 registered RVs as of 2023.

- More than 50% of Japanese RV users travel domestically for festivals and nature retreats.

- Tokyo and Osaka are the leading regions for RV rentals and ownership growth.

Global Recreational Vehicle Market: Market Dynamic

Driving Factors in the Global Recreational Vehicle Market

Integration of Smart Technologies in RVs

The recreational vehicle market is experiencing a major transformation with the integration of smart technologies such as IoT-based energy management systems, voice-activated controls, and advanced GPS navigation tailored for oversized vehicles. Modern RVs now feature climate control via mobile apps, Wi-Fi-enabled infotainment systems, real-time vehicle diagnostics, and smart home-style automation for lighting and appliances. These innovations are being driven by the digital expectations of Millennials and Gen Z consumers, who demand both mobility and connectivity.

RV manufacturers are investing heavily in electronics and software partnerships to provide tech-savvy living spaces that support remote working and digital nomad lifestyles. Additionally, RV renters are now increasingly prioritizing vehicles equipped with solar panels, battery management systems, and water-saving technology for extended off-grid camping. These smart features not only improve comfort and convenience but also reduce environmental impact.

Rise of Sustainable and Eco-Friendly RVs

There is a growing trend towards sustainability in the global recreational vehicle market, driven by increasing environmental awareness and regulatory pressures. Manufacturers are now exploring green technologies, including lightweight composite materials to reduce fuel consumption, eco-friendly interiors made of bamboo and recycled plastics, and even electric propulsion systems in Class B and Class C motorhomes.

Solar-powered RVs with integrated rooftop panels are gaining traction, allowing travelers to reduce reliance on campground hookups. Innovations such as lithium-ion battery systems, composting toilets, and water-recycling showers are also enhancing the off-grid sustainability of RVs. In Europe, low-emission zones and green incentives are accelerating the adoption of electric RVs. Meanwhile, in the U.S. and Canada, national parks are encouraging visitors to use low-impact vehicles through park pass discounts and preferred campsite access.

Restraints in the Global Recreational Vehicle Market

High Cost of Ownership and Maintenance

Despite increasing popularity, the high upfront cost and long-term maintenance expenses of recreational vehicles remain a major restraint. Purchasing a new motorhome or even a large towable trailer can range from tens of thousands to hundreds of thousands of dollars, depending on the size, features, and brand. Financing such investments is not feasible for many middle-income families, particularly during economic downturns or inflationary periods.

Additionally, operational costs such as insurance, fuel, registration, campground fees, and repairs add substantial recurring expenses. Maintenance of water systems, generators, air conditioning, and slide-outs requires specialized servicing, which is not always readily available in remote areas. Storage fees during off-season months and depreciation further burden the total cost of ownership. These financial constraints are especially relevant in regions without supportive credit schemes or infrastructure, reducing market accessibility for new entrants.

Limited Urban Accessibility and Parking Challenges

Recreational vehicles are often difficult to operate and park in urban settings due to their size and maneuverability challenges. Many cities across North America, Europe, and Asia have restrictions on oversized vehicles in central zones, making it hard for RV users to access cultural, culinary, and urban amenities without additional transportation. Public parking facilities are typically not designed to accommodate large motorhomes or trailers, resulting in limited parking availability and increased risk of fines or towing.

Moreover, many residential neighborhoods enforce homeowner association (HOA) rules or zoning laws that prevent RVs from being parked on streets or driveways, forcing owners to rent expensive storage lots far from home. This lack of urban integration diminishes the everyday usability of RVs, especially for full-time users and digital nomads who wish to remain close to cities for work or healthcare.

Opportunities in the Global Recreational Vehicle Market

Digital Nomadism and Full-Time RV Living

The rise of digital nomadism and alternative lifestyles is unlocking immense growth opportunities in the RV market. Remote work has become a permanent feature across many industries, enabling professionals to travel without taking time off work. RVs, particularly those equipped with Wi-Fi boosters, solar energy systems, ergonomic workstations, and space-efficient interiors, offer the perfect blend of mobility and comfort for these modern workers.

Millennials and Gen Z, many of whom are priced out of home ownership, are increasingly considering RVs as affordable living solutions that double as office spaces. Countries like the U.S., Germany, Australia, and the Netherlands are seeing a growing number of people adopting full-time RV life, not just for retirement but as a cost-effective, flexible, and adventurous housing alternative. This shift has also spurred the growth of niche products like office-integrated RVs, modular furnishings, and satellite-enabled mobile homes.

Expansion into Asia-Pacific and Emerging Markets

While North America and Europe dominate the RV market, the Asia-Pacific region is emerging as a promising frontier for growth. Rising disposable incomes, increased domestic tourism, and improved road networks in countries like China, India, South Korea, and Thailand are laying the groundwork for recreational vehicle expansion. Japan already has a well-established RV culture, and China is following closely with policy support for RV parks and off-grid tourism.

Moreover, regional governments are starting to recognize the economic potential of RV tourism and are launching awareness campaigns, subsidies for domestic manufacturers, and favorable zoning laws to promote growth. In India, for example, state tourism boards are developing RV rental policies and designating caravan-friendly routes in hill stations and coastal belts. Additionally, international RV manufacturers are entering joint ventures with local firms to produce affordable, compact RVs tailored to regional road conditions.

Trends in the Global Recreational Vehicle Market

Expanding Interest in Outdoor Recreation Post-Pandemic

One of the most influential growth drivers for the recreational vehicle market has been the global surge in demand for outdoor travel following the COVID-19 pandemic. With international air travel restricted and health concerns surrounding crowded spaces, consumers began seeking safer, socially-distanced alternatives for vacations and long-term travel. RVs provided an ideal solution, offering controlled, self-contained environments that enabled families, retirees, and digital nomads to travel while maintaining social distancing.

National park systems in the U.S., Canada, and Australia recorded record campground bookings between 2020 and 2023, many of which were from first-time RV users. This shift in consumer behavior led to skyrocketing sales of towable and motorized RVs, along with increased adoption of rental platforms. The growing culture of wellness, remote work, and reconnection with nature continues to support RV travel's appeal even in the post-pandemic world.

Government Support for Tourism and Mobility Infrastructure

Government initiatives to promote domestic tourism, invest in highway infrastructure, and improve national camping networks are driving RV market expansion. In North America, the U.S. Federal Highway Administration and state governments have allocated billions toward improving rest stops, recreational corridors, and signage suitable for large vehicles. Canada’s provincial governments have also expanded seasonal campground infrastructure to accommodate increasing RV usage.

In Europe, several nations are offering subsidies for low-emission campervans and investing in RV parking zones close to eco-tourism attractions. Similarly, Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) supports RV-friendly infrastructure development through motorhome rental support and roadside station upgrades. These government-driven enhancements ensure smoother travel for RV owners and increase accessibility for first-time users. Moreover, tax rebates for electric or hybrid recreational vehicles and zoning laws that favor RV park expansion are further incentivizing ownership and investment.

Global Recreational Vehicle Market: Research Scope and Analysis

By Type Analysis

The Recreational Vehicle (RV) market is projected to dominate this market as it holds the highest market share in 2025. The Recreational Vehicle (RV) market is primarily segmented into Towable RVs and Motorhomes, each addressing distinct consumer needs and economic tiers. Towable RVs, which include travel trailers, fifth-wheel trailers, folding camping trailers, and toy haulers, are designed to be pulled by passenger vehicles. Their key advantage lies in cost-effectiveness.

Towables are significantly cheaper than motorized RVs and offer the flexibility to detach and use the tow vehicle independently, making them ideal for extended stays. Additionally, many towable units feature expandable sections and luxury fittings, making them suitable for long trips.

Motorhomes, categorized as Class A (luxury bus-like models), Class B (campervans), and Class C (truck chassis-based), offer integrated driving systems and onboard amenities. These are highly preferred by luxury travelers and retirees seeking convenience, easy setup, and longer road travel. Class B models are increasingly popular due to their compact size and fuel efficiency, making them suitable for urban travel as well.

Towables dominate in volume due to their affordability and low maintenance. First-time RV buyers, younger families, and seasonal campers opt for towables. Meanwhile, motorhomes dominate revenue share due to their high average selling price and customization potential. The North American market is highly skewed towards towables (over 80% share), while Europe sees rising demand for compact motorhomes. The dominance of towables is reinforced by the growth of RV rentals and sharing economy platforms.

However, innovations in lightweight motorhomes and compact diesel engines are narrowing the gap. With evolving consumer preferences, both segments are expected to coexist, but towables will likely retain numerical superiority over the forecast period due to their economic viability.

By Propulsion Analysis

Propulsion type is a critical classification in the RV market, evolving with technological advancements and environmental regulations. Internal Combustion Engine (ICE) RVs are currently poised to dominate the market. They offer reliable power, extensive driving ranges, and widespread fueling infrastructure, making them suitable for long-haul and off-grid travel. Their mature supply chain and familiarity among service technicians contribute to their enduring popularity. Most Class A and C motorhomes are diesel or gasoline-powered ICE variants, optimized for heavy-duty performance.

Hybrid RVs, while still emerging, blend ICE with electric propulsion, offering improved fuel efficiency and lower emissions. These models are gradually being adopted, especially in countries with stringent emission norms. They appeal to eco-conscious travelers who seek a balance between power and environmental impact. Despite their benefits, high production costs and limited model availability restrict large-scale adoption.

Battery-Electric RVs (e-RVs) represent the future of sustainable travel. These are powered exclusively by electric motors and supported by lithium-ion batteries or solar-integrated energy systems. Though still niche due to range anxiety, high upfront costs, and limited charging infrastructure, manufacturers like Winnebago and Thor Industries are actively investing in e-RV prototypes. Europe leads early adoption, backed by environmental subsidies and strong EV ecosystems.

ICE remains dominant today, but government incentives, zero-emission mandates, and growing climate awareness are reshaping propulsion preferences. Battery technology improvements, fast-charging networks, and lightweight chassis materials will play pivotal roles in increasing the market share of hybrid and electric RVs. The transition will be gradual, but hybrid and electric RVs are expected to see rapid compound growth, especially in North America and Europe by 2030.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Length Category Analysis

Recreational vehicles are often segmented by length as it directly affects usability, amenities, mobility, and buyer profile. The three main length categories, below 20 ft, 20–30 ft, and above 30 ft, cater to varied lifestyle needs and parking considerations.

The 20–30 ft segment is expected to dominate the market due to its balance of space, features, and driveability. These RVs offer enough room for small families and often include full kitchens, bathrooms, and slide-outs to expand living space. They also comply with most parking regulations and are versatile for both long-distance travel and local getaways. This category includes many Class C motorhomes, travel trailers, and fifth wheels. Their popularity is driven by affordability, utility, and ease of operation.

RVs below 20 ft typically include teardrop trailers, Class B campervans, and lightweight travel trailers. These compact units are gaining favor among solo travelers, couples, and weekend adventurers. They are easier to tow or drive, offer better fuel efficiency, and can access narrow campsites and urban parking areas. Their minimal interior space is balanced with clever modular design, making them ideal for short trips or minimalist travelers.

RVs above 30 ft are primarily used for long-term travel or full-time living. Found mainly in the Class A motorhome category and luxury fifth-wheel trailers, they offer premium interiors, multiple sleeping areas, and extended tank capacities. However, they require special licenses in some regions, large parking spaces, and come with high operating and insurance costs.

The 20–30 ft segment strikes the optimal balance for most consumers and remains dominant in both unit sales and rentals across North America and Europe.

By Application Analysis

The recreational vehicle market, when viewed through the lens of application, is segmented into Domestic/Personal Use and Commercial Use. The Domestic segment is projected to command a significant market share due to the deep-rooted tradition of road travel, especially in the U.S., Canada, and parts of Europe. Personal RV use is associated with lifestyle choices, offering flexibility, mobility, and comfort. Families, retirees, digital nomads, and adventure seekers use RVs for vacations, seasonal travel, and even full-time residence. The COVID-19 pandemic accelerated RV adoption as people sought safe, isolated travel alternatives. In many cases, RV ownership reflects a cultural and emotional value beyond its functional utility.

Commercial Use is a smaller but growing segment. It includes applications in tourism (mobile hotels, guided tours), healthcare (mobile clinics), education (mobile classrooms), emergency response (command centers), and business (mobile offices, pop-up stores). This segment is gaining relevance due to the flexibility and mobility offered by RV-based infrastructure. Event companies and media agencies also employ customized RVs as hospitality units or broadcasting centers. Demand for such units is particularly rising in Asia-Pacific and Europe, driven by rapid urbanization and mobile services.

Despite commercial growth, personal/domestic use dominates due to broader consumer appeal, resale value, and deep rental ecosystems. Peer-to-peer rental platforms like Outdoorsy and RVshare further fuel personal use adoption by allowing owners to monetize idle units. Meanwhile, government initiatives for mobile healthcare and education are opening new doors for commercial applications.

In terms of value, personal use holds the majority, but commercial applications offer high-margin, specialized opportunities that will grow steadily through the next decade.

The Global Recreational Vehicle Market Report is segmented on the basis of the following:

By Type

- Towable RVs

- Travel Trailers

- Fifth-Wheel Trailers

- Folding Camp Trailers

- Truck Campers

- Motorhomes

- Class A

- Class B (Camper Vans)

- Class C

By Propulsion

- Internal-Combustion Engine (ICE)

- Hybrid

- Battery-Electric RVs

- Motorized

- Non-motorized

By Length Category

- Below 20 ft

- 20 - 30 ft

- Above 30 ft

By Application

- Domestic/Personal Use

- Commercial

Impact of Artificial Intelligence in the Global Recreational Vehicle Market

- AI-Enhanced Navigation and Route Optimization: Artificial Intelligence is revolutionizing how RV users plan and navigate their trips. Smart GPS systems integrated with AI can analyze traffic patterns, weather conditions, terrain, and road closures in real-time, offering optimized routes and alternate suggestions. These systems not only improve travel efficiency and fuel economy but also enhance safety by avoiding high-risk zones, particularly for large motorhomes and towable units that require specific road clearance and turning radius.

- Predictive Maintenance and Diagnostics: AI is playing a pivotal role in ensuring vehicle longevity and reducing downtime. Through IoT sensors and AI algorithms, RVs can now monitor engine health, tire pressure, fluid levels, and other mechanical systems in real time. Predictive analytics alert owners to potential failures before they occur, facilitating proactive maintenance. This reduces repair costs, enhances reliability, and boosts resale value, especially crucial for full-time travelers and fleet operators.

- AI-Driven Smart RV Interiors: AI is enabling smart living environments inside recreational vehicles. Voice-controlled systems now manage lighting, temperature, entertainment, and security. AI learns user preferences and adjusts settings automatically, offering a hotel-like comfort experience on the move. From dimming lights at night to pre-heating water before showers, AI brings automation that enhances convenience and energy efficiency for users, making RVs more appealing to tech-savvy and luxury-seeking travelers.

- Autonomous Driving Capabilities: While fully autonomous RVs are still under development, AI technologies like adaptive cruise control, lane-keeping assist, parking automation, and collision detection are increasingly embedded in new models. These systems reduce driver fatigue, especially during long-distance trips or challenging terrains. Enhanced safety, combined with ease of operation for first-time RV owners, is accelerating adoption and widening the customer base.

- AI-Powered Rental and Sharing Platforms: AI is reshaping the rental and peer-to-peer sharing ecosystem in the RV market. Platforms utilize machine learning to match renters with ideal vehicles based on preferences, budget, and travel history. AI also assists in dynamic pricing, fraud detection, and customer service automation, enabling scalable, secure, and user-friendly booking experiences. This is critical for the growing millennial and Gen Z demographic entering the RV lifestyle via rentals instead of ownership.

- Consumer Behavior and Market Analytics: AI tools are empowering manufacturers and dealers to analyze consumer data more effectively. From social media trends to service requests and purchase histories, AI helps understand shifting preferences, enabling agile product development and marketing. Real-time feedback loops also support customization options, allowing users to configure layouts, features, and aesthetics, paving the way for personalized RVs that meet niche consumer needs in a competitive market.

Global Recreational Vehicle Market: Regional Analysis

Region with the Largest Revenue Share

North America, particularly the United States and Canada, is expected to dominate the global recreational vehicle (RV) market as it commands over 58.0% of total revenue by the end of 2025, due to a combination of cultural, economic, and infrastructural factors. The region has a deep-rooted tradition of road travel and outdoor recreation, with over 11 million U.S. households owning an RV as of 2023, according to the RV Industry Association (RVIA). This ownership culture is supported by a vast network of RV parks, campgrounds, and well-maintained interstate highways tailored for RV travel.

The U.S. benefits from strong domestic manufacturing, with major OEMs such as Winnebago, Thor Industries, and Forest River operating robust production facilities in Indiana and other Midwestern states. The presence of these companies ensures wide availability, competitive pricing, and continuous product innovation. Moreover, favorable financing options and tax incentives in certain U.S. states for RV purchases further accelerate market penetration.

Demographically, the aging Baby Boomer generation has driven RV sales through retirement travel, while younger millennials and Gen Z consumers are increasingly embracing RV lifestyles for remote work and adventure travel, particularly post-pandemic. Additionally, a growing trend in RV rentals and shared mobility platforms has broadened access.

The strong dealership network, aftermarket services, insurance coverage, and promotional events like RV expos and shows contribute to customer retention and loyalty. Canada also mirrors similar trends, especially in provinces like British Columbia and Alberta, where RVing is a preferred vacation mode. Altogether, North America's ecosystem, from manufacturing to culture, firmly secures its lead in the global RV market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia Pacific region is witnessing the highest compound annual growth rate (CAGR) in the recreational vehicle market, fueled by rising disposable incomes, growing tourism, infrastructure development, and increasing Western cultural influence. Countries such as China, Japan, South Korea, Australia, and India are leading this expansion with localized trends and unique market drivers.

In China, despite being a nascent market, government efforts to promote domestic tourism and camping have spurred rapid growth. The Ministry of Culture and Tourism has endorsed “self-driving tourism” and invested heavily in building RV parks and campgrounds across provinces. The rise of a wealthy middle class, interest in off-grid lifestyles, and post-pandemic travel preferences are collectively increasing RV adoption.

Japan, though space-constrained, has developed a strong mini-RV segment (kei campers) due to its innovative use of compact spaces and a growing senior population seeking convenient travel options. South Korea’s camping culture and support for leisure travel are also driving demand. Meanwhile, Australia already has a mature RV tourism industry and continues to grow due to its vast geography and strong domestic tourism.

India, an emerging player, is witnessing rising interest in RV rentals and luxury motorhomes for events and tourism, especially in high-traffic states like Maharashtra and Himachal Pradesh. The region’s growth is further accelerated by tech integration, localized production, and the entry of international brands.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Recreational Vehicle Market: Competitive Landscape

The global recreational vehicle (RV) market is moderately consolidated, with a mix of long-established manufacturers and emerging players competing on the basis of product innovation, price, technology integration, and customer service. Major companies such as Thor Industries Inc., Winnebago Industries Inc., Forest River Inc. (a subsidiary of Berkshire Hathaway), and REV Group Inc. dominate the North American landscape, controlling a significant share of the global market. These firms have built robust supply chains, wide dealership networks, and strong brand equity over decades.

Thor Industries, the world’s largest RV manufacturer, continues to expand its portfolio through acquisitions and innovative model launches. Winnebago emphasizes sustainable mobility and smart technology in its latest Class A and B motorhomes, targeting environmentally conscious consumers. Forest River holds a major position in towable RVs and benefits from Berkshire Hathaway’s deep capital base, allowing scale-driven advantages.

In Europe, key players like Hymer GmbH & Co. KG (part of the Erwin Hymer Group) and Trigano Group lead the market with advanced campervans and motorhomes designed for compact roads and high fuel efficiency. Asia-Pacific is seeing rising competition from regional firms and global entrants. Companies like SAIC Maxus in China and Jayco Australia are focusing on locally adapted models with improved safety features and energy efficiency.

The competitive landscape is also witnessing disruption from startups and tech-driven RV rental platforms such as Outdoorsy and Indie Campers, which are expanding access without ownership. As electrification and digitalization evolve, R&D capabilities, brand loyalty, and customer-centric innovations will define long-term leadership in this dynamic industry.

Some of the prominent players in the Global Recreational Vehicle Market are:

- Thor Industries Inc.

- Forest River Inc.

- Winnebago Industries Inc.

- REV Group Inc.

- Trigano SA

- Knaus Tabbert AG

- Jayco Inc.

- Grand Design RV Co.

- Keystone RV Co.

- Airstream Inc.

- Hymer GmbH

- Bürstner GmbH & Co. KG

- Dethleffs GmbH & Co. KG

- Triple E Recreational Vehicles

- Tiffin Motorhomes Inc.

- Coachmen RV

- Gulf Stream Coach Inc.

- Leisure Travel Vans

- Nexus RV

- Fendt Caravan

- Other Key Players

Recent Developments in the Global Recreational Vehicle Market

July 2025

- Fun Town RV acquired Edmundson RV in Indiana to expand its dealership footprint and strengthen regional market presence through enhanced service and inventory capacity.

- The Shyft Group finalized its merger with Aebi Schmidt Group, integrating specialty vehicle divisions and increasing operational synergy across commercial and recreational segments.

June 2025

- Vision Kore acquired Lance Camper Manufacturing, marking its entry into lightweight trailers and allowing REV Group to exit the towable RV segment.

- Fun Town RV entered Arizona by acquiring a former Lazydays RV location in Phoenix, establishing its presence in the Southwest market.

- Ron Hoover RV expanded in Oklahoma by acquiring a Lazydays Tulsa site, doubling its footprint in the region.

- Bish’s RV entered Alabama with a new dealership in Calera, strategically expanding into the Southeastern United States.

May 2025

- The Guangzhou International RV & Camping Expo 2025 showcased global innovations in electric RVs, off-road travel units, and advanced camping technologies.

- The 2025 RV Dealers Convention & Expo was announced for Las Vegas, focusing on dealer training, digital tools, and business strategy sessions.

February 2025

- Camping World acquired former Lazydays dealerships in Tennessee and Washington, enhancing its national dealership network coverage.

- Patrick Industries acquired Medallion Instrumentation Systems to strengthen RV electronic component offerings and improve in-house manufacturing capabilities.

- National Powersport Auctions expanded into Kansas City, adding RV auction services in the Midwest.

January 2025

- Forest River acquired L.A. West Coaches to enhance its custom luxury coach and van lineup in the RV segment.

- Blue Compass RV purchased an Airstream dealership in Albuquerque, expanding its premium recreational vehicle sales presence in the Southwest.

October 2024

- RVBS Holdings acquired Happy Camper Insurance and formed "The Happy Camper Group," integrating RV insurance, finance, and service offerings into a unified brand portfolio.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 76.7 Bn |

| Forecast Value (2034) |

USD 220.6 Bn |

| CAGR (2025–2034) |

12.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 16.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Towable RVs, and Motorhomes), By Propulsion (Internal-Combustion Engine (ICE), Hybrid, Battery-Electric RVs, Motorized, and Non-motorized), By Length Category (Below 20 ft, 20–30 ft, and Above 30 ft), By Application (Domestic/Personal Use, and Commercial) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Thor Industries, Forest River, Winnebago, REV Group, Trigano, Knaus Tabbert, Jayco, Grand Design RV, Keystone RV, Airstream, Hymer, Bürstner, Dethleffs, Triple E RV, Tiffin Motorhomes, Coachmen RV, Gulf Stream Coach, Leisure Travel Vans, Nexus RV, Fendt Caravan, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Recreational Vehicle Market?

▾ The Global Recreational Vehicle Market size is estimated to have a value of USD 76.7 billion in 2025 and is expected to reach USD 220.6 billion by the end of 2034.

What is the growth rate in the Global Recreational Vehicle Market in 2025?

▾ The market is growing at a CAGR of 12.5 percent over the forecasted period of 2025.

What is the size of the US Recreational Vehicle Market?

▾ The US Recreational Vehicle Market is projected to be valued at USD 16.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 45.1 billion in 2034 at a CAGR of 11.7%.

Which region accounted for the largest Global Recreational Vehicle Market?

▾ North America is expected to have the largest market share in the Global Recreational Vehicle Market with a share of about 58.0% in 2025.

Who are the key players in the Global Recreational Vehicle Market?

▾ Some of the major key players in the Global Recreational Vehicle Market are Thor Industries, Forest River, Winnebago, REV Group, Trigano, Knaus Tabbert, Jayco, Grand Design RV, Keystone RV, Airstream, Hymer, Bürstner, and many others.