Market Overview

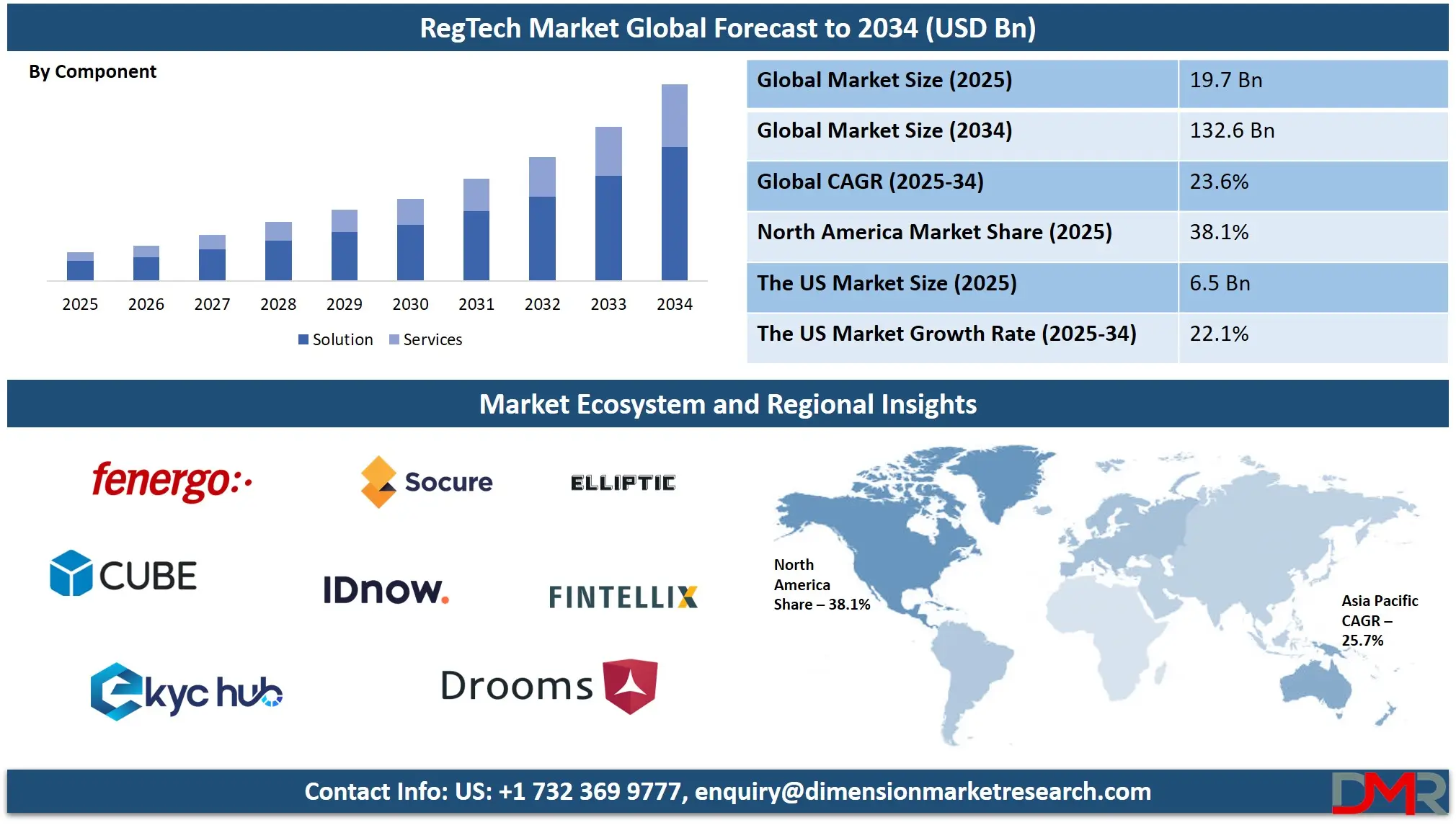

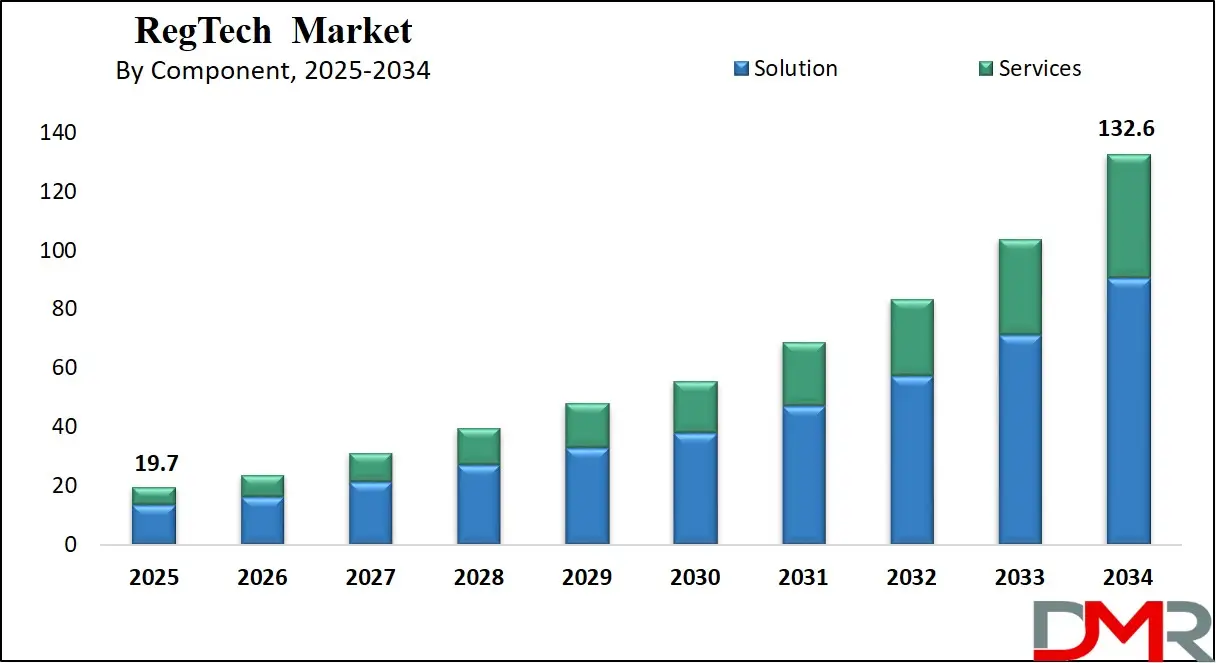

The Global RegTech Market size is projected to reach

USD 19.7 billion in 2025 and grow at a compound annual growth

rate of 23.6% from there until 2034 to reach a value of

USD 132.6 billion.

RegTech (Regulatory Technology) refers to using technology to help companies adhere more easily and efficiently to regulations. RegTech utilizes software tools, data analytics, automation and monitoring capabilities to monitor, manage, report and report regulatory processes more efficiently and effectively. RegTech solutions are especially valuable in industries like finance, insurance and healthcare that impose stringent operating regulations upon their businesses - they help companies spot potential issues before directly reporting them thereby eliminating human error over manual checks alone.

RegTech is experiencing rapid expansion due to an explosion of regulation, creating increased compliance challenges. Governments and regulatory bodies have issued new rules designed to protect consumers, prevent financial crimes and enhance data security; digital business models are proliferating quickly in banking and finance requiring companies to use traditional methods with difficulty - thus necessitating smarter solutions that save both time and costs when meeting compliance obligations. RegTech offers smarter solutions which save time while cutting compliance costs significantly.

RegTech tools can be utilized for various purposes, including identity verification (KYC), anti-money laundering (AML), fraud detection, risk management and regulatory reporting. Banks could utilize regtech to automatically verify customer documents and spot suspicious transactions - an invaluable asset when operating globally. Likewise, these tools help companies stay current with changing regulations across countries - an especially helpful asset if operating globally.

RegTech has seen major advancements in artificial intelligence, machine learning and cloud computing over the last several years. These technologies help process large volumes of data quickly while simultaneously detecting patterns that indicate risk or noncompliance with regulations. Startups and small firms that don't have enough resources for in-house systems have increasingly turned to specialized regtech providers offering compliance as a service solutions as an increasingly popular trend.

RegTech has seen tremendous advancements in artificial intelligence, machine learning, and cloud computing technologies over recent years, which allow rapid data processing and analysis as well as quickly identifying patterns indicating risk or noncompliance quickly and efficiently. Another trend has been "compliance-as-a-service," where companies outsource compliance tasks to specialized regtech providers - particularly appealing for startups or smaller firms without enough resources to build in-house systems.

The US RegTech Market

The US RegTech Market size is projected to reach USD 6.5 billion in 2025 at a compound annual growth rate of 22.1% over its forecast period.

The US plays a pivotal role in driving the growth of the global RegTech market due to its robust financial sector, complex regulatory environment, and early acceptance of advanced technologies. Financial institutions in the US are subject to extensive regulations, requiring efficient solutions for them to remain compliant with laws such as the Bank Secrecy Act, Dodd-Frank Act and anti-money laundering rules.

RegTech tools that automate monitoring, reporting, and risk management are therefore in high demand in the US. Major tech hubs as well as investments in AI, big data, and cloud computing also facilitate innovation within RegTech further supporting it alongside an increased emphasis on data privacy, fraud prevention, and regulatory transparency as part of an innovative ecosystem for global RegTech adoption.

Europe RegTech Market

Europe RegTech Market size is projected to reach USD 5.9 billion in 2025 at a compound annual growth rate of 21.6% over its forecast period.

Europe plays an essential role in the RegTech market due to stringent regulatory frameworks like GDPR, MiFID II and AML directives. These regulations demand businesses maintain high levels of compliance, prompting an overwhelming need for automated and efficient RegTech solutions. Financial institutions and other regulated industries in Europe are turning to digital tools for risk management, transparency and adhering to changing legal requirements.

Europe promotes innovation through regulatory sandboxes and cross-border collaboration, encouraging development and testing of new technologies. Thanks to a mature financial ecosystem and increasing focus on data protection, Europe continues to embrace RegTech solutions as they facilitate compliance across industries and streamline regulatory performance.

Japan RegTech Market

Japan RegTech Market size is projected to reach USD 7.0 billion in 2025 at a compound annual growth rate of 21.8% over its forecast period.

Japan has emerged as an influential player in the RegTech market as it strengthens its financial regulatory landscape and embraces digital transformation across industries. Financial institutions and corporations in Japan are rapidly adopting RegTech solutions as a means of combating money laundering, improving cybersecurity, and strengthening data governance. The government supports this transformation by encouraging innovation and allowing businesses to use technology more efficiently in meeting compliance requirements.

Japan faces an aging workforce and limited regulatory staff, so automation through RegTech tools helps reduce manual workloads and boost accuracy. Backed by strong investments in fintech and an emphasis on higher transparency and efficiency, Japan is becoming an integral contributor to the Asia-Pacific RegTech market's development.

RegTech Market: Key Takeaways

- Market Growth: The RegTech Market size is expected to grow by 108.8 billion, at a CAGR of 23.6%, during the forecasted period of 2026 to 2034.

- By Component: The solution segment is anticipated to get the majority share of the RegTech Market in 2025.

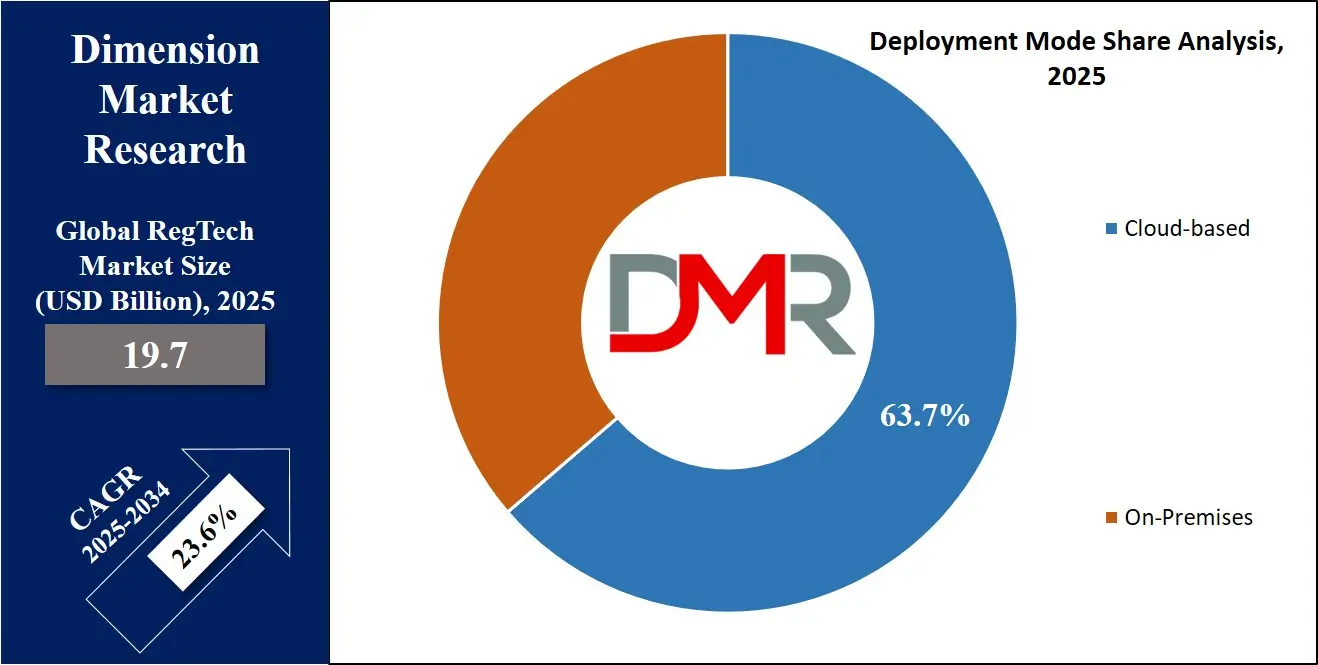

- By Deployment: The cloud-based segment is expected to get the largest revenue share in 2025 in the RegTech Market.

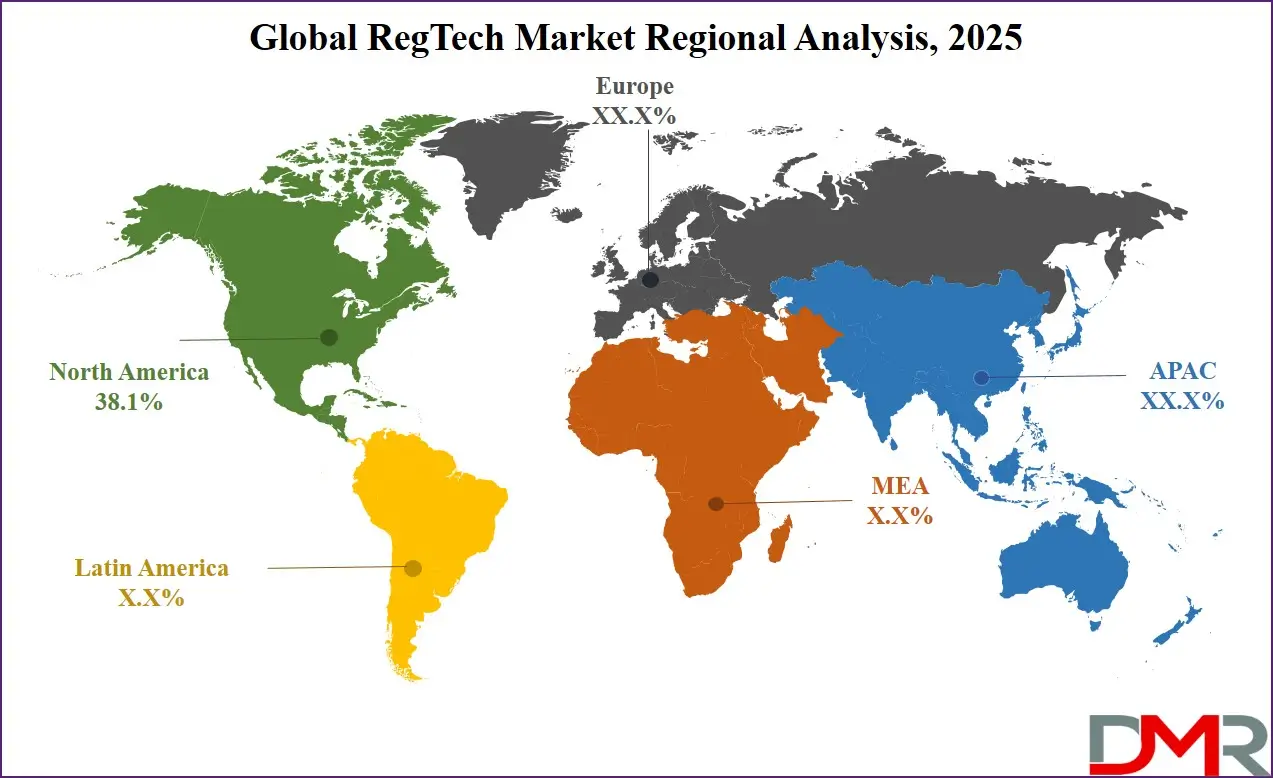

- Regional Insight: North America is expected to hold a 38.1% share of revenue in the Global RegTech Market in 2025.

- Use Cases: Some of the use cases of digital payment KYC, Risk Management & Monitoring, and more.

RegTech Market: Use Cases

- Fraud Detection and Prevention: RegTech tools use data analytics and machine learning to monitor transactions in real-time and spot unusual patterns that may signal fraud. These tools can flag suspicious behavior quickly, supporting companies to take action before damage is done, which is mainly useful in finance, where fraud risks are high.

- KYC (Know Your Customer) Compliance: RegTech supports automating identity verification by checking documents, biometrics, and databases to confirm who a customer is, which speeds up onboarding and reduces the risk of fake identities slipping through. It also ensures companies meet legal requirements without heavy manual work.

- Regulatory Reporting Automation: Instead of preparing reports manually, companies can use regtech to collect, organize, and submit required data automatically, which minimizes human error, saves time, and ensures that reports are accurate and on time. It also helps businesses stay ready for audits.

- Risk Management and Monitoring: RegTech systems can track risk exposure across different departments and flag potential issues early. These tools allow businesses to set alerts and get updates in real-time when risks arise. It helps decision-makers act quickly and maintain control over complex operations.

Stats & Facts

- According to Zluri, 83% of risk and compliance professionals believe that ensuring compliance with all applicable laws and regulations is essential when making decisions, highlighting how deeply embedded compliance has become in corporate governance and strategic planning processes.

- Drata reports that 91% of companies plan to implement continuous compliance within the next five years, reflecting a growing industry-wide shift from reactive to proactive compliance management as organizations recognize its long-term value and efficiency.

- Based on Zluri’s findings, 70% of corporate risk and compliance professionals have observed a noticeable shift from basic check-the-box compliance to a more strategic role, integrating compliance with broader business goals and using it as a competitive edge.

- Drata states that 87% of organizations have experienced negative consequences from having low compliance maturity or relying on reactive compliance methods, reinforcing the risks associated with outdated or insufficient compliance strategies.

- As per Zluri, 73% of organizational leaders in 2023 agreed that cyber and privacy regulations effectively reduce cyber risks, a significant increase from 2022, showing rising confidence in the effectiveness of regulatory frameworks to safeguard against cyber threats.

- Drata reveals that 41% of businesses without continuous compliance practices experience slowdowns in their sales cycles, indicating how real-time compliance can directly influence operational efficiency and revenue generation.

- Zluri highlights that nearly 70% of service organizations reported needing to comply with at least six different information security and data privacy frameworks in 2023, underscoring the increasing complexity of regulatory environments that businesses must navigate.

- Drata found that 74% of organizations report being unable to address vulnerabilities properly due to limited budgets and resources, pointing to the ongoing challenge of underfunded compliance programs in the face of rising risks and expectations.

- According to Zluri, 84% of IT and security professionals say following data protection laws like GDPR and CCPA is mandatory in their industries, which showcases the critical role data privacy regulations play in modern compliance ecosystems.

- Drata reports that only 5% of teams perform compliance control reviews right before an audit or only when required, while 40% use continuous automated reviews and 55% still rely on periodic manual reviews, illustrating the spectrum of approaches to compliance monitoring.

- As Zluri shares, 80% of corporate compliance professionals believe their roles now extend beyond oversight and are seen as business advisory functions, actively supporting and enhancing core business strategies and outcomes.

- From Drata’s data, 76% of companies using point-in-time compliance approaches say it creates a burden, whereas three in four organizations with continuous compliance believe their methods support and even drive business growth, emphasizing the impact of compliance models on business agility.

Market Dynamic

Driving Factors in the RegTech Market

Growing Regulatory ComplexityOne major driver of the RegTech market is the rising number and complexity of global regulations. Governments are introducing new laws to protect consumers, ensure financial stability, and strengthen data privacy. As a result, businesses must follow more detailed and often changing rules across different regions, which creates pressure on companies to stay compliant without slowing down operations.

Traditional compliance methods often fall short because they are time-consuming and prone to errors. RegTech offers a smart solution by automating tasks, improving accuracy, and providing real-time updates. With global businesses expanding and operating across borders, the demand for tech-driven compliance tools continues to rise. This complexity directly fuels the growth of the RegTech market.

Digital Transformation Across Industries

Another important growth driver is the ongoing digital shift in industries like finance, healthcare, insurance, and e-commerce. As these sectors adopt digital platforms, mobile apps, and cloud services, the volume of data and online transactions is increasing, which creates new risks and requires updated compliance measures.

RegTech solutions are designed to handle large datasets and automate rule-checking in these digital environments. They help companies manage risk without interrupting digital services. Since customers expect speed and ease, businesses need tools that keep them compliant without slowing things down. As digital transformation continues, more companies are turning to RegTech for efficient, tech-based compliance support.

Restraints in the RegTech Market

High Implementation Costs and Integration Issues

One major restraint in the RegTech market is the high cost of adopting and integrating new technologies. For many small and medium-sized businesses, setting up advanced RegTech systems can be expensive. These solutions often require specialized IT infrastructure, trained staff, and regular updates to stay effective. In some cases, companies also face difficulties integrating RegTech tools with their existing systems, especially if those systems are outdated.

This creates delays and may reduce the effectiveness of the technology. The upfront investment and complexity of deployment can discourage businesses from adopting RegTech quickly. As a result, many companies stick to manual or semi-automated methods, slowing down the market’s overall growth.

Data Privacy and Security Concerns

Another key challenge in the RegTech market is ensuring the privacy and security of sensitive data. RegTech systems process large amounts of personal, financial, and business information to ensure compliance. If not properly secured, this data can be at risk of cyberattacks, leaks, or misuse. Companies may hesitate to adopt RegTech tools if they fear that outsourcing data to a third-party provider could expose them to new risks. Additionally, strict data protection laws, such as GDPR, make it essential for RegTech firms to build high-trust systems. Any breach or mistake can damage a company’s reputation and lead to legal trouble, making businesses cautious about adoption.

Opportunities in the RegTech Market

Expansion into Emerging Markets

Emerging markets represent an immense opportunity for the RegTech industry's growth as financial systems develop further and regulations become more codified. Asia, Africa, and Latin America are developing stronger regulatory frameworks to increase transparency and attract international investment, leading local businesses and financial institutions to require efficient compliance tools to comply with these new standards.

RegTech provides businesses with an invaluable way to establish trust with global partners while avoiding penalties. Since many markets are still developing their digital infrastructure, many are open to adopting new technologies right from the beginning, giving RegTech providers a great chance to establish themselves early and shape the market. As smartphone usage and digital finance adoption increase across these regions, RegTech expansion opportunities become even greater.

AI and Advanced Analytics Integration

Artificial intelligence and advanced data analytics have opened new avenues of opportunity for RegTech solutions. AI can make compliance tools smarter, faster, and better at identifying risks than ever before. Machine learning models, for instance, can analyze large volumes of data in real time to detect suspicious patterns that might indicate fraud or regulatory breaches. Not only does this increase accuracy, it also allows predictive compliance, meaning potential issues are identified before they cause problems. As AI technology evolves, RegTech providers can tailor and scale solutions more precisely for specific industries. Demand for intelligent compliance tools continues to rise; companies that leverage AI have an edge in the market.

Trends in the RegTech Market

AI-Powered Compliance Automation

In 2025, artificial intelligence (AI) and machine learning (ML) will become central to RegTech solutions. These technologies automate complex compliance tasks like fraud detection, transaction monitoring, and customer due diligence. By analyzing vast datasets in real-time, AI can identify suspicious activities more accurately, reducing false positives and manual errors, which not only improves efficiency but also ensures timely reporting and adherence to evolving regulations. As regulatory frameworks become more intricate, the adoption of AI-driven tools is expected to accelerate, offering businesses a proactive approach to compliance management.

Cloud-Based RegTech Solutions

The transformation towards cloud computing is transforming the RegTech landscape. Cloud-based platforms offer scalable and flexible solutions that can adapt to the dynamic nature of regulatory requirements. They enable real-time data processing and seamless integration with existing systems, facilitating efficient compliance monitoring across various jurisdictions. Moreover, cloud solutions support remote access and collaboration, which is increasingly important in today's distributed work environments. As organizations seek cost-effective and agile compliance tools, the demand for cloud-based RegTech services is on the rise, marking a significant trend in the industry's evolution.

Research Scope and Analysis

By Component Analysis

The solutions segment will hold 68.4% market share in 2025 and will play an essential role in driving the development of RegTech by providing advanced tools that streamline and automate complex regulatory tasks. These include software platforms designed for compliance monitoring, fraud detection, transaction screening, identity verification, real-time reporting, and real-time monitoring. Companies across finance, healthcare, and insurance are turning to digital solutions as a way of cutting operational burdens and staying compliant with ever-evolving regulatory rules.

As regulations become stricter and data privacy laws tighten, businesses are turning towards cost-effective solutions that are easy to integrate and deliver real-time insights and accuracy improvements. Scalable cloud platforms with AI compliance tools continue to increase in popularity as companies look for effective means of mitigating risks while simultaneously increasing efficiency.

Further, the services have seen strong growth over the forecast period due to demand for expert help with implementation, system integration, and ongoing compliance management. Many organizations, especially smaller ones, depend on external expertise for help with regulatory updates and technical challenges. These services provide tailored guidance, maintenance, training, and real-time system updates to ensure tools operate seamlessly while meeting local and global regulatory standards. Due to increasing compliance requirements, businesses are opting for managed compliance and consulting services as a solution to reduce internal workload and ensure audit-readiness.

By Deployment Mode Analysis

Cloud deployment dominated the RegTech market in 2025 with 63.7% market share, playing an essential part in its expansion by providing flexible, scalable and cost-effective solutions. Businesses are turning to cloud platforms to manage compliance tasks such as risk assessments, regulatory reporting, and transaction monitoring without the need for costly IT infrastructure. Cloud-based RegTech tools enable real-time updates, faster integration and easy access to new features that enable businesses to keep pace with changing laws. In addition, these platforms support secure data storage and global access - ideal solutions for firms operating across regions. With digital finance regulations intensifying and remote working and data privacy laws expanding, the movement toward cloud-based RegTech tools has increased dramatically to assist companies remain efficient while compliant.

RegTech companies that prioritize full control over data and system security have seen rapid on-premises deployment experience exponential growth over the forecast period. Certain industries, like banking and government-related services, prefer on-site solutions to comply with internal policies or regulatory demands. These setups offer greater customization while also providing businesses with control of their servers, data access settings, and security settings. Though less flexible than cloud systems, on-premises deployment is increasingly valued for its strong data protection and reduced risk of third-party exposure. As cybersecurity and data governance concerns rise, many firms have relied upon in-house RegTech systems to support compliance while decreasing external dependency.

By Organization Size Analysis

Large enterprises are set to dominate the RegTech market in 2025 with a share of

57.8% and play an essential part in its development due to their need for strong compliance systems across various regions and departments. These organizations must comply with complex regulatory requirements, necessitating sophisticated tools for risk management, fraud detection, and regulatory reporting.

RegTech solutions allow large enterprises to automate compliance tasks more quickly and accurately, reduce manual errors, and cut operational costs by automating compliance reporting tasks. Companies of this nature benefit from cloud-based platforms that enable them to scale and manage compliance across their global operations, staying abreast of ever-evolving regulations. RegTech solutions play a crucial role in maintaining compliance, avoiding penalties, and driving efficiency within these processes.

SME companies are projected to experience impressive growth in the RegTech market over the coming years as they recognize the significance of compliance tools to meet regulatory demands. Small and midsized enterprises (SMEs) face limited resources when compared with large enterprises; therefore, more SMEs are turning to cost-effective and user-friendly RegTech solutions in order to manage compliance and reduce risks.

Cloud-based platforms and subscription models that offer scalable solutions without an initial capital outlay are great assets to SMEs as their digital transformation progresses, increasing demand for efficient regulatory technology that is both cost-effective and flexible. RegTech solutions become invaluable assets to meet compliance obligations without needing large teams or high costs; driving their adoption.

By Technology Analysis

AI (Artificial Intelligence) will lead in 2025 with a 24.7 percent share, driving the growth of the RegTech market by revolutionizing how businesses approach compliance and risk management. AI-powered tools enable researchers to rapidly analyze large volumes of data, identify patterns, and detect any potential fraud, money laundering or noncompliance with regulations. Furthermore, these time-saving tools automate time-consuming tasks, thereby eliminating human error and increasing efficiency. AI can also assist businesses with keeping pace with regulatory changes by offering real-time updates and predictive insights, helping them make informed decisions. As regulations become more complex, AI continues to offer faster solutions that increase accuracy while also helping manage risks more effectively, making it one of the key technologies of RegTech in its entirety.

Big data analytics has seen substantial expansion within the RegTech market over recent years due to its ability to process massive volumes of information to identify trends and compliance risks. RegTech solutions powered by big data can quickly analyze large datasets to detect patterns that would pass unnoticed during manual checks, providing businesses with insights that help identify any potential problems early and ensure compliance with changing regulations.

Big data analytics enables more precise risk evaluation and predictive analyses, which is vital for industries like banking and insurance. As more data becomes available, demand will only grow for solutions that can effectively utilize and extract value from this information, propelling RegTech market expansion

By Application Analysis

Compliance will lead the RegTech market in 2025 with a

29.4% market share, playing an essential role in keeping businesses compliant with ever-evolving regulations. Compliance management tools simplify compliance tasks like monitoring transactions, submitting reports, and staying abreast of changing laws to alleviate some of the burden on businesses.

These solutions help organizations maintain consistency and accuracy, complying with local and global regulations while avoiding penalties. With increasingly stringent regulations across industries like finance, healthcare, and insurance, RegTech solutions for compliance management have become essential to streamlining processes, minimizing human error, and improving operational efficiency, driving their adoption within the market.

Further, data governance has seen significant expansion within the RegTech market over the coming year as businesses aim to manage and secure sensitive information while meeting compliance regulations. With the change in regulations surrounding data privacy like GDPR, companies require robust solutions that can ensure data is collected, stored, and utilized responsibly.

RegTech tools for data governance provide businesses with a framework to meet regulatory compliance and manage quality, privacy, and security issues, as well as track usage to build trust among customers and regulators. With data becoming an ever more integral component of business operations, demand for efficient governance solutions has continued to surge, leading to the exponential expansion of the RegTech market.

By End Use Industry Analysis

Banking will be the leading as end user in 2025 with a 39.9% share in terms of revenue generated from RegTech sales due to an increasing need for regulatory compliance, fraud prevention, and risk management solutions. Banks must comply with numerous complex regulations, such as anti-money laundering (AML) laws and know-your-customer (KYC) requirements. RegTech solutions help banks automate compliance tasks, mitigate human error risks, and ensure timely reporting.

Tools like transaction monitoring, identity verification, and reporting automation enable banks to improve operational efficiency while strengthening security while remaining compliant with emerging regulations. With digital banking and financial services becoming more prevalent than ever, RegTech continues to be essential in managing compliance and preventing financial crimes, driving its adoption within banking.

Healthcare has experienced dramatic growth over the forecast period in the RegTech market as its regulatory demands and data privacy concerns increase. Due to increasing amounts of patient data and stringent regulations such as HIPAA, healthcare providers require efficient tools for compliance management and information protection.

RegTech solutions help automate tasks like data management, reporting, and risk analysis, ensuring healthcare organizations meet regulatory requirements while protecting patient privacy and keeping regulatory requirements met. As healthcare industry digitization increases, demand for automated, scalable compliance solutions increases, driving growth within this industry sector and propelling further expansion within this RegTech market segment.

The RegTech Market Report is segmented on the basis of the following

By Component

- Solutions

- Compliance Management

- Risk Management

- Identity Management

- Regulatory Reporting

- Transaction Monitoring

- Services

- Professional Services

- Managed Services

By Deployment Mode

By Organization Size

By Technology

- Artificial Intelligence (AI)

- Machine Learning (ML)

- Blockchain

- Cloud Computing

- Big Data Analytics

- Natural Language Processing (NLP)

By Application

- Regulatory Compliance

- Fraud Detection & Risk Management

- Identity Verification

- AML (Anti-Money Laundering)

- KYC (Know Your Customer)

- Transaction Monitoring

- Data Governance

By End User

- Banking

- Insurance

- FinTech

- Capital Markets

- Healthcare

- Government & Public Sector

- Energy & Utilities

Regional Analysis

Leading Region in the RegTech Market

North America leads with

38.1% market share for RegTech growth by virtue of its strong regulatory environment and rapid adoption of innovative technologies. In this region, many financial institutions, fintech companies, and regulatory bodies are driving demand for effective compliance solutions. As regulatory requirements become more stringent across sectors such as banking, insurance and healthcare, companies in North America have turned increasingly towards RegTech tools in order to decrease manual work, improve accuracy and manage risks more efficiently.

Businesses find adopting AI, big data analytics and cloud services more straightforward due to advanced digital infrastructure and increased investments in these tools. Strict regulations such as anti-money laundering (AML) laws and data privacy rules force firms to implement automated compliance systems as a means of staying ahead. North America continues to be at the forefront of innovation while meeting strong demand for safe and secure solutions - one factor driving its global RegTech market growth.

Fastest Growing Region in the RegTech Market

Asia Pacific's RegTech market is poised for rapid expansion over its forecast period due to digital disruption, expanding financial inclusion measures, and the addition of new regulatory frameworks. Countries in this region are strengthening compliance systems to manage increasing risks in banking, insurance and digital finance. With more and more people turning to financial services online, demand for automated identity verification tools, anti-money laundering measures and risk management solutions has grown steadily.

Governments are encouraging regulatory technology as a way of increasing transparency and decreasing fraud. Asia Pacific boasts strong potential in this regard, with both emerging markets as well as developed ones offering great potential for its adoption, making it one of the fastest-growing regions by 2025.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

RegTech market competition is growing as many companies enter this space to provide smart solutions for managing regulations. Big tech firms, small startups, and specialized providers all compete to provide faster, more accurate tools that are user-friendly. RegTech solutions help businesses comply with rules, manage risks, and avoid fines more effectively.

While some solutions specialize in identity checks or fraud detection, others can meet all compliance needs. With more industries facing strict rules comes more demand for RegTech, leading more players into this space and allowing innovation while keeping prices low and making tools easy to use. Partnerships between regulators and businesses have also become common, helping spread these tools further afield.

Some of the prominent players in the Global RegTech are

- Fenergo

- Socure

- Elliptic

- Jumio

- CUBE

- IDnow

- KYC Hub

- WorkFusion

- Sumsub

- Droit

- Fintellix

- Drooms

- Capiche

- Taina Technology

- Checkedsafe

- 360factors

- CleverChain

- AQMetrics

- Sift Science

- Other Key Players

Recent Developments

- In April 2025, Geneva-based Polixis and SpeciTec have announced a strategic partnership to deliver integrated AML, KYC, and CLM solutions for private banking. Combining Polixis’ regulatory intelligence with SpeciTec’s advanced platforms, the collaboration leverages four AI-driven business cases to enhance compliance, streamline risk management, and accelerate digital transformation, offering a unified, innovative approach tailored for banks and wealth managers.

- In April 2025, Hadrius, a leader in AI-driven compliance tech, has been honored in the RegTech category at the 2025 Global Tech Awards. This recognition highlights Hadrius’ innovative role in transforming compliance management for financial services. Its intelligent platform empowers compliance teams to navigate complex regulations, automate manual tasks, and reduce risk, all while boosting efficiency. The award underscores Hadrius’

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.7 Bn |

| Forecast Value (2034) |

USD 132.6 Bn |

| CAGR (2025–2034) |

23.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 6.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Mode (Cloud-based and On-Premises), By Organization Size (Large Enterprises and SMEs), By Technology (Artificial Intelligence (AI), Machine Learning (ML), Blockchain, Cloud Computing, Big Data Analytics, Natural Language Processing (NLP)), By Application (Regulatory Compliance, Fraud Detection & Risk Management, Identity Verif, ication, AML (Anti-Money Laundering), KYC (Know Your Customer), Transaction Monitoring, Data Governance), By End User (Banking, Insurance, FinTech, Capital Markets, Healthcare, Government & Public Sector, and Energy & Utilities) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Fenergo, Socure, Elliptic, Jumio, CUBE, IDnow, KYC Hub, WorkFusion, Sumsub, Droit, Fintellix, Drooms, Capiche, Taina Technology, Checkedsafe, 360factors, CleverChain, AQMetrics, Sift Science, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global RegTech Market size is expected to reach a value of USD 19.7 billion in 2025 and is expected to reach USD 132.6 billion by the end of 2034.

North America is expected to have the largest market share in the Global RegTech Market, with a share of about 38.1% in 2025.

The RegTech Market in the US is expected to reach USD 6.5 billion in 2025.

Some of the major key players in the Global RegTech Market are Fenergo, Socure, Elliptic, and others

The market is growing at a CAGR of 23.6 percent over the forecasted period.