Market Overview

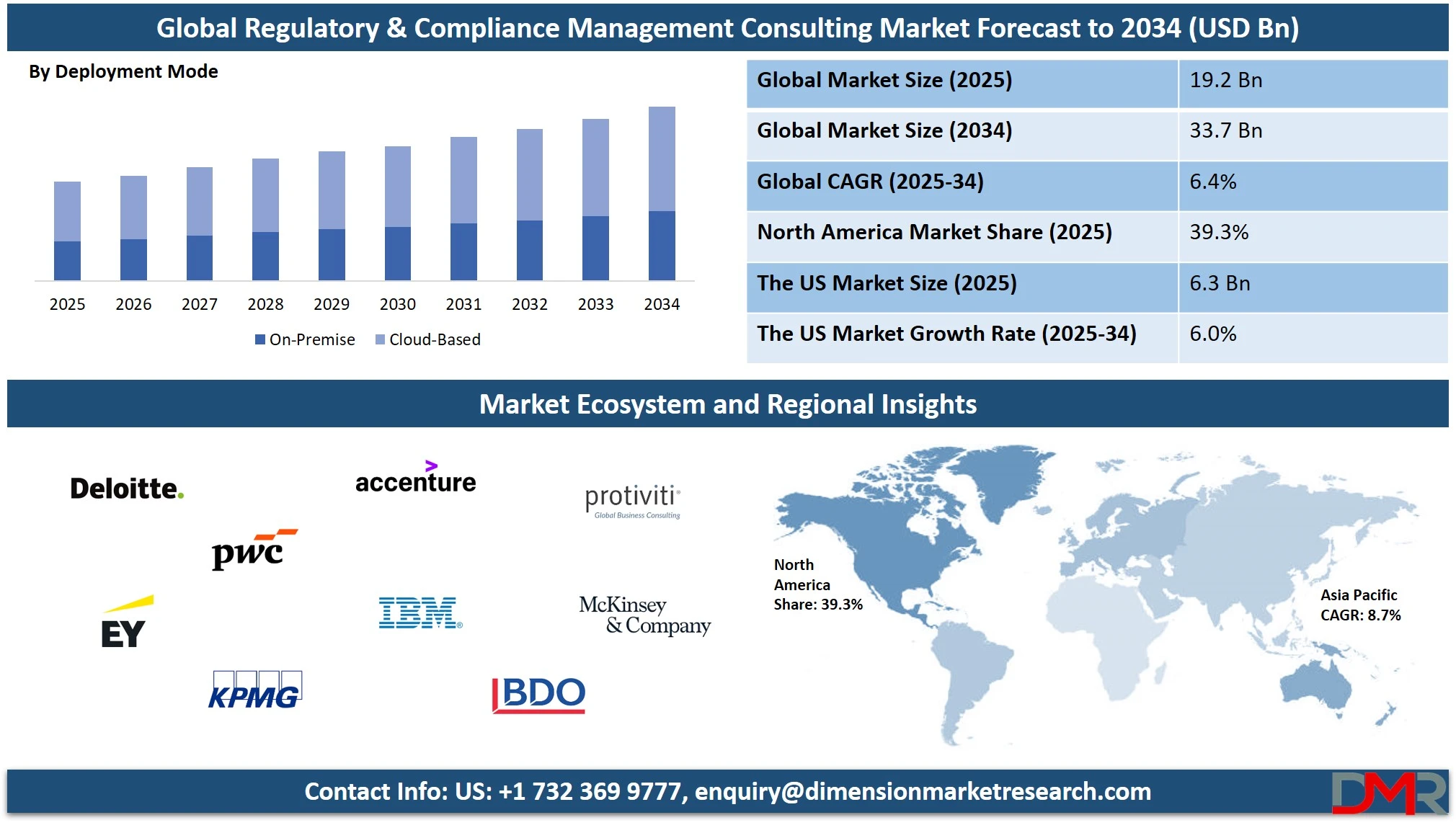

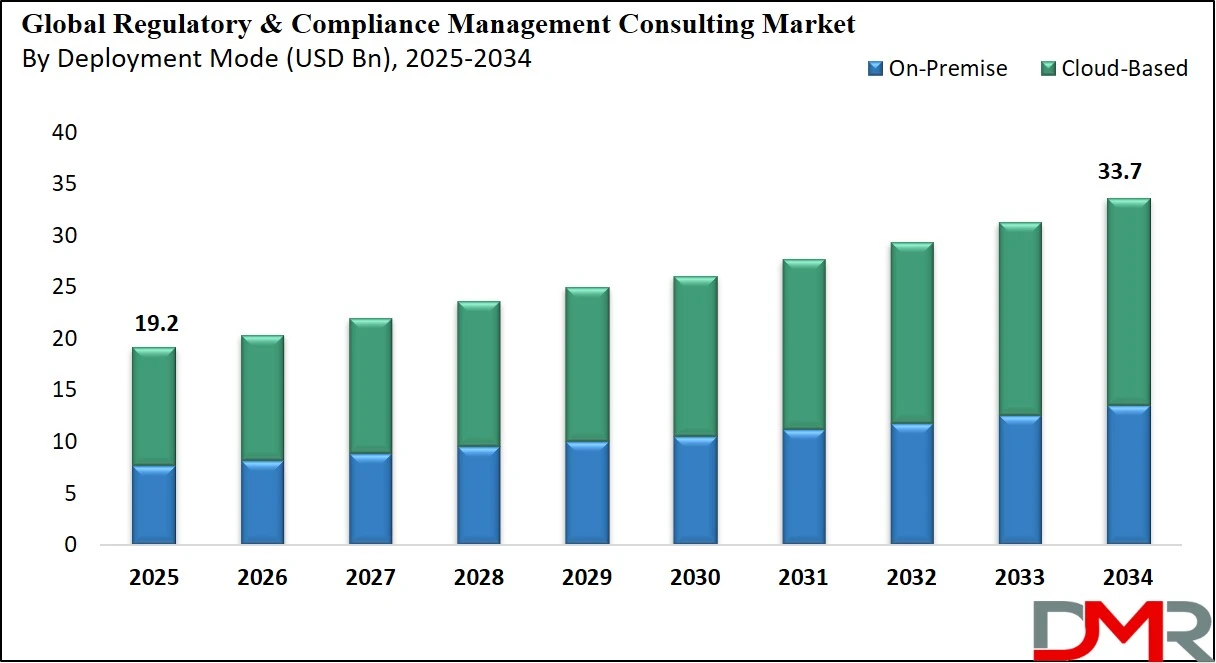

The Global Regulatory and Compliance Management Consulting Market is valued at USD 19.2 billion in 2025 and is projected to reach USD 33.7 billion by 2034. Driven by rising demand for risk advisory services, governance consulting, and regulatory compliance solutions, the market is expanding steadily. With a CAGR of 6.4%, growth is fueled by evolving industry regulations, compliance management systems, and corporate risk mitigation strategies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Regulatory and compliance management consulting refers to a specialized advisory practice that assists organizations in navigating complex legal frameworks, industry-specific mandates, and internal governance protocols. These consulting services help businesses assess compliance risks, design robust control systems, implement compliance programs, and ensure adherence to national and international regulations.

Consultants in this domain offer expertise in a wide array of areas such as data privacy, anti-corruption, financial compliance, workplace safety, environmental standards, and corporate ethics. By guiding companies through policy development, audit preparation, regulatory reporting, and enforcement response, regulatory consultants play a pivotal role in reducing legal exposure, preserving brand integrity, and fostering a culture of compliance within the organization.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global regulatory and compliance management consulting market has emerged as a critical segment within the broader professional services industry, fueled by the escalating complexity of regulatory landscapes and heightened scrutiny from oversight bodies. As industries grapple with evolving compliance mandates such as GDPR, HIPAA, Basel III, and ESG-related disclosures, the demand for external advisory support continues to rise.

Organizations across sectors, including financial services, pharmaceuticals, energy, technology, and public administration, are investing in external consultants to ensure accurate interpretation and implementation of regulatory requirements. The rapid pace of regulatory change, integrated with severe financial and reputational penalties for non-compliance, has positioned regulatory advisory services as indispensable to enterprise risk management strategies.

This market is further propelled by the globalization of operations, the digital transformation of compliance processes, and the growing emphasis on ethical governance and transparency. Regulatory consulting firms are expanding their offerings beyond traditional audit support to include compliance automation, policy digitization, regulatory technology integration, and real-time monitoring systems.

Regions such as North America and Europe dominate due to stringent legal frameworks and mature consulting ecosystems, while emerging markets in Asia-Pacific and the Middle East are witnessing accelerated growth as they align with international compliance benchmarks. The market's evolution is marked by the convergence of legal, technological, and operational expertise, making it a cornerstone for sustainable and accountable business practices.

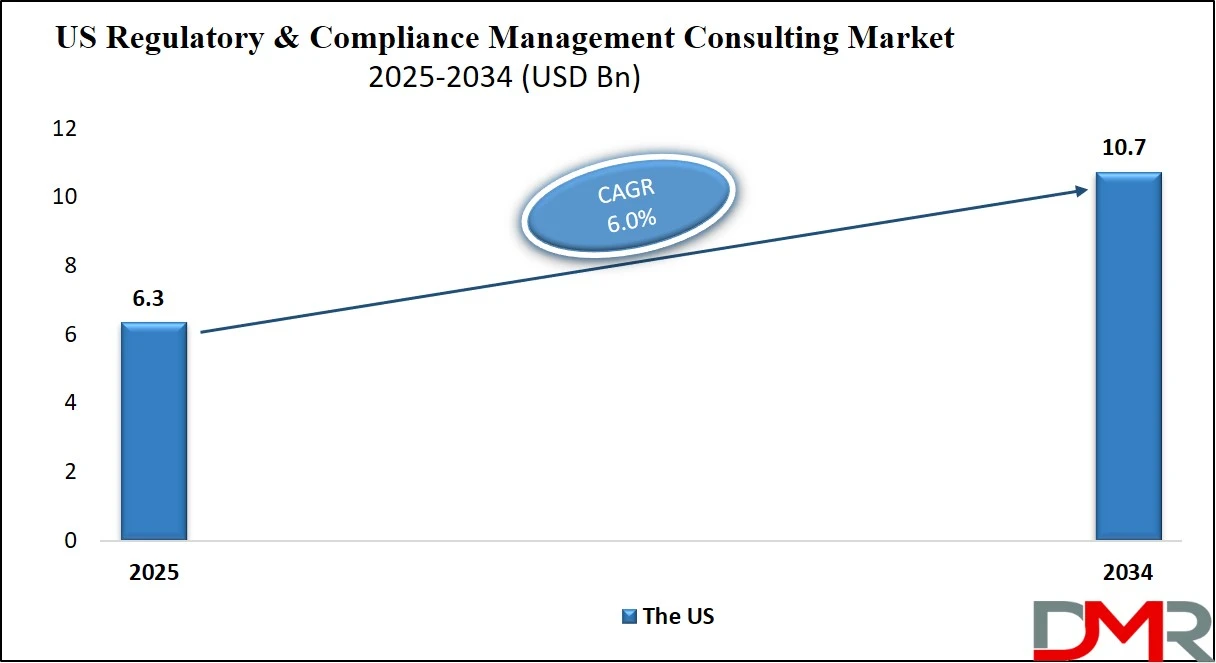

The US Regulatory & Compliance Management Consulting Market

The U.S. Regulatory & Compliance Management Consulting Market size is projected to be valued at USD 6.3 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 10.7 billion in 2034 at a CAGR of 6.0%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Regulatory and Compliance Management Consulting market plays a pivotal role in helping organizations navigate a highly complex and dynamic regulatory environment. With stringent oversight from agencies such as the SEC, FDA, EPA, and FINRA, businesses across sectors are turning to consulting firms for strategic guidance on compliance frameworks, regulatory audits, and risk management solutions.

These services address a wide spectrum of needs, including internal controls assessment, anti-money laundering compliance, corporate governance practices, and data privacy regulations such as HIPAA and CCPA. The growing reliance on regulatory intelligence tools, compliance reporting, and third-party risk assessments has positioned the US as one of the most mature and influential markets in this space.

Demand is particularly high in industries like financial services, healthcare, energy, and pharmaceuticals, where evolving compliance obligations and enforcement actions create continuous pressure for operational transparency and legal adherence. US consulting firms are offering tailored solutions that combine regulatory consulting expertise with compliance automation, GRC (governance, risk, and compliance) technology integration, and enterprise-wide training. With increased focus on ESG compliance, cybersecurity regulation, and whistleblower program implementation, companies are investing in scalable and proactive compliance strategies.

This market continues to grow as organizations seek trusted partners to manage regulatory change, ensure ethical conduct, and mitigate reputational and financial risks through customized advisory support.

The Europe Regulatory & Compliance Management Consulting Market

Europe’s regulatory and compliance management consulting market is projected to be valued at approximately USD 5.0 billion in 2025. This strong regional presence is driven by the continent’s well-established legal frameworks, active regulatory bodies, and a high level of institutional enforcement across industries. European firms face a wide range of complex compliance obligations, including financial regulations like MiFID II, sustainability mandates under the CSRD, and data privacy rules enforced through GDPR. As a result, businesses are reliant on external consulting partners to interpret evolving directives, update governance structures, and ensure regulatory alignment across borders.

The market is expected to grow at a steady CAGR of 5.8% from 2025 to 2034, fueled by the rising focus on ESG compliance, digital governance, and supply chain transparency. With stricter enforcement of climate-related disclosures, human rights due diligence laws, and cybersecurity frameworks, demand for specialized consulting is growing among corporations and public sector entities alike. Countries like Germany, France, the UK, and the Netherlands are particularly active, with strong uptake in sectors such as finance, pharmaceuticals, and manufacturing. Furthermore, the integration of compliance automation and AI-driven risk analytics is beginning to reshape how European organizations approach regulatory transformation, opening new avenues for consulting firms across the region.

The Japan Regulatory & Compliance Management Consulting Market

Japan’s regulatory and compliance management consulting market is estimated to reach USD 860 million in 2025. While relatively modest in size compared to North America and Europe, Japan’s demand for compliance advisory services is steadily rising due to growing regulatory pressures across sectors such as finance, healthcare, and manufacturing.

Domestic companies are navigating both local requirements and international standards, including those related to data protection, anti-money laundering, and ESG disclosures. Japanese corporations are traditionally conservative and in-house focused, but globalization, digital transformation, and the need for external audit preparedness are prompting a shift toward professional consulting support.

With a projected CAGR of 4.9% through 2034, Japan's market is expected to grow in tandem with rising corporate governance reforms, digital compliance adoption, and mounting pressure from institutional investors. Regulatory consulting firms are being engaged to help businesses improve transparency, establish risk governance frameworks, and align with sustainability reporting guidelines, such as Japan’s TCFD-based climate disclosures.

Additionally, the government’s push for the digitization of compliance systems and wider adoption of GRC platforms is creating fresh opportunities for both local and international consulting firms to expand their footprint in Japan’s evolving compliance ecosystem.

Global Regulatory & Compliance Management Consulting Market: Key Takeaways

- Market Value: The global regulatory & compliance management consulting market size is expected to reach a value of USD 33.7 billion by 2034 from a base value of USD 19.2 billion in 2025 at a CAGR of 6.4%.

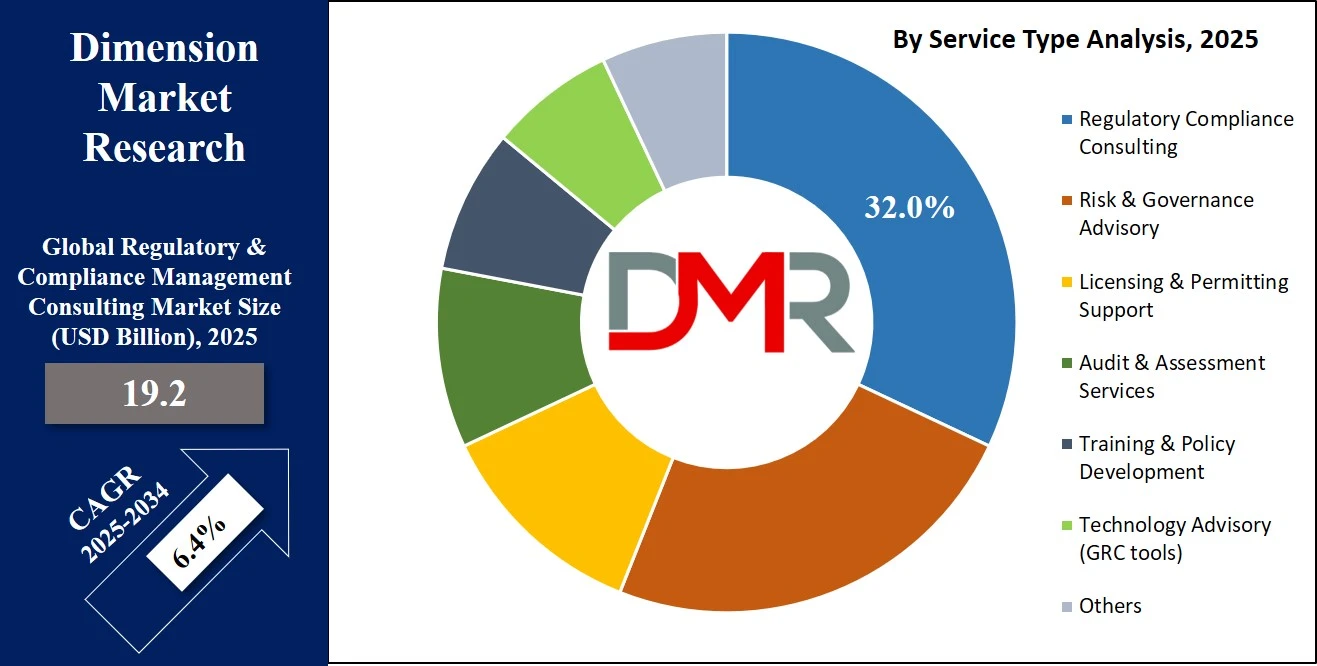

- By Service Type Segment Analysis: Regulatory Compliance Consulting service type is anticipated to dominate the service type segment, capturing 32.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-Based deployment mode is poised to consolidate its dominance in the deployment mode segment, capturing 60.0% of the total market share in 2025.

- By Enterprise Size Segment Analysis: Large Enterprises are expected to maintain their dominance in the enterprise size segment, capturing 68.0% of the total market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry will dominate the industry vertical segment, capturing 28.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global regulatory & compliance management consulting market landscape with 39.3% of total global market revenue in 2025.

- Key Players: Some key players in the global regulatory & compliance management consulting market are Deloitte, PwC, ET, KPMG, Accenture, IBM, BDO, Protiviti, FTI Consulting, and Others.

Global Regulatory & Compliance Management Consulting Market: Use Cases

- Financial Services Compliance Enhancement: Banks and financial institutions use consulting services to align with regulations like Basel III, MiFID II, and AML laws. These services help implement internal controls, streamline compliance reporting, and integrate risk assessment tools. Consulting firms enable faster adaptation to regulatory change while minimizing penalties and audit risks.

- Pharmaceutical Regulation and Quality Assurance: Pharma companies rely on compliance consultants to meet FDA, EMA, and global drug safety requirements. Use cases include clinical trial compliance, product labeling standards, and regulatory submissions. Advisory firms support policy alignment, audit readiness, and quality system development across R&D and manufacturing.

- ESG and Sustainability Reporting Compliance: Enterprises consult experts to comply with ESG mandates and sustainability disclosures. Consultants assist in implementing reporting frameworks, conducting risk analysis, and aligning ESG goals with global standards. This ensures regulatory alignment while enhancing brand reputation and stakeholder trust.

- Cross-Border Data Privacy and Cyber Compliance: Multinational firms turn to consulting firms to manage global data privacy laws such as GDPR, CCPA, and HIPAA. Consultants help design privacy governance structures, perform data risk assessments, and ensure secure cross-border data flows in line with compliance expectations.

Global Regulatory & Compliance Management Consulting Market: Stats & Facts

OECD & World Bank Regulatory Governance

- 85 of 186 countries prepare forward regulatory plans; 84% of OECD high‑income and Europe/Central Asia economies follow this practice.

- 138 of 186 economies routinely solicit stakeholder consultations on proposed regulations.

- Only around 36% of East Asia & Pacific economies report consultation outcomes, compared to 84% that consult stakeholders.

- 86 of 186 countries conduct regular regulatory impact assessments (RIAs).

- Among high‑income countries, only 14 do not require RIAs.

- 54 of 86 countries implementing RIAs have dedicated oversight bodies.

- Ex‑post reviews of regulations are practiced in only 6 of 21 Europe & Central Asia states.

- 31 of 186 countries don’t make their current regulations accessible in a centralized location.

- Eleven OECD and three Europe/Central Asia countries score a perfect 5 on the regulatory governance index.

OECD Public Integrity Indicators

- The OECD average score for internal control effectiveness is 81; the EU average is 82.

- Japan scores 30 on internal control effectiveness, significantly below the OECD average.

Government of Canada – Regulatory Burden

- In 2011, SMEs in Canada bore CAD 4.76 billion in annual compliance costs.

- Firms with 1–4 employees face CAD 2,252 in regulatory costs; those with 100–499 employees face CAD 24,960.

- 68% of Canadian small-business owners report reduced productivity due to red tape.

- In 2020, red tape cost Canadian businesses CAD 11 billion; U.S. businesses incurred USD 364.3 billion.

- The cost per employee for firms under five employees in Canada was CAD 1,945 versus CAD 398 for large firms.

- Regulatory accumulation from 2006 to 2021 reduced Canada’s business sector GDP growth by 1.7 percentage points.

- The same accumulation reduced employment growth by 1.3 percentage points.

- Business investment in Canada would have been 9% higher in 2021 without regulatory increases.

- Business start-up rates would have been 10% higher and exit rates 5% higher without added regulation.

- Canada’s transport-related paperwork burden rose 37% from 2006 to 2021.

U.S. Small Business Administration (SBA)

- Very small firms (fewer than 20 employees) spend 45% more per employee on federal compliance than larger firms.

- Firms under 20 employees spend USD 7,647 per employee annually versus USD 5,282 for firms with 500+ employees.

- SMEs (fewer than 500 employees) account for 99.7% of all U.S. businesses.

- Small businesses generated 64% of net new U.S. jobs over the past 15 years.

OECD Regulatory Policy & Delivery

- Only one-third of OECD countries provide feedback after stakeholder consultation.

- 58% of economic regulators do not have legally defined environmental sustainability targets.

- 42% of regulators lack the legal authority to consider environmental goals in decision-making.

- Use of data-driven enforcement tools like AI and analytics is increasingly common in compliance monitoring.

- The average time to start a business is 19 days in OECD countries compared to 60 days in Sub-Saharan Africa; average OECD cost is 8% of GNP.

Global Regulatory & Compliance Management Consulting Market: Market Dynamics

Global Regulatory & Compliance Management Consulting Market: Driving Factors

Increasing Complexity of Regulatory Environments

The rising volume and intricacy of global regulatory mandates, ranging from financial compliance to environmental reporting, are pushing organizations to seek external expertise. Consulting firms provide essential guidance in interpreting complex governance frameworks, ensuring policy enforcement, and aligning operations with both domestic and international standards. As cross-industry regulations like GDPR, ESG reporting, and anti-corruption laws expand, regulatory transformation consulting becomes a critical service.

Rising Cost of Non-Compliance

Firms face escalating financial and reputational penalties for failing to meet compliance obligations. This has led to increased demand for compliance audits, enterprise risk assessments, and internal controls development. Consultants support companies in strengthening risk mitigation strategies, setting up early warning systems, and creating accountability through structured compliance monitoring processes.

Global Regulatory & Compliance Management Consulting Market: Restraints

High Cost of Customized Consulting Services

Many small and medium enterprises struggle with the high fees associated with professional regulatory consulting, especially when tailored services and proprietary digital compliance solutions are involved. This cost barrier limits widespread adoption, particularly in emerging economies where budgets for governance consulting remain constrained.

Fragmented Regulatory Frameworks across Jurisdictions

Inconsistencies in regulatory structures across regions make it challenging for consulting firms to deliver standardized solutions. Navigating multi-jurisdictional laws without clear harmonization creates inefficiencies in compliance implementation and hinders the scalability of consulting offerings for global clients.

Global Regulatory & Compliance Management Consulting Market: Opportunities

Surge in ESG and Sustainability Compliance Needs

The rapid institutionalization of ESG compliance reporting has created a new avenue for growth. Regulatory consultants are assisting companies with ESG data validation, sustainability audit frameworks, and alignment with reporting standards like GRI and CSRD. As ESG becomes a board-level concern, the demand for strategic compliance advisory in sustainability continues to rise.

Digital Transformation of Compliance Functions

The adoption of technology-driven tools such as AI-powered risk analytics, cloud-based GRC platforms, and automated regulatory reporting systems offers a major growth opportunity. Consulting firms are now expanding their capabilities to include tech advisory services that digitize compliance workflows, improve policy tracking, and streamline regulatory change management.

Global Regulatory & Compliance Management Consulting Market: Trends

Integration of AI and Predictive Analytics in Compliance

Consulting firms are leveraging artificial intelligence to enhance compliance forecasting and scenario modeling. AI tools support predictive regulatory monitoring, allowing businesses to preempt compliance breaches. This integration improves decision-making and enables more dynamic governance practices across industries.

Shift toward Continuous Compliance and Real-Time Auditing

The traditional reactive approach to compliance is being replaced by continuous monitoring systems and real-time auditing frameworks. This shift is being driven by demand for transparency and real-time policy enforcement. Consulting services are now evolving to support dynamic compliance environments that prioritize agility, scalability, and ongoing risk evaluation.

Global Regulatory & Compliance Management Consulting Market: Research Scope and Analysis

By Service Type Analysis

Regulatory Compliance Consulting is expected to lead the service type segment in the global regulatory and compliance management consulting market, accounting for 32.0% of the total market share in 2025. This dominance is primarily due to the growing need for expert support in interpreting, implementing, and monitoring adherence to rapidly evolving legal and industry-specific regulations.

Organizations across sectors such as banking, healthcare, manufacturing, and energy rely on these consulting services to build structured compliance frameworks, manage audits, and respond to enforcement actions. The scope of these services includes regulatory risk analysis, compliance program design, internal policy alignment, and assistance with regulatory filings, helping businesses stay ahead of non-compliance penalties and reputational damage.

Alongside this, Risk and Governance Advisory is also gaining traction within the market as companies seek to enhance their enterprise-wide risk awareness and establish stronger governance structures. These consulting services focus on identifying and mitigating operational, financial, legal, and strategic risks through well-defined governance practices.

Consultants support in developing board governance frameworks, ethical conduct policies, risk appetite models, and integrated reporting systems that align with global standards. As stakeholder scrutiny intensifies and corporate accountability becomes a priority, the demand for strategic advisory services that embed risk management and governance into business decision-making processes continues to grow steadily.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Deployment Mode Analysis

Cloud-based deployment is expected to dominate the deployment mode segment in the global regulatory and compliance management consulting market, capturing 60.0% of the total market share in 2025. This shift toward cloud adoption is driven by the growing demand for scalability, remote accessibility, cost efficiency, and real-time updates in compliance management systems. Cloud platforms allow organizations to automate compliance tracking, integrate with enterprise systems, and receive real-time alerts on regulatory changes.

As regulatory landscapes become more dynamic and data-driven, cloud-based compliance solutions offer enhanced flexibility and faster implementation, making them the preferred choice for businesses looking to streamline their compliance processes and reduce IT infrastructure costs. Moreover, the integration of cloud with advanced technologies such as AI and machine learning is enabling predictive compliance analytics and dynamic policy enforcement, further boosting adoption across industries.

On the other hand, on-premise deployment continues to serve a significant portion of the market, particularly among organizations with high-security requirements, data residency concerns, or legacy infrastructure. Sectors such as defense, government, and traditional banking institutions often opt for on-premise solutions due to the perceived control over data, tighter access management, and compliance with specific regulatory mandates that restrict cloud usage.

Although on-premise models involve higher upfront investments and maintenance responsibilities, they are valued for their customizability and in-house data protection. However, with growing confidence in cloud security protocols and growing demand for agility, the on-premise segment is witnessing a gradual shift, especially among firms looking to adopt hybrid models or transition to cloud-based compliance ecosystems over time.

By Enterprise Size Analysis

Large enterprises are projected to hold a dominant position in the enterprise size segment of the global regulatory and compliance management consulting market, with an anticipated 68.0% share in 2025. This dominance is largely attributed to the scale and complexity of operations in large organizations, which often span multiple jurisdictions and industries. These enterprises are subject to more stringent regulatory scrutiny, greater public visibility, and higher compliance risks, all of which necessitate the engagement of specialized consulting services.

Large firms invest heavily in regulatory advisory to manage legal exposure, design enterprise-wide compliance frameworks, integrate governance, risk, and compliance (GRC) platforms, and ensure readiness for external audits. The demand for continuous monitoring, global policy harmonization, and sector-specific compliance solutions further reinforces their reliance on consulting firms for strategic regulatory support.

In contrast, small and medium-sized enterprises (SMEs) represent a growing but comparatively smaller share of the market. While they face fewer regulatory burdens than large corporations, SMEs are seeking compliance consulting services to navigate sectoral regulations, meet client expectations, and establish credibility in global markets. Many SMEs are adopting risk management practices and compliance programs to qualify for contracts, secure funding, or expand internationally.

However, budget constraints often limit their ability to access comprehensive consulting support. As a result, SMEs typically opt for modular or industry-specific consulting packages that focus on core compliance areas such as data protection, workplace safety, or financial reporting. With the rise of affordable digital compliance tools and outsourced consulting models, the SME segment is gradually becoming a more active participant in the regulatory advisory space.

By Industry Vertical Analysis

The BFSI industry is expected to lead the industry vertical segment in the global regulatory and compliance management consulting market, accounting for 28.0% of the total market share in 2025. This dominance stems from the highly regulated nature of the banking, financial services, and insurance sectors, where compliance requirements are continually evolving in response to new policies, cross-border financial regulations, anti-money laundering directives, and digital finance innovations.

Institutions in this space depend on consulting firms to interpret complex legal frameworks, implement risk governance systems, manage regulatory reporting, and ensure adherence to standards such as Basel III, FATCA, MiFID II, and local banking regulations. The sector also demands constant adaptation to cybersecurity rules, data privacy laws, and ESG disclosure mandates, further reinforcing the need for expert compliance management support.

Healthcare and life sciences are another critical industry vertical in this market, characterized by its unique regulatory challenges. Organizations in this sector face strict compliance mandates from authorities such as the FDA, EMA, and WHO related to drug development, clinical trials, patient data privacy, and quality control. Consulting services are vital in helping these companies align with health regulations like HIPAA, GxP standards, pharmacovigilance protocols, and global safety reporting requirements.

From biotech firms to hospital systems, healthcare organizations rely on consultants to streamline policy documentation, ensure audit preparedness, and integrate compliance systems that track ever-changing health-related laws. As the sector continues to evolve with advancements in digital health, telemedicine, and personalized treatments, the need for specialized regulatory guidance is only expected to grow further.

The Regulatory & Compliance Management Consulting Market Report is segmented on the basis of the following:

By Service Type

- Regulatory Compliance Consulting

- Risk & Governance Advisory

- Licensing & Permitting Support

- Audit & Assessment Services

- Training & Policy Development

- Technology Advisory (GRC tools)

- Reporting & Disclosure Compliance

- Others

By Deployment Mode

By Enterprise Size

By Industry Vertical

- BFSI

- Healthcare & Life Sciences

- Energy & Utilities

- IT & Telecom

- Government & Public Sector

- Manufacturing & Industrial

- Retail & Consumer Goods

- Transportation & Logistics

- Others

Global Regulatory & Compliance Management Consulting Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global regulatory and compliance management consulting market in 2025, contributing 39.3% of the total market revenue. This leadership position is driven by the region's mature regulatory ecosystem, strong presence of global consulting firms, and high adoption of advanced compliance technologies across key industries such as banking, healthcare, energy, and technology.

The region faces rigorous oversight from regulatory bodies like the SEC, FDA, EPA, and FINRA, prompting organizations to invest in specialized consulting services for risk mitigation, governance advisory, and regulatory reporting. Additionally, the growing focus on ESG compliance, data privacy laws like CCPA, and growing corporate accountability further bolster demand for consulting support, solidifying North America’s position as the most advanced and commercially significant market for regulatory advisory services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

Asia-Pacific is projected to witness significant growth in the global regulatory and compliance management consulting market over the coming years, driven by rapid industrialization, expanding financial services, and evolving regulatory frameworks across emerging economies. Countries like China, India, Singapore, and Australia are tightening corporate governance standards, introducing sector-specific compliance mandates, and aligning with global norms such as GDPR, Basel III, and sustainability reporting frameworks.

This regulatory evolution, combined with the growing digital transformation of businesses and increased foreign investments, is creating strong demand for expert consulting services. As organizations across the region face rising scrutiny and seek to strengthen risk management and internal controls, Asia-Pacific is becoming a key growth hub for compliance consulting solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Regulatory & Compliance Management Consulting Market: Competitive Landscape

The global competitive landscape of the regulatory and compliance management consulting market is characterized by the presence of well-established multinational firms alongside a growing number of specialized regional players. Major consulting giants such as Deloitte, PwC, KPMG, EY, and Accenture dominate the space by offering end-to-end compliance advisory services, regulatory technology integration, and sector-specific consulting solutions across diverse industries.

These firms benefit from extensive global networks, proprietary risk management frameworks, and deep expertise in legal and regulatory matters. At the same time, niche consultancies and boutique firms are carving out space by focusing on tailored compliance solutions, industry specialization, and cost-effective delivery models.

The market is also witnessing strategic partnerships, mergers, and digital transformation initiatives as firms aim to strengthen their offerings in areas like ESG compliance, cybersecurity governance, and AI-driven regulatory reporting. This intensifying competition is fostering innovation and expanding service capabilities, reshaping the consulting landscape to meet the growing complexity of global compliance demands.

Some of the prominent players in the global regulatory & compliance management consulting market are:

- Deloitte

- PwC

- EY (Ernst & Young)

- KPMG

- Accenture

- IBM Consulting

- BDO

- Protiviti

- McKinsey & Company

- Boston Consulting Group (BCG)

- Booz Allen Hamilton

- FTI Consulting

- Navigant (a Guidehouse company)

- Capgemini

- Grant Thornton

- Alvarez & Marsal

- Huron Consulting Group

- Cognizant

- Wipro Consulting

- Infosys Consulting

- Other Key Players

Global Regulatory & Compliance Management Consulting Market: Recent Developments

- April 2025: AuditBoard introduced a new regulatory compliance solution within its connected risk platform, designed to help compliance teams manage rapidly evolving regulations and streamline risk management processes.

- March 2025: Brightly Software (a Siemens company) launched Compliance Pro, an integrated, cloud-based module in TheWorxHub platform to automate compliance tasks and integrate them into maintenance workflows.

- June 2025: Compliance Risk Concepts (CRC) closed its acquisition of Oyster Consulting, creating CRC‑Oyster to enhance its financial services compliance and strategy offerings.

- January 2025: Akkodis, part of Adecco Group, acquired Raland Compliance Partners to reinforce its life sciences regulatory and quality consulting expertise.

- April 2025: The RegTech sector rebounded in Q1 2025, raising USD 2.3 billion, up 63 percent from Q4 2024, as investors showed renewed interest in regulatory technology startups.

- April 2025: Maine-based Conductor AI, founded by former Palantir employees, secured approximately USD 15 million in Series A funding to expand its AI-driven compliance software, which already serves U.S. defense and security agencies.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.2 Bn |

| Forecast Value (2034) |

USD 33.7 Bn |

| CAGR (2025–2034) |

6.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Regulatory Compliance Consulting, Risk & Governance Advisory, Licensing & Permitting Support, Audit & Assessment Services, Training & Policy Development, Technology Advisory (GRC tools), Reporting & Disclosure Compliance, and Others), By Deployment Mode (On-Premise and Cloud-Based), By Enterprise Size (Large Enterprises and SMEs), and By Industry Vertical (BFSI, Healthcare & Life Sciences, Energy & Utilities, IT & Telecom, Government & Public Sector, Manufacturing & Industrial, Retail & Consumer Goods, Transportation & Logistics, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Deloitte, PwC, ET, KPMG, Accenture, IBM, BDO, Protiviti, FTI Consulting, and Others.

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global regulatory & compliance management consulting market?

▾ The global regulatory & compliance management consulting market size is estimated to have a value of USD 19.2 billion in 2025 and is expected to reach USD 33.7 billion by the end of 2034.

What is the size of the US regulatory & compliance management consulting market?

▾ The US regulatory & compliance management consulting market is projected to be valued at USD 6.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 10.7 billion in 2034 at a CAGR of 6.0%.

Which region accounted for the largest global regulatory & compliance management consulting market?

▾ North America is expected to have the largest market share in the global regulatory & compliance management consulting market, with a share of about 39.3% in 2025.

Who are the key players in the global regulatory & compliance management consulting market?

▾ Some of the major key players in the global regulatory & compliance management consulting market are Deloitte, PwC, ET, KPMG, Accenture, IBM, BDO, Protiviti, FTI Consulting, and Others.

What is the growth rate of the global regulatory & compliance management consulting market?

▾ The market is growing at a CAGR of 6.4 percent over the forecasted period.