Market Overview

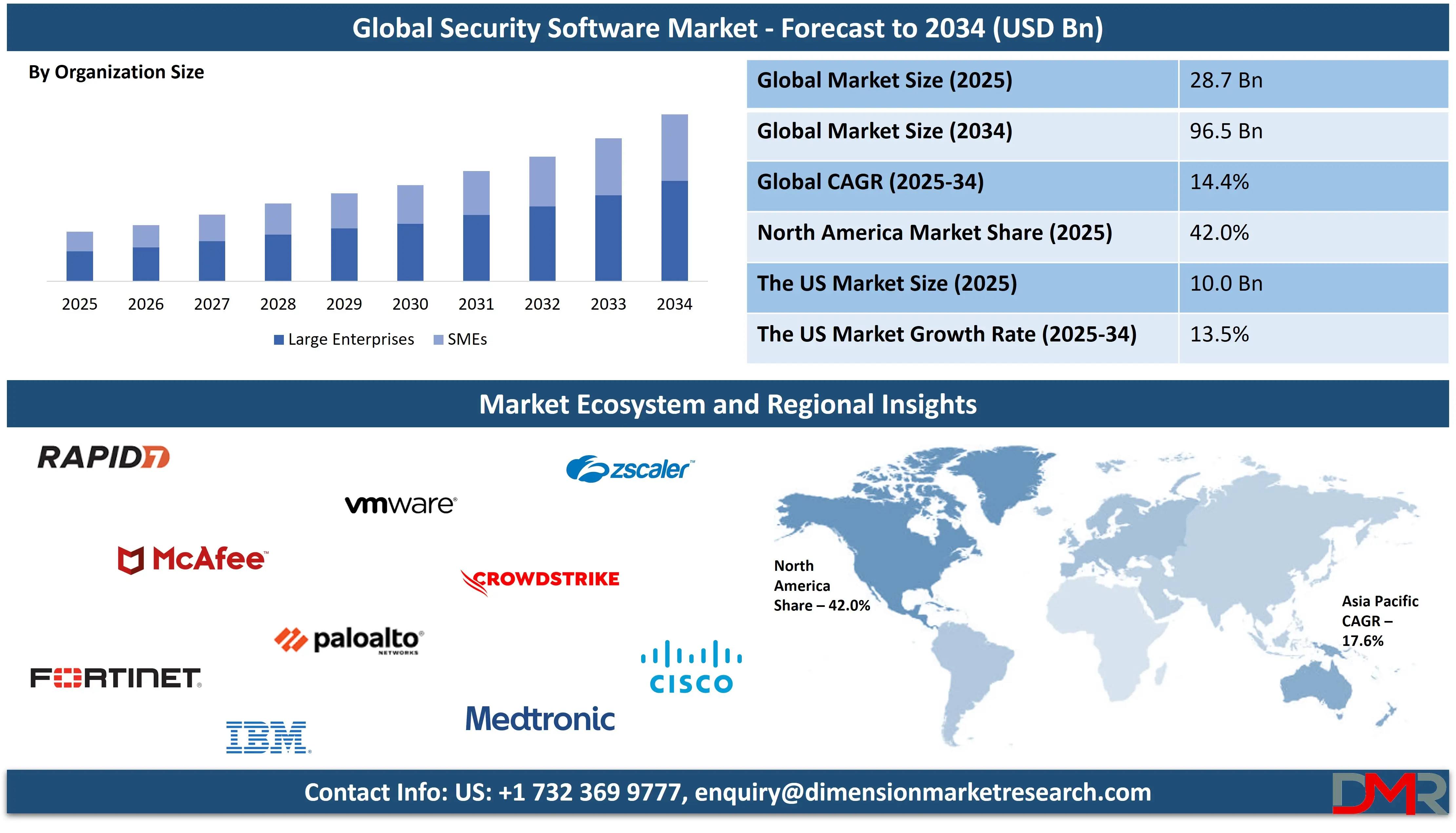

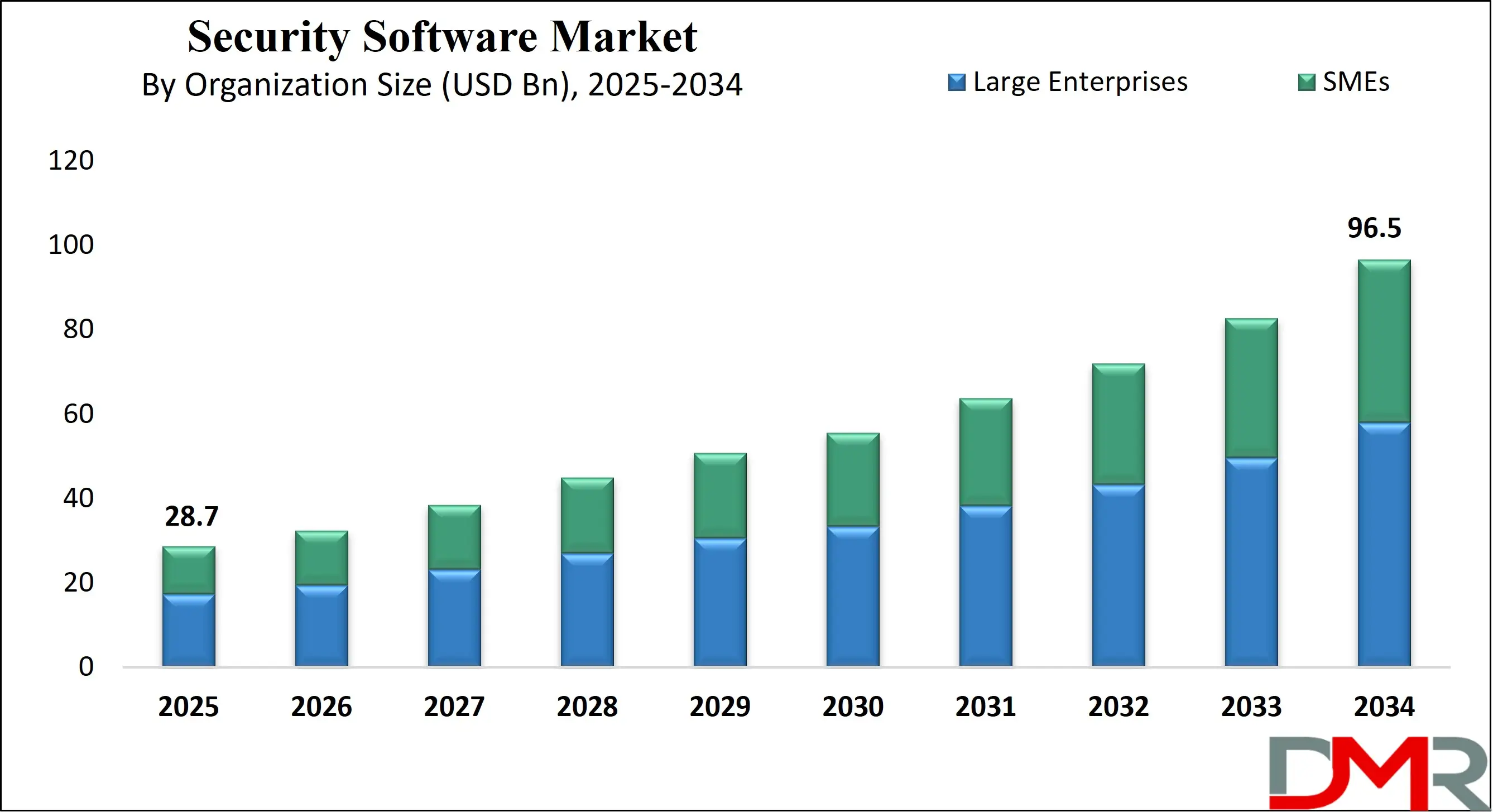

The Global Security Software Market size is projected to reach USD 28.7 billion in 2025 and grow at a compound annual growth rate of 14.4% to reach a value of USD 96.5 billion in 2034.

The Security Software market encompasses a broad range of tools and solutions aimed at protecting digital infrastructure, networks, endpoints, and sensitive data from cyber threats. These solutions integrate multiple technologies, including antivirus, firewalls, intrusion detection and prevention systems, encryption, and identity and access management platforms. Modern security software also leverages AI and machine learning to predict, detect, and mitigate potential attacks in real-time. With the increasing sophistication of cyberattacks, organizations are prioritizing comprehensive security frameworks that not only defend against malware and ransomware but also ensure compliance with industry regulations and data protection standards.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

In recent years, the growing volume of digital data, widespread cloud adoption, and expansion of remote workforces have intensified the demand for robust security solutions. Enterprises are adopting cloud-native security platforms that enable scalable, flexible, and centralized management of threats across hybrid IT environments. AI-driven threat detection and automated remediation are key developments enhancing the speed and accuracy of security operations. Furthermore, regulatory compliance requirements such as GDPR, HIPAA, and PCI DSS are prompting businesses to deploy advanced security software to mitigate operational risks and avoid penalties. These factors collectively reinforce the critical role of security software in safeguarding business continuity and customer trust.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Industry-wide adoption is further fueled by the proliferation of IoT devices, connected infrastructure, and digital transformation initiatives. Organizations across BFSI, healthcare, retail, government, and manufacturing sectors are increasingly investing in multi-layered security strategies to address evolving threats. Government policies, cybersecurity frameworks, and national standards are also driving market expansion by encouraging enterprises to implement best practices and standardized protective measures. As cyber threats become more sophisticated and frequent, the Security Software market is witnessing a surge in demand for solutions that combine scalability, automation, and intelligence to ensure resilient and adaptive cyber defense.

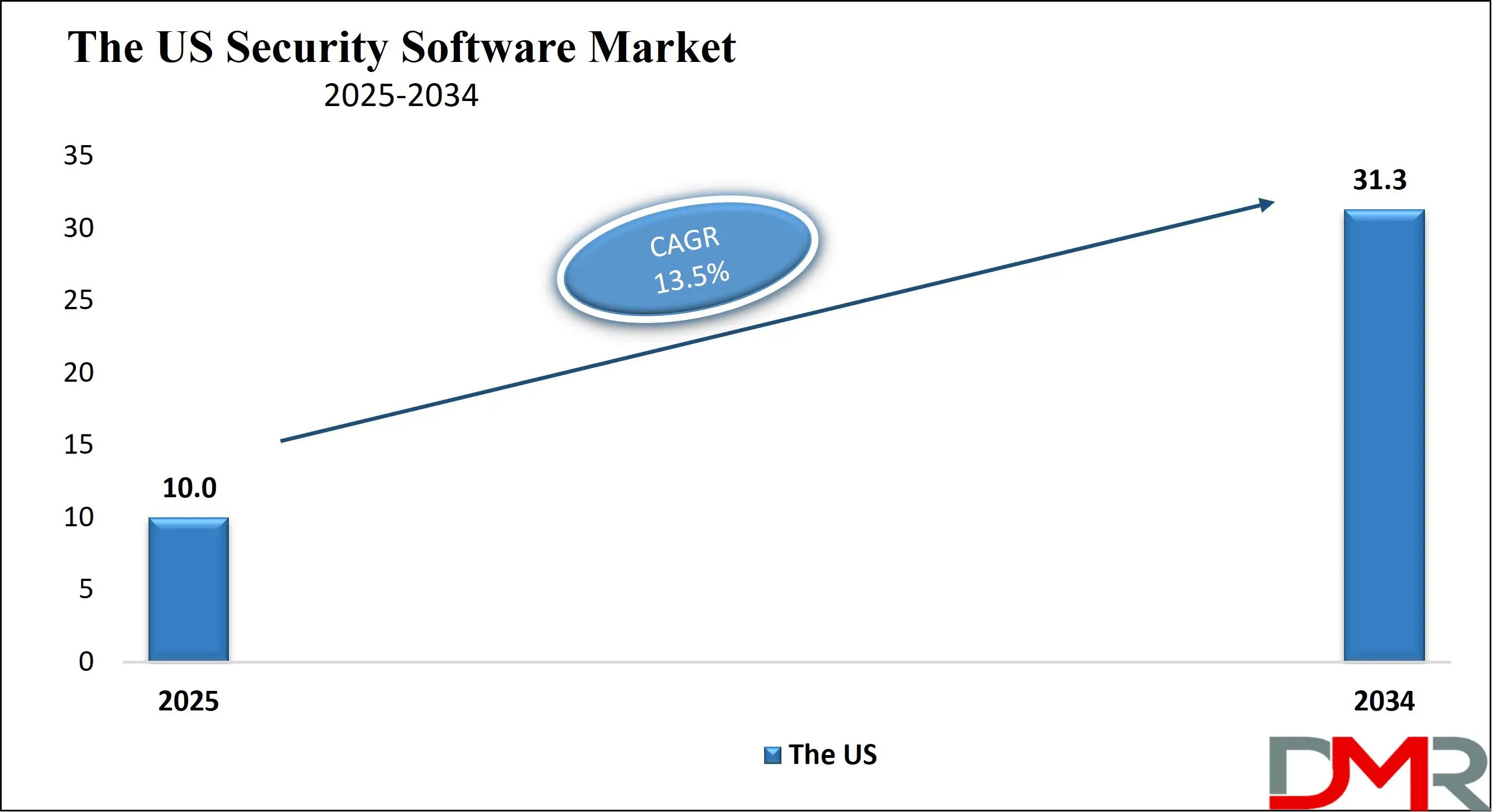

The US Security Software Market

The US Security Software Market size is projected to reach USD 10.0 billion in 2025 at a compound annual growth rate of 13.5% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Security Software market is characterized by mature adoption of advanced cybersecurity technologies. Enterprises and government agencies are increasingly integrating AI, machine learning, and cloud-based security platforms to safeguard sensitive data. The US market prioritizes regulatory compliance, threat intelligence integration, and real-time monitoring solutions. High awareness among organizations regarding ransomware, phishing, and insider threats drives continuous investments in security software solutions.

Europe Security Software Market

Europe Security Software Market size is projected to reach USD 8.1 billion in 2025 at a compound annual growth rate of 13.7% over its forecast period.

Europe's Security Software market is marked by stringent data protection regulations and high penetration of cloud services. Organizations emphasize identity and access management, vulnerability management, and compliance-oriented security solutions. Cybersecurity directives from the EU and national governments accelerate demand for robust security software adoption. Europe is also witnessing investments in AI-based monitoring and cross-border cybersecurity initiatives to counter sophisticated threats.

Japan Security Software Market

Japan Security Software Market size is projected to reach USD 2.0 billion in 2025 at a compound annual growth rate of 15.1% over its forecast period.

Japan's Security Software market emphasizes industrial cybersecurity and enterprise data protection. With advanced technology adoption, Japanese businesses focus on endpoint, cloud, and network security solutions. Government-led cybersecurity policies and initiatives, particularly in the manufacturing and critical infrastructure sectors, encourage deployment of advanced security solutions. Japanese enterprises are increasingly integrating AI-driven threat detection and automated response systems to manage cybersecurity risks effectively.

Security Software Market: Key Takeaways

- Market Growth: The Security Software Market size is expected to grow by USD 67.8 billion, at a CAGR of 14.4%, during the forecasted period of 2026 to 2034.

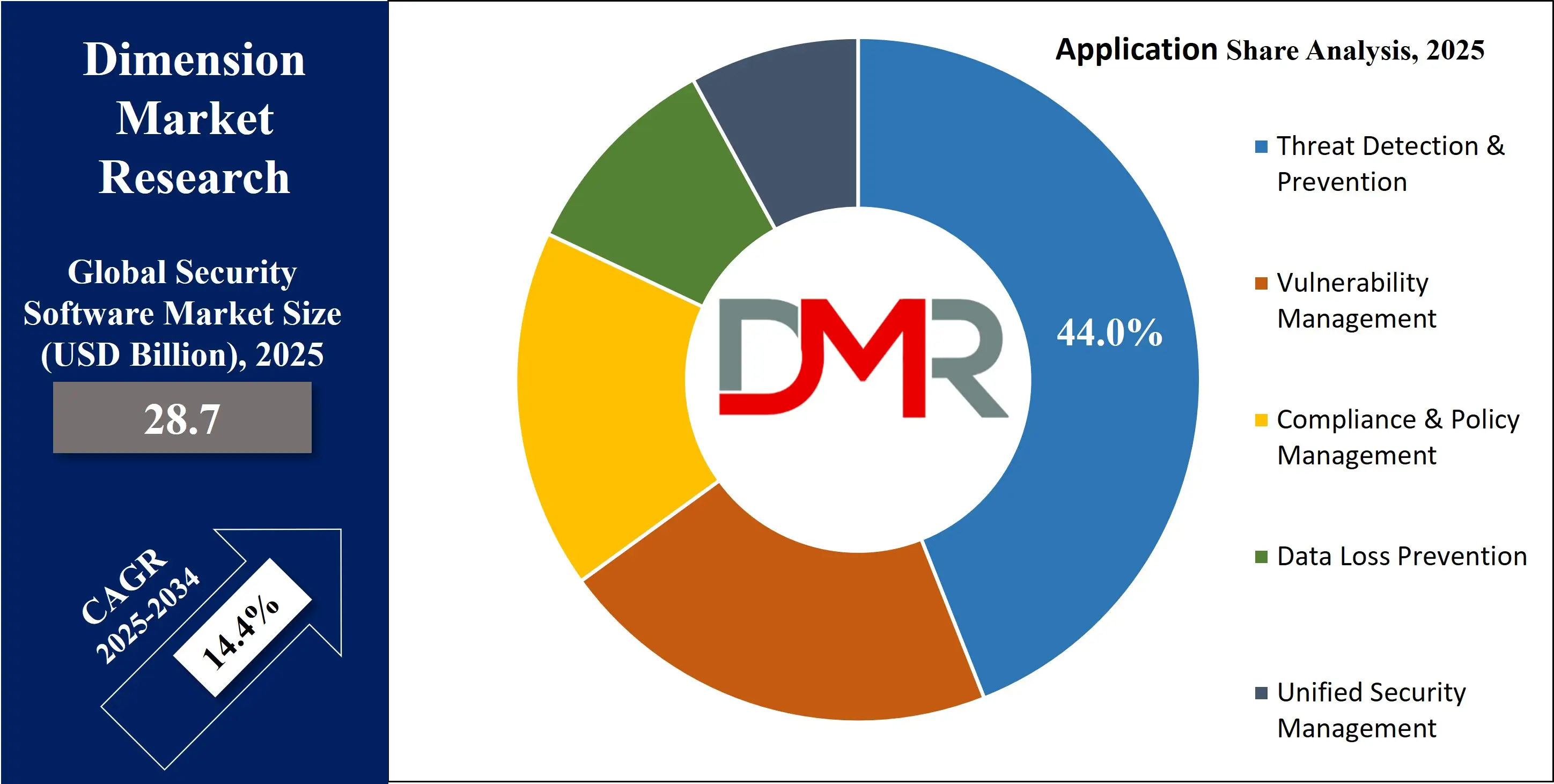

- By Application: The Threat Detection & Prevention segment is anticipated to get the majority share of the Security Software Market in 2025.

- By Organization Size: The Large Enterprises segment is expected to get the largest revenue share in 2025 in the Security Software Market.

- Regional Insight: North America is expected to hold a 42.0% share of revenue in the Global Security Software Market in 2025.

- Use Cases: Some of the use cases of Security Software include cloud security, compliance management, and more

Security Software Market: Use Cases

- Enterprise Data Protection – Secures sensitive organizational data across networks, endpoints, and cloud platforms.

- Threat Detection & Prevention – Identifies and mitigates malware, ransomware, and phishing attacks in real time.

- Compliance Management – Ensures adherence to regulations such as GDPR, HIPAA, and ISO standards.

- Cloud Security – Protects cloud-based applications and infrastructure from unauthorized access and breaches.

Stats & Facts

- Cybersecurity breaches increased globally by 38% according to the U.S. Department of Homeland Security 2025 report.

- Over 80% of enterprises in Europe reported adopting cloud-based security solutions in 2024 (EU Agency for Cybersecurity).

- Japan saw a 25% rise in industrial sector cybersecurity initiatives in 2025 (Japanese Ministry of Internal Affairs & Communications).

- WHO reported that healthcare sector cyberattacks increased by 32% globally in 2024.

Market Dynamic

Driving Factors in the Security Software Market

Rising Cyber Threats

The increasing frequency and sophistication of cyberattacks are driving organizations to invest heavily in security software. Malware, ransomware, phishing, and advanced persistent threats require robust solutions, prompting adoption across industries. Enterprises are seeking integrated platforms that provide real-time threat detection, automated responses, and predictive analytics. Regulatory mandates and rising customer awareness of data privacy amplify this need. As organizations expand cloud usage and remote workforce capabilities, the demand for multi-layered, scalable, and AI-driven security solutions continues to surge.

Cloud Adoption & Digital Transformation

The rapid shift toward cloud computing and digital business operations fuels demand for security software solutions. Enterprises require security software to safeguard hybrid and multi-cloud environments, ensuring data integrity and compliance. AI-enabled monitoring, identity management, and endpoint security solutions are becoming integral to digital transformation strategies. Organizations are increasingly adopting managed security services to complement in-house capabilities, addressing scalability challenges while mitigating evolving cyber threats.

Restraints in the Security Software Market

High Implementation Complexity

Deploying comprehensive security software often involves technical complexity, integration challenges, and significant investment in training. Organizations, particularly SMEs, may find implementation costly and resource-intensive. Managing updates, patches, and threat intelligence integration adds operational burdens, slowing adoption rates. Additionally, interoperability issues with legacy systems pose significant barriers for enterprises transitioning to advanced security platforms.

Shortage of Skilled Cybersecurity Professionals

The global shortage of cybersecurity talent limits organizations’ ability to deploy and manage security software effectively. Despite increased automation, human expertise is essential for threat analysis, incident response, and strategic security planning. The skills gap creates delays in implementation and reliance on external vendors, impacting overall cybersecurity posture.

Opportunities in the Security Software Market

AI & Machine Learning Integration

Security software solutions integrating AI and ML provide predictive threat detection, behavior analytics, and automated remediation. These capabilities reduce manual intervention, improve response times, and enhance overall security posture. Organizations adopting AI-driven security platforms can address evolving cyber threats more efficiently while optimizing operational resources.

Expansion in Emerging Markets

Emerging regions, particularly in Asia-Pacific and Latin America, present growth opportunities due to increasing digitalization and regulatory emphasis on cybersecurity. Enterprises in these regions are gradually adopting cloud-based and AI-driven security software solutions. Investment in infrastructure, awareness programs, and government-led cybersecurity initiatives further support market expansion.

Trends in the Security Software Market

Zero Trust Architecture Adoption

Organizations are increasingly adopting zero-trust principles, verifying every access request to secure networks, applications, and data. This approach minimizes insider threats and limits unauthorized access. Zero trust adoption is growing rapidly across sectors such as BFSI, healthcare, and government.

Integration with IoT & Industrial Systems

Security software solutions are expanding to protect IoT devices and industrial control systems. With increasing IoT adoption, enterprises are deploying endpoint security, network segmentation, and threat intelligence platforms to safeguard connected devices.

Impact of Artificial Intelligence in Security Software Market

- AI improves threat detection accuracy and reduces false positives.

- Machine learning algorithms automate threat classification and response.

- AI-driven analytics enhance real-time monitoring across cloud and network environments.

- Predictive modeling powered by AI identifies potential vulnerabilities before exploitation.

- AI integration reduces operational costs while improving overall cybersecurity efficiency.

Research Scope and Analysis

By Type Analysis

Endpoint security continues to be the most widely adopted segment of the Security Software market, accounting for 38% of total adoption in 2025. It protects individual devices, workstations, laptops, and mobile systems from malware, ransomware, phishing, and other cyber threats. Enterprises increasingly prioritize endpoint security as remote work and BYOD (Bring Your Own Device) policies expand across sectors. Advanced solutions now integrate AI-driven threat detection, behavioral analytics, and automated remediation to respond to potential attacks in real time. Endpoint security also supports centralized monitoring and compliance reporting, ensuring business continuity while minimizing damage from breaches. Companies deploying these solutions can proactively manage device security across distributed networks, improving operational efficiency and reducing downtime.

Network security is the fastest growing segment, driven by rising network complexity, hybrid cloud adoption, and IoT expansion. These solutions include firewalls, intrusion detection and prevention systems, secure VPNs, and encrypted communications. Growth is fueled by enterprises requiring robust protection for sensitive data traversing multiple network nodes and cloud platforms. Modern network security leverages AI to detect anomalies, prevent lateral movement of malware, and maintain compliance with regulatory frameworks. Organizations are increasingly adopting real-time monitoring, automated threat intelligence, and network segmentation to reduce vulnerability. The demand for integrated network security platforms that provide multi-layered defense continues to accelerate adoption globally.

By Deployment Mode Analysis

On-premise deployment accounts for 55% of the market in 2025, primarily favored by large enterprises and critical sectors such as BFSI, government, and defense. Organizations choosing on-premise solutions gain full control over security infrastructure, data sovereignty, and policy enforcement. Customizable security software enables integration with legacy IT systems, advanced analytics, and internal monitoring tools. On-premise solutions remain preferred where compliance and regulatory standards demand local data storage and strict access controls. Additionally, organizations benefit from reduced dependency on third-party cloud providers and the ability to implement tailored threat mitigation strategies across endpoints, networks, and applications.

Cloud-based security software is experiencing rapid growth due to scalability, flexibility, and lower upfront costs. Cloud solutions enable quick deployment, automated updates, centralized monitoring, and seamless integration with hybrid IT environments. Organizations, particularly SMEs and rapidly growing enterprises, are leveraging cloud security to complement internal IT teams, optimize resource usage, and ensure continuous protection against emerging threats. Managed cloud services further support real-time threat detection, automated remediation, and compliance management, making the cloud deployment mode increasingly attractive for organizations pursuing digital transformation initiatives.

By Organization Size Analysis

Large enterprises dominate adoption, representing 60% of the Security Software market in 2025. These organizations manage extensive IT environments, spanning multiple locations, cloud platforms, and endpoints, necessitating comprehensive, multi-layered security solutions. Large enterprises deploy advanced threat intelligence, AI-driven analytics, and real-time monitoring to detect and mitigate cyber threats effectively. Integration with identity and access management, data encryption, and vulnerability management solutions ensures robust defense against ransomware, insider threats, and phishing attacks. High-value targets, such as financial institutions and multinational corporations, prioritize a proactive cybersecurity posture, which drives continuous investment in innovative and integrated security software.

Small and medium-sized enterprises (SMEs) are the fastest growing segment as cybersecurity awareness rises globally. Cloud-based and subscription-driven security solutions allow SMEs to access enterprise-grade protection at lower costs. Security software tailored for SMEs focuses on ease of deployment, automated updates, and scalability. With increasing digitization and adoption of cloud applications, SMEs are addressing regulatory compliance requirements while managing limited IT resources. Rapid growth in remote work and e-commerce operations among SMEs further fuels demand for endpoint, cloud, and network security solutions that are cost-effective yet robust.

By Application Analysis

Threat detection and prevention solutions remain the largest application segment, holding 44% of the market in 2025. These tools identify, monitor, and mitigate malware, ransomware, phishing, and insider threats in real-time. AI integration enhances threat intelligence, enabling predictive detection and faster response times. Enterprises in BFSI, healthcare, retail, and government sectors rely heavily on these solutions to protect sensitive data and critical infrastructure. Continuous monitoring, automated alerts, and integrated response systems ensure that organizations can prevent potential breaches before they impact business operations. Advanced threat detection platforms also support compliance, reporting, and audit requirements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

DLP solutions are gaining rapid adoption as organizations increasingly prioritize the protection of sensitive information. DLP tools monitor user behavior, enforce data access policies, and secure data across endpoints, networks, and cloud environments. Growing regulations, including GDPR, HIPAA, and other privacy laws, are driving demand for DLP. Organizations use DLP to prevent accidental or malicious data leaks, safeguard intellectual property, and ensure operational continuity. AI-driven DLP solutions enhance threat detection by analyzing patterns and anomalies in real-time, making this segment the fastest-growing application area within the security software market.

By Industry Vertical Analysis

The BFSI sector continues to lead adoption, representing 48% of the market in 2025. Financial institutions, insurers, and fintech companies rely on advanced security software to protect sensitive financial data, maintain regulatory compliance, and prevent fraud. AI-powered analytics help detect suspicious patterns, insider threats, and real-time transactional anomalies. Multi-layered security, including endpoint, network, and cloud protection, ensures uninterrupted operations while safeguarding customer trust. Regulatory mandates, such as PCI DSS and local banking standards, further drive the deployment of robust cybersecurity solutions across the BFSI industry.

Healthcare organizations are rapidly adopting security software due to the digitalization of medical records, telehealth adoption, and increasing cyberattacks targeting patient data. Cloud, network, and endpoint security solutions safeguard sensitive health information while ensuring HIPAA and local compliance. AI-driven monitoring, automated threat detection, and anomaly analysis are becoming essential to protect hospitals, clinics, and research centers. With growing remote consultations and IoT-enabled medical devices, healthcare represents the fastest-growing vertical in the security software market.

By Sales Channel Analysis

Direct sales remain the primary channel, accounting for 52% of the market in 2025. Vendors engage directly with enterprise clients to offer tailored security solutions, professional services, and ongoing technical support. This approach allows close collaboration for deployment, training, and managed services. Large enterprises often prefer direct engagement to ensure customization, compliance adherence, and integration with existing IT systems. Direct sales enable vendors to build long-term relationships and provide immediate updates and patches in response to evolving cyber threats.

MSPs are the fastest-growing sales channel as organizations increasingly outsource security management. MSPs provide cost-effective, scalable, and continuously updated solutions, including monitoring, detection, and response services. This model benefits SMEs and large enterprises seeking expertise in threat intelligence, cloud security, and compliance without heavy internal investments. Managed services also allow organizations to leverage AI-driven tools and real-time monitoring, enhancing security posture while reducing operational complexity.

The Security Software Market Report is segmented on the basis of the following

By Type

- Endpoint Security

- Network Security

- Cloud Security

- Application Security

- Identity & Access Management

- Data Security

- Email Security

- Web Security

By Deployment Mode

By Organization Size

By Application

- Threat Detection & Prevention

- Vulnerability Management

- Compliance & Policy Management

- Data Loss Prevention

- Unified Security Management

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare

- Retail & E-Commerce

- Government & Defense

- Manufacturing

- Energy & Utilities

By Sales Channel

- Direct Sales

- Distributors & Resellers

- Managed Service Providers

Regional Analysis

Leading Region in the Security Software Market

North America is the leading region in the Security Software market, accounting for 42% in 2025. High cybersecurity awareness, regulatory mandates, and adoption of advanced technologies such as AI and cloud security drive this dominance. The presence of major security software vendors and continuous innovation further strengthen North America’s position. Enterprises in BFSI, IT, and healthcare sectors are particularly proactive in deploying integrated security solutions to protect sensitive data and critical infrastructure. Government initiatives, coupled with widespread cloud adoption, also support the region’s market leadership, making it a benchmark for global cybersecurity practices.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Security Software Market

The Asia-Pacific region is the fastest growing market for security software, fueled by rapid digital transformation, increased internet penetration, and rising cyber threats. Countries such as India, China, and Australia are investing in AI-enabled security platforms and cloud-based solutions. Government-led cybersecurity initiatives, growing enterprise IT infrastructure, and awareness programs for SMEs further accelerate market growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Security Software market is highly competitive, with vendors focusing on product innovation, AI integration, and cloud-enabled solutions. Leading companies emphasize strategic partnerships, acquisitions, and research initiatives to enhance market presence. Continuous innovation in threat detection, endpoint protection, and managed services enables vendors to differentiate themselves. Key players actively invest in expanding their footprint across regions, targeting emerging markets while strengthening capabilities in established economies.

Some of the prominent players in the global Security Software Market are

- Microsoft

- IBM

- Cisco

- Palo Alto Networks

- Fortinet

- CrowdStrike

- Check Point Software Technologies

- Trend Micro

- Broadcom

- Splunk

- McAfee

- Trellix

- Sophos

- Okta

- Zscaler

- SentinelOne

- Proofpoint

- VMware

- Rapid7

- Tenable

- Other Key Players

Recent Developments

- In May 2025, Orca Security acquired Opus Security, a startup specializing in agentic‑AI-driven automation and orchestration. The deal brings Opus’s AI agents into Orca’s CNAPP platform, enabling autonomous cloud risk remediation and prevention at scale.

- In May 2025, Check Point Software Technologies agreed to acquire Veriti Cybersecurity, a company that pioneered preemptive exposure management, as the acquisition enables Check Point’s Infinity Platform to automatically identify, prioritize, and remediate multi-vendor threat exposures.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 28.7 Bn |

| Forecast Value (2034) |

USD 96.5 Bn |

| CAGR (2025–2034) |

14.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 10.0 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Endpoint Security, Network Security, Cloud Security, Application Security, Identity & Access Management, Data Security, Email Security, and Web Security), By Deployment Mode (On-Premise and Cloud), By Organization Size (SMEs and Large Enterprises), By Application (Threat Detection & Prevention, Vulnerability Management, Compliance & Policy Management, Data Loss Prevention, and Unified Security Management), By Industry Vertical (BFSI, IT & Telecom, Healthcare, Retail & E-Commerce, Government & Defense, Manufacturing, and Energy & Utilities), By Sales Channel (Direct Sales, Distributors & Resellers, and Managed Service Providers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microsoft, IBM, Cisco, Palo Alto Networks, Fortinet, CrowdStrike, Check Point Software Technologies, Trend Micro, BroadcomSplunk, McAfee, Trellix, Sophos, Okta, Zscaler, SentinelOne, Proofpoint, VMware, Rapid7, Tenable, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Security Software Market?

▾ The Global Security Software Market size is expected to reach a value of USD 28.7 billion in 2025 and is expected to reach USD 96.5 billion by the end of 2034.

Which region accounted for the largest Global Security Software Market?

▾ North America is expected to have the largest market share in the Global Security Software Market, with a share of about 42.0% in 2025.

How big is the Security Software Market in the US?

▾ The Security Software Market in the US is expected to reach USD 10.0 billion in 2025.

Who are the key Security Software Market?

▾ Some of the major key players in the Global Security Software Market include IBM, Cisco, Microsoft and others.

What is the growth rate in the Global Security Software Market?

▾ The market is growing at a CAGR of 14.4 percent over the forecasted period.