Further, the strong growth in the semiconductor market comes from its important role in emerging tech like AI, autonomous driving, IoT, & 5G. Also, strong competition fuels innovation & drives R&D investment among key players, encouraging a dynamic landscape.

Semiconductors are important components with conductivity between metals & insulators, showing modern technology, and powering devices from smartphones to industrial machinery. They control & amplify electrical signals, driving integrated circuits & electronic systems.

The semiconductor market grows on technological developments, increasing demand for electronics, and the rise of new technologies. Yet, challenges like cyclical industry nature and manufacturing complexities persist.

In addition, electric vehicle adoption, driven by sustainability goals, highlights semiconductors' importance and is expected to become the central processing unit of EVs, aligning with global efforts toward a greener future, which provides significant growth in the semiconductor market, as these technologies integrate to shape the future of mobility & electronics.

The semiconductors market continues to experience robust growth driven by rising demand across several industries, particularly consumer electronics, automotive and industrial applications. 5G networks, AI and IoT applications have increased semiconductor demand dramatically; new innovations such as quantum computing and next-gen processors further fuel this surge.

One key trend in the semiconductor market is its shift towards sustainability. As energy-saving solutions become more pressing, semiconductor manufacturers have prioritized eco-friendly materials and green technologies in their designs. This has resulted in more energy-efficient low-power semiconductors to satisfy an increasingly eco-sensitive market.

Companies looking to leverage automation and smart manufacturing trends have many opportunities at their disposal. Cutting-edge semiconductor fabrication techniques, coupled with smart cities and electric vehicles, present numerous avenues of growth. Strategic partnerships and investments in R&D also position businesses to expand in this rapidly evolvable semiconductor ecosystem.

As of 2024, Asia-Pacific remains the dominant region for semiconductor production with China, South Korea and Taiwan being major players. North American production should increase 7-8% year over year as investments into advanced semiconductor manufacturing and AI applications continue. European production may expand by 6-7% due to rising 5G adoption and demand for automotive chips for electric and connected vehicles.

As per Brandongaille, the semiconductor market underscores its critical role in global and domestic industries. The United States imports approximately $53.7 billion worth of semiconductors annually to fuel its electronics manufacturing sector.

The North and South American semiconductor industry collectively generates $106 billion each year. DRAM quarterly revenues average $28 billion, with Samsung leading at over 30% of sales and Micron Group contributing 23% globally.

Intel dominates the

microprocessor with a 76% share, while globally, over 479 million graphics chips are sold annually. Intel accounts for 13.8% of global semiconductor revenues, though Samsung outpaces with $10 billion more in yearly revenue.

The U.S. semiconductor sector represents 45% of the global market, directly employing 250,000 workers and indirectly supporting 1 million jobs. Investing 20% of its revenue into R&D, the sector boasts one of the highest innovation rates. Worker wages average $38,800 annually, peaking at $57,000 for top earners.

Key Takeaways

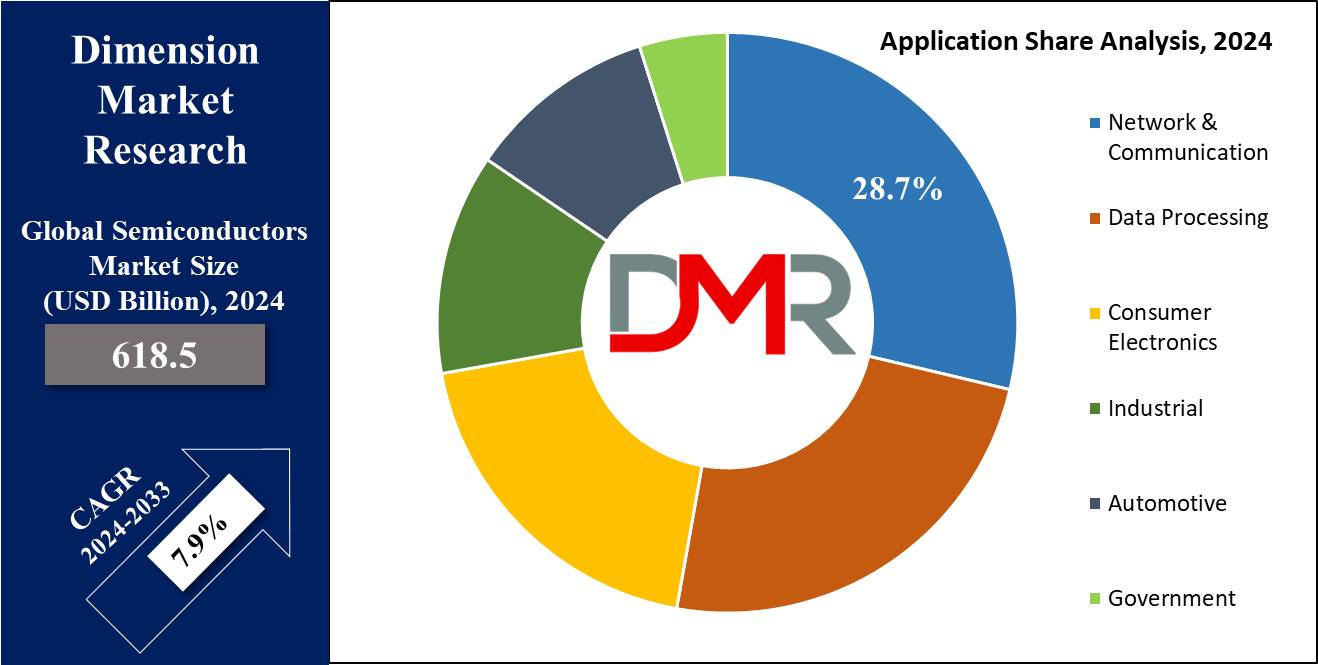

- Market Growth: The Semiconductors Market is expected to grow by 563.1 billion, at a CAGR of 7.9% during the forecasted period of 2025 to 2033.

- By Component: The memory devices segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Source: Silicon is expected to get the largest revenue share in 2024 in the semiconductors market.

- By Node Size: The 16/14nm node size is expected to lead the semiconductors market in 2024

- By Application: The networking & communications application is expected to get the largest revenue share in 2024 in the semiconductors market.

- Regional Insight: Asia Pacific is expected to hold a 54.7% share of revenue in the Global Semiconductors Market in 2024.

- Use Cases: Some of the use cases of the semiconductors include consumer electronics, renewable energy, and more.

Use Cases

- Consumer Electronics: Semiconductors are critical to the functioning of consumer electronics like smartphones, tablets, laptops, &televisions. They are placed in microprocessors, memory chips, display drivers, and other components. Like, the central processing unit (CPU) in a smartphone is mainly a semiconductor chip that processes data &executes instructions.

- Automotive Industry: Semiconductors play an important role in modern vehicles, powering many electronic systems like engine control units (ECUs), infotainment systems, advanced driver-assistance systems (ADAS), & sensors. Semiconductors are used in automotive applications for managing engines, managing power distribution, allowing connectivity features, & providing safety mechanisms like anti-lock braking systems (ABS) & airbag deployment.

- Renewable Energy: In renewable energy systems, semiconductors are used in solar photovoltaic (PV) cells to convert sunlight into electricity. Solar panels include semiconductor materials like silicon, which absorb photons from sunlight & generate an electric current through the photovoltaic effect. Semiconductor-based devices like diodes & power inverters are also utilized in solar energy systems to control and convert the generated electricity effectively.

- Healthcare and Medical Devices: Semiconductors are mainly used in healthcare & medical devices for various purposes like diagnostics, imaging, monitoring, and treatment. Semiconductor sensors & imaging chips are used in medical imaging technologies like MRI (Magnetic Resonance Imaging), CT (Computed Tomography), & ultrasound machines. In addition, semiconductor-based devices are used in wearable health monitors, insulin pumps, pacemakers, and other medical equipment for data processing, communication, and control functions.

Market Dynamic

The expansion of household electronics adoption, due to the growth of the global population and rapid urbanization, drives a strong market for consumer electronics, which includes both fundamental and innovative products, with integrated circuit chips acting as crucial components in many electronic devices like televisions, mobile phones, and refrigerators, as major consumer electronics companies invest largely in R&D to meet growing consumer demands for advanced technology.

These investments focus on introducing new products that satisfy changing consumer preferences, thereby stimulating market expansion. Further, the semiconductor industry experiences rapid growth, mainly due to the large consumption of consumer electronics across the world.

Machine learning and artificial intelligence provide new opportunities for market expansion within the semiconductor sector. With a variety of consumer products requiring semiconductor integration, like communication devices, computers, entertainment systems, and home appliances, the need for semiconductors continues to rise. Furthermore, the adoption of fast-charging options in tablets & laptops, along with the transition to GaN integration, adds to the sector's growth prospects.

However, the semiconductor sector experiences challenges coming from its dependency on a global supply chain & trade tariff, as disruptions in production, logistics, or transportation can create shortages and delays, negatively impacting the market. Production processes for semiconductors involve various components, like advanced materials and scarce metals.

Any disruption in the supply chain of these components can result in increased costs & production setbacks. Despite factors like the growth in demand for consumer electronics & wireless communications driving market growth, challenges like silicon wafer shortages and concerns regarding return on investment metrics may hinder overall market growth.

Research Scope and Analysis

By Component

The memory devices segment is expected to command the largest revenue share of the global semiconductors market in 2024 and is anticipated to retain its dominant position throughout the forecast period, which can be due to the continuous digitalization, permeating various aspects of modern life, & the exponential growth of digital businesses across industries.

As businesses and individuals alike adopt digital transformation, the need for memory devices expands to help the storage and retrieval of large data generated by digital activities. Furthermore, the growth in cloud computing services, driven by the need for scalable & efficient data storage solutions, and the growing adoption of immersive technologies like virtual reality further drive the growth expansion of this segment. These technological trends showcase the indispensable role of memory devices in providing smooth digital experiences and showcasing the infrastructure of the digital age.

Further, the MPU and MCU segments are set to be the fastest-growing segment during the forecast period, driven by the general integration of computing capabilities into a myriad of devices. In the past, these components have found a variety of applications in traditional computing devices like notebooks, desktops, PCs, and laptops, contributing largely to the segment's growth. However, with the expansion of the Internet of Things (IoT) era, characterized by the interconnectivity of devices & the proliferation of smart technologies, the need for powerful controllers and processors has grown.

The changing landscape of IoT devices, like smart homes, connected vehicles, industrial automation, and wearable gadgets, requires advanced MPU and MCU solutions to allow efficient data processing, real-time decision-making, and smooth connectivity, which highlights the important role of these components in driving innovation across diverse industries & shaping the future of interconnected devices and intelligent systems.

By Source

Semiconductors are the backbone of electronic gadgets and are operating on three primary materials: silicon, germanium, and gallium arsenide. Among these, silicon is expected to come out as the major driving factor, by dominating a significant share of the global semiconductors market in 2024. Its dominance in semiconductor manufacturing is due to its higher stability and versatility, making it shape the complex structures of gates, circuits, and switches important for electronic functionality.

The broad adoption of silicon in electronics comes from its ability to support efficient & reliable performance across a variety of applications. Further, manufacturers use the integration of silicon with germanium & gallium arsenide to substitute traditional thermoelectric components, which are bulkier & less conducive to portability.

Miniaturization has been a defining trend since the inception of semiconductor technology, allowing electronic devices to become highly compact & lightweight while maintaining or even improving performance. Also, silicon's supremacy in the semiconductor landscape remains unchallenged, serving as a driver for innovation and constant evolution in the realm of electronic gadgets, ensuring that they remain at the forefront of technological advancement and consumer demand.

By Node Size

The semiconductor market is predicted to be led by chips manufactured at the 16/14nm node size in 2024, representing a significant portion of the overall market share. Node size, a critical metric in semiconductor fabrication, measures the dimensions of integrated circuit components in nanometers, with 14 and 10-nanometer chips being largely produced at present.

However, the industry is advancing towards even smaller node sizes to meet the need for better performance, power efficiency, and miniaturization in electronic devices. However, the challenge comes from the complexity of interpreting physical dimensions accurately.

While 7-nanometer chips are already available in the market, their classification aligns with Intel's 10-nanometer node, showcasing industry standards established by key players like Samsung and TSMC. TSMC, a leader in semiconductor manufacturing, constantly looks to develop a 5-nanometer product supporting an impressive transistor density of 171.3 million transistors per square millimeter.

Furthermore, both TSMC and Samsung plan to advance chip production with 3-nanometer nodes, signaling current developments and promising future growth in this segment. These advancements highlight the continuous pursuit of technological excellence & efficiency within the semiconductor industry, driving forward the evolution of electronic devices to meet evolving consumer needs & expectations.

By Application

The networking & communications application is expected to maintain its dominance in the global semiconductors market in 2024, accounting for a high revenue share, due to the high adoption of smartphones & smart devices globally, providing access to the internet for billions of individuals.

With about 4 billion people connected to the internet, mainly through smartphones as reported by the ITU, the segment is expected to have strong growth as internet penetration constantly expands, mainly in emerging markets. Further, the increasing dependency on digital connectivity for communication, entertainment, & commerce drives the need for networking & communication infrastructure, driving the semiconductor market's growth in this segment.

Also, the automotive segment is anticipated to come out as the fastest-growing sector during the forecast period, owing to several factors contributing to growth in vehicle adoption globally. Developed & developing nations together in private vehicle ownership, mainly in regions like North America, where limited public transport availability and a preference for convenient commuting contribute to the strong demand for personal vehicles.

Furthermore, the growing popularity of electric vehicles globally adds momentum to the automotive sector's growth trajectory. As consumers use EVs for their environmental sustainability and cost-saving benefits, the need for semiconductor components in electric vehicles rises significantly, which showcases the role of semiconductor technology in allowing the electrification and digitization of automobiles, shaping the future of mobility and transportation.

The Semiconductors Market Report is segmented on the basis of the following

By Component

- Memory Devices

- Logic Devices

- MPU

- MCU

- Analog IC

- Sensors

- Power Devices

- Discrete Power Devices

- Others

By Source

- Silicon

- Germanium

- Gallium Arsenide

- Others

By Node Size

- 16/14 nm

- 10/7/5 nm

- 32/28 nm

- 65 nm

- 5 nm

- Others

By Application

- Network & Communication

- Data Processing

- Consumer Electronics

- Industrial

- Automotive

- Government

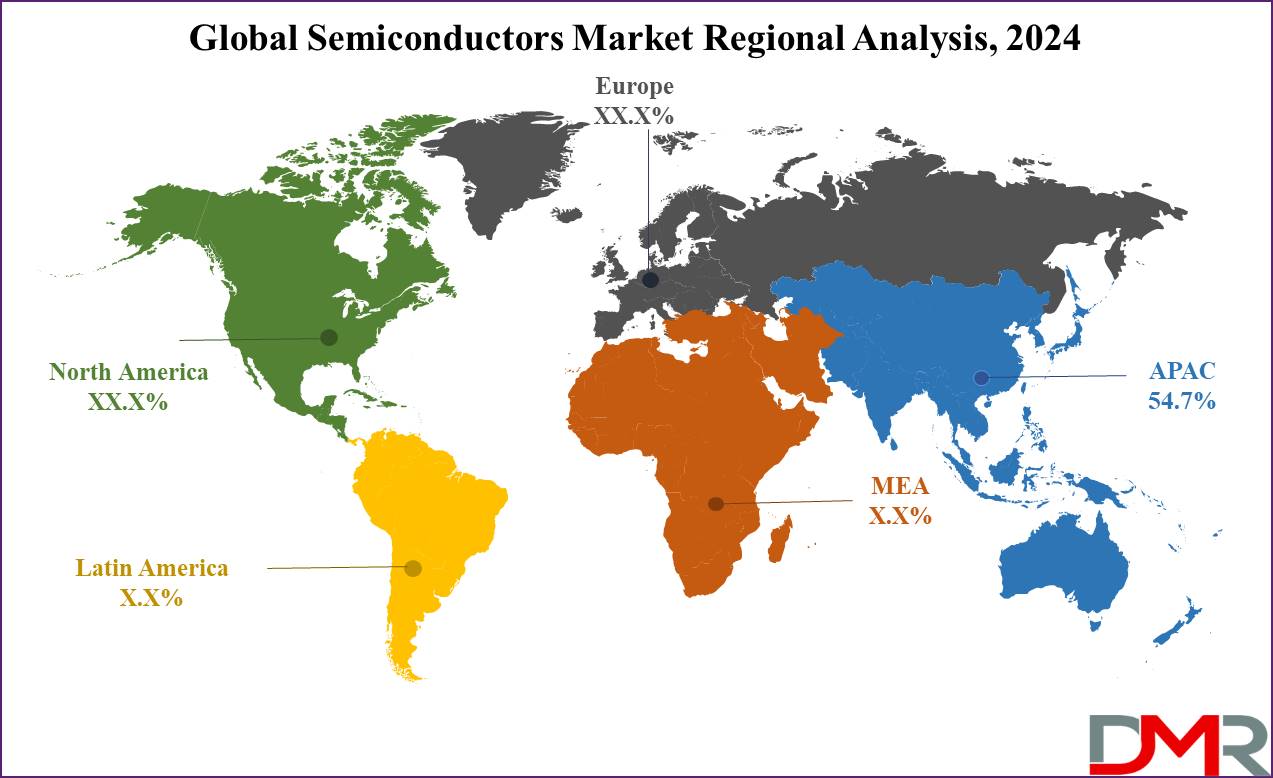

Regional Analysis

Asia Pacific is expected to show its dominance in the global semiconductors market, commanding a substantial

54.7% share in revenue in 2024, a position that is anticipated to persist throughout the forecast period, due to a large consumer base, growing disposable incomes, higher demand for industrial processing & consumer electronics, and fast urbanization and industrialization.

Further, all such factors fuel the consumption of semiconductors, with countries like Taiwan, China, & South Korea known for their advanced electronics industries. The ongoing usage of many consumer electronics further drives the market growth in Asia Pacific. In addition, the growing adoption of IoT devices,

Artificial Intelligence (AI), & Virtual Reality (VR) provide well for sustained market expansion in the region, as these technologies constantly gain traction & permeate various sectors.

Further, North America is expected to show dynamic growth in its semiconductor market, driven mainly by augmented investments in R&D initiatives. Data from the Semiconductor Industry Association (SIA) highlights the significant growth in R&D investments within the US semiconductor industry, which is fueled by significant high levels of corporate expenditure on operational R&D activities, showcasing a commitment to innovation & technological development.

Also, in Europe, major developments are anticipated, mainly supported by the telecom & automotive sectors, highlighting their potential for significant development and contribution to the semiconductor market's growth in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global semiconductor market has various companies competing for market share through innovation & efficiency. Key players use advanced technologies to produce high-quality semiconductor components, meeting various industry demands. Intense competition provides constant development and efforts to stay ahead in the rapidly changing market.

Companies look to enhance manufacturing capabilities, optimize supply chains, & expand their product portfolios to meet a broad spectrum of applications. Partnerships & strategic collaborations further intensify competition, as companies look to capitalize on emerging trends and secure their positions in this dynamic & highly competitive market.

Some of the prominent players in the global Semiconductors Market are

- Intel Corp

- SK Hynix

- Broadcom Inc

- Micron Technology

- Maxim Integrated Products

- Qualcomm Technologies

- Samsung Electronics

- Advantest Corp

- Mediatek Inc

- Kyocera Corp.

- Other Key Players

Recent Developments

- In February 2024, the U.S. Department of Commerce announced a Notice of Funding Opportunity (NOFO) to look into applications for R&D activities that will establish & accelerate domestic capacity for advanced packaging substrates &substrate materials, a key technology for manufacturing semiconductors. The CHIPS for America program anticipates about USD 300 million in funding innovation across various technologies ranging from semiconductor-based to glass and organics.

- In February 2024, Murugappa Group entity CG Power and Industrial announced a partnership with Renesas Electronics America and Stars Microelectronics to build an outsourced semiconductor assembly and testing facility in India. As a part of the joint venture (JV), CG Power and Industrial signed agreements on Technology and Services, and offtake & manufacturing agreements with Renesas Electronics Corporation, Japan. Further, as part of the agreement, CG, Renesas, & Stars would be funding USD 205 million, USD 15 million, & USD 2 million making an equity share of 92.34 percent, 6.76 percent, and 0.90 percent respectively.

- In January 2024, Taiwan’s Foxconn Technology Group and India’s HCL Group unveiled that the company plans to build a joint venture to set up a semiconductor outsourced assembly and testing (OSAT) unit, where Foxconn would hold 40% equity with an investment of USD 37.2 million, and the company aims to build an ecosystem and support supply chain resilience for the domestic industry.

- In January 2024, Tata Group announced that the company plans to build a semiconductor factory in Gujarat, India, which will provide complete services from fab to outsourced semiconductor assembly and testing (OSAT).

- In June 2023, Micron Technology, Inc. unveiled its plans to build a new assembly and & facility in Gujarat, India, which will allow assembly & test manufacturing for both DRAM and NAND products & address the needs of domestic & international markets, where the phased construction of the new assembly and test facility in Gujarat is expected to begin in 2023 and would include 500,000 square feet of planned cleanroom space, which will start to become operational in late 2024.

- In December 2022, Mitsubishi Electric Corporation launched the SLIMDIP-Z power semiconductor module, consisting of an extra-high 30A rated current for usage in inverter systems of home appliances, which would allow the SLIMDIP series to meet a variety of power and size needs for inverter units, mainly by simplifying & downsizing systems for multifunctional and specialized products like air conditioners, washing machines, and refrigerators.