A Smart TV is a television that connects to the internet, allowing users to stream content, browse the web, and interact with other smart devices. Unlike traditional TVs, which only display content from external sources like cable or satellite, Smart TVs offer built-in applications such as Netflix, YouTube, and Hulu, making them multifunctional hubs for entertainment.

They also support voice assistants like Amazon Alexa and Google Assistant, adding a level of convenience and interactivity. With these capabilities, Smart TVs have revolutionized the way we consume content, making it easier to access a wide range of entertainment options without needing additional devices.

The Smart TV Market refers to the global industry for these connected televisions. The market is expanding rapidly, driven by the growing demand for internet-based streaming services and the desire for more integrated home entertainment systems.

In addition to well-established brands like Samsung, LG, and Sony, the market also includes newcomers and entry-level businesses offering more affordable models. The increasing adoption of streaming services and the trend towards home automation make Smart TVs a central part of the modern entertainment ecosystem. As consumers seek more personalized and accessible viewing experiences, the Smart TV market is expected to continue its growth trajectory.

In 2024, there are significant growth opportunities for both established and emerging businesses in the Smart TV market. For big players such as Samsung, LG, and Sony, there are several avenues to drive growth. These companies can leverage their strong brand presence and technological expertise to enhance Smart TV features. One key opportunity lies in improving the AI-powered content recommendation systems, making it easier for users to discover new shows and movies based on their preferences. Additionally, partnerships with popular streaming platforms and content creators can create exclusive features or content, attracting more customers.

For new and entry-level businesses, the opportunity lies in offering affordable yet feature-rich Smart TVs. As the demand for more budget-friendly models rises, especially in emerging markets, companies can tap into this growing segment by delivering high-value products that meet the needs of price-sensitive consumers.

OEM partnerships with tech firms can also be a great strategy for newer brands to enhance their product offerings, particularly by focusing on simple user interfaces and seamless app integration. With over 80% of U.S. households already having at least one connected TV device, the market is ready for brands that can offer innovation and quality at competitive prices.

Several key trends are shaping the Smart TV market today, reflecting the evolution of consumer preferences and technological advancements. First, streaming dominance is a major trend. According to a Hub Entertainment Research survey, 60% of respondents’ most-used TV sets are connected to a streaming platform, demonstrating that Smart TVs are becoming the preferred method for consuming online content. This shift is significant, as it highlights the declining relevance of traditional cable and satellite TV in favor of streaming services like Netflix, Disney+, and Amazon Prime Video.

Another trend is the growing role of app-driven discovery. The survey reveals that 38% of U.S. consumers say that the first thing they see when they turn on their TV is the apps installed on their Smart TV’s home screen. This points to a growing trend where the discovery process for content is led by apps, not traditional programming. For Smart TV manufacturers, this trend highlights the importance of offering intuitive, well-designed interfaces and ensuring seamless integration with popular streaming services.

Lastly, the growth of connected TVs is another important trend. The survey also found that over 80% of U.S. households now own at least one connected TV device. This widespread adoption underscores the critical role Smart TVs play in modern households and highlights a significant opportunity for marketers and content creators to reach their target audiences.

Key takeaways

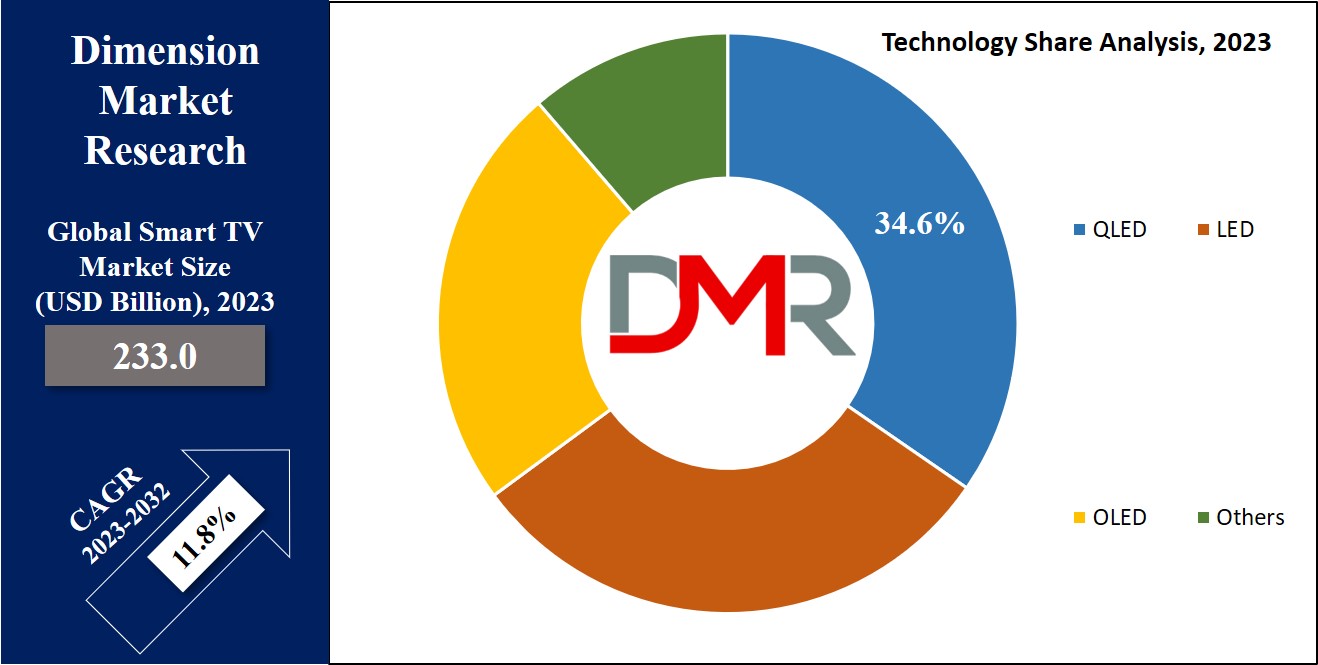

- Market Growth: The global Smart TV market is projected to grow from USD 233.0 billion in 2023 to USD 637.5 billion by 2032, at a CAGR of 11.8%.

- Technology Leadership: QLED technology leads the market in 2023 due to superior color and brightness; OLED is also gaining traction for picture quality and viewing angles.

- Resolution Demand: Full HD TVs hold the largest share in 2023, favored for their high-definition quality, extensive content compatibility, and reasonable data requirements.

- Operating System Dominance: Android TV is the most popular operating system in 2023, driven by the widespread popularity of the Google ecosystem and easy app access.

- Screen Size Trend: The 46 to 55-inch segment dominates due to consumer preference for larger screens offering a cinema-like experience at home.

- Regional Insight: Asia Pacific commands 41.2% of the market share, supported by economic growth and rising demand in China, India, and Japan.

- Consumer Trends: More than 80% of U.S. households own at least one connected TV device; streaming and app-based content discovery dominate viewing habits.

Use Cases

- Home Entertainment Hubs: Smart TVs serve as integrated centers for streaming, gaming, and smart home connectivity, meeting rising consumer demand for multifunctional media solutions.

- Educational Content Delivery: Schools and e-learning providers use smart TVs for interactive lessons and multimedia content, enhancing remote and in-class learning experiences.

- Affordable Mass Market Models: Entry-level brands target price-sensitive customers in emerging markets by offering low-cost smart TVs with essential features and app access.

- Smart Advertising Platforms: Businesses leverage smart TVs' data and app ecosystems to deliver targeted ads and content, increasing engagement and monetization opportunities.

- Partnered Streaming Integration: Streaming services collaborate with TV manufacturers for pre-installed apps and exclusive content, expanding user base and reducing content access friction.

- Retail & Hospitality Display: Hotels and retail stores deploy smart TVs for guest entertainment, digital signage, or interactive product information, improving customer engagement and satisfaction.

Market Dynamic

The growth of video-on-demand (VoD) is anticipated to be a major driver of market growth, owing to the support that smart TVs provide for several popular video platforms providing on-demand content. For instance, applications like ESPN+ on smart TVs allow users to access on-demand sports streaming & related content.

Moreover, smart TVs provide the flexibility to access the internet & run different supported applications, including educational ones created for children. These smart TVs also contain interactive features, like voice input & remote cursor functionality, improving the educational experience.

Additionally, manufacturers are attracting customers by creating affordable products & establishing competitive pricing strategies. Major manufacturers provide a range of smart TVs, from entry-level to high-end models, meeting varying features & quality preferences.

High-end smart TVs have top-quality display panels & components, which can highly increase the product's price. In contrast, affordable smart TVs contribute to market growth by making these products accessible to a large audience & lowering the barriers to entry for new customers.

Research Scope and Analysis

By Technology

In terms of technology, the market is divided into LED, OLED, QLED, and more. In 2023, the QLED segment emerged as the market leader, commanding the largest share of revenue and also showing its potential for future growth. This technology contains

Quantum dots, which are known for their stability, durability, & inorganic nature, resulting in improved color & brightness. The growing popularity of QLED-based products has made industry players introduce fresh offerings that include this technology, driving QLED as well as smart TV market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Moreover, the OLED segment is also anticipated to capture a major share of revenue in the coming time, as this growth is mainly due to high consumer demand stemming from the better picture quality delivered by OLED TVs. These televisions excel in producing smooth motion, deep black levels, vividly saturated colors, & enhanced viewing angles. The introduction of new products in the OLED segment is anticipated to further boost the market's prospects in the coming years.

By Resolution

Regarding the resolution of smart TV, the full HD TV category holds the largest market share in 2023, mainly due to its high-definition picture quality & the extensive range of content that it supports. Full HD TVs provide a resolution of 1920 x 1080 pixels, which has served as the industry standard for several years, and is widely adopted owing to a significant amount of existing content is compatible with it. Streaming content & watching live sports at this resolution doesn't need excessive internet bandwidth, yet it provides an immersive & high-quality viewing experience.

Further, the 8K TV segment is anticipated to notice high growth during the forecast period, driven by the rise in demand for super high-resolution picture quality. 8K TVs offer highly detailed image resolution, having over 33 million pixels. This resolution continues to grow in popularity as the content library supporting it grows and expands. The segment is anticipated for major growth as manufacturers integrate additional features like Dolby Atmos sound, high-dynamic range (HDR), & more to improve the viewing experience.

By Operating System

Based on operating systems, the market is divided into Android TV, Tizen, WebOS, Roku & others. In 2023, the Android TV segment comes supreme in the market, by having the largest share of revenue. Its dominance can be said owing to the already well-established Google Android ecosystem, which has widespread popularity.

This segment's strength depends on its large access to the Play Store, making it easily available for users to download a variety of applications. Additionally, Android TV enhances the user experience by providing features like voice search & content aggregation from a large number of media apps & services. Furthermore, it seamlessly integrates with high-end Google technologies like the Knowledge Graph, Cast, and Assistant.

Also, the Roku operating system is expected to have significant expansion during the forecast period, which is driven by its compatibility with Apple AirPlay, easing the process of streaming movies, photos, music, & other content from Apple devices to smart TVs. Further, several smart TV manufacturers are collaborating with Roku to deliver the built-in feature of Roku software, removing the need for an additional set-top box.

By Screen Size

46 to 55-inch TV segment primarily dominated the global market in 2023, which had the highest revenue share, which is mainly owing to the increase in the trend of consumers looking for larger TVs to recreate a cinema-like viewing experience at home. The appeal of this segment comes from the excellent balance between screen size & price, making full HD &

4K TVs more affordable, thus driving up demand, along with the flexible payment options like EMIs, customers can comfortably invest in bigger TVs without affecting their finances.

Additionally, the over 65-inch TV segment is expected to notice high growth in the coming years., which can be attributed to the growth in the trend of creating home theaters & the decreasing prices of smart TVs in this category.

Furthermore, given the relatively small price difference between TVs over 65 inches & their smaller counterparts, coupled with zero-cost payback options, discounts, & other incentives, a large number of buyers who start considering 55-inch TVs are opting for the larger screens, as this shift is anticipated to continue globally, driven by the rise in spending capacity, with new market players focusing to offer competitively priced products in this large TV segment.

By Screen Shape

The flat TV category is the dominant force in the market, holding the major market share in 2023, & it's anticipated to experience substantial growth in the coming future, which is mainly due to its simple manufacturing process. Consumers prefer flat-screen smart TVs as they are easy to install by mounting on walls. Additionally, flat-screen smart TVs are in high demand as they are more affordable compared to their curved counterparts. Also, they provide a wide viewing angle & are less prone to glare & reflections.

Moreover, the curved TV segment is anticipated to experience moderate growth during the forecast period, mainly because it offers a more captivating viewing experience. Curved smart TVs are typically designed in larger screen sizes, providing viewers with an increase in sense of depth. These curved screens are usually featured in high-end, more expensive smart TVs, offering a premium & luxurious feel to the viewer.

The Global Smart TV Market Report is segmented on the basis of the following

By Technology

By Resolution

- HDTV

- 4K UHD TV

- Full HD TV

- 8K TV

By Operating System

- Android TV

- Tizen

- WebOS

- Roku

- Others

By Screen Size

- Below 32 inches

- 32 to 45 inches

- 46 to 55 inches

- 56 to 65 inches

- Above 65 inches

By Screen Shape

Regional Analysis

Asia Pacific region plays a significant role in driving the growth of the market by accounting for a market

share of 41.2%, which is fueled by recent growth, driven by an increase in consumer demand & the economic growth of China, India, and Japan. The region is anticipated to maintain its dominance in the market, mainly owing to the growing disposable income of consumers.

Additionally, the increasing popularity of on-demand video services such as Netflix, Amazon Prime Video, HOOQ, and more along with the availability of HD content & set-top boxes, as well as gaming options, have contributed to the sustained demand for smart TVs in this region.

Further, Europe is anticipated for significant growth in the coming future, owing to recent developments in content creation that are driving the need for smart TVs. For instance, shows on streaming apps like Netflix offer interactive viewing experiences, where users make choices according to his/her preferences Additionally, the change in consumer preference toward streaming online content, supported by the growing availability of high-speed internet connections, is fueling the demand for smart TVs in the region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global smart TV market faces strong competition, and in order to maintain their market positions, big companies are using strategies such as teaming up with others, investing in new ideas, conducting research, & increasing their reach to different places.

Further, these companies also working on making their products better to meet the needs of what users want & to stay competitive. Also, streaming platforms are partnering with smart TV makers to deploy their apps in the TVs right from the start, making sure that customers can easily use them without any difficulties.

Like, in April 2022, Samsung Electronics Co. introduced its Neo QLED 8K smart TV series, which contained television models with 65-inch & 85-inch screens. Further, the company started marketing initiatives that enabled customers to buy their TVs at lower prices, leading to growth in demand for Samsung's products.

Some of the prominent players in the Global Smart TV Market are:

- Sansui Electric Co

- Koninklijke Philips N.V

- Sony Corp

- LG Electronics

- Toshiba Visual Solutions

- Intex Technologies

- Haier Inc

- Panasonic Corp

- Hisense International

- Samsung Electronics

- Other Key Players

Recent Developments

- In September 2025, Dish TV launched its VZY Smart TVs lineup in India, featuring built-in DTH set-top boxes and OTT streaming support across models from 32-inch HD to 55-inch 4K QLED.

- In September 2025, Samsung unveiled its new 2025 TV range featuring OLED displays, 8K resolution, and advanced AI upscaling technology to enhance viewer experience.

- In August 2025, major Indian brands such as Redmi and Infinix launched new Smart Fire TV and Plus Smart TV models, offering competitive prices and enhanced features in the LED smart TV segment.

- In July 2025, Charter Communications and Cox Communications merged their broadband and cable assets, creating one of the largest U.S. broadband and cable operators with expanded video and fiber infrastructure.

- In January 2025, TCL introduced its X11K TV at CES 2025, boasting 14,112 local dimming zones and HDR 6500 nits for industry-leading picture performance.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 233.0 Bn |

| Forecast Value (2032) |

USD 637.5 Bn |

| CAGR (2023–2032) |

11.8% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (LED, OLED, QLED, Others), By Resolution (HDTV, 4K UHD TV, Full HD TV, 8K TV), By Operating System (Android TV, Tizen, WebOS, Roku, Others), By Screen Size (Below 32 inches, 32 to 45 inches, 46 to 55 inches, 56 to 65 inches, Above 65 inches), By Screen Shape (Curved, Flat) |

| Regional Coverage |

North America – The US, Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Sansui Electric Co, Koninklijke Philips N.V, Sony Corp, LG Electronics, Toshiba Visual Solutions, Intex Technologies, Haier Inc, Panasonic Corp, Hisense International, Samsung Electronics, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0, 3, and 5 analyst working days respectively. |