Overview

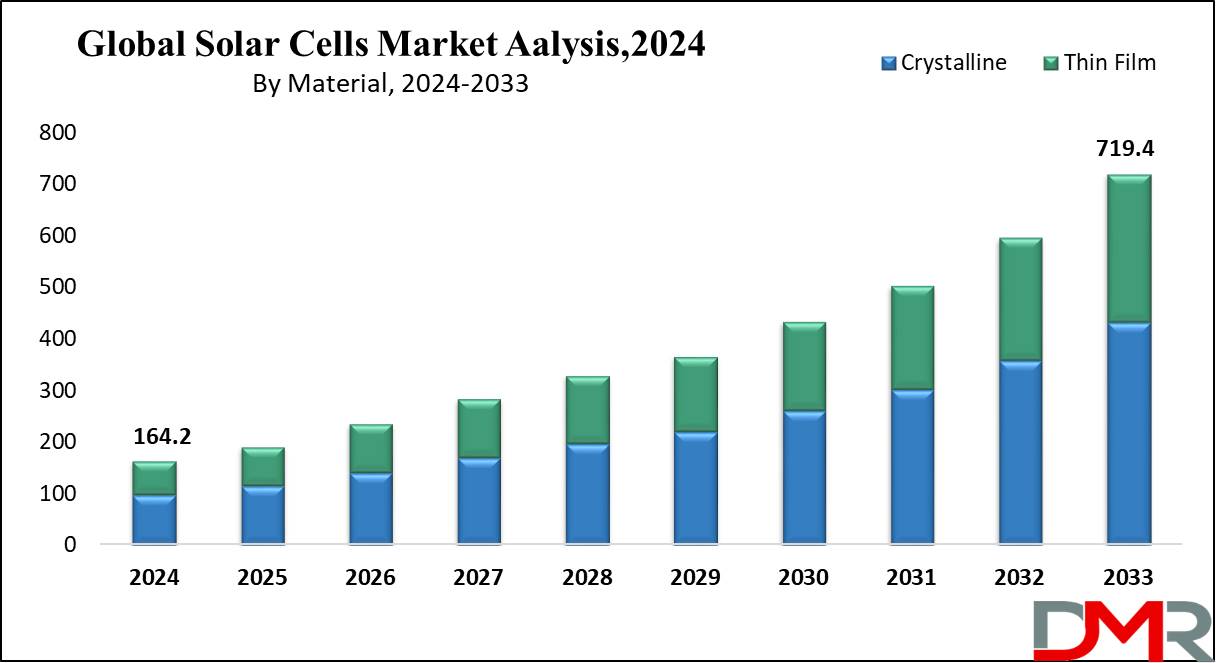

Global Solar Cells Market size was valued at USD 164.2 Bn in 2024 and it is further anticipated to reach a market value of USD 719.4 Bn in 2033 at a CAGR of 17.8%.

Solar cells or photovoltaic (PV) cells are semiconductor devices which directly convert sunlight to electricity using the photovoltaic effect. This process involves photons from sunlight energizing electrons in semiconductor material to generate current. Solar cells play an essential role in harnessing renewable energy sources while providing long-term, clean power solutions - thus, their popularity continues to soar globally.

Increased environmental consciousness and the need to reduce carbon emissions have propelled governments and consumers alike towards renewable energy solutions. Technological advances in solar cell manufacturing have improved efficiency while making solar power more cost-effective, as have government policies, subsidies, and incentives which promote its wider adoption.

Furthermore, increased demand for sustainable solutions from residential, commercial, and industrial sectors; along with investments into solar infrastructure are fuelling market expansion in this field.

Key Takeaways

- Market Size & Share: Solar Cells Market size was valued at USD 164.2 Bn in 2024 and it is further anticipated to reach a market value of USD 719.4 Bn in 2033 at a CAGR of 17.8%.

- Material Analysis: Crystalline silicon will remain the dominant material segment for solar cell manufacturers in 2023, representing approximately 75% of market share.

- Product Analysis: In 2023, PERC (Passivated Emitter and Rear Cell) and related technologies such as PERL, PERT and TOPCON held approximately 55% market share for solar cells

- Technology Analysis: Monocrystalline silicon technology holds approximately 50% market share for solar cells in 2023.

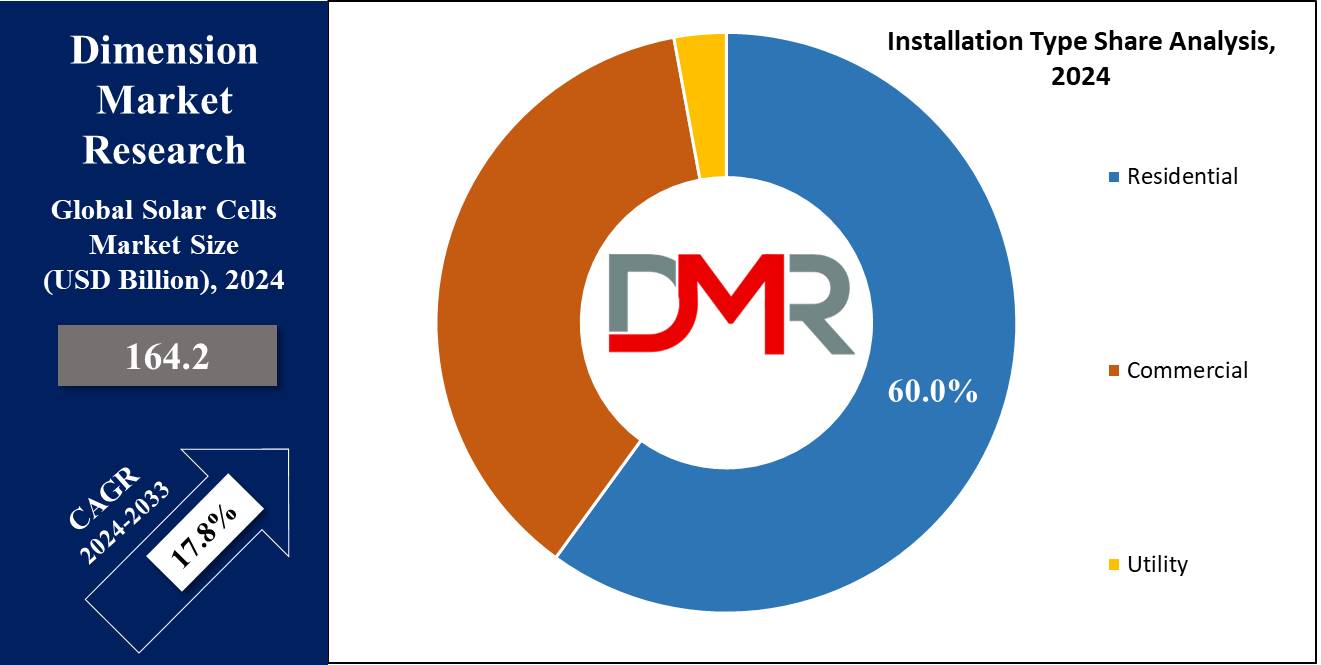

- Installation Type Analysis: Utility installations dominated the solar cell market in 2023, accounting for roughly 60% of market share.

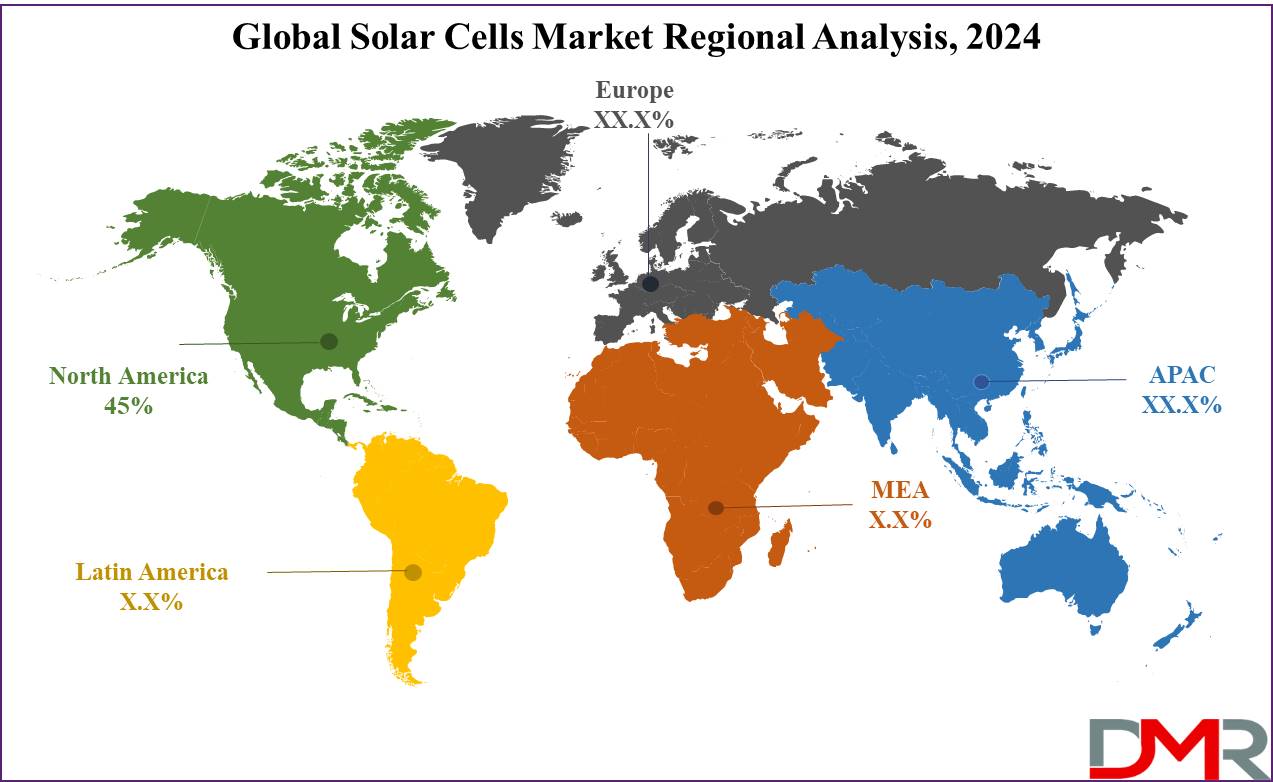

- Regional Analysis: Asia-Pacific held approximately 45% of the solar cells market in 2023, accounting for almost all total market shares.

Use Cases

- Residential Power Generation: Solar cells are widely used in homes for rooftop solar panels, allowing homeowners to generate electricity for personal use, reducing reliance on the grid, and lowering energy bills.

- Commercial and Industrial Power: Businesses and industries utilize solar cells to power facilities, lower operational costs, and reduce carbon footprints. Solar farms often supply large-scale solar power to grids.

- Off-Grid Power Solutions: In remote or rural areas without access to a centralized power grid, solar cells provide off-grid energy solutions, powering homes, telecommunications, and water pumping systems.

- Portable Solar Devices: Solar cells are integrated into portable devices such as solar chargers, backpacks, and lights, making them convenient for outdoor activities and emergency situations.

- Solar-Powered Vehicles: Solar cells are increasingly being used in electric vehicles and spacecraft, offering sustainable energy solutions for transportation and space exploration.

Report Dynamics

Driver

The solar cell market is propelled forward by global efforts to embrace renewable energy solutions to combat climate change, with governments and organizations actively encouraging solar power as an environmentally friendly replacement to fossil fuels through policies, incentives, and subsidies designed to promote its adoption.

Rising electricity costs coupled with increasing environmental awareness among consumers also drive solar installations while rapid technological advances make solar power more cost-effective and accessible across residential, commercial, and industrial applications; further spurring market expansion.

Trend

One key trend in the solar cell market is the continual advancement of photovoltaic technologies. Advancements in materials like perovskite and bifacial solar cells have significantly increased efficiency and energy output, as have innovations like building-integrated photovoltaics (BIPV) and solar roads, reflecting innovation.

Furthermore, smart energy systems that combine solar with battery storage and grid integration enhance energy management, while digitalization, remote monitoring, and AI optimization have transformed solar power deployment and maintenance operations to become more cost efficient deployment and maintenance operations than ever before - creating more efficient deployment and maintenance operations over time.

Restriction

Although solar cell markets show promise of robust growth, they do face restraints that limit initial installation costs and initial energy generation costs. While the initial expenses associated with panels, inverters, batteries can become more affordable over time, residential consumers still may find initial installation expenses prohibitive.

Furthermore, efficiency varies based on weather conditions such as reduced sunlight or cloudy days; large surface areas for solar installations in densely populated areas present challenges; in addition to long-term environmental issues related to disposing or recycling solar panels which need addressing.

Opportunity

The solar cell market presents many exciting prospects, especially in emerging economies and off-grid applications. Countries that boast ample sunlight while experiencing rising energy demands are increasingly investing in solar infrastructure. Solar power provides a sustainable and viable energy solution in regions without reliable grid access.

Furthermore, innovations in solar technology, such as floating solar farms and space-based solar power are opening up new avenues of energy production. As global sustainability goals advance, solar energy continues to present incredible growth potential. When combined with energy storage solutions, its stability and efficiency become even more assured. Solar will remain an invaluable energy resource.

Research Scope and Analysis

Material Analysis

Crystalline silicon will remain the dominant material segment for solar cell manufacturers in 2023, representing approximately 75% of market share. Crystalline silicon's superior efficiency, long-term durability, and proven manufacturing processes make it the go-to material choice in residential, commercial, utility-scale installations with limited space as well as for large-scale applications; monocrystalline is particularly desirable due to its higher energy conversion rates; polycrystalline remains cost effective while still meeting many of those criteria.

Thin-film solar cells made of materials such as amorphous silicon (a-Si), cadmium telluride (CdTe), and copper indium gallium selenide (CIGS) currently represent approximately 25% of the market. Thin-film cells are popular due to their flexible, lightweight structure, lower production costs, and specific applications like building integrated photovoltaics (BIPV) or large industrial projects; however their efficiency tends to fall lower than crystalline silicon which limits mainstream adoption despite niche applications.

Product Analysis

In 2023, PERC (Passivated Emitter and Rear Cell) and related technologies such as PERL, PERT and TOPCON held approximately 55% market share for solar cells. PERC cells became popular due to their improved efficiency and relatively lower manufacturing costs compared to traditional cells; additionally they provide enhanced light capture and energy conversion efficiency that makes them highly effective solutions in residential, commercial and utility-scale applications.

BSF (Back Surface Field) cells, an older yet reliable technology, make up around 25 per cent of the market share. Although less efficient than PERC cells, their cost-effectiveness makes them attractive in price-sensitive markets.

HJT (Heterojunction Technology) and IBC (Interdigitated Back Contact) solar cells, two emerging high-efficiency technologies, hold around 15% and 5% market shares respectively. HJT cells boast low temperature coefficients and improved performance while IBC & MWT (Metal Wrap Through) cells excel in advanced applications for high-end environments as well as space constraints with higher production costs preventing widespread adoption.

Technology Analysis

Monocrystalline silicon technology holds approximately 50% market share for solar cells in 2023. Monocrystalline cells are widely preferred because of their superior efficiency and durability; making them the go-to choice in residential, commercial, and utility-scale installations especially in space-constrained areas. Their higher energy conversion rates and sleek appearance also contribute to their widespread adoption.

Polycrystalline silicon continues to hold approximately 25% of the market, offering cost-effective solar solutions at large scale solar farms due to lower production costs and slightly decreased efficiency compared to monocrystalline cells. While slightly less efficient than their monocrystalline counterparts, polycrystalline technology still proves beneficial due to lower production costs.

Cadmium Telluride (CdTe), used primarily in thin-film applications, accounts for approximately 15% of the market. CdTe cells are known for their lower production costs and performance in hot humid climates - making them perfect for utility scale projects.

Installation Type Analysis

Utility installations dominated the solar cell market in 2023, accounting for roughly 60% of market share. Utility-scale solar installations usually include large solar farms designed to supply electricity directly into the grid through economies of scale and government incentives; these installations help meet growing energy demands while supporting global sustainability goals and thus became the largest segment within this market.

Commercial solar installations make up approximately 25-30% of market share. Installed on business premises, industrial sites and public buildings to reduce energy costs and carbon footprints; particularly popular in regions that offer favorable government policies or financial incentives to encourage companies transitioning towards renewable energy sources.

Residential solar is steadily expanding market, representing about 15%. Residential systems tend to be smaller but are increasingly being adopted by homeowners seeking energy independence and cost savings. Falling solar panel costs and advances in energy storage technology have fuelled this segment's steady expansion; nonetheless it still remains small when compared with utilities or commercial installations.

The Global Solar Cells Market Report is segmented based on the following

By Material

By Product

- BSF

- PERC/PERL/PERT/TOPCON

- HJT

- IBC & MWT

- Others

By Technology

- Monocrystalline

- Polycrystalline

- Cadmium Telluride (CDTE)

- Amorphous Silicon (A-Si)

- Copper Indium Gallium Diselenide

By Installation Type

- Residential

- Commercial

- Utility

Regional Analysis

Asia-Pacific held approximately 45% of the solar cells market in 2023, accounting for almost all total market shares. This success can be attributed to significant investments made in renewable energy infrastructure by countries like China, India, and Japan; China being the primary producer and installer of solar cells globally has significant sway over market trends and pricing while other factors like favorable government policies, incentives, and an emphasis on sustainable energy solutions also play a role. As energy demands continue to increase and solar technology continues its advancement this region should remain at the top of this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global solar cells market is comprised of both established manufacturers and innovative startups, each playing an essential part in driving growth and technological advances. Key players strive to improve efficiency, reduce production costs, expand product offerings and attract diverse applications; strategic partnerships and collaborations provide access to new markets while supporting joint research efforts; investments are prioritized to develop advanced solar cell technologies like bifacial and perovskite cells in order to expand adoption worldwide while upholding sustainability and environmental responsibility.

Some of the prominent players in the global Solar Cells Market are:

Recent Development

- Panasonic Corporation: In 2023, Panasonic launched its HJT solar modules at the RE+ conference, featuring half-cut cells with efficiencies of 22.2% for the 430 W model and 21.7% for the 420 W model. Additionally, the company introduced the EverVolt home battery system, which supports both DC and AC coupling, enhancing energy management for residential users.

- JINERGY: JINERGY unveiled its new 120-cell bifacial solar modules in 2023, achieving efficiencies up to 22.46%. This innovation aims to maximize energy capture from both sides of the panel, catering to the increasing demand for high-performance solar solutions in both utility-scale and residential applications.

- Hevel: In 2023, Hevel focused on enhancing its production capabilities by advancing its bifacial module technology. This development is intended to improve energy generation efficiency, thereby meeting the growing market demand for solar solutions. Hevel's commitment to sustainability continues to drive its innovation efforts in solar technology.

- ReneSola: ReneSola experienced substantial growth in 2023, reporting a 78% year-over-year increase in sales, reaching $34.5 million. The company is actively expanding its presence in the U.S. and Europe, particularly in community solar projects, which are crucial for promoting renewable energy adoption.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 164.2 Bn |

| Forecast Value (2033) |

USD 719.4 Bn |

| CAGR (2024-2033) |

17.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material (Crystalline, N Material, P Material, Thin Film) By Product (BSF, PERC/PERL/PERT/TOPCON, HJT, IBC & MWT, Others) By Technology (Monocrystalline, Polycrystalline, Cadmium Telluride (CDTE), Amorphous Silicon (A-Si), Copper Indium Gallium Diselenide) By Installation Type (Residential, Commercial, Utility) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Panasonic Corporation, JINERGY, Hevel, ReneSola, United Renewable Energy, LLC, SunPower Corporation, Risen Solar, Trina Solar, Jinko Solar |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Contents