Space tourism involves providing travel experiences to private individuals or tourists for leisure, adventure, and recreational purposes. It encompasses various activities such as suborbital and orbital spaceflights, deep space journeys, lunar missions, and other space-related adventures that allow participants to experience travel near the Earth's atmosphere. These missions rely heavily on advanced

Space Telemetry systems to monitor spacecraft performance and ensure passenger safety throughout the journey, reflecting the rapid advancements within the commercial spaceflight industry.

As an emerging and increasingly popular industry, space tourism features key players including those offering space exploration experiences, spacecraft manufacturers, spaceports, and associated service providers. These companies are focused on delivering premium experiences to a growing customer base willing to invest in such unique opportunities, driving broader space travel demand across global markets.

As per sci-tech-today Private orbital spaceflight, priced at $55 million per person, is predicted to see around 13,000 participants in suborbital flights by 2028. Despite the high cost, interest in space tourism continues to grow, with the suborbital market projected to rise significantly, from $44.5 million in 2021 to $396.6 million by 2031.

Concerns about space debris are rising, as 69% of Americans foresee significant issues with man-made debris in the next 50 years. Simultaneously, challenges like discovering extraterrestrial life (58%) and human colonization of space (65%) highlight the complexity of space exploration and the public's awareness of its difficulties.

While 55% of Americans believe space tourism will become routine within the next 50 years, readiness for such travel remains divided. By 2073, 44% of people are still hesitant about routine space tourism, reflecting mixed public sentiment despite projections of $555 million in orbital space travel revenue by 2030.

Space tourism is experiencing an unprecedented boom, thanks to companies like SpaceX, Blue Origin and Virgin Galactic making space travel more attainable and affordable for wealthier individuals. Through their initiatives and advances in technology they are making space travel accessible.

Virgin Galactic recently achieved success with their commercial flights, offering luxury experiences for tourists seeking suborbital space travel. Meanwhile, SpaceX's plans of sending tourists around the Moon has created buzz and raised expectations of what lies ahead for space tourism in general.

Market trends also point towards expansion in terms of infrastructure development. Spaceports and spacecraft development projects have become essential to meeting future space tourism demand and enriching traveler experiences, while collaborations between government agencies are expected to expand further in order to ensure safe space travel.

As space tourism becomes mainstream, new opportunities emerge across aerospace technology, hospitality and entertainment industries. Orbital and lunar tourism sectors represent lucrative investment opportunities for businesses; additionally virtual reality space experiences could serve as an entryway into space travel without leaving Earth behind.

The US Space Tourism Market

The US Space Tourism Market is projected to reach USD 443.1 million by the end of 2024 and grow substantially to an expected USD 11,295.5 million market by 2033 at an anticipated CAGR of 43.3 percent.

The U.S. space tourism market held the largest revenue share of 84.1% in the North American region in 2024 and is expected to retain its dominance over the forecast period owing to the inclination of high-net-worth individuals towards space tourism and growing technological investments in the region.

Advancements in space travel technology, such as reusable rockets and spacecraft, have reduced costs and made space tourism more accessible. Increased investment and partnerships are fueling innovation and accelerating market expansion. This is expected to drive further growth in the U.S. market.

Space Tourism Market Key Takeaways

- Market Growth: It is expected that the global Space Tourism market will experience a growth of USD 38,537.2 million at an average CAGR of 46.3 %.

- Market Definition: Space tourism refers to the space travel experiences for individuals or tourists, typically for recreational, leisure, or adventure purposes.

- Analysis by Tourism Type: Sub-orbital is projected to hold the largest revenue share at 45.3% in 2024.

- Category Analysis: Direct supplier is anticipated to hold the highest market share of 63.1% based on technology in 2024.

- Booking Channel Analysis: The Online Booking Channel should capture a significant revenue share by the end of 2024.

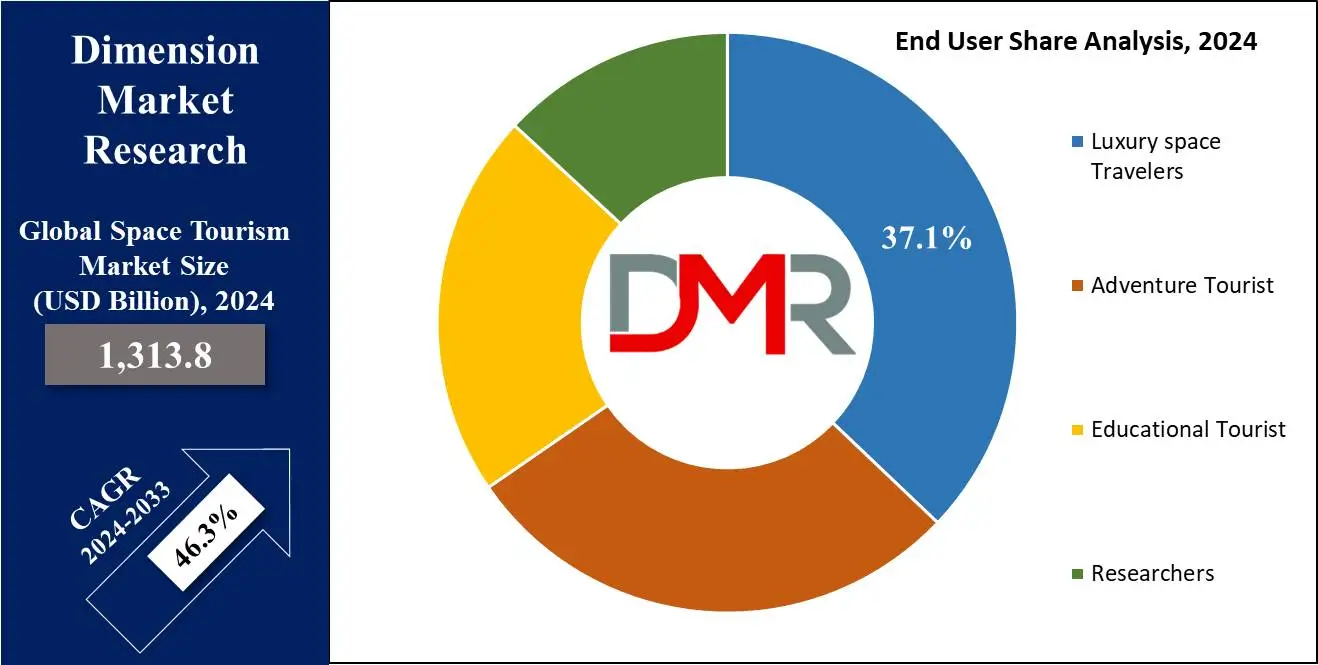

- Analysis by End User: Luxury Space Travelers is expected to lead the market with the largest revenue share by 2024.

- Regional Analysis: North America is predicted to lead the Space tourism market globally with a 40.1% market share by 2024.

Space Tourism Market Use Cases

- Space Exploration for Non-Astronauts: Space tourism offers private individuals the chance to experience space travel, allowing them to view Earth from orbit, experience zero gravity, and participate in space missions previously exclusive to trained astronauts.

- Commercial and Luxury Experiences: Space tourism companies offer high-end, luxury travel experiences. Some companies, like SpaceX or Blue Origin, are planning extended trips to space stations or even the moon, targeting wealthy tourists seeking unique and once-in-a-lifetime adventures.

- Scientific Research by Private Entities: Private companies or academic institutions can sponsor passengers to conduct research in a low-gravity or zero-gravity environment, where experiments on materials science, biology, and medicine can be carried out more effectively.

- Space Station Development and Hospitality: With advancements in space tourism, there is the potential to develop space stations that act as hotels or tourist hubs, where people can stay for longer periods and experience life in space, thus creating a new frontier in hospitality and tourism infrastructure.

Space Tourism Market Dynamic

Drivers

Technological Advancement in Space Tourism

Technological innovations are transforming space tourism, driving it into a new phase of growth and accessibility. Advances in spacecraft design and engineering have greatly improved safety, efficiency, and the overall experience for passengers. The development of reusable rockets and spacecraft has reduced launch and transportation costs, making space travel more affordable and appealing to a wider audience.

Growing Interests and Motivations

The increasing interest and motivations of billionaires and investors in various forms of space tourism are fueling the market's growth and investment. Suborbital tourism, which offers short but thrilling trips to the edge of space, appeals to those seeking a space travel experience without committing to extended stays. The excitement of weightlessness and the opportunity to view Earth from space are key drivers behind the surge in interest in suborbital missions, drives the growth of the market, while supporting technologies such as

Edge Data Center infrastructures enhance real-time data processing and operational efficiency.

Restraints

Environmental Concerns

The growth of the global space tourism market is hampering with growing concerns about the environmental impact of rocket and space shuttle launches. Greenhouse gas emissions, air pollution, and water contamination are at the forefront of environmental debates, leading consumers to demand eco-friendly alternatives. The harmful effects of chemical pollutants and carbon emissions are dissuading consumers who prioritize sustainability, and negatively impacting the growth of the market, further highlighting the need for improved handling and management practices within Chemical Logistics to reduce environmental risks.

Increased Traffic and Space Debris

The rising number of spacecrafts in near-Earth orbit is worsening the issue of space debris, which presents significant risks to future missions and satellites. Without proper regulation, the expansion of the space tourism industry could lead to a more crowded and polluted orbital environment, creating additional challenges for the long-term sustainability of space activities, which obstruct the growth of the market.

Opportunities

Research and Development

Ongoing research and development efforts by both government agencies and private companies are helping to overcome the technical and logistical challenges of space tourism. These advancements are expected to make space travel more accessible to a broader audience. As technology progresses, costs may decrease, opening opportunities for middle-class consumers to engage in astronomical tourism.

Economic Growth and Job Creation

The growth of the space tourism expected to create jobs not only in aerospace but also in related industries such as hospitality and tourism. This presents opportunities for businesses to develop specialized services catering to space tourists, from luxury accommodations to travel planning and safety solutions.

Trends

Emergence of Commercial Spaceflights

Companies like SpaceX, Blue Origin, and Virgin Galactic are pioneering commercial spaceflights, offering suborbital and orbital experiences. They are investing heavily in technology and infrastructure to make space tourism accessible to a broader audience.

Initially, space tourism was reserved for the wealthy elite. However, advancements in technology and increased competition are gradually reducing costs, making space travel more accessible. This trend is expected to continue, with the aim of democratizing space tourism.

Focus on Sustainable Space Travel

There is a growing emphasis on developing sustainable technologies to minimize the environmental impact of space travel. Companies are exploring reusable rockets, efficient propulsion systems, and sustainable fuel sources.

Governments and international bodies are beginning to establish regulations and safety standards for space tourism to ensure responsible practices. This includes addressing the environmental impact and safety measures for passengers and spacecraft.

Research Scope and Analysis

By Tourism Type

Sub-orbital is expected to dominate the space tourism market based on tourism type with a revenue share of 45.3% in 2024. Sub-orbital flights are significantly less expensive than orbital and lunar tourism, making them more accessible to a broader customer base.

They provide a brief but impactful experience of weightlessness and views of Earth from space, which satisfies many traveler's spaceflight ambitions without the high costs and complexities of orbital travel. Unlike orbital flights, suborbital flights operate at lower speeds and don’t achieve orbit, with rockets ascending to a set altitude and returning once their engines shut down.

Companies are increasingly focusing on suborbital flights due to the cost-saving benefits of reusable rockets. Sub-orbital tourism requires less advanced technology and shorter flight durations than orbital and lunar missions. Flights typically last a few hours, which appeals to customers who want a space experience without the time commitment.

These flights involve lower risks, as they do not require achieving full orbit or navigating deep space, making them easier to execute with current commercial spaceflight technology.

By Category

Direct supplier is anticipated to dominate the space tourism market with the largest revenue share of 63.1% based on the category in 2024. This dominance of direct suppliers is due to its critical role in providing the core services that make space travel possible. Famous airlines and spaceflight operators are responsible for the essential infrastructure, technology, and expertise required to safely transport tourists to and from space.

These entities, such as SpaceX, Blue Origin, and Virgin Galactic, invest heavily in research, development, and innovation to create reusable rockets, space capsules, and other cutting-edge technologies that reduce costs and enhance the overall customer experience. Hotel companies also play a key role by offering potential accommodations in space, such as orbital space stations or future space hotels.

This direct interaction with space tourists provides them with a competitive advantage in capturing significant market share as they can offer unique experiences unavailable from indirect suppliers.

Moreover, government bodies and national space agencies are often involved in regulating, funding, and collaborating with private companies in the space tourism industry, further solidifying the influence of direct suppliers. Their involvement helps set standards for safety, sustainability, and accessibility, providing credibility to the sector.

By Booking Channel

Online booking will dominate the space tourism market with the highest revenue share by 2024 due to its ease of access and convenience for potential space tourists. These platforms enable customers to quickly explore a wide selection of space travel options, compare prices, and make informed decisions from their own homes - simplifying and streamlining booking space travel arrangements for customers.

This booking platform makes a wealth of information easily accessible for potential travelers, providing easy research on various space tourism providers like SpaceX, Blue Origin and Virgin Galactic as well as their respective experiences and offerings. These resources enable customers to make well-informed choices, fostering transparency and trust throughout the booking process.

These platforms feature customer reviews and ratings that provide prospective space tourists with confidence by showing firsthand experiences from others. These booking platforms may specialize in space tourism by offering packages such as pre-flight training, accommodations and travel insurance coverage.

As online booking grows rapidly within space tourism, offline booking has seen increased adoption within traditional travel agencies or dedicated space tourism operators who offer personalized services that may not be found on online platforms.

By End User

Luxury Space Travelers are expected to account for an increasing percentage of revenue by 2024 due to their higher spending power and exclusive nature of space travel. Space tourism remains an emerging industry with limited accessibility; therefore, its associated technology - and therefore travel costs - are relatively costly.

As such, only a relatively small segment of global society can afford these experiences, with high-net-worth individuals being their main customers. SpaceX, Blue Origin, and Virgin Galactic all provide luxurious space travel experiences at high costs to attract an affluent clientele looking for unique, exceptional adventures. Space traveler is usually driven by their desire to discover uncharted territories and experience events only available to select few; which aligns perfectly with space exploration.

These travelers value status symbols and are willing to invest in experiences which raise their social standing. Space tourism companies naturally cover their high costs in R&D, infrastructure, and operation by targeting wealthy travelers as an audience; adventure tourism has increasingly gained prominence among space tourists as an attraction because adventure seekers demand unique, thrilling experiences that set them apart from luxury travelers.

The Global Space Tourism Market Report is segmented based on the following

By Tourism Type

- Orbital

- Sub-orbital

- Lunar Space

By Category

- Direct Supplier

- Airlines

- Hotel Companies

- Tour Operators

- Government Bodies

- Indirect Supplier

- OTA (Online Travel Agency)

- Traditional Travel Agencies

- TMCs (Travel Management Companies)

- Corporate Buyers

- Aggregators

By Booking Channel

- Offline Booking

- Online Booking

By End User

- Luxury space Travelers

- Adventure Tourist

- Educational Tourist

- Researchers

Space Tourism Market Regional Analysis

North America is predicted to take the highest

share of 40.1% in the space tourism market by the end of 2024 due to its advanced infrastructure and focus on research & development which make up its revenue contribution over this forecast period.

Strong infrastructure facilitates rapid adoption of cutting-edge technologies. North American SMEs that provide parts and services to industry giants like SpaceX, Blue Origin, and Virgin Galactic have also contributed significantly to market expansion.

Additionally, the region's favorable regulatory environment, headed up by the Federal Aviation Administration (FAA), has inspired greater private sector involvement by offering clear rules and requirements for commercial spaceflight operations. Government support through grants, contracts, and initiatives such as Artemis is expected to drive further acceleration of growth.

Europe should experience rapid compound annual growth rates due to advances in aerospace technology as well as private sector involvement and government backing. European governments and organizations like the European Space Agency (ESA) are focused on increasingly promoting space tourism efforts.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Space Tourism Market Competitive Landscape

The space tourism market is still in its early stages, with major players using various strategies to gain market share. The technological landscape is continuously evolving, with new advancements emerging regularly. As technology progresses, companies are working to make space tourism more attractive and accessible to a wider range of customers, including individuals and businesses.

Additionally, supplier support networks are strengthening, and companies are forming effective partnerships with direct suppliers. Many space tourism firms are also actively promoting their services through advertising campaigns and celebrity endorsements to boost interest and demand.

Some of the prominent players in the global space tourism market are

- Blue Origin

- Virgin Galactic

- SpaceX

- Airbus Group SE

- Boeing

- Zero Gravity Corporation

- Axiom Space, Inc.

- Rocket Lab USA

- Space Adventures

- Space Perspective

- World View Enterprises, Inc.

- Zero 2 Infinity S.L.

- Others

Space Tourism Market Recent Development

- In September 2023, according to Firefly Aerospace, Inc., L3Harris Technologies and Firefly Aerospace, Inc. have inked a multi-launch agreement for three dedicated launches on Firefly's Alpha vehicle in 2026. The arrangement strengthens Firefly's position as the industry's top provider of small-lift launch services as it increases Alpha vehicle manufacturing to meet the expanding demands of both government and commercial clients

- In June 2023, Virgin Galactic commercial spaceflight service launch was announced. The "Galactic -01" flight window, the first commercial space mission, was scheduled for June 27 to June 30.

- In October 2023, Blue Origin introduced the Blue Ring, a versatile spacecraft platform designed to enhance in-space logistics and delivery, advancing its mission of building a pathway to space for the benefit of Earth.

- In February 2023, Rocket Lab USA, Inc., a leading provider of launch services and space systems, launched two new high-performance space system products aimed at increasing the availability of crucial satellite components for the global small satellite market.

- In October 2023, Axiom Space and the European Space Agency (ESA) signed a Memorandum of Understanding (MOU) to explore collaborative efforts in human spaceflight, science, technology, and commercialization.