ℹ

To learn more about this report –

Download Your Free Sample Report Here

One major trend shaping the landscape is the convergence of cloud computing and edge analytics in sports infrastructure. This combination enhances real-time insights during live events, which is crucial for both competitive advantage and broadcasting enrichment. Additionally, the integration of sports analytics with betting platforms is transforming the fan experience, delivering hyper-personalized content and boosting user retention.

A prominent growth opportunity lies in the integration of sports analytics with smart stadiums. Connected stadiums embedded with IoT sensors and AI-powered surveillance offer vast datasets that can be monetized for operational efficiency and immersive fan experiences. Emerging markets in Asia and Latin America also present untapped potential due to growing sports viewership and smartphone penetration.

However, the market faces restraints including data privacy concerns, inconsistent data standardization across regions, and the high initial investment for tech infrastructure. Smaller teams and leagues struggle to adopt such tools due to limited budgets.

Nevertheless, the outlook remains promising. With increasing emphasis on injury prevention, tactical intelligence, and revenue generation from digital streams, the sports analytics ecosystem is set to evolve into a core pillar of the global sports economy, making data literacy a non-negotiable skill for sports professionals.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Sports Analytics Market

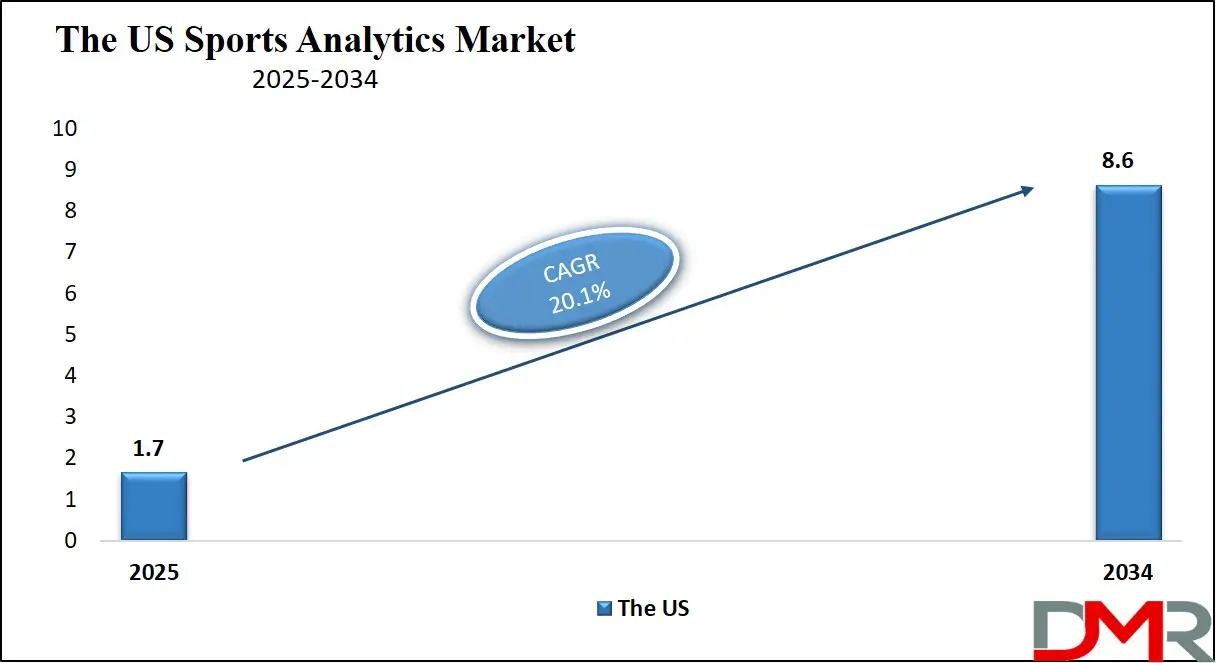

The US Sports Analytics Market is projected to reach

USD 1.7 billion in 2025 at a compound annual growth rate of

20.1% over its forecast period.

The U.S. sports analytics market benefits from the country’s rich sports culture, technological leadership, and strong government-backed sports infrastructure. According to the U.S. Bureau of Labor Statistics (BLS), over 16,000 professional athletes are employed nationwide, with leagues like the NFL, NBA, and MLB heavily investing in analytics for player performance and commercial outcomes. The NCAA, through its Sports Science Institute, is also promoting injury tracking systems and data-driven coaching in college sports.

The U.S. Census Bureau reports over 330 million citizens, providing a massive fan base for data-driven fan engagement platforms. Additionally, institutions like the U.S. Olympic & Paralympic Committee (USOPC) employ motion capture and biomechanical analytics to train elite athletes. Public funding via the Department of Health and Human Services supports physical activity monitoring, indirectly fostering a broader analytics ecosystem in youth sports.

The U.S. leads in wearable tech adoption with companies like Catapult and Whoop based domestically, contributing to widespread athlete data acquisition. Universities such as MIT and Stanford also conduct pioneering research in sports biomechanics and AI-based strategy tools, fueling innovation.

With legalized sports betting expanding across states, regulated analytics is being used to detect fraud and personalize betting experiences. Yet, privacy concerns and inconsistent tech access at amateur levels remain challenges. The U.S. continues to dominate this space, thanks to structured talent development, rich sports databases, and high consumer expectations for real-time sports insights. Its leadership in AI, cloud computing, and 5G ensures that U.S. sports organizations will remain at the cutting edge of data-driven performance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Sports Analytics Market

The European Sports Analytics Market is estimated to be valued at

USD 825.0 million in 2025 and is further anticipated to reach

USD 3.31 billion by 2034 at a

CAGR of 17.1%.

Europe’s sports analytics market is thriving, propelled by a strong football culture, tech-savvy clubs, and supportive public sports frameworks. UEFA and national sports federations have been instrumental in integrating analytics into performance, injury prevention, and fan services. The European Commission’s Erasmus+ Sport initiative supports innovation and digital transformation, indirectly boosting analytics adoption at the grassroots and professional levels.

With a population exceeding 740 million across 27 member states (Eurostat, 2024), Europe presents a large and diverse consumer base for sports data. Football clubs in the English Premier League, Bundesliga, and La Liga are among the world’s most advanced in deploying GPS-based athlete tracking, video analytics, and performance optimization tools. Data-driven scouting using tools like SAP Sports One has become mainstream.

Government agencies such as UK Sport and INSEP (France) support scientific training methods, including biomechanical analysis and cognitive performance tracking. European universities, including Loughborough and KU Leuven, collaborate with teams to develop AI and machine learning models tailored for sports.

Despite these advances, smaller leagues often face barriers in accessing cutting-edge analytics due to financial constraints and fragmented vendor ecosystems. Also, compliance with GDPR imposes strict data handling rules, slowing some deployments.

Nevertheless, the region’s emphasis on health, transparency, and technology-driven performance remains unwavering. Continued investment in digital infrastructure, combined with the region’s love for football, rugby, and cycling, positions Europe as a critical hub in the global sports analytics landscape. The synergy of policy, talent, and data maturity ensures sustainable long-term growth.

The Japan Sports Analytics Market

The Japan Sports Analytics Market is projected to be valued at USD 330.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1.81 billion in 2034 at a CAGR of 22.0%.

Japan’s sports analytics market is rapidly expanding, driven by government-supported digitization, an aging yet active population, and the nation's precision-oriented sporting culture. The Japan Sports Agency (under MEXT) actively promotes scientific training methodologies across elite and grassroots levels. The "Sport for Tomorrow" initiative, launched before the Tokyo 2020 Olympics, emphasized sports science integration, fostering analytics adoption nationwide.

Japan’s demographic profile, with over 29% of its population aged 65 or older (Statistics Bureau of Japan, 2024), pushes the demand for injury prevention and physical performance monitoring through analytics. Elder sports programs are leveraging data to promote healthy aging and reduce healthcare burdens. Simultaneously, young athletes are benefiting from biometric tracking and AI-based coaching in schools and academies.

The Japan Institute of Sports Sciences (JISS) plays a central role in developing analytics platforms in biomechanics and sports psychology. Japan Professional Football League (J-League) and Nippon Professional Baseball (NPB) are using performance analytics for scouting, game strategy, and fan engagement. Tech firms like NTT Data and Fujitsu are creating homegrown solutions combining IoT, AI, and real-time analytics.

However, language barriers, fragmented tech infrastructure in rural areas, and limited commercialization outside elite sports pose challenges. Cultural concerns over data sharing and privacy also restrict broader adoption.

Nonetheless, Japan’s reputation for innovation, coupled with increasing international collaborations, is accelerating analytics penetration across various sports. As Japan continues to invest in

digital health, smart stadiums, and AI, its sports analytics market is poised for sustained growth, particularly in urban centers and professional sports leagues.

Global Sports Analytics Market: Key Takeaways

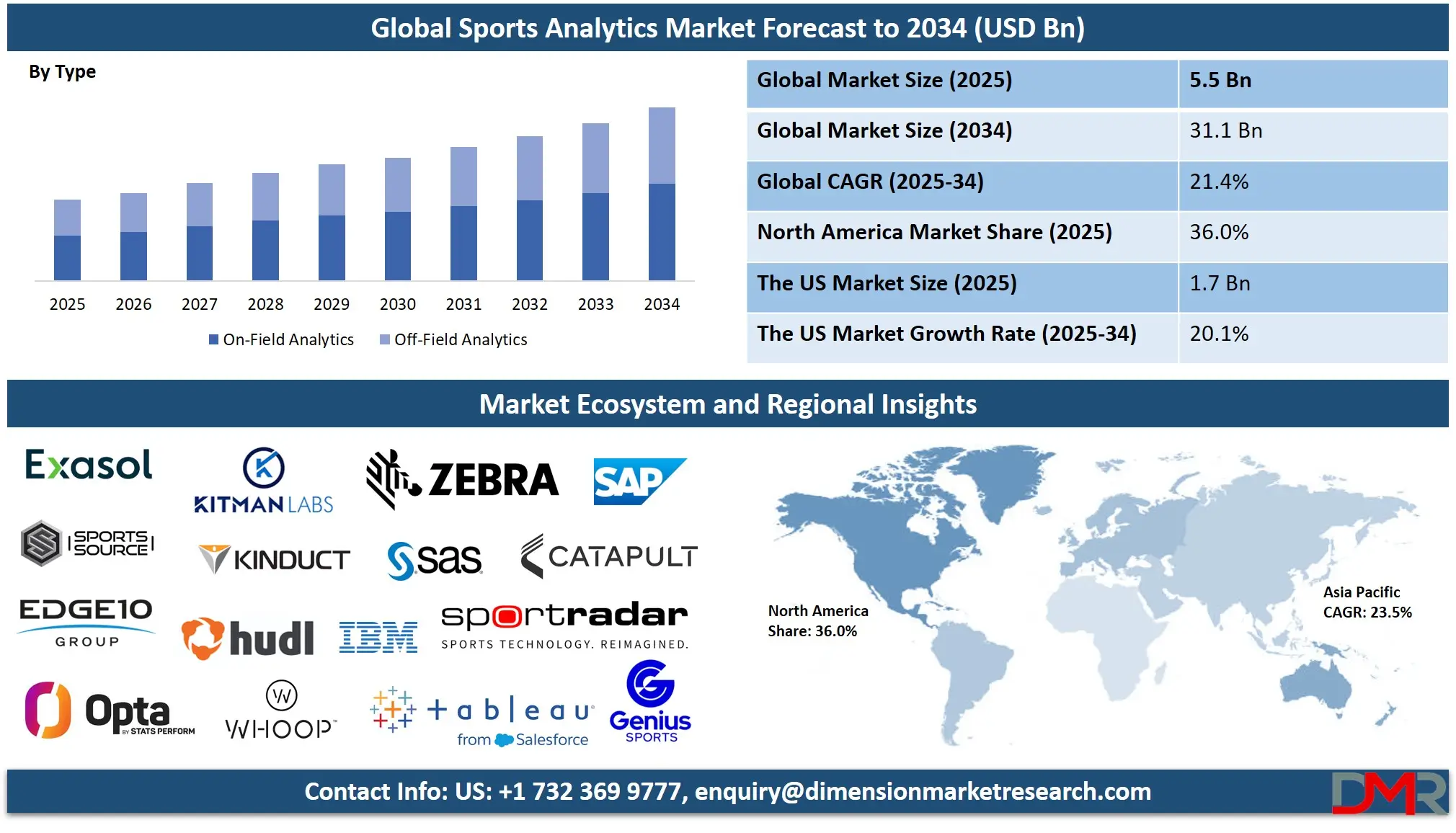

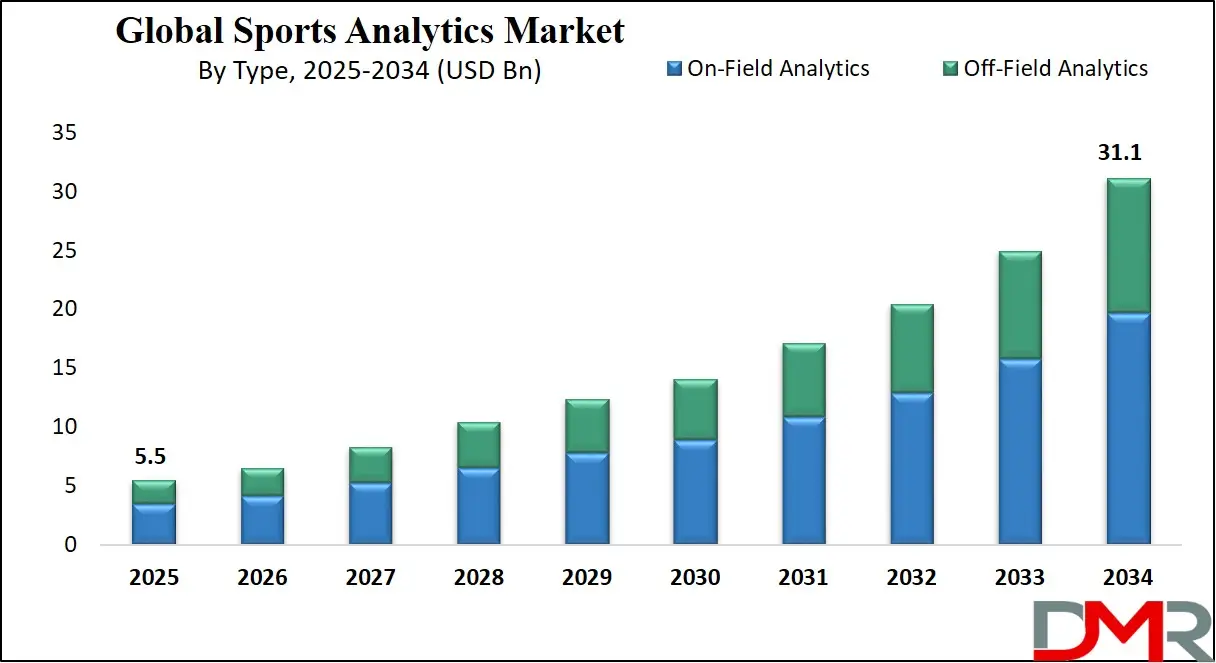

- Global Market Size Insights: The Global Sports Analytics Market size is estimated to have a value of USD 5.5 billion in 2025 and is expected to reach USD 31.1 billion by the end of 2034.

- The US Market Size Insights: The US Sports Analytics Market is projected to be valued at USD 1.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 8.6 billion in 2034 at a CAGR of 20.1%.

- Regional Insights: North America is expected to have the largest market share in the Global Sports Analytics Market with a share of about 36.0% in 2025.

- Key Players: Some of the major key players in the Global Sports Analytics Market are International Business Machines Corporation (IBM), SAP SE, SAS Institute Inc., Catapult Group International Ltd., Stats Perform, Sportradar Group AG, Zebra Technologies Corporation, Agile Sports Technologies Inc. (Hudl), Oracle Corporation, Genius Sports Limited, Tableau Software LLC, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 21.4 percent over the forecasted period of 2025.

Global Sports Analytics Market: Use Cases

- Player Performance Optimization: Professional teams use biometric and movement tracking through wearables to assess training loads, prevent overexertion, and enhance personalized recovery programs. This has been especially pivotal in sports like soccer and basketball, where marginal gains lead to competitive advantage.

- Injury Prediction and Prevention: By leveraging historical player health data, predictive analytics tools assess injury risks. For example, NFL and NBA teams use AI-based alerts to modify player routines, decreasing long-term injury rates and improving athlete longevity.

- Tactical Strategy Development: Coaches apply real-time heatmaps and video analytics to assess opposition patterns and player positioning. This data guides in-game decision-making and post-match reviews, refining strategies for future games in cricket, football, and rugby.

- Fan Experience and Engagement: Teams integrate analytics with social media and ticketing data to offer dynamic pricing and personalized promotions. Real Madrid and Manchester United, for instance, use fan insights to enhance loyalty programs and digital engagement through AR/VR content.

- Sports Betting Integrity: Analytics is increasingly employed to monitor unusual betting patterns, ensuring fair play. Organizations like Sportradar collaborate with governing bodies to flag anomalies in real time, supporting anti-corruption efforts in professional leagues.

Global Sports Analytics Market: Stats & Facts

U.S. National Center for Health Statistics (CDC NHIS, 2020)

- 54.1% of U.S. children aged 6–17 participated in organized sports within the past year. This high level of youth participation feeds directly into the long-term growth of sports analytics, as more structured programs adopt tracking and performance tools.

- Among these, 56.1% of boys and 52.0% of girls engaged in organized sports, indicating a fairly balanced participation trend and growing inclusivity.

- Participation varies by race: 60.4% of non-Hispanic White, 42.1% of Black, 46.9% of Hispanic, and 51.4% of Asian children were involved.

- Education levels of parents significantly influence participation. Only 36.8% of children from households where parents had high school education or less participated, compared to 67.6% for children whose parents held bachelor’s degrees or higher.

- Household income also plays a critical role: Just 31.2% of children from families below 100% of the federal poverty level participated, compared to 70.2% from families earning 400% or more.

- Regionally, the South had the lowest participation rate (48.7%) compared to 56% to 59% in the Midwest, West, and Northeast.

U.S. Government Accountability Office (GAO)

- During the 2013–14 school year, 39% of students at traditional public high schools participated in school-sponsored sports, compared to 19% at charter schools.

- Among all school-sponsored sports participants, 57% were boys and 43% were girls, even though the availability of teams was nearly equal.

- In 77% of schools, girls’ participation rates were lower than boys’. Only 19% of schools reported girls’ rates matching or exceeding boys’.

U.S. Bureau of Labor Statistics (BLS)

- The entertainment and sports occupations sector is growing faster than the average job market, with an estimated 108,900 job openings projected each year between 2023 and 2033. Many of these roles now require proficiency in data analytics.

- The median annual wage for sports and entertainment jobs is $54,870, notably higher than the national median of $49,500, suggesting a premium on skilled roles such as sports data analysts and technologists.

U.S. Bureau of Economic Analysis (BEA)

- In 2023, outdoor recreation, which includes organized and competitive sports, contributed $639.5 billion to U.S. GDP, accounting for 2.3% of total GDP. This signifies how large and economically impactful the broader sports and recreation sector has become, providing fertile ground for analytics investment.

National Center for Biotechnology Information (NCBI) & PubMed Studies

- Wearable wireless sensor systems are capable of tracking real-time speed, acceleration, and distance for athletes. These systems have transitioned from experimental to commercial-grade applications, making them viable tools in professional and amateur sports.

- Artificial intelligence combined with Internet of Things (IoT) devices is being deployed to identify risk factors for injuries. These tools use prior injury history, movement patterns, and fatigue markers to forecast potential health concerns.

- Over the past 20 years, data shows a decline in U.S. boys’ participation in multiple team sports, while girls’ participation in single-sport teams has increased. This shift indicates evolving analytics needs to address gender-specific athletic development.

European Commission / Eurostat

- Europe’s population stands at over 740 million, providing a vast base for analytics-driven sports platforms.

- The European Commission’s Erasmus+ Sport program supports digitalization and innovation in sport, with over €290 million invested from 2021–2027 for education, performance tech, and anti-doping analytics.

Japan Statistics Bureau & Sports Agency (MEXT)

- As of 2024, 29% of Japan’s population is aged 65 and older, making senior health and injury prevention analytics a growing priority in the sports sector.

- The Japan Institute of Sports Sciences (JISS) leads the country's integration of biomechanics, sports psychology, and motion tracking in elite athletic programs.

- Through the “Sport for Tomorrow” legacy initiative post-Tokyo Olympics, Japan has increased its investment in sports tech startups and academic partnerships, promoting the domestic analytics ecosystem.

National Youth Sports Strategy (U.S. Department of Health and Human Services)

- There has been no standardized federal monitoring of community youth sports since 2016, which poses challenges in data consistency and policy-making. New calls for federal support aim to reintroduce analytics into underserved communities.

- The strategy identifies inequitable access to performance tracking tools in minority and low-income youth sports programs, underlining the need for scalable, cost-effective analytics solutions.

Global Sports Analytics Market: Market Dynamic

Driving Factors in the Global Sports Analytics Market

Increasing Investments by Professional Leagues and Teams

Top-tier sports leagues such as the NFL, NBA, MLB, EPL, and Formula 1 are making substantial investments in analytics infrastructure to gain a competitive edge. These investments are directed toward software, hardware, and personnel skilled in data science, biomechanics, and game theory. Analytics is now embedded in player scouting, health monitoring, and post-game evaluations, transforming subjective decision-making into evidence-based strategies. Additionally, team owners and sponsors view analytics as a value multiplier, optimizing everything from training schedules to ticketing.

This surge in spending is not confined to elite leagues; semi-professional and college sports programs are also embracing analytics to enhance performance and recruitment. Universities, for example, use performance data in athlete development programs and scholarship decisions. As competition intensifies and sports become more commercialized, data-driven decision-making is now indispensable, fueling widespread adoption and deepening market penetration.

Expanding Adoption in Amateur and Grassroots Sports Ecosystems

The democratization of technology is bringing sports analytics to amateur clubs, schools, and grassroots organizations. Thanks to affordable wearable devices, smartphone apps, and cloud platforms, basic analytics capabilities are now accessible to athletes outside professional setups. For example, high school coaches use video breakdown software and GPS tracking tools to analyze practice sessions, manage fatigue, and prevent injuries.

Parents and student-athletes also benefit from tools that help showcase performance metrics to college recruiters. Local federations are employing analytics for talent identification and sports development programs. This widening user base has created a lucrative avenue for vendors targeting low-cost, high-volume analytics tools. It also enhances the long-term outlook for the market, as early exposure to analytics fosters familiarity and reliance. With government-backed initiatives in education and youth sports promoting digital tools, the grassroots adoption wave is poised to drive substantial market growth.

Restraints in the Global Sports Analytics Market

High Cost and Complex Implementation in Lower-Tier Teams

Despite the benefits, the upfront cost of sports analytics systems can be prohibitive for smaller teams and amateur organizations. High-end video analytics setups, AI-driven software, and wearable devices require significant investment, not only in equipment but also in training and data infrastructure. Implementation is further complicated by the need for skilled personnel, often lacking at grassroots levels. Without experienced analysts, even the best tools may be underutilized or misinterpreted.

Moreover, integration with existing training regimes or management platforms can be time-consuming and disruptive. These barriers hinder adoption in markets that could otherwise benefit from analytics, particularly in developing countries or rural areas. For the sports analytics industry to achieve broader penetration, vendors must focus on modular, affordable solutions and provide extensive user training and support services.

Data Privacy, Ownership, and Ethical Concerns

The collection and usage of athlete data raise serious ethical and legal concerns, particularly regarding privacy, consent, and ownership. Athletes are increasingly wary of how biometric and performance data are stored, shared, or monetized. For example, contractual disputes have arisen around who owns the data: the player, the team, or the analytics vendor. In some cases, teams have been accused of using sensitive health data to influence roster decisions or negotiations.

Regulatory frameworks like GDPR in Europe add further complexity by imposing strict requirements on data handling and processing. Youth sports face even stricter scrutiny, as minors’ data protection rules are more stringent. These issues may slow down analytics adoption or result in costly litigation and compliance overhead. Vendors and teams must navigate this landscape carefully, implementing transparent, ethical data governance policies and offering opt-in models to build trust and ensure sustainability.

Opportunities in the Global Sports Analytics Market

Development of Analytics-as-a-Service (AaaS) Models

The emergence of Analytics-as-a-Service (AaaS) presents a compelling growth opportunity, particularly for mid-tier clubs and sports organizations with limited IT infrastructure. This model allows users to access sophisticated analytics tools via subscription-based cloud services, avoiding upfront capital investments. Vendors provide plug-and-play platforms for video analysis, health diagnostics, opponent scouting, and fan behavior tracking.

These services often include dashboards with customizable KPIs, making them user-friendly even for non-technical staff. For example, second-division football clubs in Europe or minor league baseball teams in the U.S. are increasingly turning to AaaS to stay competitive without hiring full-time analysts. The scalability of cloud systems also allows real-time collaboration across geographies, a boon for globally dispersed coaching teams. As data security and bandwidth improve, AaaS could become the default delivery method for analytics, expanding the market’s total addressable size and recurring revenue potential.

Expansion into Non-Traditional Sports and Emerging Markets

As sports analytics matures, its application is expanding beyond traditional sports like football and basketball to emerging areas such as eSports, drone racing, and adaptive sports. eSports, in particular, presents massive untapped potential due to its digital-native audience and real-time performance data. Analytics is being used to track in-game behavior, reaction times, and decision-making strategies.

Similarly, developing markets in Asia, Latin America, and Africa are showing increased interest in sports technology. Governments and private entities are investing in analytics to professionalize sports, support Olympic aspirations, and attract global tournaments. For instance, cricket boards in India and Australia use detailed analytics for pitch condition modeling and match simulations. These newer sports and markets offer less-saturated entry points, giving vendors first-mover advantages. As affordability and awareness increase, so does the appetite for analytics, creating substantial room for global market expansion.

Trends in the Global Sports Analytics Market

Integration of Artificial Intelligence and Machine Learning in Sports Analytics

The sports analytics landscape is undergoing a transformative shift with the integration of

artificial intelligence (AI) and machine learning (ML). These technologies enable real-time data processing and predictive modeling, which are revolutionizing how teams assess performance, manage health, and make strategic decisions. AI-powered video analytics tools can automatically tag and classify game events, saving time and enabling deeper tactical reviews. ML algorithms, trained on historical player data, can forecast injury risks, performance dips, and even the optimal substitution timing.

AI is also being embedded into wearables and IoT devices, offering coaches and medical teams actionable insights on biometrics like heart rate variability, hydration levels, and muscle fatigue. These innovations are particularly beneficial in high-stakes sports like football, tennis, and cricket, where milliseconds and inches can determine outcomes. The ability to gain a competitive advantage using AI-driven analytics is increasingly compelling for professional and semi-professional teams alike, making it one of the most significant technological trends shaping the future of the sports analytics market globally.

Growing Adoption of Cloud-Based Analytics Platforms

Cloud technology has emerged as a dominant trend in the sports analytics ecosystem, primarily due to its scalability, accessibility, and lower infrastructure costs. Teams, leagues, and broadcasters are adopting cloud-based platforms to centralize data from multiple sources GPS wearables, match footage, ticketing systems, and fan engagement tools, into a single, unified dashboard. This consolidation facilitates comprehensive insights and cross-functional decision-making. Cloud-based platforms also enable real-time access to performance metrics, allowing analysts and coaches to make instant tactical adjustments.

Moreover, cloud storage reduces data loss risks and ensures secure backup, which is critical for compliance and integrity in professional leagues. Another driving force behind this trend is the increasing need for remote analytics during live events, especially in a post-pandemic world where hybrid work models and digital sports operations are normalized. Major cloud service providers are even customizing solutions specifically for sports franchises, further accelerating this trend. As global connectivity improves and data volumes grow, the shift toward cloud-native sports analytics platforms is expected to define the next generation of sports technology infrastructure.

Global Sports Analytics Market: Research Scope and Analysis

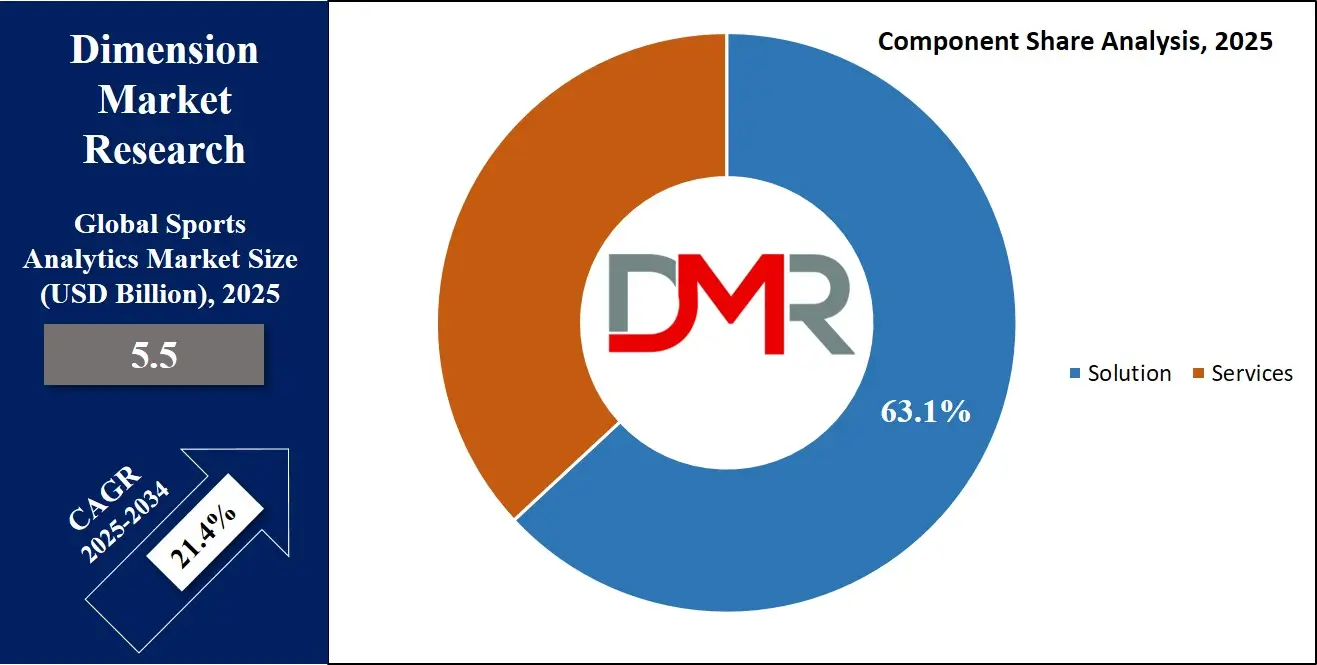

By Component Analysis

The solution segment is projected to dominate the sports analytics market primarily due to its indispensable role in enabling real-time decision-making, performance analysis, and strategic planning. Sports organizations globally, ranging from professional teams to grassroots programs, rely on sophisticated software solutions to gather, process, and visualize data on player health, movement, game strategy, and opponent behavior. These solutions encompass a wide range of functionalities, including video analytics, AI-driven game simulations, injury risk modeling, and predictive performance forecasting. They are also increasingly integrated with wearables and IoT devices, providing continuous monitoring and feedback loops.

One of the key advantages driving the dominance of the solution segment is scalability. Analytics platforms can be customized to suit the needs of diverse sports and different levels of competition, from elite football leagues to university-level basketball. Furthermore, advanced dashboards, cloud-based access, and user-friendly interfaces make these solutions accessible to both data scientists and coaching staff.

In contrast, the services segment, while essential for implementation and support, tends to be one-time or recurring on a smaller scale. The growing demand for autonomy in data management and the preference for in-house analytics capabilities further reinforce the leading role of solutions. Vendors also focus heavily on innovating their product offerings, launching AI- and ML-powered upgrades, which strengthens the competitive appeal of the solution segment. As sports organizations continue to transition into data-first ecosystems, analytics software solutions remain the strategic backbone for performance optimization, talent acquisition, fan engagement, and injury prevention, making them the dominant component across global markets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Type Analysis

On-field analytics is anticipated to hold the dominant position in the sports analytics market due to its direct impact on performance enhancement, injury reduction, and tactical decision-making. This segment captures data from live gameplay and training sessions to assess player movement, physical exertion, positioning, stamina, and technical execution. By employing tools such as wearable trackers, high-speed cameras, and real-time GPS data, on-field analytics provides coaches and analysts with actionable insights that inform substitutions, formation changes, and player development plans.

In highly competitive environments such as the NFL, FIFA World Cup, NBA, and international cricket, success hinges on marginal gains. On-field analytics enables these improvements by highlighting areas for tactical adjustments and individual player refinement. Teams can track sprint speeds, workload intensity, and reaction times, which are essential for tailoring training regimens and avoiding burnout or overuse injuries. These insights lead to improved player longevity and better game outcomes.

Another reason for the segment’s dominance is its versatility across both training and live matches. The integration of artificial intelligence and motion capture technology enhances data precision, allowing for split-second evaluation and instant feedback. Additionally, youth academies and amateur clubs are adopting basic on-field analytics for scouting and training purposes, extending the segment's reach beyond elite sports.

While off-field analytics is valuable for operations and fan engagement, it lacks the immediacy and performance-critical role that on-field analytics delivers. With sports increasingly embracing performance science, on-field analytics has become an indispensable tool, solidifying its dominance in the global market landscape.

By Deployment Mode Analysis

Cloud-based deployment is expected to dominate the global sports analytics market owing to its scalability, flexibility, and cost-efficiency. Unlike traditional on-premise systems, cloud-based platforms provide instant access to large volumes of data from anywhere, enabling real-time collaboration among coaches, data analysts, sports scientists, and medical staff. This model is especially crucial for geographically dispersed teams or sports organizations with decentralized operations, such as national associations and international franchises.

A significant driver for cloud adoption is its compatibility with mobile devices, wearables, and remote data-gathering tools. Whether tracking a football player’s GPS stats during a live match or analyzing tennis swing biomechanics from a training center, cloud systems allow seamless syncing and data integration. Furthermore, cloud platforms support the use of advanced analytics technologies like machine learning and AI, which require high computational power and continuous updates, something far more accessible in a cloud environment.

Cloud solutions also reduce IT infrastructure costs and eliminate the need for complex in-house maintenance. Subscription-based pricing models make them especially attractive to small and mid-tier sports organizations that seek advanced analytics capabilities without large capital expenditures. Moreover, major cloud vendors offer high-grade security, regular updates, and compliance with regulations like GDPR, making them trustworthy for sensitive athlete data.

Given the global push toward digitization, cloud-based deployments are future-ready and facilitate fast innovation, agile responses, and wider market adoption. Their role in supporting performance analytics, injury prevention, fan engagement, and revenue optimization ensures they remain the dominant mode of deployment in the sports analytics industry.

By Sports Type Analysis

Team sports are poised to dominate the sports analytics market due to their complexity, commercial scale, and high data variability. Sports such as football, basketball, cricket, hockey, rugby, and baseball require deep tactical planning, player rotation, and formation analysis, which makes analytics a critical part of strategy. These sports often involve multiple players with varying roles and movements that need continuous monitoring, making them fertile ground for applying big data analytics, machine learning, and video analysis technologies.

The economic scale of team sports further boosts the demand for advanced analytics. Major leagues like the NFL, NBA, EPL, IPL, and UEFA Champions League generate billions in revenue and heavily invest in data to gain competitive advantages. Analytics is used for scouting, performance optimization, health management, and contract valuation. It also aids in audience engagement and broadcast analytics vital for monetizing large fan bases.

Additionally, the collaborative nature of team sports makes them uniquely dependent on understanding group dynamics. Metrics such as pass accuracy, heat maps, defensive gaps, and player interconnectivity are crucial for game planning. This complexity drives the adoption of sophisticated analytics platforms capable of processing multidimensional data in real-time.

In contrast, individual sports, while important, have fewer variables and require less team-based modeling. Moreover, team sports often serve as pilot grounds for analytics innovation due to their broader stakeholder base, including media, sponsors, and betting companies. This multi-tiered ecosystem reinforces the need for robust analytics, securing team sports’ dominance in the global sports analytics landscape.

By Application

Team and performance analysis is projected to dominate the application segment of the sports analytics market due to its integral role in enhancing athletic output, optimizing strategy, and minimizing injury risks. This segment leverages real-time and historical data to assess how teams function collectively and how individual players contribute to overall performance. With metrics like pass accuracy, possession time, sprint frequency, player fatigue, and tactical responsiveness, coaches and analysts gain deep visibility into team efficiency and player synergy.

Across team sports such as football, basketball, and hockey, where game outcomes depend heavily on unit cohesion and situational awareness, this type of analysis enables informed decision-making before, during, and after matches. Whether evaluating match footage through video breakdown tools or interpreting biometric data from wearables, the goal is to extract patterns that inform lineup adjustments, training regimens, and recovery protocols.

The rise of AI and predictive analytics has further expanded the scope of performance analysis by enabling coaches to simulate game scenarios, forecast player fatigue, and plan substitutions accordingly. Teams that incorporate this approach often experience measurable improvements in win-loss ratios, injury reduction, and player development.

The dominance of this segment is also reinforced by its direct impact on ROI. Enhanced performance leads to better league standings, higher ticket sales, and improved fan engagement, key financial metrics for any sports organization. As a result, team and performance analysis continues to be the most utilized and advanced application in the global sports analytics ecosystem.

By End User Analysis

Sports leagues and associations are anticipated to dominate the sports analytics market’s end-user segment due to their centralized governance, access to substantial funding, and need to maintain performance consistency across multiple teams or regions. National and international leagues such as the NFL, UEFA, IPL, and NBA invest heavily in analytics to maintain competitive balance, enhance game quality, and optimize broadcasting and fan experience strategies. Their influence spans entire ecosystems, making them pivotal in setting analytical benchmarks and protocols.

These organizations use analytics not only for team and player evaluation but also for rule changes, injury surveillance, and scheduling optimization. For instance, leagues analyze injury trends to implement rule amendments or develop safer playing formats. They also use fan engagement analytics to improve broadcasting rights packages, ticket pricing models, and digital content strategies. Since leagues and associations typically operate with long-term horizons, they are more inclined to invest in scalable, enterprise-grade analytics systems that cover everything from grassroots development to international tournament management.

Furthermore, many leagues offer centralized analytics platforms for their member teams, driving standardization and efficiency across the board. Their control over data rights and broadcast revenue also allows them to harness large data sets for broader insights, including sponsorship effectiveness and market expansion strategies.

By setting industry standards, funding innovation, and driving widespread adoption among stakeholders, sports leagues and associations play a leading role in the global sports analytics movement, making them the dominant end-user group in this dynamic and evolving market.

The Global Sports Analytics Market Report is segmented on the basis of the following

By Component

- Solutions

- Video Analytics

- Big Data Analytics

- Real-time Analytics

- Smart Wearable Technology

- Others

- Services

By Type

- On-Field Analytics

- Athlete Performance Monitoring

- Personalized Coaching

- Health & Injury Risk Assessment

- Sports Integrity & Anti-Doping Analysis

- Off-Field Analytics

- Fan Engagement & Experience Optimization

- Ticketing & Dynamic Pricing

- Sponsorship & Advertising Optimization

- Sports Event & Revenue Management

- Betting & Gambling Analytics

- Merchandise & Sales Analysis

By Deployment Mode

By Sports Type

- Team Sports

- Football (Soccer)

- Cricket

- Basketball

- Baseball

- Hockey

- Rugby

- Other Team Sports

- Individual Sports

- Tennis

- Boxing

- Athletics

- Racing Other Individual Sports

- eSports

- Multiplayer Online Battle Arena (MOBA)

- First-Person Shooter (FPS)

- Sports Simulation Games

- Others

By Application

- Team & Performance Analysis

- Player Valuation & Recruitment

- Fitness, Health, and Injury Prevention

- Video Breakdown & Tactics

- Fan Engagement & Digital Experience

- Data Interpretation & Visualization

- Broadcast Management & Media Optimization

- Betting Analysis

- Revenue & Merchandise Analytics

- Other Applications

By End User

- Sports Teams

- Sports Leagues & Associations

- Individual Players & Coaches

- Media & Broadcasting Organizations

- Sports Betting Companies

- Event Organizers & Sponsors

- Others

Global Sports Analytics Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global sports analytics market as it holds 36.0% of the total revenue by the end of 2025 due to the widespread adoption of technology in professional sports leagues such as the NFL, NBA, MLB, and NHL. These leagues are highly data-driven, using advanced analytics for player performance, injury prediction, tactical decisions, and fan engagement. The presence of major analytics software vendors and sports technology startups across the U.S. and Canada further boosts regional innovation and deployment.

The U.S. also benefits from extensive investments in collegiate sports, where institutions leverage analytics to scout athletes, improve team strategy, and ensure player safety, supported by organizations such as the NCAA and the U.S. Olympic & Paralympic Committee. High internet penetration, advanced IT infrastructure, and increasing focus on fan experience optimization through AR, VR, and AI analytics are other contributors to market dominance. Government-supported initiatives promoting health, fitness, and sports technology innovation reinforce the growth trajectory.

Moreover, North America houses key data management and cloud service companies, ensuring seamless integration with sports analytics platforms. With strong commercial sports ecosystems and tech-friendly environments, the region continues to lead globally in sports analytics adoption and innovation.

Region with the Highest CAGR

Asia Pacific is projected to record the highest CAGR in the sports analytics market due to rapid digitization, growing investments in sports infrastructure, and rising popularity of professional leagues across countries like India, China, Japan, and Australia. Initiatives such as China's “Sports Development Plan” and India's “Khelo India” program are driving grassroots sports digitization, fostering analytics adoption. The expansion of regional leagues like the Indian Premier League (IPL), Chinese Basketball Association (CBA), and A-League (Australia) has led to increased demand for player and team analytics to enhance performance and audience engagement.

The region's massive youth population, growing middle class, and surge in sports tech startups contribute to a fertile environment for innovation. Governments and private organizations are also investing in AI and IoT integration in sports, especially in cricket, football, and eSports. Additionally, increased smartphone penetration and affordable cloud solutions are making analytics tools more accessible. As these countries continue to professionalize their sports ecosystems, Asia Pacific will maintain its rapid growth trajectory in this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Sports Analytics Market: Competitive Landscape

The global sports analytics market is highly competitive, with a mix of established technology giants and specialized sports tech firms. Key players include IBM Corporation, SAS Institute Inc., Oracle Corporation, and SAP SE, all of which offer enterprise-grade analytics platforms that cater to professional leagues and sports associations. These companies leverage AI, machine learning, and cloud capabilities to deliver real-time performance insights and operational efficiency across sports domains.

In addition to global tech leaders, companies like Catapult Sports, Stats Perform, Hudl, and Zebra Technologies play a crucial role in wearable tracking, athlete monitoring, and video analytics. These firms focus on niche segments such as injury prevention, biomechanical analysis, and tactical video breakdown. Emerging startups like Kitman Labs, Orreco, and Spiideo are also gaining traction by offering cloud-native, data-driven platforms for performance optimization.

Strategic partnerships between analytics providers and major leagues (e.g., NFL with AWS, NBA with Second Spectrum) are common, ensuring market growth and technological advancement. Innovation, customization, and end-user training are major competitive factors. Companies that integrate sports science, fan experience analytics, and scalable AI tools continue to gain a competitive edge. The market remains dynamic, with frequent M&A activity aimed at expanding capabilities and global reach.

Some of the prominent players in the Global Sports Analytics Market are

- IBM Corporation

- SAP SE

- SAS Institute Inc.

- Catapult Sports

- Stats Perform

- Sportradar AG

- Zebra Technologies

- Hudl

- Oracle Corporation

- Genius Sports

- Tableau Software (Salesforce)

- Whoop Inc.

- Kinduct

- Opta Sports

- Zebra Medical Vision

- Exasol

- Edge10 Group

- SportsSource Analytics

- Kitman Labs

- Oracle Red Bull Racing Tech Division

- Other Key Players

Recent Developments in the Global Sports Analytics Market

April 2025

- Sports Business Summits and Conferences: Several high-profile summits focused on sports analytics were held. SPORTEL America took place in Miami from April 1–2, highlighting developments in sports broadcasting, data integration, and media analytics. The SportsETA Women’s Summit, held in Tampa from April 2–4, explored gender equity and the use of analytics to boost inclusion and leadership in sports administration. SportsPro Live in London on April 29–30 focused on the digital transformation of sports, featuring discussions on data analytics, AI, and fan experience technologies, with participation from global leagues and analytics providers.

March 2025

- MIT Sloan Sports Analytics Conference: One of the world’s most influential analytics events, this conference took place on March 7–8 in Boston. It featured keynote addresses, research presentations, and networking from leaders in sports, data science, and AI. Representatives from major teams, leagues, academic institutions, and analytics startups discussed cutting-edge applications of machine learning, wearable data, and video analysis.

- NCAA-Oriented Sports Tech Panels: Late February and March saw increased focus on collegiate-level analytics through dedicated panels and sessions. Topics included performance biomarkers, injury rehabilitation analytics, and ROI assessments for NCAA programs. Experts emphasized the growing use of AI and predictive analytics in training student-athletes.

February 2025

- Global Sports API Conference: Held virtually with participation from India and global markets, this two-day conference (Feb 21–22) centered on the use of APIs in fan engagement, fantasy sports, live performance tracking, and sports betting. Attendees included developers, sports technology vendors, and federations seeking to standardize and commercialize data access in real time.

January 2025

- BEYOND Expo 2025 – SportsTech Forum Launch: BEYOND Expo hosted its first-ever dedicated SportsTech Forum, showcasing global leaders such as Cisco, FIFA, Nike, and the NBA. The event covered themes like next-gen wearable analytics, immersive fan experiences, AI-based scouting tools, and integrity monitoring in sports. It also featured product demos and collaborative announcements, reinforcing the convergence of data science and elite sports performance.

April 2024

- Investment in Sports Betting Analytics: Cipher Sports Technology Group’s platform, Dimers, raised 5 million AUD to fuel its U.S. expansion. The investment is earmarked for advanced data analytics tools in real-time betting, targeting fantasy sports and live wagering segments across North America.

- Training Ecosystem Expansion in India: SiGMA Group acquired iGaming Academy, signaling its deeper foray into training and technology for betting analytics in India. This move is expected to bolster the regional talent pool and support responsible gaming through data-driven education.

August 2023

- Formation of Infinite Athlete: Tempus Ex Machina, known for its real-time sports data pipeline, merged with Biocore, a leader in injury biomechanics and analytics, to form Infinite Athlete. This new entity aims to redefine athlete performance and safety tracking for major leagues, including the NFL and college conferences such as the Pac-12. The merger combines real-time video sync capabilities with deep physiological data modeling to offer an all-in-one analytics ecosystem.