Market Overview

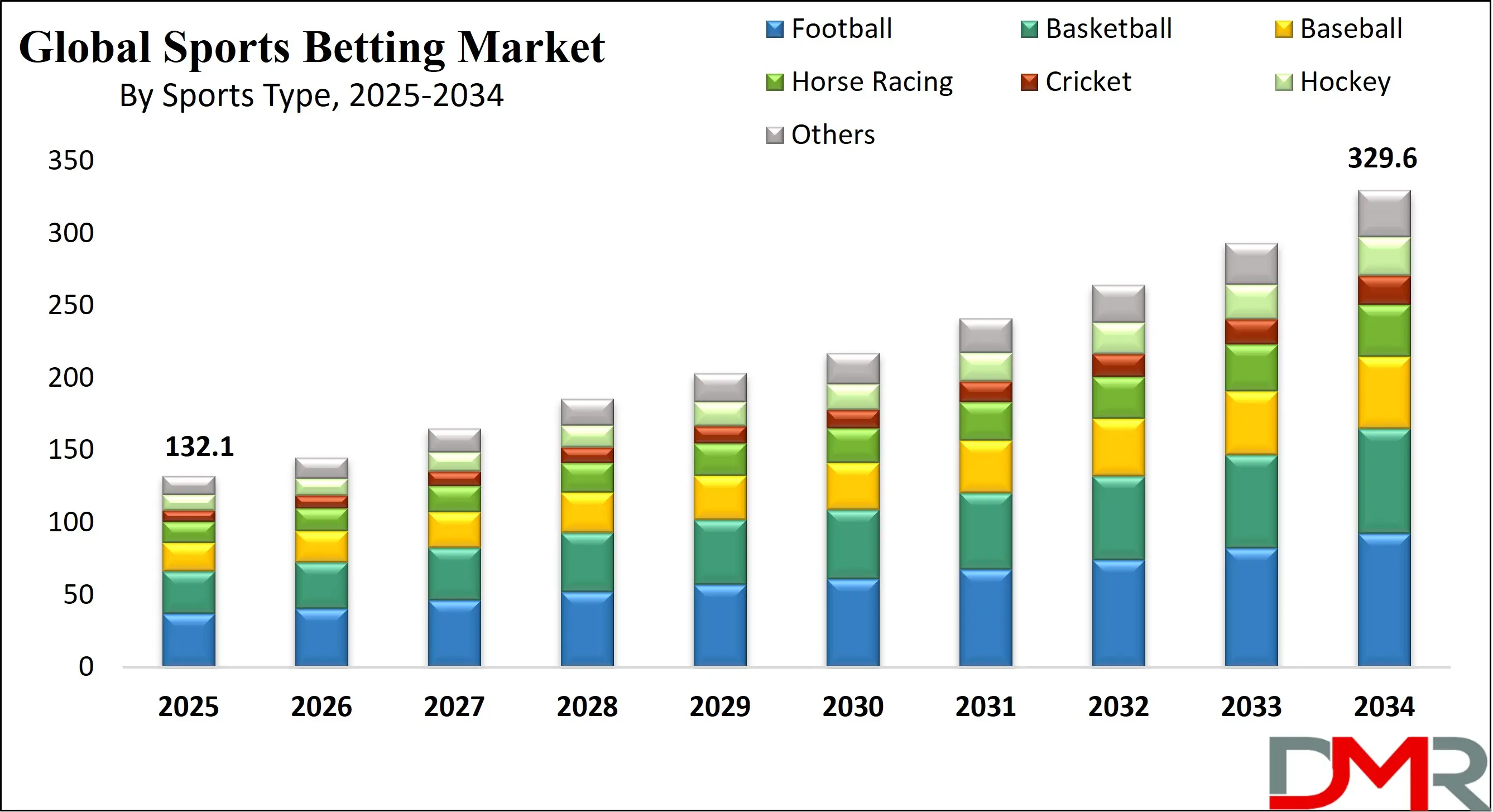

The global Sports Betting market was valued at

USD 132.1 billion in 2025 and is expected to grow to

USD 329.6 billion by 2034, registering a

CAGR of 10.7% from 2025 to 2034.

Sports betting involves predicting the outcome of sports events and placing wagers on those predictions. Bettors can choose from various markets, including point spreads, money lines, totals, and futures. It's popular in various sports such as football, basketball, baseball, and horse racing. The legality of sports betting varies by region, with some areas offering regulated betting markets, while others prohibit it. Many bettors use strategies, statistics, and analysis to increase their chances of winning, though sports betting remains inherently risky. Online platforms and mobile apps have made sports betting more accessible, with both recreational and professional bettors participating globally.

The demand for sports betting is fueled by several factors, including significant changes in the regulatory framework of the global gambling industry, the widespread use of connected devices, and the growing digital infrastructure. Online sports betting saw a surge in popularity during the pandemic, driven by the rise of eSports and other forms of digital betting. Moreover, the increased use of smartphones has made sports betting more accessible, contributing to the expansion of the global market.

The US Sports Betting Market

The US Sports Betting market is projected to be valued at

USD 32.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 76.5 billion in 2034 at a

CAGR of 10.0%.

The growth of the US sports betting market is primarily driven by state-level legalizations, increasing consumer interest, and technological advancements. With over 30 states now offering legal sports wagering, bettors are more confident in participating. Additionally, the rise of mobile apps and online platforms has made betting more accessible.

Live in-game betting is becoming more popular, allowing bettors to wager on real-time events, enhancing engagement. There’s also a growing emphasis on data analytics and AI, helping sportsbooks personalize offerings and set more accurate odds. Collaborations between sportsbooks and sports leagues are increasing, fostering legitimacy and mainstream acceptance.

Key Takeaways

- Market Growth: The global Sports Betting market is anticipated to expand by USD 185.8 billion, achieving a CAGR of 10.7% from 2026 to 2034.

- Betting Type Analysis: Fixed odds wagering is predicted to dominate the global market with a revenue share of 51.4% based on product by the end of 2025.

- Sports Type Analysis: Flexible Foam is likely to dominate the Sports Betting market with a revenue share in 2025.

- Platform Analysis: Online platforms are projected to dominate the global market with the highest revenue share by 2025.

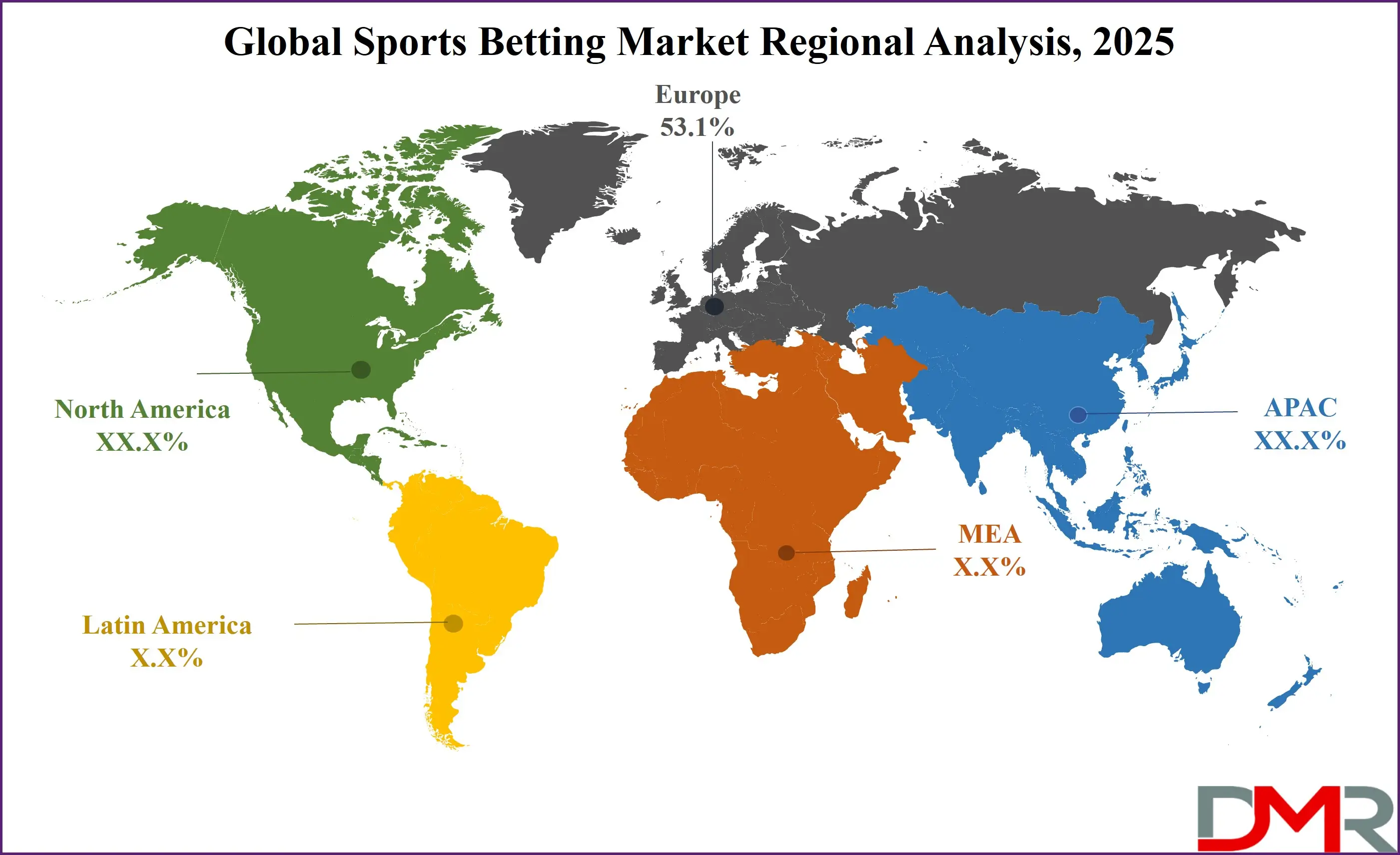

- Regional Analysis: Europe is projected to dominate the global Sports Betting market, holding a market share of 53.1% by 2025.

Use Cases:

- Online Sportsbook Platforms: Sports betting markets enable users to place wagers on various sports events via online platforms, offering odds on outcomes like match results or player performance.

- Fantasy Sports Leagues: Sports betting markets integrate with fantasy sports, allowing users to wager on athlete performance in fantasy leagues, enhancing fan engagement.

- In-Game Betting: Live or in-game betting allows users to place wagers during a match, predicting outcomes like the next goal or score, with dynamic odds.

- Sponsorship and Partnerships: Betting companies partner with sports teams or events for sponsorship, promoting their brands through advertisements and exclusive betting opportunities.

Stats & Facts

- As reported by OddsMatrix, sports betting now constitutes 30% to 40% of the global gambling industry, making it the largest segment, surpassing lotteries, casinos, poker, and other gaming sectors. The global market for sports betting is valued at approximately USD 250 billion.

- The American Gaming Association indicates that sportsbook revenue reached a record $7.5 billion in 2023 in the U.S. Since the 2018 Supreme Court ruling on PASPA, legalized sports betting has generated USD 220 billion in wagers across the country. By September 2023, 73 million Americans were expected to bet on the NFL season, and U.S. sports betting revenue for 2023 is projected to hit $7.62 billion, with predictions exceeding USD 14.44 billion by 2027.

- According to OddsMatrix, esports betting saw a 40-fold increase in early 2023, with esports revenues now seven times higher than pre-pandemic levels. FIFA and NBA2K have seen growing demand, with FIFA ranking among the top five sports on their platform and NBA2K ranked seventh. This highlights the ongoing popularity of sports simulation games even with the return of live sports.

- OddsMatrix reports that football continues to be the most bet-on sport globally, with major leagues such as the English Premier League, Spanish La Liga, and Portuguese Premier League leading the way. Additionally, 35% of bets placed on their platform involve sports and events outside of football, signaling increasing interest in other sports.

- According to OddsMatrix, American football is expanding its global reach, particularly in Europe, where countries like Germany and the UK now have 2.37 million NFL fans. The Super Bowl remains the largest annual betting event worldwide. In the U.S., 73 million people were expected to wager on the NFL in 2023, benefiting operators through player props and micro-markets.

- The Associated Press reports that the NBA generated USD 76 million in betting revenue in 2023, placing it among the top 10 most-bet-on leagues worldwide. In Europe, the Turkish Airlines EuroLeague draws average crowds of over 8,000, especially in Greece, Turkey, and Spain, where basketball ranks just below football in popularity.

Market Dynamic

Driving Factors

Expanded Sports Leagues and Events

An ever-expanding pool of sporting leagues and events worldwide plays an instrumental role in fuelling the expansion of the sports betting market. Leagues bring teams, nations, and individuals together in competition for trophies or championships attracting vast audiences and creating enthusiasm among fans. Their scheduled nature ensures regular participation and viewership thus creating frequent betting activities and opportunities. New professional sports leagues across different regions provide bettors with more betting options to diversify their wagers, not only increasing engagement but also helping drive global expansion and popularity of the sports betting industry.

Global Digital Infrastructure Growth

Global digital infrastructure's fast expansion plays an essential role in expanding sports betting markets worldwide. Improved internet connectivity and smartphone ownership enable users to conveniently access betting platforms at any time or place. This digital transformation has simplified placing bets, drawing a wider demographic of participants.

Technological developments such as live streaming, in-app features, and secure payment systems have made online sports betting increasingly desirable and accessible to users. Digital technologies continue to develop cutting-edge solutions that enhance user experiences; creating the conditions necessary for sustained expansion in this sector of betting.

Restraints

Regulative and Legal Challenges

Strict regulations surrounding sports betting could restrict market growth over the forecast period. While regulations designed to ensure fairness and combat fraud may serve their intended purpose of keeping competition fair, expanding into new regions or offering services may create significant legal and operational hurdles that inhibit growth in certain regions or limit opportunities available to legitimate sports betting operators - the combination of regulatory obstacles and legal risks may limit potential market growth potentials in general.

Public Perception and Social Impact

Sports betting market growth could also be limited by concerns over potential negative social impacts associated with gambling and public perception of it, including addiction issues and its influence on young audiences. Negative attitudes regarding betting could prompt governments and advocacy groups to implement more stringent regulations or even ban certain betting activities altogether such action would limit market expansion while impeding adoption amongst members of society as a whole.

Opportunities

Diversifying Betting

Bettors now have more betting opportunities to bolster their wagering portfolios with new professional sports leagues emerging across various regions. Because these leagues encompass such an expansive spectrum of sports and competition formats, bettors have access to an unparalleled selection of events on which to place bets ranging from traditional sports competitions to niche competitions. Diversifying betting opportunities helps maintain consistent participation as bettors can explore a wide variety of new options and strategies, which cater to bettors with varied preferences and boost engagement as a whole.

Soaring Interest in Sports Betting among Millennial and Older Generations

Millennials, widely known for their affinity toward tech and entertainment, engage with online platforms and innovative betting formats actively. Older generations are also increasing their engagement in sports betting as an enjoyable recreation, driven by digital accessibility and tailored offerings. This convergence of interests among different age groups fosters inclusivity within the market as operators develop formats and promotions tailored specifically for individual preferences, broadening the appeal and accessibility of sports betting while guaranteeing long-term growth with expanded market reach.

Trends

Integrating Machine Learning Technologies

Machine learning technologies continue to take root as more sportsbooks embrace them as key strategies in improving player selections and betting odds.

Machine learning tools have transformed the betting landscape by enabling the creation of predictive algorithms capable of analyzing vast quantities of historical data and trends. These tools assist bettors with informed decisions by accurately predicting likely game and event outcomes with increasing accuracy. As they look for strategies to increase their odds of success, machine learning gives them the insight they need to optimize their approach.

Diversifying Distribution Channels

The sports betting market is experiencing rapid expansion of distribution channels due to technological innovations like video streaming and instant messaging services. These developments allow bettors to engage in real-time betting, enriching user experiences by offering immediate access to game updates and odds. Video streaming services enable bettors to watch games live while placing bets, increasing engagement and providing an immersive betting experience. Coupled with AI, blockchain, and 5G networks these distribution channels open new opportunities for sports betting platforms by expanding their reach and reaching more bettors than ever.

Research Scope and Analysis

By Betting Type

Fixed odds wagering is predicted to dominate the sports betting market with the highest revenue share by the end of 2025, due to its simplicity, predictability, and accessibility. Bettors find comfort in its straightforward nature where payout potentials are known before placing bets, providing clarity and providing peace of mind for betting decisions.

Betting on sports and events with bookmakers has long been available across various sports and regions and is widely popular with both newcomers to gambling as well as experienced wagerers alike. Regulation plays a pivotal role, with fixed odds wagering often the dominant form in emerging and established markets alike. Furthermore, its prevalence enables sports books to manage risk effectively and secure its dominance further.

Live/in-play betting, the second most prominent segment, has seen immense growth due to its dynamic and interactive nature. As opposed to fixed odds betting, live in-play allows wagers to be placed during events for an engaging experience that appeals to bettors seeking real-time thrills and spills.

Due to advancements in mobile technology and live streaming, this format has become more readily accessible, providing various betting opportunities such as predicting goals or minute-by-minute outcomes. Operators benefit from high turnover and flexible odds adjusting based on live events while fixed odds and in-play betting dominate the market by satisfying various bettor preferences while offering reliability as well as thrill and immersion.

By Sports Type

Football is likely to remain the leader of sports betting markets, accounting for the highest market revenue by 2025. Football's dominance can be traced to its international appeal and support by various leagues and tournaments like the NFL, EPL, and FIFA World Cup which attract millions of followers and bettors worldwide. Football remains at the core of the sports betting market with regular matches and extensive fan engagement driving revenue and market adoption trends for football betting.

Its steady rise indicates its impactful effect on market adoption as more bettors gravitate to it as their sport of choice. Horse Racing is predicted to be the second-largest segment of the sports betting market and is projected to experience a high CAGR throughout its forecast period. Horse racing draws fans due to its historical relevance, global appeal, and thrill it provides bettors. Popular events like the Kentucky Derby and Royal Ascot increase its appeal further while drawing high stakes and wide participation.

By Platform

Due to increasing smartphone and internet penetration globally, the online platform is anticipated to dominate the sports betting market by the end of 2025, driven by technological innovation and digitization. These innovations have revolutionized consumer lifestyles by making online betting more accessible and convenient.

Factors including rising financial development, higher living standards and an increase in discretionary income have all played an instrumental role in creating this trend of more people engaging with online betting platforms. User-friendly interfaces, live betting options, secure transactions, and mobile app accessibility further boost its appeal and cement its place as the leader segment.

Offline betting remains the second-leading segment, serving traditional bettors who prefer in-person experiences. Gambling thrives through social engagement. Physical locations like casinos and betting shops enable users to interact socially while placing bets - creating a community-like setting in which users can join together in placing bets and enjoy themselves in this fun activity. Even as online platforms gain in popularity, offline betting still retains some appeal in areas with limited internet connectivity or for those who prefer tactile interactions over digital experiences.

The Sports Betting Market Report is segmented based on the following

By Betting Type

- Fixed Odds Wagering

- Exchange Betting

- Live/In-Play Betting

- eSports Betting

- Others

By Sports Type

- Football

- Basketball

- Baseball

- Horse Racing

- Cricket

- Hockey

- Others

By Platform

Regional Analysis

Europe is predicted to dominate the sports betting market with revenue share of

53.1% by the end of 2025, due to a combination of favorable regulations, established legal frameworks, and a strong cultural affinity for sports. This region benefits from some of the most advanced, and transparent laws as sports betting is legalized in European countries which creates a secure environment for both operators and bettors. These strict regulations have significantly reduced fraud, bolstering trust, and driving market expansion. The popularity of sports such as football, rugby, motor racing, and tennis, which have large, passionate fan bases, further fuels the growth of the betting industry.

Additionally, the rise of online sports betting has played a crucial role in Europe’s market dominance. The combination of a sizable customer base, robust infrastructure, and continuous technological advancements ensures Europe’s continued dominance in the sports betting market, making it a hub for both local and international operators.

Asia Pacific emerges as the second dominant region in the sports betting market due to a growing population, increasing legalization of gambling, and a cultural inclination toward betting activities. The region boasts a significant percentage of individuals engaging in various forms of gambling, such as sports betting, lotteries, and casino games.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Leading companies in the sports betting industry are concentrating on developing engaging, user-friendly websites and introducing exclusive promotions to maintain a competitive edge in the market. They are increasingly integrating advanced technologies, such as APIs, to improve functionality and create a more seamless user experience.

This approach helps in attracting and retaining a larger customer base by simplifying interactions and enhancing the overall platform efficiency. Furthermore, these market players are actively pursuing collaborations and partnerships to drive innovation, improve product offerings, and open new revenue streams. Such strategic initiatives are reshaping the industry and fostering sustained growth in the competitive landscape.

Some of the prominent players in the global Sports Betting are:

- 888 Holdings Plc

- Bet365

- Betsson AB

- Churchill Downs IncorporatedEntain plc

- Flutter Entertainment Plc

- IGT

- Kindred Group Plc

- Sportech Plc

- William Hill Plc

- Other Key Players

Recent Developments

- In December 2023, The UK and Ireland divisions of Flutter Entertainment Plc announced their commitment to philanthropy, dedicating up to USD 10.1 million to charitable efforts in 2023. The company also revealed new agreements for its three primary brands—Paddy Power, Sky Betting & Gaming (SBG), and Betfair. Through fundraising initiatives, an additional USD 318,175 was raised for its two Charities of the Year.

- In October 2023, Entain completed the acquisition of Angstrom Sports, a specialist in sports modeling, forecasting, and analytics, for a total of up to £203.0 million.

- In August 2023, ESPN, owned by Disney, announced it would rename Penn Entertainment's betting app, granting Penn exclusive rights to use the ESPN name. Under the new agreement, Penn will manage the ESPN Bet app, which will be promoted across ESPN’s online and television platforms. The licensing agreement is valid for ten years, with a possible extension of another decade. Additionally, Penn will pay ESPN a $1.5 billion licensing fee and offer the sports broadcaster the option to acquire approximately $500 million worth of stock in the business.

- In March 2023, OpenBet, a global provider of sports betting-related entertainment, expanded its presence in the United States with a day-one launch in Massachusetts.

- In September 2023, DraftKings launched its mobile sportsbook in Kentucky on September 28, 2023. In June 2023, DraftKings reached an agreement with ECL Corbin, LLC, a subsidiary of ECL Entertainment, LLC, to operate at The Mint Gaming Hall at Cumberland and Cumberland Run, marking a significant expansion in the state's growing online sports betting market. This move increases competition among online gaming providers in Kentucky.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 132.1 Bn |

| Forecast Value (2034) |

USD 329.6 Bn |

| CAGR (2025–2034) |

10.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 32.3 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Betting Type (Fixed Odds Wagering, Exchange Betting, Live/In-Play Betting, eSports Betting, and Others), By Sports Type (Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, and Others), By Platform (Online, and Offline) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

888 Holdings Plc., Bet365, Betsson AB, Churchill Downs Incorporated, Entain plc., Flutter Entertainment Plc., IGT, Kindred Group Plc., Sportech Plc., William Hill Plc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Sports Betting Market size is estimated to have a value of USD 132.1 billion in 2024 and is expected to reach USD 329.6 billion by the end of 2033.

Europe is expected to be the largest market share for the Global Sports Betting Market with a share of about 53.1% in 2024.

Some of the major key players in the Global Sports Betting Market are Bet365, Flutter Entertainment Plc., William Hill Plc. and many others.

The market is growing at a CAGR of 10.7 percent over the forecasted period.

The US Sports Betting Market size is estimated to have a value of USD 32.3 billion in 2024 and is expected to reach USD 76.5 billion by the end of 2033.