ℹ

To learn more about this report –

Download Your Free Sample Report Here

Sports equipment is the tools, devices, or clothing designed for use in sports, fitness, and recreational activities. It involves items like balls, rackets, protective gear, shoes, gym machines, and outdoor game setups. These products are vital not only for enhancing performance but also for ensuring the safety & comfort of athletes. Over the years, developments in technology & material science have significantly enhanced the quality, durability, and functionality of sports equipment.

Further, the demand for sports equipment has seen steady growth due to growing health awareness and the increase in the popularity of sports & fitness activities. Post-pandemic, people are more focused on maintaining an active lifestyle, which has driven sales of gym and fitness equipment. In addition, the growth of e-commerce platforms has made sports gear more accessible to a large audience.

The Indian sports equipment industry, for instance, has grown significantly, with Jalandhar and Meerut being key hubs, accounting for a large portion of the country's production and exports. Similarly, trends in markets such as the

Agriculture Equipment Market and Construction Equipment Market show how regional hubs are crucial to scaling production and export capabilities.

Further, major trends in the sports equipment industry are the adoption of eco-friendly and sustainable materials as consumers become more environmentally conscious. Technology is also playing a major role, with innovations like smart fitness devices, lightweight materials, and advanced protective gear improving the user experience.

Another trend is the growing preference for personalized and customized equipment to cater to individual needs, mainly among professional athletes. Brands are using data analytics to create products that improve performance and reduce the risk of injuries. Similar technological shifts are also evident in areas such as the

Dental Equipment Market, where customization and precision are becoming industry standards.

Further, the sports equipment industry has been influenced by many major events in recent years. The 2022 FIFA World Cup in Qatar, for instance, showcased hi-tech football gear, benefiting manufacturers globally. Similarly, the Tokyo 2020 Olympics (held in 2021) showcased the importance of high-performance equipment, with brands competing to showcase their innovations on the world stage.

In addition, the growing popularity of e-sports and virtual fitness during the pandemic has opened new avenues for equipment tailored to these domains. One exciting development in this space is the rise of

Generative AI in the Sports Market, which is transforming how training, fan engagement, and product design are approached in real time.

The future of the sports equipment industry looks promising, with opportunities driven by technological development and increasing global interest in sports and fitness. Emerging markets like India and Southeast Asia are expected to play a significant role in this growth. As consumers continue to prioritize health and wellness, the demand for high-quality, sustainable, and innovative sports equipment is likely to increase. For manufacturers, focusing on quality, sustainability, and meeting changing consumer needs will be key to success in the coming years.

The US Sports Equipment Market

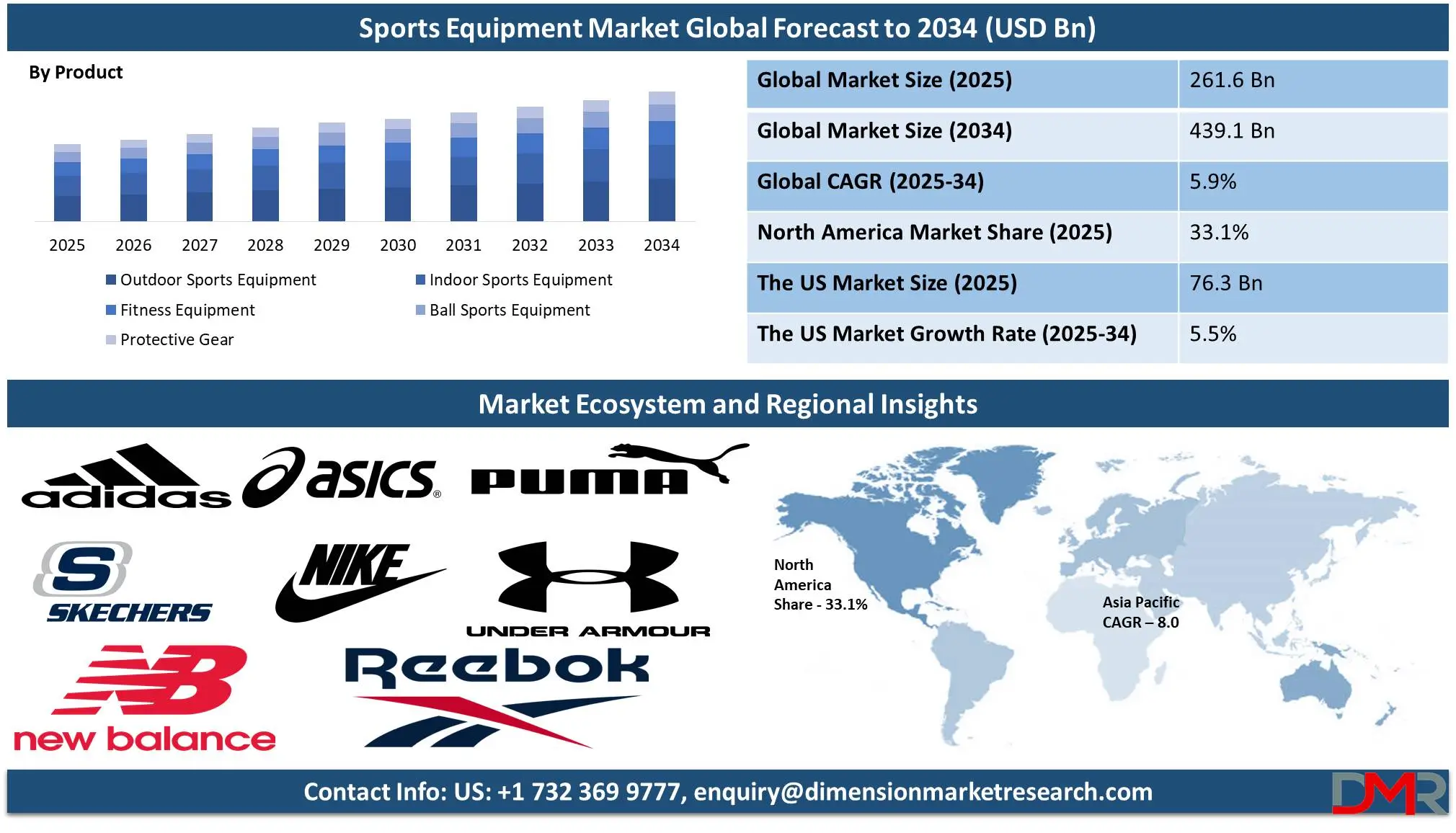

The US Sports Equipment Market is projected to reach USD 76.3 billion in 2025 at a compound annual growth rate of 5.5% over its forecast period.

The sports equipment market in the US provides growth opportunities through major participation in fitness activities, growing health awareness, and the rise in the popularity of home workout gear. Technological innovations, like smart equipment and wearable devices, provide a competitive edge. In addition, the expansion of e-commerce platforms and targeted marketing strategies will continue to drive consumer demand and enhance market growth.

Further, the market is driven by a rise in health consciousness, higher participation in fitness activities, and the increase in demand for home workout gear. Technological development in smart equipment and wearable devices further boosts market potential. However, a key challenge is the high cost of premium sports equipment, which can limit affordability for some consumers, and intense competition from both global and local brands can challenge market growth.

Key Takeaways

- Market Growth: The Sports Equipment Market size is expected to grow by 163.6 billion, at a CAGR of 5.9% during the forecasted period of 2026 to 2034.

- By Product: The outdoor sports equipment segment is anticipated to get the majority share of the Sports Equipment Market in 2025.

- By Application: Professional Sports segment is expected to be leading the market in 2025

- By Distribution Channel: The specialty & sports shops segment is expected to get the largest revenue share in 2025 in the Sports Equipment Market.

- Regional Insight: North America is expected to hold a 33.1% share of revenue in the Global Sports Equipment Market in 2025.

- Use Cases: Some of the use cases of Sports Equipment include skill development, performance enhancement, and more.

Use Cases

- Performance Enhancement: Sports equipment like specialized shoes, rackets, and training gear is developed to improve athletes' performance, precision, and efficiency during games or practice sessions.

- Safety and Protection: Protective gear like helmets, pads, gloves, and mouthguards reduces the risk of injuries, ensuring players' safety in high-contact or demanding sports.

- Fitness and Recreation: Gym equipment, yoga mats, and outdoor game setups serve fitness enthusiasts and recreational users, promoting an active and healthy lifestyle.

- Skill Development: Training equipment like agility ladders, resistance bands, and practice nets helps athletes and beginners hone their skills and build strength.

Stats & Facts

- According to Indian Brand Equity Foundation (IBEF), India manufactures over 300 sports-related goods, including toys, video game consoles, gymnastics goods, outdoor game equipment, and fishing articles. The leading states in production are Uttar Pradesh, Punjab, Maharashtra, Delhi, Tamil Nadu, Jammu, and West Bengal. Jalandhar (Punjab) and Meerut (Uttar Pradesh) together account for 75-80% of India’s production, hosting over 3,000 manufacturing units and 130 exporters.

- Further, IBEF reported that the Indian sports goods sector, dominated by small and medium-sized enterprises (SMEs), employs around 500,000 people and exports 60% of its production globally. India was the 22nd largest exporter of sports equipment in 2022, with exports worth USD 198 million, while exports from April-June 2024-25 reached USD 131.66 million.

- In addition, India exported sporting goods worth USD 523.24 million in 2023-24, a slight increasew of 0.43% from USD 521 million in the previous year. Gymnasium/athletic requisites and cricket equipment each contributed 4% to exports in 2022-23, while football equipment and water surfing boards accounted for 2% and 1%, respectively. India is also a leading sourcing destination for inflatable balls and sports goods for global brands such as Mitre, Lotto, Umbro, and Wilson.

- According to Investing.com, Nike leads the sports apparel industry with a 38.68% global market share, supported by USD 4.06 billion in advertising spending that year. Nike’s market capitalization stands at USD 142.04 billion, making it one of the top 100 most valuable companies worldwide.

- Further, Nike Direct revenues rose by 15% to USD 5.5 billion in Q4 2023, driven by a 24% increase in digital sales. Also, in March 2024, Nike.com recorded over 124 million visits, with the U.S. accounting for 36.95% of traffic, followed by South Korea (10.14%) and the U.K. (5.05%).

- According to Play Today, women’s elite sports are projected to surpass the billion-dollar revenue threshold for the first time. In addition Qatar spent USD 46 billion on constructing and renovating eight stadiums for the 2022 FIFA World Cup, while the Tokyo Summer Olympics 2020 generated USD 7.6 billion in revenue, the highest for any Olympics.

- Further as per Play Today, companies are willing to pay USD 7 million for a 30-second Super Bowl commercial spot.

- Germany is home to Adidas and Puma, the second and third largest sports apparel brands globally, where professional players can secure sponsorship deals worth up to USD 1 billion from such major brands.

Market Dynamic

Driving Factors

Rising Health and Fitness AwarenessThe rise in awareness about the benefits of an active lifestyle and fitness among people of all age groups has significantly driven the demand for sports equipment. Post-pandemic, there has been a growth in home fitness activities, promoting the sales of gym equipment, yoga gear, and resistance tools. Schools & sports academies are also investing in better training gear to promote physical activity among students.

Technological Advancements and E-commerce

Innovations like smart fitness devices, lightweight materials, & performance-enhancing technologies have boosted consumer interest in advanced sports equipment. In addition, the growth of e-commerce platforms has made it easier for consumers to access numerous sports gear globally, driving market expansion. These platforms also look into personalized and niche demands, further fueling growth.

Restraints

High Production Costs and Pricing

The increase in costs of raw materials, advanced technologies, and manufacturing processes makes sports equipment expensive, limiting affordability for many consumers. Also, SMEs experience challenges in maintaining profitability while ensuring quality, which is mainly evident in price-sensitive markets where demand for low-cost alternatives often impacts premium sales.

Counterfeiting and Quality Concerns

The sports equipment market experiences major issues with counterfeit products that are cheaper but lack quality and safety standards. Such products not only create risks to users but also undermine the reputation of established brands. In addition, inconsistent quality from smaller manufacturers can impact consumer trust and repeat purchases.

Opportunities

Sustainable and Eco-Friendly Products

With the increase in environmental awareness, there is a major opportunity for manufacturers to produce sports equipment using sustainable materials like recycled plastics & biodegradable components. Brands that adopt eco-friendly practices can attract environmentally conscious consumers and develop a competitive advantage in the market, which also opens doors to partnerships with global sustainability initiatives.

Expansion in Emerging Markets

Emerging markets in Asia, Africa, and South America present untapped potential for the sports equipment industry due to rising disposable incomes, increasing sports participation, and government initiatives promoting fitness. Establishing localized production & distribution channels in these regions can highly boost sales and market penetration.

Trends

Integration of Smart Technology

The adoption of smart sports equipment, like connected fitness devices, wearables, and sensors integrated into gear, is a major trend. These innovations provide live performance tracking, customized training insights, and injury prevention analytics. Consumers are highly drawn to technology-enabled products that improve their fitness experience and performance.

Customization and Personalization

The need for customized sports equipment customized to individual preferences and needs is rising, mainly among professional athletes and fitness enthusiasts. From customized shoes to equipment designed for specific skill levels, brands are using consumer data to provide unique and targeted solutions, which strengthens brand loyalty and enhances user satisfaction.

Research Scope and Analysis

By Product

In terms of products, outdoor sports equipment is expected to dominate the sports equipment market in 2025 by encouraging people to engage in physical activities and explore outdoor adventures. As more individuals prioritize health & wellness, products like camping gear, bicycles, fishing equipment, and outdoor game sets have gained popularity. These items meet a growing demand for recreational activities that support fitness, social interaction, and a connection with nature. With a rise in interest in outdoor sports like hiking, cycling, and water sports, outdoor equipment sales have surged. In addition, the growth of eco-consciousness has led to a focus on sustainable materials in the production of outdoor sports gear, further driving market growth and attracting environmentally aware consumers.

Also, fitness equipment has become a key driver in the growth of the sports equipment market, mainly with the rising awareness of health and fitness. As more people turn to home workouts, products like treadmills, dumbbells, yoga mats, and resistance bands have seen a growth in demand, which is driven by the desire for convenience and maintaining physical well-being, continues to expand the market as individuals prioritize fitness and wellness in their daily routines.

By Application

In 2025, professional sports is projected to lead the sports equipment market by creating a high demand for specialized, high-quality gear. Athletes in professional sports need top-tier equipment to improve their performance, prevent injuries, and meet the higher demands of their respective games, which creates a market for advanced products, from custom-made football helmets to lightweight tennis rackets. Moreover, the visibility and popularity of professional sports, through events like the Olympics and World Cup, inspire consumers to invest in similar equipment for personal use. Also, sponsorship deals and brand endorsements with professional athletes further boost product visibility, making it a vital part of the sports equipment market's growth. As professional sports continue to transform, so does the demand for innovative and superior gear.

Further, fitness and gym activities are also expected to be major contributors to the growth of the sports equipment market in the coming years. As more people focus on enhancing their health and fitness, the need for gym equipment like weights, treadmills, and resistance machines has increased. Home fitness trends have also grown, leading to higher sales of compact and versatile workout gear, which in personal fitness, supported by gyms and fitness centers, drives continuous innovation and expansion in the sports equipment market.

By Distribution Channel

The specialty and sports shops segment is expected to be the leading contributor to the sports equipment market in 2025, accounting for the highest revenue share. These stores are well-known for offering various branded products that cater to the different needs of consumers. One of the key advantages of this distribution channel is the expert customer service provided by knowledgeable staff, who guide shoppers in choosing the right equipment based on their needs. In addition, specialty shops provide a high level of convenience, with the ability to stock popular brands that attract customers looking for trusted and reliable products. The combination of a broad selection of products, customized services, and brand variety makes specialty and sports shops an important part of the growth of the sports equipment market.

Further, the online retail segment is expected to see significant growth throughout the forecast period, owing to the growth in internet access, which has made it easier for consumers to shop online for sports equipment. Companies are also adopting target marketing strategies to reach a large audience, ensuring they meet customers at all touchpoints, both online and offline. The growth in smartphone usage and the major trend of online shopping, mainly through e-commerce platforms, have further driven this transformation towards digital retail.

As more consumers use the convenience of shopping from home and compare products online, the online retail segment is set to expand rapidly, contributing to the overall growth of the sports equipment market. Factors like increased consumer spending and better internet connectivity will continue to drive this shift in the coming years.

The Sports Equipment Market Report is segmented on the basis of the following

By Product

- Outdoor Sports Equipment

- Indoor Sports Equipment

- Fitness Equipment

- Ball Sports Equipment

- Protective Gear

By Application

- Professional Sports

- Amateur Sports

- Fitness & Gym

- Recreational Activities

- Sports Education

By Distribution Channel

- Online Retail

- Specialty & Sports Shops

- Department & Discount Stores

Regional Analysis

North America is anticipated to dominate the sports equipment market, holding the largest

revenue share of 33.1% in 2025, which is largely due to the growing popularity of sports like football and basketball, which has prompted regional governments to invest in building new arenas and enhancing sports facilities. These developments are focused on improving the complete sports experience for citizens and encouraging more participation in physical activities. The rise in interest in these sports, along with government support, is developing a positive outlook for the market, as it drives the demand for high-quality sports equipment, which is expected to continue in the coming years, making North America a key player in the global sports equipment market.

Further, in the Asia Pacific region, the sports equipment market is anticipated to experience the fastest growth over the forecast period. The growth in fitness equipment sales, mainly after the recent pandemic, has contributed to this growth. In addition, countries like India have seen a major growth in demand for outdoor sports equipment due to the increasing popularity of various sports and the growth of related leagues. Australia has also experienced a rise in the demand for sports equipment as more people aim for physical fitness.

Moreover, the growing disposable income and higher consumer spending in emerging markets such as India, China, and the Middle East are expected to further drive the demand for sporting goods. These countries have also been hosting various athletic events and investing in infrastructure to attract more participants, which is fueling market growth in the Asia Pacific region. This combination of rising sports participation, better infrastructure, and economic growth is set to make APAC a significant contributor to the global sports equipment market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The sports equipment market is highly competitive, with several global and regional players offering a variety of products. Leading companies like Nike, Adidas, Puma, and Under Armour dominate the market, known for their innovation, quality, and brand reputation. Smaller, niche brands also play a role by meeting specific sports or personalized equipment. To stay ahead, companies focus on technological development, sustainability, and expanding their presence in emerging markets. E-commerce platforms & partnerships with professional athletes are key strategies driving growth and reaching large customer bases.

Some of the prominent players in the global Sports Equipment are

- Adidas

- Nike

- Puma

- Under Armour

- Yonex

- Asics

- Easton Sports

- Reebok

- Sketchers

- New Balance

- Gap

- Other Key Players

Recent Developments

- In January 2025, WYOX Sports unveiled its latest additions to its product lineup for the upcoming year, which include advanced training boxing gloves, ergonomic gym belts, and reinforced gym gloves, each crafted to meet the demand of athletes and fitness enthusiasts. The newly introduced Training Boxing Gloves feature better padding and wrist support, designed to improve performance and reduce injury risk during intensive training sessions. In the weightlifting category, the Gym Belt provides lumbar support to ensure safe lifting techniques, while the Gym gloves provide enhanced grip and hand protection for improved training efficiency.

- In December 2024, BigCommerce an open SaaS, composable ecommerce platform for fast-growing and established B2C and B2B brands and retailers announced that the leading sports equipment brand Mizuno USA launched its new website on the BigCommerce platform.

- In April 2024, WHP Global announced their new long-term license for LOTTO with Agilitas Sports, an innovation-led sportswear and athletic solutions platform, which will allow Agilitas to have exclusive rights to design, manufacture, promote, and distribute the LOTTO brand in India, Australia, and soon in South Africa.

- In February 2024, Sports Development and Youth Welfare Minister of Tamil Nadu, India, announced the launch of an initiative called the ‘Kalaignar Sports Kit’, under which sports equipment would be distributed in 12,000 village panchayats to mark former Chief Minister M. Karunanidhi’s birth centenary.