Market Overview

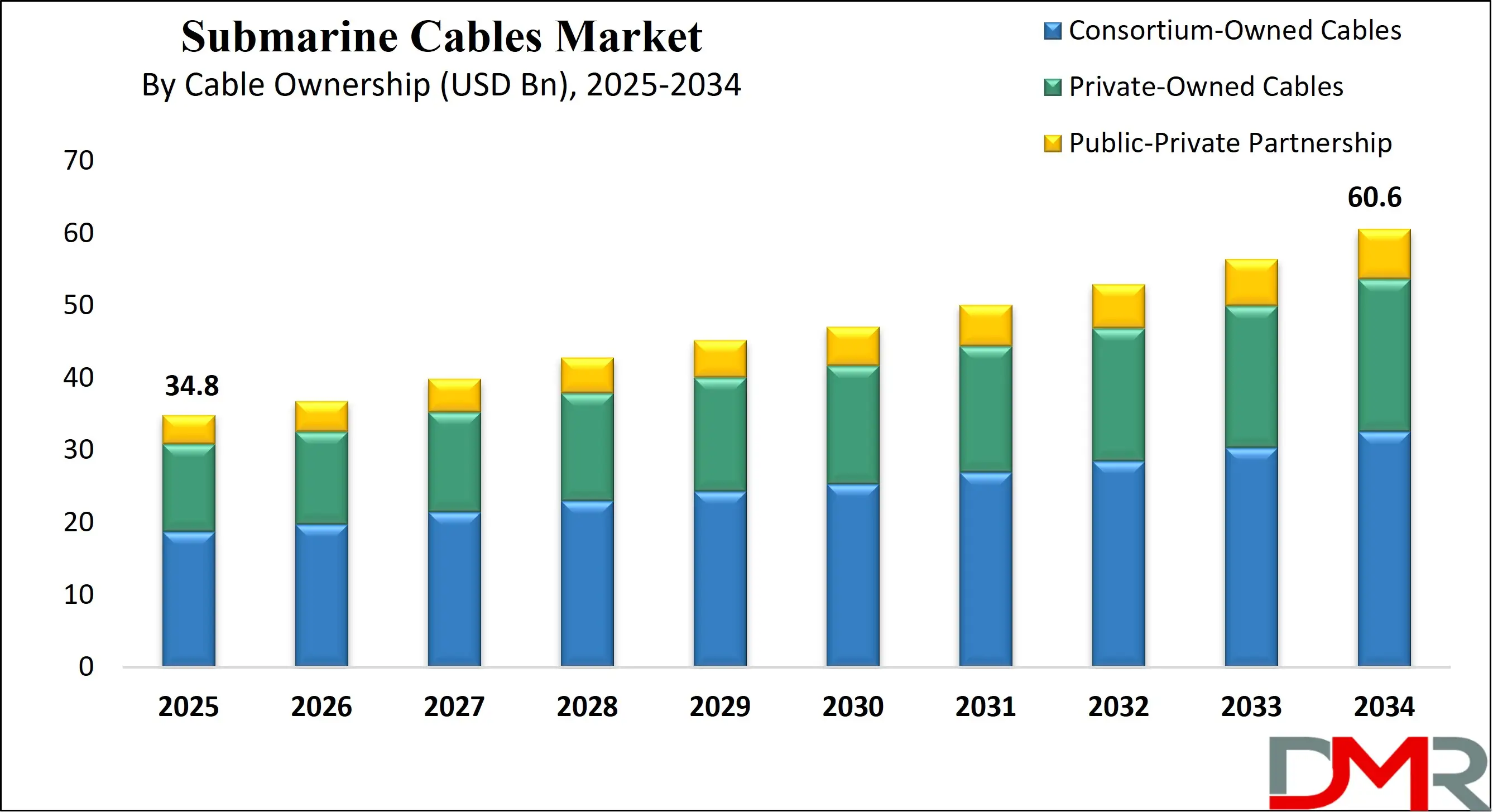

The Global Submarine Cables Market size is projected to reach USD 34.8 billion in 2025 and grow at compound annual growth rate of 6.3% from there until 2034 to reach a value of USD 60.6 billion.

Submarine cables are fiber-optic or power cables laid under oceans and seas to transmit data or electricity across long distances. These cables form the backbone of the global internet and communication infrastructure, connecting continents, countries, and regions. Data travels through light signals in these cables, enabling fast and reliable international communication. Unlike satellites, submarine cables offer higher bandwidth and lower latency, making them essential for internet services, cloud computing, financial transactions, and content streaming.

The demand for submarine cables has been growing steadily due to the rapid rise in global internet usage, video streaming, remote work, and cloud-based services. With more people using smartphones and digital services, telecom operators and tech companies need stronger and faster international connections. Cloud service providers and data center operators are also investing heavily in new cables to support growing global traffic. Emerging markets and coastal nations are especially driving demand as they work to improve connectivity and join the global digital economy.

Recent trends show a shift from consortium-led projects to private investments by tech giants. Companies like Google, Microsoft, Amazon, and Meta are increasingly funding and managing their own submarine cables to ensure better control over data traffic and service quality. There is also growing interest in newer cable technologies like SDM (space-division multiplexing), which allows more data to pass through each cable. These developments are making undersea cables more efficient and powerful, helping meet the rising data demand.

Several key events in recent years have brought more attention to submarine cables. New projects connecting Africa to Europe and Asia are helping bridge the digital divide. Geopolitical tensions have also raised concerns about the security of international cables, prompting discussions around data sovereignty and cable protection. Some countries are strengthening regulations and monitoring systems to safeguard these critical infrastructures from damage or misuse.

The US Submarine Cables Market

The US Submarine Cables Market size is projected to reach USD 9.0 billion in 2025 at a compound annual growth rate of 5.9% over its forecast period.

The US plays a major role in the global submarine cables market due to its leadership in technology, data traffic, and international connectivity. Many major tech companies based in the US, such as Google, Meta, Microsoft, and Amazon, are heavily investing in building and operating private submarine cable systems to support cloud infrastructure and digital services. The US also serves as a key landing point for transatlantic and transpacific cables, making it a critical hub for global internet traffic.

Additionally, the US government and regulatory bodies are actively involved in ensuring the security and resilience of these networks amid rising geopolitical concerns. Through innovation, investment, and policy, the US continues to shape the future of undersea communication infrastructure.

Europe Submarine Cables Market

Europe Submarine Cables Market size is projected to reach USD 8.0 billion in 2025 at a compound annual growth rate of 5.8% over its forecast period.

Europe plays a vital role in the submarine cables market as a major hub for intercontinental connectivity between the Americas, Africa, Asia, and the Middle East. Many key landing stations are located across European countries, especially in the UK, France, Spain, and Portugal, enabling the region to serve as a gateway for global data traffic. European telecom operators and infrastructure companies are also actively involved in the planning, construction, and management of submarine cable systems.

In addition, the European Union promotes digital sovereignty and cybersecurity, influencing policies on cable deployment and ownership. Europe’s strategic location, advanced digital infrastructure, and focus on secure, high-capacity data routes position it as a crucial player in global submarine cable development and digital connectivity.

Japan Submarine Cables Market

Japan Submarine Cables Market size is projected to reach USD 2.0 billion in 2025 at a compound annual growth rate of 6.4% over its forecast period.

Japan holds a strategic position in the submarine cables market as a key connectivity hub in the Asia-Pacific region. It acts as a major landing point for transpacific cables linking Asia with North America and plays a central role in regional cable networks connecting countries like China, South Korea, Taiwan, and Southeast Asia. Japanese telecom operators and technology firms are deeply involved in the development, operation, and innovation of submarine cable systems.

Japan’s advanced digital economy and leadership in electronics, data, and telecom infrastructure further enhance its influence in the market. The country also emphasizes cable resilience and disaster preparedness due to its seismic activity, driving innovation in robust cable technologies. Japan remains essential to global digital traffic and infrastructure stability.

Submarine Cables Market: Key Takeaways

- Market Growth: The Submarine Cables Market size is expected to grow by USD 23.8 billion, at a CAGR of 6.3%, during the forecasted period of 2026 to 2034.

- By Cable Ownership: The consortium-owned cables is anticipated to get the majority share of the Submarine Cables Market in 2025.

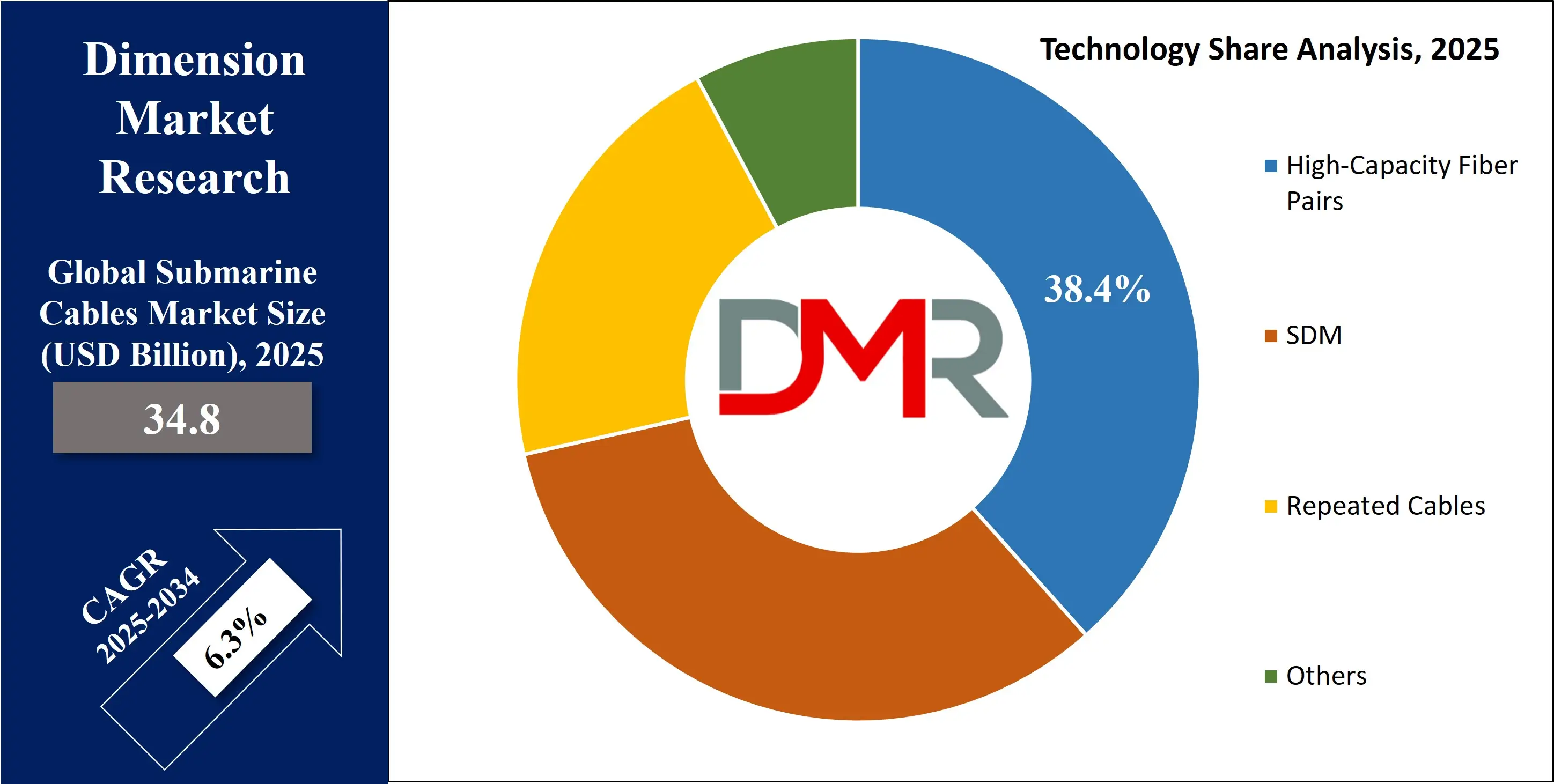

- By Technology: The High-capacity fiber pairs segment is expected to get the largest revenue share in 2025 in the Submarine Cables Market.

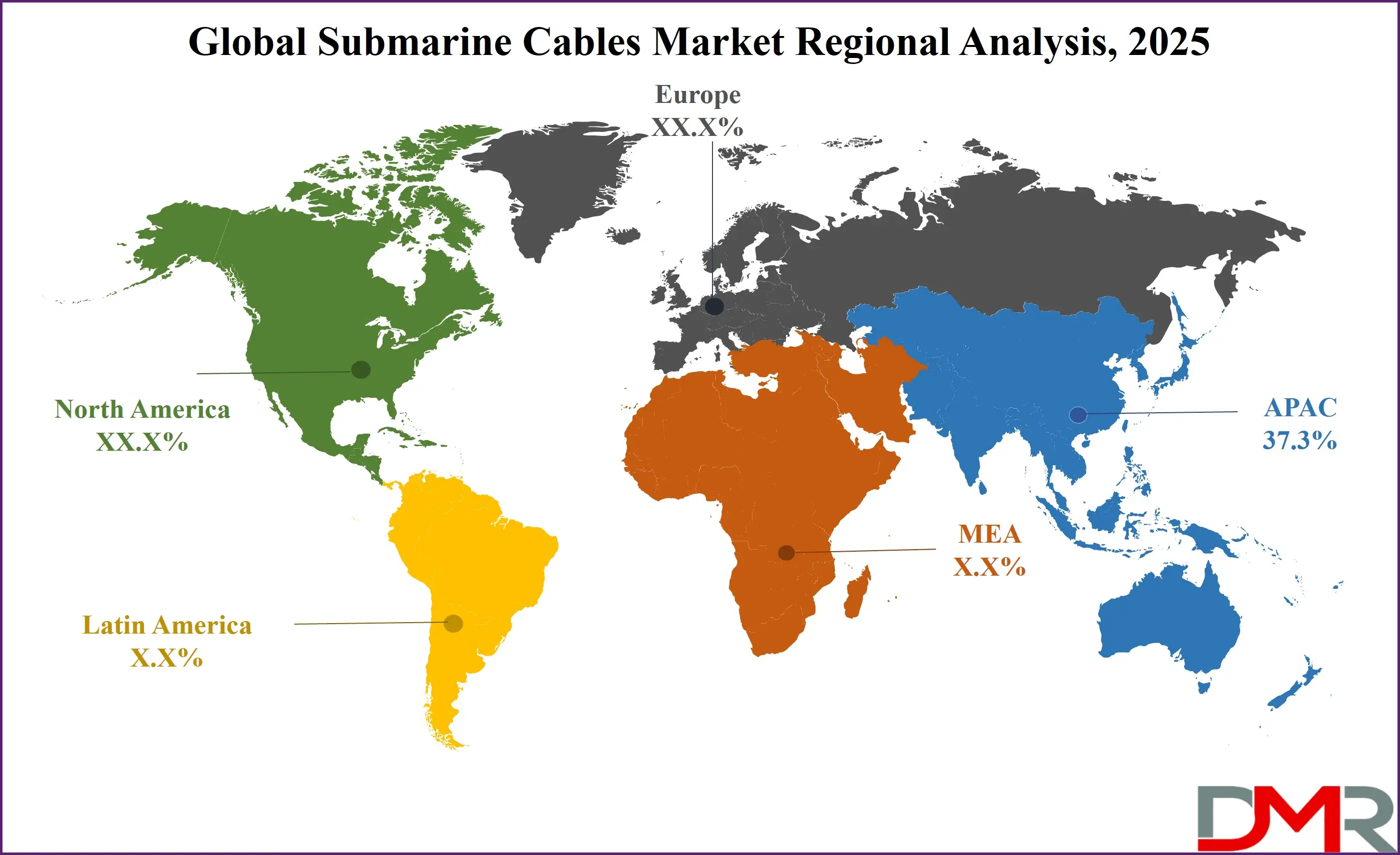

- Regional Insight: Asia Pacific is expected to hold a 37.3% share of revenue in the Global Submarine Cables Market in 2025.

- Use Cases: Some of the use cases of Submarine Cables include global internet connectivity, international business operations, and more.

Submarine Cables Market: Use Cases:

- Global Internet Connectivity: Submarine cables enable international internet access by carrying the majority of global data traffic between continents. They support seamless online experiences for users across different countries. These cables form the foundation of the global digital communication network.

- Cloud Services and Data Centers: Tech giants use submarine cables to link their global data centers and improve cloud service delivery. They help reduce latency and increase speed for cloud-based applications and storage. This supports businesses, developers, and individuals who rely on real-time data processing.

- International Business Operations: Multinational companies depend on submarine cables for secure, fast communication between global offices. They enable smooth video conferencing, financial transactions, and data exchange. This ensures business continuity and collaboration across borders.

- Media and Content Streaming: Streaming platforms use submarine cables to deliver high-definition content globally. They help users watch videos, play games, and access media without delays or buffering. This supports the entertainment industry and enhances user experiences worldwide.

Stats & Facts

- According to ITU (International Telecommunication Union):

- Submarine telecom cables serve as the core infrastructure for global digital connectivity, handling more than 99% of international data transfer across borders and underpinning critical services such as communication, finance, and cloud computing.

- Over 200 submarine cable repairs were recorded globally in 2023, which means on average, there were more than three cable failures each week, showing the vulnerability of these essential systems to disruption from both natural and human activities.

- Damage to submarine cables can affect not just commercial and government operations, but also limit access to essential public services like education, healthcare, and digital banking, underlining the need for stronger resilience strategies.

- The resilience of submarine cables has become a global priority due to rising internet demand, and enhancing this requires multistakeholder collaboration between governments, regulators, cable engineers, and international institutions.

- As per Internet Society:

- In May 2024, two major submarine cables—SEACOM and EASSy—were damaged by a suspected ship anchor near South Africa’s KwaZulu-Natal coast, which caused significant connectivity issues across multiple East African countries.

- Although all damaged cables were repaired by 3 June 2024, the outage lasted for nearly three weeks, showing how a single incident can strain the digital infrastructure of entire regions and delay access to critical cloud services.

- Countries like Burundi, Rwanda, Uganda, Kenya, Malawi, Mozambique, and Tanzania, which heavily rely on SEACOM and EASSy for connecting to hyperscale cloud platforms in South Africa, were the most affected during this outage.

- East Africa’s digital transformation began in 2009 with the arrival of the region’s first submarine fiber cables, which dramatically lowered internet latency by 400% and reduced bandwidth costs by over 50% compared to satellite connectivity.

- Landlocked countries like Uganda benefit from terrestrial fiber connections to submarine landing points in coastal areas like Mombasa, Kenya, making regional interconnection critical for extending submarine cable benefits inland.

- South Africa leads in local interconnection with 10 IXPs and over 54% of its networks directly linked to them, supporting faster and more efficient routing of internet traffic nationwide.

- Uganda and Rwanda lag in IXP connectivity, with only 14.29% and 17.86% of local networks directly connected, making them more vulnerable to disruptions in submarine infrastructure.

- Kenya has eight IXPs, yet only 30% of its local networks are directly connected, indicating room for improvement in harnessing local traffic exchange to reduce reliance on international bandwidth.

- Around 2,000 Gbps (or 2 Tbps) of internet traffic flows within the East African sub-region, and most of it is exchanged with South Africa, which is home to several hyperscale cloud facilities.

- While South Africa has already launched multiple hyperscale cloud zones, Kenya and Nigeria currently depend on edge pops with some announcements of pending edge zones, delaying access to full cloud performance.

- In Kenya, Tanzania, Uganda, and the Democratic Republic of Congo, the 12 May submarine cable cuts led to a sharp and measurable drop in local internet traffic through IXPs, highlighting the direct impact of undersea cable failures on everyday digital activity.

- Rwanda experienced a relatively smaller decline in IXP traffic during the outage, despite cloud services being affected, which may be due to more localized caching or limited dependency on international routing.

- The organization has helped strengthen the digital resilience of affected African countries by providing IXP-related assistance including training workshops, equipment donations, peering events, and cache fill grants, aimed at improving local connectivity and reducing dependency on global links.

Market Dynamic

Driving Factors in the Submarine Cables Market

Surging Demand for High-Speed Internet and Cloud-Based Services

The global rise in internet usage, fueled by video streaming, remote work, and social media, is significantly driving the need for submarine cables. As users demand faster connectivity and lower latency, traditional satellite and terrestrial systems fall short in meeting these needs over long distances. Submarine cables offer unmatched speed and bandwidth, making them the preferred option for global data transmission. In addition, the rapid adoption of cloud computing across enterprises and governments has led to the expansion of data centers.

To ensure seamless integration and efficient performance, these data centers require reliable undersea cable systems that can handle massive amounts of data. Cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud are increasingly investing in private cable networks to optimize traffic flow. This consistent demand for robust infrastructure continues to be a key driver of market growth.

Rising Digital Inclusion Efforts and International Collaborations

Global efforts to bridge the digital divide and improve internet access in underserved regions are boosting investments in submarine cable infrastructure. Developing countries across Africa, Southeast Asia, and Latin America are witnessing increased deployment of cables to connect them to the global digital economy. Governments, telecom operators, and international organizations are collaborating to fund and support these initiatives. Large-scale regional projects like Africa Connect and Southeast Asia–Middle East–Western Europe cables are designed to improve access and lower bandwidth costs.

These projects not only increase global connectivity but also encourage economic development and innovation in emerging markets. Public-private partnerships are also gaining traction, ensuring shared responsibilities in cost, maintenance, and security. As more countries prioritize digital transformation, such initiatives will continue fueling the growth of the submarine cables market.

Restraints in the Submarine Cables Market

High Installation and Maintenance Costs

One of the major restraints in the submarine cables market is the high cost involved in the installation and maintenance of cable systems. Laying cables across ocean floors requires specialized ships, advanced machinery, and skilled labor, making it a capital-intensive process. Additionally, navigating through deep-sea terrains and geopolitical zones further adds to the complexity and expense. Even after deployment, cables are prone to physical damage from fishing trawlers, anchors, and natural disasters like earthquakes, which demand frequent and costly repairs. Insurance and regulatory approvals also increase the overall cost burden on operators. For developing nations or smaller telecom players, these financial barriers can delay infrastructure expansion. The long planning and deployment timelines further impact return on investment, making it a challenge for many stakeholders to participate.

Geopolitical Tensions and Data Security Concerns

Rising geopolitical tensions and national security concerns are increasingly affecting the submarine cables market. Countries are becoming more cautious about who builds, operates, or owns cables that pass through or connect their territories. Suspicion around foreign involvement, especially from rival nations or global tech firms, can result in project delays, cancellations, or additional restrictions. Concerns over espionage, cyberattacks, and data interception are prompting governments to impose stricter security regulations and demand local control over critical infrastructure. These political sensitivities can disrupt international collaborations and reduce the willingness of stakeholders to participate in cross-border projects. As a result, some planned cables face legal or diplomatic challenges, slowing down progress in enhancing global connectivity.

Opportunities in the Submarine Cables Market

Expansion into Underserved and Remote Regions

A significant opportunity for the submarine cables market lies in expanding connectivity to underserved and remote regions. Many island nations, coastal towns, and developing economies still rely on outdated or expensive satellite connections with limited bandwidth. Deploying submarine cables in these areas can drastically improve internet access, support digital education, enable e-commerce, and boost economic development. As global organizations and governments focus on digital inclusion and equitable access, funding for such initiatives is becoming more available. Cable projects targeting Africa, the Pacific Islands, and parts of Latin America present immense growth potential. Improved connectivity in these regions also opens new markets for cloud services, digital platforms, and fintech. By bridging the digital divide, submarine cables can foster long-term regional growth and new demand streams for operators and investors.

Integration with 5G, AI, and Emerging Technologies

The rapid development and deployment of 5G networks, artificial intelligence, and the Internet of Things (IoT) offer a fresh opportunity for the submarine cables market. These technologies require ultra-fast, low-latency connections and massive data capacity, especially for real-time analytics, autonomous systems, and smart city applications. Submarine cables play a critical role in connecting global data centers that power these technologies, ensuring uninterrupted performance. As demand for real-time connectivity and edge computing grows, there is a pressing need to strengthen international data routes with more advanced and redundant cable systems. This also includes developing intelligent monitoring tools and predictive maintenance technologies to manage network traffic efficiently. Partnerships between telecoms, tech companies, and infrastructure providers will drive innovation in this space, creating new revenue models and applications.

Trends in the Submarine Cables Market

Shift Towards Private Ownership by Tech Giants

In recent years, there’s been a clear shift from consortium-built submarine cables to systems owned and operated by private tech companies. Firms that run large cloud platforms, data centers, and digital services are increasingly financing and managing their cables to control capacity, latency, and routing. This move allows them to tailor cable paths to suit their network needs and secure higher reliability. By securing end-to-end connectivity, these companies can optimize quality of service for users and reduce dependency on traditional telecom networks. It also signals a strategic commitment to infrastructure ownership, reinforcing their role not just as software providers but as owners of critical physical assets. This trend is reshaping how undersea connectivity is planned, funded, and governed globally.

Advances in Cable Design and Monitoring Technology

A prominent trend in the submarine cables market is the adoption of advanced technologies aimed at increasing capacity and resilience. Space-Division Multiplexing (SDM) designs are being developed to allow more data channels within a single cable, boosting throughput while keeping the physical footprint manageable. Alongside this, digital signal processing and coherent optical systems are enhancing signal quality and reach. Meanwhile, network operators are deploying smart monitoring systems embedded along cable routes to detect faults in real time, predict maintenance needs, and minimize downtime. Buoy-based sensors and AI-driven analytics are becoming more common, enabling faster response to threats like fishing interference or cable damage. These innovations are making undersea networks not only faster but also smarter and more reliable.

Impact of Artificial Intelligence in Submarine Cables Market

Artificial Intelligence (AI) is having a growing impact on the submarine cables market by improving the way these systems are designed, managed, and maintained. AI-powered tools are being used to optimize cable route planning, helping operators avoid hazardous oceanic zones and reduce deployment risks. Advanced algorithms can process vast datasets on ocean conditions, seismic activity, and marine life to identify the safest and most efficient paths. During installation, AI assists in real-time monitoring and predictive analysis, ensuring cables are laid with precision and minimal environmental disruption. This results in better reliability, fewer errors, and cost-effective deployment. AI also enhances project forecasting and resource allocation, improving overall planning and efficiency in large-scale undersea cable projects.

In operations and maintenance, AI plays a key role in detecting and preventing faults. Machine learning models can monitor network health continuously, identifying unusual patterns or disturbances in data transmission. These tools allow for quicker diagnosis of issues such as signal loss, pressure changes, or potential physical damage to the cable. Predictive maintenance, powered by AI, helps reduce downtime and extend the life of undersea infrastructure. Additionally, AI-driven cybersecurity tools are being applied to protect sensitive data traveling through submarine cables, identifying potential threats and reacting in real time. As global dependence on digital communication and data services continues to grow, AI is becoming essential to keeping submarine cable networks more resilient, responsive, and efficient. This integration supports faster global internet traffic and helps meet the rising expectations for secure, high-speed connectivity.

Research Scope and Analysis

By Cable Ownership Analysis

Consortium-owned cables, leading in 2025 with a share of 53.7%, are expected to play a vital role in the expansion of the submarine cables market. These systems are jointly owned by multiple telecom operators or global stakeholders, allowing them to share the cost, capacity, and maintenance responsibilities. This collaborative model makes large-scale undersea projects more feasible, especially across high-demand international routes. Consortium ownership ensures more secure and balanced access to data transmission resources for all involved parties. It also encourages regional participation, helping connect multiple countries and improve overall global connectivity. As digital demand rises in various parts of the world, consortium-owned systems are supporting long-distance communication, boosting digital infrastructure, and enabling efficient traffic management. Their presence across key transatlantic, transpacific, and intra-regional routes continues to make them essential for supporting cross-border data flow and long-term infrastructure growth in the submarine cable network.

Private-owned cables, having significant growth over the forecast period, are transforming the submarine cables market by offering more flexibility, speed, and control. These systems are usually funded and managed by single companies—mostly major cloud service providers and tech firms—allowing them to meet their growing data needs without relying on shared capacity. With increasing focus on data traffic management, performance, and security, many private players are building dedicated routes between their data centers and major markets. This ownership model gives them more independence over bandwidth use and system upgrades. As digital services and cloud adoption continue to rise globally, private-owned submarine cable systems are supporting faster, more reliable communication. Their role in connecting new regions and creating direct, high-performance data paths is helping drive innovation and meet modern digital demands in the global connectivity space.

By Technology Analysis

High-capacity fiber pairs are set to lead in 2025 with a share of 38.4%, and are expected to be a key technology driving the growth of the submarine cables market. These fiber pairs allow for greater bandwidth and faster data transmission over long distances, making them ideal for supporting the massive increase in global internet traffic. As more people and businesses rely on cloud computing, video streaming, and real-time communication, high-capacity fiber systems provide the scalability needed to meet this demand. They are especially useful in transoceanic routes, connecting major data hubs across continents. With advanced optical technologies, these cables reduce latency and improve overall performance. Telecom companies and tech giants are increasingly choosing high-capacity fiber pairs to future-proof their infrastructure.This technology not only boosts network efficiency but also enhances global digital connectivity and supports the seamless flow of large volumes of data.

PSDM technology, having significant growth over the forecast period, is playing an important role in enhancing submarine cable systems. Also known as Probabilistic Space Division Multiplexing, PSDM enables the use of multiple spatial channels within a single cable, increasing overall capacity without needing extra fiber. This helps cable operators deliver more data using the same infrastructure footprint. As global demand for faster and more reliable communication grows, PSDM is proving to be a cost-effective and efficient solution. It improves signal quality and extends cable life by optimizing how light signals travel through the fibers. With rising digital needs and evolving technologies, PSDM is helping operators build smarter and more energy-efficient undersea cable networks. Its ability to scale up bandwidth while managing operational costs is making it a valuable technology in long-distance data transmission and future submarine cable planning.

By Route Analysis

Transpacific (Asia–North America), is set to dominate in 2025 with a share of 22.7%, and is expected to play a central role in the growth of the submarine cables market due to the heavy flow of digital traffic between the two regions. This route connects major tech hubs like Japan, South Korea, China, and Singapore with the United States and Canada, supporting large-scale data exchange for cloud services, international business, and content streaming. As demand for high-speed, low-latency communication rises, new trans-Pacific cable projects are being launched to strengthen capacity and redundancy. These systems help global companies maintain smooth operations across borders and ensure reliable internet connectivity. With growing investments from both telecom providers and cloud companies, this route continues to see expansion in cable infrastructure. It supports not only commercial data needs but also research, finance, and digital development across both regions.

Africa-Europe/Africa-Asia, having significant growth over the forecast period, is becoming a vital corridor in the submarine cables market as Africa’s digital landscape rapidly evolves. This route connects emerging markets in Africa with advanced internet ecosystems in Europe and Asia, creating new opportunities for trade, digital services, and cloud connectivity. Increased focus on digital inclusion, improved access to broadband, and regional economic development are fueling investments in new undersea cable projects along this path. These cables are helping reduce latency, lower costs, and improve reliability of international communication for African nations. Governments, private companies, and global partnerships are driving infrastructure expansion to support mobile networks, e-learning, fintech, and e-commerce. The growing demand for stronger international connections is turning Africa into a more connected and digitally enabled region, making this route an increasingly important part of global data transmission networks.

By End Customer Type Analysis

Telecom carriers, leading in 2025 with a share of 38.7%, are expected to remain key drivers in the growth of the submarine cables market due to their role in delivering internet and voice services across borders. These companies rely on undersea cables to manage growing data traffic and ensure reliable communication between countries and continents. As global demand for faster and uninterrupted internet continues to rise, telecom carriers are investing heavily in upgrading existing cable systems and building new routes. These cables help carriers reduce latency, manage network congestion, and expand into underserved areas. By partnering with governments and tech companies, telecom providers are improving global connectivity and supporting essential services such as mobile communication, streaming, and international business. Their involvement also helps in maintaining network redundancy and improving the resilience of cross-border digital infrastructure, making telecom carriers an essential part of the global cable ecosystem.

Hyperscalers is set to have significant growth over the forecast period, are rapidly becoming dominant end users in the submarine cables market due to their need for massive data movement between global data centers. These include major cloud providers and internet companies that deliver services like cloud storage, AI processing, and digital content streaming. To maintain performance, reduce latency, and control bandwidth, hyperscalers are increasingly investing in building their own private undersea cable systems. This approach helps them manage rising traffic loads and maintain independence from traditional carriers. Their global expansion strategies rely heavily on high-speed, scalable, and secure international networks, which submarine cables make possible. As more businesses and users shift to cloud-based platforms, hyperscalers are playing a critical role in shaping the future of global connectivity infrastructure.

The Submarine Cables Market Report is segmented on the basis of the following:

By Cable Ownership

- Consortium-Owned Cables

- Private-Owned Cables

- Public-Private Partnership

By Technology

- SDM

- High-Capacity Fiber Pairs

- Repeated Cables

- Others

By Route

- Transatlantic (Europe-North America)

- Transpacific (Asia-North America)

- Intra-Asia

- Europe-Asia

- Africa-Europe/Africa-Asia

- Latin America-North America

- Domestic/Sub-regional

By End Customer Type

- Telecom Carriers/ISPs

- Hyperscalers

- CDNs/OTT Providers

- Enterprises

- Governments/Military

Regional Analysis

Leading Region in the Submarine Cables Market

Asia Pacific, leading in 2025 with a share of 37.3%, plays a key role in driving the growth of the submarine cables market due to its rapid digital transformation, growing internet penetration, and expanding cloud infrastructure. The region includes some of the world’s most connected and data-heavy economies like China, Japan, India, South Korea, and Singapore, which are constantly increasing their demand for high-speed international data transfer. With rising investments from both governments and private companies, many new undersea cable projects are being launched to connect Asia Pacific with North America, Europe, and Africa. Countries in Southeast Asia are also upgrading their digital infrastructure to support e-commerce, smart cities, and 5G networks, adding to the demand. Major technology firms are collaborating with local telecom operators to build new cable routes, making the region a central hub for global data traffic. The strong push for connectivity, digital inclusion, and data security is expected to support long-term growth in the submarine cables market.

Fastest Growing Region in the Submarine Cables Market

Latin America is showing significant growth and is set to grow further over the forecast period in the submarine cables market due to rising demand for high-speed internet, digital services, and cloud connectivity. As more people in the region use smartphones, video streaming, and online platforms, the need for reliable and faster international data transfer is increasing. Countries like Brazil, Chile, and Colombia are becoming important landing points for new undersea cable systems, improving regional and global data flow. Investments from global tech companies and telecom providers are supporting the development of new routes connecting Latin America with North America, Europe, and Africa. These efforts are strengthening digital infrastructure, boosting connectivity, and supporting the region’s growing digital economy.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the submarine cables market is dynamic and shaped by a mix of global telecom providers, technology firms, infrastructure companies, and specialized marine contractors. Competition is mainly driven by the rising need for faster internet, high data capacity, and reliable international communication. Companies compete on technology innovation, cable length and capacity, maintenance services, and strategic partnerships. With growing demand for private and hybrid cable systems, some firms focus on owning complete infrastructure, while others collaborate through consortiums. Market players are also expanding their footprint by targeting new routes and underserved regions. The push for lower latency, stronger security, and better cost efficiency continues to fuel intense competition across both established and emerging markets in this industry.

Some of the prominent players in the global Submarine Cables are

- Mobily (Etihad Etisalat)

- Nexans

- NEC Group

- Microsoft

- ZTT

- Sumitomo Electric Industries Ltd

- NKT A/S

- SubCom LLC

- STC Group

- Bharti Airtel

- Zain Omantel Consortium

- Telecom Egypt

- Orange

- G42

- Singtel

- Ethisalat

- PCCW

- TeleYemen

- Other Key Players

Recent Developments

- In June 2025, a new submarine cable system, the Asia–Africa–Europe-2 (AAE-2), has been announced by a consortium including PCCW Global, Sparkle, Telecom Egypt, and ZOI. Designed to provide seamless, reliable connectivity across Asia, Africa, and Europe, the cable will link Hong Kong and Singapore to Italy, with high-capacity terrestrial crossings through Thailand, the Arabian Peninsula, and Egypt. While specific details like length, landing points, and capacity have not been disclosed, the project includes plans for strategic extensions to key destinations along its route, indicating early-stage development.

- In March 2025, The E2A consortium has officially begun construction of the new E2A submarine cable system, selecting ASN to develop a cutting-edge transpacific fiber optic network. Spanning around 12,500 km, the system aims to greatly improve digital connectivity between Asia and North America. Driven by rising demand from cloud services, data processing, and advanced mobile networks, E2A is set to deliver ultra-high-capacity, low-latency performance. This project marks a significant advancement in global communications, combining scalability, reliability, and sustainability-focused design for future-ready infrastructure.

- In March 2025, NTT DATA, unveiled that its Malaysia, India, Singapore Transit (MIST) submarine cable system will be commissioned by June 2025. Spanning 8,100 kilometers, MIST is designed to handle over 200 terabits per second (Tbps) of data, making it one of Asia’s largest and most advanced undersea cable systems. The network will enhance regional connectivity by linking Malaysia, India, Singapore, and Thailand, supporting the region’s growing demand for high-speed, high-capacity digital communication infrastructure.

- In January 2025, NATO has announced the launch of a new mission aimed at protecting critical undersea cables in the Baltic Sea region. The initiative will involve a variety of assets, including frigates and maritime patrol aircraft, to strengthen maritime security and increase vigilance. As part of the operation, named Baltic Sentry, a fleet of naval drones will also be deployed to support enhanced surveillance and deterrence. The mission reflects growing concerns over the security of vital infrastructure in increasingly sensitive and strategic maritime areas.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 34.8 Bn |

| Forecast Value (2034) |

USD 60.6 Bn |

| CAGR (2025–2034) |

6.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 9.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Cable Ownership (Consortium-Owned Cables, Private-Owned Cables, and Public-Private Partnership), By Technology (SDM, High-Capacity Fiber Pairs, Repeated Cables, and Others), By Route (Transatlantic (Europe-North America), Transpacific (Asia-North America), Intra-Asia, Europe-Asia, Africa-Europe/Africa-Asia, Latin America-North America, and Domestic/Sub-regional), By End Customer Type (Telecom Carriers/ISPs, Hyperscalers, CDNs/OTT Providers, Enterprises, and Governments/Military) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Mobily (Etihad Etisalat), Nexans, NEC Group, Microsoft, ZTT, Sumitomo Electric Industries Ltd, NKT A/S, SubCom LLC, STC Group, Bharti Airtel, Zain Omantel Consortium, Telecom Egypt, Orange, G42, Singtel, Ethisalat, PCCW, TeleYemen, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Submarine Cables Market is estimated to reach USD 30.8 billion in 2023, which is further

expected to reach USD 52.7 billion by 2032.

Asia Pacific dominates the Global Submarine Cables Market with a share of 36.9% in 2023.

Some of the major key players in the Global Submarine Cables Market are Nexans, ZTT, NEC Corp, and

many others.

The market is growing at a CAGR of 6.1 percent over the forecasted period.