ℹ

To learn more about this report –

Download Your Free Sample Report Here

The subscription economy refers to a business model where companies provide ongoing access to products or services in exchange for recurring payments. Instead of one-time purchases, consumers opt for continuous value through monthly, quarterly, or annual fees. This model is rooted in long-term customer relationships and convenience, often enhanced by personalized experiences and digital automation.

It spans various sectors, including streaming services, cloud-based software, personal care, e-commerce, and mobility solutions. As consumption habits evolve, customers prefer access over ownership, driving rapid adoption of subscription-based services across both B2C and B2B domains. The model also empowers businesses to benefit from predictable revenue streams, improved customer lifetime value, and scalable engagement.

The global subscription economy market is witnessing substantial growth due to growing digitization, shifting consumer preferences, and the expansion of subscription platforms across diverse industries. Enterprises in sectors such as media, SaaS, fitness, and online retail are leveraging the recurring revenue model to improve financial predictability and customer loyalty.

Consumers are gravitating toward flexible, on-demand access to services rather than investing in permanent ownership. This is particularly evident in the surge of media streaming platforms, cloud software providers, and curated product boxes. The integration of

artificial intelligence, behavioral analytics, and mobile-based platforms further enhances customer engagement and retention, enabling brands to deliver targeted content and dynamic pricing models.

From a business perspective, the subscription model enables companies to generate consistent cash flows, reduce customer acquisition costs, and respond swiftly to market feedback. The market is further catalyzed by startups and SMEs adopting subscription platforms as a way to enter competitive spaces with lower upfront costs. In mature markets like North America and Western Europe, innovation is focused on hyper-personalization and bundling of services, while emerging economies are embracing mobile subscriptions and micro-payment models.

Companies are also exploring hybrid revenue models combining subscription with pay-per-use elements to increase appeal. Overall, the global subscription economy market is becoming a fundamental component of digital commerce strategies and is expected to redefine how products and services are delivered and monetized across sectors.

The US Subscription Economy Market

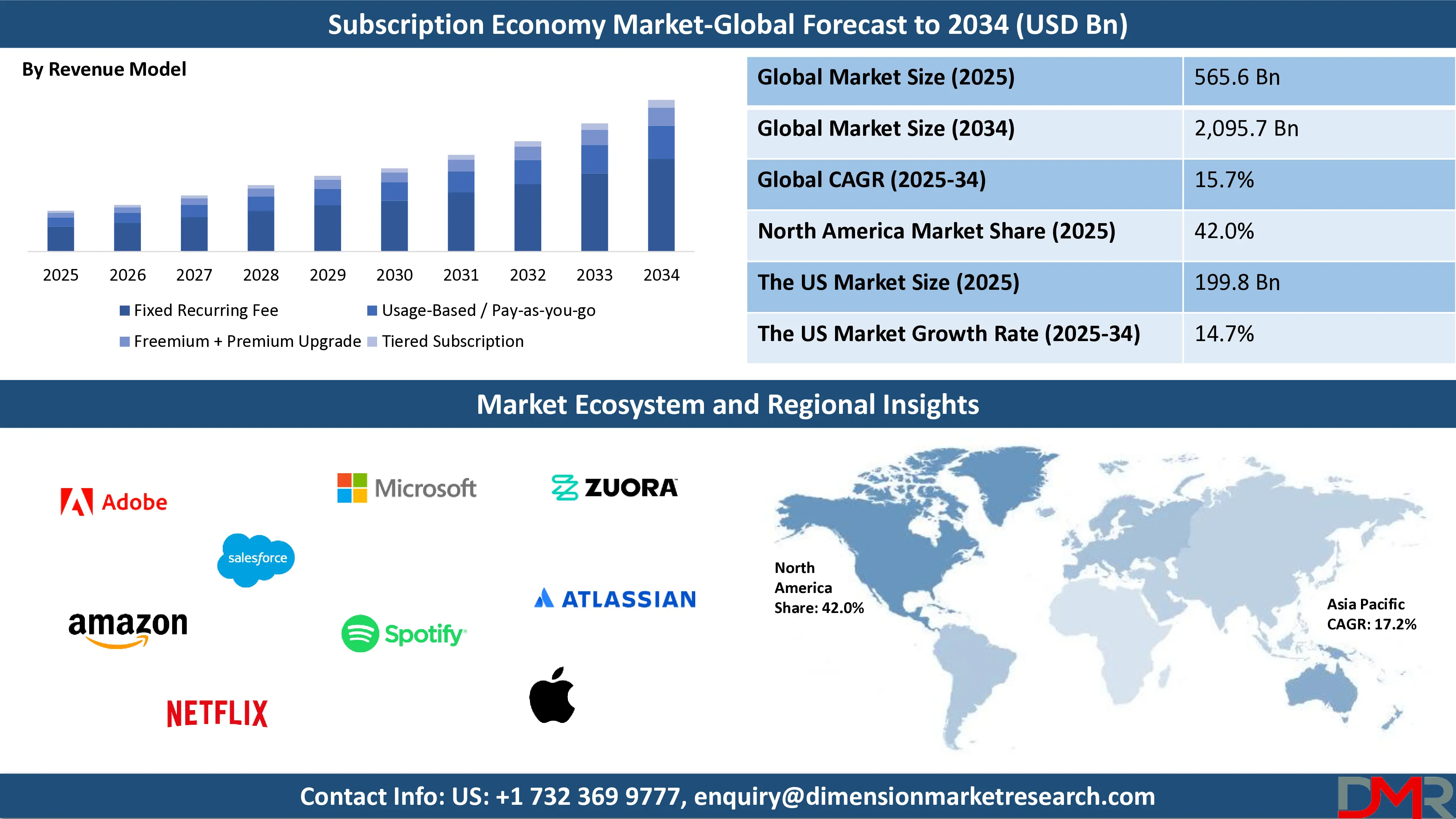

The U.S. Subscription Economy Market size is projected to be valued at USD 199.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 688.1 billion in 2034 at a CAGR of 14.7%.

The U.S. Subscription Economy technology market is experiencing robust expansion, underpinned by the country’s mature digital infrastructure, consumer preference for convenience, and widespread enterprise digitalization. The surge in cloud-based subscription platforms, combined with the widespread use of Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) models, has revolutionized how both businesses and consumers access software and digital tools.

Leading tech companies such as Adobe, Salesforce, and Microsoft are optimizing subscription-driven revenue streams to improve customer retention and scale rapidly. Furthermore, the U.S. market benefits from a tech-savvy population and high internet penetration, fueling the adoption of automated billing solutions, subscription management software, and AI-driven personalization features. These advancements are crucial in delivering seamless user experiences and driving subscription renewals.

In addition, the U.S. technology subscription ecosystem is being transformed by the rise of integrated analytics, usage-based billing, and multi-tier pricing models. Startups and SMEs are leveraging these tools to offer scalable and cost-effective digital products, reducing customer acquisition costs and enhancing customer lifetime value (CLV). The growing use of mobile-first subscription platforms, API monetization, and microservices architecture is also empowering tech providers to deliver agile and customizable solutions across verticals.

Notably, industries such as fintech, cybersecurity, healthtech, and IoT are embracing subscription models to monetize services and generate predictable, recurring income. As businesses prioritize digital transformation and cloud-native operations, the U.S. subscription technology landscape is poised for continued acceleration, making it a critical growth driver within the broader global subscription economy.

The Europe Subscription Economy Market

In 2025, Europe is projected to hold a significant share of the global subscription economy market, with an estimated value of USD 147.1 billion. This strong position is driven by the region's high digital maturity, widespread internet penetration, and early adoption of subscription-based business models across industries such as streaming media, software-as-a-service (SaaS), e-commerce, and digital publishing.

Countries like the United Kingdom, Germany, France, and the Nordic nations have become key markets, thanks to their tech-savvy consumer base and openness to recurring digital services. Additionally, the presence of major global and regional players, along with a well-established infrastructure for secure digital payments, supports the seamless expansion of subscription services across B2C and B2B channels.

Looking forward, the European subscription economy is expected to grow at a healthy CAGR of 14.3% from 2025 to 2034, fueled by continued innovation in bundled offerings, growing use of AI for personalization, and integration of mobile-first and cloud-based platforms. The rise of hybrid work models is further accelerating demand for enterprise SaaS tools, while consumers rely on subscription access for entertainment, wellness, and learning.

Regulatory frameworks like GDPR, while stringent, have also pushed companies to invest in more transparent and secure user experiences, building greater customer trust. As digital transformation deepens across sectors, Europe is poised to remain a key growth hub in the global subscription economy landscape.

The Japan Subscription Economy Market

Japan’s subscription economy market is estimated to be valued at USD 33.9 billion in 2025, reflecting the country’s steady adoption of recurring revenue models across both consumer and enterprise segments. Japan's strong digital infrastructure, high smartphone penetration, and deeply embedded culture of brand loyalty support sustained growth in areas such as OTT streaming, e-learning, digital publishing, and personal wellness subscriptions.

Additionally, Japan’s mature e-commerce landscape and growing demand for convenience-driven services have made subscription boxes for food, health, and beauty products particularly popular among consumers. Enterprises are also gradually embracing subscription-based software for cloud storage, project management, and CRM, driving consistent growth in the B2B space.

With a projected

CAGR of 13.2% from 2025 to 2034, Japan’s subscription market is expected to expand further, particularly as more small and medium-sized enterprises adopt SaaS platforms to support digital transformation. Moreover, the aging population and rising demand for personalized, home-based digital services are opening new avenues for subscription models in healthcare and eldercare. Japanese consumers’ preference for high-quality, reliable services makes them ideal long-term subscribers, and companies are leveraging this by offering value-rich, loyalty-driven experiences. While regulatory conservatism and market maturity may limit explosive growth, Japan remains a key market for stable, sustainable expansion within the global subscription economy.

Global Subscription Economy Market: Key Takeaways

- Market Value: The global subscription economy market size is expected to reach a value of USD 2,095.7 billion by 2034 from a base value of USD 565.6 billion in 2025 at a CAGR of 15.7%.

- By Type of Subscription Segment Analysis: Access Subscription is anticipated to dominate the type of subscription segment, capturing 47.0% of the total market share in 2025.

- By Delivery Platform Segment Analysis: Web-based platforms are poised to consolidate their dominance in the delivery platform segment, capturing 53.0% of the total market share in 2025.

- By Business Model Segment Analysis: B2C (Business-to-Consumer) model is expected to maintain its dominance in the business model segment, capturing 54.0% of the total market share in 2025.

- By Revenue Model Segment Analysis: Fixed Recurring Fee revenue model will lead in the revenue model segment, capturing 61.0% of the market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises will lead the organization size segment, capturing 63.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: Media & Entertainment will dominate the industry vertical segment, capturing 26.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global subscription economy market landscape with 42.0% of total global market revenue in 2025.

- Key Players: Some key players in the global subscription economy market are Adobe Inc., Salesforce, Amazon, Netflix, Microsoft, Spotify, Apple, Zuora, Google (Alphabet Inc.), Oracle Corporation, Atlassian, Peloton, Disney+, Dropbox, Box, Inc., Marchesini Group, and Others.

Global Subscription Economy Market: Use Cases

- SaaS-Based Workflow Optimization for Enterprises

- Use Case:

- A multinational corporation adopts a Software-as-a-Service (SaaS) model to streamline internal operations and improve team collaboration. By subscribing to platforms like Salesforce, Adobe Creative Cloud, and Atlassian Jira, the enterprise replaces its traditional one-time licensing model with scalable, cloud-based software solutions.

- Impact:

- Enables real-time collaboration and remote accessibility.

- Reduces upfront capital expenditure.

- Offers flexible user-based pricing tiers and monthly billing cycles.

- Provides regular updates and integrations without downtime.

- Personalized Content Delivery via Media Subscriptions

- Use Case:

- A digital content consumer subscribes to services like Netflix, Spotify, and Disney+, which use AI-driven recommendation engines to tailor entertainment choices based on past behavior and preferences. These platforms deliver hyper-personalized experiences across devices using subscription management software.

- Impact:

- Enhances customer retention and lifetime value (CLV).

- Reduces churn rate through personalization.

- Promotes multi-device streaming and bundled offers.

- Drives user engagement with data-backed content curation.

- Subscription-Based E-Commerce for Consumables

- Use Case:

- A DTC (Direct-to-Consumer) brand like HelloFresh or Dollar Shave Club offers replenishment and curated product boxes through a recurring delivery model. Customers choose meal kits or personal care products delivered weekly or monthly based on custom preferences.

- Impact:

- Ensures predictable revenue and inventory planning.

- Strengthens brand loyalty through convenience.

- Utilizes subscription analytics for upselling and retention.

- Enhances customer satisfaction with automated fulfillment and customization.

- Education & Upskilling via Subscription-Based Learning Platforms

- Use Case:

- A working professional subscribes to platforms like Coursera, LinkedIn Learning, or Skillshare for continuous upskilling in digital marketing or data science. These e-learning platforms offer unlimited access to course libraries on a monthly or annual subscription plan.

- Impact:

- Supports lifelong learning and career development.

- Offers flexible, self-paced learning modules.

- Utilizes gamification and progress tracking for motivation.

- Generates recurring revenue for education tech providers.

Global Subscription Economy Market: Stats & Facts

U.S. Bureau of Economic Analysis (BEA)

- In 2021, priced digital services generated USD 1.592 trillion in gross output—a 9.8% real growth from 2020, led by 21.8% growth in cloud services.

- E-commerce contributed USD 942 billion in gross output in 2021, increasing 8.7% year-over-year.

- Digital economy activities accounted for 43.1% of total U.S. gross output in 2021.

- The information sector (including digital goods/services) generated USD 1.600 trillion in 2021, making up 43.2% of the digital economy’s total gross output.

- Cloud services realized 19.3% real value-added growth in 2021.

- Infrastructure (ICT goods/services) produced USD 1.167 trillion in current-dollar gross output in 2021, growing 11.1% YoY.

U.S. BEA (Historical Growth)

- From 2006–2018, the digital economy’s real value-added grew at an average of 6.8% annually, compared to 1.7% for the overall U.S. economy.

- In 2018, the digital economy made up 9.0% of U.S. GDP (USD 1.849 trillion), up from 7.3% in 2005.

- In 2018, the digital economy supported 8.8 million jobs, or 5.7% of U.S. employment.

- Digital economy compensation averaged USD 105,473 per employee—compared to USD 70,858 across the U.S. economy.

U.S. Census Bureau – Internet-Based Services

- From 2015 to 2022, internet access services revenue grew from USD 79.1 billion to USD 115.8 billion—a 46.3% increase.

- Cable and other subscription programming revenue increased from USD 82.1 billion in 2015 to USD 92.4 billion in 2022—a 12.6% increase.

- Radio networks’ revenues rose 63.3%, from USD 6.7 billion to USD 10.9 billion between 2015 and 2022.

- Wireless-only U.S. households grew from 47.7% in 2015 to 72.6% in 2022.

U.S. Congressional Research Service

- Between 2017 and 2022, e-commerce became the largest digital economy segment, while cloud services had the fastest output growth—up 42%.

Government of India – National Broadband Mission

- Fixed broadband subscribers increased from 362.9 million in December 2017 to 945.0 million in December 2024.

- A 10% rise in internet subscribers in India is associated with a 3.2% increase in per-capita state GDP.

Government e-Marketplace (India)

- As of May 2025, GeM recorded a Gross Merchandise Value (GMV) of INR 13.60 lakh crore, with 2.86 crore orders, 1.64 lakh buyers, and 23 lakh sellers.

Global Subscription Economy Market: Market Dynamics

Global Subscription Economy Market: Driving Factors

Rising Consumer Preference for Access over Ownership

The global shift in consumer behavior, favoring on-demand access rather than full ownership, is propelling the subscription model across sectors. Millennials and Gen Z value convenience, flexibility, and cost efficiency offered by subscriptions. Whether it's streaming services, fitness platforms, or mobility-as-a-service (MaaS), users are drawn to flexible billing models and personalized experiences over traditional one-time purchases.

Proliferation of Cloud-Based Infrastructure

The rapid adoption of cloud computing, SaaS platforms, and API-driven integrations has significantly lowered the entry barrier for companies to launch scalable subscription offerings. Businesses can now automate billing cycles, manage customer lifecycles, and deliver real-time updates through cloud-native systems, which enhances both operational agility and customer experience.

Global Subscription Economy Market: Restraints

High Customer Churn and Subscription Fatigue

While subscription models thrive on user retention, many consumers experience subscription fatigue, the overwhelming burden of managing multiple recurring payments. This leads to higher churn rates, especially in saturated markets like media streaming and wellness apps. Brands must continuously deliver value and engage users to avoid cancellations and short lifecycle metrics.

Complex Regulatory Compliance and Data Privacy

Managing user data under global compliance frameworks such as GDPR, CCPA, and upcoming AI governance laws poses a significant challenge for subscription businesses. Ensuring secure payment gateways, data encryption, and regulatory transparency increases operational complexity, especially for cross-border services in fintech, healthtech, and enterprise software.

Global Subscription Economy Market: Opportunities

Growth in Emerging Markets and Mobile-First Economies

With growing smartphone penetration and digital infrastructure in regions like Southeast Asia, Latin America, and Africa, mobile-first consumers are embracing micro-subscriptions for services like news, entertainment, education, and fintech. Localized pricing strategies and multi-language platforms provide a major growth runway for global and regional players alike.

Expansion into Non-Traditional Sectors

Subscription models are expanding beyond media and SaaS into unexpected industries such as automotive (car-as-a-service), agriculture (smart farm analytics), and healthcare (digital therapeutics and diagnostics). These sectors are now adopting recurring revenue models to offer convenience, data-driven services, and better asset utilization to end users.

Global Subscription Economy Market: Trends

Rise of Subscription Bundling and Super Apps

Enterprises are offering bundled services, such as telecom operators including OTT content, cloud storage, and security apps in one package. Similarly, super apps in Asia and the Middle East are integrating financial, retail, and entertainment subscriptions under one digital roof, encouraging longer customer engagement.

AI-Powered Personalization and Dynamic Pricing

Subscription platforms are leveraging artificial intelligence to offer customized content recommendations, predictive churn analytics, and dynamic pricing models. This not only enhances user satisfaction but also boosts conversion rates and lifetime value by targeting users based on behavior, preferences, and engagement levels.

Global Subscription Economy Market: Research Scope and Analysis

By Type of Subscription Analysis

In the global subscription economy market, Access Subscription is expected to remain the dominant segment, accounting for approximately 47.0% of the total market share in 2025. This model enables users to gain continuous access to digital content, platforms, or services in exchange for a recurring fee. It is widely adopted in industries such as media streaming, SaaS (Software-as-a-Service), and e-learning, where customers value ongoing usage over ownership.

Popular examples include platforms like Netflix, Spotify, Microsoft 365, and Coursera, which offer users unlimited access to content libraries or tools for as long as they maintain an active subscription. The appeal of Access Subscriptions lies in their flexibility, cost-efficiency, and the ability to provide real-time updates or content personalization, making them highly attractive to both consumers and businesses.

Replenishment Subscriptions, on the other hand, are designed to automatically deliver consumable products regularly, ensuring customers never run out of essential items. This segment is particularly prominent in e-commerce, personal care, and household goods, where convenience and habit-forming behavior play a key role.

Companies like Amazon (with Subscribe & Save), Dollar Shave Club, and The Honest Company utilize this model to send products like razors, baby supplies, pet food, and household items at regular intervals. Replenishment subscriptions contribute to predictable revenue streams for brands and reduce the effort required from consumers to reorder products, fostering long-term loyalty. While this segment holds a smaller share than access-based models, its potential is expanding with the rise of automation, personalized product recommendations, and AI-driven inventory forecasting.

By Delivery Platform Analysis

Web-based platforms are expected to consolidate their dominance in the delivery platform segment of the subscription economy, capturing around 53.0% of the total market share in 2025. These platforms offer broad accessibility through browsers on desktops and laptops, catering to both B2B and B2C users. Web-based delivery is especially prominent in sectors like SaaS, enterprise software, streaming services, and news portals. Businesses prefer web platforms for their ability to integrate with other enterprise tools, offer advanced analytics, and deliver content or services without the constraints of mobile operating systems.

For users, web platforms provide larger interfaces, better navigation for complex tools, and a seamless experience across multiple devices, including desktops and smart TVs.

Mobile apps, however, represent a rapidly growing delivery platform within the subscription economy. They cater primarily to on-the-go consumers who prioritize convenience, personalized experiences, and push notifications. Mobile-first subscriptions are common in health and fitness apps, language learning, mobile gaming, and digital wallets. Companies like Spotify, Audible, Calm, and Duolingo have built entire subscription ecosystems around mobile apps, leveraging features like biometric login, offline access, and in-app recommendations to boost user engagement.

As smartphone penetration rises globally, particularly in emerging markets, mobile apps are playing a crucial role in expanding subscription reach and building daily usage habits. While their market share trails that of web-based platforms, mobile apps are expected to continue gaining traction as consumers demand more portable and customized digital experiences.

By Business Model Analysis

The B2C (Business-to-Consumer) model is projected to maintain its leading position in the business model segment of the global subscription economy, securing around 54.0% of the total market share in 2025. This dominance is driven by the widespread adoption of subscription services among individual consumers in areas like media streaming, e-commerce, digital fitness, personal finance, and wellness.

Services such as Netflix, Amazon Prime, Spotify, and HelloFresh are prime examples of B2C subscription models that offer convenience, personalization, and cost savings. The B2C model thrives on high-volume, low-cost subscriptions that rely on consumer behavior, brand engagement, and lifestyle integration. Its success is also supported by advancements in user experience design, mobile-first strategies, and targeted marketing powered by data analytics.

In contrast, the B2B (Business-to-Business) subscription model caters to organizational clients, providing scalable, enterprise-grade services like cloud-based software, data analytics tools, cybersecurity solutions, and digital collaboration platforms. Companies such as Salesforce, Adobe, and Oracle operate under this model, offering recurring access to mission-critical tools via monthly or annual subscriptions.

B2B subscriptions are typically characterized by higher average revenue per user (ARPU), longer contract cycles, and more complex onboarding and customization requirements. While this segment accounts for a slightly smaller market share compared to B2C, it continues to grow steadily due to growing enterprise digital transformation, rising demand for SaaS platforms, and a shift from capital expenditures to operational expenditure models in IT spending. As organizations prioritize efficiency, scalability, and automation, the B2B subscription economy is expected to become a core element of business infrastructure across industries.

By Revenue Model Analysis

The Fixed Recurring Fee revenue model is set to lead the revenue model segment in the global subscription economy, capturing an estimated 61.0% of the total market share in 2025. This model offers predictable, flat-rate pricing, usually billed monthly or annually, regardless of usage levels. It is widely used across streaming platforms, productivity software, digital news, and fitness applications, where consistent value is delivered over time. Companies like Netflix, Microsoft 365, and The New York Times use this approach to ensure steady cash flows, enhance budgeting predictability for consumers, and simplify the billing process.

The fixed fee model also supports easier marketing and customer acquisition, as users are attracted to straightforward pricing without the concern of variable charges. On the other hand, the Usage-Based or Pay-as-you-go revenue model is gaining traction, especially in sectors like cloud computing, communication APIs, and developer tools. In this model, customers are charged based on actual consumption, making it more cost-effective for businesses with fluctuating needs.

Companies such as AWS, Twilio, and Snowflake have adopted this flexible pricing strategy to cater to startups and enterprises alike, allowing them to scale without committing to fixed costs. While it currently holds a smaller share compared to the fixed model, the usage-based model is appealing to customers seeking transparency, performance-based pricing, and financial flexibility. It also encourages responsible usage and can lead to stronger customer loyalty when combined with analytics and real-time tracking dashboards.

By Organization Size Analysis

Large enterprises are expected to lead the organization size segment of the global subscription economy market, capturing approximately 63.0% of the total market share in 2025. These organizations are relying on subscription-based models to streamline operations, reduce upfront IT investments, and ensure scalability. Large companies typically adopt subscription services for enterprise software, cybersecurity, cloud infrastructure, analytics, and customer engagement tools. Their preference for long-term, multi-user contracts and integration with complex IT ecosystems makes them a key revenue source for SaaS providers and digital platforms.

Additionally, large enterprises benefit from customized solutions, dedicated support, and advanced analytics, making the subscription model highly strategic for managing digital transformation and maintaining competitive advantage.

Small and Medium-sized Enterprises (SMEs), while holding a smaller share of the market, represent a rapidly growing segment in the subscription economy. SMEs are leveraging affordable, pay-as-you-go and modular subscription services to access the same enterprise-grade tools once only available to larger corporations. Subscription models provide SMEs with financial flexibility, reduced capital expenditures, and the ability to scale operations efficiently.

Platforms offering marketing automation, customer relationship management, accounting software, and e-commerce services are particularly popular among SMEs. As more small businesses digitize their operations, especially in emerging markets, their demand for easy-to-deploy, cloud-based subscription solutions is expected to grow significantly, making this segment a key opportunity for future market expansion.

By Industry Vertical Analysis

The media and entertainment sector is anticipated to dominate the industry vertical segment of the global subscription economy, capturing around 26.0% of the total market share in 2025. This growth is largely driven by the massive global demand for streaming services, digital content platforms, and interactive entertainment.

Companies like Netflix, Disney+, Spotify, and Amazon Prime have revolutionized how consumers access movies, music, news, and podcasts by offering unlimited content under a recurring subscription model. These platforms use personalized recommendation engines, multi-device compatibility, and offline access features to boost engagement and reduce churn. The surge in video-on-demand consumption, integrated with the global shift toward digital media, continues to reinforce the dominance of this sector within the subscription economy landscape.

Software and SaaS (Software-as-a-Service) is another major contributor to the subscription economy, steadily gaining market share across both enterprise and consumer segments. This vertical includes a wide range of services—from productivity tools and CRM platforms to design software and cybersecurity solutions. Companies such as Adobe, Salesforce, and Microsoft lead this space by offering cloud-based applications that customers can access via monthly or annual subscriptions.

The SaaS model provides scalability, automatic updates, and low upfront costs, making it especially appealing to businesses undergoing digital transformation. With organizations favoring operational expenditure over capital investment, and demanding seamless integration, automation, and remote collaboration tools, the software and SaaS segment is expected to continue growing rapidly as a key pillar of the subscription economy.

The Subscription Economy Market Report is segmented on the basis of the following:

By Type of Subscription

- Access Subscription

- Replenishment Subscription

- Curation Subscription

- Membership/ Club-based

- Hybrid

By Delivery Platform

- Web-based

- Mobile Apps

- Multi-channel

By Business Model

- B2C (Business-to-Consumer)

- B2B (Business-to-Business)

- B2B2C (Business-to-Business-to-Consumer)

By Revenue Model

- Fixed Recurring Fee

- Usage-Based/Pay-as-you-go

- Freemium + Premium Upgrade

- Tiered Subscription

By Organization Size

By Industry Vertical

- Media & Entertainment

- Software & SaaS

- E-commerce & Retail

- Telecom

- Healthcare & Wellness

- Education & E-learning

- Automotive & Mobility

- Financial Services & Insurance

- Others

Global Subscription Economy Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global subscription economy market in 2025, accounting for approximately

42.0% of total global market revenue. This dominance is driven by the region’s advanced digital infrastructure, high consumer adoption of subscription-based services, and strong presence of leading market players such as Netflix, Amazon, Adobe, and Salesforce.

The widespread use of high-speed internet, smartphones, and cloud computing platforms has enabled rapid growth across diverse sectors, including media, SaaS, e-commerce, and fintech. Additionally, North American enterprises are early adopters of recurring revenue models, supported by developed billing systems, data analytics capabilities, and a favorable regulatory environment. This makes the region a major hub for innovation and expansion in the global subscription economy.

Region with significant growth

The Asia-Pacific region is projected to witness significant growth in the global subscription economy market over the coming years, driven by rapid digitalization, growing smartphone penetration, and a rising middle-class population with growing disposable incomes. Countries like India, China, Indonesia, and Vietnam are seeing a surge in mobile-first subscriptions across sectors such as OTT streaming, online learning, health and wellness, and fintech.

Localized content, regional pricing strategies, and expanding internet connectivity are further accelerating adoption. Additionally, the region’s startup ecosystem and small businesses are embracing subscription-based SaaS tools to scale operations cost-effectively. As consumer preferences shift toward convenience and flexibility, Asia-Pacific is emerging as one of the fastest-growing regions in the subscription economy landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Subscription Economy Market: Competitive Landscape

The global competitive landscape of the subscription economy market is characterized by a mix of established tech giants, sector-specific leaders, and agile startups, all competing to capture recurring revenue streams through innovative service delivery and customer retention strategies. Major players such as Adobe, Amazon, Netflix, Microsoft, and Salesforce dominate through expansive platforms, diversified subscription offerings, and strong brand loyalty.

Meanwhile, companies like Spotify, Zuora, and Shopify are driving niche excellence with specialized models in music streaming, subscription billing infrastructure, and e-commerce, respectively. Intense competition is fostering continuous innovation in pricing models, AI-driven personalization, bundled services, and customer analytics. Additionally, regional players in emerging markets are rapidly scaling by offering localized, mobile-first subscriptions customized to local consumer needs. As the market matures, strategic partnerships, mergers, and acquisitions are becoming key tactics for companies to expand their subscriber base and enter new verticals.

Some of the prominent players in the global subscription economy market are:

- Adobe Inc.

- Salesforce

- Amazon

- Netflix

- Microsoft

- Spotify

- Apple

- Zuora

- Google (Alphabet Inc.)

- Oracle Corporation

- Atlassian

- Peloton

- Disney+

- Dropbox

- Box, Inc.

- HelloFresh

- Shopify

- HubSpot

- Patreon

- The New York Times Company

- Other Key Players

Global Subscription Economy Market: Recent Developments

Product Launches

- May 2025: CNN announced a new “All Access” streaming tier launching in fall 2025, expanding its subscription-based offering with live news and on-demand programming.

- June 2025: Google introduced “Google AI Ultra,” a high-tier AI subscription plan providing access to advanced models, increased usage limits, and integrated features like YouTube Premium for USD 249.99/month.

Merger & Acquisition News

- June 2025: Comcast agreed to sell Sky Deutschland to RTL Group for up to EUR 617 million, creating a combined entity with around 11.5 million subscribers across German-speaking markets.

- July 2025: Skydance Media and Paramount Global finalized their merger to form Paramount Skydance Corporation in a transaction valued at approximately USD 8 billion, pending closure in the first half of 2025.

Funding & Investment Updates

- June 2025: Meta acquired a 49% stake in Scale AI for over USD 14 billion, a strategic investment that may accelerate AI-driven subscription services and content personalization.

- June 2025: SoftBank invested in Perplexity AI, valuing the AI search startup at USD 3 billion, a move highlighting rising investment in AI-enhanced analytics for subscription platforms.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 565.6 Bn |

| Forecast Value (2034) |

USD 2,095.6 Bn |

| CAGR (2025–2034) |

15.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 199.8 Bn |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type of Subscription (Access Subscription, Replenishment Subscription, Curation Subscription, Membership/Club-based, Hybrid), By Delivery Platform (Web-based, Mobile Apps, Multi-channel), By Business Model (B2C, B2B, B2B2C), By Revenue Model (Fixed Recurring Fee, Usage-Based/Pay-as-you-go, Freemium + Premium Upgrade, Tiered Subscription), By Organization Size (Large Enterprises and SMEs), and By Industry Vertical (Media & Entertainment, Software & SaaS, E-commerce & Retail, Telecom, Healthcare & Wellness, Education & E-learning, Automotive & Mobility, Financial Services & Insurance, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Adobe Inc., Salesforce, Amazon, Netflix, Microsoft, Spotify, Apple, Zuora, Google (Alphabet Inc.), Oracle Corporation, Atlassian, Peloton, Disney+, Dropbox, Box, Inc., Marchesini Group, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |