Market Overview

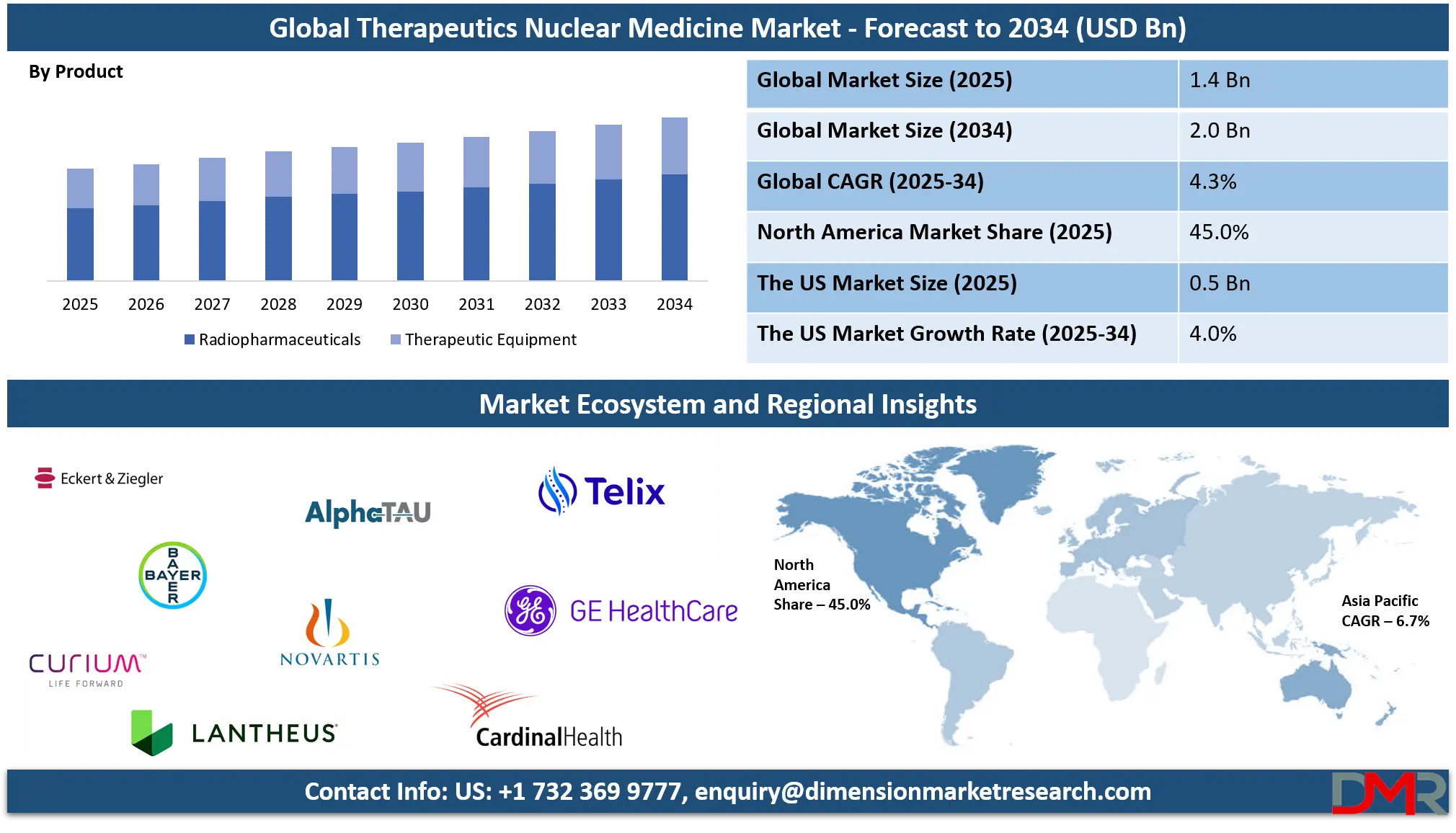

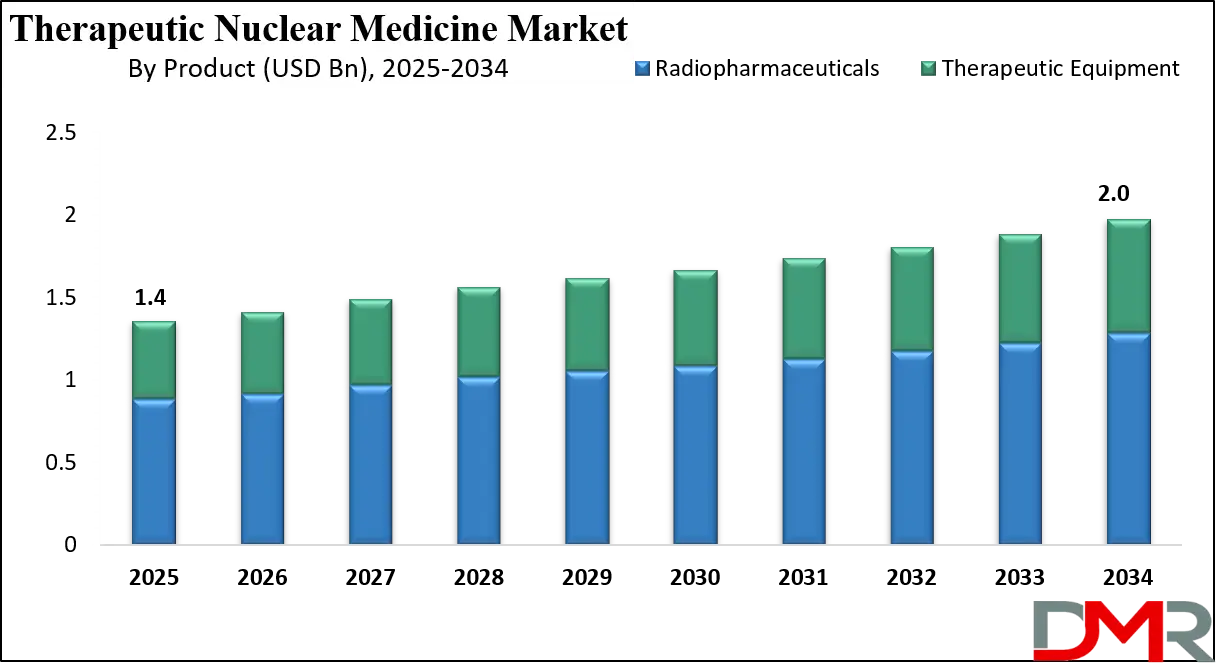

The Global Therapeutic Nuclear Medicine Market size is projected to reach USD 1.4 billion in 2025 and grow at a compound annual growth rate of 4.3% to reach a value of USD 2.0 billion in 2034.

Therapeutic Nuclear Medicine refers to the use of targeted radioactive substances to diagnose and treat various diseases, particularly cancer, by delivering radiation directly to diseased tissues while minimizing damage to surrounding healthy cells. The market includes nradiopharmaceuticals, therapeutic equipment, and associated services used across oncology and specialty care. It plays a critical role in precision medicine by enabling personalized treatment approaches, improving clinical outcomes, and addressing unmet needs in complex cancers. Its relevance has grown significantly within the broader healthcare and life sciences industry due to rising cancer prevalence and demand for targeted therapies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is undergoing a structural transformation driven by advancements in radionuclide production, imaging-guided therapies, and molecular targeting techniques. Improvements in isotope availability, radiolabeling technologies, and hybrid diagnostic-therapeutic platforms have enhanced treatment accuracy and safety. Shifts toward outpatient nuclear therapy, expanded clinical indications, and integration with oncology care pathways are accelerating adoption. Regulatory frameworks are evolving to support faster approvals for novel radionuclide therapies, reflecting growing confidence in their clinical value.

A major momentum is also coming from increased investments in nuclear medicine infrastructure, clinical research, and cross-border isotope supply chains. The transition from conventional radiation therapy to targeted radionuclide therapy represents a paradigm shift in cancer treatment. Emerging trends such as alpha-emitter therapies, combination regimens with immunotherapy, and AI-supported treatment planning are reshaping growth trajectories and reinforcing the market’s long-term strategic importance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Therapeutic Nuclear Medicine Market

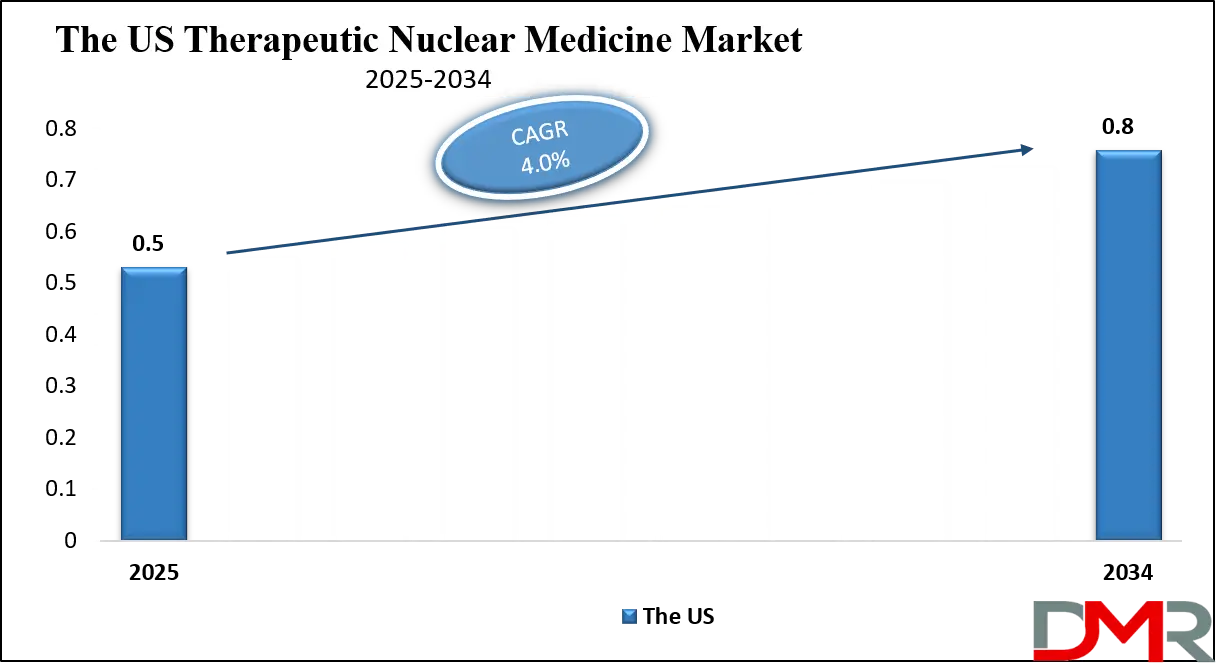

The US Therapeutic Nuclear Medicine Market size is projected to reach USD 500.0 million in 2025 at a compound annual growth rate of 4.0% over its forecast period.

The US market is shaped by strong clinical research capabilities, advanced healthcare infrastructure, and early adoption of innovative therapies. Favorable reimbursement policies for approved radiopharmaceuticals and the presence of specialized nuclear medicine centers support widespread utilization. Regulatory clarity from federal agencies has encouraged accelerated approvals and expanded indications. Government funding for cancer research and isotope production infrastructure further strengthens market growth. The US also benefits from a robust pipeline of clinical trials, increasing physician awareness, and strong collaboration between healthcare providers and research institutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Therapeutic Nuclear Medicine Market

Europe Therapeutic Nuclear Medicine Market size is projected to reach USD 392.0 million in 2025 at a compound annual growth rate of 4.1% over its forecast period.

Europe demonstrates steady growth driven by supportive regional healthcare policies, strong public healthcare systems, and coordinated research initiatives. Regulatory harmonization across countries facilitates cross-border clinical trials and technology diffusion. Initiatives aligned with sustainability and healthcare innovation frameworks support investments in nuclear medicine infrastructure. The region has strong adoption in oncology-focused hospitals, particularly in Western Europe, while Eastern Europe is emerging as a growth hub. Emphasis on cost-effective therapies and value-based care continues to influence adoption patterns and innovation priorities.

Japan Therapeutic Nuclear Medicine Market

Japan Therapeutic Nuclear Medicine Market size is projected to reach USD 70 million in 2025 at a compound annual growth rate of 4.6% over its forecast period.

Japan’s market benefits from advanced medical technology adoption, an aging population, and strong government backing for cancer care innovation. High disease awareness, early diagnosis, and integrated hospital systems support uptake of radionuclide therapies. Government initiatives promoting nuclear medicine research and domestic isotope production enhance supply reliability. Urban concentration of advanced hospitals enables rapid deployment of new therapies. However, strict regulatory approval processes and high operational costs pose challenges, balanced by strong clinical expertise and long-term policy commitment.

Therapeutic Nuclear Medicine Market: Key Takeaways

- Market Growth: The Therapeutic Nuclear Medicine Market size is expected to grow by USD 600 million, at a CAGR of 4.3%, during the forecasted period of 2026 to 2034.

- By Product: The radiopharmaceuticals segment is anticipated to get the majority share of the Therapeutic Nuclear Medicine Market in 2025.

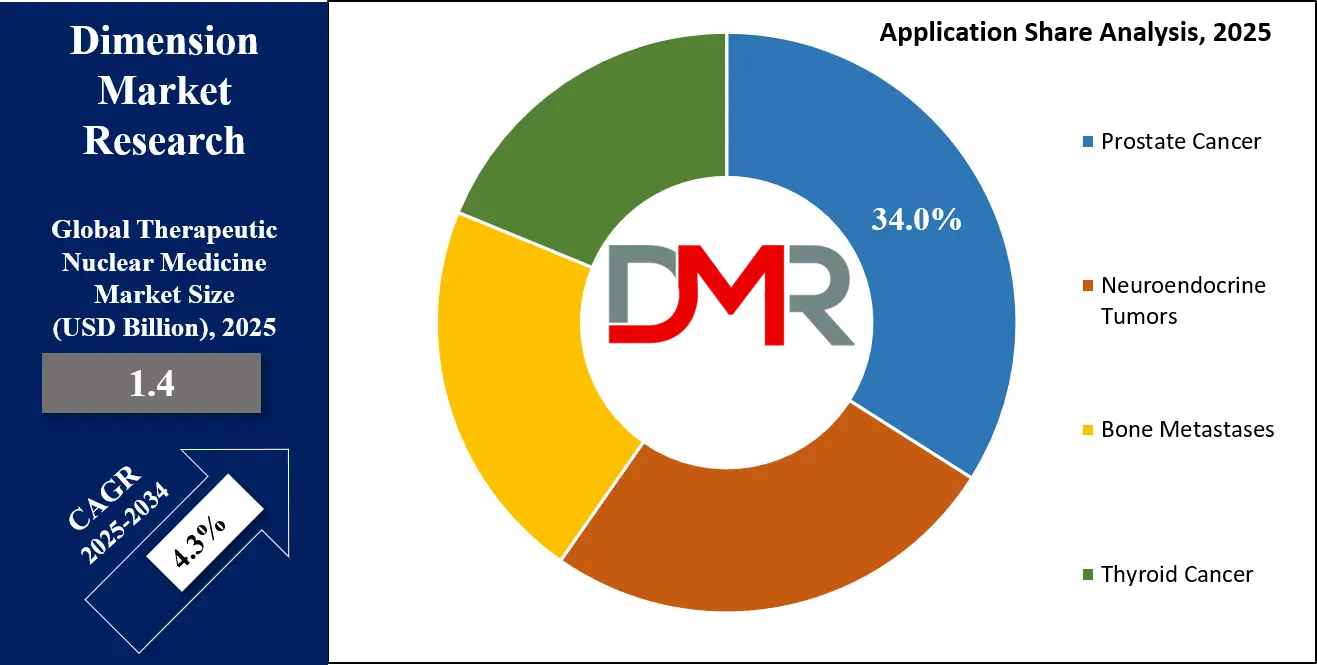

- By Application: The prostate cancer segment is expected to get the largest revenue share in 2025 in the Therapeutic Nuclear Medicine Market.

- Regional Insight: North America is expected to hold a 45.0% share of revenue in the Global Therapeutic Nuclear Medicine Market in 2025.

- Use Cases: Some of the use cases of Therapeutic Nuclear Medicine include targeted oncology therapy, personalized cancer treatment, and more.

Therapeutic Nuclear Medicine Market: Use Cases

- Targeted Oncology Therapy: Precision delivery of radiation to tumors while sparing healthy tissue improves survival outcomes and reduces side effects.

- Personalized Cancer Treatment: Molecular targeting enables therapy selection based on individual tumor characteristics.

- Palliative Care Applications: Effective pain management and symptom control in advanced-stage cancers.

- Combination Treatment Regimens: Integration with chemotherapy and immunotherapy enhances overall treatment efficacy.

Stats & Facts

- U.S. Food and Drug Administration reported over 10 radionuclide therapy approvals or label expansions during 2024–2025 reflecting accelerated innovation.

- European Commission recorded increased funding allocations exceeding €1.5 billion toward oncology and nuclear medicine research in 2025.

- Japan Ministry of Health, Labour and Welfare indicated a 12% year-over-year rise in nuclear medicine procedures in 2024.

- International Atomic Energy Agency noted global medical isotope demand growth at approximately 8% annually during 2024–2025.

- National Cancer Institute (USA) reported cancer incidence growth driving sustained demand for targeted radiotherapies in 2025.

Market Dynamic

Driving Factors in the Therapeutic Nuclear Medicine Market

Advancement in Targeted Cancer Therapies

Rapid progress in molecular biology and radiochemistry has enabled highly targeted radionuclide therapies that significantly improve treatment efficacy while reducing off-target toxicity. Unlike conventional radiation, these therapies selectively bind to cancer cells, allowing precise dose delivery. Growing clinical evidence demonstrating improved survival rates and better quality-of-life outcomes has accelerated physician confidence and adoption. Continuous investment in research and development, along with expanding global clinical trial pipelines, is further strengthening therapeutic nuclear medicine’s position as a preferred option for treating complex, refractory, and advanced-stage cancers.

Government Support and Regulatory Facilitation

Governments across developed and emerging economies are increasingly prioritizing oncology care, resulting in higher funding allocations for nuclear medicine research and infrastructure. Streamlined regulatory pathways, orphan drug designations, and accelerated approval mechanisms are encouraging faster innovation and commercialization of radionuclide therapies. Public–private partnerships are also improving isotope production capacity and strengthening supply chain resilience. These supportive policy measures reduce market entry barriers, promote technology diffusion, and enable wider adoption of therapeutic nuclear medicine across diverse healthcare systems.

Restraints in the Therapeutic Nuclear Medicine Market

High Capital and Operational Costs

The establishment and operation of nuclear medicine facilities require significant upfront capital investment in specialized equipment, radiation shielding, and safety compliance systems. Ongoing costs related to isotope procurement, storage, transportation, and waste management further increase operational expenditure. Stringent regulatory requirements necessitate continuous monitoring and skilled personnel, adding to cost pressures. These financial constraints limit adoption in cost-sensitive and resource-constrained regions, slowing market penetration and creating challenges for smaller healthcare providers.

Limited Awareness and Skilled Workforce Shortages

Despite strong clinical benefits, limited awareness among patients and referring physicians restricts timely diagnosis and therapy referrals. Additionally, shortages of trained nuclear medicine specialists, medical physicists, and radiopharmacists hinder service availability. Lengthy training programs and certification requirements delay workforce expansion, creating capacity bottlenecks. These human resource constraints reduce treatment accessibility and slow scalability, particularly in emerging markets, even as demand for targeted radionuclide therapies continues to rise globally.

Opportunities in the Therapeutic Nuclear Medicine Market

Expansion of Alpha-Emitter Therapies

Alpha-emitting radionuclides present a major growth opportunity due to their ability to deliver high-energy radiation over very short distances, enabling effective treatment of resistant and metastatic cancers. Ongoing research and late-stage clinical trials are expanding therapeutic indications and improving safety profiles. Increasing investment from pharmaceutical companies and research institutions is accelerating development. As regulatory approvals broaden and clinical evidence strengthens, alpha-emitter therapies are expected to emerge as a key next-generation growth driver in the market.

Emerging Markets and Infrastructure Development

Emerging economies are investing heavily in oncology infrastructure, creating significant untapped potential for therapeutic nuclear medicine adoption. Government-backed healthcare expansion programs, rising cancer incidence, and increasing access to advanced diagnostics are accelerating demand. International collaborations and technology transfer initiatives are improving local capabilities in isotope production and treatment delivery. As awareness and reimbursement frameworks improve, developing regions are expected to contribute substantially to long-term market growth.

Trends in the Therapeutic Nuclear Medicine Market

Shift Toward Precision and Personalized Medicine

The market is increasingly aligned with precision medicine, emphasizing individualized treatment strategies based on molecular profiling and tumor biology. Personalized radionuclide therapies improve therapeutic outcomes by optimizing dose delivery and minimizing adverse effects. Integration of diagnostics with therapeutics enables better patient stratification and treatment monitoring. This trend is gaining strong traction across oncology centers, supported by clinical evidence and technological advancements, reinforcing long-term adoption of targeted nuclear medicine solutions.

Integration of Digital and Hybrid Technologies

Digitalization is transforming therapeutic nuclear medicine through the integration of advanced imaging, automation, and hybrid diagnostic-therapeutic platforms. These technologies improve workflow efficiency, enhance treatment accuracy, and support real-time decision-making. Automated dose planning and digital monitoring systems reduce errors and improve patient safety. As healthcare providers adopt smart infrastructure and data-driven tools, digital and hybrid technologies are reshaping clinical practices and operational scalability within the market.

Impact of Artificial Intelligence in Therapeutic Nuclear Medicine Market

- Treatment Planning Optimization: Artificial Intelligence improves dose calculation accuracy and therapy personalization.

- Imaging Analysis Enhancement: Advanced algorithms enable faster and more precise tumor identification.

- Operational Efficiency: Automation reduces workflow delays and human error.

- Predictive Outcome Modeling: AI forecasts treatment response and patient outcomes.

- Supply Chain Optimization: Predictive analytics enhance isotope demand planning and logistics.

Research Scope and Analysis

By Product Analysis

Radiopharmaceuticals represent the dominant product category within the therapeutic nuclear medicine market, accounting for approximately 65% of total market share in 2025 due to their indispensable role in targeted radiation delivery. These agents enable precise treatment by transporting radioactive isotopes directly to cancerous tissues, significantly minimizing damage to healthy cells. Both beta and alpha emitters are increasingly utilized in oncology applications because of their improved therapeutic accuracy and favorable clinical outcomes. Continuous innovation in radiochemistry, expanding regulatory approvals, and strong clinical trial pipelines further reinforce adoption.

Therapeutic equipment represents the fastest-growing product segment, driven by rising investments in advanced radionuclide delivery systems, radiation shielding, and safety infrastructure. Growth is further supported by increasing procedure volumes and modernization initiatives across nuclear medicine departments. Hospitals and specialty clinics are upgrading equipment to comply with stricter safety regulations and to accommodate newer isotopes and therapy protocols. Automation, digital monitoring systems, and hybrid imaging-therapy platforms are enhancing operational efficiency and treatment precision. As healthcare providers expand nuclear medicine capabilities and outpatient services, demand for advanced therapeutic equipment continues to rise, positioning this segment for strong long-term expansion.

By Therapy Type Analysis

Peptide Receptor Radionuclide Therapy holds a leading position in the market, contributing nearly 42% of overall revenue share in 2025, largely due to its proven clinical efficacy in treating neuroendocrine tumors. PRRT enables targeted delivery of radioactive isotopes to tumor cells expressing specific receptors, resulting in high therapeutic effectiveness with manageable toxicity profiles. Strong clinical outcomes, well-established treatment protocols, and increasing physician familiarity support its widespread adoption. Expanding indications beyond neuroendocrine tumors and ongoing clinical research are further strengthening demand. Reimbursement support and growing patient awareness also contribute to PRRT’s sustained dominance within therapeutic nuclear medicine.

Radioimmunotherapy is emerging as one of the fastest-growing therapy types due to advancements in antibody engineering and improved radionuclide conjugation techniques. By combining the specificity of monoclonal antibodies with the cytotoxic power of radiation, this approach enables highly selective tumor targeting. Increased use in combination with chemotherapy and immunotherapy regimens is enhancing clinical effectiveness. Ongoing innovation, expanding clinical trials, and improved safety profiles are driving adoption across oncology centers. As research continues to unlock new targets and improve antibody stability, radioimmunotherapy is expected to gain wider clinical acceptance and accelerate market growth.

By Isotope Analysis

Lutetium-177 remains the most widely used isotope in therapeutic nuclear medicine, contributing approximately 38% of the total isotope-based market share in 2025. Its favorable half-life, balanced radiation emission, and strong therapeutic efficacy make it suitable for a wide range of oncology applications. Lutetium-177 is commonly used in PRRT and prostate cancer therapies, offering effective tumor control with limited off-target toxicity. Reliable production methods, expanding supply chains, and increasing regulatory approvals further strengthen its market position. Continued clinical success and ongoing research into new indications support sustained demand for this isotope.

Radium-223 is experiencing rapid growth, particularly in the treatment of metastatic prostate cancer with bone involvement. Its alpha-emitting properties allow highly localized radiation delivery, reducing damage to surrounding healthy tissue. Rising prostate cancer incidence and increasing clinical adoption are driving demand. Ongoing research exploring combination therapies and expanded indications is further accelerating usage. As awareness among oncologists grows and treatment guidelines evolve, Radium-223 is expected to witness continued uptake, reinforcing its role as a key growth-driving isotope in the therapeutic nuclear medicine market.

By Application Analysis

Prostate cancer represents the largest application area, accounting for nearly 34% of total therapeutic nuclear medicine utilization in 2025. The high global prevalence of prostate cancer, coupled with the effectiveness of radionuclide therapies such as Lutetium-177 and Radium-223, underpins this dominance. These therapies offer targeted treatment options for advanced and metastatic disease stages, improving survival outcomes and quality of life. Increasing screening rates, early diagnosis, and favorable reimbursement policies further support adoption. Continuous clinical research and expanding therapy approvals reinforce prostate cancer as a core application segment.

Neuroendocrine tumors constitute one of the fastest-growing application segments due to rising diagnosis rates and increasing use of PRRT. Improved awareness among clinicians and patients, along with advancements in imaging and molecular diagnostics, has led to earlier detection and treatment. PRRT has demonstrated strong clinical efficacy in managing progressive and metastatic neuroendocrine tumors, driving wider adoption. Expanding treatment centers and supportive reimbursement frameworks further fuel growth. As research continues to explore new radionuclide therapies for this indication, the segment is expected to maintain strong momentum.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Hospitals remain the leading end-user segment, contributing approximately 58% of total market demand in 2025, primarily due to their comprehensive infrastructure and multidisciplinary oncology capabilities. Large hospitals are equipped with specialized nuclear medicine departments, radiation safety systems, and trained personnel necessary for complex radionuclide therapies. They also serve as primary centers for clinical trials and advanced cancer treatments. Strong patient inflow, integrated diagnostic and therapeutic services, and reimbursement access further reinforce hospital dominance. Continuous investments in nuclear medicine expansion ensure sustained leadership in this segment.

Specialty nuclear medicine and oncology clinics are witnessing rapid expansion, driven by increasing demand for outpatient and specialized treatment services. These clinics focus on targeted radionuclide therapies, offering shorter treatment cycles and improved patient convenience. Lower operational complexity compared to large hospitals enables faster adoption of new therapies and technologies.

Growing physician specialization, patient preference for outpatient care, and rising cancer incidence support strong growth. As healthcare systems emphasize efficiency and decentralized care delivery, specialty clinics are expected to play an increasingly important role in market expansion.

The Therapeutic Nuclear Medicine Market Report is segmented on the basis of the following:

By Product

- Radiopharmaceuticals

- Beta Emitters

- Alpha Emitters

- Therapeutic Equipment

By Therapy Type

- Peptide Receptor Radionuclide Therapy (PRRT)

- Radioimmunotherapy

- Bone-Targeted Radionuclide Therapy

- Thyroid Radionuclide Therapy

By Isotope

- Lutetium-177

- Yttrium-90

- Iodine-131

- Radium-223

By Application

- Prostate Cancer

- Neuroendocrine Tumors

- Bone Metastases

- Thyroid Cancer

By End User

- Hospitals

- Specialty Nuclear Medicine & Oncology Clinics

Regional Analysis

Leading Region in the Therapeutic Nuclear Medicine Market

North America holds the leading position in the therapeutic nuclear medicine market, contributing approximately 45% of total global revenue in 2025 due to its highly advanced healthcare infrastructure and strong innovation ecosystem. The region benefits from extensive research funding, a well-established network of nuclear medicine centers, and early adoption of novel radionuclide therapies.

Favorable regulatory frameworks and reimbursement support accelerate clinical translation and commercialization of new treatments. High awareness among healthcare professionals, strong clinical trial activity, and reliable isotope supply chains further strengthen regional dominance. Continuous investment in oncology research and precision medicine ensures North America’s sustained leadership in the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the Therapeutic Nuclear Medicine Market

Asia-Pacific represents the fastest-growing regional market, driven by rapidly increasing cancer incidence, expanding healthcare infrastructure, and supportive government initiatives promoting nuclear medicine adoption. Rising healthcare expenditure and growing access to advanced oncology treatments are accelerating market penetration across both developed and emerging economies.

Governments are investing in cancer care programs, isotope production facilities, and workforce training to strengthen domestic capabilities. Increasing awareness, earlier diagnosis, and partnerships with global healthcare providers further support growth. As urbanization and aging populations continue to rise, Asia-Pacific is expected to experience sustained expansion in therapeutic nuclear medicine utilization.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The therapeutic nuclear medicine market is characterized by high entry barriers due to regulatory complexity, capital requirements, and specialized expertise needs. Companies focus on R&D investment, strategic collaborations, and vertical integration to strengthen positions. Innovation-driven differentiation, clinical trial expansion, and long-term supply agreements are key competitive strategies. Continuous improvement in safety, efficacy, and scalability underpins sustained competitiveness.

Some of the prominent players in the global Therapeutic Nuclear Medicine are:

- Novartis AG

- Bayer AG

- GE HealthCare

- Lantheus Holdings

- Cardinal Health

- Curium Pharma

- Telix Pharmaceuticals

- Siemens Healthineers

- Eckert & Ziegler

- ABX Advanced Biochemical Compounds

- ITM Isotope Technologies Munich

- NorthStar Medical Radioisotopes

- SOFIE Biosciences

- Alpha Tau Medical

- Radiopharm Theranostics

- IBA Group

- Institute of Radioelement (IRE)

- NTP Radioisotopes (Pty) Ltd.

- ANSTO

- czacıbaşı-Monrol

- Other Key Players

Recent Developments

- In November 2025, UCLA Health inaugurated the Department of Nuclear Medicine and Theranostics, the first of its kind in the United States, which will drive the next generation of discovery and patient-centered care by integrating advanced imaging and therapy, accelerating scientific discovery and advancing precision health at UCLA Health. The Department of Nuclear Medicine and Theranostics will broaden its clinical services, create new research and training opportunities, and deepen its collaborations across UCLA Health, the David Geffen School of Medicine at UCLA and the UCLA Health Jonsson Comprehensive Cancer Center.

- In April 2025, Orano Med announced hat its long-standing collaboration with the multinational pharmaceutical company Roche is entering the next phase, as the companies have conducted vast preclinical research to develop a potential novel cancer treatment approach called “two-step pretargeted radioimmunotherapy”, which pretargets the tumor with an antibody that is subsequently able to capture chelated lead-212 (212Pb) to target tumor cells. Orano Med will be responsible for the manufacturing of 212Pb, utilizing its industrial manufacturing platform in France and the US.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.4 Bn |

| Forecast Value (2034) |

USD 2.0 Bn |

| CAGR (2025–2034) |

4.3% |

| The US Market Size (2025) |

USD 0.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Radiopharmaceuticals and Therapeutic Equipment), By Therapy Type (Peptide Receptor Radionuclide Therapy (PRRT), Radioimmunotherapy, Bone-Targeted Radionuclide Therapy, and Thyroid Radionuclide Therapy), By Isotope (Lutetium-177, Yttrium-90, Iodine-131, and Radium-223), By Application (Prostate Cancer, Neuroendocrine Tumors, Bone Metastases, and Thyroid Cancer), By End User (Hospitals and Specialty Nuclear Medicine & Oncology Clinics) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Novartis AG, Bayer AG, GE HealthCare, Lantheus Holdings, Cardinal Health, Curium Pharma, Telix Pharmaceuticals, Siemens Healthineers, Eckert & Ziegler, ABX Advanced Biochemical Compounds, ITM Isotope Technologies Munich, NorthStar Medical Radioisotopes, SOFIE Biosciences, Alpha Tau Medical, Radiopharm Theranostics, IBA Group, Institute of Radioelement (IRE), NTP Radioisotopes (Pty) Ltd., ANSTO, czacıbaşı-Monrol, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Therapeutic Nuclear Medicine Market?

▾ The Global Therapeutic Nuclear Medicine Market size is expected to reach USD 1.4 billion by 2025 and is projected to reach USD 2.0 billion by the end of 2034.

Which region accounted for the largest Global Therapeutic Nuclear Medicine Market?

▾ North America is expected to have the largest market share in the Global Therapeutic Nuclear Medicine Market, with a share of about 45.0% in 2025.

How big is the Therapeutic Nuclear Medicine Market in the US?

▾ The US Therapeutic Nuclear Medicine market is expected to reach USD 0.5 billion by 2025.

Who are the key players in the Therapeutic Nuclear Medicine Market?

▾ Some of the major key players in the Global Therapeutic Nuclear Medicine Market include Novartis, GE Healthcare, Bayers, and others

What is the growth rate in the Global Therapeutic Nuclear Medicine Market?

▾ The market is growing at a CAGR of 4.3 percent over the forecasted period.