Thermoplastic solenoid valves are electrical devices that handle the flow of fluids via a pipe or tube by utilizing an electromagnetic coil to open or close the valve. These valves are made from thermoplastic materials, like CPVC, PVC, or polypropylene, which provides high resistance to chemicals and corrosive environments.

The Thermoplastic Solenoid Valves Market continues to experience steady expansion due to an increasing need for reliable and efficient control systems across industries like water treatment, chemicals manufacturing and food processing. These valves boast superior corrosion resistance making them suitable for handling aggressive fluids as well as extreme environments.

Recent advancements in thermoplastic solenoid valve technology aim at increasing their performance, durability, and precision. Manufacturers are using cutting-edge materials, automation features, and energy-saving designs in their designs in order to meet market needs and ensure greater control of fluid flow and pressure for critical applications.

Demand for thermoplastic solenoid valves has seen an explosive surge, particularly among chemical and pharmaceutical firms that rely on precise fluid control for production processes. Furthermore, increasing automation requirements necessitate valves that integrate seamlessly with smart systems or IoT platforms.

Opportunities in the market lie in expanding use of thermoplastic solenoid valves across emerging industries, such as renewable energy and wastewater treatment. With sustainability becoming a top priority worldwide, their ability to withstand harsh chemicals while maintaining operational efficiency within eco-friendly projects makes them essential components for numerous industrial applications.

As per statista In 2024, the Asia Pacific region is expected to have a thermoplastic composites market valued at around 12.5 billion U.S. dollars, holding the largest market share globally. This growing sector reflects the increasing demand for lightweight, durable materials across various industries, driving the expansion of thermoplastic composites in the region.

Plastics, a diverse group of synthetic organic polymers, play a crucial role in modern society’s operations. Since the onset of mass plastic production in the 1940s, the global plastic market has grown significantly, reaching 712 billion U.S. dollars in 2023. This market is projected to continue growing substantially over the next decade.

By 2025, the global production of thermoplastics is expected to reach 445.25 million metric tons. Looking ahead, production volumes are forecasted to rise steadily, with projections suggesting a 30% increase by 2050, reaching about 590 million metric tons, further solidifying the significance of thermoplastics in various industries.

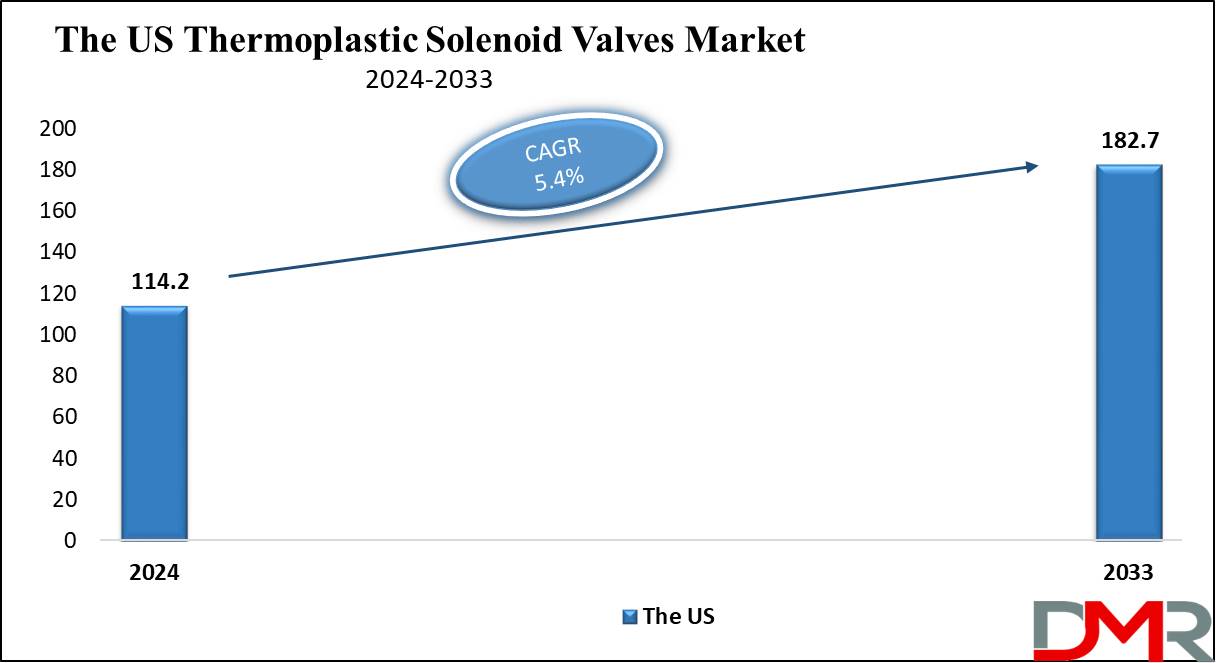

The US Thermoplastic Solenoid Valves Market

The

US Thermoplastic Solenoid Valves Market is projected to reach

USD 114.2 million in 2024 at a compound annual growth rate of

5.4% over its forecast period.

In the US, the opportunities in the thermoplastic solenoid valve market are due to higher investments in infrastructure upgrades, water treatment advancements, and chemical processing innovations, as the need for efficient, corrosion-resistant solutions in these sectors, along with a focus on sustainability and technology, drives the demand for thermoplastic solenoid valves, fostering market expansion in the region.

Further, the growth of the thermoplastic solenoid valve market in the US is driven by developments in water treatment and chemical processing, which demand durable, corrosion-resistant components. However, the market experiences restraint from high competition and the availability of alternative valve technologies, which can limit the adoption of thermoplastic solenoid valves despite their advantages in specific applications.

Key Takeaways

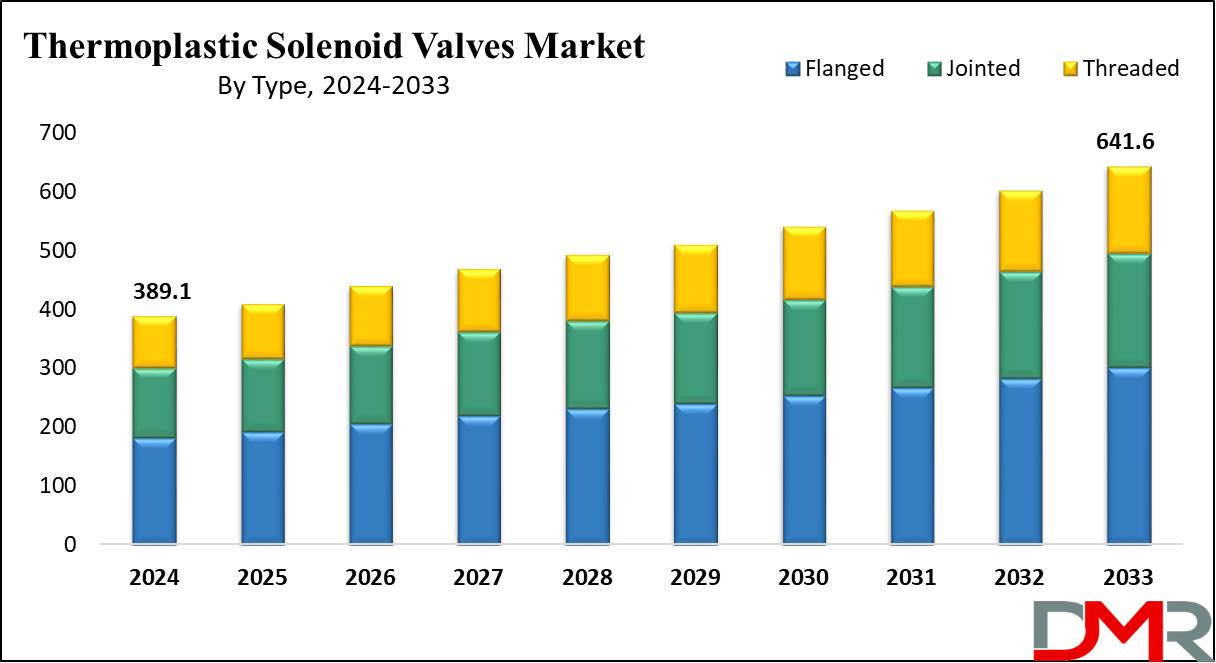

- Market Growth: The Thermoplastic Solenoid Valves Market size is expected to grow by 232.6 million, at a CAGR of 5.7% during the forecasted period of 2025 to 2033.

- By Type: The flanged type is expected to lead in 2024 with a majority & is anticipated to dominate throughout the forecasted period.

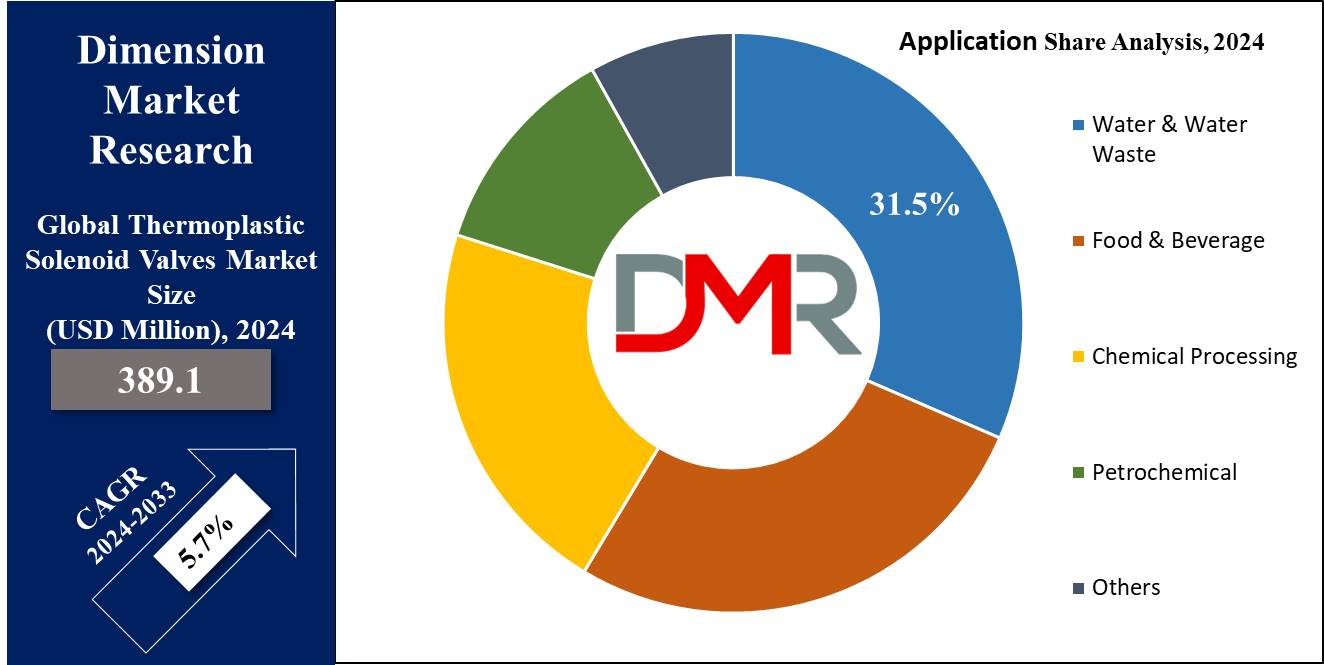

- By Application: The water & water waste segment is expected to get the largest revenue share in 2024 in the Thermoplastic Solenoid Valves Market.

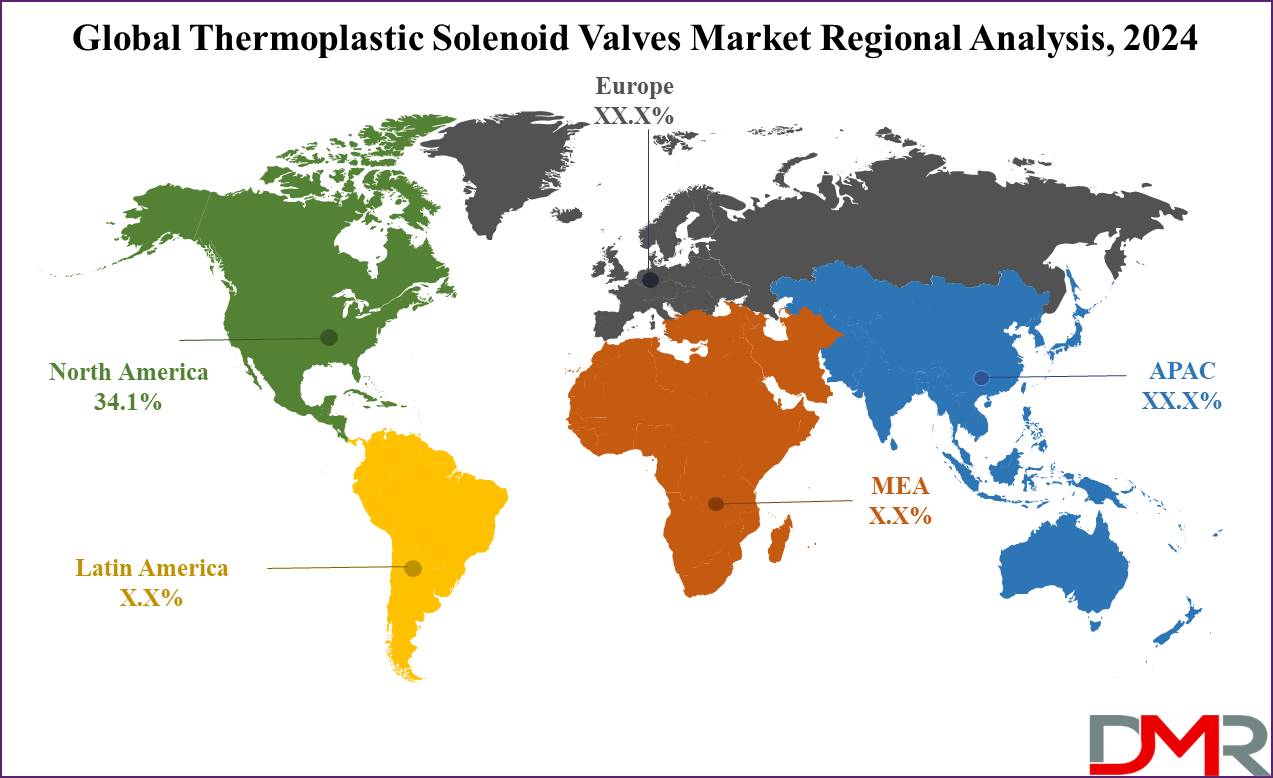

- Regional Insight: North America is expected to hold a 34.1% share of revenue in the Global Thermoplastic Solenoid Valves Market in 2024.

- Use Cases: Some of the use cases of Thermoplastic Solenoid Valves include HVAC systems, water treatment, and more.

Use Cases

- Fluid Control in Automotive Systems: Thermoplastic solenoid valves regulate fuel, coolant, or air in vehicles, provide corrosion resistance and durability in harsh environments

- Chemical Processing: These valves are utilized in handling corrosive chemicals. They provide reliability and chemical resistance in aggressive fluid systems.

- Water Treatment: Ideal for controlling the flow of clean or wastewater, they provide durability and resistance to scaling or chemical damage.

- HVAC Systems: Due to their minimal weight, and corrosion-resistant properties, they manage refrigerants or water flow in heating, ventilation, and air conditioning systems.

Market Dynamic

Driving Factors

Rising Demand for Chemical-Resistant Materials

The growing use of corrosive and aggressive fluids in industries like chemical processing, water treatment, and pharmaceuticals drives demand for thermoplastic solenoid valves due to their superior resistance to corrosion and chemicals compared to metal valves.

Expansion of Automotive and HVAC Industries

Growth in the automotive & HVAC sectors, where lightweight, durable, and cost-effective components are vital, expand the adoption of thermoplastic solenoid valves, which provide better efficiency and resistance to wear in these applications.

Restraints

Temperature Limitations

Thermoplastic solenoid valves may have lower heat tolerance in comparison to their metal counterparts, making them unsuitable for high-temperature applications, which can limit their adoption in industries demanding extreme temperature resistance.

Pressure-handling constraints

These valves generally have lower pressure resistance in comparison to metal valves, limiting their use in high-pressure environments, and thereby limiting their market potential in industries requiring robust pressure management solutions.

Opportunities

Growing Adoption in Green Technologies

The growing focus on sustainable solutions, like water conservation systems, renewable energy, and eco-friendly HVAC systems, provides opportunities for thermoplastic solenoid valves due to their lightweight, durable, and corrosion-resistant nature, which fits well with environmentally conscious applications.

Expansion in Emerging Markets

Fast industrialization and infrastructure development in emerging economies, mainly in sectors like automotive, water treatment, and chemical processing, offer growth opportunities for thermoplastic solenoid valves as the need for efficient, cost-effective, and corrosion-resistant components rises.

Trends

Increased Use of Advanced Polymer Materials

Current developments in polymer technology have led to the innovations of more durable and heat-resistant thermoplastic materials, enhancing the performance of solenoid valves in harsher environments, and expanding their applicability across industries.

Shift toward Miniaturization

There is a major trend toward smaller, more compact thermoplastic solenoid valves, driven by the demand for space-saving solutions in applications like automotive and

medical devices, where efficiency and precision in a smaller footprint are highly prioritized.

Research Scope and Analysis

By Type

Flanged-type thermoplastic solenoid valves are set to play a key role in the growth of the thermoplastic solenoid valve market in 2024 by offering easier installation and maintenance in comparison to traditional valves. These valves provide a protective and reliable connection, mainly in industries where the handling of corrosive or abrasive fluids is common, like water treatment, chemical processing, and wastewater management.

The flanged design allows for easy assembly and disassembly, minimizing downtime and operational costs. In addition, the use of thermoplastic materials makes these valves lightweight, corrosion-resistant, and affordable, making them suitable for a variety of applications. As industries highly focus on efficiency, durability, and cost savings, the need for flanged thermoplastic solenoid valves continues to grow, contributing to the overall growth of the market.

Further, threaded-type thermoplastic solenoid valves are growing steadily while contributing to market growth by offering a compact and easy-to-install solution, ideal for systems with space constraints. Their lightweight, corrosion-resistant design makes them suitable for many applications like water treatment, chemical handling, and

HVAC systems. The threaded connection ensures a secure fit while being simple to install and replace, making them an affordable and efficient choice for industries looking for reliable fluid control.

By Application

Water and wastewater management as an application is set to lead the thermoplastic solenoid valve market in 2024. These valves are broadly used in water treatment plants, irrigation systems, and sewage management due to their resistance to corrosion, chemicals, and scaling. Thermoplastic solenoid valves effectively control the flow of clean water, wastewater, and harsh chemicals used in treatment processes.

Their durability and affordability make them a preferred choice in environments where metal valves may fail due to rust or chemical reactions. As global water management efforts expand to address increase in populations and environmental concerns, the need for reliable, low-maintenance valves like thermoplastic solenoid valves continues to rise, driving growth in this market segment.

Further, in chemical processing, thermoplastic solenoid valves are vital due to their strong resistance to corrosive chemicals and aggressive fluids. Unlike metal valves, they don’t rust or degrade, making them perfect for handling acids, solvents, and other harsh substances.

Their lightweight and durable design helps minimize maintenance costs and downtime in chemical plants. As the chemical industry grows and looks for more efficient, long-lasting solutions, the need for thermoplastic solenoid valves continues to grow, helping in market growth.

The Thermoplastic Solenoid Valves Market Report is segmented on the basis of the following:

By Type

By Application

- Water & Water waste

- Food & Beverage

- Chemical Processing

- Petrochemical

- Others

Regional Analysis

North America plays a key role in the growth of the thermoplastic solenoid valve market due to its strong industrial base and focus on advanced technologies, where it is projected to

have 34.1% of the total market share in 2024. Industries like water treatment, chemical processing, and automotive manufacturing are well-developed in the region, driving demand for efficient and durable fluid control solutions.

The implementation for environmentally friendly and energy-efficient systems, mainly in the U.S. and Canada, further enhances the adoption of thermoplastic solenoid valves due to their corrosion resistance and lightweight design.

In addition, the region’s focus on upgrading aging infrastructure, mainly in water management and chemical industries, provides more opportunities for these valves.

Further, Asia Pacific is anticipated to be the fastest-growing region in the market due to rapid industrialization and urbanization, as countries like China and India are expanding their water treatment,

chemical processing, and manufacturing sectors, there is growth in the demand for reliable and cost-effective valves. Also, the region’s aim of improving infrastructure and adopting modern technologies drives the demand for durable, corrosion-resistant thermoplastic solenoid valves, supporting the market’s expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the thermoplastic solenoid valve market is characterized by a mix of established players & emerging companies, each looking for innovation and specialization. Key factors driving competition such developments in material technology, like better polymers, and the development of valves that provides better performance in many applications.

Companies compete on factors like product durability, efficiency, and cost-effectiveness. Market players also focus on customer support and customized solutions to meet specific industry needs, contributing to a dynamic and evolving market environment.

Some of the prominent players in the Global Thermoplastic Solenoid Valves are:

- AVFI

- Plast-O-Matic

- Burkert

- Norgren

- Lee Company

- Bimba Manufacturing

- Parker Hannifin

- SMC Corporation

- Festo

- Rotork

- Other Key Players

Recent Developments

- In August 2024, SMC Corporation launched a compact 5-port solenoid valve, as expanded the JSY3000 valve series in its latest iteration, providing access to optional pressure sensor compatibility and improving convenience and flexibility for industrial automation, as it offers flexible installation options in space-critical applications. The plug-in design provides convenience when it comes to installation or replacement, reducing downtime in the event of maintenance or swapping of components

- In August 2024, Rotork unveiled the addition of new features to the industry-leading IQ3 Pro range of intelligent actuators, which include higher speeds for the IQT3F Pro electric modulating actuators, independent open/close speeds for part-turn actuators, and closed-loop control for both multi-turn and part-turn actuators.

- In September 2023, Asahi/America, Inc. introduced a strategic partnership with McElroy Manufacturing, to provide industry-leading fusion equipment to the market, compatible with Asahi/America’s thermoplastic piping systems.

- In August 2022, PMC Hydraulics launched the Sun Common (SC) cavity cartridge valves, which are optimized for lower-pressure systems. These valves consist of a common SAE-style cavity, which is compliant to SAE cavity standard ISO 17209:2013.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 389.1 Mn |

| Forecast Value (2033) |

USD 641.6 Mn |

| CAGR (2024-2033) |

5.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 114.2 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Flanged, Jointed, and Threaded), By Application (Water & Water waste, Food & Beverage, Chemical Processing, Petrochemical, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AVFI, Plast-O-Matic, Burkert, Norgren, Lee Company, Bimba Manufacturing, Parker Hannifin, SMC Corporation, Festo, Rotork, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |