Blockchain in particular has emerged as a transformative force, offering real-time visibility into goods movement while decreasing fraud risk and providing secure cross-border payments. Such innovations promise to change how trade finance is administered by creating more agile and transparent systems.

Although these opportunities exist in this sector, structural challenges still abound in its operations. From regulatory complexities and rising compliance costs, to tightening credit policies at financial institutions and tighter access requirements for financing SMEs are among some of the main sources of disruptions to global trade.

Future prospects of trade finance offer substantial promise; its development hinges on addressing these obstacles effectively. Businesses and financial institutions that embrace technology, form strategic relationships, and navigate regulatory environments effectively will have the best chances to take advantage of emerging opportunities. Furthermore, improving accessibility and modernizing trade finance are vitally important to maintain growth while remaining competitive in an increasingly interdependent global marketplace.

Key Takeaways

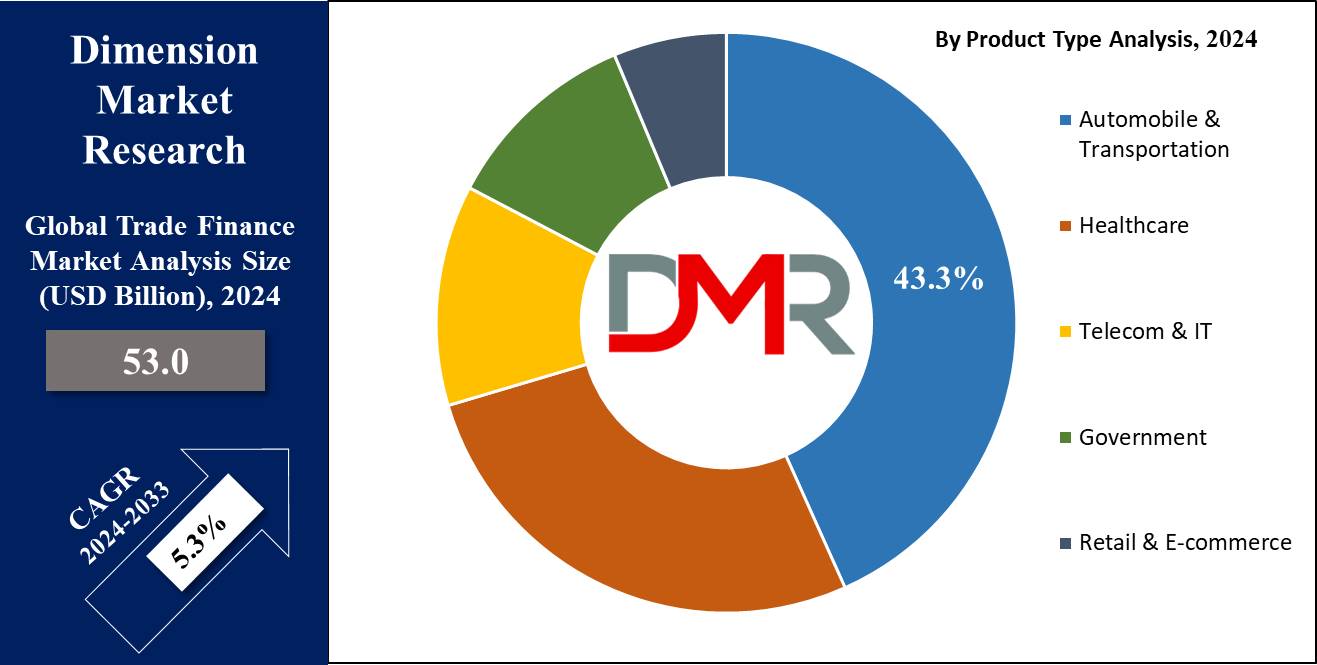

- Trade finance market size reaches USD 53.0 Bn in 2033 at a CAGR of 5.3%.

- Letters of Credit were the market-share leader among product types in 2023, accounting for an astounding 44.3% market share.

- Supply Chain Finance hNad captured 44.2% market share among finance type products by 2023.

- Banks held more than 55.6 % market share by 2023.

- Importers and Exporters held over 40.3% market share as end users in 2023.

- Asia Pacific dominates the global trade finance market, capturing 40.3% of the market share.

- Expansion of access to trade finance among SMEs represents an enormous growth potential.

- Integrating blockchain, AI and machine learning technology has revolutionized trade finance.

Use Cases

- Cross-Border Payments: Trade finance presents cross-border payments to international buyers and sellers in a secure and expeditious manner. it is free from such risks as currency fluctuation and nonpayment.

- Supply Chain Financing: Implementing the use of trade finance by firms involves the provision of extended payment terms to buyers and early payments to suppliers. This would further enhance increased liquidities throughout their supply chains.

- Letters of Credit: Businesses can use letters of credit as an allocation method for insurance relating to international trade transactions between an importer and exporter, ensuring payment occurs pursuant to the terms of their contract.

- Invoice Factoring: SMBs looking to quickly receive cash through a trade finance provider by selling their accounts receivable and who can benefit from immediate liquidity and have short-term working capital requirements can take this sort of agreement.

Driving Factors

Global Trade Expansion

Global trade activity has contributed significantly to expanding trade finance markets worldwide. Companies increasingly engage in cross-border transactions; according to World Trade Organization estimates, global merchandise trade volume will expand by 3.5% between now and 2024 - reflecting their continuous expansion - necessitating sophisticated financial solutions designed to ensure timely payment between buyers and sellers across different jurisdictions.

Trade finance instruments like letters of credit and export financing have become essential in mitigating risks associated with international trading operations, including currency fluctuations, geopolitical unrest and nonpayment issues. With businesses diversifying global supply chains further the demand for trade finance solutions will likely grow substantially - thus becoming a cornerstone of global commerce operations.

Trade Finance as an Engine of Business Continuity

Businesses' increasing need for working capital has also driven the trade finance market forward, fuelled by their need for working capital. Companies engaged in international trading often experience liquidity challenges due to long payment cycles and variable cash flows; trade finance provides essential liquidity that allows these businesses to bridge any gaps between shipment of goods and payment receipt. According to estimates by the International Chamber of Commerce (ICC), trade financing represents 80-90% of global trade activity highlighting its essential role.

As companies strive to maintain seamless production and supply chain functions, short-term financing solutions remain essential in driving market expansion. Trade finance's growing role as part of working capital management enables businesses to remain functional even during times of financial instability or disruptions in supply chains.

Recent Advancements in Digital Technology

Technological advancements such as blockchain and

artificial intelligence (AI), in particular, are revolutionizing the trade finance market by improving efficiency, transparency and security. Digital solutions have transformed traditionally manual processes by speeding them up considerably while mitigating fraud risks; blockchain provides real-time shipment tracking via secure payment channels while at the same time improving the visibility of trade transactions allowing faster settlement times and settlement speeds.

AI-powered tools are also being implemented to automate risk assessments and credit evaluations, further streamlining trade finance decision-making. A report released by Boston Consulting Group estimates digital trade finance could unlock $1.1 trillion globally by 2026; as these innovations gain ground they should help enhance businesses and financial institutions alike by offering smoother services that address inefficiencies while offering new growth opportunities for expansion in trade finance market.

Growth Opportunities

Blockchain Tech Enabling Transparency, Security, and Efficiency in Trade Finance

Blockchain offers transformational potential to the trade finance market in 2023 by providing secure and immutable records of trade transactions that allow verification processes to move faster while eliminating intermediaries and fraud risk, ultimately shortening transaction times while decreasing costs making cross-border trade more accessible and making cross-border trade cheaper than ever. According to estimates by World Economic Forum's report "World Economic Forum Estimates That Blockchain Could Increase Trade Volume by $1 Trillion By 2026", signifying its significance for financial institutions and businesses adopting this technology.

Digital Trade Platforms: Exploiting Market Expansion Through Process Optimization

Digital trade platforms represent another exciting development for the global trade finance market in 2023. By streamlining documentation, communication, transaction processing and payment into one digital interface - eliminating paperwork errors, administrative bottlenecks and manual labor bottlenecks while real-time tracking transactions, automating compliance checks and improving data accuracy they significantly boost operational efficiencies as well as transparency - not only appealing to larger enterprises but making trade finance accessible even smaller companies as digital transformation surges forward - these platforms could fuel exponential market expansion as demand accelerates further.

SME Financing: Facilitating Growth through Support of Underserved Small Businesses

SME (small and medium-sized enterprises) represent an untapped opportunity in trade finance. Accounting for around 90 of businesses worldwide, they can often struggle to gain access to traditional trade finance due to strict credit requirements. By tailoring solutions that specifically meet SMEs' unique requirements, financial institutions can open a whole new segment of the market - opening it further up for expansion during 2023 when these vital businesses play key roles in global supply chains.

Key Trends

Increased Automation to Strengthen Trade Finance Operations

By 2023, trade finance automation is projected to further advance due to increasing operational efficiencies and decreasing manual errors. Automated systems for invoicing, payments, compliance checks are replacing paper-based processes with computerized versions which speed transactions faster while decreasing administrative costs and errors for businesses of all sizes - according to one McKinsey report, automation could reduce operational costs by 30- 40% thus underscoring its growing role within the market.

Focusing on Real-Time Payments to Reducing Transaction Times

Real-time cross-border payments have emerged as another notable trend reshaping the trade finance market, providing businesses with faster settlement payments while improving cash flow management in an ever more globalized economy. Traditional trade financing transactions usually take several days or even weeks due to multiple intermediaries and time zones involved, yet real-time solutions allow business to complete payments faster - this trend proves especially valuable given how important speedy cross-border trade transactions can be for overall economic health!

Smart Contracts in Trade Finance

Smart contracts have quickly become an invaluable tool in trade finance, offering an efficient means of automating and enforcing trade agreements securely. Execution occurs automatically once predetermined conditions have been fulfilled - eliminating intermediaries altogether while decreasing risks related to disputes and increasing efficiency while providing greater transparency and security in transactions.

AI and Machine Learning

AI and

machine learning technologies are revolutionizing trade finance by streamlining risk evaluation processes, fraud detection methods and decision-making procedures. By continuously processing massive volumes of data in real time, these AI systems can quickly identify any potential risks while streamlining credit evaluation procedures while also detecting anomalies indicative of fraud - ultimately making trade finance safer than ever.

Restraining Factors

Regulatory Challenges

Regulation represents one of the major constraints to growth within the trade finance market, particularly for international transactions. Regulation in various countries often places stringent compliance obligations upon businesses and financial institutions operating therein. These regulations, designed to mitigate risks such as money laundering, terrorist financing and sanctions violations can significantly delay adoption of trade finance services. Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements have significantly burdened financial institutions, prolonging and increasing costs related to trade finance transactions approval and execution processes.

According to a report released by the International Chamber of Commerce (ICC), 45% of banks identify regulatory requirements as one of the main obstacles to trade finance expansion. Lacking harmonized global standards exacerbates this situation further and creates operational inefficiency - particularly among small and midsized enterprises (SMEs) struggling with meeting stringent compliance demands; further restricting trade finance services thus hampering market expansion.

Cybersecurity and Fraud Risks

As trade finance becomes more digitalized, security breaches and fraud become an ever-greater risk to its market. Financial institutions and businesses increasingly relying on digital trade finance platforms increase the risks of cyber attacks, data breaches and fraud while trade transactions often involve sensitive commercial or financial data which make it easy for cybercriminals to breach trust in these digital solutions; invoice fraud or identity theft further compound this challenge for trade financiers.

Kaspersky reported that financial services firms account for 55% of cyber attacks against organizations worldwide, underscoring its scope. Although technologies like blockchain and AI aim to enhance security and transparency, many organizations remain cautious about fully adopting digital trade finance solutions because of perceived risks involved - thus postponing widespread adoption as well as market digitization efforts.

Research Scope and Analysis

By Product Type

Letters of Credit held the leading product type position within the trade finance market in 2023, representing 44.3 % of total market share. They remain one of the best instruments to mitigate cross-border trade risk mitigation while offering secure payment solutions to both importers and exporters alike. Their popularity can be attributed to providing high levels of protection and trustworthiness during international transactions.

Export Factoring has gained significant traction among small and medium-sized enterprises (SMEs). This segment continues to experience steady growth thanks to its ability to provide immediate cash flow by selling receivables at discounted rates; making this solution especially appealing for exporters with lengthy payment cycles or needing short-term financing - contributing significantly to overall trade finance market development.

Insurance products in trade finance that protect businesses against political and commercial risks have also become essential components of international trading activities. This segment continues to gain significance as companies attempt to secure themselves against geopolitical instability, currency risks and the possible default of trading partners.

Bills of Lading play an invaluable part in global trade by serving as contracts of carriage and proofs of ownership documents. Electronic bills of lading (eBL) will likely increase with the digitization of trade finance processes boosting this segment's expansion further.

Guarantees are another key product in trade finance, providing both buyers and sellers with security by guaranteeing contract fulfillment. Demand has remained strong, especially within large infrastructure projects or emerging markets.

Other instruments, including forfeiting and promissory notes, continue to meet niche market needs while contributing to the overall diversity of trade finance products.

By Finance Types

Supply Chain Finance was the undisputed market leader among finance types within trade finance in 2023, accounting for 44.2% of the market share overall. It's thought this market share can be attributed to Supply Chain Finance's ability to optimize working capital management for both buyers and suppliers by providing extended payment terms while simultaneously encouraging early payment from suppliers. Furthermore, rising supply chain complexity combined with rising liquidity needs have driven its widespread use across multiple industries as the preferred financing solution.

Structured Trade Finance has experienced exponential expansion among corporations and financial institutions operating in emerging markets, particularly large corporations and institutions with global operations. This segment provides tailored solutions that reduce risks while financing high-value cross-border transactions like commodities trading or infrastructure projects spanning various jurisdictions and currencies. Demand continues to surge among businesses seeking more sophisticated tools for funding large-scale trade activities.

Traditional Trade Finance remains an indispensable element of global trade finance markets, offering long-established instruments like letters of credit, bank guarantees, and trade loans. Even as digital and supply chain solutions gain in prominence, traditional trade financing still plays a crucial role for industries and regions where regulatory frameworks can be complex or trust is critical; even as its market share gradually decreases in favor of more advanced solutions like blockchain financing solutions or supply chain finance platforms - traditional trade finance will always provide businesses with reliable funding mechanisms they can rely on.

By Service Provider

Banks dominated the service provider segment of the trade finance market in 2023, holding 55.6% market share as service providers. Banks continue to hold onto this leadership due to their extensive global networks, strong financial capabilities, and trust-worthy cross-border transaction management services; offering letters of credit, guarantees, structured financing solutions such as letter of credit guarantee programs. Increasingly banks invest in digital platforms and technologies like blockchain for better service offerings while keeping an edge.

Trade Finance Houses play an essential role in today's marketplace, serving both niche segments and more specialized trade finance needs. These entities tend to be more agile than banks in providing tailored solutions for complex or high-risk transactions; their importance increases dramatically in emerging markets where regulatory or operational hurdles prevent smaller businesses from accessing traditional bank financing solutions directly. As more businesses seek alternative trade finance options that offer greater flexibility and faster transaction processing times this is becoming an ever-increasing segment of the industry.

Other providers such as fintech firms and alternative lenders are becoming key components of the trade finance ecosystem, using cutting-edge digital technologies to offer faster and more accessible supply chain financing and invoice factoring options than traditional methods. Their rapid rise is gradually shifting the competitive landscape within this segment, especially among SMEs.

By End-User

Importers and Exporters were the clear leaders of the end-user trade finance market in 2023, accounting for more than 40.3% of its market share. This can be explained by trade finance's essential role in supporting cross-border transactions while guaranteeing liquidity while mitigating risks such as nonpayment and currency fluctuations; importers and exporters heavily relied upon various trade finance instruments like letters of credit, guarantees, supply chain financing etc. to streamline operations while optimizing working capital management within today's increasingly complex global trade environment.

Banks and financiers make up another essential segment of the market, acting as intermediaries and offering essential assistance as intermediaries. Banks in particular play an instrumental role by offering financing solutions that allow companies to expand their international trade activities while mitigating risks through trade finance services such as transaction payments, documentary credits management, credit extension lines or payment security solutions. With digital platforms becoming more prevalent banks have also adopted new technologies to streamline processes more efficiently while offering their clients efficient solutions.

Insurers and Export Credit Agencies (ECAs) play an essential role in safeguarding transactions by offering insurance products that protect against risks such as political instability, default and bankruptcy. ECAs in particular play an instrumental role in encouraging trade with emerging markets where risks are higher; providing government guarantees as well as insurance products designed to mitigate trade risk is something ECAs excel at doing.

Logistics companies and freight forwarders also contribute to trade finance by managing physical movement of goods as well as providing necessary documentation and services that supplement financial transactions. Furthermore, these entities increasingly employ digital tools in line with evolving trade needs worldwide.

The Trade Finance Market Report is segmented based on the following:

By Product Type

- Letters of Credit

- Export Factoring

- Insurance

- Bill of Lading

- Guarantees

- Others

By Finance Type

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

By Service Provider

- Banks

- Trade Finance Houses

- Others

By End User

- Importers and Exporters

- Banks and Financiers

- Insurers and Export Credit Agencies

- Others

Regional Analysis

Asia Pacific led the global trade finance market in 2023 with a 40.3% market share, thanks to significant trade activities between key economies like China, Japan, South Korea and India. Asia Pacific's position as a manufacturing hub combined with adoption of digital trade finance solutions further contributed to its dominance within this market; also driving increased cross-border trade is growing demand for trade finance instruments like letters of credit and guarantees within this region.

North America holds an exceptional place in the trade finance market due to its superior financial infrastructure and robust trading relationships between its three countries: U.S., Canada and Mexico. North American trade finance operations are driven by digital platforms and technologies like blockchain and artificial intelligence (AI), which increase efficiency and transparency while the U.S. dominates this space with nearly 40% market share.

Europe is home to some major financial institutions and strong intra-regional trade within the European Union, supporting an attractive trade finance market. Countries like Germany, UK and France play key roles as main contributors with well-established banking sectors providing robust trade finance solutions. Furthermore, ECAs provide protection for trade risks in this market region.

Middle East & Africa trade finance services have experienced strong expansion due to rapidly developing trade routes and economic partnerships between Asia and Europe. Oil & gas exports as well as infrastructure projects necessitating trade finance services help support this market in particular.

Latin America has experienced moderate expansion of the trade finance market, with key economies like Brazil and Mexico benefiting from trade agreements between North America and Europe. While political unrest and economic fluctuations remain obstacles to market development in this region, digital trade finance solutions have gradually been adopted over time to aid market expansion.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 promises to be an intensely competitive global trade finance market, dominated by such players as Asian Development Bank (ADB), BNP Paribas S.A., Citigroup Inc. Euler Hermes Group Bank of America Corporation HSBC Holdings PLC Royal Bank of Scotland Group plc Standard Chartered PLC JPMorgan Chase & Co, Mitsubishi UFJ Financial Inc and others that drive both growth and innovation in this space.

Asian Development Bank (ADB) plays an essential role in encouraging trade development across emerging economies in Asia through its Trade Finance Program, offering guarantees and loans that facilitate international commerce in developing economies by increasing liquidity while mitigating risk where access to trade finance might otherwise be limited.

BNP Paribas S.A. and HSBC Holdings PLC are leading players in Europe and Asia when it comes to trade finance solutions, offering letters of credit, guarantees, supply chain finance and more. Both institutions use their extensive global networks and advanced digital platforms to boost efficiency and ensure transparency during each trade finance transaction.

Citigroup Inc. and JPMorgan Chase & Co. are two dominant forces in North America that specialize in digital innovation and blockchain solutions to streamline trade finance operations. Due to their global reach and dedication to technology, both firms lead in transitioning towards automated and secure trade finance systems.

Euler Hermes Group stands as a pioneering trade credit insurer, offering risk mitigation solutions tailored to exporters - making international trade safer by protecting against nonpayment risks.

Mitsubishi UFJ Financial Inc. and Standard Chartered PLC are two key Asian banks supporting regional and global trade flows with digital technologies to enhance trade finance processes more efficiently, shaping the market through innovation aimed at meeting real-time, secure transactions.

Some of the prominent players in the Global Trade Finance Market are:

- Asian Development Bank

- BNP Paribas S.A.

- Citigroup Inc.

- Euler Hermes Group

- Bank of America Corporation

- HSBC Holdings PLC

- The Royal Bank of Scotland Group plc

- Standard Chartered PLC

- JPMorgan Chase & Co

- Mitsubishi UFJ Financial Inc.

Recent developments

- In April 2023, Global Shipping Business Network (GSBN) and HSBC conducted a proof-of-concept utilizing confidential computing as part of an effort to fill a trillion-dollar trade finance gap. This technology enhances privacy and security by protecting data at its hardware level - using blockchain for data sharing while still offering auditability if desired.

- Exim Credit Bank in the UAE also embarked on its ambitious mission in April 2023: revolutionizing trade financing for small and medium enterprises (SMEs), importers, and exporters by providing cash flow support, meeting compliance obligations, and offering security. They collaborated with financial institutions as well as private sector partners.

- India Exim Bank established a subsidiary in Gujarat's GIFT City on August 20, 2023 to offer factoring services, providing Indian exporters immediate access to funds while expanding trade finance options.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 53.0 Bn |

| Forecast Value (2033) |

USD 84.3 Bn |

| CAGR (2024-2033) |

5.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type(Letters of Credit, Export Factoring, Insurance, Bill of Lading, Guarantees, Others), By Finance Type(Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), Service Provider(Banks, Trade Finance Houses, Others), By End User(Importers and Exporters, Banks and Financiers, Insurers and Export Credit Agencies, Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Asian Development Bank, BNP Paribas S.A., Citigroup Inc., Euler Hermes Group, Bank of America Corporation, HSBC Holdings PLC, The Royal Bank of Scotland Group plc, Standard Chartered PLC, JPMorgan Chase & Co, Mitsubishi UFJ Financial Inc. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |