Market Overview

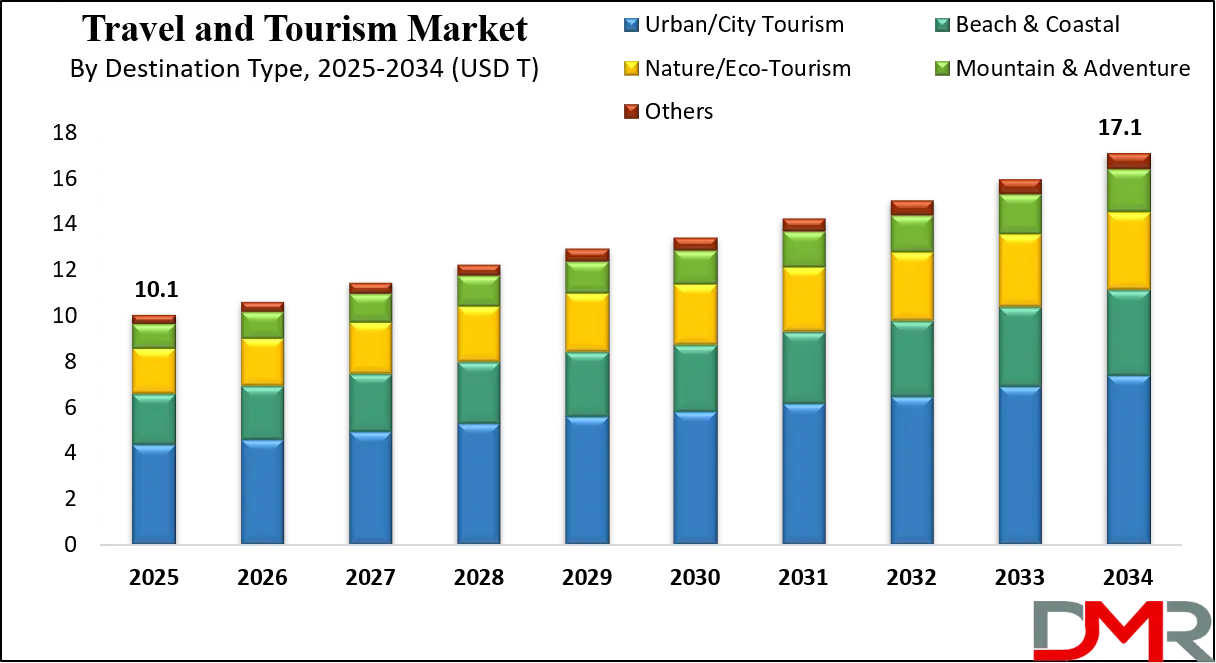

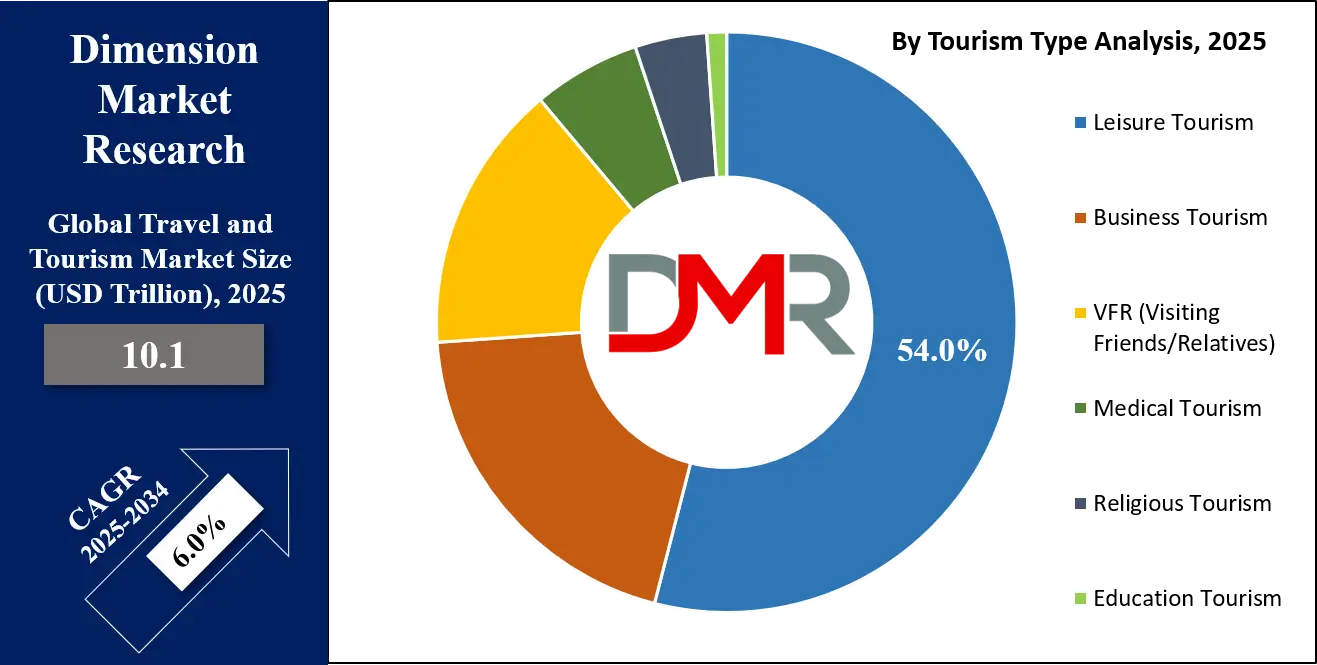

The global travel and tourism market is projected to reach USD 10.1 trillion in 2025 and grow to USD 17.1 trillion by 2034, expanding at a CAGR of 6.0%. Rising international arrivals, digital travel services, and growing demand for leisure, business, and sustainable tourism experiences drive this growth.

Travel and tourism refer to the movement of people from one location to another, whether domestically or internationally, for purposes such as leisure, business, health, religious pilgrimage, or education. It encompasses all activities undertaken during travel, including transportation, accommodation, food and beverage services, entertainment, and shopping.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

As a multifaceted sector, it involves a wide network of industries like airlines, hotels, travel agencies, tour operators, cruise lines, and destination management companies, all working together to enhance the traveler's experience. The travel and tourism industry plays a vital role in cultural exchange, economic development, and global connectivity by fostering cross-border relationships and generating employment and income in both developing and developed regions.

The global travel and tourism market represents one of the largest and fastest-evolving sectors of the world economy, driven by rising disposable incomes, growing middle-class populations, and increased access to digital booking platforms. International tourism has seen a robust recovery after the pandemic-induced slowdown, with significant demand for experiential travel, wellness retreats, and eco-tourism. Consumers today prioritize personalized travel experiences, digital convenience, and sustainable practices, creating new opportunities for service providers and technology innovators alike. Emerging economies are particularly noteworthy, contributing to a shift in traveler demographics and influencing global tourism flows.

As global mobility resumes and restrictions ease, tourism-related infrastructure is expanding at a rapid pace, particularly in regions such as Southeast Asia, the Middle East, and Latin America. Governments and private stakeholders invest heavily in smart tourism initiatives, destination branding, and infrastructure modernization to attract international tourists and enhance competitiveness.

The rise of digital nomads, adventure seekers, and bleisure travelers is redefining traditional travel patterns, prompting the integration of co-working facilities, wellness services, and remote working accommodations in travel packages. These evolving traveler expectations are reshaping the entire value chain of the tourism ecosystem, from airline route planning to hospitality design and on-demand concierge services.

The future of the global travel and tourism market is being shaped by a synergy of technological advancement and changing consumer behavior. Tour operators and travel platforms are adopting artificial intelligence, virtual reality, and predictive analytics to enhance customer engagement and streamline itinerary planning.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Meanwhile, climate-conscious travel is gaining momentum, with travelers actively seeking carbon-neutral options, green-certified accommodations, and community-based tourism models. As sustainability becomes a core tenet of the industry, businesses are aligning with global environmental goals to reduce emissions, conserve resources, and promote responsible tourism. This strategic transformation not only supports long-term profitability but also reinforces the social and ecological value of global tourism.

The US Travel and Tourism Market

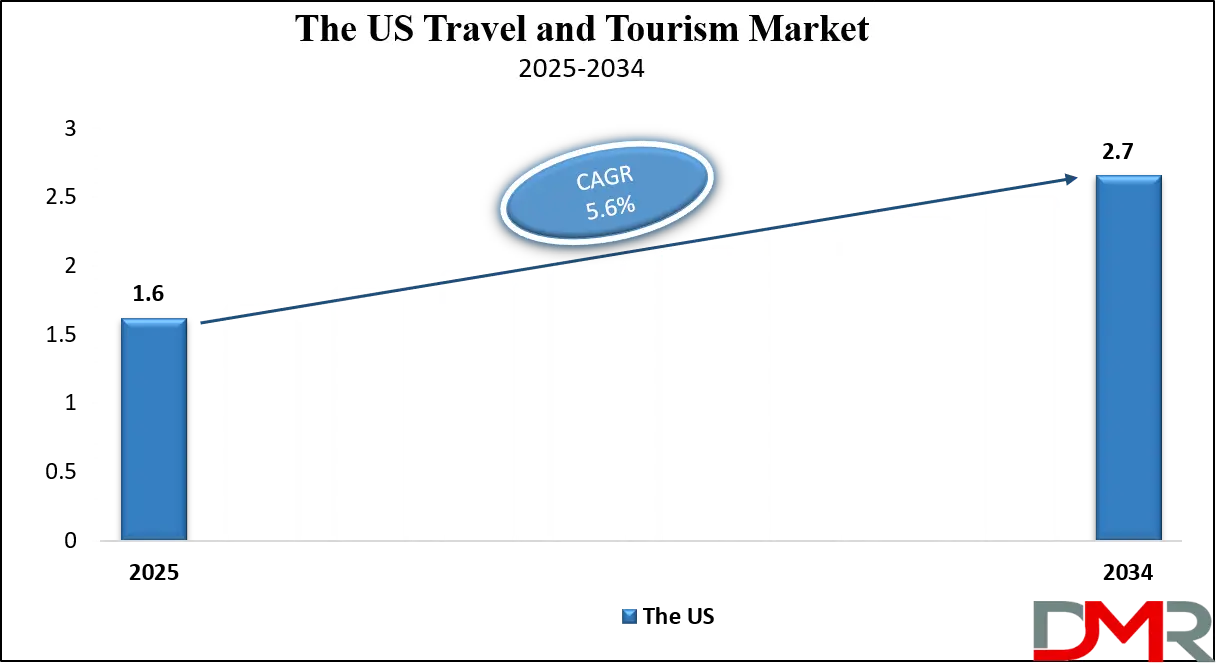

The U.S. Travel and Tourism Market size is projected to be valued at USD 1.6 trillion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.7 trillion in 2034 at a CAGR of 5.6%.

The U.S. travel and tourism market remains one of the most dynamic and mature sectors globally, supported by a diverse domestic landscape, advanced infrastructure, and a wide range of traveler demographics. From iconic urban destinations like New York and Los Angeles to natural attractions such as national parks, beaches, and mountain ranges, the country offers a broad spectrum of experiences that cater to both domestic and international travelers.

The integration of technology across the tourism value chain has enhanced the booking process, travel planning, and in-trip services, further strengthening the U.S. position as a leading tourism hub. Additionally, the presence of strong hospitality brands, a competitive airline industry, and a well-established road network ensures high accessibility and convenience across the travel ecosystem.

Shifts in traveler behavior, especially post-pandemic, have significantly reshaped the U.S. tourism landscape. There is a marked increase in interest toward experiential travel, wellness tourism, and off-the-beaten-path destinations, with travelers seeking authentic and immersive experiences over conventional sightseeing. Adventure tourism, cultural heritage exploration, and sustainable travel practices are gaining traction among younger travelers and environmentally conscious tourists.

The rise of remote work has also fueled the trend of "workations" and extended stays, prompting hotels and vacation rentals to adapt their offerings. Coupled with strong support from government policies promoting domestic tourism and infrastructure investment, the U.S. travel and tourism industry continues to evolve in alignment with global trends and consumer expectations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Travel and Tourism Market

Europe travel and tourism market is projected to generate approximately USD 4.5 trillion in revenue in 2025, underscoring its position as the largest regional contributor to the global industry. This substantial market share reflects Europe’s unparalleled appeal as a premier travel destination, enriched by its diverse cultural heritage, historic cities, world-famous landmarks, and varied landscapes ranging from scenic coastlines to alpine retreats.

The region’s mature tourism infrastructure, including extensive air, rail, and road connectivity, supports seamless travel experiences for millions of domestic and international visitors each year. Moreover, Europe’s strong emphasis on sustainable tourism and digital innovation enhances visitor engagement and operational efficiency, further solidifying its market dominance.

The market is expected to grow steadily at a compound annual growth rate (CAGR) of 3.5%, driven by consistent demand from both leisure and business travelers. Emerging trends such as personalized travel experiences, increased interest in eco-friendly destinations, and cultural tourism are fueling growth across key European countries like France, Italy, Spain, and Germany.

Additionally, ongoing investments in tourism infrastructure, hospitality upgrades, and technology adoption contribute to improved service quality and competitiveness. Despite challenges such as geopolitical uncertainties and fluctuating travel regulations, Europe’s robust tourism ecosystem and diverse appeal continue to attract a broad spectrum of traveler segments, ensuring sustained market expansion and economic contribution in the coming years.

The Japan Travel and Tourism Market

Japan travel and tourism market is projected to reach approximately USD 258 billion in 2025, reflecting its growing importance within the Asia-Pacific region and the broader global landscape. Known for its unique blend of ancient traditions and cutting-edge modernity, Japan attracts travelers seeking cultural heritage, natural beauty, and innovative urban experiences.

The country’s tourism appeal is enhanced by iconic destinations such as Tokyo, Kyoto, Osaka, and Hokkaido, which offer a rich variety of attractions from historic temples and festivals to world-class shopping and technology hubs. Japan’s strong focus on quality hospitality, safety, and efficient transportation systems further contributes to its rising market share.

The market is expected to grow at a compound annual growth rate (CAGR) of 4.0%, supported by both domestic travel recovery and growing inbound tourism fueled by government initiatives like the Japan Tourism Agency’s strategic promotion campaigns. Efforts to expand international accessibility, including enhanced visa policies and upgraded airport infrastructure, are making it easier for global travelers to explore the country.

Additionally, rising interest in niche tourism segments such as wellness tourism, culinary experiences, and eco-tourism is driving further market growth. Despite occasional challenges such as natural disasters and global economic fluctuations, Japan’s travel and tourism sector remains resilient, poised for steady expansion and greater contribution to the nation’s economy.

Global Travel and Tourism Market: Key Takeaways

- Market Value: The global travel and tourism market size is expected to reach a value of USD 17.1 trillion by 2034 from a base value of USD 10.1 trillion in 2025 at a CAGR of 6.0%.

- By Tourism Type Segment Analysis: Leisure Tourism is poised to consolidate its dominance in the tourism type segment, capturing 54.0% of the total market share in 2025.

- By Traveler Type Segment Analysis: Family Travelers are expected to dominate the traveler type segment, capturing 32.0% of the total market share in 2025.

- By Spending Behavior Segment Analysis: Mid-Range Spenders are anticipated to maintain their dominance in the spending behavior segment, capturing 60.0% of the total market share in 2025.

- By Booking Channel Segment Analysis: Online Travel Agencies (OTAs) are projected to lead the booking channel segment, capturing 35.0% of the total market share in 2025.

- By Duration of Travel Segment Analysis: Medium Trips (4–7 days) will dominate the duration of travel segment, capturing 40.0% of the market share in 2025.

- By Destination Type: Urban/City Tourism will lead the destination type segment, capturing 43.0% of the market share in 2025.

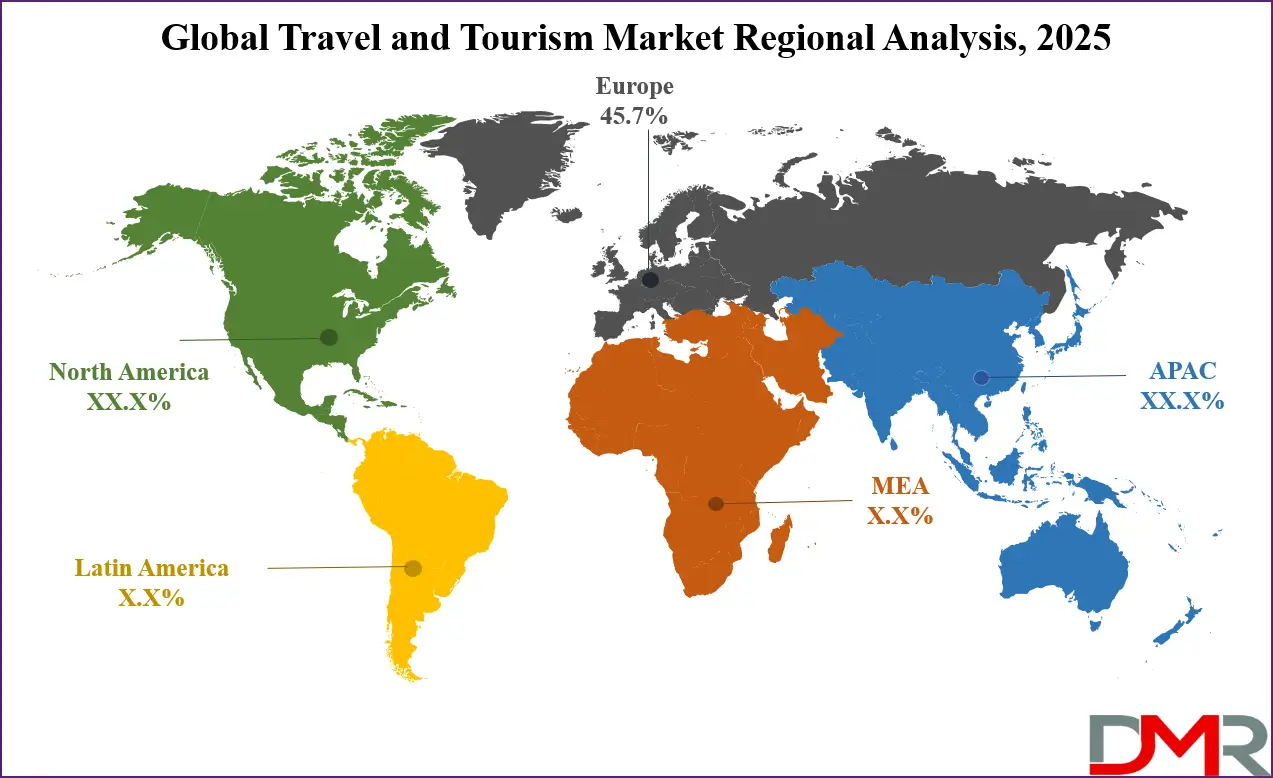

- Regional Analysis: Europe is anticipated to lead the global travel and tourism market landscape with 45.7% of total global market revenue in 2025.

- Key Players: Some key players in the global travel and tourism market are Booking Holdings, Expedia Group, Airbnb, Trip.com Group, TUI Group, Marriott International, Hilton Worldwide, InterContinental Hotels Group (IHG), Carnival Corporation, Royal Caribbean Group, Delta Air Lines, American Airlines Group, United Airlines Holdings, Emirates Group, Qatar Airways, and other key players.

Global Travel and Tourism Market: Use Cases

- Smart Destination Management through Predictive Analytics: With the rise of big data and AI in tourism, destination management organizations (DMOs) are using predictive analytics to monitor tourist flows, optimize infrastructure, and enhance visitor experiences. For instance, by analyzing real-time data from mobile apps, social media, and geolocation services, cities can predict peak tourist seasons, anticipate overcrowding, and manage resource allocation accordingly. This enables smarter urban tourism planning and improves sustainability by reducing environmental stress on heritage sites and natural attractions. These intelligent systems also support travel personalization, allowing destinations to promote lesser-known attractions and distribute tourist traffic more evenly. This use case exemplifies how digital transformation is reshaping destination competitiveness in global tourism.

- Integrated Travel Ecosystems for Seamless Booking and Mobility: Travelers demand frictionless experiences, from booking to arrival and onward movement. Global tourism platforms and hospitality providers are collaborating to create integrated travel ecosystems that combine flights, accommodation, ground transport, and activities into a single interface. This seamless integration is enabled by APIs, cloud-based travel management systems, and AI-driven itinerary planners. For example, a traveler booking a vacation through an online travel agency (OTA) can automatically receive bundled offers on airport transfers, travel insurance, and local experiences. This model supports omnichannel travel commerce, increases customer satisfaction, and enhances cross-sell opportunities for travel companies and tourism boards alike.

- Sustainable Tourism Initiatives in Emerging Markets: As climate consciousness grows, tourism stakeholders are investing in eco-friendly travel experiences, especially in biodiversity-rich regions like Southeast Asia, Sub-Saharan Africa, and Latin America. Governments, NGOs, and private operators are promoting low-impact ecotourism, community-based tourism, and carbon-neutral travel to preserve natural habitats and empower local communities. These initiatives are supported by environmental certifications, green hotel audits, and conservation-led tour planning. Tourists are also using carbon calculators to offset emissions and choosing transport modes that align with green tourism values. This use case highlights the rising demand for responsible tourism and how sustainability has become a core pillar in the long-term viability of the global travel industry.

- Travel Recovery and Resilience Planning for Post-Crisis Scenarios: The COVID-19 pandemic underscored the vulnerability of the tourism industry to global disruptions. In response, companies and governments are now prioritizing resilience planning through diversified tourism portfolios and risk-mitigation strategies. Use cases include the development of crisis response playbooks, agile pricing models, flexible booking policies, and health-safety certification programs. Airlines, cruise lines, and hotel chains are deploying advanced demand forecasting tools to adjust supply and pricing based on changing market conditions. This strategic shift supports travel market recovery, builds traveler confidence, and ensures operational continuity in future crises, whether due to pandemics, geopolitical instability, or climate-related events.

Global Travel and Tourism Market: Stats & Facts

World Tourism Organization (UNWTO)

- International tourist arrivals reached 1.4 billion globally in 2023, nearing pre-pandemic levels.

- Tourism accounted for approximately 10.6% of global GDP in 2023.

- The sector employed around 330 million people worldwide, representing about 10% of total employment.

- Asia-Pacific saw the fastest recovery with a 15% increase in international arrivals in 2023.

- Europe received over 50% of global international tourist arrivals in 2023.

- Sustainable tourism initiatives were adopted by over 70% of national tourism organizations globally.

- Domestic tourism accounts for roughly 65% of total tourism expenditure worldwide.

- The average length of stay for international tourists globally was 8.1 nights in 2023.

- Over 80% of tourists used online platforms for booking accommodations and travel in 2023.

- Cultural tourism constitutes around 40% of global tourism activities.

World Bank

- International tourism receipts globally were estimated at USD 1.7 trillion in 2023.

- Tourism-related exports contribute about 30% of total service exports in developing countries.

- Air transport accounts for over 55% of international tourist travel worldwide.

- Tourism contributes nearly 25% of GDP in some small island developing states (SIDS).

- Investments in tourism infrastructure increased by 7% annually on average between 2018 and 2023.

- Women represent approximately 54% of the workforce in the global tourism sector.

- The growth in middle-class consumers in emerging economies is expected to increase outbound tourism by 5-7% annually through 2030.

- Digital payments in the travel sector grew by 40% between 2020 and 2023.

- Tourism’s carbon footprint accounts for about 8% of global greenhouse gas emissions.

- Over 60% of new tourism jobs are created in rural or less developed regions.

International Air Transport Association (IATA)

- Passenger traffic in global commercial aviation increased by 12% in 2023 compared to 2022.

- Low-cost carriers accounted for 35% of total passenger traffic worldwide in 2023.

- Air cargo related to tourism goods and services represents nearly 15% of global air freight volume.

- The number of active global commercial aircraft reached 28,000 in 2023.

- The average load factor (seat occupancy) for passenger flights was 81.5% in 2023.

- Sustainable aviation fuel usage in the commercial aviation sector increased by 50% in 2023.

- Asia-Pacific is the fastest-growing air travel market, with a CAGR of 6.5% over the past five years.

- Safety standards in international aviation continue to improve, with accident rates decreasing by 25% over the last decade.

- Over 50% of airline passengers booked their flights online in 2023.

- Government investments in airport infrastructure have increased by 10% annually since 2020.

Global Travel and Tourism Market: Market Dynamics

Global Travel and Tourism Market: Driving Factors

Rising Middle-Class Population and Disposable Incomes

As emerging economies in Asia-Pacific, Latin America, and Africa experience significant growth in their middle-class demographics, there is a surge in outbound travel demand. Increased disposable income allows more individuals and families to participate in domestic and international tourism. This financial upliftment fuels demand for affordable air travel, mid-range hotels, and curated travel packages, expanding market reach across segments such as leisure tourism, cultural exploration, and family vacations.

Digital Transformation and Mobile Travel Ecosystems

The widespread adoption of smartphones and mobile apps has revolutionized how travelers search, plan, and book trips. With online travel agencies (OTAs), real-time flight tracking, digital check-ins, AI-powered itinerary tools, and voice-assisted booking, the user experience has become frictionless and personalized. These advancements in travel technology drive higher engagement, conversion rates, and brand loyalty, especially among tech-savvy Gen Z and millennial travelers.

Global Travel and Tourism Market: Restraints

Geopolitical Instability and Travel Restrictions

Political conflicts, terrorism threats, visa policy uncertainties, and cross-border tensions can significantly disrupt travel flows. For example, diplomatic standoffs or trade sanctions often lead to a reduction in tourist arrivals and outbound traffic. These geopolitical risks not only impact traveler sentiment but also force airlines, tour operators, and cruise lines to alter routes, delay investments, or pull out of specific markets altogether.

Environmental Concerns and Over-Tourism

The growing strain on natural and cultural heritage sites due to mass tourism is leading to regulatory crackdowns and capacity limits. Destinations like Venice, Machu Picchu, and parts of Southeast Asia are imposing visitor caps or introducing sustainable tourism taxes. Public awareness around carbon emissions, ecological degradation, and climate change is also pushing travelers toward alternative destinations or slower travel methods, which can limit short-term revenues for traditional tourism hotspots.

Global Travel and Tourism Market: Opportunities

Growth of Experiential and Wellness Tourism

Modern travelers are shifting away from transactional vacations and toward immersive, transformative experiences. This includes yoga retreats, culinary tours, wildlife conservation trips, and local cultural interactions. Experiential tourism offers high-margin opportunities for businesses and destinations that focus on authenticity, personalization, and local storytelling. Wellness tourism, in particular, is expanding rapidly, driven by growing mental health awareness and the demand for rejuvenation-focused escapes.

Untapped Potential in Secondary Cities and Rural Destinations

There is growing interest in promoting lesser-known destinations to reduce pressure on overcrowded hotspots and diversify tourist spending. Governments and tour operators are now investing in infrastructure, connectivity, and digital visibility for Tier-2 cities and rural regions. These emerging destinations provide a fresh appeal to adventure seekers, solo travelers, and those pursuing authentic, slow-paced journeys, thereby broadening the global tourism map.

Global Travel and Tourism Market: Trends

Rise of Sustainable and Responsible Travel

Travelers are conscious of their environmental and social impact, opting for eco-certified hotels, carbon-neutral flights, and ethical wildlife tours. Sustainable travel practices such as zero-waste tourism, digital boarding passes, and support for local artisans are becoming mainstream. Tour operators and hospitality brands are adapting by incorporating green technology, reducing plastic use, and promoting community-based tourism models.

Personalization through AI and Big Data

Artificial intelligence and data analytics are enabling hyper-personalized travel experiences. From AI-based travel chatbots and recommendation engines to machine learning-driven pricing strategies, businesses are leveraging traveler data to offer curated itineraries, dynamic discounts, and real-time alerts. This trend enhances customer satisfaction and operational efficiency, setting new standards in how modern tourism services are delivered.

Global Travel and Tourism Market: Research Scope and Analysis

By Tourism Type Analysis

Leisure Tourism is expected to retain its leadership in the tourism type segment, commanding approximately 54.0% of the total market share in 2025, driven by a strong post-pandemic rebound, rising consumer interest in wellness travel, and a growing preference for personalized and experience-driven holidays. This segment includes travel for recreation, vacations, cultural exploration, adventure, and relaxation, encompassing a broad range of subcategories such as beach holidays, nature retreats, theme park visits, and culinary tourism.

Factors such as growing disposable income, improved air connectivity, and the influence of social media and travel influencers continue to amplify interest in leisure-focused travel. Additionally, the proliferation of online travel agencies, mobile booking platforms, and last-minute travel deals has made leisure travel more accessible and convenient across all age groups and income brackets. Popular travel trends like solo travel, family vacations, and luxury getaways also contribute to the segment's sustained momentum.

Business Tourism, also known as corporate or MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism, plays a vital role in the global travel ecosystem, despite accounting for a comparatively smaller share than leisure tourism. This segment involves travel associated with professional purposes, including conferences, trade fairs, corporate events, client meetings, and employee incentive trips.

Business tourism often generates higher per-trip spending due to premium-class travel, upscale accommodations, and professional services, which contribute significantly to local economies, especially in urban centers and financial hubs. While it faced a temporary decline due to the rise of virtual meetings and hybrid work models during the pandemic, there has been a steady resurgence fueled by the return of in-person networking events and global trade expos.

Major cities are expanding their convention infrastructure and offering business-friendly travel packages to attract corporate travelers. Business tourism also creates opportunities for cross-sector collaboration, including hospitality, logistics, tech solutions, and event management services, making it a crucial pillar of the broader tourism industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Traveler Type Analysis

Family Travelers are projected to dominate the traveler type segment in 2025, accounting for approximately 32.0% of the total market share. This dominance is driven by a growing emphasis on multi-generational travel, improved family-focused hospitality offerings, and rising disposable income among working parents globally. Family tourism includes vacations with children, elderly members, and sometimes extended relatives, making it a high-value segment due to longer stays, diverse activity preferences, and higher per-trip expenditure.

Destinations and service providers are tailoring their offerings to accommodate families by providing kid-friendly resorts, theme parks, adventure parks, guided tours, family-sized accommodations, and curated experiences such as cultural workshops and wildlife safaris. Additionally, school holiday seasons and global travel trends like "edu-tourism" and "slow family travel" are further boosting this segment’s appeal. Airlines and hotels are also adopting loyalty programs and bundled packages to attract repeat family travelers, solidifying their long-term value in the tourism market.

Millennial & Gen Z Travelers represent one of the fastest-growing and most influential segments in the global travel and tourism market. Characterized by their digital fluency, social media engagement, and appetite for authentic and shareable experiences, these travelers prioritize cultural immersion, adventure, local cuisine, and sustainability over traditional tourist attractions. Unlike previous generations, Millennials and Gen Z travelers tend to favor flexible itineraries, budget-conscious options, and unique accommodations such as boutique hotels, hostels, and vacation rentals.

They are also more likely to use mobile apps, social platforms, and peer-reviewed travel websites for trip planning and bookings. This cohort plays a significant role in driving trends like solo travel, bleisure (business + leisure) trips, voluntourism, and digital nomadism. Their preference for personalized experiences and experiential travel is encouraging the market to adopt user-generated content strategies, influencer marketing, and immersive technology solutions such as virtual reality previews and AI-driven recommendations. As this demographic continues to age and increase its purchasing power, its influence on global tourism patterns will only become more pronounced.

By Spending Behavior Analysis

Mid-Range Spenders are expected to maintain a stronghold in the spending behavior segment, capturing 60.0% of the total market share in 2025, making them the dominant force in global travel and tourism expenditure. This segment includes travelers who seek a balance between quality and cost, opting for well-rated services and experiences without indulging in luxury or compromising on essential comfort.

The dominance of mid-range spenders is largely attributed to the expanding middle class in emerging economies, increased accessibility to international travel, and a rise in value-conscious behavior post-pandemic. These travelers prioritize smart budgeting, value-for-money travel packages, and all-inclusive deals that cover accommodation, transportation, dining, and guided experiences. They frequently use online travel aggregators, budget airlines, and mid-tier hotels while still engaging in sightseeing, cultural exploration, and recreational activities, contributing significantly to tourism revenue across destinations.

Mid-Range Spenders form the backbone of the travel and tourism economy due to their large volume and consistent travel patterns. This group includes solo travelers, couples, small families, and business travelers who avoid ultra-budget options but are not driven by luxury branding. They typically choose 3 to 4-star accommodations, dine at local restaurants rather than high-end venues, and book experiences based on user reviews and digital convenience.

Mid-range spenders are highly influenced by promotional offers, loyalty programs, and bundled services that offer both convenience and savings. They are also more likely to travel during shoulder seasons to take advantage of better rates and fewer crowds. Their travel decisions are shaped by a mix of comfort, reliability, and curated experience, making them a primary target for travel marketers and service providers aiming to capture steady revenue through scalable, repeatable offerings. The sustained growth of this segment reinforces its critical role in driving volume-based profitability across the global tourism value chain.

By Booking Channel Analysis

Online Travel Agencies (OTAs) are projected to dominate the booking channel segment, capturing 35.0% of the total market share in 2025, reflecting a significant shift toward digital travel planning and convenience-driven consumer behavior. OTAs such as Booking.com, Expedia, Trip.com, and MakeMyTrip have revolutionized how travelers search, compare, and book their trips by offering a one-stop platform for accommodations, flights, car rentals, and vacation packages.

These platforms provide a seamless user experience with filters for price, reviews, location, and amenities, making it easier for travelers to find designed options. The dominance of OTAs is further propelled by real-time availability, competitive pricing, last-minute deals, and the integration of user-generated content like ratings and reviews. Their global presence, multi-language support, and loyalty programs also enhance customer retention and market penetration, especially among mid-range spenders and international travelers seeking reliable booking options.

Direct Booking Channels, which include hotel websites, airline portals, and brand-specific apps, are also playing a strategic role in the travel and tourism market. While they may capture a smaller share than OTAs, direct channels offer businesses greater control over customer relationships, pricing, and branding. Travel providers are investing heavily in improving their websites and apps with AI-driven personalization, exclusive offers, mobile-friendly interfaces, and flexible cancellation policies to encourage direct engagement.

Direct booking is particularly favored by loyal customers who prefer to interact directly with the service provider for better customer support, rewards, and transparency. Hotels and airlines are also leveraging direct booking channels to avoid hefty commission fees charged by OTAs, making this segment attractive from a profitability standpoint. The growth of brand loyalty programs, app-exclusive discounts, and dynamic pricing models is expected to boost direct bookings, especially among repeat travelers and business tourists looking for streamlined services.

By Duration of Travel Analysis

Medium Trips, typically lasting between 4 to 7 days, are set to dominate the duration of travel segment in 2025, capturing approximately 40.0% of the market share. This travel duration strikes an ideal balance for many travelers who seek a comprehensive and immersive experience without committing to extended time away from work or daily responsibilities. Medium trips allow tourists to explore a destination in depth, combining sightseeing, cultural activities, dining, and relaxation within a manageable timeframe.

These trips are popular among families, couples, and solo travelers who want to maximize value while maintaining convenience. The rise of affordable airfares, efficient transport options, and flexible leave policies has made week-long vacations especially appealing, enabling travelers to venture beyond local getaways and explore international or regional destinations. Tour operators and hospitality providers often design travel packages specifically catering to this segment, offering curated itineraries that blend leisure and adventure, which further fuels demand.

Short Trips, lasting 1 to 3 days, serve a significant niche within the travel market, particularly for urban dwellers and working professionals seeking quick escapes or weekend getaways. This segment is characterized by spontaneous or planned mini-vacations that focus on relaxation, entertainment, or short cultural immersions without requiring extensive travel arrangements. Short trips are favored for their convenience, affordability, and minimal disruption to work or family commitments.

Destinations with easy accessibility, such as nearby cities, beach resorts, or nature parks, benefit from this segment’s growth. The popularity of short trips has been amplified by flexible remote work trends and the growing availability of weekend travel deals through online travel agencies and discount platforms. Additionally, short trips encourage repeat visitation, helping local economies sustain steady tourism revenue throughout the year. As lifestyle preferences shift toward balancing work-life demands, short-duration travel remains an essential component of the overall tourism ecosystem.

By Destination Type Analysis

Urban/City Tourism is projected to lead the destination type segment, capturing approximately 43.0% of the market share in 2025, driven by the growing appeal of metropolitan experiences that blend culture, entertainment, business, and lifestyle. Cities offer a unique combination of attractions such as museums, theaters, shopping districts, historical landmarks, and vibrant nightlife that cater to a wide variety of traveler interests. The convenience of well-developed infrastructure, extensive public transport networks, and a high concentration of hotels and restaurants further enhances their appeal.

Urban tourism is also a major hub for business travelers attending conferences, trade shows, and corporate events, adding a significant economic boost to city economies. Additionally, cities are positioning themselves as cultural capitals by hosting festivals, exhibitions, and international sporting events, which attract diverse visitor profiles. The rise of smart city initiatives and digital concierge services is improving visitor experiences, making urban destinations more accessible, efficient, and attractive for both leisure and business tourism.

Beach & Coastal Tourism remains a highly sought-after segment, offering travelers relaxation, adventure, and natural beauty along coastlines and seaside resorts. This destination type appeals to those looking to unwind through sunbathing, swimming, water sports, and coastal exploration. Beach tourism attracts families, honeymooners, and wellness seekers, often combining leisure with activities such as snorkeling, diving, fishing, and marine wildlife watching. Coastal regions frequently benefit from year-round mild climates, making them attractive for extended stays and repeat visits.

Investments in luxury resorts, eco-friendly beach accommodations, and sustainable tourism initiatives have further enhanced the appeal of beach destinations. Moreover, the rise in cruise tourism complements coastal travel by providing access to multiple ports and beaches in a single itinerary. As travelers seek authentic experiences, coastal communities are leveraging local culture, cuisine, and heritage to diversify offerings and attract a broader audience, reinforcing the importance of this segment within the global tourism market.

The Travel and Tourism Market Report is segmented on the basis of the following:

By Tourism Type

- Leisure Tourism

- Business Tourism

- VR (Visiting Friends/Relatives)

- Medical Tourism

- Religious Tourism

- Education Tourism

By Traveler Type

- Family Travelers

- Millennial & Gen Z Travelers

- Solo Travelers

- Luxury Travelers

- Senior Travelers

- Budget Travelers

By Spending Behavior

- High Spenders

- Mid-Range Spenders

- Budget Spenders

By Booking Channel

- Online Travel Agencies (OTAs)

- Direct

- Meta-search Engines

- Traditional Travel Agents

- Others

By Duration of Travel

- Medium Trips (4-7 days)

- Short Trips (1-3 days)

- Long Trips (8+ days)

By Destination Type

- Urban/City Tourism

- Beach & Coastal

- Nature/Eco-Tourism

- Mountain & Adventure

- Others

Global Travel and Tourism Market: Regional Analysis

Region with the Largest Revenue Share

Europe is expected to lead the global travel and tourism market in 2025, accounting for approximately 45.7% of total global market revenue. This dominance is driven by the region’s rich cultural heritage, diverse landscapes, and well-established infrastructure that attracts millions of international and domestic travelers annually. Europe’s extensive connectivity through high-speed rail networks and international airports facilitates seamless travel between countries, while its world-renowned cities, historic landmarks, and vibrant festivals continue to captivate tourists.

Additionally, strong government support for sustainable tourism, investment in digital tourism technologies, and a broad portfolio of leisure and business travel options contribute to Europe’s leading position. The region’s appeal to varied traveler types, from family vacations and cultural tours to luxury and adventure travel, ensures its sustained revenue generation and market resilience.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is projected to register the highest compound annual growth rate (CAGR) in the global travel and tourism market, driven by rapid economic development, rising middle-class populations, and growing urbanization across countries such as China, India, and Southeast Asian nations. Expanding air connectivity, government initiatives promoting tourism infrastructure, and growing outbound and domestic travel trends further fuel this growth. Additionally, the region’s rich cultural diversity, emerging luxury travel segments, and rising demand for experiential and wellness tourism contribute significantly to its dynamic expansion, positioning Asia-Pacific as the fastest-growing region in the travel and tourism landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Travel and Tourism Market: Competitive Landscape

The global travel and tourism market is characterized by intense competition among a diverse range of players, including online travel agencies, hospitality giants, airlines, cruise operators, and technology providers. Leading companies such as Booking Holdings, Expedia Group, Marriott International, and Airbnb compete by leveraging advanced digital platforms, extensive service portfolios, and strategic partnerships to capture market share.

The competitive landscape is shaped by continuous innovation in customer experience, adoption of AI and big data analytics for personalized offerings, and broader expansion into emerging markets. Companies are also focusing on sustainability initiatives and loyalty programs to differentiate themselves amid rising traveler awareness. Additionally, mergers, acquisitions, and collaborations are common strategies used to enhance geographic presence and diversify service offerings, making the market highly dynamic and customer-centric.

Some of the prominent players in the global travel and tourism industry are:

- Booking Holdings

- Expedia Group

- Airbnb

- Trip.com Group

- TUI Group

- Marriott International

- Hilton Worldwide

- InterContinental Hotels Group (IHG)

- Carnival Corporation

- Royal Caribbean Group

- Delta Air Lines

- American Airlines Group

- United Airlines Holdings

- Emirates Group

- Qatar Airways

- China Southern Airlines

- Southwest Airlines

- Trivago

- MakeMyTrip

- Despegar.com

- Other Key Players

Global Travel and Tourism Market: Recent Developments

Product Launches

- May 2024: Airbnb pledged USD 1 million to fund a multi-year rural tourism exchange program between the U.S. and Japan, aiming to strengthen economic opportunities through tourism in rural areas in both countries.

- April 2024: Expedia Group announced the launch of two new programs, Destination Climate Champions and the Destination Giveback Initiative, to support destination marketing and management organizations in becoming better environmental stewards and ensuring travel is a force for good in local communities.

Mergers & Acquisitions

- October 2024: Uber explored a potential acquisition of Expedia Group, a USD 20 billion travel booking platform, to diversify its offerings and boost growth. The talks were in early stages, with no formal approach made.

- July 2024: Trip.com Group announced a strategic partnership with the Department of Culture and Tourism – Abu Dhabi for 2025, aiming to showcase Abu Dhabi's unique offerings to global audiences.

Funding & Investments

- February 2025: Airbnb's CEO, Brian Chesky, announced plans to invest USD 200- USD 250 million to launch new services on its app by May 2025, aiming to transform the company into a comprehensive travel platform similar to Amazon.

- April 2024: Expedia Group provided foundational philanthropic support to the Wildlife Conservation Society (WCS) to launch the Nature Positive Tourism Fund, aiming to protect habitats and wildlife by engaging with local communities in regions important for conservation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 10.1 T |

| Forecast Value (2034) |

USD 17.1 T |

| CAGR (2025–2034) |

6.0% |

| The US Market Size (2025) |

USD 1.6 T |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Tourism Type (Leisure Tourism, Business Tourism, Visiting Friends/Relatives (VR), Medical Tourism, Religious Tourism, Education Tourism), By Traveler Type (Family Travelers, Millennial & Gen Z Travelers, Solo Travelers, Luxury Travelers, Senior Travelers, Budget Travelers), By Spending Behavior (High Spenders, Mid-Range Spenders, Budget Spenders), By Booking Channel (Online Travel Agencies (OTAs), Direct, Meta-search Engines, Traditional Travel Agents, Others), By Duration of Travel (Medium Trips (4-7 days), Short Trips (1-3 days), Long Trips (8+ days)), and By Destination Type (Urban/City Tourism, Beach & Coastal, Nature/Eco-Tourism, Mountain & Adventure, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Booking Holdings, Expedia Group, Airbnb, Trip.com Group, TUI Group, Marriott International, Hilton Worldwide, InterContinental Hotels Group (IHG), Carnival Corporation, Royal Caribbean Group, Delta Air Lines, American Airlines Group, United Airlines Holdings, Emirates Group, Qatar Airways, and other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global travel and tourism market?

▾ The global travel and tourism market size is estimated to have a value of USD 10.1 trillion in 2025 and is expected to reach USD 17.1 trillion by the end of 2034.

What is the size of the US travel and tourism market?

▾ The US travel and tourism market is projected to be valued at USD 1.6 trillion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.7 trillion in 2034 at a CAGR of 5.6%.

Which region accounted for the largest global travel and tourism market?

▾ Europe is expected to have the largest market share in the global travel and tourism market, with a share of about 45.7% in 2025.

Who are the key players in the global travel and tourism market?

▾ Some of the major key players in the global travel and tourism market are Booking Holdings, Expedia Group, Airbnb, Trip.com Group, TUI Group, Marriott International, Hilton Worldwide, InterContinental Hotels Group (IHG), Carnival Corporation, Royal Caribbean Group, Delta Air Lines, American Airlines Group, United Airlines Holdings, Emirates Group, Qatar Airways, and other key players.

What is the growth rate of the global travel and tourism market?

▾ The market is growing at a CAGR of 6.0 percent over the forecasted period.