Market Overview

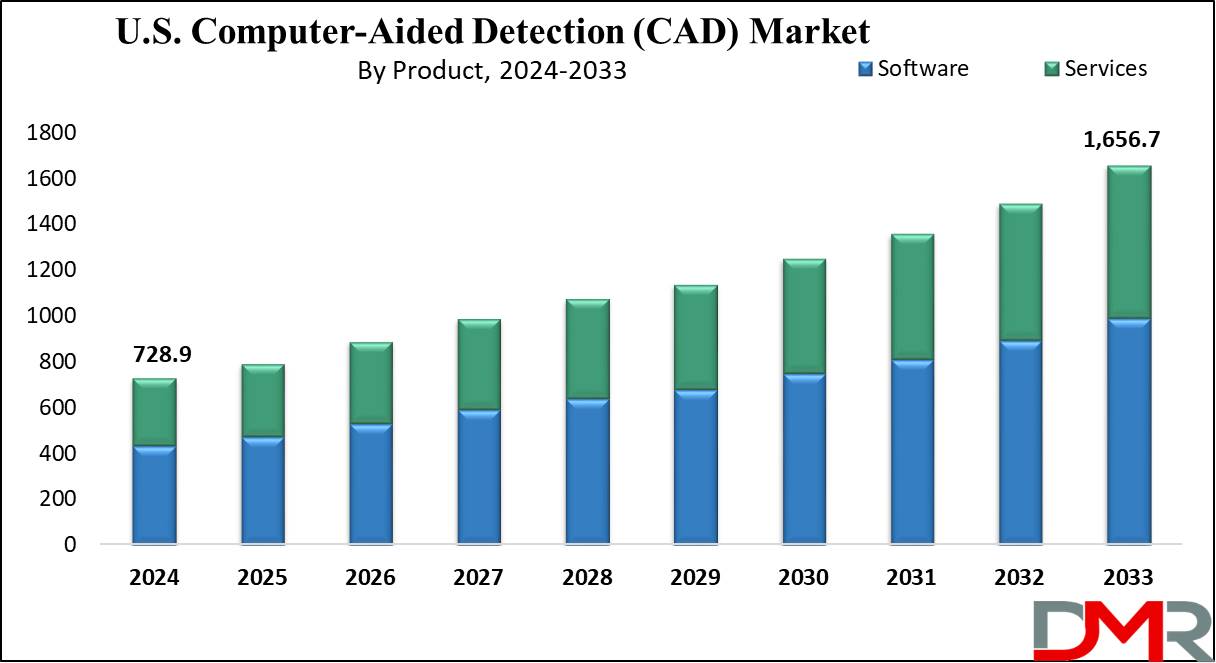

The U.S. Computer-Aided Detection (CAD) Market is expected to reach a value of USD 728.9 million by the end of 2024, and it is further anticipated to reach a market value of USD 1,656.7 million by 2033 at a CAGR of 9.6%.

Computer-Aided Detection or CAD is a process that uses computer algorithms and software to help in interpreting medical imaging, like X-rays and CT scans. It identifies potential irregularity in images, helping healthcare providers in further examination. CAD improves diagnosis efficiency by inspecting patterns and densities in images, though it complements rather than replaces human expertise in the diagnostic process.

As per PubMed, the U.S. Computer-Aided Detection (CAD) market demonstrates significant potential in enhancing diagnostic accuracy. CAD applied to 20 chest MDCT scans with 190 non-calcified nodules (≥3mm) showed a sensitivity increase from 53% (44%-59%) at 1.15 false positives (FP)/patient to 69% (59%-82%) at 1.45 FP/patient.

Early CAD evaluation improved sensitivity by 14% within 100 seconds, with minimal FP increase. Time for true positive and false negative detections averaged 9.5s and 8.4s, respectively, while false positive decisions took 14.4s, nearly three times longer than true negative decisions (4.7s). These results underscore CAD's role in improving radiologist efficiency and accuracy.

The U.S. Computer-Aided Detection (CAD) market is witnessing significant activity with conferences like RSNA and HIMSS spotlighting advancements in AI-driven diagnostic tools. Opportunities abound in early disease detection, particularly in oncology and radiology, as healthcare providers seek to enhance diagnostic accuracy. These advances also reflect broader trends seen in the

Anomaly Detection, where machine learning and AI-driven software are transforming real-time monitoring across sectors including healthcare.

Recent mergers, such as between leading tech and healthcare firms, highlight a push for integrated solutions, boosting market growth. Deals focusing on cloud-based CAD platforms and AI-enhanced imaging signal robust investment trends. Startups and established players alike are leveraging partnerships to accelerate innovation, ensuring the CAD market remains a pivotal segment in the U.S. healthcare technology landscape.

Key Takeaways

- The U.S. Computer-Aided Detection (CAD) Market is expected to grow by 927.8 million, at a CAGR of 9.6% during the forecasted period.

- By Product, the software is expected to lead in 2024 & is anticipated to dominate throughout the forecasted period.

- By Imaging Modality, breast imaging is anticipated to drive the growth of the U.S. Computer-Aided Detection (CAD) Market.

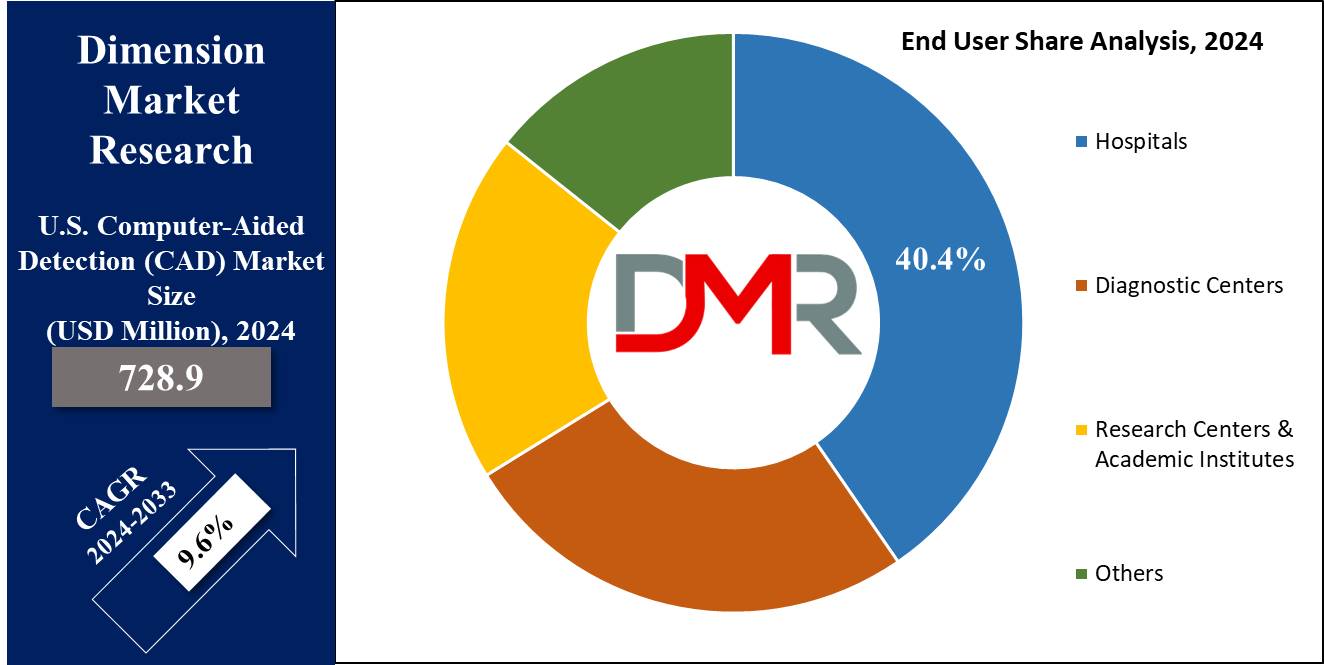

- By End User, hospitals are expected to have a lead throughout the forecasted period.

- Some of the use cases of CAD include radiology, pathology, and more.

Use Cases

- Radiology: CAD systems in the US are largely used in radiology for early detection of abnormalities in medical images like mammograms & X-rays. These systems help radiologists in identifying subtle signs of diseases like cancer, improving diagnostic accuracy & patient outcomes. The integration of Computer Graphics technologies, especially in 3D modeling and visualization, enhances radiologists’ interpretation of complex image datasets.

- Pathology: CAD technology is mainly used in pathology to help pathologists in analyzing tissue samples for signs of disease. By automating the detection of anomalies in histopathological images, CAD systems improve efficiency & reliability in diagnosing conditions like cancer & infectious diseases.

- Cardiology: In the field of cardiology, CAD systems are essential in analyzing cardiac imaging data, like angiograms & echocardiograms. By helping cardiologists detect and quantify areas of concern like arterial blockages or abnormalities in heart function, CAD technology helps with timely intervention & treatment planning for cardiovascular diseases.

- Oncology: CAD systems are also used in oncology to help oncologists in diagnosing & monitoring cancer. By analyzing medical images like CT scans & MRIs, CAD technology helps in detecting tumors, evaluating their characteristics, and tracking disease progression, which helps oncologists formulate personalized treatment strategies and assess treatment effectiveness.

Market Dynamic

The demand for computer-aided detection (CAD) solutions is growing, especially in the U.S. market, which is largely driven by the growing adoption of CAD units in multispecialty hospitals, where all-purpose diagnostic systems are preferred for their affordable & better return on investment.

Initially used mainly in radiology for analyzing complex images like mammograms, CAD systems have now expanded their reach to many medical disciplines like pathology, cardiology,

oncology, and neurology. Their adaptability & effectiveness in helping medical professionals across different specialties are evident in revolutionizing healthcare procedures, providing early identification, accurate diagnosis, and treatment planning for various diseases.

However, the integration of CAD systems into healthcare facilities' diagnostic workflows creates challenges, as the initial requirements for acquiring & implementing CAD systems, along with the need for medical imaging-specific hardware & software, can be discouraging, particularly for smaller facilities with tighter budgets.

Moreover, a shortage of trained radiologists & technicians capable of operating CAD systems further restrains market growth. To address this constraint, hospitals and centers must prioritize the recruitment of completely trained personnel to maximize the benefits of CAD technology in improving healthcare outcomes.

Research Scope and Analysis

By Product

Software is projected to lead the U.S. Computer-Aided Detection (CAD) Market in 2024 by allowing advanced functionalities & smooth integration with existing healthcare systems. CAD software improves the efficiency & accuracy of medical image analysis by automating the detection of anomalies and providing detailed insights to healthcare professionals.

In addition, continuous development in CAD software technology, like the integration of artificial intelligence and machine learning algorithms, further enhances the capabilities of CAD systems in detecting & diagnosing various medical conditions across various specialties.

Moreover, software solutions provide scalability & customization options, making healthcare facilities customized to CAD systems to their specific needs & workflows. As a result, the changing landscape of CAD software contributes highly to the expansion and adoption of CAD technology in the U.S. healthcare industry.

By Imaging Modality

Breast imaging is expected to be driving the growth of the U.S. Computer-Aided Detection (CAD) Market during the forecasted period due to its high adoption and effectiveness in breast cancer screening & diagnosis.

CAD systems highly augment the capabilities of mammography by helping radiologists detect subtle abnormalities & potential signs of breast cancer at an early stage. With the growing focus on preventive healthcare and the rising number of breast cancer, the need for CAD solutions in breast imaging continues to soar.

Moreover, technological development in CAD software, such as improved image processing algorithms and integration with digital mammography systems further enhances the accuracy & efficiency of breast cancer detection.

By Mode of Purchase

Group Purchase Organizations (GPOs) are anticipated to be leading the U.S. Computer-Aided Detection (CAD) Market in 2024 by using their collective purchasing power to handle favorable terms & prices for CAD systems on behalf of member healthcare facilities.

By combining the procurement needs of various hospitals, clinics, and medical centers, GPOs can get bulk discounts and analyze the acquisition process for CAD technology, which not only minimizes the financial load on individual healthcare organizations but also supports high adoption of CAD systems across the healthcare sector.

In addition, these often provide valuable guidance & support to member facilities in assessing different CAD solutions, ensuring that they invest in the most suitable and affordable technologies, which is driving the expansion and accessibility of CAD technology in the U.S. healthcare market.

By Application

The growing number of Cancer patients and the increasing need for early detection and accurate diagnosis are the major drivers of growth in the U.S. Computer-Aided Detection (CAD) Market throughout the forecasted period. CAD systems play an important role in supporting healthcare professionals in identifying & analyzing abnormalities associated with many types of cancer, like breast, lung, prostate, & colorectal cancer.

By using advanced imaging technologies & machine learning algorithms, it improves the efficiency & accuracy of cancer detection, creating timely intervention and better patient outcomes. Further, the growing demand for customized medicine & targeted therapies in cancer treatment enhances the importance of CAD technology in oncology.

By End User

Hospitals are expected to play a major role in driving the growth of the U.S. Computer-Aided Detection (CAD) Market in the coming years, by knowing the importance of CAD technology to enhance diagnostic accuracy and patient care. As a primary healthcare provider, hospitals mostly combine CAD systems into their diagnostic workflows across many specialties like radiology, oncology, and cardiology.

By investing in CAD solutions, hospitals aim to enhance their capabilities in early disease detection, accurate diagnosis, and treatment planning, thereby improving patient outcomes & satisfaction. In addition, hospitals are the main influencers in the adoption of CAD technology by setting standards for quality healthcare delivery & promoting innovation in medical imaging practices.

Through strategic partnerships with CAD vendors & constant investment in technology infrastructure, hospitals drive the broad adoption and development of CAD technology in the U.S. healthcare market.

The U.S. Computer-Aided Detection (CAD) Market Report is segmented on the basis of the following:

By Product

By Imaging Modality

- Breast Imaging

- Lung Imaging

- Oncology & Radiation

- Abdominal & Pelvic Imaging

- Dental Imaging

- Cardiovascular Imaging

- Others

By Mode of Purchase

- Group Purchase Organization

- Individual

By Application

- Cancer

- Neurological Disorders

- Cardiovascular Diseases

- Musculoskeletal Diseases

- Others

By End User

- Hospitals

- Diagnostic Centers

- Research Centers & Academic Institutes

- Others

Competitive Landscape

In the U.S. Computer-Aided Detection (CAD) Market, competition is very strong among many players providing CAD solutions. Companies compete for market share by creating innovative CAD technologies, improving diagnostic accuracy, and enhancing workflow efficiency.

Key strategies like pricing, performance, ease of integration, & customer support, along with strategic partnerships with healthcare providers & research institutions, along with regulatory compliance, play important roles in shaping the competitive landscape of the CAD market.

Some of the prominent players in the U.S. Computer-Aided Detection (CAD) Market are

- iCAD Inc

- FUJIFILM Holdings Corp

- Median Technologies

- Hologic Inc

- EDDA Technology Inc

- Siemens Healthcare

- Canon Medical Systems Corp

- Riverain Technologies

- Koninklijke Philips N.V.

- General Electric Company

- Other Key Players

Recent Developments

- In November 2023, GE HealthCare launched MyBreastAI Suite, an all-in-one AI platform assisting clinicians in breast cancer detection & workflow efficiency. The suite integrates three iCAD AI apps: ProFound AI for DBT, SecondLook for 2D Mammography, & PowerLook Density Assessment. In the middle of rising cancer rates across the world and challenges faced by radiologists, this initiative focuses on improving early detection, streamlining operations, and improving patient outcomes.

- In October 2023, W.H.O's Global Tuberculosis Programme introduced ScreenTB, a web-based tool helping countries prioritize risk groups for screening & developing personalized screening and prevention strategies. Screening is important in achieving the ambitious targets set at the 2023 UN High-Level Meeting on TB, aiming to inspect and treat over 45 million TB patients & initiate preventive treatment for 45 million by 2027.

- In July 2023, PTC announced a leading computer-aided design (CAD) solution named Creo+, which integrates the power &proven functionality of Creo with new cloud-based tools to improve design collaboration and simplify CAD administration, which also includes the PTC Control Center application, powered by its Atlas™ SaaS platform, which provides simple installation & management of software licenses for cloud-based tools.

- In December 2022, Olympus Corporation announced that the company has signed a definitive agreement to acquire Odin Vision, a cloud-AI endoscopy company with a strong portfolio of commercially available CAD solutions & a deep innovation channel of cloud-enabled applications, for up to USD 79 million in upfront and milestone-based payments.

- In December 2022, Imagen Technologies, Inc. unveiled the company got the U.S. Food and Drug Administration's clearance of the computer-assisted detection (CADe) device Aorta-CAD, which is developed to help physicians detect findings on chest X-rays that are suggestive of Aortic Atherosclerosis and Aortic Ectasia. Further, it is a cloud-based, software-only medical device that utilizes deep learning to inspect & highlight findings associated with Aortic Atherosclerosis and Aortic Ectasia.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 634.1 Mn |

| Forecast Value (2033) |

USD 1.582.0 Mn |

| CAGR (2023-2032) |

10.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Earplugs, Hearing Bands, Earmuffs, Uniform Attenuation Earplugs, Canal Caps, and Connected Devices), By Protection (Enclosure, Aural Insert, Super-aural, and Circumaural), By End User (Healthcare, Mining, Manufacturing, Construction, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

3M, ProtectEar USA, McKeon Products, DEWALT, Moldex-Metric, MSA, David Clark Company, Altus Brands, Honeywell, SoundGear, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The U.S. Computer-Aided Detection (CAD) Market size is estimated to have a value of USD 728.9 million

in 2024 and is expected to reach USD 1,656.7 million by the end of 2033.

Some of the major key players in the U.S. Computer-Aided Detection (CAD) Market are iCAD Inc.,

FUJIFILM Holdings Corp, Median Technologies, and many others.

The market is growing at a CAGR of 9.6 percent over the forecasted period.