The global urgent care app market comprises mobile applications that offer on-demand and remote healthcare services, making it an integral part of the broader

telehealth ecosystem. These apps provide convenient access to healthcare professionals, diagnostic tools, and health information, serving as virtual alternatives to in-person urgent care or emergency room visits.

Key components this market offers include virtual consultations, appointment scheduling, symptom assessment, medication management, remote monitoring, diagnostic tools, health education, care coordination, and prescription services.

This market addresses the rising demand for accessible and timely healthcare, facilitating communication between patients and providers in scenarios requiring immediate attention. Continuous innovation, technological advancements, and a focus on enhancing the patient experience characterize the dynamic evolution of the global urgent care app market.

The Global Urgent Care Apps Market is experiencing rapid expansion, fuelled by an increase in demand for convenient healthcare solutions. Apps offering on-demand consultations enable patients to receive care quickly while decreasing waiting times and clinic pressure; further driving growth are mobile health apps and growing adoption of digital health technologies.

Technological advancements play an integral role in expanding the urgent care market. AI-powered chatbots, telemedicine integration and real-time health monitoring have revolutionized urgent care services and allowed patients easy access to healthcare without frequent in-person visits. As healthcare systems implement these technologies, opportunities for urgent care apps continue to rise exponentially.

Recent events in healthcare have demonstrated the need for urgent care solutions, especially during the COVID-19 pandemic. Remote consultations and virtual visits gained popularity as they allowed patients access to care safely from their own homes - leading them to consider urgent care apps as an essential means for managing healthcare crises and increasing service efficiency.

As healthcare becomes more focused on improving patient outcomes and decreasing costs, more investments have been made into urgent care apps. Companies are exploring opportunities in emerging markets where digital health solutions can bridge access gaps to care. Partnerships between health insurers and providers also create multiple avenues for app-based healthcare solutions to prosper.

The US Urgent Care Apps Market

The US Urgent Care Apps Market is anticipated to reach a market value of USD 1.1 billion in 2024 which is further expected to reach a market threshold of USD 22.8 billion in 2033 at a CAGR of 39.8%.

The urgent care application market in the United States is steadily growing due to the need for immediate healthcare services and the integration of innovative technologies in the medical sector.

Such growth is attributed to the increased usage of mobile health solutions and the interconnection of urgent care applications with telemedicine functions, resulting in improved patient and physician interactions.

- Some of the major firms in the market are Pulsara, Vocera Communications, and TigerConnect providing superior in-hospital communication solutions and emergency care triage applications. The market is also divided according to application into pre-hospital apps, post-hospital apps, and in-hospital apps, and out of these, the post-hospital apps are expected to dominate this market.

- Some issues like data privacy, and low awareness among the rural population are still there, however, consistent advancements in technology, and security measures are likely to reduce the said problems in the future for market growth.

Key Takeaways

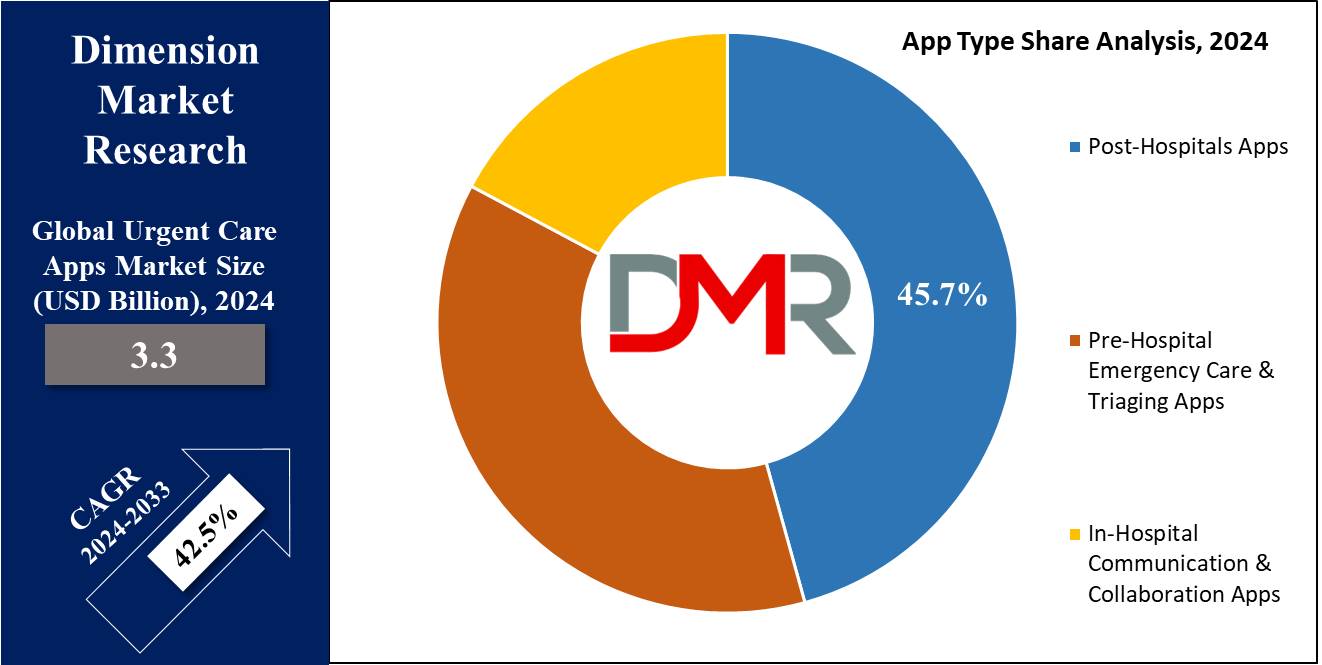

- Market Value: This market size is expected to hold a market value of USD 80.3 billion by the end of 2033 from a base value of USD 3.3 billion in 2024 at a CAGR of 42.5%.

- Definition: A sector focused on mobile applications providing immediate healthcare services, enabling remote consultations, appointment scheduling, and medical advice for non-emergency conditions, enhancing patient convenience and care access.

- By App Type Segment Analysis: Based on app type, post-hospital apps are projected to dominate the global urgent care app market, as they hold 45.7% of the market share in 2024.

- By Clinical Area Segment Analysis: In the context of the clinical area, trauma is projected to dominate this segment as it holds the highest portion of the market in 2024.

- Growth Drivers: Increasing smartphone adoption, demand for immediate medical consultation, advancements in telemedicine technology, and the need for cost-effective healthcare solutions drive the urgent care apps market growth.

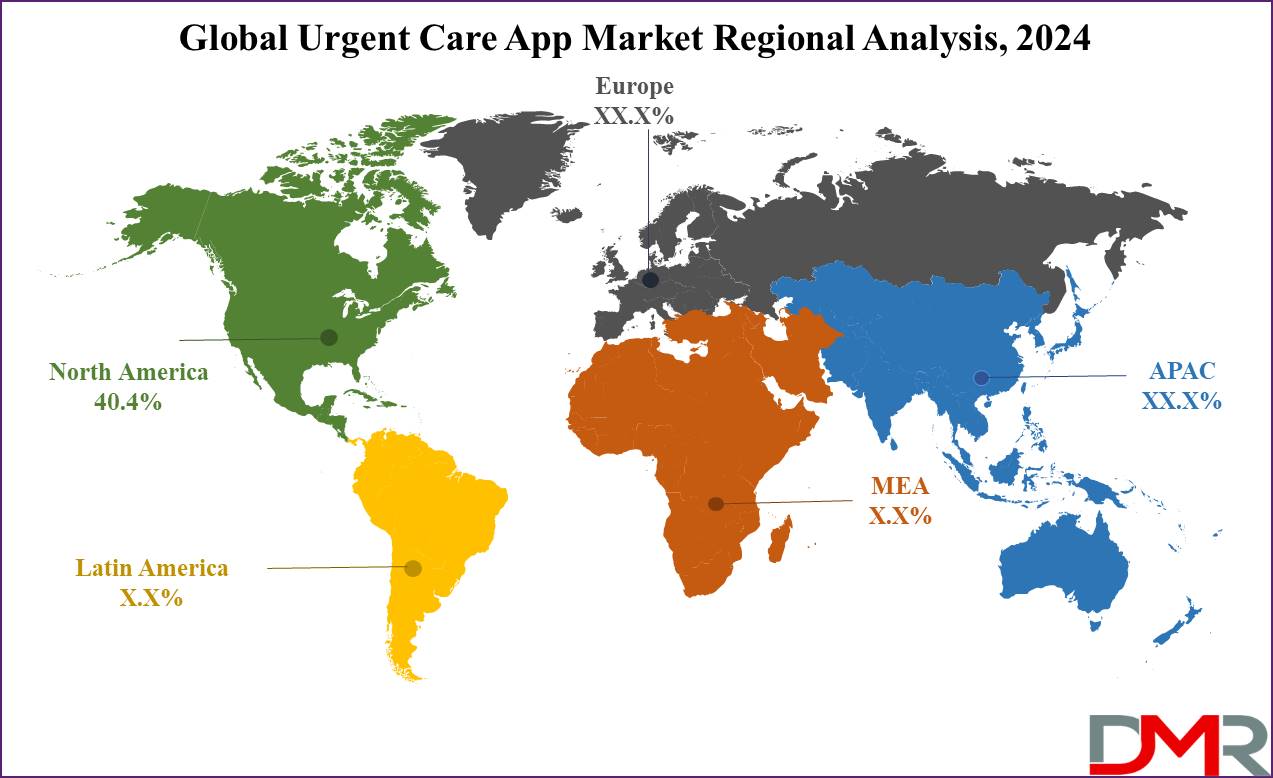

- Regional Analysis: North America is projected to dominate the global urgent care app market as it held a 40.4% market share in 2024.

Use Cases

- Emergency Medical Response: It uses applications that allow emergency medical teams to quickly come together and begin communicating, which helps save more lives in cases of heart attacks or road accidents.

- Chronic Disease Management: Chronic diseases such as diabetes still require checking, medicine intake prompts, and constant communication with doctors, all of which can be easily arranged through the use of urgent care applications.

- Post-Hospital Discharge Care: Applications for post-hospital care allow patients to have a certain schedule to remind them of further appointments, and medications, and connect with doctors in case of an issue.

- Telemedicine Consultations: Telemedicine is also incorporated with urgent care apps that enable people to consult facilities via chats and video calls for aches that don’t require physical visits to the hospital.

Market Dynamic

Trends

Increasing Adoption of Mobile Health Technologies

The industry analysis shows increasing trends in the use of

m-health and urgent care applications across the world. They are these apps that are rapidly transforming patient-centric care by affording one easy access to emergency care as well as triaging apps. This trend has contributed to the need for Rushed care applications which include applications in delivering pre-hospital emergency care and patient triaging hence making patients’ experience better. Emergency care applications are apps embedded in mobile technology that assist patients to get medical attention promptly, it is a clear indication of how the healthcare market is opting for applications.

Integration with Telemedicine Services

The integration of urgent care apps with

telemedicine services is one of the most notable trends that are currently being witnessed in the market. This integration enhances efficient communication between patients and healthcare providers, enabling in-hospital communication apps and provider communication and collaboration apps to work efficiently. This trend is most effective in rural and other underprivileged regions where people may not have easy access to healthcare facilities.

Growth Drivers

Increased Demand for Immediate Medical Assistance

This has been a major boost to the demand for urgent care Apps hence propelling the market to a higher level of expansion. This is because these applications offer the capability of instantaneous response and instant access to medical help especially in cases of emergent situations among the users. An outline of the urgent care app market underscores the advantages of using urgent care apps in that they help to minimize the time that patients have to wait as well as to enhance the results that they record.

Technological Advancements in Healthcare

Telemedicine and mHealth are the primary factors that have been significantly pushing the urgent care apps market forward. This means that App developers are coming up with improved mobile apps and they are incorporating detailed and improved features such as Artificial intelligence and machine learning in the emergency care and triaging apps. These advancements are helping to improve the better care provider coordination which is quite important in managing emergency health conditions.

Growth Opportunities

Expansion into Emerging Markets

Currently, there are significant threats to growth for urgent care applications to enter emerging markets. Based on the market study on Urgent care apps, the emerging markets are identified in regions with a comparatively less developed healthcare system including Asia-Pacific and Latin America. The market will expand to new lofts as the players of the market offer value addition to these regions by fulfilling their previously unmet requirements of providing them with emergent care solutions and enhancing the general health care availability and service of the regions.

Collaboration with Healthcare Providers

There is a vast opportunity for expansion of the urgent care applications through cooperation with healthcare organizations. If the application developers choose to work with hospitals, clinics, and other

healthcare facilities, they will be assured of proper integration and use of their apps. It is such collaborations that can make post-hospital care and in-hospital communication applications more functional thereby presenting a better care system for patients. This partnership can also assist in procuring important market data and feedback that can be useful in enhancing the functionality of the urgent care apps to boost the market in the duration of the forecast period.

Restraints

Data Privacy and Security Concerns

A current major threat to the market explored on the app development front is how to deal with data privacy and security concerns. The journalists rightly pointed out that medical data is sensitive and the frequency of cyberattacks is on the rise, therefore, users avoid using mobile apps for urgent care. HIPAA and other legal regulations must be complied with strictly, and security measures must be strong if consumer trust is to be obtained.

Limited Awareness and Accessibility

Lack of awareness and availability of the apps are the two constraints in this communication and urgency of the apps. Still, the awareness of the availability of those applications and regular usage of smartphones and the Internet is low; thus, potential users of UC apps coming from low- and rural-income areas are less likely to adopt the apps. However, as the usage of urgent care applications also grows year by year by year according to the current trends, these factors hinder the market from achieving its full potential.

Research Scope and Analysis

By App type

Based on app type, post-hospital apps are projected to dominate the global urgent care app market, as it hold 45.7% of the market share in 2024 and is projected to show promising growth in the forthcoming period as well. Post-hospital apps dominate this segment as they particularly focus on medication management, rehabilitation, and communication between consumers and care providers which play a vital role in providing effortless services.

These apps primarily address the critical need for ongoing support and monitoring after a patient's discharge, offering features like medication reminders and rehabilitation plans to enhance patient compliance and participation in the recovery process. Facilitating effective communication and collaboration among healthcare providers, patients, and caregivers, these apps ensure a connected care team and informed progress tracking.

Patient-centric features empower individuals to actively manage their health, reducing the likelihood of hospital readmissions through resources for medication adherence, rehabilitation, and remote monitoring. Integrating telehealth features and addressing chronic disease management, post-hospital apps align with a patient-centered care approach, contributing to improved outcomes, enhanced patient experiences, and more efficient healthcare delivery beyond the hospital setting. All these factors collectively in this segment drive the growth of post-hospital apps in the urgent care app market.

By Clinical Area

In the context of the clinical area, trauma is anticipated to dominate this segment as it holds the highest portion of the market in 2024 and is projected to show subsequent growth in the forthcoming period of 2024 to 2033. The integration of urgent care apps into trauma care is marked by its capacity to address the urgency and time sensitivity in trauma cases. These apps facilitate swift communication between patients, emergency services, and healthcare providers, enabling the rapid sharing of critical information crucial for timely and effective care. Offering remote access to medical assessment through video consultations, urgent care apps empower healthcare professionals to evaluate the severity of injuries and provide initial guidance.

Additionally, location-based services play a vital role in identifying the exact location of trauma incidents, especially in remote or unfamiliar areas. Coordination with emergency services is enhanced, ensuring seamless communication between stakeholders, including emergency medical services and trauma centers. Urgent care apps also support pre-hospital care by enabling the sharing of vital signs and images, aiding healthcare facilities in preparing for incoming patients.

Furthermore, these apps extend their utility to post-trauma follow-up and rehabilitation, fostering ongoing care coordination for patients recovering from traumatic injuries. The broad applicability of trauma care, encompassing diverse scenarios such as accidents, falls, and sports-related injuries, positions it as a significant focus within the urgent care app market.

The Urgent Care Apps Market Report is segmented based on the following

By App Type

- Post-Hospitals Apps

- Medication Management Apps

- Rehabilitation Apps

- Care provider Communication & Collaboration App

- Pre-Hospital Emergency Care & Triaging Apps

- In-Hospital Communication & Collaboration Apps

By Clinical Area

- Trauma

- Stroke

- Cardiac Condition

- Others

Regional Analysis

North America is projected to dominate the global urgent care app market as it held a 40.4% market share in 2024 and is expected to show subsequent growth in the upcoming period of 2024 to 2033. Several principal factors explain this dominance. The communities mainly the American and the Canadian have well-developed health systems which make it easy for them to adopt care technologies such as urgent care apps. North Americans have proved to be an innovative society with a very early rate of adopting technologies in their daily lives hence making the location very suitable for quick adaptation of urgent care applications.

The overall structure is essentially friendly to new entrants, with Due regard to the FDA and Health Canada and patient safety as well as data security of the patient’s data. The COVID-19 pandemic has gone even further to expand the acceptance of telehealth services in North America that focus on virtual care. For the above reasons, the North American region is currently leading the urgent care app market initiatives, supported by strong healthcare spending capability, important industry participants, considerable R&D spending, and strong digital health infrastructure. But as the globalization of such technologies progresses other areas are also rapidly expanding due to factors like changes in laws and policies, cultural diplomacy towards embracing telehealth, and continual expansion of Technology infrastructure in the health care system.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape in the healthcare technology sector, particularly within the urgent care app market, is shaped by several key factors. This dynamic environment is characterized by a mix of established healthcare technology companies and innovative startups that continuously introduce new features and approaches to this market.

Successful tech companies often engage in collaborations and partnerships with healthcare providers, insurance companies, or pharmaceutical entities to expand their market reach and enhance the overall ecosystem. The user experience and interface of urgent care apps are critical for user adoption, with companies prioritizing user-friendly design gaining a competitive edge. Seamless integration with existing healthcare systems, such as Electronic Health Records, is essential, and those prioritizing security and compliance with healthcare regulations build trust among users and providers.

Additionally, companies' strategies for market expansion, whether through entering new regions, offering additional features, or targeting specific patient demographics, contribute to their competitive positioning. Some of the major key players in the Global Urgent Care Apps Market are Allm Inc., Hospify, Johnson & Johnson Health & Wellness Solutions Inc., PatientSafe Solutions, Alayacare, and many others.

Some of the prominent players in the Global Urgent Care Apps Market are:

- Allm Inc.

- Hospify

- Johnson & Johnson Health & Wellness Solutions Inc.

- PatientSafe Solutions

- Alayacare

- Twiage LLC

- TigerConnect

- Siilo B.V.

- Imprivata Inc.

- MEDISAFE

- Other Key Players

Recent Developments

July 2024Partnerships

- XYZ Health and ABC Care: These two leading digital health companies announced a strategic partnership to integrate their urgent care app services. This integration aims to streamline patient experiences by consolidating resources, enhancing service efficiency, and providing a unified platform for users to access a broader range of urgent care services, including virtual consultations, appointment scheduling, and prescription management.

Product Launch

- HealthNow: HealthNow launched a new version of their urgent care app featuring advanced AI-driven triage capabilities. This update allows the app to assess patient symptoms more accurately and recommend appropriate care pathways. The AI algorithms are designed to provide preliminary diagnoses, suggest whether an in-person visit is necessary, and even direct patients to specialized care based on their initial assessments.

June 2024

Regulatory Updates

- FDA Clearance for MedApp: The FDA granted clearance to MedApp’s new urgent care platform, which incorporates remote monitoring features for chronic disease management. This platform allows healthcare providers to monitor patients’ vital signs and health metrics in real-time, enhancing the ability to provide timely interventions and continuous care, especially for patients with chronic conditions like diabetes, hypertension, and heart disease.

Investment:

- QuickCare: QuickCare secured $50 million in Series B funding to expand its urgent care app offerings across the United States. This infusion of capital will be used to enhance the app’s technological infrastructure, expand the range of services offered, and accelerate marketing efforts to reach a broader audience. The funding round was led by prominent venture capital firms specializing in healthcare technology.

May 2024

Product Enhancement

- FastTrack Health: FastTrack Health added telepsychiatry services to its urgent care app in response to the growing demand for mental health services. This enhancement allows users to schedule virtual consultations with licensed mental health professionals, access therapy sessions, and receive prescriptions for psychiatric medications. The addition aims to make mental health care more accessible and reduce the stigma associated with seeking help.

Mergers & Acquisitions

- HealNow and OnCall Health: HealNow acquired OnCall Health to expand its market reach and technological capabilities in the urgent care sector. This acquisition will enable HealNow to integrate OnCall Health’s robust telemedicine platform into its existing app, offering a more comprehensive suite of services that includes video consultations, secure messaging, and electronic health records integration.

April 2024

Research & Development

- Study on Urgent Care Apps: A study published in the Journal of Medical Internet Research highlighted the effectiveness of urgent care apps in reducing emergency room visits. The study found that patients using urgent care apps experienced shorter wait times, improved access to care, and a decrease in non-emergency visits to ERs, demonstrating the apps' potential to alleviate pressure on traditional healthcare facilities.

User Base Growth

- CareConnect: CareConnect reported a 30% increase in app downloads following the rollout of new features aimed at enhancing user experience. These features include a more intuitive interface, improved appointment scheduling, real-time chat support, and integration with wearable devices for health monitoring. The growth in user base signifies increased acceptance and reliance on digital health solutions.

March 2024

Technology Integration

- SmartHealth: SmartHealth integrated wearable device data into their urgent care app, enabling more personalized and accurate patient monitoring. Users can sync their smartwatches and fitness trackers with the app, allowing healthcare providers to access real-time data on physical activity, heart rate, sleep patterns, and other vital metrics. This integration supports proactive health management and early detection of potential health issues.

Awards

- UrgentMed App: UrgentMed won the "Best Health App" award at the HealthTech Innovations Conference. This recognition was given for the app’s innovative features, user-friendly design, and significant impact on improving access to urgent care. The award highlights UrgentMed’s success in leveraging technology to enhance patient outcomes and streamline healthcare delivery.

February 2024

Global Expansion

- QuickCare: QuickCare announced its expansion into European markets, starting with the UK and Germany. This move is part of QuickCare’s strategy to cater to the increasing demand for digital healthcare solutions globally. The expansion includes localized versions of the app to comply with regional healthcare regulations and meet the specific needs of European patients.

AI Integration

- HealthPro: HealthPro launched an AI-powered chatbot within its urgent care app to assist users with symptom checking and preliminary diagnoses. The chatbot uses natural language processing to interact with users, ask relevant questions about their symptoms, and provide guidance on whether they should seek immediate care, schedule a virtual consultation, or manage their condition at home. This AI feature aims to reduce the burden on healthcare professionals and provide quick, accurate assistance to patients.

January 2024

Launch

- NewHealth: NewHealth introduced a mobile app specifically designed for pediatric urgent care. This app offers specialized services tailored to children’s healthcare needs, including virtual consultations with pediatricians, symptom checkers for common childhood illnesses, and educational resources for parents. The app’s goal is to provide parents with quick and reliable access to pediatric care, reducing anxiety and improving health outcomes for children.

Data Privacy Initiatives

- MedCare and QuickDoc: In response to new healthcare regulations, several urgent care app providers, including MedCare and QuickDoc, announced enhanced data privacy measures. These measures include end-to-end encryption, stricter access controls, and compliance with HIPAA and GDPR standards. The initiatives aim to protect patient data, ensure privacy, and build trust among users by demonstrating a commitment to safeguarding sensitive health information.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 3.3 Bn |

| Forecast Value (2033) |

USD 80.3 Bn |

| CAGR (2024-2033) |

42.5% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 1.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By App Type (Post-hospital apps, Pre-Hospital Emergency Care & Triaging Apps, and In-Hospital Communication & Collaboration Apps), By Clinical Area (Trauma, Stroke, Cardiac Condition and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Allm Inc., Hospify, Johnson & Johnson Health & Wellness Solutions Inc., PatientSafe Solutions, Alayacare, Twiage LLC, TigerConnect, Siilo B.V., Imprivata Inc., MEDISAFE, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |