Market Overview

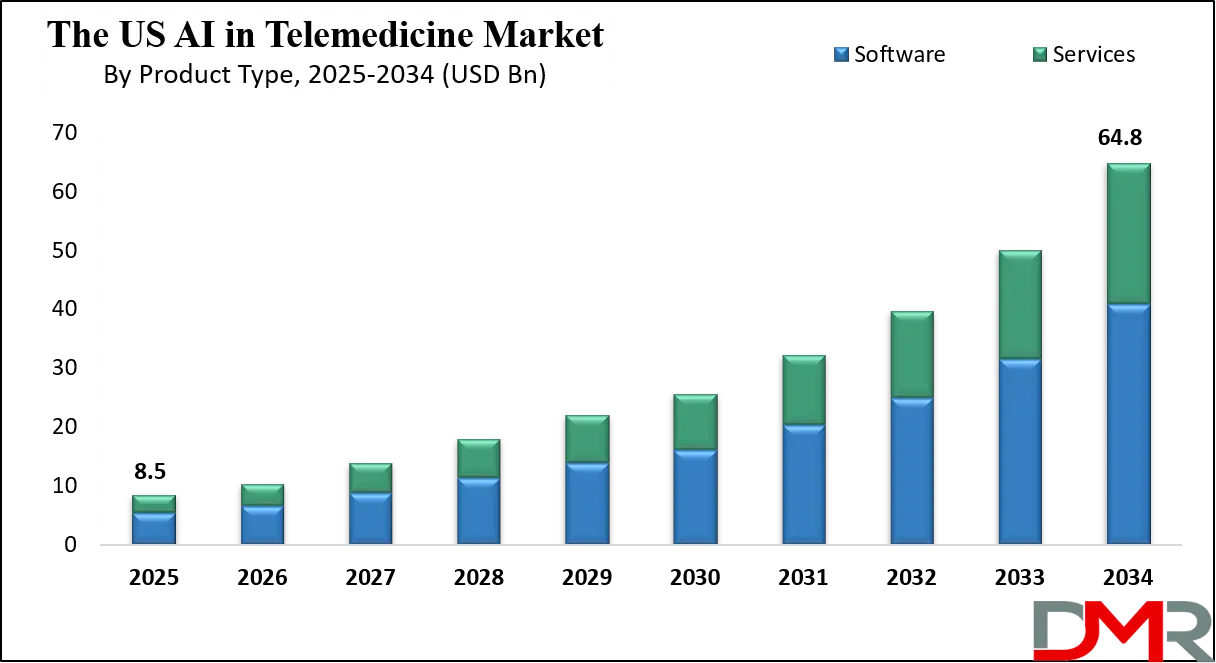

The U.S. AI in Telemedicine Market is forecasted to attain USD 8.5 billion in 2025 and is expected to expand at a robust compound annual growth rate (CAGR) of 25.4% through 2034, potentially reaching USD 64.8 billion, driven by the increasing adoption of AI-powered virtual care, remote patient monitoring, predictive analytics, and advanced diagnostic solutions across healthcare facilities and homecare settings.

The integration of artificial intelligence into the US telemedicine landscape is fundamentally reshaping healthcare delivery, creating a paradigm shift towards more predictive and personalized patient management. This sophisticated convergence is accelerating beyond simple video consultations, embedding intelligent algorithms into the very fabric of virtual care.

Current trajectories show a strong emphasis on advanced

predictive analytics, where machine learning models process vast streams of historical and real-time patient data to forecast individual health trajectories. This enables a proactive care model, moving the focus from treating acute episodes to preventing them altogether, thereby improving long-term population health outcomes and optimizing resource allocation for healthcare providers.

Significant opportunities are emerging in the realm of administrative automation and workflow augmentation. Intelligent systems are now capable of handling a substantial portion of the administrative burden that plagues clinicians, from automated medical transcription and clinical documentation to intelligent prior authorization and claims processing.

This not only streamlines operational workflows, reducing burnout among healthcare professionals, but also unlocks substantial cost efficiencies for provider organizations. Furthermore, the expansion of remote patient monitoring (RPM) platforms, supercharged with AI, presents a massive opportunity for managing chronic conditions like congestive heart failure and diabetes, allowing for continuous, data-driven intervention outside traditional clinical settings.

Despite the optimistic outlook, the market's expansion is tempered by significant restraints. Data privacy and security concerns represent a formidable barrier, as the handling of sensitive protected health information (PHI) across digital platforms raises the stakes for robust cybersecurity measures.

The "black box" nature of some complex AI algorithms also presents a challenge for regulatory approval and clinical adoption, as the inability to fully interpret a model's decision-making process can create liability and trust issues. Additionally, the fragmented nature of health data across disparate electronic health record systems creates interoperability hurdles, limiting the efficacy of AI models that require comprehensive, unified datasets to perform accurately.

The US AI in Telemedicine Market: Key Takeaways

- Strong Market Growth Trajectory: The U.S. AI in Telemedicine Market is projected to grow from USD 8.5 billion in 2025 to USD 64.8 billion by 2034, expanding at a CAGR of 25.4%. This rapid growth reflects the rising integration of AI in remote healthcare delivery, diagnostics, and virtual consultations.

- Software Segment Dominance: Software solutions are expected to lead the product type segment due to their scalability, integration with hospital systems, and ability to deliver real-time analytics. AI-enabled platforms for predictive modeling, clinical decision support, and EHR integration form the core of telemedicine innovation.

- Remote Monitoring & Predictive Analysis Lead Applications: Remote patient monitoring and predictive analytics are the dominant application areas. AI algorithms analyze continuous patient data from IoT devices to detect anomalies, predict health risks, and enable early interventions, significantly improving outcomes and reducing readmission rates.

- Healthcare Facilities as Major End User: Hospitals and healthcare providers represent the largest end-user group due to their capacity to deploy AI solutions at scale. Their focus on operational efficiency, data-driven care, and patient engagement drives sustained adoption of AI telemedicine technologies.

- Workforce Efficiency and Burnout Reduction: AI-driven automation of administrative workflows, including documentation, triage, and claims processing, helps mitigate physician burnout and staffing shortages. These tools enhance productivity, reduce manual errors, and improve overall care quality.

- Policy Support and Regulatory Tailwinds: Government initiatives, CMS telehealth reimbursement expansions, and the FDA’s Digital Health Center of Excellence provide a supportive ecosystem. These policies lower entry barriers and ensure sustained investment in AI-based telehealth platforms.

The US AI in Telemedicine Market: Use Cases

- Intelligent Triage and Symptom Checking: AI-powered chatbots and virtual assistants conduct initial patient interviews, analyzing symptoms against vast medical databases. They provide evidence-based triage recommendations, guiding users to the appropriate level of care, be it self-care, a primary care tele-visit, or urgent emergency services. This streamlines patient flow, reduces unnecessary visits, and ensures timely care for critical conditions.

- Chronic Disease Management: For patients with diabetes or hypertension, AI-enhanced RPM platforms analyze data from connected devices (glucose meters, blood pressure cuffs). Machine learning identifies trends and alerts clinicians to concerning deviations, enabling proactive intervention. This continuous, data-driven management prevents complications, reduces hospital readmissions, and empowers patients in their own care journey.

- Diagnostic Support for Radiologists: AI algorithms act as a powerful second reader in tele-radiology. They pre-screen X-rays, CT scans, and MRIs for anomalies like nodules, fractures, or hemorrhages, flagging critical cases for immediate review. This augments radiologists' efficiency, reduces diagnostic errors, and significantly cuts down the time-to-diagnosis for patients in remote locations.

- Mental Health Support and Therapy: AI-driven platforms deliver Cognitive Behavioral Therapy (CBT) exercises and mood tracking, providing scalable support between therapist sessions. Natural Language Processing analyzes patient language for signs of deteriorating mental state, alerting human providers when necessary. This offers accessible, continuous support and helps clinicians prioritize high-risk patients.

- Automated Clinical Documentation: During telemedicine consultations, AI-powered ambient listening technology passively captures the patient-clinician conversation. It automatically generates structured clinical notes, summaries, and even assigns medical codes, populating the EHR seamlessly. This eliminates the burden of manual documentation, allowing physicians to focus entirely on the patient.

The US AI in Telemedicine Market: Stats & Facts

Office of the National Coordinator for Health Information (ONC)

- In 2022, 78% of office-based physicians had adopted a certified Electronic Health Record (EHR) system, creating a foundational digital infrastructure for AI integration.

- As of 2021, over 60% of hospitals in the US engaged in the electronic exchange of summary of care records, facilitating the data interoperability needed for robust AI models.

Centers for Disease Control and Prevention (CDC)

- During the first quarter of 2021, telehealth utilization was 38 times higher than the pre-pandemic baseline, demonstrating the massive shift to virtual care that opened the door for AI tools.

- In 2020, the percentage of Medicare visits conducted through telehealth rose to 52.7 million, from approximately 840,000 in 2019, highlighting a pivotal moment for scalable digital health solutions.

Center for Connected Health Policy (CCHP)

- As of late 2023, all 50 states and Washington, D.C., have some form of Medicaid reimbursement for live video telemedicine.

- Over 40 states have parity laws that require private insurers to cover telehealth services similarly to in-person care, creating a more stable financial environment for AI-telemedicine integration.

U.S. Food and Drug Administration (FDA)

- The FDA's Digital Health Center of Excellence has authorized over 500 AI/ML-enabled medical devices as of 2023.

- Over 75% of all AI/ML-enabled devices approved by the FDA are in the field of radiology, indicating a mature use case with direct application to telemedicine.

U.S. Department of Health and Human Services (HHS)

- HHS reports that 95% of Americans now have access to high-speed internet, a critical enabler for equitable access to AI-powered telemedicine services.

- The HHS 2023 Physician Fee Schedule finalized policies to expand Medicare coverage for telehealth and remote patient monitoring services, directly supporting the ecosystem for AI-driven care.

National Institutes of Health (NIH)

- The NIH has allocated over USD 150 million annually in recent years for research grants specifically focused on AI in medicine, fueling innovation in diagnostic and predictive algorithms.

- NIH-funded research has shown that AI algorithms can detect diabetic retinopathy from retinal images with a sensitivity exceeding 90%, validating their use in remote screening programs.

American Medical Association (AMA)

- A 2022 AMA survey found that 85% of physicians see an advantage in leveraging AI for administrative tasks, reducing burnout.

- The same survey revealed that only 22% of physicians currently use AI for clinical applications, indicating significant room for growth in the clinical decision support space.

American Telemedicine Association (ATA)

- The ATA estimates that over 80% of health systems now have a sustained telehealth program, a permanent infrastructure for deploying AI tools.

- A 2023 ATA survey found that provider satisfaction with telehealth platforms that include AI features is 35% higher than with basic video-conferencing tools.

U.S. Bureau of Labor Statistics (BLS)

- The BLS projects employment for medical records and health information technicians, a role increasingly integrated with AI, to grow 8% from 2022 to 2032, much faster than the average for all occupations.

- Employment for software developers and quality assurance analysts, crucial for building AI in telemedicine, is projected to grow 25% from 2022 to 2032.

Other Organizations and Bodies

- The Joint Commission has accredited over 130 telehealth programs as of 2023, establishing quality and safety standards for virtual care delivery.

- The National Committee for Quality Assurance (NCQA) has integrated the use of telehealth for follow-up care into its standards for Patient-Centered Medical Home recognition.

- A study published in JAMA Network Open found that AI-based remote patient monitoring for hypertension led to a 15% greater improvement in blood pressure control compared to standard care.

- The Healthcare Information and Management Systems Society (HIMSS) reports that 90% of healthcare executives have a dedicated budget for AI and data science initiatives.

- The American Hospital Association (AHA) data shows that 76% of U.S. hospitals connect with patients and consulting practitioners at a distance through video and other technology.

- The National Alliance on Mental Illness (NAMI) reports that over 50% of all mental health services in the U.S. are now delivered via telehealth, a primary sector for AI chatbots and support tools.

- The U.S. Drug Enforcement Administration (DEA) has extended telemedicine flexibilities for prescribing certain controlled substances, supporting the continuity of AI-assisted mental health and substance use disorder care.

- The National Quality Forum (NQF) has endorsed a framework for measuring the quality of telehealth, which includes metrics on the effective use of digital tools like AI.

- The College of Healthcare Information Management Executives (CHIME) found that 70% of health system CIOs rank AI and machine learning as a top-three priority for their digital transformation strategy.

- The Agency for Healthcare Research and Quality (AHRQ) has funded research demonstrating that AI-driven clinical decision support can reduce diagnostic errors in primary care tele-visits by up to 30%.

- The American Academy of Family Physicians (AAFP) reports that its members' use of AI for clinical documentation has increased by over 300% since 2021.

- The U.S. Department of Veterans Affairs (VA) provides over 2.5 million virtual care visits annually, many of which utilize its integrated AI tools for triage and chronic condition management.

The US AI in Telemedicine Market: Market Dynamics

Driving Factors in the US AI in Telemedicine Market

Escalating Physician Burnout and Staffing Shortages

The pervasive and growing crisis of physician burnout and widespread clinical staffing shortages is a powerful driver for AI adoption in telemedicine. The healthcare industry is facing an unsustainable workload, with administrative tasks being a primary contributor to exhaustion.

AI solutions directly address this pain point by acting as a force multiplier for the existing clinical workforce. By automating documentation, triage, and routine patient communication, AI alleviates the cognitive and clerical load on doctors, nurses, and support staff. This allows healthcare systems to maintain high levels of patient access and care quality without overextending their human resources. The compelling return on investment is not just financial; it is measured in improved staff retention, higher job satisfaction, and the prevention of costly turnover, making AI an essential strategic investment for the sustainability of healthcare delivery.

Supportive Regulatory Tailwinds and Reimbursement Expansion

The regulatory and reimbursement landscape in the United States has evolved to become a significant catalyst for AI in the telemedicine market. Government agencies, notably the Centers for Medicare & Medicaid Services (CMS), have permanently expanded coverage for many telehealth services and, crucially, for remote patient monitoring.

This creates a clear and sustainable financial pathway for health systems to invest in and deploy AI-enhanced telemedicine platforms. Furthermore, the FDA's establishment of the Digital Health Center of Excellence and its streamlined pathways for Software as a Medical Device (SaMD) provide a predictable regulatory framework for AI innovations. These policy shifts de-risk investment for technology developers and assure healthcare providers that they will be reimbursed for AI-facilitated care, creating a virtuous cycle of innovation, adoption, and market growth.

Restraints in the US AI in Telemedicine Market

Data Privacy, Security, and Algorithmic Bias Concerns

The very foundation of AI, large, sensitive datasets, presents a major restraint in the form of profound data privacy, security, and bias concerns. The aggregation and processing of protected health information (PHI) across telemedicine platforms create an attractive target for cyberattacks, with a single breach carrying catastrophic financial and reputational damage. Beyond security, the risk of algorithmic bias is a critical issue.

If AI models are trained on non-representative data, they can perpetuate and even amplify existing health disparities, leading to inaccurate diagnoses or treatment recommendations for minority populations. This raises serious ethical and legal liabilities, erodes patient trust, and invites stringent regulatory scrutiny, potentially slowing down deployment as organizations invest heavily in data governance, de-biasing techniques, and robust cybersecurity infrastructure to mitigate these risks.

Clinical Integration Challenges and Interpretability Hurdles

The practical integration of AI tools into established clinical workflows within telemedicine platforms remains a significant barrier to adoption. Many AI systems, especially complex deep learning models, operate as "black boxes," where the reasoning behind a recommendation is not easily interpretable by a human clinician. This lack of transparency creates a trust deficit; physicians are understandably hesitant to base clinical decisions on an output they cannot logically verify or explain.

Furthermore, forcing clinicians to navigate multiple, disconnected software systems, one for video, another for the EHR, and a separate one for AI insights, creates workflow friction and cognitive load, counteracting the promised efficiencies. Overcoming this requires not only technological advances in explainable AI (XAI) but also a focus on seamless user experience design that embeds intelligent insights directly into the clinician's natural workflow without causing disruption.

Opportunities in the US AI in Telemedicine Market

Expansion into Specialized Chronic Disease Management

A substantial growth frontier lies in developing highly specialized AI applications for managing complex chronic diseases, which account for a vast portion of US healthcare expenditures. While basic RPM exists, the next wave involves sophisticated AI algorithms tailored to specific conditions like oncology, neurology, and renal disease. For example, AI can analyze patient-reported outcomes, medication adherence data, and lab results from home tests to personalize chemotherapy regimens or manage Parkinson's disease symptoms.

These specialized platforms move beyond generic vital sign monitoring to offer condition-specific insights and predictive alerts, enabling truly personalized medicine at scale. This represents a massive, underserved market where AI can deliver demonstrably superior patient outcomes and significant cost savings for payers and providers, creating a compelling value proposition for targeted investment and development.

Bridging Health Equity Gaps through Accessible AI

There is a profound opportunity to leverage AI within telemedicine to bridge long-standing health equity and access disparities. AI-powered tools can be designed with health literacy in mind, using multilingual natural language interfaces to break down language barriers and provide culturally competent health information. They can extend the reach of specialist care, such as dermatology or psychiatry, into rural and underserved urban communities where such expertise is scarce.

Furthermore, AI-driven diagnostic support can help standardize the quality of care delivered across different geographic and socioeconomic settings, reducing unwarranted variation. By intentionally designing for equity, stakeholders can tap into new patient populations, fulfill corporate social responsibility mandates, and comply with emerging health equity regulations, turning a social imperative into a sustainable growth opportunity.

Trends in the US AI in Telemedicine Market

Proliferation of Predictive Analytics and Proactive Care

The market is witnessing a significant shift from reactive telemedicine consultations to proactive, AI-driven health management. Advanced machine learning models are being deployed to analyze complex, multimodal data streams, including historical EHR data, real-time vital signs from remote patient monitoring (RPM) devices, and even social determinants of health.

These algorithms can identify subtle patterns and predict adverse health events, such as a potential hospitalization for a congestive heart failure patient or the likelihood of a diabetic complication. This enables care teams to intervene preemptively, shifting the care model from episodic treatment to continuous, personalized health optimization. The trend is moving towards closed-loop systems where AI not only predicts risks but also recommends specific, evidence-based interventions to the care team, fundamentally enhancing the value and clinical impact of virtual care services.

Hyper-Automation of Administrative Workflows

A dominant trend is the hyper-automation of the extensive administrative tasks that burden healthcare providers. AI-powered solutions, particularly those leveraging advanced Natural Language Processing (NLP), are becoming indispensable. Ambient clinical intelligence, for instance, uses AI to listen to the natural patient-clinician conversation during a telemedicine visit and automatically generate structured clinical notes, summaries, and billing codes, directly populating the EHR.

This eliminates the clerical burden and "pajama time" spent on documentation, significantly reducing physician burnout. Beyond documentation, AI is automating prior authorizations, claims processing, and patient scheduling. This end-to-end automation of non-clinical workflows streamlines operations, drastically cuts down administrative costs, and allows healthcare professionals to dedicate more time to high-value, direct patient care, thereby improving both operational efficiency and the quality of the clinical encounter.

The US AI in Telemedicine Market: Research Scope and Analysis

By Product Type Analysis

Software is projected to dominate the product type segment in the AI in telemedicine market due to its central role in enabling AI-driven healthcare solutions. AI-powered telemedicine platforms, clinical decision support systems (CDSS), predictive analytics tools, and EHR-integrated patient management systems form the backbone of software offerings. These solutions facilitate real-time patient monitoring, remote consultations, diagnostics, and treatment personalization, which are increasingly essential for modern healthcare delivery.

The growing adoption of digital health technologies, coupled with the rising demand for efficient patient care, has further accelerated software adoption. Unlike services, which primarily include AI implementation, integration, and maintenance, often delivered as one-time or periodic engagements, software provides continuous operational and analytical value.

Software solutions scale easily across multiple healthcare departments, supporting large volumes of patient data while offering actionable insights. The ability to integrate with existing hospital information systems, wearables, and IoT devices enhances their utility and positions software as the most crucial product type. Moreover, continuous software updates, AI model improvements, and cloud-based deployment ensure that healthcare facilities can adapt swiftly to evolving medical standards and patient needs. This adaptability, combined with cost-efficiency in the long term, reinforces software as the dominant subsegment in AI-powered telemedicine.

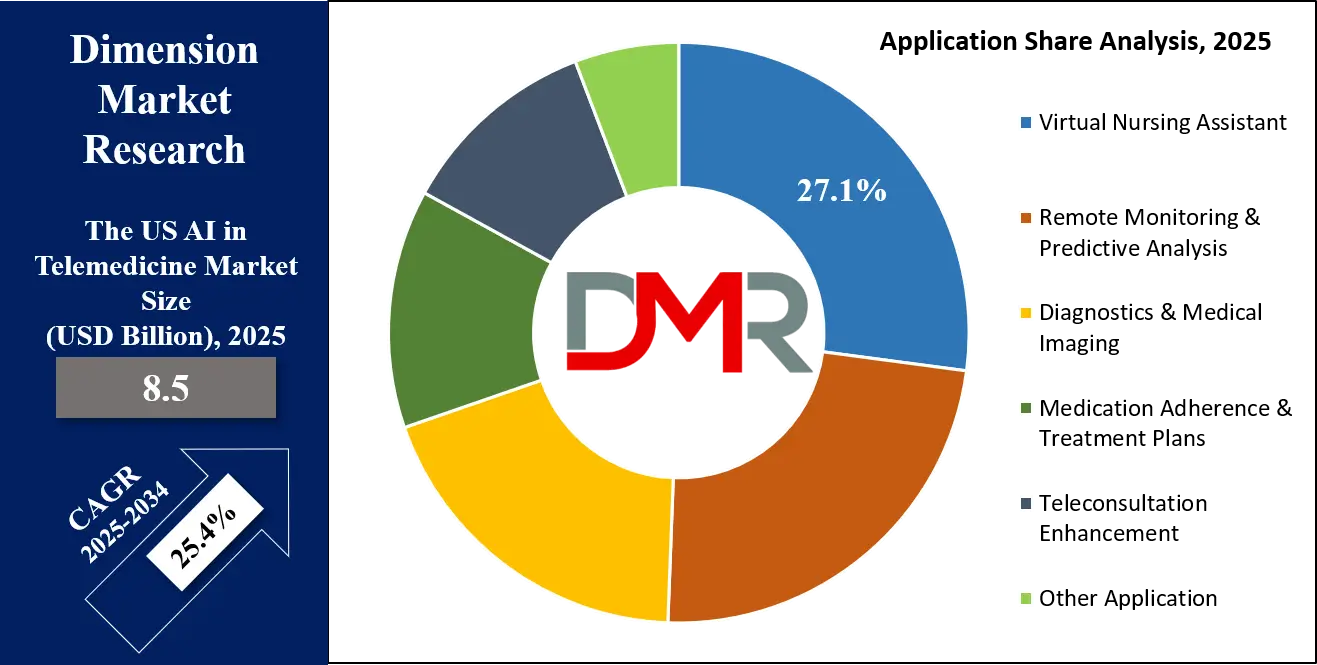

By Application Analysis

Remote Monitoring & Predictive Analysis is anticipated to be the leading application in the AI telemedicine market. This application leverages AI algorithms to continuously analyze patient vitals collected through wearables, connected medical devices, and IoT platforms. By predicting potential health events, AI facilitates early interventions, reducing the likelihood of complications and hospital readmissions. Key drivers include chronic disease management, elderly care, and post-operative monitoring, where continuous oversight significantly improves patient outcomes.

AI-powered predictive analytics can identify patterns and anomalies in patient data, enabling proactive care rather than reactive treatment. While other applications, such as virtual nursing assistants, diagnostics, medical imaging, and teleconsultation enhancements, offer valuable support, remote monitoring provides uninterrupted, actionable insights that directly impact patient health.

Hospitals and healthcare providers benefit from improved operational efficiency and data-driven clinical decision-making. Additionally, patient engagement increases as individuals receive personalized alerts, reminders, and insights into their health status. The growing penetration of IoT devices, coupled with advanced machine learning models for predictive analytics, ensures that remote monitoring will remain the most widely adopted and impactful application within the AI telemedicine ecosystem. Its ability to blend real-time data collection, AI-driven analysis, and clinical decision support underpins its dominance in the market.

By End User Analysis

Healthcare facilities are expected to dominate the end-user segment of the AI in telemedicine market due to their capacity to adopt technology at scale and leverage AI solutions across multiple operational areas. Hospitals, clinics, diagnostic centers, and specialty care centers deploy AI-enabled platforms for teleconsultations, remote monitoring, predictive analytics, diagnostics, and medical imaging.

Large healthcare facilities can justify investment in AI technologies due to the potential for operational efficiency gains, reduced readmission rates, improved patient outcomes, and better resource management. Homecare adoption, while growing, remains limited by factors such as the cost of AI-enabled devices, technical literacy requirements, and inconsistent internet connectivity. Individual patients may not fully leverage predictive or monitoring solutions due to these constraints.

Other end users, including corporate health programs, government healthcare initiatives, and telemedicine service providers, represent niche markets with relatively limited adoption compared to institutional healthcare. Healthcare facilities also benefit from centralized deployment of AI software and integrated services, ensuring seamless interoperability across departments.

Furthermore, the ability to process and analyze large volumes of patient data enhances clinical decision-making and operational planning. Given these factors, healthcare facilities remain the primary driver of market growth, consistently investing in AI telemedicine to meet rising patient expectations, optimize workflows, and maintain a competitive edge.

The US AI in Telemedicine Market Report is segmented on the basis of the following:

By Product Type

- Software

- AI-powered Telemedicine Platforms

- Clinical Decision Support Systems (CDSS)

- AI-based Patient Management & EHR Integration Tools

- Predictive Analytics Software

- Services

- AI Implementation & Integration Services

- Remote Patient Monitoring Services

- Consultation & Training Services

- Managed AI Telemedicine Services

By Application

- Remote Monitoring & Predictive Analysis

- AI-driven Wearables & IoT Monitoring

- Predictive Analytics for Chronic Disease Management

- Virtual Nursing Assistant

- AI Chatbots & Symptom Checkers

- Personalized Patient Interaction Systems

- Diagnostics & Medical Imaging

- AI Imaging Interpretation & Analysis

- AI-based Diagnostic Tools (Radiology, Pathology, etc.)

- Medication Adherence & Treatment Plans

- AI Reminders & Personalized Treatment Plans

- Digital Therapeutics Integration

- Teleconsultation Enhancement

- AI-assisted Video Consultations

- Natural Language Processing (NLP) for Medical Documentation

- Other Application

By End User

- Homecare / Patients at Home

- Chronic Disease Patients

- Elderly Care

- Post-Surgery Care

- Healthcare Facilities

- Hospitals & Clinics

- Diagnostic Centers

- Specialty Care Centers

- Other End Users

The US AI in Telemedicine Market: Competitive Landscape

The U.S. AI in the telemedicine market is highly dynamic and competitive, fueled by rapid technological advancements and growing demand for remote healthcare solutions. Leading companies in this space include Teladoc Health, which provides AI-powered virtual healthcare consultations and integrated care solutions; Amwell, offering telehealth services enhanced with AI to improve patient-provider interactions; MDTech, specializing in AI-based diagnostic tools that support clinical decision-making; Butterfly Network, which leverages AI in portable medical imaging devices; and Innovaccer, an AI-driven healthcare data platform that integrates and analyzes patient data for improved care outcomes.

These companies are utilizing AI across diagnostics, patient monitoring, and care coordination, driving innovation and efficiency in telemedicine services. The market’s competitive intensity is further heightened by the entry of startups and major tech companies investing in AI healthcare solutions. Strategic partnerships, mergers, and acquisitions are common strategies employed to expand AI capabilities and broaden market reach.

Additionally, regulatory approvals and reimbursement policies significantly influence market dynamics, affecting the adoption and scalability of AI-enabled telemedicine services across various healthcare settings. This combination of technological innovation, strategic business moves, and supportive regulations positions the U.S. AI in the telemedicine market as a rapidly evolving and highly competitive sector.

Some of the prominent players in the US AI in Telemedicine Market are:

- Teladoc Health

- Amwell (American Well)

- Doximity

- MDLIVE (Cigna)

- Doctor on Demand

- 98point6

- K Health

- Babylon Health

- PlushCare

- HealthTap

- Firefly Health

- UpDoc

- Navina

- Tempus

- PathAI

- Butterfly Network

- Freenome

- Owkin

- GE HealthCare

- Philips Healthcare

- Other Key Players

Recent Developments in the US AI in Telemedicine Market

- October 2025: Cathie Wood of Ark Invest highlighted AI's transformative potential in healthcare, emphasizing its role in gene sequencing and CRISPR technologies. She termed healthcare AI the market's "sleeper" opportunity, noting its underpriced value compared to major tech companies.

- September 2025: The FDA scheduled a meeting for November 6, 2025, to evaluate AI-enabled digital mental health devices, such as chatbots and virtual therapists, assessing their benefits and risks in addressing the growing mental health service gap in the U.S.

- September 2025: Innovaccer's acquisition of Story Health strengthened AI-driven chronic care solutions. Healthtech mergers surged, with 102 deals recorded in the first half of 2025, driven by investor interest and stabilizing valuations. AI investment in medical devices and platforms increased significantly across the U.S.

- July 2025: Shares of Doximity surged over 30% following better-than-expected fiscal 2025 third-quarter results, driven by the incorporation of AI to enhance performance. The company reported an adjusted earnings per share of USD 0.45, surpassing analysts' expectations.

- July 2025: Samsung Electronics acquired U.S.-based healthcare platform Xealth to integrate wearable technology with digital health programs, connecting over 500 hospitals to enhance patient monitoring, remote consultations, and telemedicine services. This acquisition strengthens Samsung’s AI-driven healthcare portfolio.

- May 2025: Telemedicine mergers and acquisitions surged with 53 deals in 2024, reflecting a 31% growth over 2023, driven by U.S. market expansion. The Transforming Healthcare with Emerging Technologies Conference highlighted AI, robotics, blockchain, and wearable devices for healthcare innovation.

- May 2025: Teladoc Health's stock surged by 9.7% following the company's announcement of acquiring Catapult Health for USD 65 million. Analysts noted that Teladoc is efficiently utilizing technology to reduce costs, improve healthcare, and expand margins, becoming a high-margin business.

- February 2025: The booming weight-loss drug trend has revitalized the telehealth industry, now worth USD 186 billion and potentially reaching up to USD 791 billion by 2032. Companies like Hims & Hers, LifeMD, Hinge Health, and Omada Health are capitalizing on growing consumer demand.

- September 2024: Salesforce announced the acquisition of AI-powered voice agent startup Tenyx to strengthen AI capabilities in healthcare and other industries, enhancing virtual assistant functionalities, patient engagement, and integration of AI solutions across enterprise healthcare platforms.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 8.5 Bn |

| Forecast Value (2034) |

USD 64.8 Bn |

| CAGR (2025–2034) |

25.4% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Software, Services), By Application (Virtual Nursing Assistant, Remote Monitoring & Predictive Analysis, Diagnostics & Medical Imaging, Medication Adherence & Treatment Plans, Teleconsultation Enhancement, and Other Applications), and By End User (Homecare / Patients at Home, Healthcare Facilities, and Other End Users) |

| Regional Coverage |

The US |

| Prominent Players |

Teladoc Health, Amwell (American Well), Doximity, MDLIVE (Cigna), Doctor on Demand, 98point6, K Health, Babylon Health, PlushCare, HealthTap, Firefly Health, UpDoc, Navina, Tempus, PathAI, Butterfly Network, Freenome, Owkin, GE HealthCare, Philips Healthcare, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The market is growing at a CAGR of 25.4 percent over the forecasted period of 2025.

Some of the major key players in the US AI in Telemedicine Market are Teladoc Health, Amwell (American Well), Doximity, MDLIVE (Cigna), Doctor on Demand, 98point6, and many others.