Market Overview

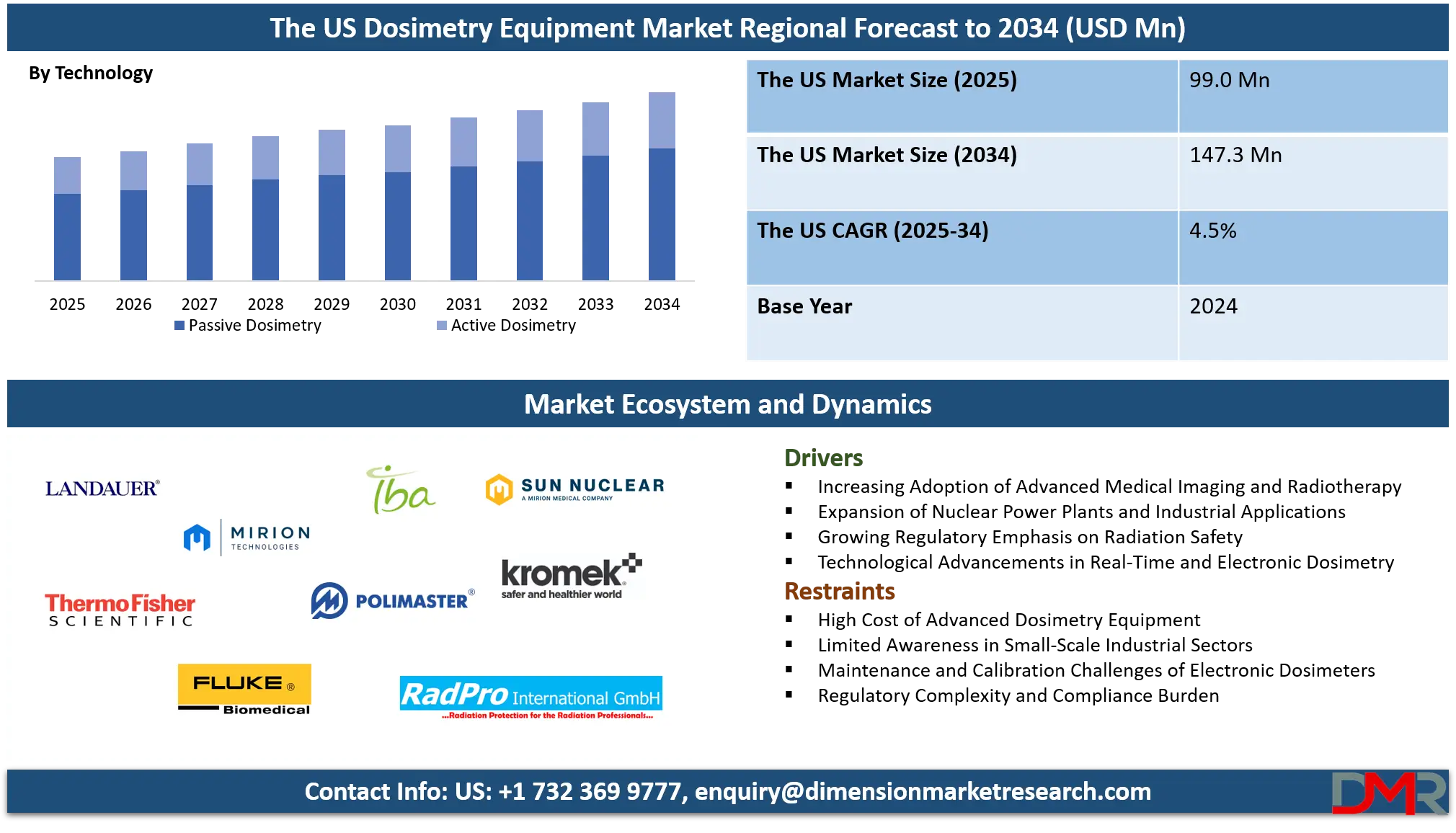

The US dosimetry equipment market is projected to grow from USD 99.0 million in 2025 to USD 147.3 million by 2034, registering a CAGR of 4.5%.

This growth is driven by growing demand for radiation monitoring solutions, rising adoption of personal and area dosimeters, stringent regulatory compliance in healthcare and nuclear sectors, and technological advancements in real-time and electronic dosimetry systems. The market expansion reflects heightened focus on occupational safety, environmental radiation surveillance, and precision monitoring across medical, industrial, and nuclear applications.

Dosimetry equipment refers to specialized instruments and devices designed to measure, monitor, and record the exposure of individuals or environments to ionizing radiation. These devices are essential for ensuring safety in industries and applications where radiation is present, such as medical imaging, radiotherapy, nuclear power generation, research laboratories, and industrial non-destructive testing.

Dosimeters can be personal, worn by individuals to track cumulative exposure, or area-based, installed in specific locations to monitor radiation levels continuously. Modern dosimetry equipment incorporates advanced technologies, including thermoluminescent, optically stimulated luminescence, electronic, and passive sensors, offering accurate, real-time data and ensuring compliance with safety regulations. They play a critical role in protecting workers, the public, and the environment from the harmful effects of radiation by providing actionable insights for preventive measures and timely interventions.

The US dosimetry equipment market is a well-established segment within the broader radiation safety and monitoring industry, driven by the growing need for radiation protection across healthcare, nuclear power, and industrial sectors. Rising investments in medical imaging technologies, expansion of nuclear facilities, and stringent regulatory requirements for occupational and environmental safety have propelled market growth.

The market encompasses a wide range of products, including personal dosimeters, area monitors, and environmental radiation detectors, with each type offering unique functionalities tailored to specific applications. Technological advancements such as real-time monitoring, wireless connectivity, and integration with digital health platforms are further enhancing the adoption of dosimetry solutions.

Market dynamics in the United States are influenced by the growing emphasis on workplace safety, government initiatives promoting radiation awareness, and the ongoing modernization of nuclear and medical infrastructure. Hospitals, research institutes, industrial units, and nuclear power plants constitute the primary end-users, each requiring reliable dosimetry systems to maintain compliance with safety standards and minimize exposure risks.

Increasing awareness about the long-term effects of radiation, integrated with rising demand for precise and efficient monitoring tools, continues to create opportunities for manufacturers and service providers. As the industry evolves, the adoption of advanced dosimetry equipment with predictive analytics and automated reporting features is expected to drive market expansion and enhance the overall safety framework.

The US Dosimetry Equipment Market: Key Takeaways

- Market Value: The US Dosimetry Equipment market size is expected to reach a value of USD 147.3 million by 2034 from a base value of USD 99.0 million in 2025 at a CAGR of 4.5%.

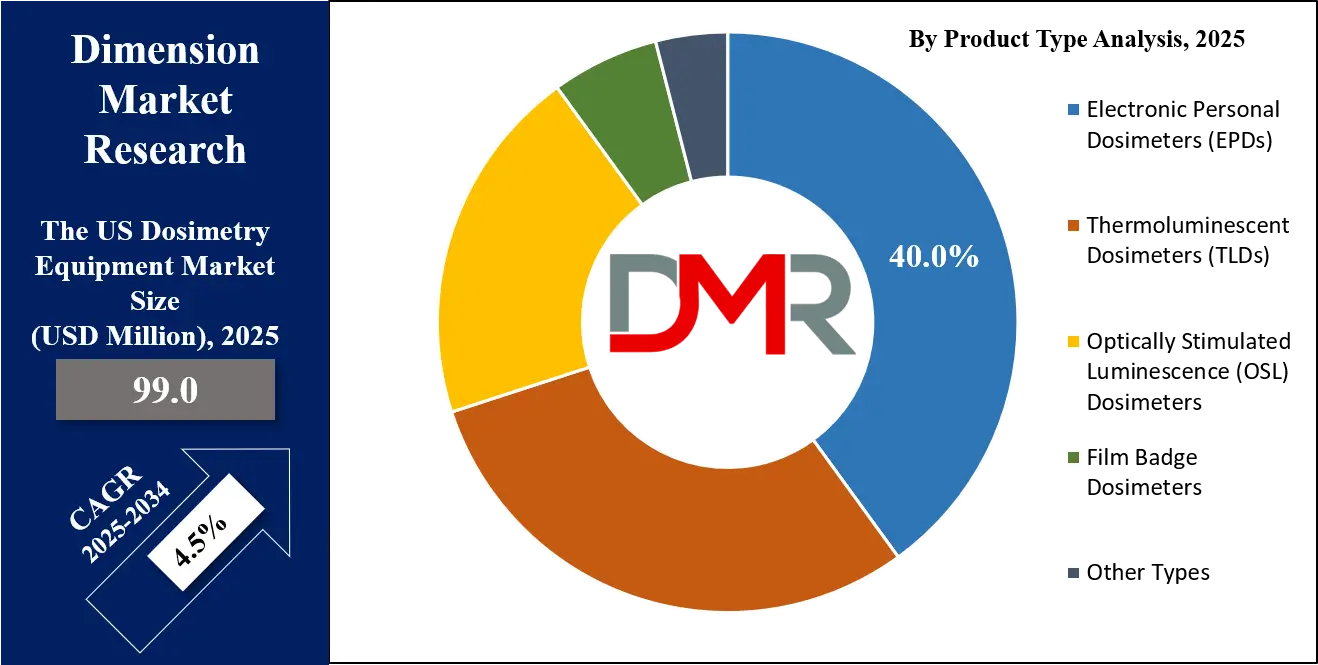

- By Product Type Segment Analysis: Electronic Personal Dosimeters (EPDs) are expected to maintain their dominance in the product type segment, capturing 40.0% of the total market share in 2025.

- By Technology Segment Analysis: Passive Dosimetry will dominate the technology segment, capturing 70.0% of the market share in 2025.

- By Application Segment Analysis: Medical applications are anticipated to dominate the application segment, capturing 50.0% of the total market share in 2025.

- By End-User Segment Analysis: Healthcare Facilities will dominate the end-user segment, capturing 35.0% of the market share in 2025.

- Key Players: Some key players in the US Dosimetry Equipment market include Landauer, Inc., Mirion Technologies, Inc., Thermo Fisher Scientific, Fluke Biomedical (RaySafe), IBA Dosimetry GmbH, Polimaster Ltd., RadPro International GmbH, Sun Nuclear Corporation, Fort Calhoun Nuclear Dosimetry Services, Kromek Group PLC, Atomtex SPE, Biodex Medical Systems, and Others.

The US Dosimetry Equipment Market: Use Cases

- Medical Radiation Safety and Diagnostic Imaging: In the healthcare sector, dosimetry equipment is extensively used to monitor radiation exposure for patients and medical personnel during diagnostic imaging and radiotherapy procedures. Hospitals and diagnostic centers rely on personal dosimeters and area monitoring systems to ensure compliance with safety standards and minimize occupational hazards. Real-time electronic dosimeters allow radiologists and technicians to track exposure instantly, reducing cumulative radiation risks. The integration of advanced dosimetry systems with hospital information networks enhances reporting, facilitates regulatory compliance, and supports safe handling of X-ray, CT, and nuclear medicine procedures.

- Nuclear Power Plant Monitoring: Dosimetry equipment plays a crucial role in nuclear power facilities, where accurate monitoring of ionizing radiation is essential for worker safety and operational efficiency. Personal dosimeters track individual exposure, while environmental and area monitors assess radiation levels in reactors, cooling systems, and surrounding areas. The use of electronic and passive dosimeters ensures real-time alerts and historical dose recording, supporting preventive measures and regulatory compliance. With nuclear energy expansion in the United States, advanced radiation detection solutions are increasingly adopted to safeguard plant personnel and maintain strict adherence to occupational safety standards.

- Industrial Applications and Non-Destructive Testing: In industrial sectors such as manufacturing, aerospace, and construction, dosimetry systems are critical for non-destructive testing and material inspection using radiation sources. Workers are exposed to ionizing radiation during radiographic inspections, requiring personal and area dosimeters for continuous exposure monitoring. Advanced electronic dosimetry devices provide real-time alerts, dose logging, and integration with safety management systems, ensuring workplace safety. Regulatory compliance and stringent safety protocols in industrial operations drive the adoption of reliable radiation monitoring equipment, mitigating risks associated with prolonged or high-level exposure.

- Environmental Radiation Monitoring and Research: Dosimetry equipment is also deployed for environmental radiation surveillance and research purposes, helping monitor radiation levels in air, water, and soil. Research institutes, government agencies, and environmental organizations use passive and active dosimeters to collect data for radiation mapping, contamination assessment, and long-term ecological studies. These systems support risk assessment, policy development, and emergency preparedness in case of radiological events. Advanced features such as wireless connectivity, automated reporting, and integration with geographic information systems enhance the effectiveness of environmental monitoring and ensure accurate tracking of radiation exposure trends.

Impact of Artificial Intelligence on the US Dosimetry Equipment Market

- Enhanced Real-Time Monitoring: Artificial intelligence enables dosimetry systems to process radiation data instantly, providing predictive alerts and automated safety notifications. Real-time analytics improve the accuracy of exposure measurements and allow immediate corrective actions in medical, industrial, and nuclear environments, enhancing overall radiation safety.

- Predictive Analytics for Risk Management: AI-driven dosimetry platforms can analyze historical exposure patterns to forecast high-risk scenarios, optimize work schedules, and reduce cumulative radiation doses. Predictive insights support regulatory compliance and proactive safety planning across hospitals, nuclear facilities, and industrial sites.

- Integration with Digital Health and IoT Systems: Artificial intelligence facilitates seamless integration of dosimetry equipment with hospital networks, wearable devices, and IoT-enabled monitoring systems. This allows centralized tracking of radiation exposure, automated reporting, and enhanced data visualization, streamlining workflow and safety management.

- Automation and Workflow Optimization: AI applications automate data processing, dose calculation, and record-keeping, minimizing manual errors and administrative burden. In industrial, research, and environmental monitoring sectors, AI-enhanced dosimeters improve operational efficiency, ensure consistent compliance, and accelerate decision-making related to radiation safety.

The US Dosimetry Equipment Market: Stats & Facts

U.S. Department of Defense (DoD)

- 2023: USD 110.4 million allocated for Overseas Operations Costs.

- 2024: USD 230.9 million requested for Overseas Operations Costs.

- 2025: USD 220.5 million requested for Overseas Operations Costs.

- 2023: USD 183.0 million transferred to VA for Lovell FHCC and the DoD-VA Joint Incentive Fund.

- 2024: USD 172.0 million requested for transfer to VA for Lovell FHCC.

- 2025: USD 162.5 million requested for transfer to VA for Lovell FHCC.

- 2023: USD 15 million allocated for transfer to the DoD-VA Joint Incentive Fund.

- 2024: USD 15 million requested for transfer to the DoD-VA Joint Incentive Fund.

- 2025: USD 15 million requested for transfer to the DoD-VA Joint Incentive Fund.

- 2023: 2.6 million Medicare-eligible retirees and their family members supported.

U.S. Department of Energy (DOE)

- 2023: Data from the DOE’s Radiation Exposure Monitoring System (REMS) used to analyze occupational radiation exposures.

- 2023: Reports provide critical information to DOE and the NRC on radiation exposure programs.

- 2023: Demonstrates transparency to workers and the public in the agencies’ commitment to the highest standards of safety.

U.S. Food and Drug Administration (FDA)

- 2025: FDA's role in radiological and nuclear emergency preparedness includes guidance for industry.

- 2025: Works to help prepare the nation for potential threats, including radiological and nuclear emergencies.

- 2025: Provides information on medical countermeasures and preparedness information for consumers.

The US Dosimetry Equipment Market: Market Dynamics

The US Dosimetry Equipment Market: Driving Factors

Rising Demand for Radiation Safety in Healthcare

The growing use of diagnostic imaging, radiotherapy, and nuclear medicine in hospitals and clinics has significantly boosted the demand for dosimetry equipment in the United States. Hospitals and diagnostic centers are investing in personal and electronic dosimeters to monitor staff and patient exposure to ionizing radiation. Advanced radiation detection systems ensure compliance with regulatory safety standards, reduce occupational hazards, and support precise dose management, which is critical in enhancing patient care and protecting healthcare professionals.

Expansion of Nuclear and Industrial Applications

The growing presence of nuclear power plants and industrial facilities requiring non-destructive testing and radiography is driving market growth. Dosimetry systems are essential for monitoring radiation exposure in workers and maintaining safe operational environments. The adoption of active and passive dosimeters, integrated with real-time monitoring capabilities, allows industrial operators to mitigate risks, comply with occupational safety regulations, and ensure continuous surveillance in high-radiation zones.

The US Dosimetry Equipment Market: Restraints

High Cost of Advanced Dosimetry Equipment

The substantial investment required for sophisticated dosimetry systems, particularly electronic and AI-enabled devices, can hinder market adoption. Small healthcare facilities, research institutes, and industrial units may face budgetary constraints, limiting their ability to implement advanced radiation monitoring solutions. This financial barrier slows the penetration of high-precision dosimeters despite their benefits in safety and regulatory compliance.

Limited Awareness in Small-Scale Industrial Sectors

Smaller industrial units and laboratories often lack awareness regarding the importance of continuous radiation monitoring and regulatory requirements. This can result in underutilization of dosimetry equipment, leading to inconsistent safety practices. Limited education about radiation hazards and insufficient training in device handling further restrain market growth, especially among small and medium-sized enterprises.

The US Dosimetry Equipment Market: Opportunities

Integration with Artificial Intelligence and IoT Platforms

There is significant opportunity to develop AI-powered dosimetry solutions that integrate with IoT-enabled healthcare and industrial monitoring systems. Such devices can offer predictive analytics, real-time alerts, automated reporting, and centralized data management, enhancing radiation safety protocols. The incorporation of machine learning algorithms can optimize exposure tracking and streamline workflow, providing value to hospitals, nuclear facilities, and industrial operators.

Growing Focus on Environmental Radiation Monitoring

Increasing regulatory emphasis on environmental safety and public health creates opportunities for dosimetry applications in ecological monitoring. Government agencies, research organizations, and environmental consultancies require reliable radiation detection systems to assess air, water, and soil contamination. Advanced environmental dosimeters with automated data logging and remote monitoring capabilities support long-term radiation assessment and contribute to risk mitigation and policy planning.

The US Dosimetry Equipment Market: Trends

Shift towards Real-Time Electronic Dosimetry

The market is witnessing a trend toward electronic dosimeters that provide instant feedback and continuous monitoring. Real-time devices allow healthcare professionals, industrial workers, and nuclear plant operators to track exposure levels instantly, enabling immediate corrective actions. Integration with mobile and cloud platforms is increasingly common, offering better visualization, data storage, and reporting capabilities.

Adoption of Wearable and Portable Radiation Monitoring Devices

Wearable dosimeters and compact, portable monitoring systems are gaining popularity due to their convenience and flexibility. These devices allow workers to carry personal radiation detectors throughout their shifts, ensuring accurate dose tracking even in dynamic environments. The trend reflects a shift toward user-centric safety solutions, combining mobility, precision, and regulatory compliance across healthcare, nuclear, and industrial sectors.

The US Dosimetry Equipment Market: Research Scope and Analysis

By Product Type Analysis

Electronic Personal Dosimeters (EPDs) are anticipated to maintain a leading position in the US dosimetry equipment market, accounting for an estimated 40% of the total market share in 2025. Their dominance is attributed to the growing need for real-time monitoring of radiation exposure across healthcare, nuclear, and industrial sectors. EPDs offer accurate, instantaneous feedback on cumulative radiation doses, enabling workers and medical personnel to take immediate precautionary measures when exposure limits are approached.

The ability to integrate with digital reporting systems, mobile applications, and centralized safety networks further enhances their adoption, providing comprehensive exposure tracking and regulatory compliance. Additionally, their user-friendly design, portability, and continuous monitoring capability make them an indispensable tool in environments where ionizing radiation is present, ensuring occupational safety and operational efficiency.

Thermoluminescent Dosimeters (TLDs) also hold a significant position within this market segment, serving as reliable instruments for cumulative radiation dose measurement. Unlike EPDs, TLDs do not provide real-time feedback but are highly valued for their sensitivity, accuracy, and long-term stability. They are widely used in healthcare institutions, research laboratories, and nuclear facilities to record exposure over extended periods.

TLDs are particularly beneficial in scenarios where detailed historical dose information is required for compliance reporting, safety audits, and long-term exposure assessment. Their proven reliability, cost-effectiveness, and compatibility with automated reading systems ensure their continued relevance in the US dosimetry equipment market alongside more technologically advanced electronic solutions.

By Technology Analysis

Passive dosimetry is expected to dominate the technology segment of the US dosimetry equipment market, capturing around 70% of the market share in 2025. This dominance is driven by the widespread adoption of passive devices such as thermoluminescent dosimeters and optically stimulated luminescence dosimeters, which provide reliable and accurate measurement of cumulative radiation exposure over time.

Passive dosimeters are highly valued in healthcare, nuclear, and industrial applications due to their simplicity, cost-effectiveness, and ability to store historical exposure data for regulatory compliance and safety audits. They do not require a power source, making them convenient for continuous monitoring in diverse work environments. Additionally, passive dosimeters are easy to distribute and manage across large workforces, which supports large-scale radiation monitoring programs and ensures long-term occupational safety.

Active dosimetry, on the other hand, provides real-time monitoring of radiation exposure, offering instant feedback and alerts when predefined dose thresholds are reached. These devices are particularly useful in high-risk environments such as radiology departments, nuclear facilities, and industrial radiography, where immediate corrective action is critical to prevent overexposure.

Active dosimeters typically incorporate electronic sensors, wireless connectivity, and integration with data management systems, allowing continuous tracking and centralized reporting. Although their adoption is lower compared to passive dosimeters due to higher costs and maintenance requirements, active dosimetry is gaining traction for applications that demand rapid response and precise monitoring of dynamic radiation conditions.

By Application Analysis

Medical applications are expected to dominate the US dosimetry equipment market, capturing approximately 50% of the total market share in 2025. This strong presence is driven by the extensive use of ionizing radiation in diagnostic imaging, radiotherapy, and nuclear medicine procedures across hospitals and healthcare facilities. Dosimetry equipment in medical settings ensures the safety of healthcare professionals and patients by accurately monitoring cumulative radiation doses and providing critical data for regulatory compliance.

The growing adoption of advanced imaging technologies such as CT scans, PET scans, and linear accelerators has further increased the demand for personal and area dosimeters. Additionally, the integration of dosimetry systems with hospital information networks, automated reporting tools, and real-time monitoring platforms enhances workflow efficiency and ensures precise dose management, reinforcing the market dominance of medical applications.

In industrial applications, dosimetry equipment is essential for monitoring radiation exposure during processes such as non-destructive testing, radiography, and material inspection. Industrial workers operating X-ray and gamma-ray sources rely on personal dosimeters and area monitoring systems to track cumulative exposure and maintain safety standards.

The adoption of both passive and active dosimetry devices in manufacturing, aerospace, and construction sectors helps minimize occupational hazards and ensures compliance with regulatory guidelines. Industrial facilities increasingly use electronic dosimeters with real-time alerts and automated logging features to improve operational safety, reduce manual errors, and provide accurate historical exposure data for safety audits and risk management.

By End-User Analysis

Healthcare facilities are expected to dominate the end-user segment of the US dosimetry equipment market, accounting for approximately 35% of the market share in 2025. Hospitals, diagnostic centers, and radiology clinics extensively use dosimeters to monitor radiation exposure for medical staff and patients during imaging procedures, radiotherapy, and nuclear medicine treatments. The growing number of advanced imaging technologies, including CT scanners, PET scanners, and linear accelerators, has significantly increased the need for accurate dose measurement and real-time monitoring.

Healthcare facilities rely on both personal and area dosimeters to ensure compliance with safety regulations, protect personnel from occupational hazards, and maintain precise control over patient radiation doses. Integration with digital reporting systems and hospital information networks further enhances operational efficiency and safety management within medical institutions.

Industrial sectors, particularly non-destructive testing and manufacturing, also constitute a significant end-user segment in the US dosimetry market. Workers in industrial facilities are exposed to radiation during radiographic inspections, material testing, and processes involving X-ray or gamma-ray sources. Dosimetry equipment such as personal dosimeters and area monitors helps track cumulative exposure, ensuring adherence to occupational safety standards and regulatory requirements.

Industrial facilities increasingly adopt electronic dosimeters with real-time monitoring, automated data logging, and centralized reporting capabilities to enhance workplace safety and reduce manual errors. These solutions are critical for managing radiation risks, improving operational efficiency, and supporting long-term safety compliance in manufacturing, aerospace, and construction applications.

The US Dosimetry Equipment Market Report is segmented on the basis of the following:

By Product Type

- Electronic Personal Dosimeters (EPDs)

- Thermoluminescent Dosimeters (TLDs)

- Optically Stimulated Luminescence (OSL) Dosimeters

- Film Badge Dosimeters

- Other Types

By Technology

- Passive Dosimetry

- Active Dosimetry

By Application

- Medical

- Industrial

- Nuclear Power

- Environment Monitoring

- Others

By End-User

- Healthcare Facilities

- Industrial (NDT & Manufacturing)

- Nuclear Facilities

- Research Institutes

- Others

The US Dosimetry Equipment Market: Competitive Landscape

The US dosimetry equipment market features a highly competitive landscape characterized by continuous innovation, technological advancements, and strategic investments in research and development. Market players focus on enhancing product accuracy, real-time monitoring capabilities, and integration with digital health and IoT systems to meet the growing demand across healthcare, nuclear, and industrial sectors.

Companies are increasingly adopting strategies such as partnerships, product launches, and service expansions to strengthen their market presence and address evolving regulatory requirements. The competitive environment is also shaped by the introduction of AI-enabled dosimeters, wearable devices, and advanced electronic solutions, which improve operational efficiency, ensure compliance with safety standards, and cater to the growing emphasis on occupational and environmental radiation monitoring.

Some of the prominent players in the US Dosimetry Equipment market are:

- Landauer, Inc.

- Mirion Technologies, Inc.

- Thermo Fisher Scientific

- Fluke Biomedical (RaySafe)

- IBA Dosimetry GmbH

- Polimaster Ltd.

- RadPro International GmbH

- Sun Nuclear Corporation

- Fort Calhoun Nuclear Dosimetry Services

- Kromek Group PLC

- Atomtex SPE

- Biodex Medical Systems

- Tracerco (Johnson Matthey)

- Centronic Ltd.

- Canberra Industries

- Ludlum Measurements, Inc.

- Bubble Technology Industries, Inc.

- Far West Technology, Inc.

- S.E. International, Inc.

- ECOTEST

- Other Key Players

The US Dosimetry Equipment Market: Recent Developments

- September 2025: Mirion Technologies announced its acquisition of Paragon Energy Solutions, a leading provider of engineered solutions for nuclear power plants and small modular reactors in the U.S. This strategic move aims to expand Mirion's portfolio in the nuclear sector and enhance its service offerings in radiation safety and monitoring.

- July 2025: IBA Dosimetry reported strong half-year results, driven by accelerated backlog conversion in its clinical and technology segments. The company continues to focus on expanding its presence in the medical dosimetry market through strategic initiatives and partnerships.

- June 2025: Thermo Fisher Scientific was awarded a USD 94.5 million U.S. government contract to supply advanced radiation detection systems to the Navy. This funding supports the development and deployment of cutting-edge technology to enhance radiation safety measures for military personnel.

- March 2025: DOSIsoft announced the FDA 510(k) clearance of PLANET® Onco Dose version 3.2, a software solution for radiation oncology and nuclear medicine. The updated version offers enhanced patient-specific imaging and dosimetry capabilities, supporting more precise and personalized treatment planning.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 99.0 Mn |

| Forecast Value (2034) |

USD 147.3 Mn |

| CAGR (2025–2034) |

4.5% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Electronic Personal Dosimeters (EPDs), Thermoluminescent Dosimeters (TLDs), Optically Stimulated Luminescence (OSL) Dosimeters, Film Badge Dosimeters, Other Types), By Technology (Passive Dosimetry, Active Dosimetry), By Application (Medical, Industrial, Nuclear Power, Environment Monitoring, Others), and By End-User (Healthcare Facilities, Industrial (NDT & Manufacturing), Nuclear Facilities, Research Institutes, Others). |

| Regional Coverage |

The US |

| Prominent Players |

Landauer, Inc., Mirion Technologies, Inc., Thermo Fisher Scientific, Fluke Biomedical (RaySafe), IBA Dosimetry GmbH, Polimaster Ltd., RadPro International GmbH, Sun Nuclear Corporation, Fort Calhoun Nuclear Dosimetry Services, Kromek Group PLC, Atomtex SPE, Biodex Medical Systems, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US Dosimetry Equipment market is projected to be valued at USD 99.0 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 147.3 million in 2034 at a CAGR of 4.5%.

Some of the major key players in the US Dosimetry Equipment market are Landauer, Inc., Mirion Technologies, Inc., Thermo Fisher Scientific, Fluke Biomedical (RaySafe), IBA Dosimetry GmbH, Polimaster Ltd., RadPro International GmbH, Sun Nuclear Corporation, Fort Calhoun Nuclear Dosimetry Services, Kromek Group PLC, Atomtex SPE, Biodex Medical Systems, and Others.