Market Overview

The US Drug Discovery Market size is projected to reach USD 27.4 billion in 2025 and grow at a compound annual growth rate of 9.3% to reach a value of USD 61.2 billion in 2034.

The US Drug Discovery market encompasses the technologies, platforms, services, and methods deployed in the United States to discover, validate, and optimize new therapeutic candidates — whether small molecules, biologics, or advanced modalities. It includes assay systems, computational tools, gene editing, AI & machine learning, screening hardware, and integrative informatics. The U.S. is a global leader in this domain, backed by significant biotech investment, deep academic research, and strong regulatory infrastructure.

Traditionally, drug discovery was a manual, iterative process dominated by bench chemistry, empirical screening, and laborious optimization. Over the past decade, the landscape has shifted toward automation, modular integration, and data‑centric methodologies. Key developments include proliferation of AI‑driven design tools, self‑driving labs, and the embedding of multi‑omics data into discovery pipelines. This evolution is accelerating timelines and reducing attrition rates.

One important insight is that success increasingly depends on convergence: hardware providers, software/AI firms, reagent vendors, and CROs now collaborate to deliver end-to-end solutions rather than standalone tools. Many companies offer bundled packages (instruments + analytics + consumables) under subscription or service models, lowering entry barriers for smaller biotech and academic labs. The U.S. ecosystem supports rapid iteration, strong IP frameworks, and venture capital flows, which further catalyze innovation.

In recent years, regulatory expectations for reproducibility, data integrity, and traceability have become stricter, driving vendors to validate and certify tools rigorously. Moreover, COVID‑era shifts toward remote operations and cloud analytics pushed adoption of more digital, connected discovery infrastructure in U.S. labs. The U.S. Drug Discovery market is thus marked by melding of automation, AI, biology, and scalable service models.

US Drug Discovery Market: Key Takeaways

- Market Growth: The US Drug Discovery Market size is expected to grow by USD 31.5 billion, at a CAGR of 9.3%, during the forecasted period of 2026 to 2034.

- By Drug Type: The small molecule drugs segment is anticipated to get the majority share of the US Drug Discovery Market in 2025.

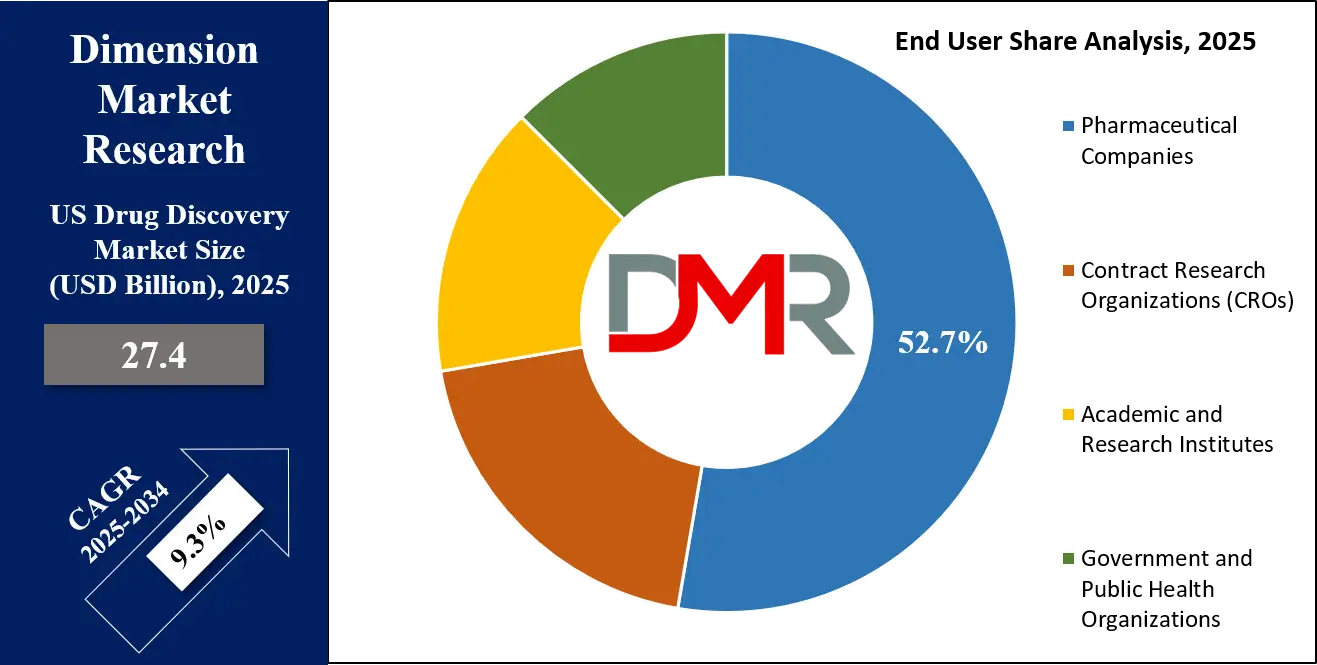

- By End User: The pharmaceutical companies segment is expected to get the largest revenue share in 2025 in the US Drug Discovery Market.

- Use Cases: Some of the use cases of US Drug Discovery includes, Hit Identification & Screening, Biologics / Cell Therapy Engineering and more.

US Drug Discovery Market: Use Cases

- Hit Identification & Screening: Use of high‑throughput assays or virtual screening to detect initial chemical or biologic hits from large libraries.

- Lead Optimization & Predictive Modeling: Iterative refinement of hit molecules using computational ADMET, structure-based modeling, and empirical feedback.

- Target Validation & Gene Editing: CRISPR, RNAi, or other genomic tools used in cellular models or organoids to validate biological targets and pathways.

- Biologics / Cell Therapy Engineering: Tools to engineer, screen, and refine biologic agents (antibodies, proteins) or cell therapy candidates for stability, potency, and safety.

Stats & Facts

- The U.S. National Institutes of Health (NIH) has funded over USD 100 billion in basic science research that underpins novel drug discoveries.

- NIH funding for basic or applied research related to 386 drugs approved between 2010 and 2019 totaled USD 47.3 billion.

- Across all new medicines approved between 2010–2016, everyone is linked to at least some NIH‑funded basic research.

Market Dynamic

Driving Factors in the US Drug Discovery Market

Technological Convergence & Automation

Advances in robotics, lab automation, microfluidics, and modular hardware allow faster, more reproducible screening and experimentation. When coupled with AI and data analytics, this convergence accelerates cycles of hypothesis, testing, and iteration. The dropping cost of instrumentation and ability to integrate devices via open architectures further push adoption across biotech and academic labs.

Intensified R&D Pressure & Cost Constraints

Pharma and biotech companies face mounting pressure to reduce development timelines, control costs, and improve success rates. Tools that increase predictive power, minimize wasted experiments, or reduce failure late in the pipeline become highly attractive. In the U.S., where R&D spend is high, the ROI from better discovery efficiency is compelling, driving investment in advanced discovery platforms.

Restraints in the US Drug Discovery Market

Regulatory & Validation Hurdles

Novel tools—particularly AI, generative chemistry models, or adaptive protocols—must satisfy regulatory scrutiny, reproducibility, and traceability standards. The required validation, benchmarking, and acceptance by regulatory bodies slow deployment. Some organizations adopt a wait‑and‑see approach until methods become “industry standard.

Legacy Infrastructure & Integration Friction

Many U.S. labs already maintain legacy instruments, data pipelines, and software. Integrating new platforms—especially across hardware, software, and informatics—often requires reengineering, revalidation, or data migration. Disparate formats, proprietary protocols, and data silos complicate adoption, and organizational inertia can slow changes.

Opportunities in the US Drug Discovery Market

Democratization to Smaller Biotech & Academic Labs

While large pharma has traditionally driven adoption, there is strong potential growth among smaller biotech firms, university spinouts, and academic labs. Lower-cost, modular, scalable systems and “discovery as a service” offerings can lower the barrier to entry and open new customer segments.

Subscription / Service / Consumables Models

Vendors can shift from one‑time instrument sales to recurring revenue models—subscriptions, reagent kits, data analytics services, and platform-as-a-service. This aligns incentives, fosters long-term customer relationships, and allows users to access cutting-edge tools with lower upfront capital.

Trends in the US Drug Discovery Market

Closed‑Loop / Self‑Driving Labs

Increasingly, U.S. discovery platforms integrate AI with robotics to autonomously plan experiments, execute them, analyze results, and decide next steps. This closed‑loop approach reduces manual intervention, shortens iteration cycles, and enhances reproducibility.

Federated & Collaborative Data Ecosystems

To protect intellectual property while enabling shared learning, federated learning, secure multi‑party computation, and open precompetitive data platforms are rising. Lab networks and institutions share models (not raw data), accelerating algorithmic progress while preserving privacy and IP.

Impact of Artificial Intelligence in US Drug Discovery Market

- Faster Molecule Ideation: AI (especially generative models) proposes novel scaffolds or analogs, speeding hit generation beyond brute force enumeration.

- Predictive ADMET & Safety: Machine learning models forecast absorption, metabolism, toxicity, and off‑target effects early to prioritize safer leads.

- Experiment Prioritization / Active Learning: AI selects the most informative experiments to run next, minimizing resource use in iterative cycles.

- Multi‑Modal Data Integration: AI fuses structural, omics, assay, and phenotypic data into coherent insights, revealing hidden correlations and off‑target risks.

- Adaptive Protocols: In real‑time, AI adjusts experimental protocols or conditions (e.g. reagent dosing or timing) based on intermediate data in self-driving labs.

Research Scope and Analysis

By Drug Type Analysis

In 2025, Small Molecule Drugs account for approximately 59.4% of the U.S. Drug Discovery market, which is dominant attributed to their well-established development pathways, regulatory familiarity, and the alignment of discovery tools—such as HTS, QSAR models, and cheminformatics platforms—around small molecule chemistries. These drugs are often easier to synthesize, modify, and test, offering cost-efficiency and broad therapeutic applicability. Their oral bioavailability and extensive clinical precedent make them foundational in many disease areas, particularly oncology, infectious diseases, and CNS disorders.

On the other hand, in the large molecule drugs, cell and gene therapies are the fastest growing segment. With the advancement of CRISPR gene editing, vector engineering, and personalized medicine, these therapies are transforming the way complex and rare diseases are approached. Discovery platforms are evolving to support engineered cells, viral vectors, and gene constructs. As more gene therapies progress into clinical phases, specialized discovery solutions are in high demand across U.S. labs and CROs.

By Technology Analysis

High Throughput Screening (HTS) remains the leading technology in U.S. drug discovery, with an estimated 41.3% market share in 2025. It remains foundational for hit identification, enabling the rapid screening of vast compound libraries using miniaturized assays and robotic automation. HTS supports both small molecule and biologics discovery and is widely adopted across academic centers, pharma R&D labs, and service providers due to its scalability and proven results.

However, AI-based Drug Discovery and Bioinformatics represent the fastest growing segment. Tools like machine learning algorithms for predictive modeling, generative chemistry, and digital twins are transforming hit-to-lead timelines. U.S.-based AI startups and tech–biotech partnerships are accelerating integration of data-driven methods into early-stage discovery. This segment's growth reflects strong investor interest, increasing validation of models, and pressure to reduce failure rates through smarter preclinical insights.

By End User Analysis

In 2025, Pharmaceutical and Biotechnology Companies dominate the U.S. Drug Discovery market with an estimated 52.7% share. These firms drive in-house innovation through substantial R&D investments, established infrastructure, and advanced internal platforms. Large pharma typically integrates discovery with later-stage development, leveraging AI tools, HTS systems, and molecular modeling to streamline drug pipelines. Biotech firms also adopt cutting-edge platforms, often focusing on niche therapeutic areas or novel modalities such as RNA therapeutics or gene editing.

Meanwhile, Contract Research Organizations (CROs) represent the fastest growing end-user segment. As outsourcing becomes more common, especially among small and mid-sized biotech firms, CROs are scaling up their discovery capabilities. They are rapidly investing in automation, AI-integrated workflows, and cloud-based collaboration tools to meet sponsor demands. Competitive differentiation now hinges on turnaround speed, customization, and the ability to support discovery across both traditional and advanced drug modalities.

The US Drug Discovery Market Report is segmented on the basis of the following:

By Drug Type

- Small Molecule Drugs

- Large Molecule Drugs

- Monoclonal Antibodies (mAbs)

- Peptides

- Recombinant Proteins

- Cell and Gene Therapies

By Technology

- High Throughput Screening (HTS)

- Pharmacogenomics

- Combinatorial Chemistry

- Nanotechnology

- AI-based Drug Discovery

- CRISPR and Gene Editing Technologies

- Other Technologies

By End User

- Pharmaceutical Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutes

- Government and Public Health Organizations

Competitive Landscape

The U.S. Drug Discovery market is highly competitive, featuring legacy instrument manufacturers, specialty AI and software firms, reagent and consumable vendors, and integrative platform providers. Major players often combine hardware, software, analytics, and consumables in bundled offerings. Agile AI startups focus on niche areas like generative chemistry, predictive modeling, or CRISPR optimization. Strategic partnerships, licensing deals, and acquisitions are common as firms seek to fill gaps or expand geographically. Differentiators include speed, integration, validation, user experience, and regulatory readiness.

Some of the prominent players in the US Drug Discovery are:

- Pfizer Inc.

- Merck & Co., Inc.

- Johnson & Johnson

- Bristol Myers Squibb

- AbbVie Inc.

- Amgen Inc.

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Biogen Inc.

- Regeneron Pharmaceuticals, Inc.

- Vertex Pharmaceuticals

- Moderna, Inc.

- Novartis AG

- Roche Holding AG

- GlaxoSmithKline plc (GSK)

- AstraZeneca plc

- Sanofi S.A.

- Bayer AG

- Takeda Pharmaceutical Company

- Daiichi Sankyo Company, Ltd.

- Other Key Players

Recent Developments

- In June 2025, U.S. startup LabAuto unveiled its AutoDiscovery Suite, a closed‑loop AI + robotic discovery platform, backed by a USD 60 million funding round from a leading pharmaceutical venture fund, targeting integration into mid‑size biotech pipelines.

- In March 2025, major U.S. discovery instrumentation company BioForge acquired generative chemistry startup NeoSynth to embed novel AI design capability into its platforms, aiming to offer end‑to‑end design‑to‑screen workflows.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 27.4 Bn |

| CAGR (2025–2034) |

9.3% |

| The US Market Size (2025) |

USD 4.2 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Drug Type (Small Molecule Drugs and Large Molecule Drugs), By Technology (High Throughput Screening (HTS), Pharmacogenomics, Combinatorial Chemistry, Nanotechnology, AI-based Drug Discovery, CRISPR and Gene Editing Technologies, and Other Technologies), By End User (Pharmaceutical Companies, Contract Research Organizations (CROs), Academic and Research Institutes, and Government and Public Health Organizations) |

| Regional Coverage |

The US |

| Prominent Players |

Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, Bristol Myers Squibb, AbbVie Inc., Amgen Inc., Eli Lilly and Company, Gilead Sciences, Inc., Biogen Inc., Regeneron Pharmaceuticals, Inc., Vertex Pharmaceuticals, Moderna, Inc., Novartis AG, Roche Holding AG, GlaxoSmithKline plc (GSK), AstraZeneca plc, Sanofi S.A., Bayer AG, Takeda Pharmaceutical Company, Daiichi Sankyo Company, Ltd., and Other Key Players

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US Drug Discovery Market size is expected to reach a value of USD 27.4 billion in 2025 and is expected to reach USD 61.2 billion by the end of 2034.

Some of the major key players in the US Drug Discovery Market are Pfizer, Merck, Johnson & Johnson, and others

The market is growing at a CAGR of 9.3 percent over the forecasted period.