Market Overview

The

U.S. Fertility Market size is expected to reach a

value of USD 5.6 billion in 2024, and it is further anticipated to reach a market

value of USD 8.7 billion by 2033 at a

CAGR of 5.1%.

Evolving societal trends and continuous technological advancement in the area of reproductive health are some of the factors that could ensure rapid growth of the fertility market in the U.S. in 2024. Increasing awareness and social acceptance of in vitro fertilization and intrauterine insemination treatment options, among others, coupled with the availability of fertility preservation options such as egg, sperm, and embryo freezing, drive the fertility market.

One factor attributing to the demand for fertility treatment in the nation is the delayed childbearing factor, generally influenced by career and lifestyle. The increase in U.S. infertility rates in both males and females continued to have more impact on the market. The increased demand for assisted reproduction technologies is also attributed to the rise in cases of same-sex couples, single parents, and individuals.

Fertility clinics are leading in this respect, while often providing specialized services for a wide range of fertility challenges. Many of them take advantage of the newest technologies to increase their success rate, such as embryo monitoring and preimplantation genetic testing. In addition, growing social acceptance of alternative family structures is the reason for an increase in the number of same-sex couples, singles, and parents undergoing fertility treatments.

Besides, with the growing awareness of fertility treatments and better insurance coverage for fertility services, accessing these procedures is easier. While costs are a concern, the improvement in legislative efforts for better coverage among legislatures will very much result in broader access. The overall US fertility market is set to continue growing supported by innovation in reproductive technologies and changing societal dynamics in family planning.

Key Takeaways

- The US Market Size: The U.S. Fertility Market size is estimated to have a value of USD 5.6 billion in 2024 and is expected to reach USD 8.7 billion by the end of 2033.

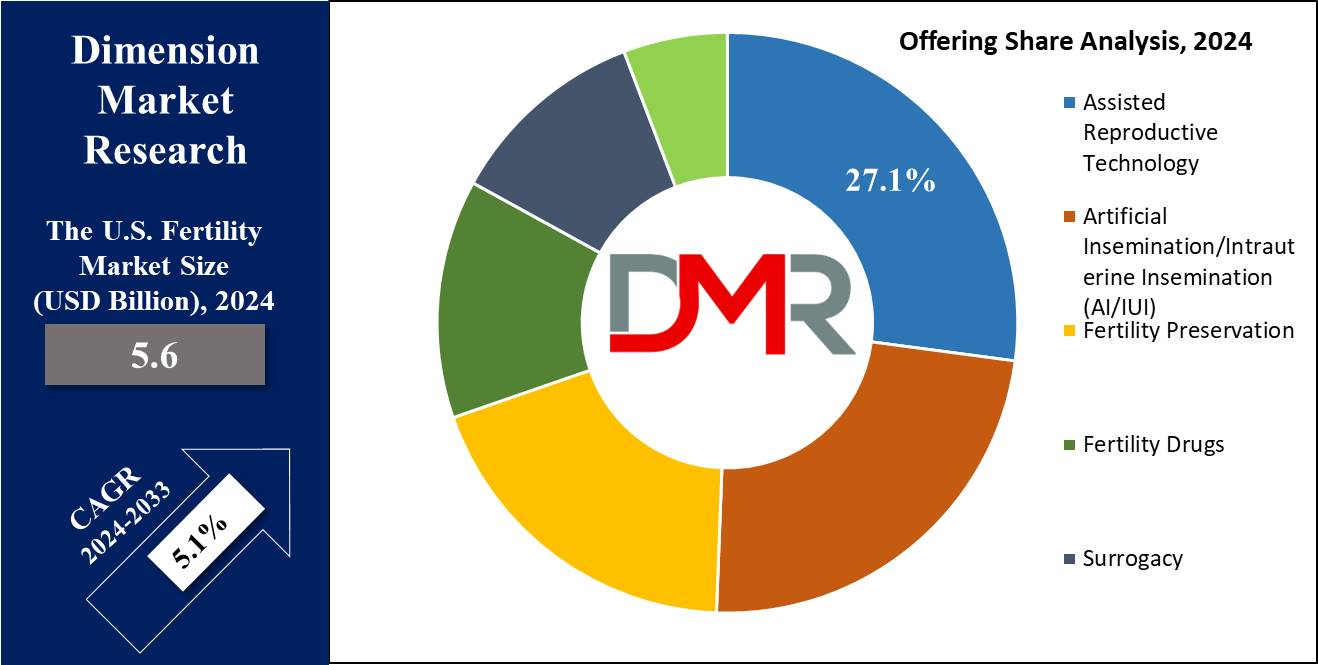

- By Offering Segment Analysis: Assisted Reproductive Technology (ART) is projected to dominate the offering segment as it is anticipated to hold over 27.1% of the market share in 2024.

- By End User Segment Analysis: Fertility clinics are expected to dominate the end-user segment of the U.S. fertility market as they hold 36.0% of the market share in 2024.

- Key Players: Some of the major key players in the U.S. Fertility Market are Boston IVF, Shady Grove Fertility, Colorado Center for Reproductive Medicine (CCRM), Prelude Fertility, Reproductive Medicine Associates, and many others.

- Market Growth Rate: The market is growing at a CAGR of 5.1 percent over the forecasted period.

Use Cases

- IVF Treatments: Infertility issues that arise in complications for couples are treated with IVF, a procedure where eggs are fertilized in the lab and embryos transferred into the uterus to achieve pregnancy.

- Fertility Preservation: Oocyte, sperm, or embryo freezing is done to keep the reproductive cells in storage for later use; this postpones childbearing but preserves fertility.

- Genetic Testing: Preimplantation genetic testing includes the screening of embryos for genetic disorders before implantation and has significantly improved success rates by reducing the chances of inherited conditions.

- Egg Donation: Through the use of donor eggs, fertilized by IVF to achieve pregnancy, it is realized that the inability of women to become pregnant with their eggs comes out of a broadened scope of reproductive health options.

- Surrogacy: Intended parents work with a surrogate who carries a child for them through IVF, enabling people or couples who cannot conceive or carry a pregnancy to become parents of children.

Market Dynamic

Trends

Rising Demand for Fertility PreservationThe desire for fertility preservation like freezing of eggs or embryos, is increasing rapidly because of various reasons for postponing child bearing for personal, professional, or health issues. These procedures afford the persons concerned the ability to prolong their ‘reproductive years’ and make proper family planning when the time is right.

One of the remarkable phenomena that is currently popular in the sphere of fertility is the trend in fertility preservation, primarily for women who are in their late thirties and early forties.

Technological Integration in Fertility Treatment

Modern test equipment continues to be integrated into fertility clinics to increase the chances of treatment success. PGT is also popular in most of today's fertility clinics and so is time-lapse embryo monitoring hence increasing the chances of pregnancy for the patient. Such technologies enable early diagnosis of genetic disorders and constant observation of development in embryos, which enables the selection of the most suitable embryos for implantation among embryologists.

This has been a trend that has considerably helped to enhance the general result for the patients and denied miscarriages and hereditary disorders.

Growth Drivers

Increased Infertility Rates

Another is the increasing incidence of infertility as a major factor in the market in general for fertility products. Elements that have introduced this pattern are: postponing child-bearing, living adjustments, and reduced fertility in the malignant years in both genders. In such a situation, more and more people including couples have adopted fertility treatment treatments as will be mentioned with reference to fertility treatment treatments.

Other related disorders are polycystic ovary syndrome and endometriosis both of which are generally known to be major contributors to the causes of infertility hence increasing its prevalence.

Technological Advancements in Assisted Reproductive Technologies (ART)

Continued advancements in ART, including improvements in IVF protocols, embryo culture techniques, and genetic testing, have also increased the success rate of treatments and expanded treatment options. Innovations such as time-lapse embryo monitoring, which allows the actual development of the embryo to be tracked in real-time, enable a more accurate selection of embryos for transfer, thereby improving overall patient outcomes.

These technological advances in treatment have placed ART at the forefront as both the most effective and the most in-demand fertility treatment option.

Growth Opportunities

Expansion of Insurance Coverage for Fertility Treatments

The growing legislative activity that provides wider health insurance coverage for fertility treatments is opening immense opportunities for growth in the U.S. fertility market. Indeed, several states are pushing for wider insurance coverage for procedures such as IVF, fertility preservation, and diagnostic fertility testing. As more insurance companies include fertility treatments in their plans, this has ensured that a larger section of people will have access to these expensive procedures, thus driving market growth.

Rising Demand for Fertility Treatments Among Non-Traditional Families

Same-sex couples, single parents, and transgender individuals are increasingly being accepted as creating non-traditional families. This, in turn, means that their demand for fertility treatments, in the forms of IVF, sperm donation, and surrogate services, has increased. In this respect, many fertility clinics have increasingly offered services aimed at addressing the needs of these emerging non-traditional families with customized offerings that help surmount their unique reproductive difficulties.

Restraints

High Cost of Fertility Treatments

Probably the single most significant factor preventing many individuals and couples from seeking treatment is the cost of fertility treatment. While insurance coverage for fertility treatments has grown, many treatments, especially ART procedures such as IVF, are too costly for patients to afford out-of-pocket. The cost of one single cycle of IVF treatment in the United States is between USD 12,000 to USD 15,000. Success usually involves multiple cycles, which makes fertility care inaccessible to a great part of the population.

Limited Insurance Coverage

Though some states in this region have enacted laws that require coverage for fertility treatments, many people either partially or are not covered under their insurance policies for fertility procedures. This has been considered a major restraint to the market, as the cost of the treatments may lead people to avoid treatment. One of the big challenges faced by this segment is increasing insurance coverage remains a key restraint for the industry.

Research Scope and Analysis

By Offering

Assisted Reproductive Technology (ART), especially in vitro fertilization (IVF), is projected to hold a dominant position within the U.S. fertility market's offering segment as it is anticipated to command over 27.1% of the market share in 2024. ART, especially in-vitro fertilization, holds a dominant position in the offering segment of the fertility market in the U.S. owing to its superior success ratio and a wide range of fertility issues covered.

So far, ART treatments, such as IVF, have made sure that people and couples of all kinds with infertility problems-from age-related infertility, and unexplained infertility, to underlying health conditions causing infertility-get the best way to address their childbearing needs.

Through IVF treatment, fertilization can be controlled outside the body by gathering an egg and sperm together to form an embryo, which is then positioned in the uterus to increase pregnancy chances. The higher success rates associated with these treatments, especially in comparative perspective to non-invasive ones such as ovulation induction or IUI, make ART the treatment of choice for many patients.

Genetic testing development, particularly PGT, which involves the screening of embryos for genetic abnormalities before the eventual implantation, adds much fuel to the ART demand. This is indeed an accomplishment in the field of fertility treatments, ensuring safer procedures, healthier pregnancies, and reducing the risk of genetic disorders.

ART also addresses different patient needs of homosexual couples, single parents, and individuals for fertility preservation. Because of the increasing acceptance of society's alternative family formation and the increasing demand for oocyte and sperm donation, ART has secured its position as the leading segment in the fertility market. Fertility preservation services include all the other activities such as egg and embryo freezing, which are usually carried out in combination with ART, and hence, the segment's leading position in the market is expected to be further replaced during the forecast period.

By End User

Fertility clinics are projected to dominate the end-user segment of the U.S. fertility market as they hold 36.0% of the market share in 2024. Fertility clinics have the leading position in the end-user segment of the US fertility market owing to their specialized services and advanced technological platforms that provide comprehensive fertility solutions based on the needs of individuals.

The fertility clinics in the US are highly structured with modern equipment and qualified reproductive endocrinologists, embryologists, and fertility specialists extended in offering a wide array of treatments, including IVF and IUI, along with fertility preservation techniques like egg freezing and sperm freezing. Specialization at this level presents huge advantages to fertility clinics over general hospitals or other healthcare service providers, as they are wholly focused on reproductive medicine.

One of the reasons fertility clinics have cropped up to become the leading end-users is basically because they achieve higher success rates of pregnancy, especially with the use of ART procedures. Advanced diagnostic tools adopted in clinics, including but not limited to PGT and time-lapse embryo monitoring, can accurately monitor embryo development and potentially improve pregnancy outcomes. These innovations thus tend to make the patient's journey a lot easier and thereby have made fertility clinics the hub for individuals and couples to conceive.

In addition, fertility clinics are often formed into extensive networks, such as the Boston IVF Fertility Network, to expand access and care and increase patient treatment options. Such networks make many administrative and operational processes easier and make it much easier for patients to navigate the maze of treatment and insurance coverage.

Clinics also offer patient-centered services, allowing them to develop individualized treatment plans based on each particular patient's unique fertility problems. Given the fact that fertility clinics focus on evidence-based fertility solutions and the growing demand for family planning services, the fertility clinics segment would continue to dominate the end-user segment in the forecast period.

The U.S. Fertility Market Report is segmented on the basis of the following

By Offering

- Assisted Reproductive Technology

- In Vitro Fertilization (IVF)

- Intracytoplasmic Sperm Injection (ICSI)

- Artificial Insemination/Intrauterine Insemination (AI/IUI)

- Fertility Preservation

- Egg Freezing

- Sperm Freezing

- Embryo Freezing

- Fertility Drugs

- Gonadotropin

- Anti-estrogen

- Others

- Surrogacy

- Ovulation Induction (OI)

By End User

- Fertility Clinics

- Hospitals

- Surgical Centers

- Research Institutions

Competitive Landscape

The fertility market in the U.S. is very competitive, with many fertility clinics, networks, and biotechnology companies all competing to maintain a major market share. The major fertility clinics, such as Boston IVF, Shady Grove Fertility, and the Colorado Center for Reproductive Medicine-or CCRM-are able to hold pole positions in the market because of their large portfolios of services and high success rates of assisted reproductive technologies, such as in vitro fertilization.

Equipped with state-of-the-art technologies, these clinics provide individualized fertility solutions with more assured results using the latest in time-lapse embryo monitoring and genetic testing.

The fertility networks, like Prelude Fertility, continue aggressive expansion footprints via acquisitions from smaller clinics and partnerships with biotechnology firms.

This also makes complete networks present a wider range of fertility services for patients, inclusive of fertility preservation, donor programs, and genetic counseling. These strategic alliances place the networks in a better position to meet demand for fertility treatments and expand their geographic reach.

Companies dealing in biotechnology also have a vital role in the fertility market, especially in developing fertility drugs and reproductive technologies. Such companies also work with fertility clinics in serving customers with new products that improve the success rate of treatments, for instance, hormone therapies, fertility medicines, and diagnostic apparatus.

Continuous innovation characterizes the market as companies compete in developing new technologies that strengthen their ability to improve patient outcomes at lower costs of fertility treatments.

Some of the prominent players in The U.S. Fertility Market are

- Boston IVF

- Shady Grove Fertility

- Colorado Center for Reproductive Medicine (CCRM)

- Prelude Fertility

- Reproductive Medicine Associates (RMA)

- Kindbody

- New Hope Fertility Center

- Inception Fertility

- Extend Fertility

- Pacific Fertility Center

- Other Key Players

Recent Developments

- September 2024: Several U.S. states passed legislation expanding insurance coverage for fertility treatments, including IVF, egg freezing, and fertility preservation for cancer patients. Notably, California enacted SB 729, which mandates comprehensive fertility coverage, including IVF, by large group health plans.

- August 2024: Boston IVF Fertility Network expanded its operations by opening new fertility clinics in underserved regions across the U.S., providing patients with greater access to fertility treatments. The network continues to invest in advanced reproductive technologies and personalized care to improve patient outcomes.

- July 2024: The Colorado Center for Reproductive Medicine (CCRM) announced a partnership with a biotechnology company to integrate cutting-edge embryo monitoring technologies into their fertility clinics. The new technology offers real-time tracking of embryo development, allowing for more accurate embryo selection and improved IVF success rates.

- June 2024: Shady Grove Fertility introduced new genetic testing services aimed at improving the success of fertility treatments by screening for genetic abnormalities. These services allow patients to make more informed decisions about their fertility treatments, increasing the likelihood of a healthy pregnancy.

- May 2024: Prelude Fertility acquired a network of fertility clinics in the Midwest, solidifying its position as one of the largest fertility networks in the U.S. The acquisition expands Prelude's geographical presence and allows the company to offer a broader range of fertility services to patients across the country.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 5.6 Bn |

| Forecast Value (2033) |

USD 8.7 Bn |

| CAGR (2024-2033) |

5.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 3.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Assisted Reproductive Technology, Artificial Insemination/Intrauterine Insemination (AI/IUI), Fertility Preservation, Fertility Drugs, Surrogacy, and Ovulation Induction (OI)), By End Users (Fertility Clinics, Hospitals, Surgical Centers, and Research Institutions) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Boston IVF, Shady Grove Fertility, Colorado Center for Reproductive Medicine (CCRM), Prelude Fertility, Reproductive Medicine Associates (RMA), Kindbody, New Hope Fertility Center, Inception Fertility, Extend Fertility, Pacific Fertility Center, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The U.S. Fertility Market size is estimated to have a value of USD 5.6 billion in 2024 and is expected to reach USD 8.7 billion by the end of 2033.

Some of the major key players in the U.S. Fertility Market are Boston IVF, Shady Grove Fertility, Colorado Center for Reproductive Medicine (CCRM), Prelude Fertility, Reproductive Medicine Associates, and many others.

The market is growing at a CAGR of 5.1 percent over the forecasted period.