Market Overview

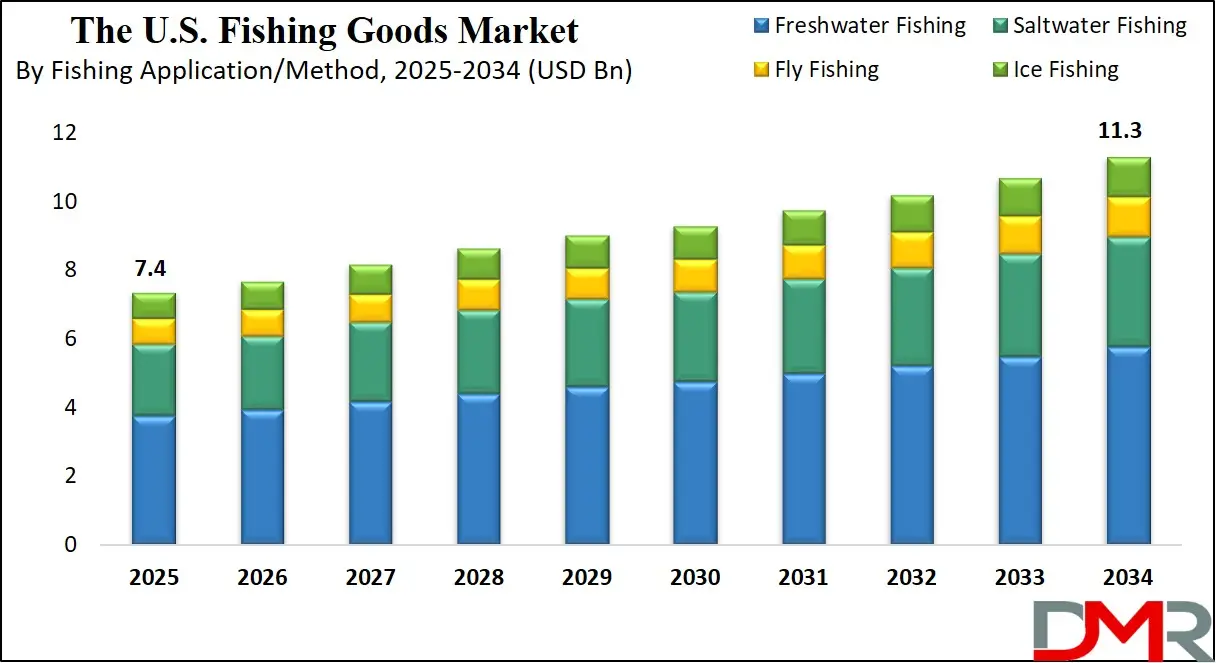

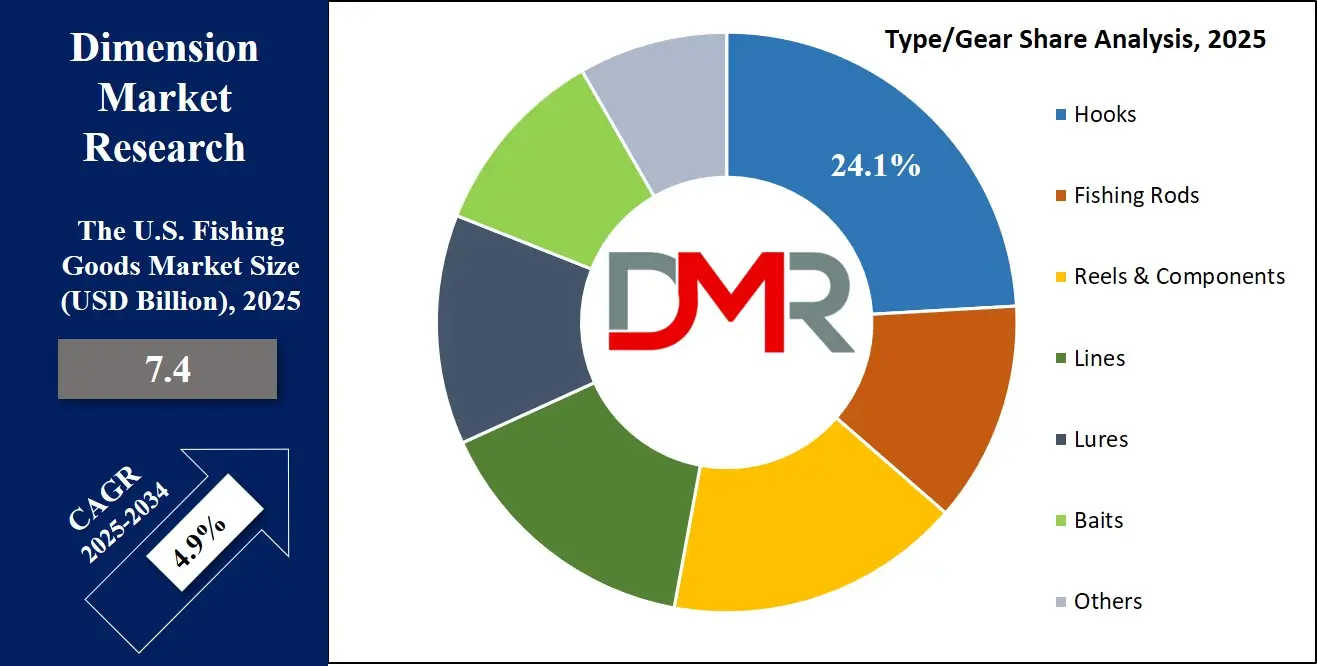

The U.S. Fishing Goods Market is projected to reach USD 7.4 billion in 2025 and grow at a compound annual growth rate of 4.9% from there until 2034 to reach a value of USD 11.3 billion.

The U.S. fishing goods market is witnessing steady growth, driven by a resurgence of interest in outdoor recreational activities and an expanding base of hobbyists and sport fishers. Factors such as increasing environmental awareness, wellness trends, and government-backed initiatives promoting fishing licenses and conservation programs have contributed to rising participation in freshwater and saltwater fishing. Technological innovations in gear, such as smart reels, lightweight rods, and advanced sonar systems, are further enhancing the angler experience, creating greater demand across both amateur and professional fishing segments.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A key trend shaping the market is the integration of digital platforms for product discovery, education, and purchase. E-commerce platforms have significantly altered the sales landscape, providing consumers with access to a wide variety of gear, tackle, and accessories. Subscription-based fishing tackle kits and mobile apps that help locate fishing spots and track catches are also gaining popularity.

Additionally, sustainable and biodegradable bait and tackle are emerging as notable trends, reflecting consumer preference for environmentally conscious fishing practices. The increased interest in ice fishing and fly fishing is also creating niche market growth areas, especially in colder and mountainous regions.

On the opportunity front, there is rising interest among younger demographics who seek experience-based outdoor activities, offering new revenue potential for manufacturers and retailers. Urban fishing initiatives and enhanced access to fishing areas near city centers are widening participation. Customizable and ergonomic gear for women and children is another growth lever that is currently underexploited in the market.

However, environmental challenges such as declining fish populations, climate-induced changes in aquatic habitats, and regulatory constraints on catch limits could restrain market expansion. Furthermore, inflationary pressures on high-end gear may reduce purchasing frequency, especially among casual anglers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Looking ahead, the U.S. fishing goods market holds solid long-term potential, underpinned by an evolving consumer base, innovative product offerings, and growing emphasis on outdoor lifestyle. Strategic efforts focused on sustainability, youth engagement, and product personalization are likely to shape the future trajectory of this dynamic and culturally rooted industry.

The U.S. Fishing Goods Market: Key Takeaways

- Steady Market Growth: The U.S. Fishing Goods Market size is estimated to have a value of USD 7.4 billion in 2025 and is expected to reach USD 11.3 billion by the end of 2034.

- Market Growth Rate Insights: The market is growing at a CAGR of 4.9 percent over the forecasted period of 2025.

- Technological Advancements Dominate Product Innovation: AI-powered smart rods, Bluetooth-enabled reels, and sonar fish finders are transforming the industry. Companies like Shimano, Garmin, and Penn Fishing are leading with connected fishing gear and real-time data analytics.

- Sustainability is a Key Market Driver: Demand for biodegradable fishing lines, lead-free tackle, and eco-friendly bait is rising. Brands like Pure Fishing and Orvis are investing in R&D for sustainable materials and conservation partnerships.

- Freshwater Fishing Leads in Application Segment: Freshwater fishing is projected to dominate due to accessibility, affordability, and widespread participation. States like Minnesota, Michigan, and Texas drive demand for bass, trout, and panfish gear.

- E-commerce & Sporting Goods Retailers Drive Sales: Online sales (Amazon, Bass Pro Shops, Tackle Warehouse) are growing, but physical sporting goods stores remain dominant for hands-on shopping. Subscription tackle boxes and influencer-driven marketing are reshaping retail strategies.

- Youth & Women Anglers Represent Untapped Potential: Women and younger anglers are the fastest-growing demographics, creating demand for ergonomic, beginner-friendly gear. Urban fishing programs and family-friendly initiatives are expanding the consumer base.

- Major Key Players Insights: Some of the major key players in the U.S. Fishing Goods Market are Shimano, Pure Fishing, Daiwa, Rapala VMC, Johnson Outdoors, Bass Pro Shops, Cabela’s, Zebco, St. Croix Rods, Lew's, Okuma, and many others.

The U.S. Fishing Goods Market: Use Cases

- Recreational Angling: Recreational anglers use fishing goods such as rods, reels, and bait to enjoy leisure activities at lakes, rivers, or coastal areas. This use case supports mental relaxation, physical engagement, and social bonding. Retailers cater to this segment with affordable, user-friendly equipment designed for casual weekend or seasonal fishing trips by families and hobbyists.

- Competitive Sport Fishing: Professional and amateur tournaments rely on high-performance fishing gear like carbon-fiber rods, precision reels, and electronic fish finders. Sport fishing drives innovation and premium product demand, as anglers require speed, accuracy, and durability under competitive conditions. Brands frequently partner with athletes to showcase their products in televised or sponsored bass and offshore fishing events.

- Ice Fishing Applications: Anglers in colder states such as Minnesota and Wisconsin use specialized ice fishing equipment, including augers, insulated shelters, and short rods. These goods are tailored to harsh winter environments and frozen waters. The segment continues to grow with innovations in heated gear and portable sonar devices that enhance performance and comfort on ice-covered lakes.

- Fly Fishing in Mountain Streams: Fly fishing enthusiasts use lightweight rods, artificial flies, and waders to catch fish in shallow streams and rivers, particularly in states like Colorado and Montana. The technique requires precision and finesse, driving demand for handcrafted, customizable gear. This niche supports premium pricing and artisan product makers within the fishing goods ecosystem.

- Youth and Educational Programs: Fishing equipment is increasingly used in school and community programs to introduce children and teens to outdoor skills and environmental stewardship. Gear designed for young users includes shorter rods, colorful tackle boxes, and simplified reels. These programs help expand the market by cultivating lifelong fishing habits among the next generation of anglers.

The U.S. Fishing Goods Market: Stats & Facts

U.S. Fish & Wildlife Service – 2022 National Survey of Fishing, Hunting, & Wildlife‑Associated Recreation

- 39.9 million people aged 16 and older went fishing in 2022.

- 14.4 million individuals participated in hunting activities.

- 148 million Americans engaged in wildlife-watching activities.

- Americans made over 1.7 billion trips for fishing, hunting, and wildlife watching.

- Total consumer spending on these outdoor recreation activities was approximately USD 394 billion.

- Fishing and hunting alone contributed about USD 145 billion to this spending.

- Wildlife watching added approximately USD 250 billion.

- 15% of Americans aged 16 and above participated in fishing in 2022.

- These activities generated 14 billion total activity-days during the year.

NOAA Fisheries – Fisheries Economics of the United States (2022)

- U.S. fisheries (commercial and recreational) supported 2.3 million jobs in 2022.

- Total economic contribution reached USD 321 billion in sales impacts.

- The industry added USD 149 billion to the national GDP.

- Commercial fishing landings revenue was USD 5.9 billion in 2022 (adjusted for inflation).

- Recreational fishing alone accounted for USD 138 billion in sales, up 22% from 2021.

NOAA – Fisheries of the United States (2022)

- U.S. commercial fishermen landed 8.4 billion pounds of seafood worth USD 5.9 billion.

- Recreational anglers took over 200 million fishing trips in 2022.

- Anglers caught around 1.1 billion fish, with 61% released back into the water.

NOAA – Status of U.S. Fish Stocks Report (2023)

- U.S. commercial harvest exceeded 8 billion pounds of seafood.

- 94% of assessed U.S. fish stocks were not subject to overfishing, an all-time high.

- Over 80% of fish stocks were found to be not overfished, meaning their populations were healthy.

American Sportfishing Association (based on federal excise data and license records)

- Roughly 50 million Americans go fishing each year.

- Recreational anglers generate about USD 51.2 billion in direct retail sales.

- Their activities create an overall economic impact of USD 129 billion annually.

- Angling supports 826,000 jobs across the United States.

- Anglers contribute USD 16.4 billion annually in state and federal tax revenues.

- The average angler spends approximately USD 1,392 per year on gear, travel, and licenses.

- Freshwater fishing is responsible for over 550,000 jobs nationwide.

The U.S. Fishing Goods Market: Market Dynamics

Driving Factors in the U.S. Fishing Goods Market

Government Initiatives and Licensing Programs

Federal and state governments in the U.S. have actively promoted recreational fishing as a means to boost local tourism, environmental awareness, and rural economic development. These efforts include easing access to fishing licenses, offering free fishing days, and investing in the maintenance of water bodies. For instance, state wildlife agencies frequently run programs that allow residents to fish without a license during specific weekends, encouraging trial participation among beginners.

Simultaneously, revenues generated from fishing licenses and excise taxes on fishing gear are reinvested into fishery conservation and infrastructure improvements, creating a feedback loop that benefits the entire ecosystem. The U.S. Fish & Wildlife Service and NOAA also fund awareness campaigns, stock freshwater bodies with fish, and support youth education programs, which help sustain interest in the sport. These policy actions not only expand the consumer base but also create recurring demand for fishing goods.

Expansion of E-commerce and Direct-to-Consumer Channels

Digital transformation in the retail landscape is significantly boosting sales of fishing goods through online platforms. E-commerce giants like Amazon, Bass Pro Shops, and dedicated outdoor gear websites have enhanced access to a wide range of fishing products from premium rods and reels to niche lures and bait. Many manufacturers are also embracing the direct-to-consumer (D2C) model, offering exclusive bundles, online tutorials, and virtual gear consultations that improve the buying experience.

The COVID-19 pandemic catalyzed this shift, with many consumers preferring online shopping over brick-and-mortar visits due to safety and convenience. Mobile optimization, subscription tackle boxes, influencer-driven marketing, and digital product reviews are now standard components of customer acquisition and retention strategies.

In addition, brands are leveraging data from online channels to personalize offerings and refine product development. These digital capabilities enable small and medium-sized enterprises (SMEs) to reach niche audiences, such as fly-fishing enthusiasts or ice fishers, without needing physical storefronts.

Restraints in the U.S. Fishing Goods Market

Environmental Degradation and Fish Stock Decline

One of the most pressing challenges facing the U.S. fishing goods market is the ongoing degradation of aquatic ecosystems and the associated decline in fish populations. Pollution, habitat destruction, invasive species, and climate change have led to reduced biodiversity in many lakes, rivers, and coastal waters. Warmer temperatures and altered water cycles also disrupt fish migration patterns and spawning seasons, resulting in less predictable catches and lower fishing success rates.

Overfishing in certain regions and illegal poaching further strain fish stocks, which can lead to stricter regulations or seasonal fishing bans. These environmental concerns not only reduce consumer confidence but also discourage casual and beginner anglers from participating. As fishing success diminishes, so does the frequency of gear purchases and outdoor trips. In the long run, ecosystem instability poses a systemic threat to both recreational and commercial fishing segments.

Inflation and Cost Sensitivity in Recreational Spending

Economic instability and inflationary pressures can significantly impact the discretionary spending patterns of American households, especially for non-essential recreational goods like fishing equipment. As the cost of living rises, including fuel, food, and housing, consumers may deprioritize leisure purchases such as new rods, reels, or tackle accessories. While avid anglers may continue to invest in high-quality gear, occasional and entry-level fishers often delay purchases or seek cheaper alternatives, including second-hand goods.

This price sensitivity has become more evident post-pandemic, with inflation hitting outdoor gear markets and driving up input costs for raw materials such as aluminum, carbon fiber, and plastic. As a result, manufacturers face a dual challenge: managing profitability while retaining price competitiveness. Retailers must also navigate changing buying behaviors, including increased bargain hunting, longer replacement cycles, and demand for bundled deals or payment plans.

Opportunities in the U.S. Fishing Goods Market

Increasing Participation Among Women and Youth

There is a growing opportunity for the U.S. fishing goods market to expand by catering more intentionally to women and younger anglers. Historically underrepresented in angling communities, women now comprise an increasing share of new fishing participants. Similarly, school programs, community outreach, and family-friendly fishing events are driving interest among children and teenagers. This demographic shift presents significant product development and marketing potential.

Customized rods, ergonomically designed gear, lightweight reels, and stylish apparel are in high demand among women. For youth, safety-enhanced equipment and beginner kits bundled with learning guides are gaining traction. Additionally, social media platforms like Instagram, TikTok, and YouTube are playing pivotal roles in showcasing inclusive fishing experiences, with influencers and content creators representing diverse backgrounds. Outdoor retailers that invest in gender- and age-inclusive designs, branding, and messaging can carve out loyal consumer segments in these rising groups.

Urban Fishing and Micro-Adventure Trends

Urban fishing has emerged as a high-potential growth niche, particularly as cities focus on enhancing waterfront access, restoring urban waterways, and creating recreational spaces close to population centers. Millennials and Gen Z consumers are increasingly pursuing micro-adventures, short, spontaneous, local trips that allow them to disconnect and explore nature without extensive travel. Urban and suburban fishing aligns perfectly with this behavior, providing low-barrier, time-efficient recreation. Consequently, the demand for compact, easy-to-carry gear such as telescopic rods, minimalist tackle boxes, and all-in-one fishing backpacks is on the rise.

Retailers can capitalize on this trend by offering kits tailored for lunch-break fishing, after-work sessions, or weekend park visits. Moreover, urban fishing opens up B2G (business-to-government) opportunities in the form of community angling programs, local park partnerships, and city-sponsored events. By recognizing cities as key hubs of market expansion, manufacturers and sellers can build deeper engagement with a digitally connected, eco-conscious, and experience-driven customer base.

Trends in the U.S. Fishing Goods Market

Technological Integration in Fishing Gear

The U.S. fishing goods market is experiencing a significant trend toward smart and tech-integrated fishing tools. Consumers, particularly younger anglers and competitive fishers, are increasingly favoring products equipped with features such as GPS navigation, Bluetooth-enabled reels, underwater cameras, and sonar-powered fish finders. These advancements provide real-time data on water temperature, fish movement, and depth detection, helping users make informed decisions on bait placement and casting angles.

Mobile apps paired with such smart gear offer digital logbooks, fish identification, and weather tracking, creating a seamless fishing experience. This integration of technology enhances the appeal of recreational fishing among tech-savvy audiences and is driving a premiumization trend in product categories. Brands that offer these innovations are gaining a competitive edge, and the inclusion of such features is becoming a baseline expectation in high-end products.

Moreover, this tech-forward evolution aligns with broader consumer preferences for data-driven outdoor recreation and strengthens the crossover between traditional leisure and digital lifestyles.

Rising Popularity of Experience-Driven Outdoor Activities

The cultural shift toward wellness, mindfulness, and experiential living is redefining consumer behavior in the fishing goods market. Fishing is increasingly perceived not just as a sport or hobby but as a wellness-oriented activity offering stress relief, digital detox, and nature immersion. As such, it aligns with broader trends in mental health, outdoor fitness, and sustainable living. The COVID-19 pandemic accelerated this behavior, drawing new demographics, particularly urban dwellers, families, and millennials, toward fishing.

These consumers value personalized, slow-paced outdoor experiences, boosting demand for compact, portable, and user-friendly gear that fits spontaneous trips and casual outings. Brands are responding by designing products that are versatile and easy to transport, such as collapsible rods, wearable tackle kits, and multi-functional gear bags. The increase in national and state-level campaigns promoting recreational fishing as a family or youth-friendly activity also supports this trend.

The U.S. Fishing Goods Market: Research Scope and Analysis

By Type/Gear Analysis

Fishing rods are projected to dominate the type/gear segment of the U.S. fishing goods market due to their indispensable role in almost every form of fishing, whether recreational, sport-based, or commercial. A fishing rod is not only a functional necessity but also a product that directly influences the angler’s experience, making it the first investment for beginners and a point of continuous upgrade for experienced users. The availability of various rod types, spinning rods, casting rods, fly rods, trolling rods, and ultralight rods caters to a broad range of fishing applications and preferences.

The growing trend toward high-performance rods made from carbon fiber, graphite, and composite materials adds value in terms of weight, sensitivity, and strength. Manufacturers are also introducing smart rods integrated with sensors, Bluetooth connectivity, and GPS tracking, enhancing their appeal among younger and tech-savvy anglers. Retail chains such as Bass Pro Shops and Dick’s Sporting Goods have dedicated significant shelf space to rods, further validating their dominance.

Additionally, customized rod options and increasing rod-and-reel combo sales are boosting volume and revenue. The versatility of fishing rods in both freshwater and saltwater environments also reinforces their market lead. U.S. recreational and sport fishing events such as bass tournaments and fly fishing competitions significantly influence consumer purchasing behavior, driving demand for higher-end rod models. Ultimately, fishing rods’ essential nature, continual innovation, and broad application base make them the leading product in the type/gear segment of the U.S. fishing goods market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Fishing Application / Method Analysis

Freshwater fishing is anticipated to lead the fishing application/method segment in the U.S. due to its accessibility, lower cost barrier, and extensive geographical coverage. The country boasts an abundance of freshwater bodies lakes, rivers, ponds, and reservoirs, found in nearly every state. This provides both novice and experienced anglers with convenient and frequent opportunities to fish, fostering high levels of participation.

According to the U.S. Fish & Wildlife Service, freshwater fishing consistently accounts for the majority of fishing licenses issued annually. Freshwater species such as bass, catfish, trout, and crappie are widely targeted and sustain a vibrant fishing culture through seasonal tournaments, family outings, and camping trips. Unlike saltwater fishing, which often requires boats, charters, and permits, freshwater fishing is generally more affordable and logistically simpler, making it more inclusive across income groups and age demographics.

The retail market is also heavily geared toward freshwater gear, with a variety of cost-effective options available through major sporting goods chains. Moreover, conservation and stocking programs by local and state agencies ensure sustained fish populations in freshwater systems, encouraging repeated participation.

Recreational fishing communities built around lakes and rivers, especially in states like Michigan, Minnesota, and Texas, contribute to steady demand for freshwater-specific gear like spinning rods, baits, and reels. The versatility, accessibility, and economic feasibility of freshwater fishing make it the dominant method in the U.S. market, catering to a large and loyal angling population across both rural and urban regions.

By Distribution Channel Analysis

Sporting goods retailers are poised to dominate the distribution channel segment of the U.S. fishing goods market by offering a comprehensive, hands-on shopping experience and serving as trusted sources for gear, accessories, and expert guidance. Well-established chains such as Bass Pro Shops, Cabela’s, and Dick’s Sporting Goods have built vast retail networks and physical footprints that specifically target fishing and outdoor sports enthusiasts. These stores provide customers with the ability to physically assess gear quality, test rod flex, compare tackle options, and receive personalized recommendations from knowledgeable staff, features that are not replicable through online channels.

Many also feature in-store experiences like aquariums, shooting galleries, or mock fishing ponds that appeal to families and reinforce brand loyalty. For beginners, in-person access to gear and live demos can significantly ease the decision-making process. Sporting goods retailers also stock seasonal and location-specific items based on regional fishing trends, such as ice fishing gear in northern states or saltwater reels near coastal areas.

Furthermore, retailers offer bundled promotions, fishing license services, and branded educational programs or workshops, further enhancing their value proposition. While online sales have grown in recent years, bulky or specialized gear like rods, tackle boxes, and bait tanks is often more conveniently purchased in-store. The ease of warranty claims and product exchanges at physical outlets also contributes to consumer preference. Altogether, sporting goods retailers' ability to deliver a full-spectrum buying experience merging expertise, convenience, and community engagement secures their dominance in this segment of the U.S. fishing goods market.

By End User Analysis

Recreational anglers are projected to dominate the end-user segment of the U.S. fishing goods market due to their vast population size, consistent purchasing behavior, and impact on gear innovation and retail trends. Recreational fishing is deeply embedded in American culture, supported by outdoor tourism, national parks, local fishing tournaments, and wellness-related outdoor hobbies.

According to the U.S. Fish and Wildlife Service, more than 40 million Americans engage in recreational fishing annually, surpassing participation rates in many other outdoor sports. Unlike professional anglers who often receive sponsorships and bulk equipment, recreational users consistently drive retail demand across multiple categories: rods, reels, lures, bait, clothing, and accessories.

They represent a diverse demographic, including youth, seniors, families, and casual enthusiasts, all of whom contribute to steady seasonal and year-round sales. Growth in youth-oriented fishing programs, family fishing events, and ‘catch-and-release’ education campaigns has encouraged participation from younger generations, ensuring long-term demand. Many recreational anglers invest in frequent gear upgrades as they progress in skill or diversify into methods like fly or ice fishing.

Their spending patterns are further supported by digital content, YouTube tutorials, influencer gear reviews, and angler communities, which influence purchasing decisions. Moreover, recreational anglers’ interest in sustainability, eco-friendly gear, and regional fishing regulations creates a feedback loop that shapes product development and availability. Their frequent interaction with both physical and online retail platforms also makes them the most commercially influential end-user group. As a result, recreational anglers are the primary growth drivers and dominant force within the U.S. fishing goods market.

The U.S. Fishing Goods Market Report is segmented on the basis of the following:

By Type/Gear

- Hooks

- Fishing Rods

- Reels & Components

- Spools

- Drag Systems

- Electric Reels

- Lines

- Monofilament

- Braided

- Fluorocarbon

- Lures

- Crankbaits

- Jigs

- Soft Plastics

- Baits

By Fishing Application / Method

- Freshwater Fishing

- Saltwater Fishing

- Fly Fishing

- Ice Fishing

By Distribution Channel

- Sporting Goods Retailers

- Online Retail

- Supermarkets/Hypermarkets

- Brand Outlets

By End User

- Recreational Anglers

- Professional Anglers

- Charters and Guided Tours

Impact of Artificial Intelligence in the U.S. Fishing Goods Market

- Smart Fishing Gear Innovation: Artificial Intelligence is revolutionizing fishing gear with the introduction of smart rods, reels, and sonar-equipped devices that integrate AI algorithms to interpret underwater data. These tools analyze water temperature, depth, fish movement patterns, and behavior in real-time to enhance accuracy and effectiveness for both recreational and professional anglers. This not only improves catch rates but also allows users to adapt quickly to environmental changes, reducing guesswork and enhancing overall fishing success.

- Predictive Fish Location Apps: AI-driven fishing apps are using historical data, satellite imagery, and environmental conditions to predict fish activity. These apps help anglers determine the best locations and times to fish based on predictive modeling. The technology benefits both freshwater and saltwater fishing by reducing time spent searching for active zones and increasing efficiency, especially in competitive or commercial settings.

- Personalized Recommendations for Equipment: AI is being used by online fishing goods retailers to provide personalized product recommendations based on user behavior, preferences, skill level, and local fishing conditions. Through machine learning algorithms, e-commerce platforms can analyze vast amounts of user data to suggest rods, lures, lines, or bait that best suit an individual’s needs, improving customer satisfaction and sales conversion rates.

- Supply Chain Optimization: Manufacturers and retailers are using AI to forecast demand trends, streamline logistics, and reduce inventory waste. By analyzing seasonal purchasing behaviors and geographic demand shifts, AI systems enable better stock management of fishing gear across stores and warehouses. This ensures the timely availability of high-demand products such as lures and baits, minimizing overstock and stockouts.

- Enhanced Customer Support via AI Chatbots: Many fishing goods brands are deploying AI chatbots to assist customers with product inquiries, sizing, maintenance guidance, or troubleshooting gear issues. These chatbots operate 24/7 and are trained on large datasets to provide accurate, context-specific answers, improving the consumer experience while reducing support costs for companies.

- AI-Integrated Training and Simulation Tools: AI-powered training tools are being introduced for amateur anglers to simulate real-world fishing conditions virtually. These tools use AI to adapt scenarios based on angler input, improving learning curves for casting techniques, species targeting, and bait selection. Such technology makes fishing more accessible, helping to grow the sport among younger and tech-savvy generations in the U.S.

The U.S. Fishing Goods Market: Competitive Landscape

The competitive landscape of the U.S. Fishing Goods Market is characterized by a blend of established multinational brands, emerging domestic manufacturers, and niche innovators focusing on product differentiation and technological advancements. Prominent players such as Shimano, Pure Fishing Inc., Rapala VMC Corporation, and Johnson Outdoors Inc. have maintained strong market footholds through extensive product portfolios, brand reputation, and distribution networks. These companies invest heavily in R&D to introduce performance-enhancing features such as lightweight materials, enhanced reel drag systems, and ergonomic rod designs, aligning with evolving consumer demands.

Domestic players and start-ups are increasingly entering the market with a focus on customized products, sustainable materials, and smart fishing gear that integrates digital functionalities like sonar-based fish finders and GPS-enabled tracking. Collaborations with outdoor retailers and sporting goods stores have become a crucial distribution strategy, enabling greater visibility and accessibility.

Brand loyalty plays a significant role in the fishing goods segment, particularly among professional and frequent recreational anglers, leading manufacturers to focus on customer experience and after-sales service. Furthermore, social media marketing, sponsorship of fishing tournaments, and influencer partnerships are being leveraged to engage the growing millennial and Gen Z consumer base.

The market also sees periodic innovation driven by environmental regulations, prompting the development of eco-friendly baits, biodegradable lines, and lead-free sinkers. Despite the market’s fragmentation, the top players maintain dominance through innovation, strategic partnerships, and global sourcing of high-quality raw materials. As sustainability and digitization reshape consumer preferences, competition is expected to intensify, with companies racing to adapt their offerings accordingly.

Some of the prominent players in the U.S. Fishing Goods Market are:

- Shimano Inc.

- Pure Fishing Inc.

- Daiwa Corporation

- Rapala VMC Corporation

- Johnson Outdoors Inc.

- Bass Pro Shops

- Cabela’s Inc.

- Zebco Brands

- St. Croix Rods

- Lew's Fishing

- Okuma Fishing Tackle

- Eagle Claw Fishing Tackle Co.

- KastKing

- 13 Fishing

- Berkley

- Abu Garcia

- Penn Fishing G. Loomis

- Academy Sports + Outdoors

- Tackle Warehouse

- Other Key Players

Recent Developments in the U.S. Fishing Goods Market

August 2024

- Pure Fishing & YETI Collaboration: Pure Fishing (parent company: Sycamore Partners, brands include Abu Garcia, Penn, Berkley) partnered with YETI Coolers to launch co-branded fishing gear, including tackle boxes, rod holders, and insulated bait coolers. The partnership aims to combine YETI’s rugged outdoor branding with Pure Fishing’s angling expertise.

- ICAST 2024 Expo (Orlando, FL): The International Convention of Allied Sportfishing Trades (ICAST), hosted by the American Sportfishing Association (ASA), showcased innovations like AI-assisted fish finders, biodegradable fishing lines, and smart rods with Bluetooth connectivity. Major exhibitors included Shimano, Daiwa, Garmin, and Googan Squad.

July 2024

- Rapala VMC Acquires 13 Fishing: Finland-based Rapala VMC Corporation acquired 13 Fishing, a U.S. brand known for high-performance rods and reels, for an undisclosed sum. The deal strengthens Rapala’s presence in the competitive bass and saltwater fishing markets.

- Shimano’s USD 50M U.S. Manufacturing Expansion: Shimano announced a new facility in California to produce high-end fishing reels, reducing reliance on overseas supply chains. The move follows increased demand for Made-in-USA fishing gear.

June 2024

- ASA Sportfishing Summit (Washington D.C.): Key topics included sustainability regulations, combating invasive species, and lobbying for angler access rights. The ASA also pushed for federal funding to restore fish habitats.

- Orvis & Trout Unlimited Conservation Partnership: Orvis pledged USD 1M to Trout Unlimited for river conservation projects. The brand also released a limited-edition fly-fishing kit, with proceeds supporting clean-water initiatives.

May 2024

- Penn Fishing Tackle (Pure Fishing) & Garmin’s Smart Rod: Penn launched an AI-powered fishing rod that syncs with Garmin’s fish-finding tech, providing real-time data on fish strikes, water depth, and optimal retrieval speeds.

- Daiwa Expands U.S. Warehouses: Daiwa opened new distribution centers in Texas and Ohio to speed up deliveries amid rising demand for tournament-grade reels and rods.

April 2024

- Bass Pro Shops’ "National Fishing Day" Campaign: The retail giant rolled out nationwide promotions, including discounts on trolling motors, fish finders, and tackle, alongside free fishing clinics at stores.

March 2024

- Shimano & Lowrance Tech Integration: The collaboration allows Lowrance fish finders to sync directly with Shimano reels, enabling automated adjustments based on sonar data.

- FLW & Major League Fishing (MLF) Merger: The two tournament giants merged to create a unified pro fishing circuit, streamlining events under the MLF brand.

February 2024

- YETI’s Fishing-Specific Gear Launch: YETI expanded into fishing with waterproof gear bags, bait-storage coolers, and a rod carrier designed for kayak anglers.

January 2024

- Pure Fishing’s R&D Innovation Lab (Iowa): The lab focuses on biodegradable fishing lines, carbon-neutral tackle production, and AI-driven lure design.

Frequently Asked Questions

How big is the U.S. Fishing Goods Market?

▾ The U.S. Fishing Goods Market size is estimated to have a value of USD 7.4 billion in 2025 and is expected to reach USD 11.3 billion by the end of 2034.

What is the growth rate in the U.S. Fishing Goods Market in 2025?

▾ The market is growing at a CAGR of 4.9 percent over the forecasted period of 2025.

Who are the key players in the U.S. Fishing Goods Market?

▾ Some of the major key players in the U.S. Fishing Goods Market are Shimano, Pure Fishing, Daiwa, Rapala VMC, Johnson Outdoors, Bass Pro Shops, Cabela’s, Zebco, St. Croix Rods, Lew's, Okuma, and many others.