Due to the growing demand for AI-enabled content creation, personalization, and synthetic data across industries such as healthcare, finance, and entertainment, the adoption of generative AI solutions has been fueled. Growth in the US generative AI market is expected to be remarkable in terms of CAGR during the forecast period.

Increasing demand for efficiency and accuracy in medical imaging, content creation, and predictive modeling, coupled with growing concerns due to increasing data privacy and security, are driving interests toward adoption. The market also continues to extend further with more and more solutions starting to emerge using AI to streamline operations and augment creativity.

The competitive landscape in the U.S. for the

generative AI market is pretty high, with key players such as OpenAI, Google DeepMind, and Microsoft. There are also vast investments in research and development to improve AI models and create innovation. Still, some of the major hindrances toward adoption include ethical issues, data privacy concerns, and regulatory frameworks.

It thus means that the U.S. generative AI market, which hitherto has been growing incrementally, will experience a major change in growth, with industries being transformed and user experiences redefined for various applications. As AI technology continues to evolve, so does its impact on the market, creating more opportunities for further adoption and innovation over the years.

As per Salesforce’s recent survey on generative AI usage across the U.S., UK, Australia, and India revealed varied adoption rates. India led with 73% of the population using generative AI, followed by 49% in Australia, 45% in the U.S., and 29% in the UK. This highlights significant differences in AI adoption across cultures.

The survey also showed that 65% of generative AI users are Millennials or Gen Z, with 72% employed. Many users, especially Gen Z (70%), feel they are mastering the technology, using it for work-related tasks, communications, and learning. A majority of users (52%) report using AI more than when they started.

However, a significant portion of the population remains hesitant. 68% of non-users are Gen X or Baby Boomers, with 88% unsure about the technology’s impact. The main barriers include a lack of familiarity, concerns over security, and a desire for better integration. 70% of non-users would engage more if they had more education on AI.

Key Takeaways

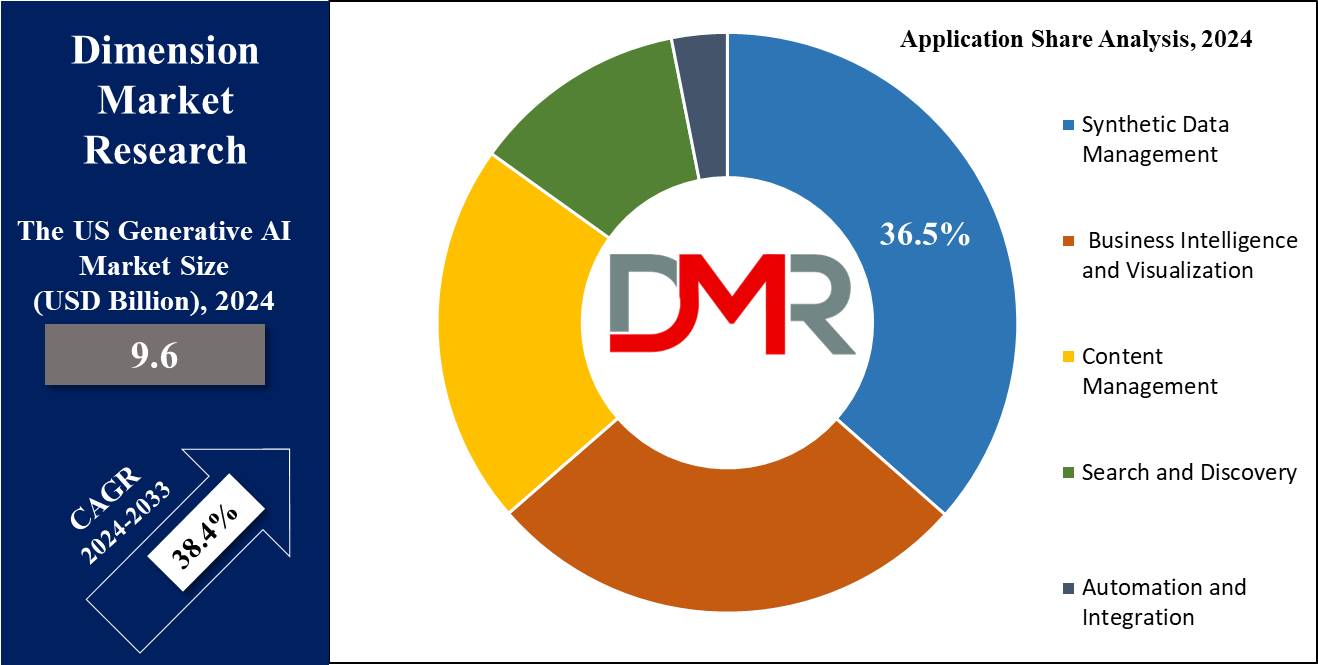

- Market Value: The U.S. Generative AI Market size is estimated to have a value of USD 9.6 billion in 2024 and is expected to reach USD 179.4 billion by the end of 2033.

- Growth Rate: The market is growing at a CAGR of 38.4 percent over the forecasted period.

- By Software Type Segment Analysis: Transformer models are projected to dominate this segment as they hold 28.0% of the market share in 2024.

- By Software Deployment Segment Analysis: On-premise deployment is projected to dominate this market as it holds the highest market share in 2024.

- By Data Modality Segment Analysis: text is anticipated to show its prominence in the data modality segment with the highest market share in 2024.

- By Application Segment Analysis: Synthetic data management is projected to dominate the generative AI market in the U.S. as it will hold 36.5% of the market share in 2024.

- Key Players: Some of the major key players in the U.S. Generative AI Market are OpenAI, Google DeepMind, Anthropic, Microsoft, NVIDIA, Cohere, Hugging Face, and many others.

Use Cases

- Healthcare: Generative AI helps in enhancing medical imaging to produce high-quality diagnostic images that are possible, personalized treatment plans, and the discovery of new drugs. Thereby, the industry continues to revolutionize healthcare for better outcomes among patients.

- Content Creation: AI-driven models generate simulated images, videos, and text, making media, marketing, and entertainment content creation more efficient while enhancing creativity and personalization.

- Synthetic Data Generation: AI models generate realistic-looking data. The generated data is, in turn, used to train, test, and develop the capabilities of machine learning algorithms by reducing real data and amplifying data privacy and security.

- Customer Experience Management: Generative AI personalizes customer experience by generating recommendations, auto-responses to customers, and enhancing user experiences in industries like retail and finance.

Market Dynamic

Trends

Increased Inclusion of Solutions Utilizing AI

The rate of adoption in the US market has been rapid across different industries for solutions that use generative AI models. Similar accommodations are being made among industries like healthcare, finance, and media to adapt to AI-powered solutions for processes, creativity, and better decision-making. For example, AI models in the healthcare arena help in generating realistic medical images and personalizing treatment plans.

Sometimes they even help in the process of

drug discovery, all of which has been instrumental in improving patient outcomes. In finance, this smooths the processes of fraud detection, risk management, and customer service, while in media, it changes the game of content creation. This is indicative of a greater trend of automation of processes and insights driven by AI, which can be expected to continue to drive growth in the generative AI market.

Advancements in AI Models and Techniques

Advancements in deep learning, GANs, and transformer models are some of the major trending factors shaping the generative AI market in the U.S. These allow the generated outputs to be much more versatile, changing from highly qualitative images and videos to coherent and contextually accurate text.

Companies continue to invest much in this area of research and development to extend further the envelope of what is possible with AI; hence, model accuracy and efficiency keep improving along with their applicability for more and more domains. This is evident by an increasing number of creative industries adopting AI to generate high-quality, unique content to act as a competitive differentiator.

Growth Drivers

Increasing Demand for Personalized Content and Experiences

Increased consumer demand to make experiences and content more personalized has become the main driving element in the generative AI market in the U.S. Companies, especially retail, marketing, and entertainment, are leveraging generative AI to create content that can target the feelings of each customer.

AI systems can create personalized recommendations, automate content creation, and even build focused marketing campaigns for the ideal audience segments, cultivating a greater number of engagements and conversions. This tectonic shift toward personalization is driven by enhanced customer satisfaction and competitive advantage; thus, an increasing number of businesses are seen to invest in generative AI technologies.

Need for Enhanced Data Privacy and Security

The generative AI market in the U.S. is increasingly seen in light of growing data privacy and security concerns. Indeed, strict regulatory requirements like GDPR and CCPA are placing greater demands on how organizations must process data. Generative AI is capable of producing synthetic data and offers a way to deal with such challenges by enabling enterprises to create realistic but anonymized data for training and testing purposes.

This could be very important in sensitive verticals, such as healthcare and finance, where the privacy of data should not be disclosed. Among the main reasons for generative AI Enterprise Adoption, especially in leading industries, is its capability to balance high-value data with strict privacy requirements because data breaches and violations of privacy could lead to the most damaging results.

Growth Opportunities

Expansion in Healthcare and Life Sciences

The healthcare sector is a key growth area for the U.S. generative AI market. AI-driven models are increasingly being used for enhancing diagnosis from medical images, accelerating the development of new treatments in drug discovery, and making personalized medicine applications possible by adjusting treatment schemes to individual patients.

In essence, the AI-powered health market is slated to grow multi-fold as the healthcare sector continues to adopt AI technologies, a factor that has increased demand for advanced generative AI solutions. This could be a lucrative front for AI companies in offering specialized solutions to solving challenges and needs that are peculiar to the healthcare sector.

Integration with Cloud Computing and AI Platforms

Integrating generative AI with cloud computing platforms would provide new avenues for growth in the U.S. market. Cloud-based AI solutions enable businesses to scale their AI models more easily, access greater computing resources, and decrease most of the costs frequently related to AI deployment.

This will prove especially effective for SMEs, as they lack the resources necessary for investments in on-premise infrastructure for AI. The flexibility and scalability that cloud-based AI solutions offer will accelerate the rate of adoption across industries and drive growth for this segment of the generative AI market.

Restraints

Ethical Concerns and Regulatory Challenges

Ethical concerns and a lack of an explicit regulatory framework act as considerable restraints on the growth of the U.S. generative AI market. With the misuse of AI-generated content, deepfakes, and other such aspects come important questions regarding accountability and ethics within AI decision-making processes. Furthermore, the speed at which AI is developing outstrips the drafting of laws and regulations that could circumscribe its use, therefore miring it in uncertainty and potential legal issues.

In addition, these issues are more critical in areas such as finance and healthcare, where AI-made decisions have unbearable stakes. There is an urgent need for the elaboration of stringent ethical provisions and regulatory oversight, while the absence thereof tends to stand in the way of the wide use of generative AI.

High Implementation and Operational Costs

High costs for the implementation and operationalization of generative AI solutions keep it out of reach for most businesses, especially SMEs. Setting up and deploying advanced AI models requires high investments in infrastructure, highly specialized talent, and continuous research and development.

Further, recurring investments to maintain and upgrade AI systems, adapt to evolving compliance requirements, and address data privacy concerns add cost components. All these factors come to outweigh the potential benefits for organizations. In other words, this severely restricts their potential to adopt generative AI solutions. This turns out to be an enormous restraint, especially in those sectors where the return on investment into AI is not noticeable or the cost of AI mistakes can be high.

Research Scope and Analysis

By Software Type

Transformer models are projected to dominate the U.S. generative AI market in the context of software type, as they will hold 28.0% of the market share in 2024. Within the U.S. generative AI market, the transformer model has emerged as the dominant software type, surpassing other architectures such as Rule-Based Models, Statistical Models, and CNNs. Above all, transformers specifically, OpenAI's GPT and Google's BERT have transformed the landscape of NLP and text generation applications and have thus been considered the cornerstone for generative AI development.

Key advantages for the transformer models include processing text and generating human-like text within mechanisms of attention, thereby understanding context and relationships between words in a sequence. This architecture extracts massive data and generates high-quality outputs, which is an important task in language translation, automated content creation, chatbots, and even code generation.

While older models, such as rule-based or statistical models, rely heavily on pre-defined rules or statistical correlations, Transformers are much more flexible and scalable. Because of the parallel processing capacity, they often outperform other deep learning models and CNNs on many NLP tasks by speeding up the training time.

The fact that transformers scale and improve with larger datasets makes them a key driver of growth in healthcare, finance, marketing, and entertainment fields where personalized content, advanced analytics, and automation are in high demand. With iterative improvement to models like GPT-4 and BERT, transformer models are bound to remain well on top in this landscape of generative AI.

By Software Deployment

The on-premise deployment is projected to dominate the generative AI market in the US, primarily due to the enhanced power of control, security, and customization it offers to businesses. On-premise solutions allow organizations to retain direct oversight of their AI models and data, which is particularly critical in industries where data privacy and security are paramount, such as the healthcare, finance, and government sectors.

This makes on-premise deployment more sought after since this avoids data breaches and unauthorized access when sensitive data can be stored and processed inside an organization's infrastructure. With on-premise, businesses can better tailor AI models to suit their needs and have better infrastructure for involving more AI.

Furthermore, organizations with on-premise infrastructures like the deployment method because it allows them an opportunity to continue leveraging value from their investments while adding the advantage of advanced AI. In this case, an organization will be absolutely in control of the deployment, management, and scaling of its AI models for better performance and low latency.

Though cloud-based AI solutions are considered an emerging trend, the dominance of on-premise deployment in the generative AI market of the United States has been driven by a need for security, compliance, and customization; hence, it is a vital segment for companies with stringent data protection needs.

By Data Modality

Text is anticipated to lead in the U.S. generative AI market due to the growing number of applications, taking the lead in many AI-related processes. Some of the key generative AI models that are based on text include GPT-3 and BERT; hence, they can perform several tasks ranging from text generation, summarization, translation, and even chatbots.

These models have been instrumental in nurturing communication, content creation, and data processing in several industries. Indeed, increasing demand for personalized content and customer engagement advocates the same dominance of text-based AI solutions.

Companies in retail, marketing, and customer service make use of text-based AI to craft personalized messages, automate response processes, and gain real-time insights, thus enhancing user experiences and operational efficiency.

The ongoing improvements in technologies like NLP with deep learning techniques have greatly improved the accuracy and contextual understanding in wholly text-based AI models. This has now increased their applicability to even some of the most basic tasks: sentiment analysis, information retrieval, and automatic content generation.

It hence finds wide applications in fields ranging from drug discovery to car manufacturing and still manages to hold the highest market share of generative AI in the US, driving innovation and adoption across industries.

By Application

Synthetic data management is projected to dominate the generative AI market in the U.S. as it holds 36.5% of the market share in 2024 due to such the critical role it plays: it helps bring data privacy concerns to the fore and enhances the performance of machine learning models.

With organizations increasingly dependent on AI-driven solutions, high volumes, as well as quality data, have become of the essence. In reality, however, obtaining and using real-world data often raises ethical and privacy issues, especially in sensitive industries such as health and finance.

Generative models like GANs and variational autoencoders enable the creation of synthetic data that closely resembles real-world data without exposing private information. This synthetic data can be used for training, testing, and validating AI models, ensuring they are robust and well-trained while maintaining data privacy.

By generating synthetic data on demand, businesses can overcome challenges such as data scarcity and bias. This technology supports continuous AI advancement by providing abundant, diverse, and privacy-safe datasets for model development and improvement.

Synthetic data management is also gaining further impetus under the regulatory requirement embracing data protection concerning data perils related to disclosure. These regulations have left companies to respect data privacy laws while marching forward with the AI agenda.

Such emphasis on privacy, security, and model performance is propelling synthetic data management to the front in the generative AI market of the U.S.

By Vertical

The BFSI segment continues to hold its leading position within the US-based generative AI market, since there is an undeniable need for the implementation of AI-driven solutions when it comes to making each operation smoother and more secure, thereby achieving the best customer experience.

Generative AI models are thus changing the way financial institutions manage risk, detect fraud, and personalize services, becoming extremely important tools in the BFSI industry. Generative AI models scan large data sets in fraud detection and detect unusual patterns to predict fraud activities and, by extension, greatly minimize financial loss.

They base the synthesis of more data that could be used in training other AI models without exposing customer data, which is critical in compliance with various stringent data protection regulations.

Generative AI will go on to further disrupt customer service within the BFSI realm, as it fosters the creation of intelligent

chatbots and virtual assistants that provide personalized advice on finances. Autocreation leads to routine inquiries with increases in customer engagement for better customer satisfaction and customer loyalty.

OpenAI is renowned for its groundbreaking work on transformer models like GPT-3 and GPT-4, which have set new standards in natural language processing and text generation. These models have been widely adopted across various industries, making OpenAI a dominant force in the generative AI market.

Google DeepMind, a subsidiary of Alphabet Inc., is another key player, known for its pioneering research in AI and deep learning. DeepMind's advancements in AI, particularly in areas such as reinforcement learning and GANs, have positioned the company as a leader in AI-driven innovation. Microsoft, through its Azure AI platform, has become a significant player in the generative AI market by offering a comprehensive suite of AI tools and services.

Microsoft's strategic partnerships and investments in AI research have further strengthened its position in the market. Other notable companies include NVIDIA, which provides AI hardware and software solutions, and Hugging Face, known for its open-source NLP models. The competitive landscape is dynamic, with continuous advancements and collaborations shaping the future of the U.S. generative AI market.

Some of the prominent players in the U.S. Generative AI Market are

- OpenAI

- Google DeepMind

- Anthropic

- Microsoft

- NVIDIA

- Cohere

- Hugging Face

- Stability AI

- IBM Watson

- Adept AI

- Runway

- Jasper

- Replit

- AI21 Labs

- Other Key Players

Recent Developments

- August 2024 - OpenAI Launches GPT-4 Turbo: OpenAI introduced GPT-4 Turbo, an optimized version of its groundbreaking GPT-4 model. This new iteration focuses on improving performance, reducing latency, and enhancing the efficiency of AI-driven applications. GPT-4 Turbo is designed to handle more complex queries with faster response times, making it a valuable tool for businesses seeking to integrate AI into their operations seamlessly.

- July 2024 - Microsoft Integrates Azure OpenAI Service with GitHub Copilot: Microsoft announced the integration of its Azure OpenAI Service with GitHub Copilot, a tool designed to assist developers by providing AI-powered coding suggestions. This integration enhances the capabilities of GitHub Copilot, making it more responsive and accurate in generating code snippets, debugging, and automating repetitive tasks.

- June 2024 - Google DeepMind Unveils Gemini AI Model: Google DeepMind introduced Gemini, a new AI model aimed at advancing reinforcement learning and its applications in robotics and automated systems. Gemini is designed to improve the adaptability and learning efficiency of AI in dynamic environments, making it a key tool for industries like manufacturing, logistics, and autonomous vehicles.

- May 2024 - NVIDIA Launches DGX Quantum Supercomputer: NVIDIA unveiled the DGX Quantum, a state-of-the-art AI supercomputer specifically designed to accelerate the training and deployment of generative AI models. The DGX Quantum is equipped with advanced GPUs and quantum computing capabilities, enabling faster processing and more complex model training.

- April 2024 - Hugging Face Launches Multi-Modal AI Library: Hugging Face introduced a new library designed for multi-modal AI, allowing seamless integration of text, image, and audio processing in AI applications. This library enables developers to create more sophisticated and versatile AI models capable of handling multiple types of data simultaneously.

- March 2024 - Stability AI Releases Stable Diffusion 3.0: Stability AI announced the release of Stable Diffusion 3.0, a generative AI model focused on high-resolution image synthesis. This new version of Stable Diffusion offers enhanced capabilities for generating realistic images, making it particularly useful in creative industries such as digital art, advertising, and virtual reality.

- February 2024 - Anthropic Introduces Claude 2 for Safer AI: Anthropic, a company focused on creating safer AI, introduced Claude 2, an AI model designed to enhance safety and interpretability in AI-driven decision-making processes. Claude 2 incorporates advanced algorithms that prioritize transparency and ethical considerations, making it a valuable tool for industries where AI decisions have significant consequences.

- January 2024 - Cohere Partners with Google Cloud: Cohere announced a strategic partnership with Google Cloud to expand its offerings in natural language processing (NLP) models. This partnership aims to provide enterprise-level AI solutions that can be easily integrated into existing cloud infrastructure, making it easier for businesses to adopt and scale NLP technologies.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 9.6 Bn |

| Forecast Value (2033) |

USD 179.4 Bn |

| CAGR (2024-2033) |

38.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Software Type (Rule-Based Models, Statistical Models, Deep Learning, Generative Adversarial Networks (GANs), Autoencoders, Convolutional Neural Networks (CNNs), Transformer Models), By Software Deployment (On-premise, and Cloud), By Data Modality (Text, Image, Video, Audio and Speech, and Code), By Application (Business Intelligence and Visualization, Content Management, Synthetic Data Management, Search and Discovery, Automation and Integration, and Others), By Vertical (Media & Entertainment, BFSI, Healthcare & Life Sciences, Manufacturing, Retail & E-commerce, Transportation & Logistics, Construction & Real Estate, Energy & Utilities, Government & Defense, IT & ITeS, Telecommunications, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

OpenAI, Google DeepMind, Anthropic, Microsoft, NVIDIA, Cohere, Hugging Face, Stability AI, IBM Watson, Adept AI, Runway, Jasper, Replit, AI21 Labs, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |