Market Overview

The U.S. Identity Verification Market size is projected to reach

USD 4.4 billion in 2025 and grow at a compound annual growth

rate of 15.9% from there until 2034 to reach a value of

USD 16.7 billion.

Identity verification is the practice of verifying who someone claims to be, often through official documents like passports or driver's licenses, biometric data such as fingerprinting or facial recognition, or biometric checks like fingerprinting and facial recognition. Identity verification helps prevent fraud while guaranteeing only authorized individuals have access to certain services or information - an increasingly prevalent practice across banking, healthcare, and government services across the US.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Identity verification services have experienced rapid expansion over the last several years due to digital transactions' need for security and the increasing risk of identity theft. Organizations seeking ways to remotely verify user identities have turned to AI-powered verification systems and biometric authentication methods as they move more services online.

Identity verification trends in the US are rapidly shifting. A key trend is convergence of verification systems across various platforms; LinkedIn recently extended their verification system so users could show off their verified identities on other sites such as Instagram. Privacy and data protection has become a larger focus, leading to safer verification methods that mitigate against data breaches.

Recent events have demonstrated the vital nature of identity verification systems. For instance, Social Security Administration (SSA) implemented more stringent identity verification requirements in order to combat fraud and protect beneficiaries; this initiative shows how important identity verification systems are for maintaining public services.

However, stricter verification measures have sparked considerable debate. Advocacy groups and lawmakers argue that stricter verification measures could create additional barriers for vulnerable populations, including seniors or those without easy access to technology. While increasing security is vitally important, doing so without jeopardizing accessibility or inclusivity is another critical challenge of identity verification systems.

As digital interactions increase across organizations across various sectors, organizations must prioritize authenticating user identities with greater precision to ensure secure yet user-friendly authentication methods.

Artificial intelligence and biometrics could play an instrumental role in shaping the future of identity verification.

The U.S. Identity Verification Market: Key Takeaways

- Market Growth: The Identity Verification Market size is expected to grow by 11.6 billion, at a CAGR of 15.9%, during the forecasted period of 2026 to 2034.

- By Type: The non-biometric segment is anticipated to get the majority share of the Identity Verification Market in 2025.

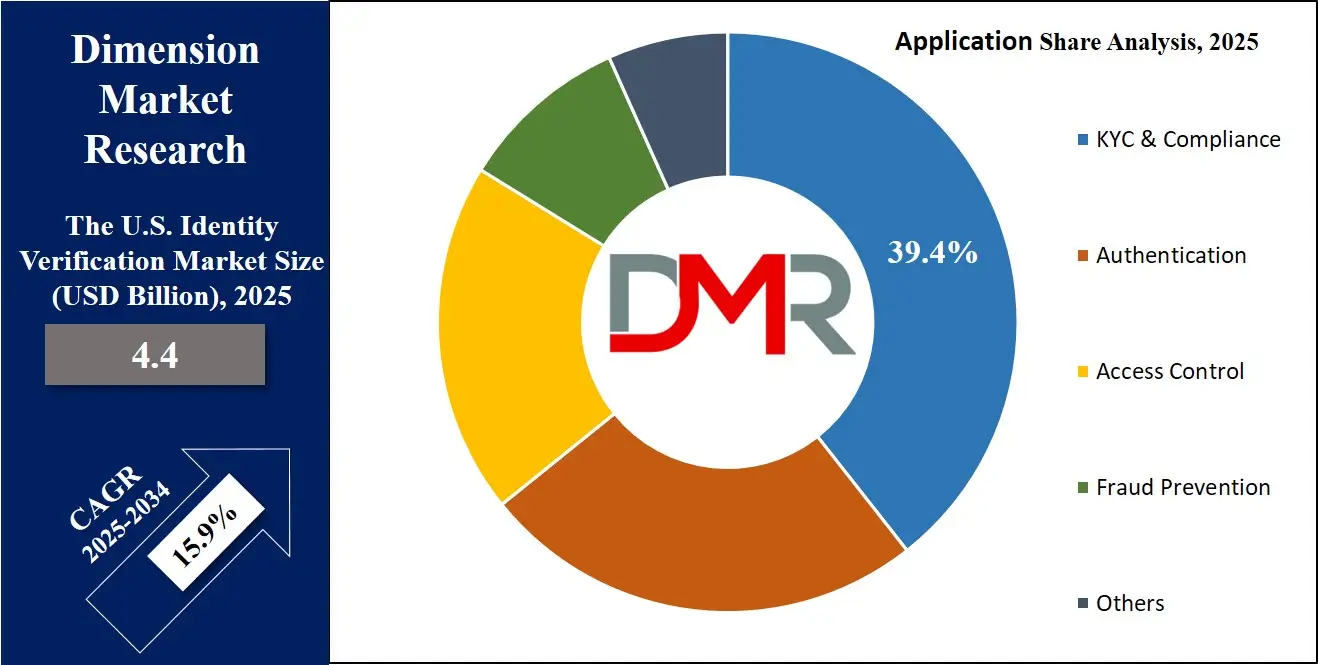

- By Application: The KYC & Compliance segment is expected to get the largest revenue share in 2025 in the Identity Verification Market.

- Use Cases: Some of the use cases of Identity Verification include building trust & safety, securing patient records, and more.

The U.S. Identity Verification Market: Use Cases

- Protecting Accounts and Preventing Fraud: Banks, credit unions and payment services use identity verification to make sure customers are authentic and prevent fraud before it happens. New account openings, loan approvals and online transactions all rely on robust ID checks as these help safeguard both their own funds as well as those belonging to customers. This protects both parties involved.

- Securing Patient Records: Hospitals and clinics use identity verification to ensure only authorized access can gain entry to patient records, prevent insurance fraud and ensure prescriptions reach the right individuals. Accurate verification helps build trust among users of sensitive health services.

- Enabling Secure Access to Benefits: Government agencies use identity verification services to check who is applying for benefits like social security, tax returns and unemployment support - this helps prevent fraud while making sure services reach the right citizens. Furthermore, digital platforms accessed by government also require strong ID checks for safety purposes.

- Building Trust and Safety: Online retailers and digital service providers use identity verification to safeguard buyers and sellers against scammers, creating a safer environment for transactions, social networking and freelance work - creating trust among users as more engage with online services.

Stats & Facts

- As noted by JUMIO, 72% of consumers across the UK, US, Singapore, and Mexico worry daily about being tricked by deepfakes into giving away sensitive information or money. Despite this high level of concern, 60% of respondents still believe they can spot a deepfake, revealing a significant gap between confidence and actual detection capability, especially as only 15% have never encountered one.

- In JUMIO's consumer insights survey, 68% of global respondents said they or someone they know had been affected by online fraud or identity theft. U.S. respondents were the most likely to be direct victims (39%), while in Singapore, 51% reported knowing someone who had been impacted, underscoring the pervasive nature of digital fraud and its social ripple effects.

- According to JUMIO, although many consumers who have been victims of identity theft or fraud found the experience to be minor (46%), a significant portion (32%) reported it caused major issues and hours of admin work. Even more striking, 14% found the ordeal traumatic, illustrating the deep psychological and logistical toll digital identity breaches can have.

- JUMIO’s research indicates over 70% of consumers would be willing to spend more time on identity verification if it improved security, especially in high-risk sectors like financial services (77%), healthcare (74%), government services (72%), and retail or e-commerce (72%), showing growing public support for stronger digital safeguards.

- Findings from JUMIO reveal a gender and age confidence gap in spotting deepfakes, with 66% of men believing they can detect them versus 55% of women. Confidence peaks among men aged 18–34 at 75%, while women aged 35–54 are least confident at 52%, pointing to potential vulnerabilities and awareness gaps in consumer self-assessment.

Market Dynamic

Driving Factors in the U.S. Identity Verification Market

Rising Digital Economy and Online ServicesThe growth in the use of online services across banking, healthcare, e-commerce, and government platforms is driving the US identity verification market forward. As more people move their day-to-day activities online, a vast need exists for secure and simple ways of verifying identity. Services like online banking, remote healthcare visits, digital tax filing, and shopping online rely on reliable ID checks to prevent fraud and protect users. Businesses are investing majorly in identity verification technologies to improve digital experiences for users and employees alike. Remote work arrangements have driven this growth as companies must verify employees working from different locations. With digital economies expanding every year, identity verification requirements also increase steadily.

Rising Threats of Identity Theft and Cybercrime

An increase in cyberattacks and identity theft cases has also played a part in fueling the growth of the US identity verification market. Criminals have become more particular, using stolen personal data to open false accounts, apply for loans fraudulently, and commit other forms of fraud. Because of this trend, organizations across all sectors are experiencing pressure to upgrade their security systems. Identity verification aids prevent fraud at its source by verifying that only legitimate users gain entry to resources. Compliance regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements have led companies to adopt more advanced verification processes; as fraud risks continue to escalate, businesses realize strong identity verification isn't just about compliance but protecting both reputations and customers alike.

Restraints in the U.S. Identity Verification Market

Privacy Concerns and Data Protection Issues

One of the key challenges in the US identity verification market is user apprehension about their data being shared online, such as Social Security Numbers, biometrics, or identity documents. Without careful management of data by companies, it could lead to breaches, identity theft, or loss of trust with customers. Strict privacy regulations like the California Consumer Privacy Act (CCPA) make it more challenging for businesses to collect and store personal data without incurring legal risks. Companies should invest heavily in secure systems and transparent policies to ease employee concerns about misuse or unauthorized access of personal data, which may slow adoption rates of digital identity solutions. Trust remains key for their success.

High Implementation Costs and Technology Challenges

Another significant barrier for the market is the cost associated with setting up advanced identity verification systems. Building or purchasing secure platforms employing biometrics, AI, and encryption technologies is a costly endeavor that demands significant capital investments to bring online identity verification systems online. Smaller companies, in particular, may find it challenging to afford these systems while remaining profitable, and technical challenges such as integration, data accuracy, and false positives may create delays and user dissatisfaction.

Organizations must constantly adapt their verification methods in response to evolving fraud schemes. Unfortunately, businesses often struggle with the balance between cost, technology upgrades, and user experience when adopting identity verification solutions, something that may impede adoption for companies with tight budgets.

Opportunities in the U.S. Identity Verification Market

Increase in Biometric Verification Technologies

One area of growth for the US identity verification market lies with biometric technologies like facial recognition, fingerprint scans, and voiceprint analysis. As technology progresses, biometrics provide a more secure and simpler means of authenticating identities than traditional methods like passwords or PINs, giving biometrics great potential in industries like banking, healthcare, and e-commerce, where secure and easy access are of utmost importance. Consumers primarily desire frictionless experiences, and biometric solutions help provide this. As more affordable and accurate biometric tools become integrated into more services, they create opportunities for businesses to enhance security while improving user convenience.

Regulatory Changes and Compliance Requirements

One opportunity in the US identity verification market comes from changing regulatory requirements regarding fraud prevention and compliance. As concern about identity theft and financial crimes increases, laws like Know Your Customer (KYC) and Anti-Money Laundering (AML) require businesses to implement stringent verification measures for customers. As regulations become tighter, businesses increasingly seek ways to streamline verification while meeting legal standards more easily, creating an increasing demand for advanced identity verification solutions that adhere to compliance standards. Businesses offering flexible, scalable, and cost-effective solutions for organizations to adhere to such regulations will do well as technology companies become interested in this sector of compliance solutions.

Trends in the U.S. Identity Verification Market

Rise of Biometric and AI-Powered Verification

Biometric technologies like facial recognition and fingerprint scanning have become more and more widespread across various sectors like retail, travel, and healthcare. These methods provide better security and convenience, allowing users to authenticate themselves quickly and accurately. In addition, artificial intelligence (AI) is being used to detect and prevent fraudulent activities by monitoring patterns and behaviors in real-time. AI-driven systems, for instance, can detect anomalous user behaviors during online transactions and flag them before potentially fraudulent activities take place, which is revolutionizing identity verification solutions while offering more efficient ways of combating identity theft and fraud.

Integration of Digital IDs and Smart Infrastructure

Digital identity solutions and smart infrastructure integration is becoming more widespread. Electronic ID cards and digital wallets are being introduced to streamline identity verification processes in various environments, such as airports and government services. Digital IDs allow individuals to quickly and effortlessly verify their identities without the need for physical documents and enhance user experience. Smart infrastructure such as biometric-enabled kiosks and automated verification systems is being deployed to facilitate faster and more secure identity checks, which signals a shift towards an integrated approach to identity verification that aligns with broader digital transformation trends in both the public and private sectors.

Research Scope and Analysis

By Component Analysis

2025 will see solutions playing an integral part in the growth of the US identity verification market, accounting for 67.9% of total market share. These include biometrics, AI-driven systems, and document verification tools. These solutions provide businesses and government agencies with more accurate, secure, and efficient methods for verifying identities, helping meet the growing need for fraud prevention and security. As digital interactions expand across industries like banking, healthcare, and e-commerce, demand for advanced verification technologies will increase accordingly, leading to market advancement. Companies offering innovative yet scalable solutions will emerge as leaders of a safer and more efficient online experience.

Services within the US identity verification market will experience rapid expansion over the forecast period as businesses look for tailored solutions that address their specific security requirements. This includes implementation, support, and maintenance of identity verification systems. As demand for secure and reliable verification processes across industries such as financial services, healthcare, and government increases, expert services will become even more in demand. Integrating, optimizing, and continually updating their verification systems. Due to rising concerns around data breaches and fraud, businesses will rely on services specialized in maintaining compliance with ever-evolving regulations, further driving demand for identity verification services.

By Type Analysis

Non-biometric identity verification will hold a 61.8% market share in 2025 in the US market, significantly contributing to its development and expansion. Non-biometric methods include both traditional methods like passwords and PINs, as well as more innovative techniques like SMS or email-based verification codes. These methods are highly employed across various industries, mainly those where biometric solutions may not be desirable or possible. Non-biometric methods are cost-effective, easy to implement, and continue to provide essential security in many applications, from online banking to e-commerce. Businesses opting for the balance between convenience and security will see non-biometric verification methods remain key components in maintaining a secure digital environment for both their users and employees alike.

Biometric identity verification will experience higher growth over the next several years as both companies and governments mainly adopt this technology for easy user authentication. Biometric methods such as facial recognition, fingerprint scanning and voice recognition offer an additional layer of security by relying on unique physical traits for identity verification. With cyber threats becoming highly specialized, biometrics offer an effective solution against fraud and identity theft. Finance, healthcare and travel industries have already implemented biometric verification into their services to increase customer demand for biometric identification. Mobile phones and the trend towards contactless authentication have only expedited its widespread use as an identity verification solution in future markets.

By Deployment Analysis

Cloud deployment will emerge as the market-leading segment in the US Identity Verification sector with 78.1% of total market share in 2025. Integration of cloud-based solutions gives businesses both operational flexibility together with scalability and cost-efficiency features necessary for secure digital identity verification. The identity verification solutions provide organizations with continuous accessibility to support handling large-scale identity verification requests at any time and without depending on on-site infrastructure.

Current technological advancements drive businesses to implement cloud-based systems, which support their operational requirements alongside growing security requirements. Cloud platforms deliver real-time system updates in addition to third-party integration capabilities, which boost security performance with organizational efficiency gains. Organizations adopt the cloud for identity verification purposes because it demonstrates quick adaptability to changing needs and implements state-of-the-art verification methods, including AI and machine learning.

The identity verification systems managed by on-premise deployment methods will expand tremendously during the forecast period because some business sectors need enhanced administration and protection for their authentication processes. The banking industry, together with defense institutions and government agencies, primarily chooses on-premises solutions because they require maximum privacy for data and need to meet regulatory standards. Such systems enable organizations to maintain complete authority regarding both their stored data and processing activities, particularly for applications with sensitive requirements.

During times when cyber threats expand, business customers can protect their data with customized security protocols through on-premise deployment. The cloud storage market continues its dominance, but organizations with rigorous privacy requirements should keep on-premise deployment as an available alternative.

By Organization Size Analysis

The US identity verification market will have large enterprises controlling 62.5% of its market share in 2025. Organizations operating in finance, together with healthcare and retail sectors, must deploy powerful identity verification infrastructure that addresses both scalability and high-volume transaction requirements. Through their substantial budgets, large enterprises acquire modern verification methods using biometrics and AI identification and cloud infrastructure to reach maximum security standards. A large number of users within these organizations require advanced identity verification solutions to build trust while upholding regulatory standards. The market advancement will continue since expanding digital operations and moving services online require dependable security systems for identity verification.

Further, the identity verification market will experience substantial expansion among small and medium-sized enterprises throughout the forecast period because these businesses place a higher emphasis on security combined with fraud defense. Digital service adoption by SMEs leads them to select economical identity verification systems that provide scalable security measures for both customer data protection and transaction safety. The limited financial resources of SMEs do not stop them from adopting user-friendly cloud-based verification systems which provide simple setup and management features. Growing industry need for robust cybersecurity practices has motivated SMEs to acquire solutions which help them verify customer trust and fulfill compliance standards. The evolving trend will boost the identity verification market's total growth.

By Application Analysis

The US Identity Verification market will grow significantly in 2025 due to KYC (Know Your Customer) and compliance applications, which will comprise 39.4% of the total market share. The need for effective identity verification solutions increases throughout banking, as well as finance and insurance sectors, because of regulatory standards established by these industries. Businesses depend on KYC verification procedures for identifying their customers because these processes protect them from financial law violations and anti-money laundering (AML) regulations.

Financial services depend on KYC applications for protecting trust levels while ensuring security because these solutions detect fraud and money laundering activities. The market’s expansion continues to grow as companies put KYC solutions first for compliance purposes and to avoid paying penalties under global regulations.

During the forecast period, access control applications will demonstrate substantial market expansion because businesses actively pursue physical and digital space protection systems. Identity verification stands vital for organizations that aim to safeguard their sensitive data and facilities through proper systems and networks, and building access management.

Security access systems depend on biometrics, together with security cards and digital IDs, to authenticate authorized personnel before granting entry. Secure access management requirements are expanding quickly because governments and healthcare organizations, and corporate institutions demand critical data and facility defense solutions. The market growth for identity verification through access control applications will be sustained by rising demands to safeguard online and physical assets.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

The Banking Financial Services and Insurance sector in the US is projected to get

37.9% of the total US Identity Verification market in 2025. This industry demands protected identity verification solutions so security becomes available alongside reliable identity authentication together with fraud blocking and regulatory adherence, and financial data protection. The BFSI sector includes banks and insurance companies which protect their transactions along with account access and customer data through advanced authentication techniques that involve biometrics and AI-based fraud detection along with multi-factor verification.

Identity verification solutions used by the BFSI sector will keep increasing due to security threats and strict regulations to defend trust and provide smooth digital banking services as well as insurance operations and financial transactions. Identity verification will expand strongly throughout the travel and hospitality industry across the US forecast period. Identity verification solutions play an indispensable role in securing bookings while protecting the safety of online transactions, as consumer flight, accommodation bookings and service bookings continue to grow.

Travel industries must enhance their verification systems for check-in counters and airport security and hotels because their accuracy and speed requirements are increasing. Identity verification systems, which enhance security and improve customer experience, have grown thanks to technology improvements in biometrics. The combination of growing internet reservations and touchless service requirements will promote identity verification systems adoption because they meet security requirements and improve operational effectiveness in the travel and hospitality industries.

The U.S. Identity Verification Market Report is segmented on the basis of the following

By Component

- Solutions

- Services

- Professional Services

- Managed Services

By Type

- Biometrics

- Fingerprint Recognition

- Facial Recognition

- Iris Recognition

- Voice Recognition

- Non-Biometrics

- Document Verification

- Knowledge-based Authentication

- Database Verification

By Deployment

By Organization Size

By Application

- Access Control

- KYC & Compliance

- Authentication

- Fraud Prevention

- Others

By End User

- BFSI (Banking, Financial Services, and Insurance)

- Government & Defense

- Healthcare

- Retail & eCommerce

- IT & Telecom

- Gaming & Gambling

- Travel & Hospitality

- Education

- Others

Competitive Landscape

Identity verification in the US market is highly competitive and rapidly evolving. Companies strive to offer the safest, fastest, and user-friendly methods of confirming people's identities as quickly as possible. Some businesses focus on advanced technologies like artificial intelligence and biometrics, while others work to make traditional methods faster and more secure. New players continue to enter the market, providing fresh perspectives while pushing established companies forward to keep improving.

At the same time, strict government regulations regarding data privacy and fraud protection are forcing companies to develop smarter verification systems. Businesses across banking, healthcare, retail, and even social media all rely on better identity checks, which keeps demand strong while competition is fierce, and innovation is key to staying ahead.

Some of the prominent players in the The U.S. Identity Verification are

- Thales Group

- IDEMIA

- GB Group

- iProov

- IDnow

- Sumsub

- NEC Corp

- Jumio

- Socure

- SecureAuth

- Okta

- ID.me

- Ping Identity

- Persona

- Acuant

- Experian

- Truiloo

- Signicat

- Face++

- Daon

- Other Key Players

Recent Developments

- In April 2025, NEC Corporation of America has launched Identity Cloud Service (ICS), a secure, cost-effective identity verification solution using NEC’s leading biometric technology. ICS offers verification and search capabilities for various sectors, including finance, e-commerce, government, and more. According to Eugene Le Roux, Senior Vice President of Digital Government, ICS provides fast, affordable access to NEC’s top-ranked facial recognition technology. The cloud-based service is hosted on Microsoft Azure, offering scalability and quick onboarding.

- In April 2025, OpenAI is considering a mandatory ID verification process for organizations to access certain upcoming AI models. The new Verified Organisation system allows developers to unlock advanced models on the platform. Verification requires a government-issued ID from a supported country, and each ID can only verify one organization every 90 days. OpenAI notes that not all organizations will qualify for verification under this new process.

- In April 2025, Blend Labs, Inc. unveiled a direct integration with Prove Identity, Inc., which incorporates Prove’s Pre-Fill® solution into Blend’s Consumer Banking platform, enhancing efficiency across deposit account, credit card, and consumer loan products. Prove Pre-Fill® securely pre-populates application forms with verified identity information, minimizing manual data entry for lenders and speeding up the onboarding process for consumers.

- In March 2025, The U.S. Patent and Trademark Office (USPTO) is launching ID.me, a modern identity verification platform, for Patent Center users. This online process eliminates the need for a notary, reduces customer costs, and strengthens security. ID.me enables users to complete verification within 30 minutes, allowing them to self-enroll and quickly access all Patent Center features.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.4 Bn |

| Forecast Value (2034) |

USD 16.7 Bn |

| CAGR (2025–2034) |

15.9% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Type (Biometrics and Non-Biometrics), By Deployment (Cloud and On-Premise), By Organization Size (Large Enterprises and SMEs), By Application (Access Control, KYC & Compliance, Authentication, Fraud Prevention, and Others), By End User (BFSI (Banking, Financial Services, and Insurance), Government & Defense, Healthcare, Retail & eCommerce, IT & Telecom, Gaming & Gambling, Travel & Hospitality, Education, and Others) |

| Prominent Players |

Thales Group, IDEMIA, GB Group, iProov, IDnow, Sumsub, NEC Corp, Jumio, Socure, SecureAuth, Okta, ID.me, Ping Identity, Persona, Acuant, Experian, Truiloo, Signicat, Face++, and Daon, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the U.S. Identity Verification Market?

▾ The U.S. Identity Verification Market size is expected to reach a value of USD 4.4 billion in 2025 and is expected to reach USD 16.7 billion by the end of 2034.

Who are the key players in the U.S. Identity Verification Market?

▾ Some of the major key players in the U.S. Identity Verification Market are Thales Group, IDEMIA, Face++ and others

What is the growth rate in the U.S. Identity Verification Market?

▾ The market is growing at a CAGR of 15.9 percent over the forecasted period.