Market Overview

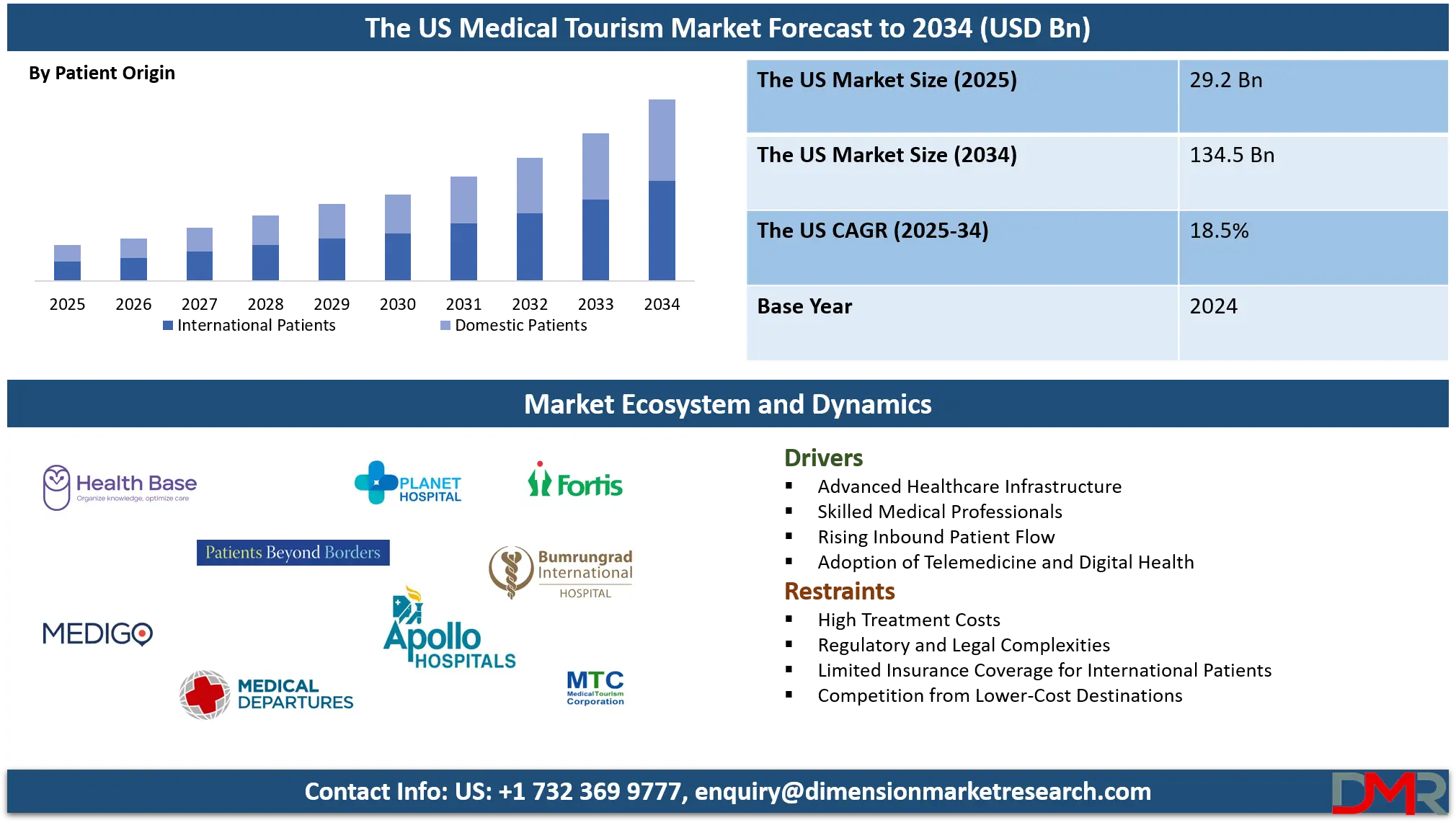

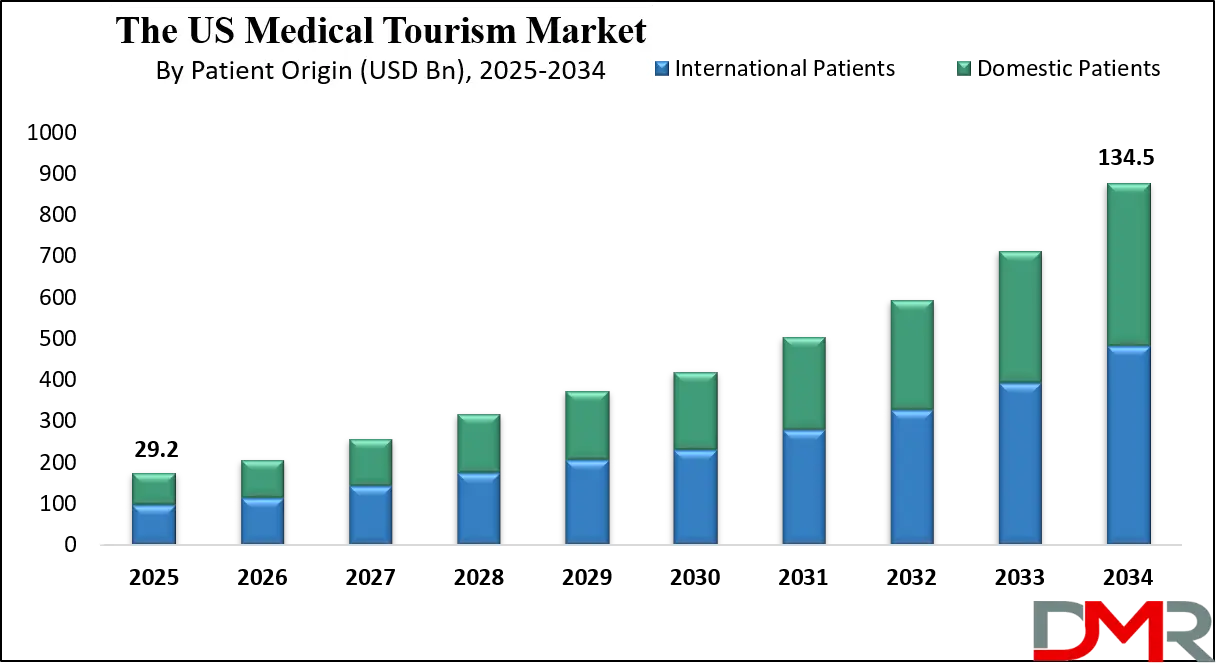

The US medical tourism market is projected to grow from USD 29.2 billion in 2025 to USD 134.5 billion by 2034, expanding at a CAGR of 18.5%.

The market growth is driven by rising inbound patient flow, demand for advanced healthcare services, elective surgeries, cosmetic procedures, orthopedic and cardiac treatments, and integrated patient care services. Increasing awareness of high-quality healthcare, hospital accreditation, and telemedicine-enabled pre- and post-treatment support are fueling market expansion, positioning the United States as a preferred destination for specialized medical travel and global healthcare tourism.

Medical tourism refers to the practice of traveling across national borders to receive medical care, combining healthcare services with travel for leisure, recovery, and wellness. It involves patients seeking treatment for procedures that may be unavailable, expensive, or associated with long waiting periods in their home country.

This market encompasses elective surgeries, cosmetic procedures, fertility treatments, dental care, orthopedic surgeries, cardiac interventions, and advanced therapies such as oncology or organ transplants. Medical tourism also integrates complementary services including post-operative rehabilitation, wellness programs, and concierge services, highlighting the convergence of healthcare quality, affordability, accessibility, and tourism infrastructure in shaping patient decisions globally.

The United States medical tourism market is one of the largest and most sophisticated globally, attracting both international patients and domestic travelers seeking specialized healthcare services. The market is driven by the country’s advanced medical technology, highly skilled healthcare professionals, and internationally accredited hospitals. Patients often visit for complex procedures including cardiac surgery, oncology treatments, organ transplants, orthopedic interventions, and cosmetic enhancements. In addition to clinical expertise, the market offers integrated patient services such as personalized care coordination, language support, luxury accommodations, and post-treatment rehabilitation, creating a comprehensive medical travel experience.

The market has witnessed continuous growth due to increasing awareness of high-quality healthcare, rising inbound medical travelers from regions with limited advanced medical facilities, and the expansion of hospital networks collaborating with medical tourism facilitators. Cost considerations, although higher compared to some destination countries, are balanced by the reputation of outcomes, availability of cutting-edge technology, and comprehensive insurance coverage for international patients. The integration of telemedicine for pre-treatment consultations, travel planning services, and follow-up care has further strengthened the market, making the United States a preferred destination for complex, elective, and specialized medical procedures globally.

The US Medical Tourism Market: Key Takeaways

- Market Value: The US medical tourism market size is expected to reach a value of USD 134.5 billion by 2034 from a base value of USD 29.2 billion in 2025 at a CAGR of 18.5%.

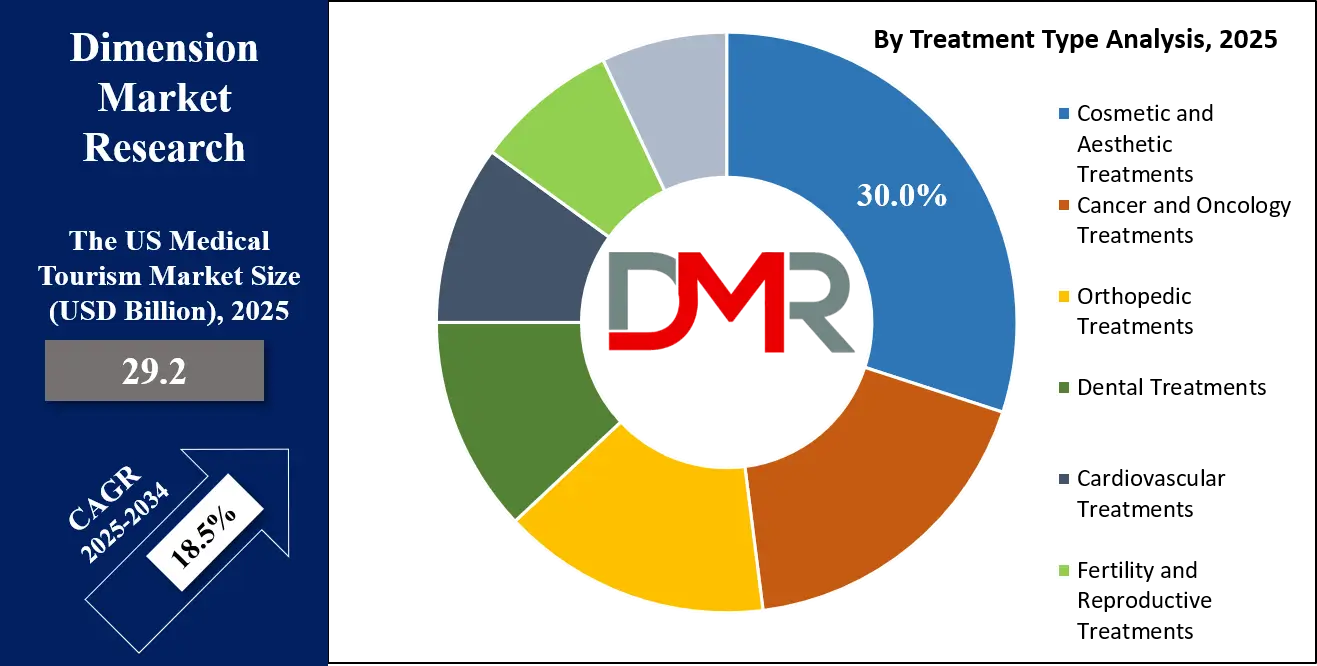

- By Treatment Type Segment Analysis: Cosmetic and Aesthetic Treatments are anticipated to dominate the treatment type segment, capturing 30.0% of the total market share in 2025.

- By Service Nature Segment Analysis: Medical and Surgical Treatment is expected to maintain its dominance in the service nature segment, capturing 50.0% of the total market share in 2025.

- By Patient Origin Segment Analysis: International Patients will account for the maximum share in the patient origin segment, capturing 55.0% of the total market value.

- By Service Provider Segment Analysis: Private Hospitals and Clinics will dominate the service provider segment, capturing 60.0% of the market share in 2025.

- Key Players: Some key players in the US medical tourism market are Healthbase, Patients Beyond Borders, Medigo, Medical Departures, Planet Hospital, Apollo Hospitals Enterprise Limited, Fortis Healthcare Limited, Bumrungrad International Hospital Group, International Medical Tourism Corporation, and Others.

The US Medical Tourism Market: Use Cases

- Cardiac Surgery Tourism: The United States is a leading destination for patients seeking advanced cardiac care. International patients travel for procedures such as bypass surgery, valve replacement, and minimally invasive heart interventions due to high success rates and access to cutting-edge medical technology. Hospitals provide integrated services including pre-surgery consultations, personalized care plans, and post-operative rehabilitation, ensuring a safe and efficient treatment experience. The reputation of US cardiac centers and highly skilled cardiologists attracts patients from regions with limited cardiac care infrastructure.

- Elective Cosmetic Procedures: US medical tourism includes a significant demand for elective cosmetic surgeries such as facelifts, breast augmentation, and body contouring. Patients combine medical treatment with travel for recovery in a safe and supportive environment. The availability of board-certified plastic surgeons, advanced surgical techniques, and accredited facilities makes the US a preferred destination. Concierge services, luxury accommodation, and seamless scheduling enhance the overall patient experience.

- Orthopedic Surgery and Joint Replacement: Patients travel to the US for orthopedic surgeries including hip and knee replacements, spinal procedures, and sports injury treatment. Advanced surgical technology, robotic-assisted procedures, and post-operative rehabilitation programs contribute to better outcomes and faster recovery. International patients value the combination of quality care, shorter wait times, and access to experienced orthopedic surgeons.

- Fertility and Reproductive Tourism: The US attracts couples seeking fertility treatments including in-vitro fertilization, egg donation, and surrogacy programs. Highly regulated clinics, advanced reproductive technologies, and personalized treatment plans provide confidence and high success rates. Patients benefit from comprehensive care including counseling, legal guidance, and follow-up support, making the US a trusted hub for reproductive medical tourism.

Impact of Artificial Intelligence on the US medical tourism market

Artificial intelligence is increasingly transforming the US medical tourism market by enhancing patient care, operational efficiency, and treatment outcomes. AI-powered tools enable personalized treatment planning, predictive diagnostics, and advanced imaging analysis, helping hospitals deliver faster and more accurate care for procedures such as cardiac surgery, oncology, and orthopedic treatments. Virtual consultations, AI-driven scheduling, and remote monitoring improve patient convenience and reduce travel-related uncertainties.

Additionally, AI supports hospital management in resource optimization, risk assessment, and quality control, strengthening the overall medical tourism ecosystem and attracting more international and domestic patients seeking advanced, technology-enabled healthcare services.

The US Medical Tourism Market: Stats & Facts

Data from U.S. Cooperative for International Patient Programs (USCIPP) / related reports

- In 2023, 60 U.S. health‑care organizations under USCIPP reported serving 47,002 international patients.

- That cohort reportedly generated USD 2.1 billion in gross revenue charges in that fiscal year.

Data on physician workforce in the U.S. (relevant to capacity and attractiveness for medical tourists / international patients)

- As of 2023, about 24.7% of active physicians in the U.S. are international medical graduates (IMGs).

- The total number of active physicians in 2023 was about 1,010,892, of which 851,282 were direct patient‑care physicians.

Data on overall health‑center visits (general care infrastructure)

- In 2023, U.S. federally qualified health centers and look‑alikes recorded an estimated 124.3 million visits across the country.

The US Medical Tourism Market: Market Dynamics

The US Medical Tourism Market: Driving Factors

Advanced Healthcare Infrastructure

The United States medical tourism market benefits from state-of-the-art hospitals, internationally accredited facilities, and access to advanced medical technologies. Patients seeking complex surgeries, oncology treatments, or cardiac interventions are drawn to the high-quality infrastructure, cutting-edge equipment, and specialized care teams. The integration of telemedicine for pre- and post-treatment consultations further enhances patient convenience and confidence, boosting inbound medical travel.

Skilled Medical Professionals

The presence of highly trained surgeons, specialists, and healthcare professionals is a key driver of US medical tourism. Expertise in orthopedic procedures, cosmetic surgeries, fertility treatments, and complex cardiac care ensures superior treatment outcomes. Patients from regions with limited access to such expertise prefer traveling to the US, where personalized care, multidisciplinary treatment planning, and global medical standards are guaranteed.

The US Medical Tourism Market: Restraints

High Treatment Costs

The high cost of medical procedures in the United States can deter price-sensitive international patients. Procedures like cardiac surgeries, cosmetic enhancements, and organ transplants are significantly more expensive compared to alternative destinations, limiting accessibility for some patient segments and slowing market penetration.

Regulatory and Legal Complexities

Navigating US healthcare regulations, insurance policies, and legal frameworks for international patients can be challenging. Compliance with medical standards, visa restrictions, and liability laws adds complexity for patients and hospitals, potentially restricting the growth of inbound medical tourism despite the high quality of care.

The US Medical Tourism Market: Opportunities

Expansion of Telemedicine Services

Telemedicine presents a significant growth opportunity in US medical tourism. Remote consultations, virtual treatment planning, and follow-up care can attract international patients by reducing travel frequency and improving convenience. Hospitals leveraging AI-driven platforms and digital health tools can enhance patient engagement, expand their global reach, and strengthen competitive positioning.

Rising Demand for Elective and Specialized Procedures

Increasing interest in cosmetic surgeries, fertility treatments, orthopedic interventions, and advanced oncology therapies offers growth potential. International and domestic patients seek high-quality care and innovative procedures not easily available elsewhere, providing hospitals opportunities to develop premium service packages, integrated wellness programs, and concierge-based patient experiences.

The US Medical Tourism Market: Trends

Integration of Artificial Intelligence and Robotics

AI and robotic-assisted surgeries are shaping the US medical tourism market. Hospitals are using these technologies for precision surgeries, predictive diagnostics, and personalized treatment plans. AI-enabled imaging, remote monitoring, and automated scheduling improve efficiency, enhance patient outcomes, and attract tech-savvy international patients seeking cutting-edge medical care.

Patient-Centric Service Models

There is a growing trend toward personalized patient experiences that combine medical treatment with hospitality services. Hospitals are offering concierge services, language support, luxury accommodations, and holistic wellness programs. This trend enhances patient satisfaction, strengthens brand reputation, and encourages repeat medical travel among both international and domestic patients.

The US Medical Tourism Market: Research Scope and Analysis

By Treatment Type Analysis

Cosmetic and aesthetic treatments are expected to lead the treatment type segment in the US medical tourism market, accounting for approximately 30% of the total market share in 2025. The dominance of this segment is driven by the growing demand for procedures such as facelifts, breast augmentation, liposuction, and minimally invasive cosmetic surgeries. International patients are attracted to the United States due to the availability of board-certified plastic surgeons, advanced surgical techniques, and globally accredited hospitals. The integration of personalized care, luxury recovery services, and post-operative support enhances the overall patient experience, making cosmetic treatments a preferred choice for medical travelers seeking quality outcomes combined with convenience and comfort.

Cancer and oncology treatments also hold a significant position in the treatment type segment, attracting patients who require advanced diagnostics, precision therapies, and specialized cancer care that may not be readily available in their home countries. The US medical tourism market benefits from leading oncology centers offering innovative treatments such as immunotherapy, targeted therapy, and robotic-assisted surgeries.

Patients are drawn by the reputation of US cancer hospitals for high survival rates, multidisciplinary care teams, and access to clinical trials. Comprehensive care packages, including pre-treatment consultations, follow-up care, and personalized support services, further reinforce the appeal of cancer and oncology treatments as a vital segment within the medical tourism landscape.

By Service Nature Analysis

Medical and surgical treatment is expected to maintain its leading position in the service nature segment of the US medical tourism market, capturing around 50% of the total market share in 2025. This dominance is driven by the high demand for complex procedures such as cardiac surgeries, orthopedic interventions, organ transplants, and advanced oncology treatments.

Patients are attracted to the United States for its world-class hospitals, cutting-edge medical technology, and highly skilled healthcare professionals. The availability of personalized care plans, pre- and post-operative support, and advanced diagnostic services ensures superior treatment outcomes and patient safety. These factors make medical and surgical treatments the most sought-after services among both international and domestic medical travelers.

Wellness and preventive treatments are also an important part of the service nature segment, catering to patients seeking non-invasive care and proactive health management. This includes services such as routine health check-ups, nutrition and lifestyle programs, stress management therapies, and preventive screenings.

International and domestic patients increasingly prefer these treatments to maintain long-term health, detect potential issues early, and complement other medical procedures. The integration of wellness programs with luxury accommodations, spa therapies, and personalized lifestyle guidance enhances patient satisfaction and positions the United States as a preferred destination for preventive and holistic health services.

By Patient Origin Analysis

International patients are expected to account for the largest share in the patient origin segment of the US medical tourism market, capturing approximately 55% of the total market value. This dominance is driven by the reputation of US healthcare facilities for advanced medical technology, specialized treatments, and highly skilled healthcare professionals. Patients from regions with limited access to complex procedures, longer waiting periods, or lower-quality healthcare travel to the United States for surgeries, oncology treatments, orthopedic interventions, fertility procedures, and cosmetic surgeries. Comprehensive services such as personalized care coordination, language support, luxury accommodations, and post-treatment follow-up further enhance the appeal for international medical travelers.

Domestic patients also form a significant portion of the patient origin segment, representing the remaining share of the market. These patients often seek specialized care, elective procedures, or advanced treatments within the United States that may not be available locally or require long wait times. Hospitals cater to domestic medical travelers through streamlined scheduling, personalized care plans, and integrated wellness services. The convenience, quality of care, and access to innovative medical technologies encourage domestic patients to travel across states for medical treatment, contributing to the overall growth of the US medical tourism market.

By Service Provider Analysis

Private hospitals and clinics are expected to dominate the service provider segment of the US medical tourism market, capturing around 60% of the total market share in 2025. This leadership is attributed to the high-quality infrastructure, internationally accredited facilities, and advanced medical technologies available in private healthcare institutions. These hospitals offer specialized treatments including cardiac surgeries, oncology care, orthopedic interventions, fertility procedures, and cosmetic surgeries.

In addition, private providers focus on patient-centric services such as personalized care coordination, concierge support, luxury accommodations, and streamlined administrative processes, which attract both international and domestic medical travelers seeking convenience, comfort, and superior treatment outcomes.

Public healthcare institutions also play an important role in the service provider segment, offering medical care to patients who prefer or require government-supported healthcare facilities. These institutions provide access to essential medical services, preventive care, and certain specialized treatments at relatively lower costs compared to private hospitals. While public hospitals may not offer the same level of luxury or elective services as private providers, they remain crucial in addressing the healthcare needs of domestic patients and supporting the broader medical tourism ecosystem through collaborations, research programs, and quality treatment services.

The US Medical Tourism Market Report is segmented on the basis of the following:

By Treatment Type

- Cosmetic and Aesthetic Treatments

- Cancer and Oncology Treatments

- Orthopedic Treatments

- Dental Treatments

- Cardiovascular Treatments

- Fertility and Reproductive Treatments

- Other Treatments

By Service Nature

- Medical and Surgical Treatment

- Wellness and Preventive Treatments

- Alternative Treatments and Therapies

By Patient Origin

- International Patients

- Domestic Patients

By Service Provider

- Private Hospitals and Clinics

- Public Healthcare Institutions

The US Medical Tourism Market: Competitive Landscape

The US medical tourism market features a highly competitive landscape characterized by intense rivalry among hospitals, clinics, and healthcare service providers aiming to attract both international and domestic patients. Market players compete on the basis of treatment quality, advanced medical technology, patient outcomes, and comprehensive care services.

Hospitals focus on differentiating themselves through specialized procedures, personalized patient experiences, concierge support, and integration of telemedicine for pre- and post-treatment care. Strategic partnerships, accreditation by international healthcare organizations, and investment in cutting-edge infrastructure further intensify competition, while innovation in elective surgeries, complex treatments, and wellness services continues to shape market dynamics and drive growth in this sector.

Some of the prominent players in the US medical tourism market are:

- Healthbase

- Patients Beyond Borders

- Medigo

- Medical Departures

- Planet Hospital

- Apollo Hospitals Enterprise Limited

- Fortis Healthcare Limited

- Bumrungrad International Hospital Group

- International Medical Tourism Corporation

- Global Healthcare Connections

- Medical Tourism Corporation

- Care at Distance

- MedConnect Global

- Mediplus International

- MedTourEasy

- Health-Tourism.com

- MY Health Global

- Healing Holidays

- World Med Assist

- Koç Healthcare Group

- Other Key Players

The US Medical Tourism Market: Recent Developments

- Nov 2025: A major international medical-tourism platform announced an initiative to improve access for patients with late-stage disease, launching a global programme to enable treatment of stage-4 pancreatic cancer at certified clinics abroad, aiming to expand patient coverage and global care coordination.

- Oct 2025: A UK–India oriented medical-travel startup raised seed funding of $4.5 million to build an integrated cross-border patient referral and care coordination system, enhancing ease of access, affordability, and reliable care pathways.

- Oct 2025: In the US, a large health system completed the acquisition of a multi-center ambulatory-surgery network, significantly expanding its footprint and capacity for outpatient and surgical care across multiple states.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 29.2 Bn |

| Forecast Value (2034) |

USD 134.5 Bn |

| CAGR (2025–2034) |

18.5% |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Treatment Type (Cosmetic and Aesthetic Treatments, Cancer and Oncology Treatments, Orthopedic Treatments, Dental Treatments, Cardiovascular Treatments, Fertility and Reproductive Treatments, Other Treatments), By Service Nature (Medical and Surgical Treatment, Wellness and Preventive Treatments, Alternative Treatments and Therapies), By Patient Origin (International Patients, Domestic Patients), and By Service Provider (Private Hospitals and Clinics, Public Healthcare Institutions) |

| Regional Coverage |

The US |

| Prominent Players |

Healthbase, Patients Beyond Borders, Medigo, Medical Departures, Planet Hospital, Apollo Hospitals Enterprise Limited, Fortis Healthcare Limited, Bumrungrad International Hospital Group, International Medical Tourism Corporation, and Others.

|

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The US medical tourism market size is estimated to have a value of USD 29.2 billion in 2025 and is expected to reach USD 134.5 billion by the end of 2034, with a CAGR of 18.5%.

Some of the major key players in the US medical tourism market are Healthbase, Patients Beyond Borders, Medigo, Medical Departures, Planet Hospital, Apollo Hospitals Enterprise Limited, Fortis Healthcare Limited, Bumrungrad International Hospital Group, International Medical Tourism Corporation, and Others.