Market Overview

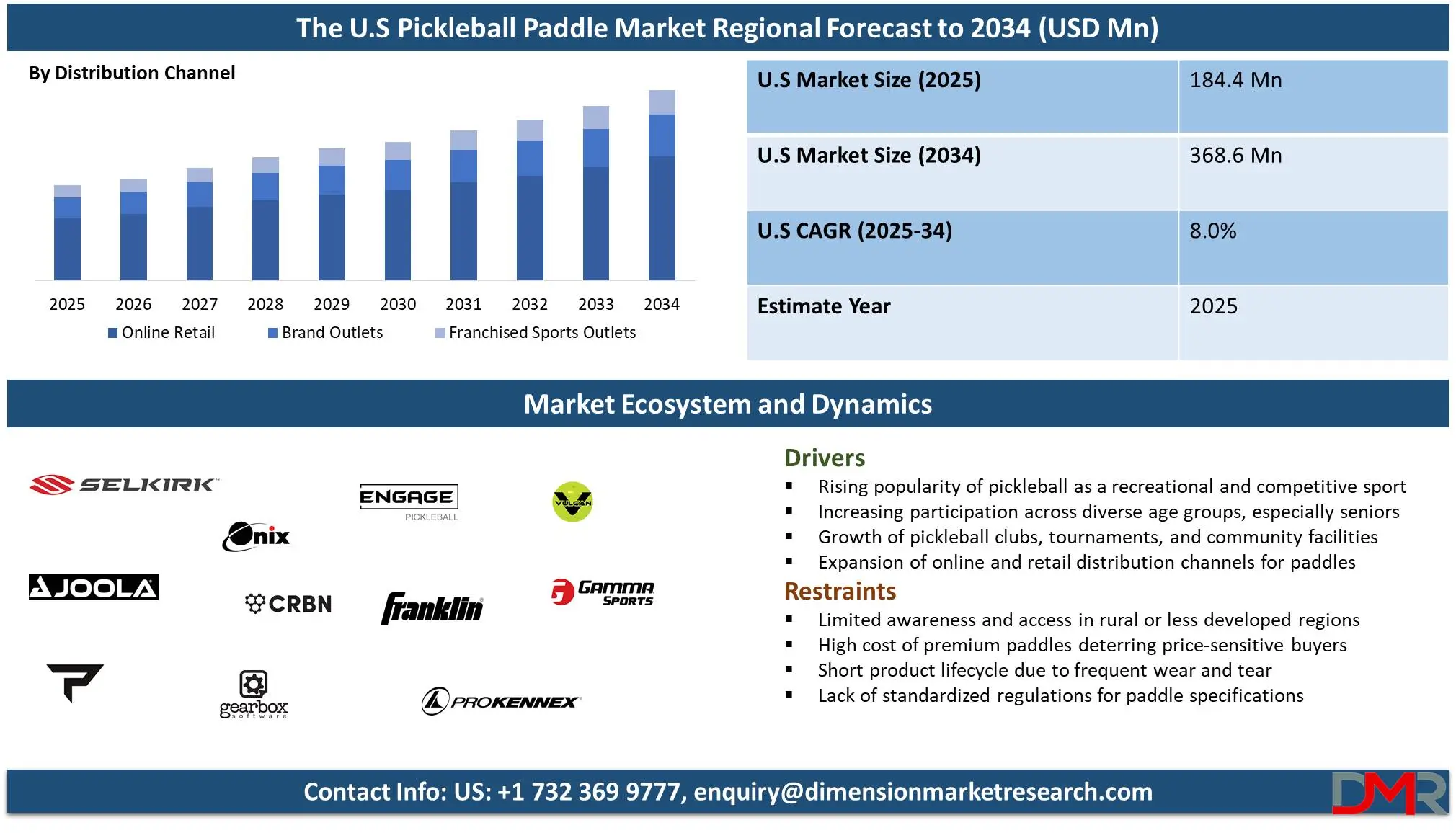

The U.S Pickleball Paddle Market is estimated to be valued at

USD 184.4 million in 2025 and is further anticipated to reach

USD 368.6 million by 2034 at a

CAGR of 8.0%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A

pickleball paddle is a specialized piece of equipment used in the sport of pickleball, a hybrid game combining elements of tennis, badminton, and table tennis. The paddle is typically constructed from lightweight yet durable materials such as wood, composite, or graphite, with a solid face and a perforated or cushioned handle to enhance grip and control. Unlike stringed racquets used in tennis, pickleball paddles feature a smooth surface that helps generate consistent ball contact and maneuverability during play.

The design and construction of a paddle significantly influence gameplay by affecting shot power, spin, and precision. Paddles vary in shape, weight, and core material, continually introducing innovations to improve player performance and comfort. Manufacturers often incorporate polymer, aluminum, or Nomex cores to balance control and power. As the sport continues to expand globally, paddle technology has become sophisticated, catering to players across all skill levels, from casual participants to professional athletes.

The U.S pickleball paddle market has experienced rapid growth in recent years, fueled by the sport's rising popularity among all age groups. Initially concentrated among older adults, pickleball has seen a remarkable surge in participation from younger demographics, which has expanded the consumer base for paddles. This increasing demand has encouraged manufacturers to diversify product offerings with a focus on advanced technology, improved ergonomics, and performance-driven materials.

Moreover, the rise of pickleball leagues, tournaments, and celebrity endorsements has helped elevate the profile of the sport, further driving demand for high-quality paddles across amateur and professional segments.

Market dynamics in the U.S are also shaped by the evolving preferences of players and advancements in paddle design. Consumers are now more informed and selective, seeking paddles designed to their playing style, whether it's control-oriented for strategic placement or power-oriented for aggressive gameplay.

Brands are responding with innovations like vibration-damping features, edge guard reinforcements, and custom grip options. The proliferation of e-commerce platforms and dedicated sporting goods retailers has made it easier for consumers to access a wide range of products, contributing to higher sales and greater market competition.

U.S Pickleball Paddle Market: Key Takeaways

- Market Value: The U.S pickleball paddle market size is expected to reach a value of USD 368.6 million by 2034 from a base value of USD 184.4 million in 2025 at a CAGR of 8.0%.

- By Core Material Type Segment Analysis: The Polymer Core Materials are poised to consolidate their dominance in the core material type segment, capturing 86.5% of the total market share in 2025.

- By Price Range Type Segment Analysis: Premium Equipment is anticipated to maintain its dominance in the price range type segment, capturing 75.8% of the total market share in 2025.

- By Distribution Channel Type Segment Analysis: Online Retail channels are poised to consolidate their market position in the distribution channel type segment, capturing 65.2% of the total market share in 2025.

- By End-User Type Segment Analysis: Men are expected to maintain their dominance in the end-user type segment, capturing 52.7% of the total market share in 2025.

- Key Players: Some key players in the U.S pickleball paddle market are Selkirk, Joola, Paddletek, Onix, CRBN, Gearbox, Engage, Franklin, ProKennex, Vulcan, Gamma, Wilson, Diadem, Holbrook, Babolat, Six Zero, ProLite, Adidas, Prince, Head, and Other Key Players.

U.S Pickleball Paddle Market: Use Cases

- Recreational & Community-Level Play: Pickleball's rapid growth has made it a favorite among community centers, fitness clubs, retirement communities, and local parks. Recreational players, especially older adults and beginners, form a significant portion of the paddle market. These users typically purchase entry-level or mid-range paddles that are durable, lightweight, and affordable.

- Professional & Competitive Tournaments: The growing number of sanctioned tournaments, including national-level and pro-league events, has given rise to a competitive pickleball scene. Professional and advanced players seek high-performance paddles engineered with premium materials like carbon fiber or graphite, offering superior control, spin, and power. This segment not only drives innovation but also elevates brand loyalty and endorsement opportunities for manufacturers.

- Youth & School Sports Programs: Pickleball is being integrated into school PE curriculums and youth sports leagues due to its easy learning curve and low injury risk. This opens up a dedicated market for kid-friendly paddles, which are typically smaller, lighter, and designed with added safety features. Schools and recreation programs often purchase paddles in bulk, fueling B2B demand.

- Corporate Wellness & Fitness Centers: As part of employee engagement and health initiatives, many companies and fitness facilities are incorporating pickleball into their wellness offerings. In such environments, demand arises for durable, all-purpose paddles suitable for shared use. These paddles are generally mid-range in cost and built for versatility rather than specialization. This use case is expanding as more employers recognize pickleball's benefits in promoting physical activity, stress relief, and team-building.

U.S Pickleball Paddle Market: Stats & Facts

According to the National Institutes of Health (NIH):

- A study analyzing data from the National Electronic Injury Surveillance System (NEISS) reported an estimated 19,012 pickleball-related injuries treated in U.S. emergency departments between 2001 and 2017. The annual number of injuries increased notably during 2013–2017. About 90.9% of these injuries occurred in individuals aged 50 years or older, with strains or sprains (28.7%) and fractures (27.7%) being most common. The lower extremity was affected in 32% of cases, and the upper extremity in 25.4%. Additionally, 88% of patients were treated and released without hospitalization.

- In a more recent study, NIH estimated 66,350 pickleball-related injuries between 2013 and 2022, with the mean age of injured individuals being 64 years. Falls accounted for 65.5% of injuries, and fractures were the most common diagnosis (32.7%), followed by strains/sprains (30.8%). Wrist injuries were most frequent (12.7%). Injury rates dipped 14% from 2019 to 2020 but rose by 41% between 2020 and 2021 during the COVID-19 pandemic.

- Another NIH study focusing on upper limb injuries estimated 12,021 wrist, hand, and finger injuries related to pickleball from 2013 to 2022. The majority occurred in white women over 55, with falls accounting for 90.5% of cases. Injuries increased by over 765% in this period, with 70% involving the wrist and 60.3% resulting in fractures.

According to the U.S. Department of Veterans Affairs (VA)

- The Martinsburg VA Medical Center partnered with the Paralyzed Veterans of America to offer pickleball clinics for wheelchair users, showcasing the sport’s accessibility and therapeutic benefits.

- The VA Madison Health Care System has introduced a 15-week pickleball program as part of its recreation therapy services, requiring medical clearance, illustrating its role in veteran rehabilitation.

- According to the Centers for Disease Control and Prevention (CDC):

- The CDC’s "Still Going Strong" campaign promotes group physical activities like pickleball as vital for maintaining social and physical well-being among older adults.

- The CDC also states that regular physical activity, such as playing pickleball, helps children and adolescents strengthen bones and muscles, manage weight, and reduce symptoms of anxiety and depression.

- Additionally, the CDC encourages inclusive physical education and group activities to help youth achieve the recommended 60 minutes of daily physical activity, with pickleball highlighted as a suitable option.

According to the Fairfax County Park Authority:

- An overwhelming 99.8% of county residents are within a 20-minute drive of a pickleball court, with 96.5% within 15 minutes and 77.3% within 10 minutes, reflecting widespread accessibility.

- According to the Washington, D.C. Department of Parks and Recreation (DPR):

- Since 2019, DPR has expanded from having no pickleball facilities to 58 dedicated or blended outdoor courts and 19 indoor sites with marked lines for pickleball. In Fiscal Year 2023, DPR hosted pickleball programs at 19 facilities, engaging over 1,500 participants. Additionally, in 2022, DPR organized one of the largest amateur pickleball tournaments in the country, with over 275 participants.

- According to the City of Raleigh Parks Department:

- Raleigh Parks maintains six permanent outdoor pickleball courts at Method Community Park and six at North Hills Park, all equipped with lighting for evening play.

- According to the City of Mountain View:

- The city has observed a significant increase in pickleball players utilizing both temporary and permanent courts, prompting plans for further development to meet the growing demand.

U.S Pickleball Paddle Market: Market Dynamics

U.S Pickleball Paddle Market: Driving Factors

Surge in Multi-Generational Participation

Unlike many high-impact sports that lean heavily on youth or athletic ability, pickleball is built around accessibility, low physical strain, and an easy learning curve. This has made it especially appealing to seniors aged 55 and above, who make up a significant portion of new adopters, but also to millennials and Gen Z, who are discovering the sport through social media trends and community leagues.

As a result, manufacturers are diversifying their paddle lines to match the needs of different player profiles, offering ergonomic designs for older players, lightweight paddles for beginners, and power-optimized models for younger, competitive users. This inclusive player base ensures recurring sales, encourages brand experimentation, and supports a broader ecosystem of accessories, coaching, and events, all funneling demand back to paddle manufacturers.

Rapid Commercialization and Brand-Driven Innovation

The evolution of pickleball to a mainstream sport has created fertile ground for commercial expansion and brand competition. Leading sports equipment brands, including Adidas, Wilson, and Head, have entered the market with high-tech paddle designs, leveraging their R&D capabilities to push performance boundaries.

These brands are bringing innovation to the forefront, integrating materials like carbon fiber composites, thermoformed edges, vibration-dampening cores, and aerodynamic shape features once exclusive to elite tennis or racquet sports. This technology arms race, combined with aggressive marketing campaigns and athlete endorsements, is transforming pickleball gear into performance-driven products rather than simple recreational tools.

U.S Pickleball Paddle Market: Restraints

Fragmented Regulation and Lack of Equipment Standardization

While organizations like USA Pickleball provide approval for paddles used in sanctioned tournaments, a vast number of brands and models in the recreational market operate in a loosely regulated environment. This creates confusion for consumers, particularly beginners, who are unsure about paddle legality, material differences, or specifications like grit, surface texture, and core thickness.

This regulatory gray area opens the door for low-quality or non-compliant paddles to flood the market, which dilutes consumer trust and creates inconsistency in playing experiences. For manufacturers aiming to uphold performance and quality standards, it becomes difficult to maintain competitive pricing when cheaper, unregulated alternatives are readily available.

Short Product Lifespan and Replacement Fatigue

Due to the repetitive impact and friction with balls, courts, and environmental exposure, even high-end paddles may begin to lose responsiveness or develop structural issues within months of regular play. For avid players, this leads to regular and sometimes costly replacements, creating what's often referred to as “replacement fatigue.”

This ongoing need for renewal can act as a deterrent for casual players or newcomers who view the sport as a low-commitment hobby. It also adds financial pressure on families and community centers that purchase equipment in bulk. While some brands offer warranties, the overall perception of fragility in even premium paddles can discourage long-term investment and loyalty, particularly in a market where durability is becoming as important as performance.

U.S Pickleball Paddle Market: Opportunities

Customization and Personalization of Paddle Design

Much like the evolution seen in sneakers and golf clubs, the opportunity lies in creating a consumer experience that goes beyond "one-size-fits-all." This could involve customizable grip sizes, weight distribution, face textures, or even player-designed graphics, turning the paddle into a reflection of one’s identity on the court.

Brands that use online configurators, limited-edition drops, or AI-driven paddle fitting systems can carve out a niche in the premium segment. Personalization also enhances customer loyalty and reduces return rates by aligning the product more closely with user expectations. With direct-to-consumer channels growing, this opens a new revenue stream with high margins and strong word-of-mouth marketing potential.

Integration of Smart Technology and Data Analytics

The next frontier in paddle innovation could lie in the fusion of sports tech and pickleball, giving rise to smart paddles embedded with sensors and performance tracking features. As wearables and connected fitness gear continue to boom, there’s a clear opportunity to create IoT-enabled paddles that measure swing speed, shot accuracy, paddle angle, and even fatigue levels. These smart paddles can pair with mobile apps to deliver personalized training feedback, game analytics, and coaching tips, transforming the way both recreational and competitive players improve their game. Beyond performance, such data can provide valuable user insights to brands, fueling R&D and targeted marketing.

U.S Pickleball Paddle Market: Trends

Rise of Lifestyle Branding and Cross-Sport Influences

Pickleball is evolving from a backyard sport into a cultural movement, and brands are embracing this by building paddles into lifestyle products. Companies are launching limited-edition designs, collaborating with influencers, artists, and even fashion labels to create paddles that make a visual and personal statement.

There’s growing crossover appeal from other sports like tennis and skateboarding, with hybrid design elements attracting younger players. These stylized paddles don’t just reflect player performance; they reflect personality, helping brands connect more deeply with the millennial and Gen Z demographic.

Eco-Conscious Paddle Innovation

With sustainability becoming a priority for both consumers and companies, brands are exploring green materials and cleaner manufacturing processes. Paddles made from recycled polymers, eco-friendly cores, and biodegradable grips are emerging as a new product category.

This eco-conscious trend appeals strongly to younger and wellness-oriented audiences, particularly in urban and fitness-focused markets. As the sport grows, brands that lead in responsible design can not only strengthen their image but also tap into sustainability-focused partnerships and certifications, creating long-term brand equity.

U.S Pickleball Paddle Market: Research Scope and Analysis

By Core Material Type Analysis

Polymer Core Materials are expected to solidify their leadership in the U.S pickleball paddle market, commanding a projected 86.5% share of the total core material segment in 2025. Their dominance stems from a winning combination of versatility, durability, and player-friendly performance, making them the preferred choice across both recreational and competitive levels. Polymer cores typically crafted from polypropylene are known for offering a soft, quiet feel, which is crucial in environments with strict noise regulations like gated communities and indoor courts.

More importantly, they provide an excellent balance of control and power, which caters to a wide skill spectrum, from beginners looking for forgiveness to advanced players demanding precision. The popularity of polymer cores is also bolstered by their adaptability; manufacturers can fine-tune paddle thickness and internal structure to suit different playing styles without compromising structural integrity.

Aluminum Core Paddles also continue to hold relevance in specific user segments. These paddles are often appreciated for their lightweight build and heightened responsiveness, which appeals to players who favor quick hand transitions and aggressive net play.

The honeycomb structure of aluminum cores enhances shot feedback and pop, making them suitable for players who rely on fast volleys and touch control. However, their stiffer nature tends to result in less forgiveness and more vibration, making them less ideal for players prone to joint strain or looking for a softer feel.

Additionally, aluminum core paddles are less common in professional and high-level play, as many competitive athletes gravitate toward the nuanced control and quieter play offered by polymer alternatives. Despite these limitations, aluminum cores continue to find a foothold in training scenarios, junior paddles, and budget-friendly options, where responsiveness and cost-effectiveness are prioritized.

By Price Range Analysis

Premium Equipment is projected to dominate the U.S pickleball paddle market in 2025, commanding an estimated 75.8% of the total market share. This segment’s dominance reflects a broader trend in consumer behavior where players, both amateur and professional, are seeking out high-performance paddles with advanced features. Premium paddles, typically priced above USD 120, are crafted using cutting-edge materials like carbon fiber faces, polymer honeycomb cores, thermoformed edges, and vibration-dampening layers.

These enhancements offer not only superior durability and responsiveness but also a refined playing experience that appeals to serious enthusiasts and competitive athletes. The growth of this segment is also driven by the sport’s rising visibility as televised tournaments, pro endorsements, and influencer marketing campaigns push high-end paddle designs into the spotlight. Players now view their equipment as an extension of their skill level and identity, making them more willing to invest in gear that provides a competitive edge.

On the other hand, Standard Equipment, generally priced between USD 40 and USD 100, continues to serve a critical role in market accessibility. These paddles are usually made with composite or fiberglass faces and basic polymer or aluminum cores. While they lack the advanced engineering of premium models, standard paddles offer a balanced performance for casual players and beginners who are just entering the sport.

They provide a functional blend of power and control, sufficient for recreational games, community leagues, and introductory coaching programs. Standard equipment is especially prevalent in bulk purchases by schools, wellness centers, and rental programs, where cost-efficiency is prioritized. Although this segment is less glamorous, it remains essential for expanding pickleball’s grassroots reach.

By Distribution Channel Analysis

Online Retail channels are expected to strengthen their dominance in the U.S pickleball paddle market, capturing an estimated

65.2% of the total market share in 2025. This surge is largely driven by shifting consumer buying behavior, where convenience, variety, and access to user reviews play a pivotal role in purchase decisions. E-commerce platforms like Amazon, DICK’S Sporting Goods online store, and dedicated

pickleball equipment websites have become the preferred destinations for both novice and experienced players.

These platforms offer a broad catalog of products, ranging from entry-level to pro-level paddles, along with detailed specifications, comparison tools, and customer feedback, all of which enhance consumer confidence in making informed choices.

Moreover, online retail facilitates direct-to-consumer (DTC) models, allowing brands like Selkirk, CRBN, and Gearbox to bypass traditional retail markups and offer exclusive product lines, limited editions, and customization options through their official websites. Flash sales, loyalty programs, and subscription-based deals have further incentivized online purchases.

In comparison, Brand Outlets, including physical stores owned and operated by paddle manufacturers or their authorized dealers, hold a more curated and experiential role within the market. While they account for a smaller share, these outlets serve as brand-building hubs, providing players with the opportunity to physically test paddles, receive expert fitting advice, and explore accessories in a hands-on setting.

These stores often act as community anchors, hosting demo days, workshops, and local tournaments, which help foster brand loyalty and grassroots engagement. Brand outlets are particularly important for high-end paddle purchases, where customers seek personalized consultation and immediate product interaction before investing. In some cases, these outlets also offer exclusive product lines or early access to new launches that aren’t immediately available online.

By End-User Analysis

Men are expected to retain a leading position in the U.S pickleball paddle market, capturing approximately 52.7% of the total market share in 2025. This dominance can be attributed to several factors, including higher participation in competitive and league-based play, greater spending per player on equipment upgrades, and stronger engagement with performance-driven paddle features.

Men are more likely to invest in specialized paddles customized to their specific playing style, whether that’s maximizing power, spin, or control, making them a lucrative segment for premium product lines. Their demand also drives innovation in paddle design, such as reinforced core materials, edge guard durability, and ergonomic grip enhancements aimed at intense play.

Moreover, the male segment shows a strong affinity for data and technology in sports gear. Brands that offer smart paddles, performance analytics, or customized builds often find early adopters within this group. Sponsorships, male professional athletes, and influencer-driven branding also continue to elevate product visibility and influence purchase behavior within this demographic.

However, women are playing an influential role in shaping the paddle market, both in terms of volume and purchasing power. While the female segment currently holds a slightly smaller share, their presence in pickleball is growing rapidly, especially within recreational leagues, wellness communities, and family-based participation groups.

Women tend to prioritize paddles that offer a balanced feel, lightweight construction, and wrist-friendly performance features that align well with long rally play and control-based tactics. This has pushed brands to design paddles that are not only performance-optimized but also more aesthetically versatile and ergonomically inclusive. The rise of female-oriented clubs, coaching programs, and tournaments has contributed to stronger brand engagement among women.

The U.S Pickleball Paddle Market Report is segmented based on the following:

By Core Material

- Polymer Core Paddles

- Nomex Core Paddles

- Aluminum Core Paddles

By Price Range

By Distribution Channel

- Online Retail

- Brand Outlets

- Franchised Sports Outlet

By End User

U.S Pickleball Paddle Market: Competitive Landscape

The U.S pickleball paddle market is highly dynamic and moderately fragmented, with a mix of legacy sports brands, specialist paddle manufacturers, and a growing influx of new entrants shaping the competitive terrain. The market thrives on innovation, community-driven branding, and rapidly evolving consumer preferences, creating a space where both established players and emerging brands can compete on differentiated value.

Specialist brands like Selkirk, CRBN, and Paddletek are at the forefront of high-performance paddle development, often setting the standard for product innovation. These companies focus on research-driven designs, including advanced core materials, thermoforming, edge-sealing, and surface technologies that enhance control, spin, and durability. Their direct-to-consumer (DTC) models allow them to engage closely with players, fine-tune offerings based on feedback, and build loyal communities around their products. Selkirk, in particular, has cultivated a strong brand ecosystem through its pro athlete partnerships, tutorial platforms, and limited-edition drops that drive exclusivity.

Some of the prominent players in the U.S Pickleball Paddle market are:

- Selkirk

- Joola

- Paddletek

- Onix

- CRBN

- Gearbox

- Engage

- Franklin

- ProKennex

- Vulcan

- Gamma

- Wilson

- Diadem

- Holbrook

- Babolat

- Six Zero

- ProLite

- Adidas

- Prince

- Head

- Other Key Players

U.S Pickleball Paddle Market: Recent Developments

- March 2024: The merger between the PPA and MLP was finalized, creating a unified professional pickleball entity with significant backing and a shared vision for the sport's growth.

- January 2024: Thirty-5 Capital, LLC, a private equity firm, formed United Pickleball Paddles by acquiring Paddletek and combining it with ProXR Pickleball and Boundless Pickleball, consolidating multiple paddle brands under one umbrella.

- September 2023: Major League Pickleball (MLP) and the Professional Pickleball Association (PPA) Tour announced a merger, backed by a USD 50 million investment from private equity firms and team owners, aiming to unify professional pickleball under a single entity.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 184.4 Mn |

| Forecast Value (2034) |

USD 368.6 Mn |

| CAGR (2024-2034) |

8.0% |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Core Material (Polymer Core Paddles, Nomex Core Paddles, and Aluminum Core Paddles), By Price Range (Standard and Premium), By Distribution Channel (Online Retail, Brand Outlets, and Franchised Sports Outlet), and By End User (Men, Women, and Kids) |

| Regional Coverage |

The U.S. |

| Prominent Players |

Selkirk, Joola, Paddletek, Onix, CRBN, Gearbox, Engage, Franklin, ProKennex, Vulcan, Gamma, Wilson, Diadem, Holbrook, Babolat, Six Zero, ProLite, Adidas, Prince, Head, and Other Key Players. |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

What is the size of the US pickleball paddle market?

▾ The US pickleball paddle market is projected to be valued at USD 184.4 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 368.6 million in 2034 at a CAGR of 9.0%.

Who are the key players in the U.S Pickleball Paddle market?

▾ Some of the major key players in the U.S Pickleball Paddle market are Selkirk, Joola, Paddletek, Onix, CRBN, Gearbox, Engage, Franklin, ProKennex, Vulcan, Gamma, Wilson, Diadem, Holbrook, Babolat, Six Zero, ProLite, Adidas, Prince, Head, and Other Key Players.

What is the growth rate of the U.S Pickleball Paddle market?

▾ The market is growing at a CAGR of 8.0 percent over the forecasted period.