Market Overview

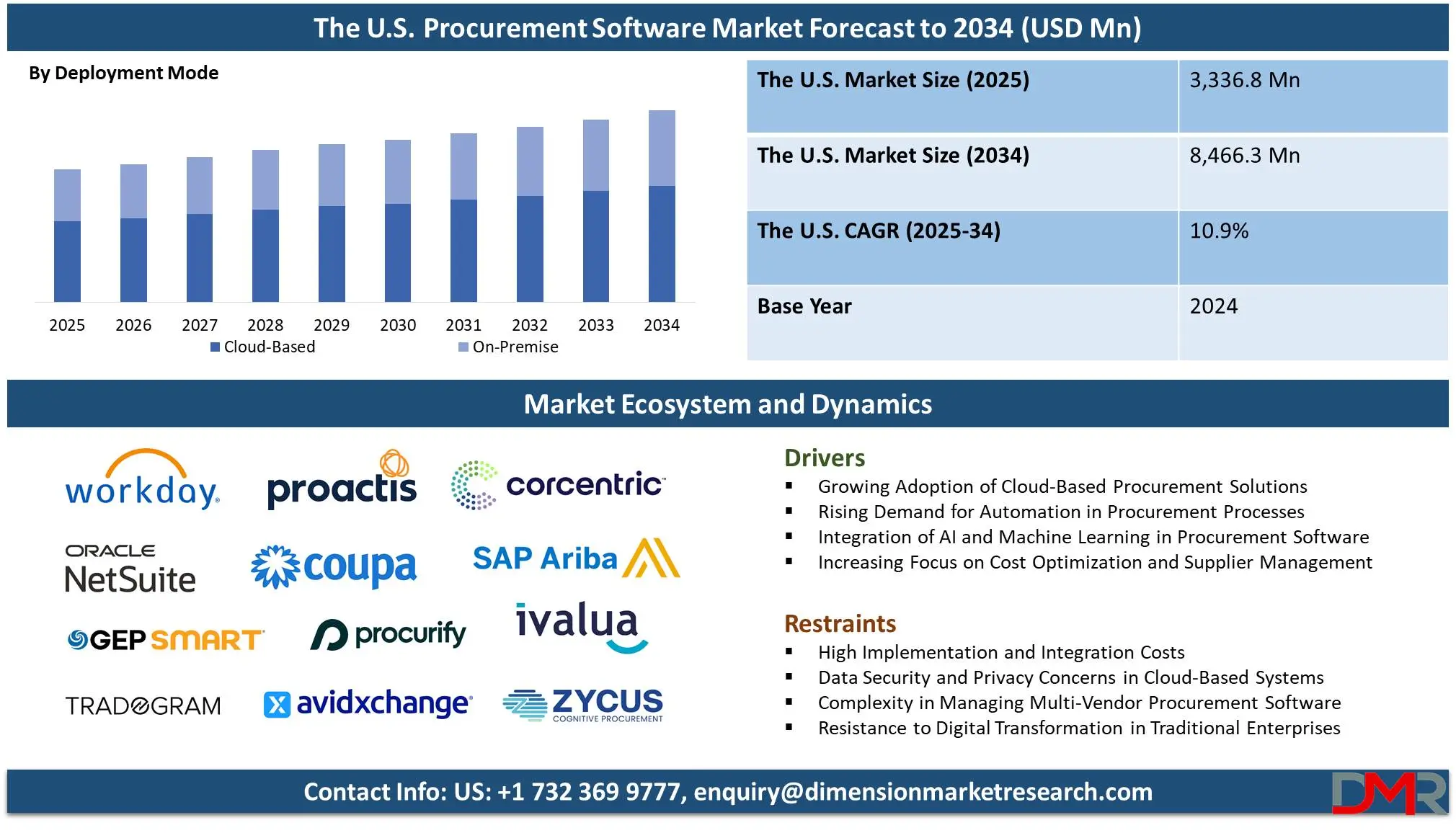

The U.S. Procurement Software Market is predicted to be valued at

USD 3,336.8 million in 2025 and is expected to grow to

USD 8,466.3 million by 2034, registering a compound annual growth rate

(CAGR) of 10.9% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. procurement software market is experiencing rapid expansion due to digital transformation efforts across industries. Businesses are turning to advanced procurement solutions to optimize supplier relationships, enhance spending visibility, and automate purchasing processes. Cloud deployment solutions have gained popularity due to their scalability, cost effectiveness and integration capability with enterprise resource planning (ERP) systems, while artificial intelligence and machine learning are revolutionizing procurement with predictive analytics for real-time decision-making capabilities and real-time decision support features. As organizations strive for operational efficiencies this demand for software that automates procurement workflows while minimizing manual intervention continues to rise.

Procurement software vendors stand to benefit from an expanding e-commerce sector and increasing global supply chains, with data-driven procurement strategies helping organizations maximize cost savings, supplier negotiations, and risk mitigation. Furthermore, sustainable procurement practices are driving demand for solutions that facilitate supplier compliance and ethical sourcing practices, and government initiatives to digitize procurement provide additional growth. Embarking on blockchain technology may provide further transparency, security, and traceability within supplier transactions.

Even as its market offers growth potential, procurement platforms face several hurdles and limitations, like high initial implementation costs and complicated integration into legacy systems. Security concerns over handling financial and supplier information by procurement platforms also create difficulties, resistance from traditional enterprises reluctant to transition away from manual processes also delays adoption, and prevents investments into software solutions. Economic uncertainties or supply chain disruptions also impose restrictions that limit budget allocation for purchasing solutions such as these.

U.S. Procurement Software Market: Key Takeaways

- The US Market Size Insights: The U.S. Procurement Software Market size is estimated to have a value of USD 3,336.8 million in 2025 and is expected to reach USD 8,466.3 million by the end of 2034.

- By Software Type Segment Analysis: Procure-to-Pay (P2P) software is anticipated to command the U.S. procurement software market as it hold 24.1% of the market share in 2025.

- By Deployment Segment Analysis: Cloud-based procurement software is projected to lead the U.S. market procurement software market in this segment with 63.1% of total revenue by 2025.

- By Organization Size Segment Analysis: Large enterprises are projected to lead the U.S. procurement software market sector with highest market share by the end of 2025.

- By End-User Industry Segment Analysis: Manufacturing is poised to lead the end user segment in this market with highest market share in 2025.

- Key Players Insights: Some of the major key players in the U.S. Procurement Software Market are Coupa Software, SAP Ariba, GEP SMART, JAGGAER, Procurify, Precoro, Ivalua, Tradogram, Pipefy, Proactis, Zycus, AvidXchange, and many others

- The US Market Growth Rate: The market is growing at a CAGR of 10.9 percent over the forecasted period of 2025.

U.S. Procurement Software Market: Use Cases

- Automated Purchase Order Management: Businesses use procurement software to automate purchase order creation, approval workflows, vendor communications, and order processing - eliminating manual errors while complying with procurement policies faster, while improving efficiency with improved supplier relationships and decreased procurement cycle times for greater organizational benefit.

- Supplier Performance & Risk Management: Enterprises use procurement software to monitor supplier performance with key performance indicators (KPIs) and compliance tracking capabilities. AI-powered analytics help enterprises assess risks related to supplier reliability, financial stability, and adherence to sustainability standards, helping make informed supplier decisions while mitigating disruptions that might otherwise arise from supplier performance gaps.

- Spend Analysis & Cost Optimization: Procurement platforms enable organizations to analyze spending patterns across departments, pinpoint cost-cutting opportunities and to minimize high spending. Real-time dashboards and predictive analytics provide enhanced budget control, contract negotiations and strategic sourcing initiatives; leading to greater financial efficiency and stronger procurement strategies.

- Contract Lifecycle Management: Companies use procurement software to automate contract creation, storage and renewal tracking. AI-powered insights identify contract risks and suggest renegotiation opportunities as well as ensure regulatory compliance to reduce legal risk, enhance supplier collaboration and avoid missed renewal deadlines leading to cost savings.

- E-Procurement & Supplier Collaboration: Organizations utilize electronic procurement software to streamline supplier interactions from sourcing to invoicing. Digital procurement portals increase transparency, enable real-time bidding and enable seamless communication between buyers and suppliers - which all serve to accelerate procurement cycles, minimize paperwork requirements and comply with procurement regulations more easily than before.

U.S. Procurement Software Market: Stats & Facts

- According to The Hackett Group, 75% of companies have a data analytics and reporting improvement initiative for 2024, emphasizing the role of analytics in procurement performance enhancement through better insights, cost efficiency, supplier management, and operational transparency.

- Research by MHI & Deloitte reveals that 55% of companies increased supply chain investments in 2024, with 88% planning to invest over $1 million and 42% exceeding $10 million, reflecting a strong commitment to procurement technology, logistics efficiency, and supplier relationship improvements.

- A report from Amazon Business states that 85% of companies struggle with procurement sustainability goals due to challenges in sourcing eco-friendly suppliers, emphasizing the need for better visibility, supplier collaboration, and technology-driven solutions to meet corporate sustainability and environmental responsibility objectives.

- A PWC survey finds that 57% of companies report improved decision-making from AI, automation, and analytics-based risk management technologies, helping procurement teams enhance supply chain resilience, mitigate disruptions, optimize cost efficiency, and strengthen compliance with regulatory frameworks and corporate governance policies.

- According to Amazon Business, 98% of decision-makers plan to invest in AI, automation, and insights tools to improve procurement efficiency, enhance cost savings, streamline supplier negotiations, optimize contract management, and boost overall supply chain performance through data-driven strategies.

- MHI & Deloitte research indicates that 53% of supply chain leaders cite inflation-driven price increases as a key challenge impacting procurement, forcing companies to adopt cost-containment strategies, supplier diversification, digital procurement tools, and risk mitigation tactics to manage market volatility.

- A BCG study highlights that 65% of executives prioritize supply chain and manufacturing cost management in 2024, aiming to enhance financial resilience through supplier negotiations, process optimization, AI-driven procurement strategies, and cost-reduction initiatives to counter market uncertainties and inflationary pressures.

U.S. Procurement Software Market: Market Dynamics

Drivers in the US Procurement Software Market

Growing Demand for Automation of Procurement and Cost-CuttingAs companies seek to reduce procurement costs, simplify processes, and improve supplier relationships in the United States, the application of procurement software is growing at a phenomenal pace. Manual procurement is labor-intensive, error-prone, and wasteful; therefore, organizations like to invest in automated systems. Automation enhances efficiency by removing redundant steps while maintaining procurement cycle times low and regulatory compliance under control. Automating processes gives companies even more cost-saving opportunities, which translates to more demand across industries for advanced procurement solutions with an automated workflow.

Development of E-Commerce and Digital Supply Chains

With more e-commerce and sophisticated digital supply chains, procurement software applications have been in high demand over the past few years. Global retailing or trading companies need procurement platforms that have real-time collaboration with suppliers, automated order processing, and supply chain visibility. Procurement software analytics powered by Artificial Intelligence provides visibility into supplier performance, order fulfillment effectiveness, and inventory management. Companies moving towards omnichannel strategies and just-in-time procurement models are highly dependent on digital procurement solutions to handle sourcing, price negotiations, and vendor relationships. Digital commerce has facilitated fast adoption across several industries of procurement software solutions.

Restrictions in the US Procurement Software Market

High Implementation Costs and Integration Issues

While software purchasing brings many benefits, initial implementation costs and integration issues with existing enterprise systems are normally barriers to adoption. Large companies will have multiple legacy systems that are heavy in customization and data migration to accommodate new procurement platforms, whereas SMEs will have cost limitations that deter the investment in advanced procurement solutions. Procurement software integration with ERP, SCM, and financial management systems requires a lot of IT resources and expertise, posing barriers that slow the pace of adoption while lowering return on investment (ROI) rates and inhibiting market growth.

Data Security and Compliance Issues

Procurement software systems hold sensitive business information, like supplier agreements, financial transactions, and procurement history, which are prone to cyberattacks. Data breaches, unauthorized access, and system vulnerabilities are security threats that can hamper procurement operations. Organizations in highly regulated sectors, like healthcare, BFSI, and government, have to follow data protection regulations and procurement regulations stringently so as not to incur legal settlements and reputational damage. With time, cybersecurity threats are more sophisticated, and organizations have to implement strict cybersecurity protocols to secure procurement data, an additional cost factor in the implementation of software systems.

Opportunities in the U.S. Procurement Software Market

Blockchain Procurement Adoption for Transparency

Blockchain technology presents a huge growth opportunity for the U.S. procurement software market with enhanced transparency, security, and traceability of procurement transactions. The traditional procurement processes are open to data inaccuracies, tampering, and a lack of insight into suppliers' activities. Blockchain-based procurement platforms provide decentralized and tamper-evident transaction records with secure supplier contracts, purchase orders, and payment transactions that can be traced. Blockchain-based smart contracts provide automated procurement contracts and assist in minimizing disputes, as well as providing buyer-seller trust. As organizations aspire to greater accountability in procurement practices, blockchain-based procurement solution adoption must keep increasing.

Increased Focus on Green Procurement Practices

A growing emphasis on environmental, social, and governance (ESG) compliance is opening up new opportunities for procurement software providers. Companies are setting a priority on green procurement by choosing low-carbon footprint ethical suppliers while adhering to all the regulations in regulatory compliance and meeting all other sustainable procurement principles. Procurement software in conjunction with sustainability analysis allows companies to track supplier sustainability scores, oversee carbon emissions, and adopt specific green procurement processes. Government and regulatory agencies in the US are promoting accountable sourcing practices among companies, and this has opened up greater demand for procurement platforms with ESG monitoring. Providers of sustainable-themed procurement solutions have a high chance of success in a continuously changing market scenario.

Trends in the U.S. Procurement Software Market

Use of Machine Learning and Artificial Intelligence in Procurement Processes

The U.S. procurement software industry is witnessing a huge shift towards artificial intelligence (AI) and machine learning (ML) powered solutions that automate and streamline the procurement process. Artificial Intelligence-based procurement solutions enhance supplier selection, risk assessment, and predictive spend analysis and minimize manual intervention, and improve accuracy. Machine learning algorithms analyze historical buying patterns and market trends to provide data-driven suggestions for supplier negotiations or contract renewals.

AI-powered chatbots have also become an integral part of procurement platforms, supporting procurement teams with real-time queries, purchase approvals, and document processing. These technologies result in improved efficiency, cost savings, and compliance adherence while enhancing compliance adherence simultaneously, making AI and machine learning key elements in modern procurement strategies.

Widening Embracement of Cloud-Based Supply Purchasing Solutions

Cloud-based procurement software has rapidly become popular among U.S. businesses due to its ability to scale, cost savings, and ease of integration with enterprise resource planning (ERP) software and financial management software. Cloud-based procurement platforms differ from others in that they provide instant access to procurement data from anywhere, and remote procurement management is enabled.

Cloud solutions have been driven by a requirement for greater collaboration among procurement teams, suppliers, and the finance department, with seamless communication and data sharing being of prime importance. As businesses concentrate on digital transformation, cloud procurement platforms offer automatic updates, enhanced security features, and AI-powered insights that enable organizations to optimize procurement spending.

U.S. Procurement Software Market: Research Scope and Analysis

By Software Type Analysis

Procure-to-Pay (P2P) software is projected to dominates the U.S. procurement software market as it command over 24.1% of the total revenue in 2025. U.S. procurement software markets choose Procure-to-Pay (P2P) software because it unites and simplifies procurement operational processes starting from requirements requests through to billing and payment conclusion. Organizations select P2P solutions because these systems enable complete purchasing process automation and better control of spending data and strengthened supplier partnership activities. The software cuts down human handling through automatic procurement workflow processes including approval systems and generation of purchase orders and payment verification operations which leads to both faster transactions and decreased manual error rates.

Practical implementations of P2P software quickly gained popularity because it effectively achieves implementation objectives along with managing risks. The P2P solution implements essential procurement methodologies which remove shadow spending while upholding regulatory compliance regulations so organizations from BFSI and healthcare sectors as well as the government sector mandate its usage. Live analysis systems together with reporting features help organizations to assess procurement efficiency and maximize supplier interactions for cost reduction objectives.

Market leadership of P2P systems increased due to growing industry demand for cloud-based solutions as well as AI-driven platforms. Companies use artificial intelligence-powered P2P solutions to identify future spending patterns while simultaneously detecting frauds and automating contract management processes. Companies rapidly implement P2P systems through their digital transformation programs so P2P has become more appealing than self-contained procurement tools.

By Deployment Analysis

Cloud-based procurement software controls the entire U.S. market because it offers flexibility and cost-effectively scalable benefits which surpass those of on-premise solutions. Cloud platforms save businesses money on infrastructure costs so small enterprises together with large organizations can start using procurement solutions at affordable operational expenses. Subscription-based models expand cloud procurement software accessibility to enable both small and medium enterprises (SMEs) as well as large corporations to adopt it.

The leading position of the cloud industry stems from its capability to provide immediate access to its resources. Cloud procurement solutions enable workers to access the system remotely as they link their procurement teams across different locations. Global enterprises with decentralized procurement operations benefit the most from cloud platforms which ensure smooth connection with their existing ERP and SCM systems.

The implementation of security measures alongside compliance specifications drives organizations to adopt cloud services. Cloud procurement platforms provide businesses with enhanced security through their advanced cybersecurity functions and data security protocols that ensure compliance standards as well as protection from unauthorized access. Business performance improves through automatic software updating capabilities combined with AI-driven analytics which helps organizations optimize their purchasing approaches while minimizing operational dangers.

By Organization Size Analysis

Large enterprises are projected to lead the U.S. procurement software market sector because they perform extensive procurements while having sophisticated supply chains and extended funding for digital transformation programs. The large purchasing operations handled by these organizations require sophisticated procurement solutions for supplier relationship management and compliance implementation and procurement efficiency optimization.

The primary reason why large companies hold control over the marketplace is their requirement to automate their procurement operations at substantial scale. Large-scale entities need procurement software solutions that link directly to ERP and financial and supply chain management systems to fully automate their purchasing activities. These companies benefit from procurement software to enforce their compliance standards through which they reduce their procurement risks and improve their negotiation ability with suppliers to achieve better cost efficiencies.

Large enterprises deploy artificial intelligence systems for procurement analytics which provide instant observations of spending activities and both supplier achievements with contract management functions. Real-time analysis of procurement data allows organizations to make fact-based decisions thus cutting procurement expenses while improving business operations. Large enterprises can achieve better procurement standardization by implementing cloud-based procurement platforms that unite their distributed teams into a centralized procurement process.

By End-User Industry Analysis

Manufacturing is anticipated to lead the end user segment as the top market sector for procurement software in the United States because it needs standardized procurement management, supplier supervision and stock optimization systems. Production-based companies depend on procurement software to achieve efficient material acquisition while minimizing delay times in their manufacturing operations.

The main factor behind its market dominance results from visibility into spending control and reduced costs. Manufacturers can manage their purchasing expenses through procurement software while executing better supplier negotiations and source raw materials according to their demand predictions. The automated processes of procurement workflows hasten supply chain activities thus maintaining constant production operations without breakage.

Supplier risk management serves as one main motivating factor. The extensive supplier and vendor network of manufacturing companies requires tracking supplier performance and compliance while monitoring supply chain risks. Real-time supplier evaluations through procurement software enable manufacturing companies to work only with dependable vendors who offer cost-efficient solutions. Through AI analytics manufacturers can reduce supply chain breakdowns by finding substitute providers and optimizing their procurement procedures.

The adoption of Industry 4.0 technologies combined with smart manufacturing solutions causes manufacturing companies to combine procurement software platforms with Internet of Things supply chain systems to achieve efficiency while minimizing operational costs. Manufacturing maintains its leading position in the procurement software industry because of advancing technological developments.

The U.S. Procurement Software Market Report is segmented on the basis of the following

By Software Type

- Procure-to-Pay (P2P) Software

- Spend Analysis Software

- E-Sourcing Software

- E-Procurement Software

- Supplier Management Software

- Strategic Sourcing Software

- Other Software Type

By Deployment

By Organization Size

- Large Enterprise

- Small and Medium Enterprise

By End-User Industry

- Manufacturing

- Retail & E-commerce

- BFSI (Banking, Financial Services & Insurance)

- Healthcare & Pharmaceuticals

- IT & Telecom

- Government & Defense

- Other End Users

U.S. Procurement Software Market: Competitive Landscape

AI-driven automation remains the primary competitive focus among key U.S. procurement software companies which also develop cloud-based products and enhance supplier management capabilities. The market leadership belongs to Coupa Software along with SAP Ariba and Ivalua and JAGGAER because they provide extensive procurement platforms which merge well with enterprise resource planning (ERP) systems. These software systems from Oracle along with Workday make use of AI technologies including machine learning to maximize their spend analysis and contract management processes.

Procurify together with Precoro and Tradogram have entered the market to provide flexible procurement software solutions which specifically serve small to mid-size businesses. The industry demonstrates notable growth because companies forge strategic partnerships while making cloud migrations and conducting acquisitions. Smart contracts built on blockchain and AI analytics for analysis shape the competitors' changing dynamic in the procurement market.

The sector remains consolidated through recent examples of Coupa's acquisition of LLamasoft along with SAP Ariba's ongoing development of AI capabilities. Market stakeholders are concentrating on developing customized solutions for specific verticals which include manufacturing and healthcare and BFSI. Businesses that seek to buy procurement solutions at lower costs and higher scalability are increasingly adopting vendor-managed procurement and supplier collaboration platforms.

Some of the prominent players in the U.S. Procurement Software Market are

- Coupa Software

- SAP Ariba

- GEP SMART

- JAGGAER

- Procurify

- Precoro

- Ivalua

- Tradogram

- Pipefy

- Proactis

- Zycus

- AvidXchange

- Tradeshift

- Basware

- Corcentric

- Kissflow Procurement Cloud

- Oracle Procurement Cloud

- NetSuite Procurement

- Proactis

- Workday Procurement

- Other Key Players

Recent Developments in the U.S. Procurement Software Market

March 2025

- Coupa Software announced AI-driven supplier risk management enhancements, integrating machine learning algorithms to predict supplier performance, detect fraud risks, and ensure regulatory compliance. The upgraded system enhances spend visibility and mitigates financial exposure for enterprises.

- SAP Ariba partnered with a leading U.S. defense contractor to deploy cloud-based procurement automation, streamlining contract management and supplier negotiations. The partnership focuses on increasing efficiency and compliance with federal procurement standards.

February 2025

- Workday Procurement integrated generative AI into its spend analysis tool, improving real-time data insights and cost-saving recommendations. This AI enhancement helps enterprises optimize vendor selection and procurement planning through predictive analytics.

- JAGGAER unveiled a blockchain-enabled smart contract module, ensuring automated, transparent, and secure supplier verification and payment processing. This innovation enhances trust and efficiency in supplier relationships, reducing manual intervention and contract disputes.

January 2025

- Oracle Procurement Cloud expanded its AI-powered contract management capabilities, enabling enterprises to conduct real-time risk assessments, automate contract negotiations, and ensure compliance with dynamic regulatory frameworks. The update is designed to enhance procurement efficiency across industries.

- Precoro secured $20 million in Series B funding to accelerate the development and expansion of its cloud-based procurement platform, with a focus on small and medium-sized enterprises (SMEs). The funding will be used to enhance AI-driven analytics, automation, and global market expansion.

December 2024

- Ivalua launched a new supplier collaboration platform, integrating predictive analytics for spend optimization and risk mitigation. This solution facilitates seamless supplier communication, performance tracking, and strategic sourcing decisions for enterprises.

- Basware acquired a U.S.-based e-procurement startup, strengthening its position in the North American market. The acquisition enhances Basware’s capabilities in automated invoice processing, supplier collaboration, and procurement workflow optimization.

November 2024

- Tradeshift hosted the U.S. Procurement Summit 2024, a major industry event focused on advancements in AI-driven procurement, automation, and supplier diversity. The event attracted leading procurement professionals, discussing innovations and strategies to enhance digital procurement transformation.

- Zycus expanded its AI-driven procurement suite, introducing enhanced sourcing automation, compliance tracking, and supplier risk assessment tools. These improvements help enterprises reduce procurement cycle times and improve cost efficiency.

October 2024

- GEP SMART partnered with a Fortune 500 manufacturer to implement an AI-driven procurement system that reduces operational costs, enhances supplier visibility, and optimizes sourcing strategies. The system integrates AI-powered analytics for real-time procurement decision-making.

- Kissflow Procurement Cloud launched an updated vendor management module, streamlining supplier onboarding, performance tracking, and contract compliance. This update aims to improve transparency, reduce administrative overhead, and enhance supplier collaboration.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3,336.8 Mn |

| Forecast Value (2034) |

USD 8,466.3 Mn |

| CAGR (2024-2034) |

10.9% |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Software Type (Procure-to-Pay (P2P) Software, Spend Analysis Software, E-Sourcing Software, E-Procurement Software, Supplier Management Software, Strategic Sourcing Software, Other Software Type), By Deployment (Cloud-Based, On-Premise), By Organization Size (Large Enterprise, Small and Medium Enterprise), By End-User Industry (Manufacturing, Retail & E-commerce, BFSI (Banking, Financial Services & Insurance), Healthcare & Pharmaceuticals, IT & Telecom, Government & Defense, Other End Users) |

| Regional Coverage |

The U.S. |

| Prominent Players |

Coupa Software, SAP Ariba, GEP SMART, JAGGAER, Procurify, Precoro, Ivalua, Tradogram, Pipefy, Proactis, Zycus, AvidXchange, Tradeshift, Basware, Corcentric, Kissflow Procurement Cloud, Oracle Procurement Cloud, NetSuite Procurement, Proactis, Workday Procurement, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the U.S. Procurement Software Market?

▾ The U.S. Procurement Software Market size is estimated to have a value of USD 3,336.8 million in 2025 and is expected to reach USD 8,466.3 million by the end of 2034.

Who are the key players in the U.S. Procurement Software Market?

▾ Some of the major key players in the U.S. Procurement Software Market are Coupa Software, SAP Ariba, GEP SMART, JAGGAER, Procurify, Precoro, Ivalua, Tradogram, Pipefy, Proactis, Zycus, AvidXchange, and many others.

What is the growth rate in the U.S. Procurement Software Market in 2025?

▾ The market is growing at a CAGR of 10.9 percent over the forecasted period of 2025.