As a result, manufacturers are increasingly adopting transparent delivery chains and obtaining certifications to appeal to discerning customers. Technological advancements in ingredient sourcing, formulation strategies, and packaging innovations, including those from the Halal Packaging Market which also emphasizes purity and ethical sourcing, also make a contribution to market growth, permitting brands to provide a much wider variety of vegan cosmetics with high quality and functionality.

Moreover, shifting client demographics, together with the rising recognition of veganism amongst younger generations and the growing disposable income in rising markets, continue to drive expansion opportunities for the global vegan cosmetics market. Overall, the marketplace remains dynamic, pushed with the aid of a convergence of client values, regulatory pressures, and technological advancements.

Research Scope and Analysis

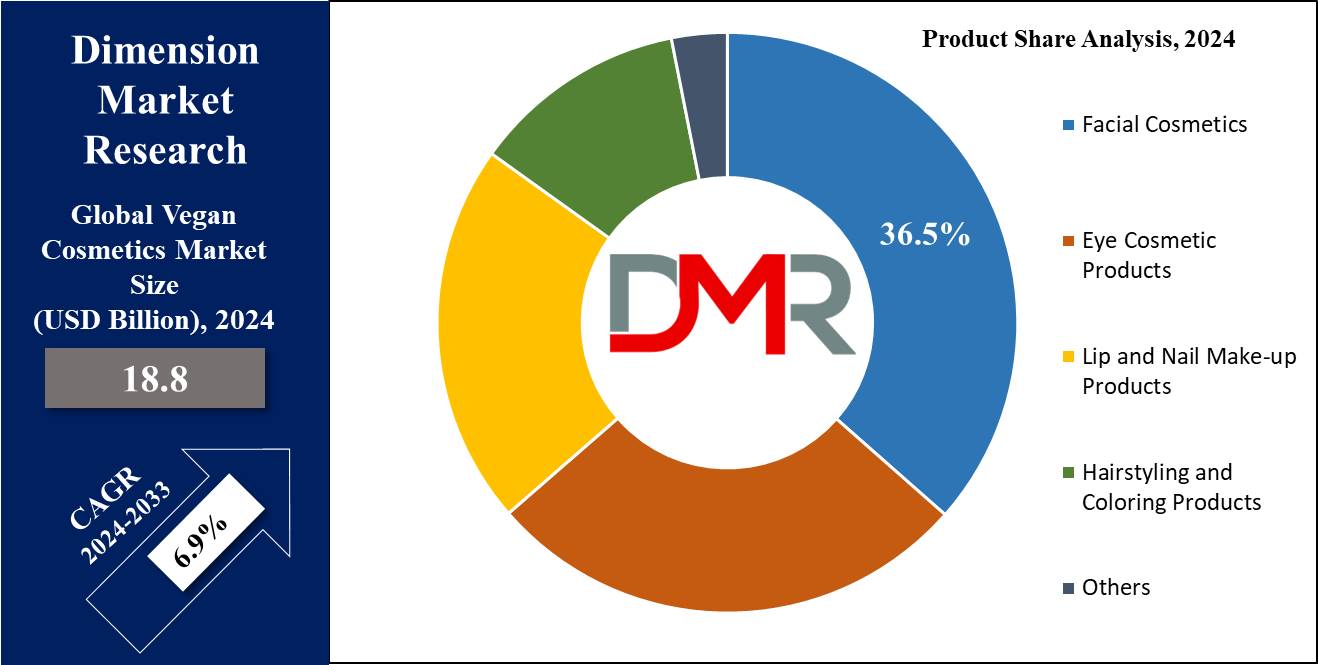

By Product

Facial cosmetics are projected to exert its dominance in the product segment in the global vegan cosmetics market in 36.5% of the market share in 2024. Facial cosmetics dominate the vegan cosmetics segment due to their essential role in daily beauty routine and their capability to fill a wide range of customer needs and alternatives. Facial cosmetics encompass a numerous array of products, including foundations, concealers, blushes, powders, and skincare objects which include cleansers, moisturizers, and serums, with innovation often supported by adjacent fields like the Skincare Devices Market and Cosmetic Laser Market for enhanced product efficacy and application.

One key factor contributing to the dominance of facial cosmetics is the emphasis on skincare and complexion enhancement. Consumers prioritize facial skincare because it forms the foundation for a wonderful makeup application, regularly in search of vegan options to align with their ethical and sustainability values. Vegan facial cosmetics offer formulations free from animal-derived substances and vicious chemical compounds, attractive to health-aware consumers with sensitive skin or allergic reactions.

Additionally, facial cosmetics cater to diverse skin issues and pores and skin sorts, which include anti-aging, hydration, acne-susceptible, and sensitive skin, providing purchasers with tailored solutions to their skin problems. The versatility of facial cosmetics lets individuals personalize their makeup looks to suit different occasions, from herbal and regular make-up to glamorous and special event looks.

By Price Point

In this segment, economically efficient vegan cosmetic products exert their dominance in 2024. The economic section dominates the vegan cosmetics marketplace due to its accessibility, affordability, and wide attraction to various consumer bases. Economic vegan cosmetics cater to price-conscious consumers in search of cost-efficient options without compromising on nice or ethical requirements.

These products usually provide aggressive pricing compared to top-rate premium counterparts while adhering to cruelty-free and vegan concepts.

One key element driving the dominance of the economic segment is the growing adoption of vegan cosmetics by means of mainstream consumers, together with those with moderate budgets. As veganism has gained momentum as a lifestyle preference, more customers are in search of low-priced alternatives that align with their values of animal welfare and sustainability.

Additionally, economic vegan cosmetics benefit from the expanding distribution channels, which include mass-market retailers, drugstores, and online platforms, making them readily available to a much broader audience. This accessibility in addition contributes to their market dominance, as consumers can easily incorporate vegan beauty products into their shopping routines within their budget. Furthermore, economic vegan cosmetics often offer important beauty products consisting of facial cleansers, moisturizers, and primary make-up gadgets, meeting the everyday needs of clients without extravagant price tags.

By Gender

Women are anticipated to dominate the global vegan cosmetic market with 79.2% of the market share in 2024. Women dominate the vegan cosmetics market based on gender due to numerous elements, which include ancient beauty norms, societal expectancies, and the wider representation of ladies within the beauty industry. Traditionally, women have been the primary target demographic for cosmetics, skincare, and personal care products, resulting in a more extensive range of services tailored to their needs and preferences.

Moreover, women are frequently greater engaged with beauty and self-care routines, mainly due to a better intake of cosmetics compared to men and children. This heightened interest in beauty products translates into a greater demand for vegan cosmetics among women, particularly as ethical and sustainable beauty practices gain traction.

Additionally, the beauty industry has traditionally targeted its advertising efforts on women, by promising beauty standards and developments that strengthen the significance of cosmetics in enhancing femininity and self-expression. As an end result, women are much more likely to search for vegan cosmetics that align with their values of cruelty-free and ethical beauty, further solidifying their dominance within this segment.

By Distribution Channel

The specialty store is projected to dominate the distribution channel segment with 39.0% of the market share in 2024. Specialty stores dominate the distribution channel for vegan cosmetics because of their ability to provide a curated choice of areas of interest and specialized products that cater specially to the various wishes of the consumers and alternatives of purchasers seeking cruelty-free and vegan beauty alternatives. These shops regularly recognition on presenting a diverse range of moral and sustainable beauty manufacturers, along with those that exclusively produce vegan cosmetics.

One key benefit of specialty stores is their expertise and knowledge in vegan beauty products, permitting them to tell consumers about material sourcing, production methods, and ethical certifications. This customized technique helps construct trust and loyalty among consumers who prioritize cruelty-free and moral purchasing decisions. Additionally, specialty stores often collaborate with independent and emerging vegan beauty brands, supplying them with a platform to show off their merchandise and attain a focused target audience of ethically-aware consumers.

By End User

Personal or individual users dominate the end-user segment with the highest market share in 2024. Their dominance is mainly due to the substantial adoption of cruelty-loose and moral beauty practices amongst individual consumers. Personal users, including everyday customers, beauty lovers, and people with precise ethical or health-related choices, drive the demand for vegan cosmetics for his or her private use.

Another factor contributing to the dominance of the personal segment is the increasing client focus approximately animal welfare, environmental sustainability, and the capability fitness advantages of using vegan beauty products. As individuals have grown to be more aware of the ingredients in their cosmetics and their impact on animals and the planet, they actively seek out cruelty-free and vegan options for their beauty routines.

Furthermore, private customers regularly prioritize the fine, efficacy, and suitability of cosmetics for their wishes and choices. Vegan cosmetics, which are formulated without animal-derived ingredients and are regularly unfastened from harsh chemical substances, attract purchasers seeking safe, gentle, and environmentally friendly beauty solutions for their skincare, makeup, and hair care needs.

The Vegan Cosmetics Market Report is segmented on the basis of the following

By Product

- Facial Cosmetics

- Eye Cosmetic Products

- Lip and Nail Make-up Products

- Hairstyling and Coloring Products

- Others

By Price Point

By Gender

By Distribution Channel

- Specialty Stores

- Hypermarkets and Supermarkets

- Online Channels

- Others

By End User

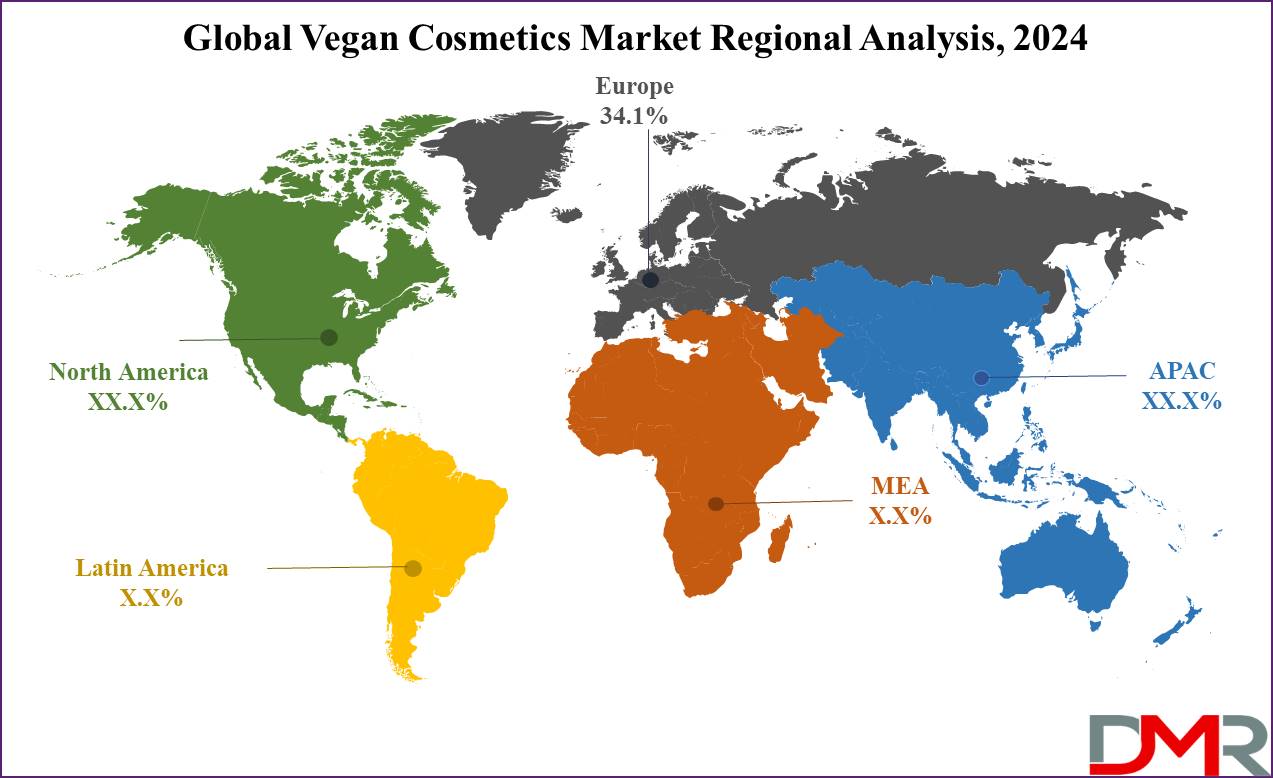

Regional Analysis

Europe is projected to dominate the global vegan cosmetics market with the highest market

share 34.1% in 2024. Europe secured its top position in the vegan cosmetics market as a result of several factors that combined to shape perfect conditions for ethical and sustainable beauty practices to thrive. In this regard, Europe has a deep-rooted culture of caring for the well-being of animals and the environment, which is shown by the existence of a wide range of guidelines and standards aimed at keeping the best interests of animals and humans in mind.

These regulations have been a catalyst for consumers’ understanding and demand for cruelty-free and vegan products at a higher stage of consciousness. Moreover, European consumers are very often more conscious of the products they buy, choosing those that meet their moral values and lifestyle preferences. It has caused an important market for vegan cosmetics, the range of brands and products is now very wide and aims to all customers’ needs. Additionally, Europe boasts a properly organized and advanced infrastructure for retail distribution, consisting of specialty stores, and online channels, which similarly helps the accessibility and availability of vegan cosmetics to consumers throughout the region.

Regions such as North America and Asia Pacific are main the vegan cosmetics marketplace, propelled by a rising wide variety of vegan consumers and strong advocacy for animal rights. However, rising markets in this region are pushed by means of growing disposable earnings and changing consumer lifestyles.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of vegan cosmetics is defined by an assortment of additional market participants, both old and new, with all of them competing with each other for a market share in a region that is characterized by high competition and periodic innovations in this market. For instance, many multinationals such as L'Oréal, The Body Shop (a company under Natura & Co), and Estee Lauder have expanded and included vegan beauty products among their collections. They are heavily marketing these products on their famous brands, distribution networks, and research expertise to win the hearts of cruelty-free consumers.

But at the same time, artisan brands for example ILIA Beauty, Milk Makeup, and Kat Von D Beauty (now KVD Vegan Beauty) are emerging and gaining popularity with the new generation as well due to their non-toxic formulations, outstanding and aggressive marketing strategies and true stories of the brands that keep the ethical and conscious consumers fascinated. Lastly, the brand landscape is in constant fluctuation due to the increasing popularity of the DTC brands that build close and personal relationships with the consumer directly through the web and social media without the need for the traditional distribution channels.

In addition, these DTC brands, like Glossier, Fenty Beauty, and Kylie Cosmetics, are characterized by disruptive business models, personalized shopping experiences, and a statement of inclusivity, which pushes the animal-free cosmetics market vendors to change the market dynamic.

Some of the prominent players in the global Vegan Cosmetics market are

- Amway Corporation

- Estee Lauder Companies Inc.

- Groupe Rocher

- L’Occitane Group

- L’Oreal S.A.

- LVMH Group, and MuLondon

- Pacifica Beauty

- Unilever plc.

- Coty Inc.

- Beauty with Cruelty

- Elf Cosmetic Company

- Urban Decay

- Nature’s Gate

- Other Key Players

Recent Development

- In March 2024, Jland Biotech formed a partnership with Evonik Venture Capital Group with an aim to meet the rising demand for vegan collagen for cosmetic and personal care applications.

- In January 2024, the Vegan Society certified the Body Shop to become the first international brand to have 100% vegan product formulations in all its products from skincare to haircare and body care.

- In February 2023, Unilever Ventures invested USD 2.0 million in a scalp care brand Straand, which is an Australian-made brand that offers products that combat dryness, flaking and thinning of hair.

- In December 2022, Esqa an Indonesian vegan cosmetic brand received an investment from the food and personal healthcare production giant Unilever.

- In November 2022, Singapore's Believe invested USD 10 million in IBA Cosmetics, an Ahmedabad-based Halal-certified and PETA-certified vegan brand, fostering a strategic partnership.