Market Overview

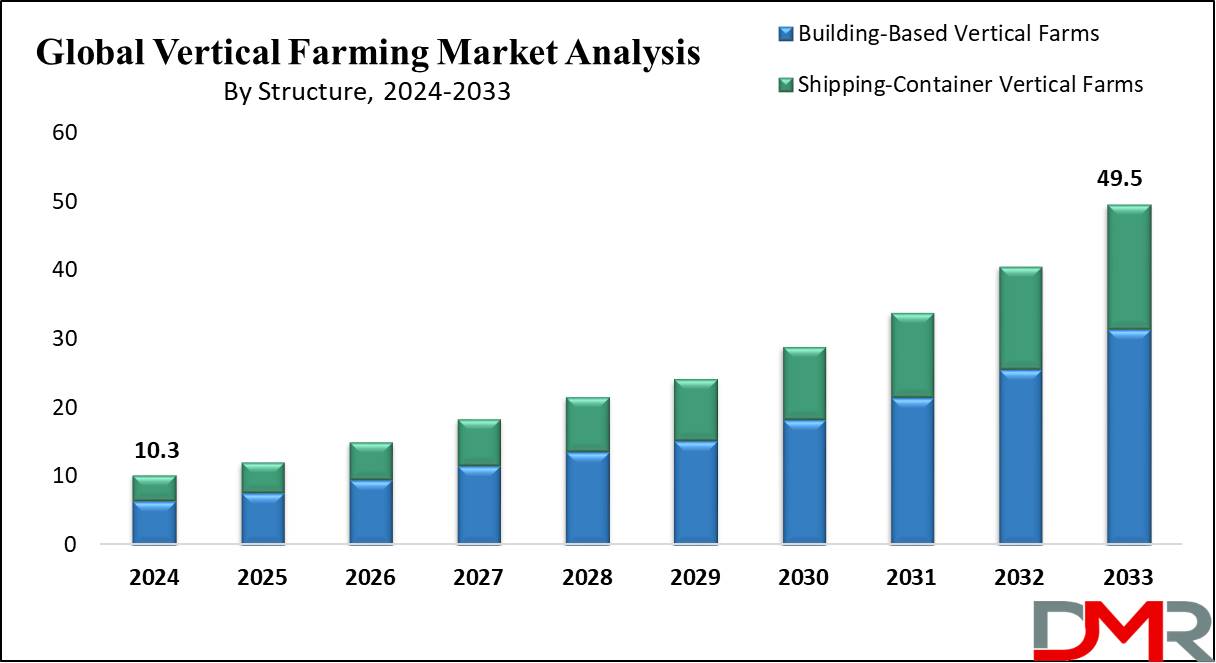

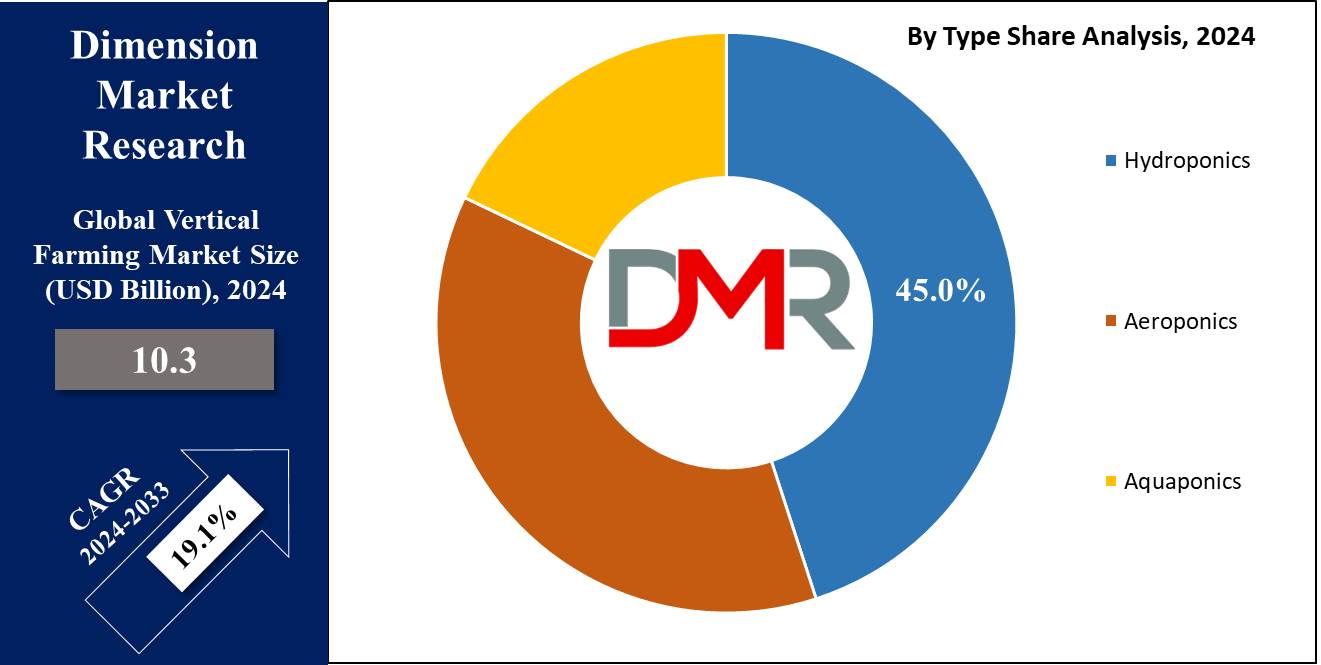

Global Vertical Farming Market size is estimated to reach USD 10.3 Billion in 2024 and is further anticipated to value USD 49.5 Billion by 2033, at a CAGR of 19.1%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Vertical farming refers to cultivators' practice of growing crops vertically instead of using flat surfaces, such as fields or greenhouses, for cultivation. Instead, vertical farmers arrange these layers within vertical structures such as skyscrapers, shipping containers, warehouses or abandoned mines .

Sometimes using hydroponic, aeroponic or aquaponic technologies - often including hydroponic, aeroponic and aquaponic techniques - often hydroponics being the system used here too. Vertical farming's market growth can be linked with increasing urbanization coupled with limited arable land shortage and innovations like light emitting diode (LED).

Farmers using vertical farming can significantly boost crop yield on equal land by optimizing space usage. Unfortunately, its implementation can be more complex due to needing precise control over environmental factors like temperature, humidity and light for plants to flourish successfully.

Many systems including hydroponics, aquaponics and aeroponics are used within vertical farms to maximize harvests while saving resources while improving productivity - these systems enable efficient use of space, conserve resources and increase productivity at vertical farms.

Key Takeaways

- Market Size & Share: Global Vertical Farming Market size is estimated to reach USD 10.3 Billion in 2024 and is further anticipated to value USD 49.5 Billion by 2033, at a CAGR of 19.1%.

- Type Analysis: Hydroponics dominates the vertical farming market in 2023 with approximately 45% market share.

- Structure Analysis: Building-based vertical farms dominate the vertical farming market in 2023, accounting for roughly 60% of market share.

- Component Analysis: Lighting system revenue held approximately 35% market share in 2023.

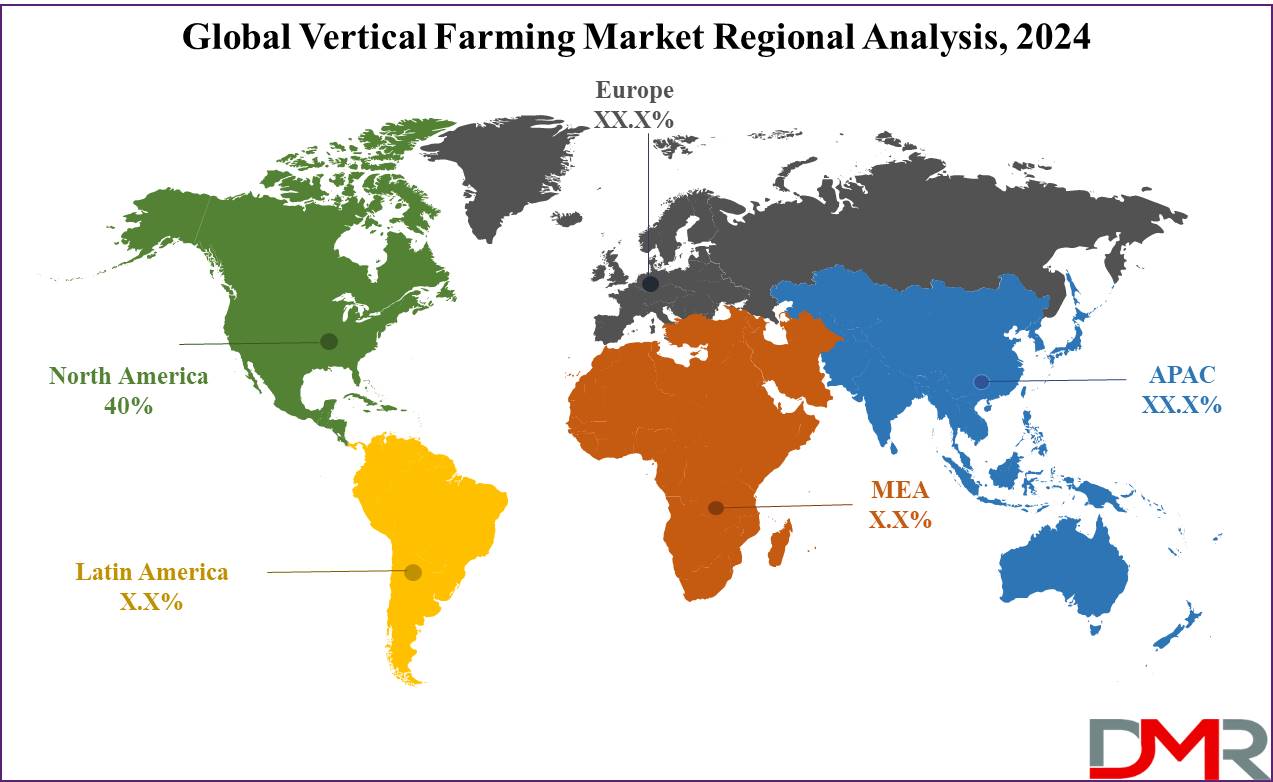

- Regional Analysis: North America dominates the vertical farming market at $32.8 billion in 2023, holding 44%.

- Sustainability Focus: Vertical farming emphasizes eco-friendly methods, conserving resources such as water and energy, which aligns with global sustainability trends.

- Technological Integration: Advanced technologies like LED lighting, automation, and IoT systems are driving efficiency and productivity in vertical farms.

Use Cases

- Urban Agriculture: Vertical farming can be especially effective in densely populated urban areas where land for traditional farming is limited, since cities can use vertical structures to grow fresh produce locally, cutting transportation costs and emissions emissions while simultaneously guaranteeing food security for their population.

- Vertical Farming Systems Enable Year-Round Crop Production: With vertical farming systems, crops can be grown under controlled environments year round regardless of seasonal changes or climate conditions, providing a consistent supply of fresh produce even in regions with harsher weather or limited growing seasons. This ensures fresh produce remains available even in places with harsh weather or limited growing seasons.

- Sustainable Resource Use: Vertical farming reduces water usage compared to traditional farming, especially when using hydroponic or aeroponic systems that recycle water, as well as pesticides and herbicides, making it more sustainable and environmentally-friendly than its traditional counterpart.

- Innovative Business Models: Vertical farming has opened up new business opportunities, such as indoor farming companies that supply fresh produce directly to restaurants, grocery stores and direct-to-consumer markets. These farms can even be set up in underutilized spaces like warehouses for economic advantages in urban settings while contributing to local food systems.

Report Dynamics

Driver: Growing Urbanization and Limited Arable Land

One of the primary factors driving vertical farming market is rapid urbanization combined with limited arable land availability. As cities expand, traditional farms find less room to farm on available space as demand for fresh produce increases.

Vertical farming provides an effective solution by using indoor spaces like buildings or warehouses as growhouses to grow crops in vertically stacked layers - also saving on transportation costs and emissions by being near urban centers; providing sustainable food solutions while simultaneously mitigating environmental impact.

Trend: Innovations in LED and Automation Technologies

LED and automation technologies are shaping the vertical farming market in key ways. LEDs provide energy-efficient lighting essential to plant growth, significantly reducing energy consumption in vertical farms while offering precise control of light spectrum for optimizing photosynthesis and crop yield.

AI/robotics technologies have become an integral component of vertical farms as these innovations streamline processes like planting, watering and harvesting while decreasing labor costs while improving efficiency - further expanding adoption rates of this form of agriculture.

As technology progresses further, vertical farming becomes more cost-effective and scalable leading to wider adoption from both business and individuals alike.

Restrictions: High Initial Capital Investment Restrictions

Vertical farming market growth has been severely limited by its prohibitively expensive initial capital requirements for system setup and ongoing operations costs, such as LED lighting, climate control systems and hydroponic or aeroponic setups.

Furthermore, operational expenses related to energy consumption for lighting and temperature control may become prohibitively expensive for potential investors or small-scale farmers looking into vertical farms - creating financial barriers of entry even as technological innovations reduce initial investments; widespread adoption can still remain restricted even in regions with less access to funding or subsidies.

Opportunity: Exploration into Emerging Markets

Emerging markets represent a tremendous opportunity for vertical farming. As populations expand in developing nations, demand for sustainable food production solutions increases significantly.

Vertical farming offers one viable solution in regions lacking arable land or traditional agriculture due to harsh climates; governments and private investors in such regions are increasingly investing in vertical farming as a means to boost local food production, reduce import dependence, create jobs, save water usage and chemical use efficiency and meet sustainability goals.

Research Scope and Analysis

Type Analysis

Hydroponics dominates the vertical farming market in 2023 with approximately 45% market share due to its simpler setup process, lower costs, and well-proven track record in growing various crops in controlled environments. Hydroponics involves growing plants directly in nutrient-rich water solutions without soil for maximum space efficiency and reduced water usage.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Aeroponics and aquaponics are quickly gaining ground. Aeroponics - in which plant roots are suspended in air and misted with nutrients - offers superior oxygen access and faster growth while being more complex and costly than its alternatives; aquaponics (fish farming combined with hydroponic plant cultivation) offers sustainability, though requires more management expertise; taken together, aeroponics and aquaponics account for much of the remaining market share while hydroponics remains most widely adopted due to its scalability and efficiency.

Structure Analysis

Building-based vertical farms dominate the vertical farming market in 2023, accounting for roughly 60% of market share. Their dominance can be explained by their superior scalability and flexibility when applied to large structures like warehouses, skyscrapers, or repurposed urban buildings as buildings allow more extensive crop production - making building-based farms ideal for large-scale operations or urban agriculture projects that seek to feed growing city populations.

Shipping-container vertical farms have grown increasingly popular as smaller-scale or mobile farming solutions, yet remain only a minority of the market. While shipping container vertical farms are highly portable and suitable for niche applications like urban gardening or remote locations such as research facilities; due to limited space and production capacities they cannot match building-based vertical farms' large scale outputs; building-based systems remain the superior choice when it comes to high volume food production.

Component Analysis

Vertical farming market components include lighting systems, irrigation and fertigation systems, climate control, sensors and others (HVAC systems, shelves and racks). Lighting system revenue held approximately 35% market share in 2023 due to artificial lighting's role in supporting year-round crop growth by providing the optimal light spectrum for photosynthesis; its efficiency in terms of energy savings made LED systems essential in vertical farms.

Irrigation and fertigation systems follow closely behind, providing precise water and nutrient delivery that is necessary for hydroponic, aeroponic, and aquaponic setups. Climate control systems regulating temperature, humidity, CO2, are also key but hold less of the market share. Sensors as well as components such as HVAC systems and shelving are crucial in optimizing farm operations while lighting systems continue to lead the market with their direct impact on plant growth as well as energy efficiency.

The Global Vertical Farming Market Report is segmented based on the following

By Type

- Hydroponics

- Aeroponics

- Aquaponics

By Structure

- Building-Based Vertical Farms

- Shipping-Container Vertical Farms

By Component

- Lighting System

- Irrigation and Fertigation System

- Climate Control

- Sensors

- Others (HVAC systems, Shelves and Racks, etc.)

Regional Analysis

North America dominates the vertical farming market at $32.8 billion in 2023, holding 44%. This success can be attributed to rapid technological advances, robust investments in urban agriculture, and major market players in North America such as United States. These innovations drive sustainable farming solutions while simultaneously meeting increasing consumer demands for locally grown produce.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe follows closely behind due to government initiatives promoting sustainability agriculture; while Asia-Pacific is emerging - particularly densely populated countries such as Japan and Singapore where space limitations drive adoption of vertical farming solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Vertical farming market is highly competitive, with key players leading innovation through advanced technologies and sustainable farming practices. Leading companies focus on integrating cutting-edge solutions like LED lighting, automation and IoT-based monitoring systems into their operations to increase crop yield and resource efficiency.

These companies are expanding globally, investing in urban agriculture initiatives, and forging strategic alliances to solidify their market presence. Environmentally conscious businesses are taking steps to make vertical farming more accessible worldwide by adopting eco-friendly approaches, including cutting water usage and mitigating environmental impact.

Their efforts at scaling production while cutting operational costs have made vertical farming more readily accessible than ever.

Some of the prominent players in the global vertical farming market are

- AeroFarms (U.S.)

- Illumitex, Inc. (U.S.)

- American Hydroponics (U.S.)

- Agrilution GmbH

- Brightfarms Inc.

- Everlight Electronics Co., Ltd.

- Freight Farms

- GrowUp Urban Farms Ltd.

- Green Sense Farms, LLC

- Vertical Farm Systems.

Recent Development

- Technological Advancements: Vertical farming companies have increasingly implemented AI-powered automation, robotics, and IoT-based systems into their operations to maximize planting, irrigation, harvesting efficiency while decreasing labor costs and errors. These advances improve planting, irrigation and harvesting efficiency while simultaneously decreasing labor costs and errors.

- LED Lighting Innovations: New energy-efficient LED systems are being created that provide more precise light spectra to promote plant growth and decrease electricity usage, leading to greater sustainability in vertical farming operations.

- Sustainable Agriculture Methods: With an increased focus on resource-efficient farming techniques - especially water and energy conservation, vertical farms are employing closed-loop systems to recycle water and limit chemical usage.

- Expansion and Investments: Companies are expanding operations worldwide, particularly in North America, Europe and Asia-Pacific urban centers. Increased investments from both private investors and governments are driving market expansion with food security and local production as key goals.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 10.3 Bn |

| Forecast Value (2033) |

USD 49.5 Bn |

| CAGR (2024-2033) |

19.1% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Hydroponics, Aeroponics, Aquaponics) By Structure (Building-Based Vertical Farms, Shipping-Container Vertical Farms) By Component (Lighting System, Irrigation and Fertigation System, Climate Control, Sensors, Others (HVAC systems, Shelves and Racks, etc.)) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

AeroFarms (U.S.), Illumitex, Inc. (U.S.), American Hydroponics (U.S.), Agrilution GmbH, Brightfarms Inc., Everlight Electronics Co., Ltd., Freight Farms, GrowUp Urban Farms Ltd., Green Sense Farms, LLC, Vertical Farm Systems. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |