Market Overview

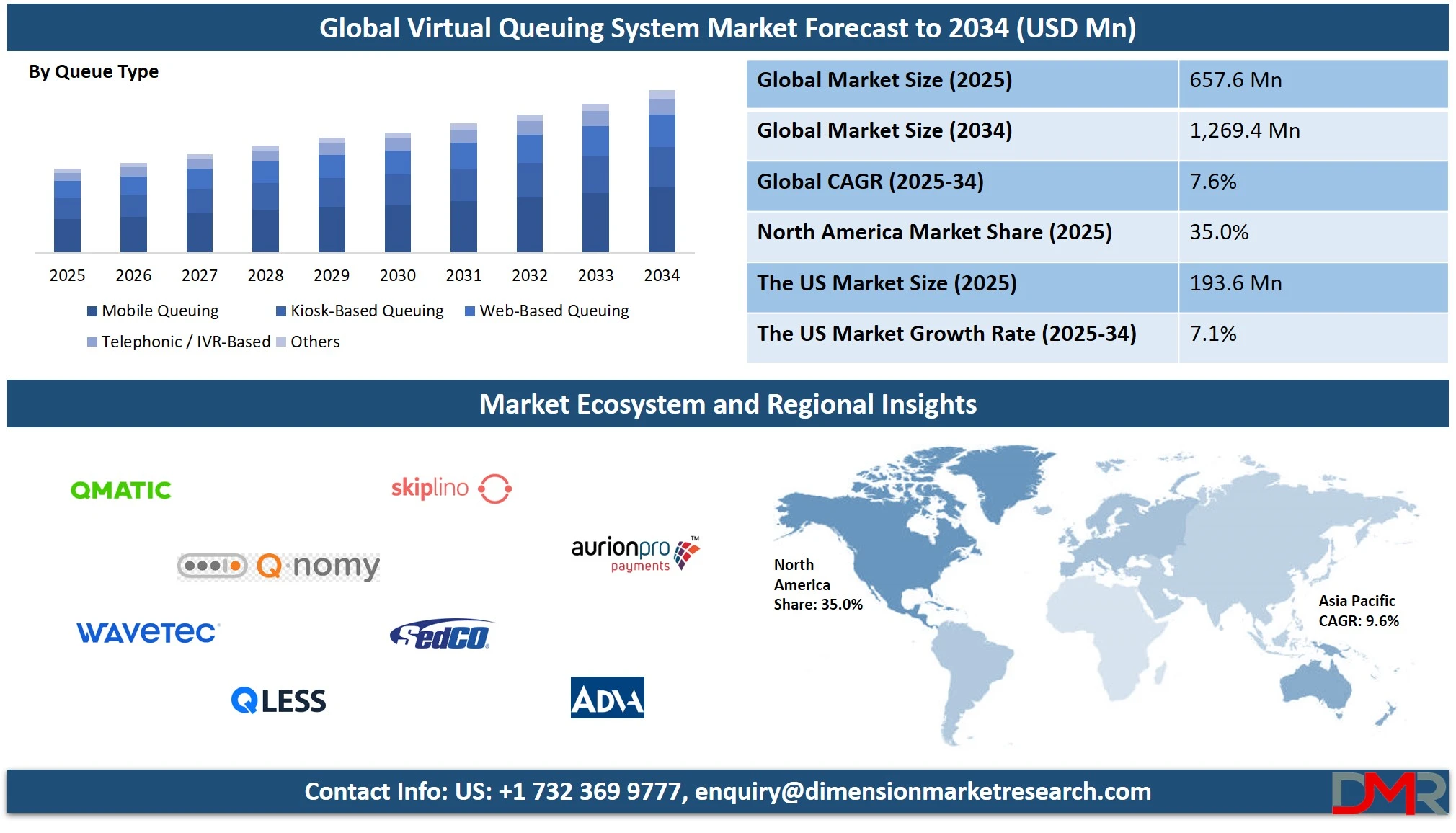

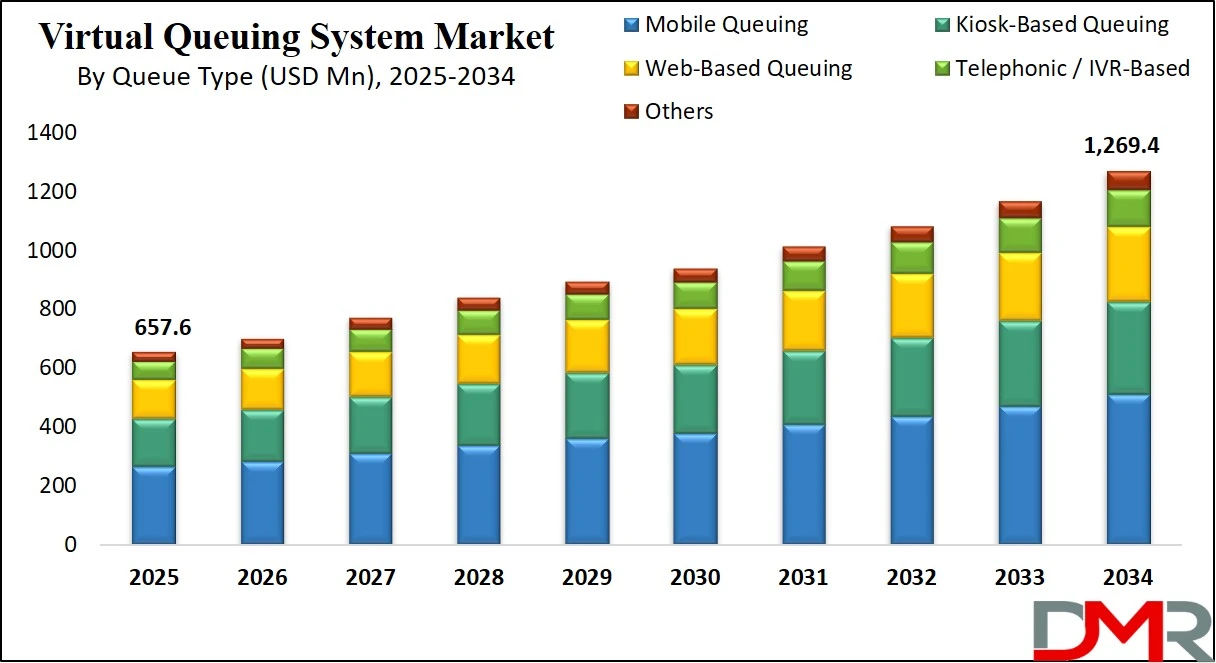

The global virtual queuing system market is projected to reach USD 657.6 million in 2025 and is expected to grow to USD 1,269.4 million by 2034, expanding at a CAGR of 7.6%. Growth is driven by growing demand for digital queue management, real-time customer flow solutions, and contactless service technologies across industries.

A virtual queuing system is an intelligent queue management solution that allows customers to secure a spot in a service line without the need for physical presence. By leveraging digital interfaces such as mobile apps, websites, SMS, or interactive kiosks, users can check in remotely, monitor their wait time in real-time, and receive alerts when it is their turn.

This system reduces on-site congestion, enhances operational efficiency, and improves overall customer satisfaction by offering a smooth and contactless experience. Integrated with appointment scheduling, real-time queue monitoring, and service flow optimization, virtual queuing systems are particularly beneficial for environments that experience high foot traffic, such as hospitals, banks, telecom service centers, and government offices.

The global virtual queuing system market is experiencing robust growth as organizations across industries adopt digital transformation strategies to modernize customer engagement and service delivery. With the growing emphasis on contactless services, personalized experiences, and efficient visitor management, businesses are turning to cloud-based queuing platforms that offer real-time data insights, automated scheduling, and seamless integration with third-party systems. This shift is driven by the rising demand for flexible service models, particularly in sectors like healthcare, retail, public administration, and transportation, where reducing physical wait lines contributes significantly to customer retention and operational agility.

Furthermore, the global market is being shaped by advancements in technologies such as artificial intelligence, IoT, and machine learning, which are enabling predictive queue analytics and smarter resource allocation. As businesses prioritize customer flow management, the use of virtual waitlist software and queue automation tools is becoming integral to delivering frictionless service experiences. Additionally, growing investments in smart infrastructure, increased smartphone penetration, and a surge in mobile-first customer behaviors support the expansion of digital queue management solutions globally, with a strong push from private and public sector initiatives.

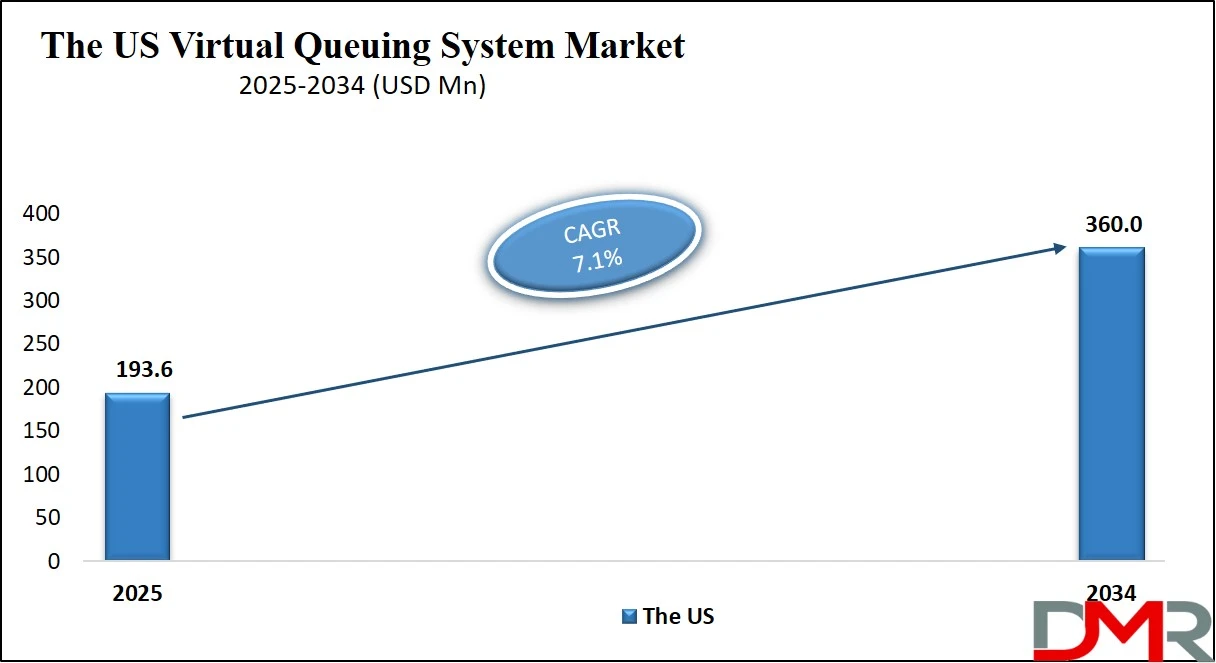

The US Virtual Queuing System Market

The U.S. Virtual Queuing System Market size is projected to be valued at USD 193.6 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 360.0 million in 2034 at a CAGR of 7.1%.

The United States virtual queuing system market is witnessing substantial growth driven by the rapid adoption of digital transformation across service-driven industries such as healthcare, banking, government, and retail. With rising expectations for seamless customer experiences and minimal physical wait times, businesses are deploying smart queue management software to optimize service workflows and improve client satisfaction.

In highly regulated sectors like healthcare and finance, virtual queue systems help maintain compliance with safety protocols while offering streamlined appointment scheduling and automated check-ins. The growing preference for contactless interactions, mobile queue apps, and remote access has further accelerated the integration of real-time queuing platforms across the U.S. service landscape.

Moreover, technological advancements such as AI-powered queue prediction, cloud-based infrastructure, and integration with CRM and ERP systems are reshaping how U.S. organizations manage customer flow. The widespread use of smartphones and strong internet penetration have enabled consumers to interact with queue systems through multiple digital service channels, including web portals, SMS, and mobile applications.

As smart cities initiatives and enterprise digitalization efforts gain momentum, the demand for queue optimization tools and virtual waitlist management is expected to surge. U.S.-based solution providers also focus on enhancing analytics, kiosk integration, and multilingual support, making virtual queuing a standard practice for improving operational efficiency and customer engagement in private and public sectors.

The Europe Virtual Queuing System Market

The Europe virtual queuing system market is estimated to reach USD 164.4 million in 2025. This strong regional share is fueled by the continent's early adoption of digital customer service technologies and its emphasis on improving public service efficiency and customer experience. Countries such as Germany, the United Kingdom, France, and the Netherlands are at the forefront of implementing advanced queue management systems across sectors including healthcare, government services, banking, and retail.

The growing demand for smart service delivery, integrated with the region's well-established digital infrastructure, is driving widespread adoption of mobile-based queue apps, cloud-based platforms, and AI-powered queue optimization tools. With a projected CAGR of 6.8% from 2025 to 2034, Europe’s market is poised for steady expansion, supported by regulatory pressure to improve service accessibility, growing focus on contactless experiences, and greater integration of queue management systems with enterprise IT ecosystems.

Moreover, public sector modernization programs, smart city initiatives, and a heightened focus on operational efficiency across both private and government-run institutions are accelerating the deployment of virtual queuing solutions. As customer expectations evolve and digital transformation deepens across industries, the European market is expected to maintain its leadership as a mature and innovation-driven region within the global virtual queuing system landscape.

The Japan Virtual Queuing System Market

Japan’s virtual queuing system market is projected to be valued at USD 39.4 million in 2025. This reflects Japan’s growing commitment to modernizing customer service infrastructure across sectors such as healthcare, public administration, retail, and transportation. Known for its high standards in operational efficiency and technology adoption, Japan is deploying digital queue management solutions to enhance convenience, reduce wait times, and improve user experience in high-density urban settings.

The country’s aging population also contributes to the demand for appointment-based and remotely accessible queuing systems that support better accessibility and service flow in clinics, government offices, and community service centers. With a forecasted CAGR of 8.4% between 2025 and 2034, Japan is set to be one of the fastest-growing markets in the Asia Pacific region for virtual queuing solutions. This robust growth is driven by several factors, including the expansion of mobile-first customer service models, the national focus on digital government initiatives, and increased integration of AI, IoT, and cloud technologies into customer engagement strategies.

Japanese businesses and local governments are recognizing the value of queue automation and predictive queue analytics to optimize staffing, reduce overcrowding, and improve citizen satisfaction. As the country continues to invest in smart infrastructure and digital transformation, demand for intelligent queuing platforms is expected to rise steadily over the next decade.

Global Virtual Queuing System Market: Key Takeaways

- Market Value: The global virtual queuing system market size is expected to reach a value of USD 1,269.4 million by 2034 from a base value of USD 657.6 million in 2025 at a CAGR of 7.6%.

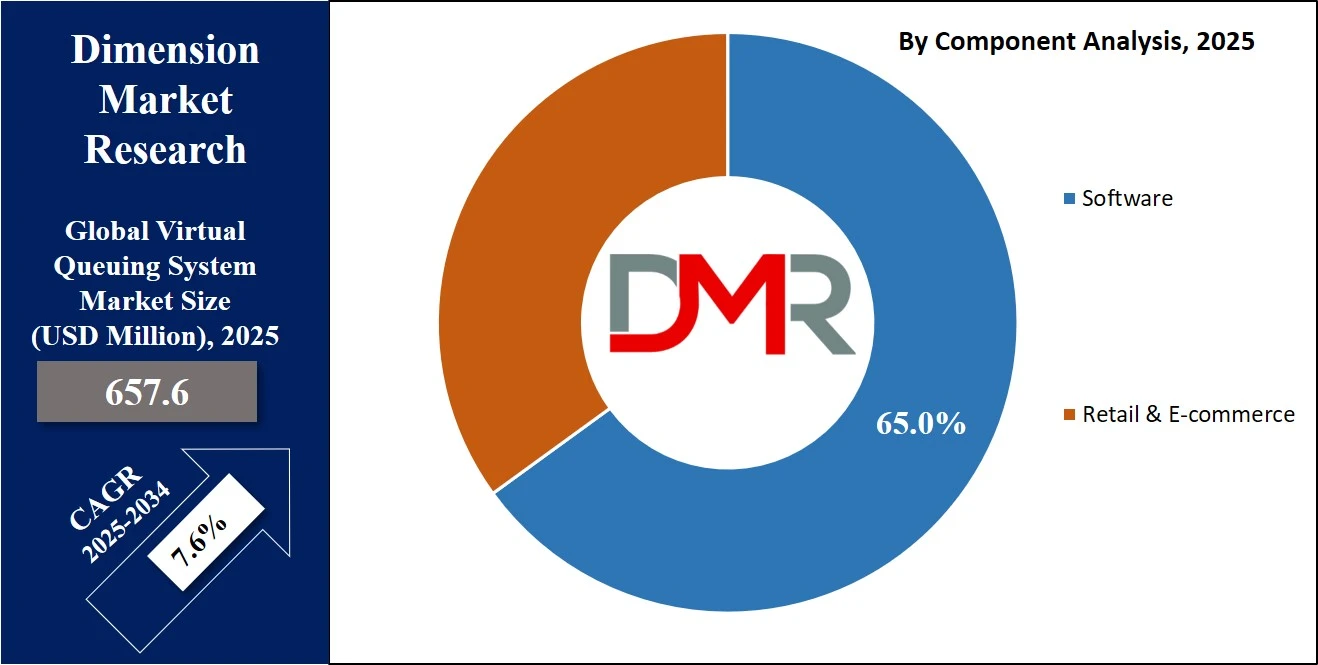

- By Component Segment Analysis: Software components are anticipated to dominate the component segment, capturing 65.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment mode is poised to consolidate its dominance in the deployment mode segment, capturing 72.0% of the total market share in 2025.

- By Queue Type Segment Analysis: Mobile Queuing will lead in the queue type segment, capturing 40.0% of the market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are expected to maintain their dominance in the organization size segment, capturing 60.0% of the total market share in 2025.

- By Technology Stack Segment Analysis: AI-enabled Queuing will dominate the technology stack segment, capturing 30.0% of the market share in 2025.

- By Industry Vertical Segment Analysis: The Healthcare industry will dominate the industry vertical segment, capturing 25.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global virtual queuing system market landscape with 35.0% of total global market revenue in 2025.

- Key Players: Some key players in the global virtual queuing system market are Qmatic, Q-nomy, Wavetec, Qless, Skiplino, SEDCO, Advantech, Aurionpro, Nemo-Q, Lavi Industries, Qudini, JRNI, Ombori, XIPHIAS Software Technologies, VirtuaQ, Qwait, and Others.

Global Virtual Queuing System Market: Use Cases

- Healthcare Facilities and Hospitals: In hospitals and clinics, virtual queuing systems are used to streamline patient check-ins, reduce in-person wait times, and prevent overcrowding in lobbies or waiting rooms. Patients can register for their appointments remotely via mobile apps, web portals, or self-service kiosks, and receive real-time updates about their position in the queue. This not only improves patient satisfaction but also enhances operational efficiency for healthcare providers. By integrating virtual queue solutions with Electronic Health Records (EHR) and hospital scheduling systems, healthcare facilities can better manage doctor availability, walk-ins, and emergency visits. Contactless queuing is also critical in ensuring infection control and adherence to social distancing protocols in post-pandemic healthcare operations.

- Banking and Financial Services: Banks and financial institutions leverage digital queue management systems to provide seamless branch experiences. Customers can book appointments in advance or queue virtually using SMS or mobile applications, allowing them to arrive only when it's their turn. This reduces in-branch congestion and ensures faster service delivery for common tasks like account opening, loan processing, and customer verification. Integration with CRM platforms allows staff to be prepared with customer data in advance, improving personalization and service accuracy. Virtual waitlist management also enables real-time queue insights for branch managers, helping them allocate resources efficiently during peak hours.

- Retail Chains and Shopping Malls: Large retail chains and shopping centers use smart queuing systems to manage customer flow during high-traffic periods, such as sales events, new product launches, or holiday seasons. With mobile-based queue ticketing and real-time status updates, shoppers can explore other sections of the store or browse online while retaining their place in the queue. Retailers can also integrate virtual queuing with loyalty programs and marketing platforms to send promotional messages or cross-sell opportunities while customers wait. This results in better crowd control, enhanced customer engagement, and improved conversion rates at physical stores. For businesses adopting an omnichannel strategy, these queue systems serve as a bridge between online and in-store experiences.

- Government Offices and Public Service Centers: Public sector departments, such as passport offices, transport authorities, and municipal service centers, implement virtual queuing technology to manage citizen appointments and walk-ins more effectively. Residents can check-in online, choose a preferred time slot, and receive alerts for documentation or follow-up requirements. These solutions help reduce long lines, improve transparency, and enhance accessibility for citizens. Government entities benefit from queue analytics to monitor peak traffic patterns, service bottlenecks, and staff productivity. In smart city initiatives, virtual queue systems are integrated into citizen service apps, enabling a centralized platform for all public-facing transactions and inquiries.

Global Virtual Queuing System Market: Stats & Facts

Washington State Employment Security Department & Virtual Hold Technology (2011)

- Saved USD 500,000 in phone bills during the first year of virtual callback deployment.

- Unemployment claimants spent 15 million fewer minutes on hold — approximately 28 fewer years cumulatively.

- Approximately 75% of callers chose callback over staying on hold.

- Average callback occurred after 20 minutes.

New York State Department of Labor (UI Will Call Program)

- Awarded USD 1.1 million in federal funding in 2009 for virtual queuing implementation.

- Expected savings of USD 370,000 per year in phone-related costs.

- Achieved a 48% decrease in call hang-ups and 19,500 fewer repeat calls in the first year of adoption.

California Public Employees' Retirement System (CalPERS) Call Center

- Handles over 650,000 calls annually.

- Performance goals: ≤ 5% abandon rate, 95% of calls answered within 2.5 minutes, and maximum hold time of 2.5 minutes.

- After implementing virtual queuing, wait times were consistently reduced to under 2.5 minutes.

- Phone costs were cut by approximately 33%.

Government Technology Reports (Citywide Digital Queuing Initiatives)

- Cities such as Providence, Lincoln, Seattle, and Buenos Aires have adopted citywide virtual queue platforms for small businesses and local government offices.

- Shared municipal queuing services have improved small business access to digital tools and enhanced economic resilience in local communities.

U.S. National Institute of Standards and Technology (NIST) / U.S. Department of Commerce

- AI in customer service operations can reduce wait times by up to 40%.

- Predictive analytics led to 35% improvement in operational efficiency.

- Government and public-facing institutions that used queue analytics saw 25% service efficiency gains and 30% reduction in administrative costs.

- 78% of U.S. consumers prefer businesses that offer appointment booking or virtual wait options.

- 85% of American adults own smartphones, supporting wide adoption of mobile-based queuing.

- Businesses using integrated customer systems realized 28% higher operational efficiency.

- Higher education institutions using appointment-based systems saw 32% drop in administrative processing costs.

- U.S. federal IT modernization budget for 2024 reached USD 58 billion, with queue and appointment systems among key priorities.

U.S. Department of Health and Human Services (HHS)

- Healthcare facilities using virtual queuing experienced a 35% reduction in perceived wait times.

- Staff utilization improved by 28% in clinics and public hospitals implementing digital queuing.

Government-Supported Clinical Trials (PubMed & PMC Data)

- In a trial with 236 emergency department patients:

- Average actual wait time dropped from approximately 27.0 minutes to 15.5 minutes.

- Perceived wait time dropped from 32.8 minutes to 11.9 minutes (statistically significant).

- In a postal/government health insurance setting:

- Daily patient registration increased from 896 to 914.

- Morning throughput rose from 686 to 777 patients.

- Afternoon queue congestion was eased with 73 fewer registrations after 10:30 AM.

Global Virtual Queuing System Market: Market Dynamics

Global Virtual Queuing System Market: Driving Factors

Growing Demand for Contactless Customer Experiences

Post-pandemic behavioral shifts have accelerated the global demand for contactless service delivery across retail, healthcare, government, and financial institutions. Virtual queuing systems enable organizations to offer safe, efficient, and frictionless experiences by allowing users to wait remotely and receive real-time updates. Businesses are adopting remote check-in and digital queue ticketing solutions to enhance service delivery while maintaining health and safety standards. This shift is also aligned with broader trends in mobile-first consumer behavior and touchless interaction expectations.

Rising Adoption of Smart Infrastructure and Digital Transformation

The rapid digitalization of customer service operations, particularly in emerging economies, has led to increased deployment of smart queue management platforms. Governments and private enterprises are investing in cloud-based queuing systems that integrate with CRM, ERP, and analytics tools for enhanced efficiency and data-driven decision-making. As smart buildings, connected kiosks, and real-time scheduling tools become more mainstream, virtual queuing systems are becoming a core component of intelligent service environments.

Global Virtual Queuing System Market: Restraints

Integration Complexities with Legacy Systems

One of the key challenges in the virtual queuing system market is the difficulty in integrating modern digital queue management platforms with outdated or siloed IT infrastructures, particularly in large government departments and traditional banking environments. Compatibility issues, lack of standardized APIs, and the high cost of system overhaul deter organizations from adopting these solutions fully. These technical barriers can delay implementation timelines and increase operational risk.

Limited Digital Access in Low-Infrastructure Regions

In regions with low internet penetration, limited smartphone usage, or inadequate digital literacy, the effectiveness of virtual queuing platforms is significantly reduced. Without access to mobile-based queuing apps or self-service kiosks, large segments of the population may be excluded from these services. This digital divide creates a challenge for governments and service providers aiming to offer equitable and inclusive queue optimization technologies.

Global Virtual Queuing System Market: Opportunities

Expansion in Emerging Economies with Urban Population Growth

With rapid urbanization and growing pressure on public services in countries across Asia, Africa, and Latin America, there is a growing opportunity for digital queuing solutions to ease congestion and improve service access. Cities investing in smart governance and urban infrastructure are deploying virtual waitlist platforms in transport hubs, licensing offices, and public utilities. This untapped market segment offers vast potential for vendors specializing in scalable and multilingual queuing solutions.

Integration with AI and Predictive Queue Analytics

There is a rising opportunity to integrate artificial intelligence and machine learning algorithms into queuing systems to enable predictive wait-time estimation, smart staff allocation, and dynamic queue routing. These advanced capabilities not only improve service delivery but also provide insights into peak load patterns and customer behavior. Businesses are beginning to value real-time data visualization and customer flow analytics as key tools for strategic decision-making and performance benchmarking.

Global Virtual Queuing System Market: Trends

Surge in Mobile-Based Queuing and Self-Service Interfaces

A prominent trend in the market is the growing reliance on mobile queue apps and touchscreen kiosks for remote check-in and virtual queue ticketing. Consumers prefer self-service options that offer convenience, speed, and control over their wait time. Retailers, hospitals, and government centers are investing in mobile-first queuing interfaces that seamlessly integrate with their existing customer service infrastructure, creating unified digital experiences.

Growing Adoption in Events, Amusement Parks, and Entertainment Venues

Beyond traditional sectors, virtual queuing is gaining traction in entertainment and hospitality, particularly in amusement parks, stadiums, cinemas, and large-scale public events. These venues use queue automation tools to minimize crowding, enhance visitor satisfaction, and optimize entry flow. Integration with ticketing platforms and real-time capacity monitoring systems enables smoother guest experiences, making digital queue systems a key component of modern event operations.

Global Virtual Queuing System Market: Research Scope and Analysis

By Component Analysis

In the virtual queuing system market, the software component is expected to hold a dominant position, accounting for approximately 65.0% of the total market share in 2025. This dominance is driven by the growing reliance on cloud-based queue management platforms, mobile queuing applications, real-time customer tracking dashboards, and integration capabilities with enterprise systems such as CRM, ERP, and POS.

Software solutions offer enhanced scalability, better user experience, and powerful analytics tools that enable organizations to monitor customer flow, reduce service delays, and optimize staffing. As digital transformation accelerates across sectors like healthcare, banking, and retail, businesses are prioritizing investment in flexible, customizable software platforms that support remote access, smart scheduling, and multi-channel queue entry points.

On the other hand, the services segment plays a crucial supporting role in the market by facilitating the deployment, maintenance, and continuous optimization of virtual queuing solutions. This includes system integration, custom configuration, user training, technical support, and ongoing consultancy to ensure seamless implementation across diverse operational environments. With many organizations lacking in-house IT capabilities, managed services and third-party support are becoming essential for maximizing the performance and value of queue management systems. As end-users seek tailored solutions and faster time-to-deployment, the demand for professional services is expected to grow, particularly in complex, multi-location enterprises and public sector implementations.

By Deployment Mode Analysis

The cloud-based deployment mode is expected to lead the virtual queuing system market in 2025, accounting for approximately 72.0% of the total market share. This growing dominance is driven by the growing demand for scalable, cost-effective, and remotely accessible solutions that support real-time queue management across various industries. Cloud-based systems allow organizations to deploy digital queue solutions without the need for heavy infrastructure investment, making them ideal for both large enterprises and SMEs.

These platforms offer benefits such as automatic software updates, remote configuration, data backup, and seamless integration with other cloud-native tools like CRM and analytics engines. Additionally, with the rise of mobile-first customer engagement and distributed service locations, businesses are prioritizing cloud deployment to ensure consistent performance, centralized control, and easy access from any device or region.

In contrast, the on-premise deployment mode remains relevant for organizations with strict data security policies, regulatory compliance requirements, or limited internet connectivity. These systems are typically hosted within the organization’s own infrastructure, giving them greater control over data and customization.

Sectors such as government institutions, defense-related agencies, and certain healthcare providers often opt for on-premise solutions to safeguard sensitive information and maintain operational autonomy. However, the high upfront cost, longer implementation cycles, and limited scalability are key limitations. While this segment continues to serve niche requirements, its growth is expected to be comparatively slower as more enterprises migrate to flexible and agile cloud-based queue management systems.

By Queue Type Analysis

Mobile queuing is set to lead the queue type segment in the virtual queuing system market, with a projected market share of 40.0% in 2025. This growth is largely driven by the widespread adoption of smartphones and growing consumer preference for contactless, flexible service experiences. Mobile queuing allows users to join a line remotely through dedicated apps, QR codes, or SMS links, providing real-time updates on wait times, queue position, and service notifications.

This convenience not only reduces physical congestion at service locations but also enhances customer satisfaction by offering greater control and transparency. Industries such as retail, healthcare, banking, and food services are rapidly deploying mobile queue solutions to handle high footfall, improve throughput, and minimize drop-off rates.

Kiosk-based queuing remains a strong and complementary component within the virtual queuing ecosystem, especially in environments where mobile usage is limited or where in-location check-ins are still preferred. These self-service kiosks enable visitors to generate digital tickets upon arrival and receive estimated wait times, helping streamline customer flow and reduce staff workload. Commonly found in hospitals, government offices, telecom centers, and transport hubs, kiosk-based systems offer an intuitive and efficient way to manage walk-ins.

They are particularly effective in locations with a high volume of unregistered or less tech-savvy users, providing a physical interface that bridges the gap between digital automation and traditional service expectations. Despite mobile queuing’s rising dominance, kiosk-based solutions continue to play a crucial role in ensuring accessibility and service standardization across diverse customer demographics.

By Organization Size Analysis

Large enterprises are projected to dominate the organization size segment of the virtual queuing system market, accounting for 60.0% of the total market share in 2025. These organizations often manage complex service environments with high customer volumes, multiple service points, and the need for advanced resource allocation. Virtual queuing systems help large enterprises streamline operations, reduce customer wait times, and maintain consistent service standards across various branches or geographic locations.

Industries such as banking, telecom, healthcare networks, and government agencies rely on queue management platforms integrated with enterprise-level CRM, analytics, and reporting tools to enhance customer flow, monitor service performance, and drive operational efficiency. The ability to deploy customized, scalable, and cloud-based queuing solutions also enables large enterprises to adapt quickly to changing service demands and user expectations.

Small and medium-sized enterprises (SMEs), while holding a smaller share of the market, are emerging as a fast-growing segment in the virtual queuing space. SMEs are adopting these solutions to modernize their customer service approach, especially as digital transformation becomes more accessible and cost-effective. With affordable cloud-based subscription models and user-friendly mobile apps, SMEs in sectors such as clinics, retail stores, and educational institutions are implementing virtual queue systems to enhance customer convenience, reduce no-show rates, and gain a competitive edge.

These businesses benefit from simplified deployments and quick integration with basic business tools, allowing them to deliver improved service experiences without significant IT infrastructure investment. As awareness of digital queue management grows among smaller businesses, their adoption is expected to rise steadily in the coming years.

By Technology Stack Analysis

AI-enabled queuing is projected to lead the technology stack segment of the virtual queuing system market in 2025, capturing around 30.0% of the total market share. This dominance is largely due to the growing need for intelligent queue management that not only organizes customer flow but also predicts wait times, allocates staff resources dynamically, and personalizes the service experience.

AI-powered systems can analyze historical data, real-time service trends, and customer behavior patterns to optimize queue performance and reduce service bottlenecks. Businesses across sectors like healthcare, banking, and government are adopting these systems to improve operational efficiency, enhance decision-making, and deliver proactive, customer-centric services. The integration of artificial intelligence also enables adaptive queue logic and smarter appointment scheduling, which helps in reducing wait time fluctuations during peak hours.

IoT-integrated queuing systems are also playing a vital role in enhancing the effectiveness of digital queue management solutions, particularly in environments that rely on real-time physical space monitoring and automation. These systems utilize connected devices such as occupancy sensors, digital signage, beacons, and smart kiosks to provide accurate, up-to-the-minute data on queue lengths, customer movement, and service counter availability.

IoT-based solutions are particularly valuable in large venues like airports, malls, hospitals, and public service buildings, where customer flow needs to be managed across multiple zones. By combining IoT with virtual queue software, organizations can gain deeper visibility into traffic patterns, enforce social distancing, and automate queue redirection based on congestion levels. As demand for location-aware, responsive queuing systems continues to rise, the role of IoT in this market is expected to expand significantly.

By Industry Vertical Analysis

The healthcare industry is expected to dominate the industry vertical segment of the virtual queuing system market in 2025, accounting for 25.0% of the total market share. Hospitals, clinics, diagnostic labs, and vaccination centers rely on digital queue management systems to reduce overcrowding, enhance patient experiences, and maintain operational efficiency. With high foot traffic and time-sensitive services, healthcare providers are adopting virtual queuing to enable remote check-ins, automated appointment scheduling, and real-time status updates via mobile apps or kiosks.

These systems not only reduce physical waiting lines but also support infection control by promoting contactless check-ins and minimizing patient interactions in shared spaces. Additionally, integration with hospital management software and electronic health records allows for a seamless service flow, ensuring patients are guided through their visits efficiently while medical staff can better manage schedules and service demand.

The BFSI sector, comprising banks, insurance providers, and financial institutions, represents another significant segment of the virtual queuing system market. These organizations are deploying queue management solutions to manage high volumes of daily footfall, especially for services requiring in-branch visits such as account openings, loan consultations, or document verification. With growing customer expectations for quick and personalized service, virtual queuing enables remote queue access, SMS alerts, and appointment-based scheduling, reducing in-branch waiting and enhancing overall service delivery.

Integration with customer relationship management systems allows staff to access relevant customer details beforehand, leading to faster processing and better engagement. In an industry where efficiency, compliance, and customer experience are critical, virtual queuing solutions offer the tools to streamline operations while maintaining high service standards across multiple service channels.

The Virtual Queuing System Market Report is segmented on the basis of the following:

By Component

By Deployment Mode

By Queue Type

- Mobile Queuing

- Kiosk-Based Queuing

- Web-Based Queuing

- Telephonic/ IVR-Based

- Others

By Organization Size

By Technology Stack

- AI-enabled Queuing

- IoT-integrated

- Standalone Systems

- Integrated Systems

By Industry Vertical

- Healthcare

- BFSI

- Retail & eCommerce

- Airports & Transportation

- Government & Public Sector

- Education

- Telecom

- Hospitality & Entertainment

- Others

Global Virtual Queuing System Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global virtual queuing system market in 2025, accounting for 35.0% of the total market revenue. This dominance is driven by the region’s early adoption of advanced customer experience technologies, strong presence of key solution providers, and widespread digitization across sectors such as healthcare, BFSI, government, and retail.

High consumer expectations for seamless and contactless service, combined with robust infrastructure and smartphone penetration, have accelerated the deployment of digital queue management systems. Additionally, public and private organizations in the U.S. and Canada are investing in cloud-based platforms, AI-powered scheduling, and IoT-enabled queuing interfaces to streamline service delivery, manage high foot traffic, and gain real-time operational insights.

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the virtual queuing system market over the coming years, driven by rapid urbanization, growing smartphone usage, and growing investments in digital infrastructure across emerging economies such as India, China, Indonesia, and Vietnam. As service-based industries expand and consumer demand for efficient, contactless service experiences rises, Business Intelligence across healthcare, banking, retail, and public services are turning to digital queue management platforms to optimize customer flow and reduce operational bottlenecks.

Government-led smart city initiatives, integrated with the rise of mobile-first populations and improved internet connectivity, are further accelerating adoption in the region. With a strong focus on customer engagement and service automation, Asia Pacific is poised to become one of the fastest-growing markets for virtual queuing solutions.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Virtual Queuing System Market: Competitive Landscape

The global competitive landscape of the virtual queuing system market is characterized by a mix of established technology providers, niche software vendors, and emerging startups, each striving to enhance customer flow management and service delivery efficiency. Leading players such as Qmatic, Q-nomy, Wavetec, and Qless dominate through comprehensive product portfolios, global reach, and strong integration capabilities with enterprise systems. These companies are investing in cloud-native solutions, AI-driven analytics, and mobile-first platforms to cater to evolving user expectations.

Meanwhile, regional players and specialized vendors like Skiplino, Qudini, and VirtuaQ are gaining traction by offering agile, cost-effective, and industry-specific solutions tailored for SMEs and public sector deployments. The market is also witnessing growing collaboration between queuing system providers and digital transformation consultancies, aiming to deliver fully integrated, end-to-end queue automation strategies. As competition intensifies, innovation, scalability, and customization remain key differentiators in this rapidly evolving landscape.

Some of the prominent players in the global virtual queuing system market are:

- Qmatic

- Q-nomy

- Wavetec

- Qless

- Skiplino

- SEDCO

- Advantech

- Aurionpro

- Nemo-Q

- Lavi Industries

- Qudini

- JRNI

- Ombori

- XIPHIAS Software Technologies

- VirtuaQ

- Qwait

- ATT Systems

- Qlinez

- AKIS Technologies

- Qminder

- Other Key Players

Global Virtual Queuing System Market: Recent Developments

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 657.6 Mn |

| Forecast Value (2034) |

USD 1,269.4 Mn |

| CAGR (2025–2034) |

7.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 193.6 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (Cloud-based and On-Premise), By Queue Type (Mobile Queuing, Kiosk-Based Queuing, Web-Based Queuing, Telephonic/ IVR-Based, and Others), By Organization Size (Large Enterprises and SMEs), By Technology Stack (AI-enabled Queuing, IoT-integrated, Standalone Systems, and Integrated Systems), and By Industry Vertical (Healthcare, BFSI, Retail & eCommerce, Airports & Transportation, Government & Public Sector, Education, Telecom, Hospitality & Entertainment, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Qmatic, Q-nomy, Wavetec, Qless, Skiplino, SEDCO, Advantech, Aurionpro, Nemo-Q, Lavi Industries, Qudini, JRNI, Ombori, XIPHIAS Software Technologies, VirtuaQ, Qwait, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The global virtual queuing system market size is estimated to have a value of USD 657.6 million in 2025

and is expected to reach USD 1,269.4 million by the end of 2034.

The US virtual queuing system market is projected to be valued at USD 193.6 million in 2025. It is

expected to witness subsequent growth in the upcoming period as it holds USD 360.0 million in 2034 at

a CAGR of 7.1%.

North America is expected to have the largest market share in the global virtual queuing system market,

with a share of about 35.0% in 2025.

Some of the major key players in the global virtual queuing system market are Qmatic, Q-nomy,

Wavetec, Qless, Skiplino, SEDCO, Advantech, Aurionpro, Nemo-Q, Lavi Industries, Qudini, JRNI, Ombori,

XIPHIAS Software Technologies, VirtuaQ, Qwait, and Others.

The market is growing at a CAGR of 7.6 percent over the forecasted period.