Market Overview

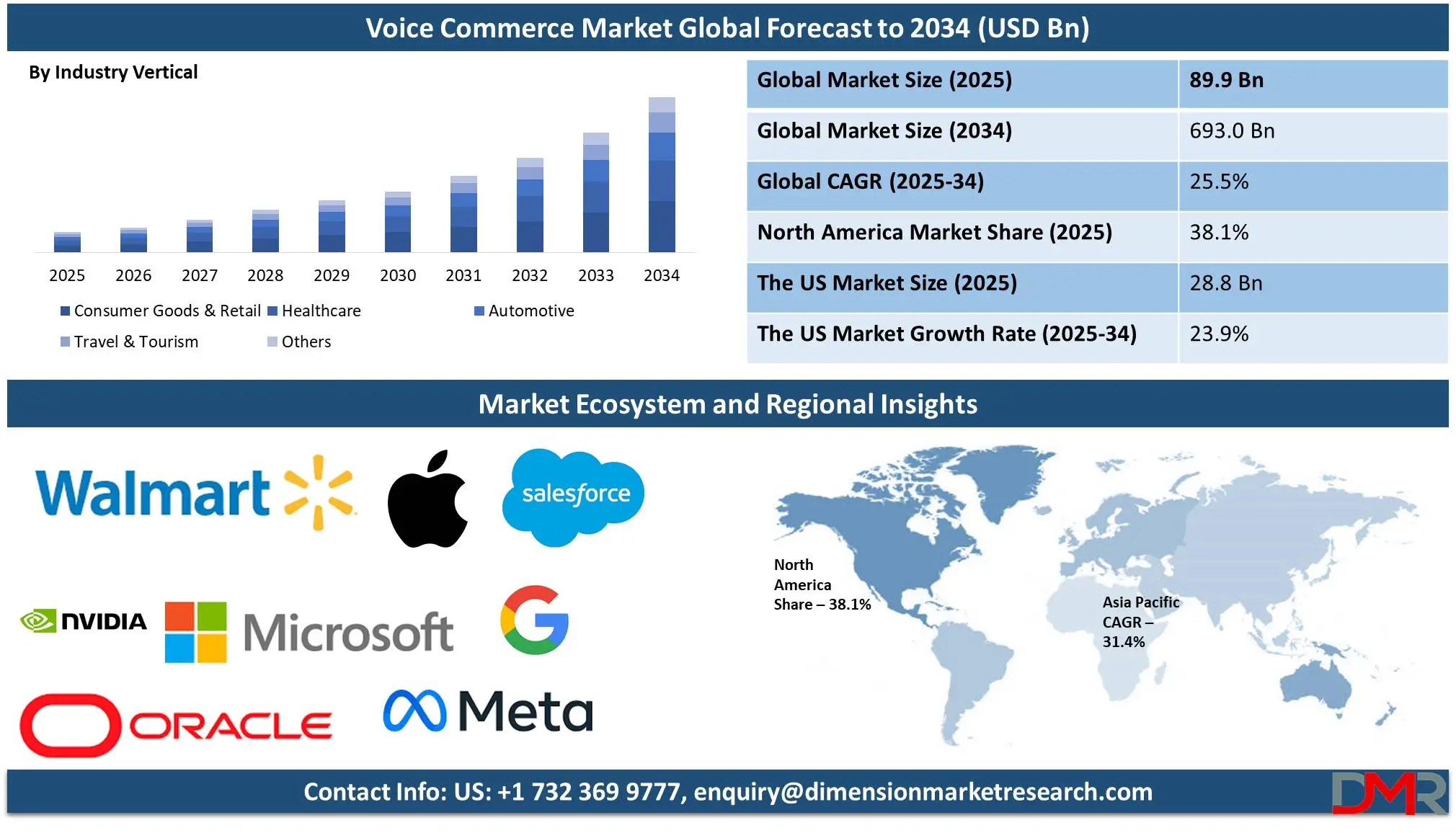

The Global Voice Commerce Market is predicted to be valued at

USD 89.8 billion in 2025 and is expected to grow to

USD 693.0 billion by 2034, registering a compound annual growth rate

(CAGR) of 25.5% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Voice commerce is a rapidly growing segment of the e-commerce industry that leverages voice assistants like Amazon Alexa, Google Assistant, and Apple Siri to facilitate online shopping. Consumers can search for products, place orders, and make payments using voice commands, offering a hands-free and convenient shopping experience. The integration of artificial intelligence (AI) and natural language processing (NLP) has significantly enhanced the accuracy and responsiveness of voice assistants, driving the adoption of voice commerce worldwide.

The primary driving factor behind the growth of the global voice commerce market is the increasing penetration of smart devices and virtual assistants. As more households and businesses integrate smart speakers and AI-powered assistants into their daily routines, voice commerce becomes a seamless and efficient shopping method. Additionally, advancements in voice recognition technology and secure payment processing have boosted consumer confidence in using voice commands for transactions.

The demand for voice commerce is fueled by the growing preference for convenience and speed in online shopping. Consumers seek frictionless experiences that reduce the need for typing or navigating websites. Moreover, the rising trend of personalized shopping, where AI-powered assistants offer tailored recommendations based on user preferences, further strengthens the need for voice commerce. As technology continues to evolve, voice commerce is poised to redefine the future of digital retail.

The US Voice Commerce Market

The US Voice Commerce market is projected to be valued at USD 28.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 198.0 billion in 2034 at a CAGR of 23.9%.

US voice commerce growth is powered by the mass adoption of smart speakers, voice assistants, and AI-driven devices. Leading e-retailers like Walmart and Amazon have adopted voice-enabled shopping, making it simple for consumers. Increased use of hands-free and frictionless shopping encourages adoption. Natural language processing innovation improves voice recognition, making it simpler to purchase. Higher smartphone penetration and voice integration into mobile applications further increase growth. Personalized recommendations and secure payment authentication also spur growth in the market, making consumers more engaged and secure.

Voice commerce space is experiencing key trends, like AI-driven personalization, with voice assistants suggesting personalized purchases. Multimodal interactions, with voice and visual outputs integrated, enhance user experience. Subscription voice buys are growing, with convenience being driven by recurring orders. Integration with Internet-of-Things devices, such as smart fridges restocking grocery supplies, is gaining ground. Brands are voice search SEO-optimizing to increase discoverability. Furthermore, security features such as voice biometrics are reducing consumer apprehensions, instilling confidence, and triggering increased adoption of voice commerce solutions.

Voice Commerce Market: Key Takeaways

- Market Growth: The Global Voice Commerce Market is anticipated to expand by USD 582.6 billion, achieving a CAGR of 25.5% from 2025 to 2034.

- Device Type Analysis: Smart speakers are expected to dominate the global voice commerce market with a revenue share of 48.9% by the end of 2025.

- Industry Vertical Analysis: The Consumer Goods & Retail segment is predicted to lead the voice commerce market, accounting for over 46.3% share in 2025.

- Regional Analysis: North America is predicted to lead the global Voice Commerce Market with a revenue share of 38.1% in 2025.

- Prominent Players: Some of the major key players in the Global Voice Commerce Market are Apple Inc., Google LLC., Salesforce Inc., and many others.

Voice Commerce Market: Use Cases

- Hands-Free Shopping: Consumers can use voice assistants like Amazon Alexa, Google Assistant, or Apple Siri to search for products, compare prices, and make purchases without needing to type or browse manually.

- Reordering and Subscription Management: Customers can conveniently reorder frequently used items, such as groceries or household essentials, by simply giving a voice command, reducing the time spent on repetitive purchases.

- Personalized Recommendations: Voice assistants can provide tailored product suggestions based on past purchase history and preferences, enhancing the shopping experience and improving customer satisfaction.

- Voice-Activated Payments: Users can complete transactions securely using voice commands, with authentication methods such as voice recognition or PIN verification, making the checkout process faster and more efficient.

Voice Commerce Market: Stats & Facts

- Widespread Adoption of Voice Assistants: 72% of people aware of voice assistants like Siri and Alexa have used voice-enabled devices, indicating widespread adoption and familiarity with voice commerce.

- Explosive Growth of Digital Voice Assistants: By 2024, the number of digital voice assistants is projected to reach 8.4 billion, surpassing the global population and highlighting the rapid growth in voice-enabled technology.

- High Consumer Satisfaction with Voice Commerce: 80% of consumers who have made purchases using voice assistants report high satisfaction, demonstrating the convenience and effectiveness of voice commerce.

- Voice Commerce Market Value Surge: Voice commerce is expected to surpass $30 billion by 2024, signaling its strong potential as a major e-commerce channel.

- Pandemic-Driven Acceleration in Voice Shopping: Due to COVID-19, voice commerce in North America saw a 72% growth, showing increased reliance on voice technology for shopping during the pandemic.

- Younger Consumers Driving Voice Purchases: 34% of shoppers aged 18-29 have made a purchase using a voice-activated device at least once, reflecting higher adoption among younger consumers.

- Conversational Commerce Market Projection: Juniper Research estimates that conversational commerce, including voice commerce, will reach $80 billion in 2023, underscoring its growing market value.

- Businesses Investing in Voice Technology: An Adobe survey of 400 business decision-makers in 2018 found that 91% had already invested in voice technology.

- Future Business Investment in Voice Commerce: 94% of businesses surveyed by Adobe planned to increase their investments in voice commerce within the next year, showcasing strong industry confidence.

Voice Commerce Market: Market Dynamic

Driving Factors in the Voice Commerce Market

Growing Adoption of Smart Speakers and Voice AssistantsVoice commerce has seen exponential growth since smart speakers and voice assistants became part of everyday life, offering users an easy shopping experience through voice commands. Busy consumers especially appreciate this hands-free convenience as it enables them to order while multitasking; devices such as Amazon Echo and Google Nest further fuelled this trend making voice commerce part of modern retailing.

Enhanced Convenience and Accessibility

Voice commerce removes many of the barriers of traditional online shopping by providing an intuitive purchase process through voice commands. Instead of having to navigate complex websites and apps for placing their orders, this way of ordering allows consumers to effortlessly place orders without any effort whatsoever - ideal for elderly and people living with disabilities who might struggle with traditional interfaces such as websites and apps. Plus voice assistants remember past purchases making repeat ordering even simpler! As such voice commerce continues its widespread adoption.

Restraints in the Voice Commerce Market

Privacy and Data Security Concerns

As our increasing reliance on voice assistant raises significant privacy and security issues, their continuous listening raises significant fears regarding data breach risks. Consumers become wary when these devices start listening in, increasing the chance for unauthorized data access by hackers or third-party breaches exposing sensitive financial data, search histories or personal conversations that could be exploited by cybercriminals or third parties; encryption efforts do not seem enough to guarantee its protection despite past incidents fuelling public skepticism about how companies handle user information securely despite encryption efforts proving otherwise; fearing surveillance or identity theft discourages consumers from fully adopting voice commerce specifically during financial transactions, restricting market growth by an expected amount.

Accuracy and Misinterpretation Issues

Voice recognition technology continues to develop but still struggles with accuracy when understanding different accents, dialects and speech patterns. Misinterpretations of commands may result in incorrect orders which result in frustration from consumers while decreasing trust in voice commerce. Background noise complicates interactions further making voice shopping less reliable than online or physical store purchases due to variations in pronunciation which make interactions unpredictable; leading to customer dissatisfaction as return rates spike which results in slower market adoption for voice shopping services. Businesses must develop natural language processing (NLP) capabilities so as to increase user trust while ensure seamless transactions occur within businesses' facilities.

Opportunities in the Voice Commerce Market

Expansion of IoT-Connected Ecosystems

Voice commerce capabilities have been transformed by IoT-connected devices, creating seamless shopping experiences across a range of environments. Smart speakers, wearables and in-car assistants now enable consumers to reorder products seamlessly using voice command technology - this trend being particularly significant within industries like retail, consumer goods and food services where convenience is an invaluable commodity. AI and natural language processing continue to advance, with integration between voice commerce ecosystems increasing over time to generate additional revenues streams while expanding consumer engagement opportunities for businesses.

Increasing Adoption by E-Commerce Giants

Amazon, Walmart and Alibaba are driving voice commerce adoption with voice-enabled shopping experiences for consumers. Reorder products seamlessly; track delivery statuses without human assistance; make hands-free purchases that improve convenience; streamline online shopping attracting broader customer bases to increase sales growth. As more retailers implement voice commerce capabilities the market will experience increased adoption which in turn spawn innovative applications as more shoppers rely on voice-activated transactions within digital retail environments.

Trends in the Voice Commerce Market

Expansion of Voice-Enabled Payments

The adoption of voice-enabled payments is transforming the voice commerce market. Consumers can now complete transactions securely using voice authentication, eliminating the need for manual input. Companies like Apple, Google, and Amazon are enhancing their payment ecosystems to support voice-activated purchases, making the process seamless and secure. With advancements in AI-driven fraud detection and biometric authentication, voice payments are becoming more reliable. This trend is driving greater convenience and efficiency, encouraging more users to embrace voice commerce. As trust in voice-based transactions grows, businesses are expected to invest further in optimizing payment security and user experience.

Integration of AI-Powered Conversational Shopping

AI-driven conversational shopping is revolutionizing voice commerce by providing interactive and intuitive shopping experiences. Retailers are leveraging AI-powered voice assistants to engage customers in real time, offering product recommendations, answering queries, and guiding them through purchases. These virtual assistants can analyze browsing history, past purchases, and user preferences to suggest relevant products, enhancing customer satisfaction. As AI continues to evolve, voice assistants are becoming more sophisticated, capable of understanding complex commands and delivering personalized shopping assistance. AI integration in voice commerce will make online shopping more interactive, efficient, and customer-centric.

Voice Commerce Market: Research Scope and Analysis

By Device Type Analysis

Smart speakers are expected to dominate the global voice commerce market with a revenue share of 48.9% by the end of 2025, due to their widespread consumer adoption, hands-free functionality, and seamless integration with smart home ecosystems. Devices like Amazon Echo and Google Home simplify shopping by allowing users to make purchases via voice commands, enhancing convenience. Their continuous connectivity with IoT-enabled devices enables users to control various home functions, reinforcing their utility. The growing reliance on smart home automation and the increasing use of voice assistants for daily tasks further drive the demand for smart speakers, making them the leading segment in the expanding voice commerce market.

Wearables are expected to witness the highest CAGR due to their advanced health and fitness tracking capabilities combined with voice commerce integration. Smartwatch and fitness trackers increasingly allow users to purchase health-related products, supplements, and services through voice commands, enhancing convenience. Their hands-free functionality is particularly beneficial during workouts, driving, or multitasking, where manual interaction is limited. As more consumers prioritize health and wellness, the seamless connection between wearable and voice commerce streamlines shopping experiences. The growing adoption of wearable technology and its expanding role in voice-assisted transactions contribute to its rapid market growth during the forecast period.

By Industry Vertical Analysis

The Consumer Goods & Retail segment is predicted to lead the voice commerce market, accounting for over 46.3% share in 2025. This dominance is driven by rapid digital transformation, prioritizing convenience and personalization. Retailers integrate voice assistants like Amazon Alexa and Google Assistant to enhance shopping experiences, providing seamless product searches, price comparisons, and order tracking. Additionally, AI-powered voice recognition enables personalized recommendations, improving customer loyalty. As consumers increasingly adopt hands-free shopping, retailers heavily invest in voice-enabled technology, further solidifying their market position. No other industry matches retail’s scale, ensuring its continued leadership in the voice commerce landscape.

The Healthcare sector is the second-largest segment in the voice commerce market, benefiting from AI-driven voice assistants that streamline patient interactions, medication reminders, and telehealth services. Voice technology enhances accessibility for elderly and disabled patients, enabling hands-free appointment scheduling and prescription refills. Healthcare providers leverage voice commerce for personalized patient engagement and remote monitoring, reducing administrative burdens. As voice recognition technology improves accuracy and security, the industry increasingly adopts voice-based solutions for medical consultations and data retrieval. With growing demand for digital health solutions, the healthcare sector continues to expand its footprint in the voice commerce ecosystem.

The Voice Commerce Market Report is segmented based on the following

By Device Type

- Smart Speakers

- Smartphones

- Wearables

- In-Car Systems

- Others

By Industry Vertical

- Consumer Goods & Retail

- Healthcare

- Automotive

- Travel & Tourism

- Others

Regional Analysis

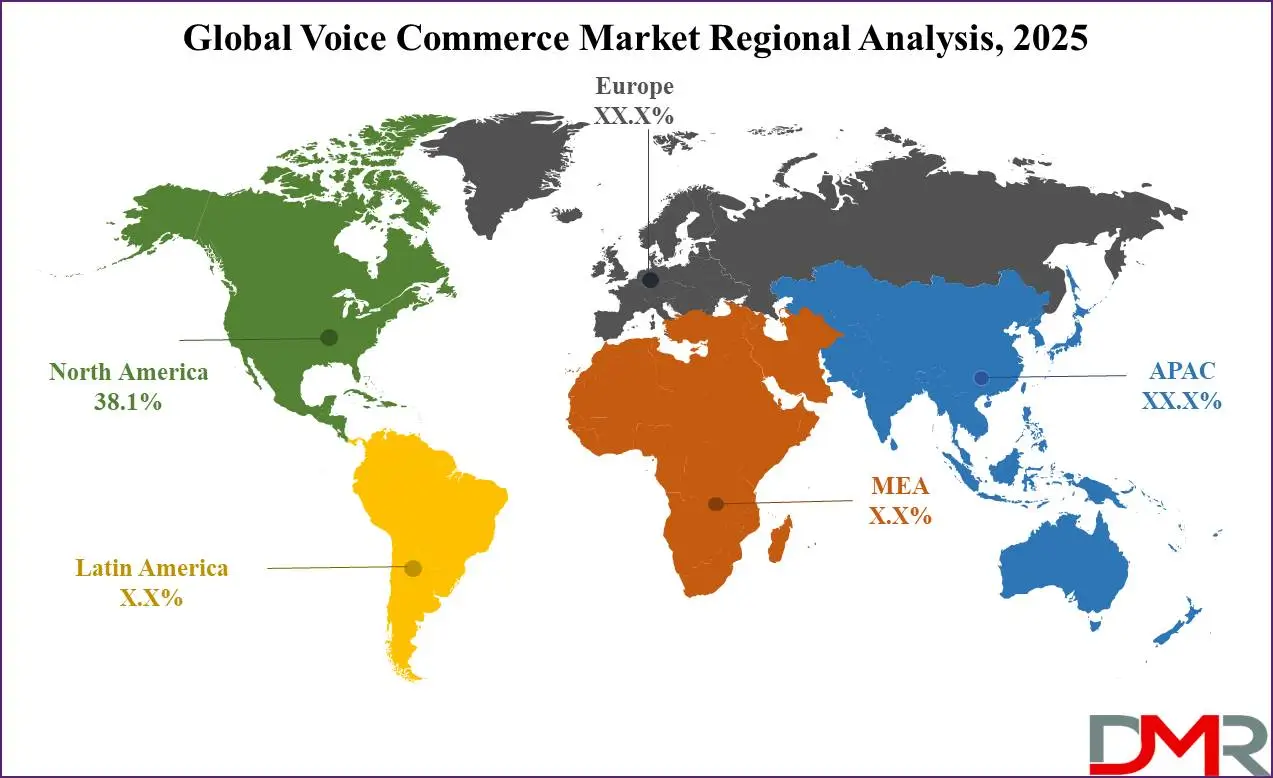

Region with the largest Share

North America is predicted to dominate the global voice commerce market with a revenue

share of 38.1% in 2025, due to its high adoption of smart speakers and voice assistants, particularly Amazon Alexa, Google Assistant, and Apple’s Siri. The region benefits from a tech-savvy consumer base, a well-developed digital infrastructure, and robust e-commerce platforms. Companies invest heavily in AI and machine learning to improve voice recognition and user experiences, making transactions seamless. Retail giants like Amazon, Walmart, and Target aggressively integrate voice commerce, enhancing customer engagement. These factors, combined with strong investment in technology and innovation, position North America as the leader in voice commerce adoption.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia-Pacific is projected to experience the highest CAGR in the voice commerce market due to its rapidly expanding internet penetration, growing smartphone adoption, and increasing use of voice assistants in countries like China, India, and Japan. The region’s rising middle-class population and digital transformation efforts are driving demand for voice-enabled shopping. E-commerce giants such as Alibaba and JD.com are heavily investing in AI-driven voice technologies. Additionally, the popularity of local voice assistants, language support advancements, and government initiatives promoting digital commerce contribute to the region’s accelerated growth, making it the fastest-growing market for voice commerce globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global voice commerce market is highly competitive, with key players like Amazon, Apple, Google, Samsung, and Alibaba leveraging AI-driven voice assistants to enhance user experience. Companies such as Salesforce, Adobe, and Twilio focus on integrating voice technology into enterprise solutions. Strategic initiatives include product innovations, partnerships, and acquisitions to strengthen market presence. Amazon’s Alexa and Google Assistant dominate, while Apple’s Siri and Samsung’s Bixby expand capabilities. Alibaba targets e-commerce dominance in Asia. Emerging players like Algolia and BigCommerce enhance search and shopping experiences. The market is driven by advancements in NLP, voice recognition, and AI-driven personalization.

Some of the prominent players in the global Voice Commerce Market are

- Adobe Inc.

- Algolia Inc.

- Alibaba Group Holding Ltd.

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- Baidu Inc.

- BigCommerce Pty. Ltd.

- Google LLC

- Salesforce Inc.

- Samsung Electronics Co.

- Sonos Inc.

- Sony Corp.

- Twilio Inc.

- Vizio Inc.

- Microsoft Corporation

- Meta Platforms, Inc.

- Walmart Inc.

- Nvidia Corporation

- Oracle Corporation

- Other Key Players

Recent Developments

- In August 2024, Samsung upgraded its AI voice control for Bespoke appliances, enhancing home management with more precise and intuitive voice commands. This advanced AI technology streamlines the operation and personalization of Samsung’s smart home devices.

- In June 2024, Adobe Commerce achieved Adobe Technology Partner status at the Gold Level following a new integration.

- In August 2024, SoundHound AI acquired Amelia, a leading enterprise AI software company specializing in voice interfaces and natural language conversational technology for customer service applications.

- In September 2024, Salesforce reached an agreement to acquire Tenyx, with the deal expected to be finalized in 2025. This acquisition will incorporate Tenyx’s Voice AI technology into Salesforce’s solutions, strengthening its autonomous agent capabilities and AI-powered customer service offerings.

- In May 2022, Sonos announced plans to enhance its voice assistant capabilities, introducing more advanced voice control for its speakers. This update aims to refine voice recognition and functionality, allowing users to interact more seamlessly with their Sonos audio systems through intuitive and responsive commands.

Frequently Asked Questions

How big is the Global Voice Commerce Market?

▾ The Global Voice Commerce Market size is estimated to have a value of USD 89.8 billion in 2024 and is expected to reach USD 693.0 billion by the end of 2033.

Which region accounted for the largest Global Voice Commerce Market?

▾ North America is expected to be the largest market share for the Global Voice Commerce Market with a share of about 38.1% in 2024.

Who are the key players in the Global Voice Commerce Market?

▾ Some of the major key players in the Global Voice Commerce Market are Apple Inc., Google LLC., Salesforce Inc., and many others.

What is the growth rate in the Global Voice Commerce Market?

▾ The market is growing at a CAGR of 25.5 percent over the forecasted period.

How big is the US Voice Commerce Market?

▾ The US Voice Commerce Market size is estimated to have a value of USD 28.8 billion in 2024 and is expected to reach USD 198.0 billion by the end of 2033.