This highlights a persistent demand for sustainable solutions. With 66% of U.S. adults classified as overweight or obese, and 35% falling into the obese category, the market's addressable base continues to expand. Additionally, evolving consumer behaviors, such as reducing added sugar consumption (currently averaging 17 teaspoons daily) and embracing lifestyle changes like daily 30-minute walks, create opportunities for innovative offerings.

Metabolism-boosting approaches, such as increased water intake (which can elevate metabolic rates by 24-30%), underline the potential for science-backed interventions. Companies positioned to deliver sustainable, evidence-based products and services are poised to capture significant growth in this $72 billion U.S. weight management industry.

Further, the global Weight Loss and Weight Management market is set to expand due to the increasing concern of alcohol misuse. Excessive alcohol consumption leads to obesity by slowing down fat burning, causing overeating, converting calories into stored fat, & triggering cravings for high-calorie foods. Furthermore, the market is fueled by the growing inactive lifestyles among individuals.

The weight loss market, influenced by health trends and shifting demographics, has grown significantly in recent years. Data reveals that 49% of U.S. adults attempt weight loss annually, with women (56.4%) outpacing men (41.7%).

Diverse motivations drive this behavior 95% for personal wellbeing, 84.6% for fitness, and 70.4% for appearance. Health disparities further highlight the need for targeted solutions—obesity affects 41% of adults, with higher rates among African Americans (55.9% of women) and Hispanics (46.8% of women).

Cultural nuances shape approaches: 50% of Hispanics dieted last year compared to 34% of non-Hispanic whites. Additionally, 32% of African Americans actively seek health benefits, surpassing 19% of non-Hispanic whites.

Adolescents (20%) and children under six (12.7%) also face rising obesity rates. The growing demand for weight loss solutions underscores the market's potential to foster healthier lifestyles, address inequalities, and promote holistic wellbeing.

The weight loss industry offers immense opportunities for innovation, with events and conferences serving as vital platforms for growth and collaboration. Global gatherings like health expos, nutrition conferences, and fitness summits bring together experts, businesses, and enthusiasts to explore cutting-edge solutions for weight management.

These events showcase advancements in technology, diet plans, and behavioral therapies, creating networking opportunities for stakeholders. The rising demand for personalized weight loss strategies, fueled by health awareness and lifestyle shifts, highlights a growing market. Participating in such events not only fosters knowledge sharing but also positions businesses to capitalize on trends and address global health challenges.

Market Dynamic

A major growth driver is the worldwide growth in overweight & obese populations, fueled by the consumption of unhealthy foods. Moreover, countries like India, Germany, China, the US, & the UK have a significant obese population. As increasing R&D investment in

medical devices, mainly in developed & developing economies, creates doors for high growth.

Further, advancements in anti-obesity medications due to robust research efforts also boost market growth. The emphasis on healthcare improvement & infrastructure further drives growth, with collaborations between public & private entities creating additional growth prospects by integrating modern technologies.

However, challenges to market growth include high R&D costs, limited infrastructure in certain regions, uneven healthcare access, & awareness gaps in less developed economies. Additionally, unfavorable compensation setups & technology gaps in emerging markets, alongside the steep initial & maintenance expenses of weight management equipment, hindered insurance coverage, regulatory hurdles, & inadequate infrastructure in lower and middle-income countries, are anticipated to restrain the market's progress during the forecast time.

Research Scope and Analysis

By Diet

In 2023, the global market is noticing remarkable growth within the supplement segment, mainly fueled by growth in demand for supplementary protein sources. This complex macromolecule plays a major role in efficient weight management & loss programs, due to its natural ability to facilitate cellular repair & regeneration.

Its significance resonates along diverse demographics, beyond gender & age barriers. Health professionals also advise pursuing a positive rapport with dietary plans that deliver large portions of beneficial fats, carbohydrates, dietary fiber, & proteins, as each of these nutrients contributes significantly to sustaining physical well-being.

Further, following established guidelines, it is recommended that an individual’s intake approx. 0.8 grams of protein per kilogram of body weight into their daily consumption. All such factors are further anticipated to drive the future of the segment along with the market as well.

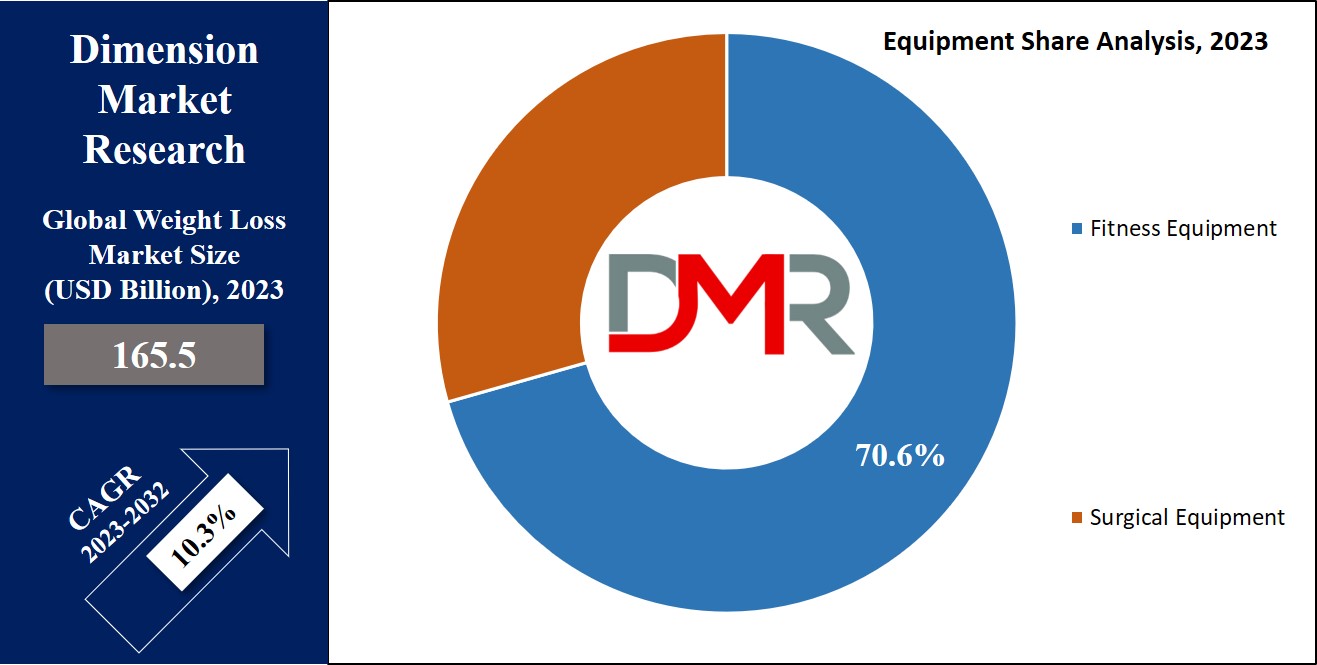

By Equipment

In 2023, fitness equipment emerges as a major driver in expanding the worldwide weight loss market. This is achieved by addressing the growing need for accessible & efficient workout solutions, as such solutions include equipment like treadmills & stationary bikes, which support cardiovascular activities, alongside smart devices possessing customized training attributes.

As health gains growth in people's priorities, the fitness equipment sector constantly generates innovative concepts, enhancing its major role in fostering successful weight loss journeys. These combined elements are anticipated to sustain market expansion well into the future.

By Services

In 2023, there is a renewal for fitness establishments, with gyms and outdoor sports facilities that started in 2022 and have gradually resumed operations following pandemic-induced shutdowns. In addition, the global market observed a rise in the establishment of fitness centers, fueled by growing consumer demand. Further, online fitness programs proved successful, contributing substantial revenue. A high number of individuals engaged with fitness applications for weight management purposes & this trend is anticipated to fuel & drive the future of the market as well

The Global Weight Loss Market Report is segmented on the basis of the following

By Diet

By Equipment

- Fitness Equipment

- Surgical Equipment

By Services

- Fitness Centers

- Consulting Services

- Slimming Centers

- Online Programs

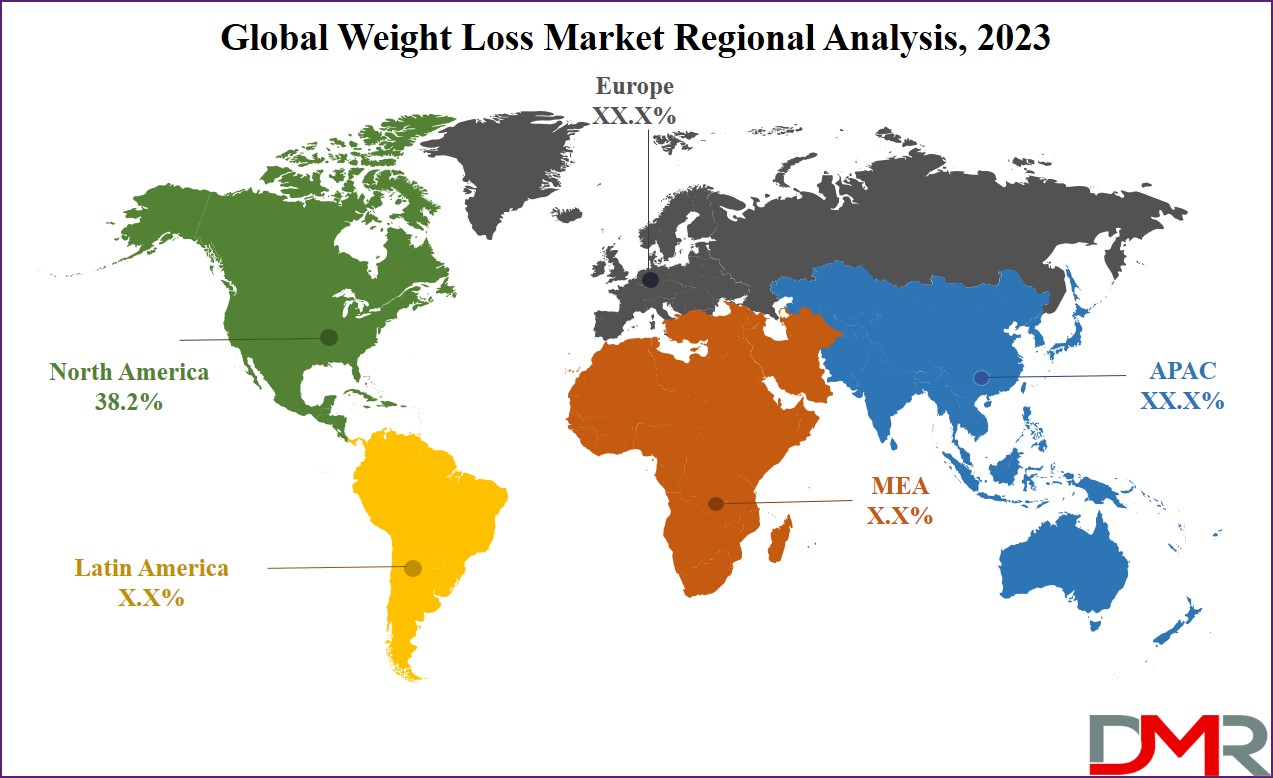

Regional Analysis

North America leads the market by capturing a significant market share of about

38.2% in 2023 and it is a leading region in the global weight loss market. Further, in the coming years, North America is anticipated to hold its lead in the global Weight Loss market, mainly driven by its large-scale accessibility to weight loss programs, including standalone physical facilities & online offerings. The cost factor plays a major role in weight loss endeavors, as the need for wholesome but relatively more expensive

food products adds to the expenses involved.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The key market players are utilizing diverse strategic measures to expand their market presence & secure a competitive advantage within the global weight loss market. These leading organizations are concentrating on tactical operations like mergers & acquisitions, collaborative technological ventures, partnerships, significant investments, & the introduction of useful products. These initiatives are focused on not only expanding their proficiency & range of offerings but also solidifying their foothold in the competitive landscape.

For instance, in March 2023, Viking Therapeutics announced the initiation of Phase I clinical trials for its weight reduction medications. This trial includes the assessment of VK2735, a compound that functions as a dual agonist targeting both glucagon-like peptide 1 (GLP-1) & glucose-dependent insulinotropic polypeptide (GIP) receptors.

Some of the prominent players in the Global Weight Loss Market are

- Herbalife Ltd

- Ethicon Inc

- Covidien Plc

- Apollo Endosurgery

- Johnson Health Tech

- Jenny Craig

- Kellogg Company

- eDiets Inc

- Nutrisystem Ltd.

- Atkins Nutritionals Inc

- Other Key Players

Recent Developments

- September 2025: Aspen Pharmacare received regulatory approval in South Africa for the Mounjaro (tirzepatide) pen formulation—previously available only as a vial—boosting competition with Novo Nordisk's Wegovy; the company anticipates that Mounjaro could reach 1 billion rand in sales within two years, with chronic weight management indication approvals pending.

- August 2025: The U.S. FDA approved Teva Pharmaceuticals' generic liraglutide—a first-ever generic version of the weight-loss drug originally branded as Saxenda—offering a more affordable option for obese adults and adolescents; this marks a major competitive shift in the weight-loss medication market.

- July 2025: Dr. Reddy’s Laboratories announced plans to launch a generic version of Wegovy (semaglutide) across 87 countries starting next year, including markets like Canada, Brazil, India, and Turkey, with rollouts in the U.S. and Europe expected between 2029 and 2033.

- June 2025: Results from the Phase III REDEFINE clinical trials for CagriSema (a combination of cagrilintide + semaglutide) were published, showing 20.4 % average weight loss over 68 weeks (versus 14.9 % with semaglutide alone), signaling a significant next-gen therapeutic potential in obesity treatment.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 165.5 Bn |

| Forecast Value (2032) |

USD 399.3 Bn |

| CAGR (2023-2032) |

10.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Diet (Beverage, Supplement and Meal), By Equipment (Fitness Equipment and Surgical Equipment), By Services (Fitness Centers, Consulting Services, Slimming Centers and Online Programs) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Herbalife Ltd, Ethicon Inc, Covidien Plc, Apollo Endosurgery, Johnso Healthcare Tech, Jenny Craig, Kellogg Company, eDiets Inc, Nutrisystem Ltd, Atkins Nutritionals Inc, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |