The global whiskey industry comprises production and its dissemination across the world and consumption by the people of different continents. It encompasses whiskey producers, from big multinational companies to micro-distilleries, developing an enormous array of whiskey variations to correspond with particular client demands. Considerations such as shifting consumer demands and affordability, regulations, and culture are among the many that keep the market intricate and ever-changing.

Countries such as North America, Scotland, and Ireland have been among the main participants in the past, yet now we are witnessing the growth of new markets in Asia and Latin America. The marketplace is marked by its flexibility in adapting to emerging trends, technological advancements in production systems as well as advertising strategies that are designed to boost the degree of brand visibility and consumer engagement. In short, the global whiskey industry is a competitive and dynamic marketplace that is driven by innovation, subculture, and consumer demands.

As per World Whisky Day, the whiskey market showcases remarkable global dynamics and growth opportunities. Kentucky leads bourbon production, contributing 95% of the world's supply, underscoring its dominance in this category. Scotland, home to 5.4 million people, boasts over 20 million casks of whisky—nearly four per citizen. If aligned end-to-end, these casks span 30,000 kilometers, equivalent to six Edinburgh-New York distances. France, a key European market, attributes 47.2% of spirit retail sales to whisky, vastly surpassing Cognac at 0.7%, according to the French Federation of Spirits.

The production process remains selective, with only a fraction of the 300,000 barley varieties suitable for malt whisky. Additionally, whisky aligns with health-conscious trends, offering just 64 calories per measure, fewer than a banana. Emerging innovations, such as Kikori, a Japanese whisky made entirely from rice, reflect market diversification. Notably, Scotch whisky alone contributes nearly £5 billion annually to the UK economy, emphasizing its economic significance.

The whiskey industry has recently witnessed significant activity in mergers and acquisitions. In December 2023, Bacardi expanded its investment in Teeling, a premium Irish whiskey brand, aiming to solidify its foothold in the high-end whiskey market. Similarly, as reported by Just-Drinks in 2024, an Italian spirits conglomerate acquired a 14.6% stake in Capevin for £69.9 million (approximately $92.3 million). Adding to this momentum, the Sazerac Company revealed plans in March 2024 to purchase BuzzBallz, a brand specializing in ready-to-drink cocktails, signaling its intent to diversify its product portfolio. These strategic initiatives highlight the industry's adaptive response to shifting consumer trends and its drive for broader market influence.

Key Takeaways

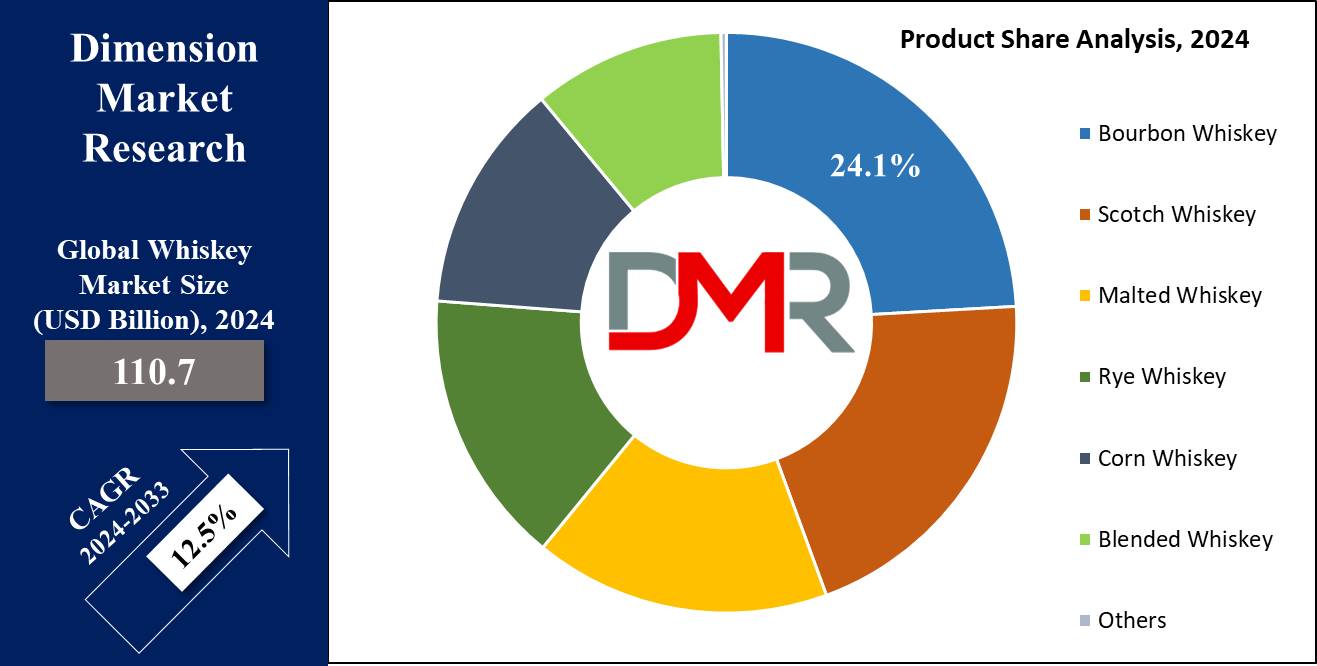

- Market Value: The global whiskey market is projected to reach a market value of USD 123.1 billion in 2025, in comparison to USD 318.3 in 2033 at a CAGR of 12.5%.

- Market Definition: The global whiskey market is a global business where companies from different countries sell whiskey to people globally.

- Product Segment Analysis: Bourbon whiskey is expected to exert its dominance in this segment with 24.1% of market share by the end of 2024.

- Quality Segment Review: Premium quality whiskey between high-end and super-premium whiskey is expected to dominate the global whiskey market with the highest market share in 2024.

- Flavor Segment Analysis: Flavored whiskey with flavors like citrus, honey, apple, caramel, and others is projected to dominate the flavor segment in 2024.

- Distribution Channel Analysis: B2C also known as the Business-to-consumer distribution channel is projected to command this market with 73.1% of the market share in 2024 followed by the B2B distribution channel with 26.9% of the market share in 2024.

- Growth Factors: The growth of the whiskey market is fueled by increasing demand from consumers, expanding distribution networks, and revolutionary product services.

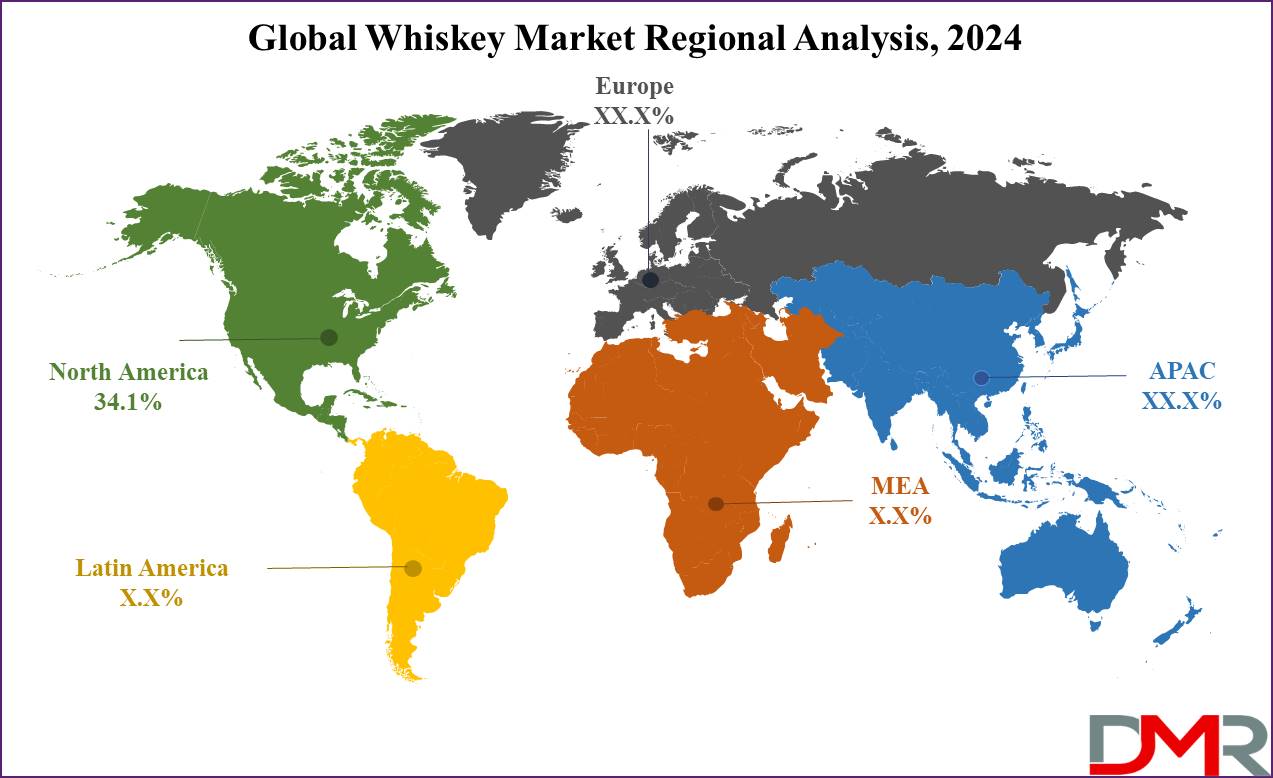

- Regional Preview: North America is anticipated to dominate the global whiskey market with 34.1% of the market share by the end of 2024.

Use Cases

- Socializing: Whiskey catalyzes social gatherings, fostering camaraderie and communique among friends, colleagues, and family members.

- Celebration: In some cases, whiskey serves as an image of milestones and achievements, generally enjoyed during weddings, anniversaries, and different massive occasions.

- Relaxation: Whiskey offers a moment of relaxation and indulgence, offering a relaxing escape from the stresses of everyday lifestyles.

- Culinary Pairing: Its complex flavors supplement a wide range of dishes, improving dining reviews and raising gastronomic adventures.

- Investment: Rare and collectible whiskies function as valuable assets, attracting buyers in search of financial returns and connoisseurship satisfaction.

Market Dynamic

The global whiskey market is pushed by numerous dynamic factors. Evolving client preferences, which include a developing interest in top-rate and craft offerings, continually shape market developments. Additionally, converting demographics, including the upward thrust of younger whiskey lovers and expanded female participation, impact product improvement and advertising and marketing techniques. Economic factors, geopolitical events, and change regulations also impact market dynamics, affecting production expenses, distribution channels, and export opportunities.

Furthermore, environmental worries and sustainability projects play a growing role, prompting distilleries to adopt eco-friendly practices, a trend also seen in the Green Technology & Sustainability Market. Technological advancements, specifically in manufacturing and distribution procedures, in addition, drive innovation and performance in the industry, with innovations in the Packaging Market ensuring product integrity and appeal.

Overall, the global whiskey market is characterized by way of its adaptability to convert customer demands, financial conditions, and industry trends, including the use of Paper Packaging Material Market solutions for eco-friendly presentation.

Research Scope and Analysis

By Product

Bourbon whiskey is projected to dominate the product segment in the global whiskey market with

24.1% of the market share in 2024. Bourbon whiskey dominates this section majority due to its deep-rooted affiliation with American subculture and heritage. Distilled predominantly inside the United States, bourbon advantages from stringent production regulations that mandate specific components and growing older methods, making sure of constant great taste.

The candy and robust flavor profile, derived from aging in charred oak barrels, appeals to a huge variety of palates, contributing to bourbon's considerable popularity. Additionally, aggressive advertising and marketing efforts and strategic branding initiatives have strengthened bourbon's visibility and patron enchantment both locally and internationally. With its wealthy records, wonderful flavor profile, and effective advertising techniques, bourbon stands out as a quintessentially American spirit, solidifying its dominance in the global whiskey market.

By Quality

Premium whiskey is expected to dominate the global whiskey market in the context of quality of whiskey with the highest market share in 2024. Premium whiskey's dominance in the quality segment is because it combines awesome craftsmanship, advanced elements, and meticulous getting-old processes. These elements bring about a cultured taste profile and a heightened sensory reveal that discerning consumers are seeking.

Moreover, top-rate whiskey brands often boast rich backgrounds, authenticity, and culture, resonating with consumers who price exclusivity and prestige. The perceived luxury and status related to top-rate whiskey make it a favored choice for unique occasions and gifting, similarly riding its dominance within the market. Additionally, focused advertising techniques emphasizing craftsmanship, history, and distinctiveness strengthen the top-class phase's attraction, solidifying its role as the preferred preference among exceptional-conscious customers.

By Flavor

Flavored whiskey is projected to dominate the global whiskey market in terms of flavor with the highest market share in 2024. Flavored whiskey commands the market broadly because of its attraction to a broader consumer base and its versatility in catering to evolving taste alternatives. Firstly, flavored whiskey offers a revolutionary twist to standard whiskey, attracting purchasers who might also find unflavored options too severe or harsh.

Flavors like citrus, honey, caramel, cider, and apple offer a smoother and extra approachable flavor profile, making them famous alternatives amongst newbie whiskey drinkers and people seeking out a milder experience. Moreover, flavored whiskey opens up opportunities for experimentation and creativity in cocktails, appealing to mixologists and purchasers alike. This versatility complements its recognition in bars, restaurants, and home settings, raising the need for flavored versions.

Additionally, flavored whiskey regularly appeals to more youthful demographics and female customers who may be drawn to its sweeter and extra numerous flavor services. As a result, flavored whiskey continues to dominate the market segment, representing a tremendous portion of common whiskey sales and intake.

By Distribution Channel

B2C also known as a Business-to-consumer distribution channel is anticipated to dominate the global whiskey market with 73.1% of market share in 2024. B2C (Business-to-Consumer) dominates the whiskey distribution channel because of numerous key reasons. Firstly, B2C channels offer direct access to cease purchasers, permitting whiskey manufacturers to establish an immediate connection with their target audience.

Through current change stores, conventional liquor shops, uniqueness stores, online retail systems, and other consumer-centered channels, manufacturers can exhibit their merchandise prominently, thereby increasing visibility and influencing purchasing choices. Moreover, B2C channels offer a diverse array of options for customers to select from, catering to various tastes, choices, and budgets. This versatility enhances purchaser pleasure and encourages repeat purchases.

By End User

HoReCa (Hotel, Restaurant, and Café) is expected to dominate the global whiskey market in the end-user segment with the highest market share in 2024. HoReCa dominates the whiskey market section in general because of its function as a key destination for socializing, dining, and enjoyment. Firstly, HoReCa establishments provide a wide range of whiskey alternatives to cater to various consumer choices, offering a platform for whiskey fanatics to explore numerous manufacturers and expressions. Moreover, these venues often hire knowledgeable staff who can guide purchasers in selecting and appreciating specific whiskies, improving the overall consumer experience.

Additionally, the atmosphere and social placement of HoReCa stores create possibilities for whiskey consumption in a convivial ecosystem, encouraging customers to bask in top-rate services and area of expertise cocktails. Furthermore, partnerships and promotions between whiskey brands and HoReCa establishments foster logo visibility and patron loyalty, further solidifying HoReCa's dominance in the whiskey market section.

The Whiskey Market Report is segmented based on the following:

By Product

- Bourbon Whiskey

- Scotch Whiskey

- Single Malt Scotch Whiskey

- Blended Scotch Whiskey

- Malted Whiskey

- Rye Whiskey

- Corn Whiskey

- Blended Whiskey

- Others

By Quality

- Premium

- High-End Premium

- Super Premium

By Flavor

- Flavored

- Citrus

- Honey

- Caramel

- Cider

- Apple

- Others

- Unflavored

By Distribution Channel

- B2C

- Modern Trade

- Traditional Liquor Stores

- Specialty Stores

- Online Retail

- Other

- B2B

By End User

- HoReCa (Hotel, Restaurant, and Café)

- Household

Regional Analysis

North America is projected to dominate the global whiskey market with the highest market

share of 34.1% by the end of 2024. North America, in particular the United States, dominates the global whiskey marketplace for numerous reasons. Firstly, America is the birthplace of bourbon, a style of whiskey that has received huge popularity globally. Additionally, the American whiskey enterprise takes advantage of huge advertising efforts, sturdy distribution networks, and a wealthy tradition and expertise in whiskey making.

Moreover, the presence of iconic manufacturers like Jack Daniel's, Jim Beam, and Maker's Mark contribute to North America's stronghold in the whiskey market. Furthermore, favorable regulatory organizations and institutions help the export of American whiskey to international markets, in addition to solidifying its international dominance. With an aggregate of background, innovation, and market right of entry, North America continues its leading position within the whiskey industry, constantly expanding its influence on an international scale.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The whiskey market is fiercely aggressive, characterized by established brands vying for market proportion alongside an influx of craft distilleries. Global giants like Diageo, Pernod Ricard, and Brown-Forman dominate with their various portfolios and good-sized distribution networks. These enterprise giants continuously innovate, introducing new expressions and leveraging advertising prowess to hold their positions.

However, the marketplace additionally sees the upward thrust of smaller, artisanal distilleries, presenting unique flavors and narratives that enchantment to a growing segment of discerning customers. Additionally, nearby players in various region’s developing countries like Japan and India have made vast strides, challenging conventional Scotch and American whiskey dominance. As customer tastes evolve, the whiskey panorama remains dynamic, developing opportunities for both hooked-up gamers and beginners to seize market attention.

Some of the prominent players in the Global Whiskey Market are

- Chivas Brothers

- William Grant & Sons

- Bacardi

- Diageo

- La Martiniquais

- The Edrington Group

- Belvedere

- Beam Suntory

- Whyte & Mackay

- Inver House

- LVMH

- Loch Lomond

- Other Key Players

Recent Development

- In January 2024, Scotch Malt Whisky Society's parent company, ASC, acquires Single Cask Nation, emphasizing international expansion and preserving distinct brands' identities.

- In December 2023, CaskX partners with Sagamore Spirit for whiskey investment, offering tangible assets with potential value appreciation. Maryland Rye Whiskey's quality and demand surge contribute to whiskey's investment appeal.

- In October 2023, Amber Beverage Group plans a huge investment in a new Irish whiskey distillery in Dunleckney, County Carlow, aiming for USD 4 million LPAs annually, enhancing global presence.

- In September 2023, Avalon Spirits Corporation, led by industry veteran John Glover, acquired TSS Brands, including Whiskey Row Bourbon, aiming to build a premium spirits portfolio.

- In September 2023, Artory and Winston Art Group introduced the Cask100 Fund, a USD 20.0 million closed-end fund investing in rare whiskies and fine wines, offering potential returns to accredited investors.

- In March 2023, Pernod Ricard USA acquired a majority stake in Skrewball, a peanut butter-flavored whiskey brand, aiming to expand its premium spirits portfolio.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 110.7 Bn |

| Forecast Value (2033) |

USD 4.7 Bn |

| CAGR (2023-2032) |

12.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product (Bourbon Whiskey, Scotch Whiskey, Malted Whiskey, Rye Whiskey, Corn Whiskey, Blended Whiskey, and Others), By Quality (Premium, High-End Premium, and Super Premium), By Flavor (Flavored, and Unflavored), By Distribution Channel (B2C, and B2B), By End User (HoReCa (Hotel, Restaurant, and Café), and Household Retail) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Chivas Brothers, William Grant & Sons, Bacardi, Diageo, La Martiniquaise, The Edrington Group, Belvedere, Beam Suntory, Whyte & Mackay, Inver House, LVMH, Loch Lomond, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |