Market Overview

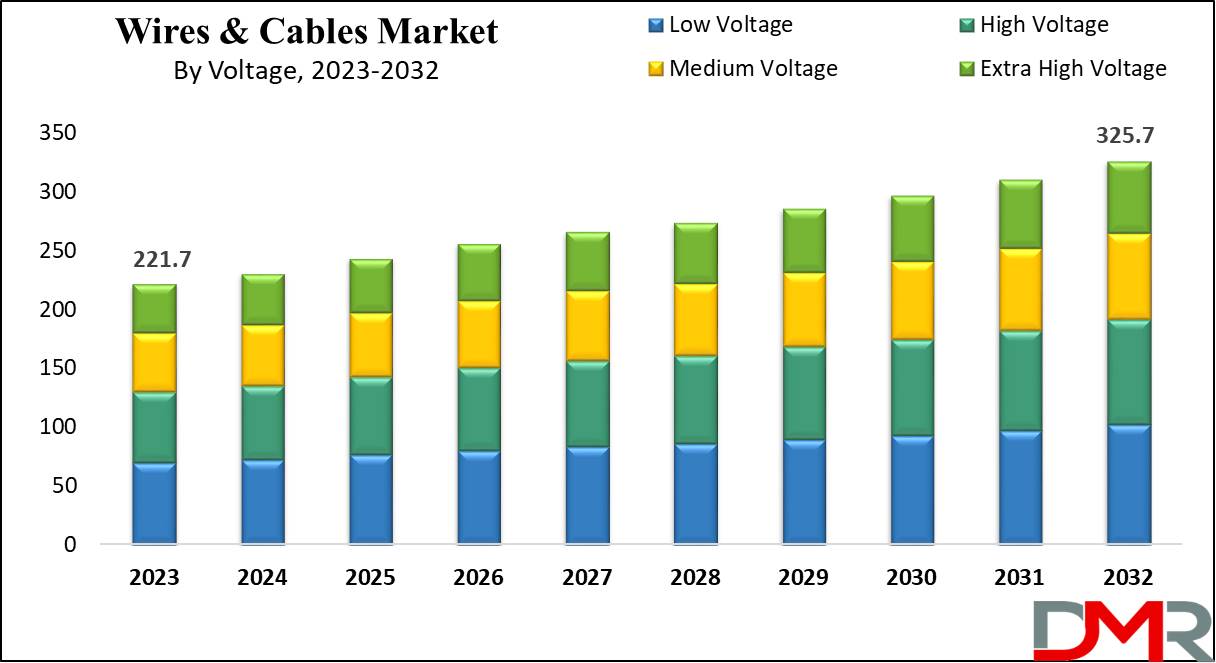

The Global Wires & Cables Market is expected to reach a value of USD 221.7 billion in 2023, and it is further anticipated to reach a market value of USD 325.7 billion by 2032 at a CAGR of 4.4%. The market has seen a significant increase in the recent past and is predicted to grow significantly during the forecasted period as well.

A cable is developed by multiple insulated wires encased in a single jacket, allowing them to be bundled together, whereas a wire consists of a single conductor. The market aims to contain different types of wire and cable installations utilized in critical end-user environments like telecommunications, construction, and power infrastructure.

Recently, the global wires and cables market has seen remarkable advancements and opportunities. Increased investments in renewable energy as well as large infrastructure projects have driven an upsurge in power transmission cables demand for wind and

Solar Cells systems as well as smart grid implementation, driving growth in high voltage cables necessary for effective energy transmission.

Demand for wires and cables has increased due to urbanization and industrialization in Asia-Pacific and the Middle East, as well as government initiatives like U.S. Infrastructure Investment and Jobs Act and Europe's Net-Zero Industry Act that promote local manufacturing while encouraging advanced cable technologies that meet energy efficiency and sustainability targets.

Emerging opportunities in this market include fiber optics for telecom and the application of advanced cables in electric vehicle charging infrastructure. Companies are investing in innovations like lightweight cables and recyclable materials in order to address environmental sustainability. Unfortunately, challenges such as raw material price volatility and supply chain disruptions continue to limit market expansion dynamics.

The global electrical wiring solutions industry has experienced increased activity across energy and telecommunications applications. Roughly 30 percent of cable usage globally supports renewable energy projects such as wind or solar farms, reflecting increasing adoption of green energy solutions. Fiber optic cables—which transmit data at nearly 99.7 percent efficiency—remain popular within telecom infrastructure industries worldwide with millions of kilometers deployed each year.

Copper cables account for over 60% of material use in construction and infrastructure due to their superior conductivity, with aluminum providing about 25% as a cost-effective alternative. Every year worldwide over 5 million kilometers of underground power cables are laid, and up to 70% of wiring applications in urban areas now utilize flame retardant materials for safety compliance purposes.

Key Takeaways

- Market size & growth: The Global Wires & Cables Market was valued at USD 221.7 billion in 2023 and is projected to reach USD 325.7 billion by 2032, reflecting a CAGR of 4.4% — steady, long-term expansion driven by infrastructure and energy transitions.

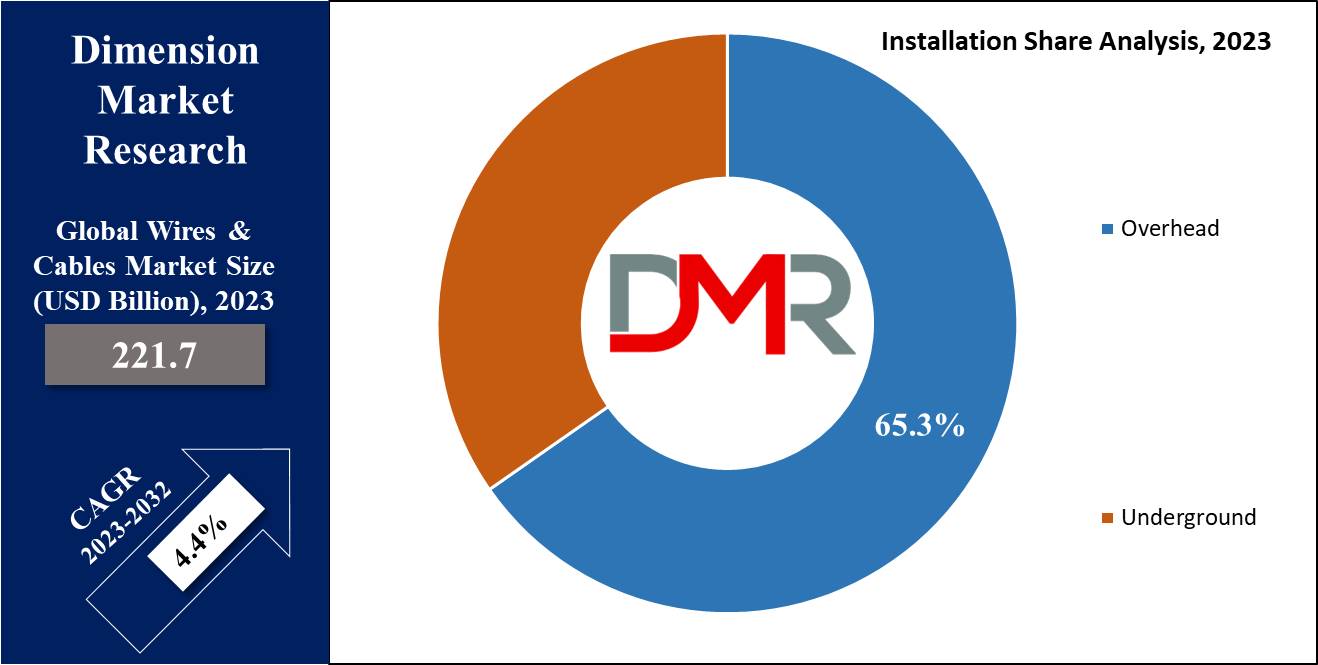

- Leading segments: The low-voltage segment held the largest revenue share in 2023 (widespread use in building wires, LAN, appliances, distribution). By installation, overhead remains the largest share today, while underground installations are the fastest growing due to lower losses and resilience.

- Top end-users & applications: Energy & power dominates revenue (grid upgrades, HV transmission, renewable interconnections). Building & construction, telecom (fiber optics), and EV charging infrastructure are important demand pockets.

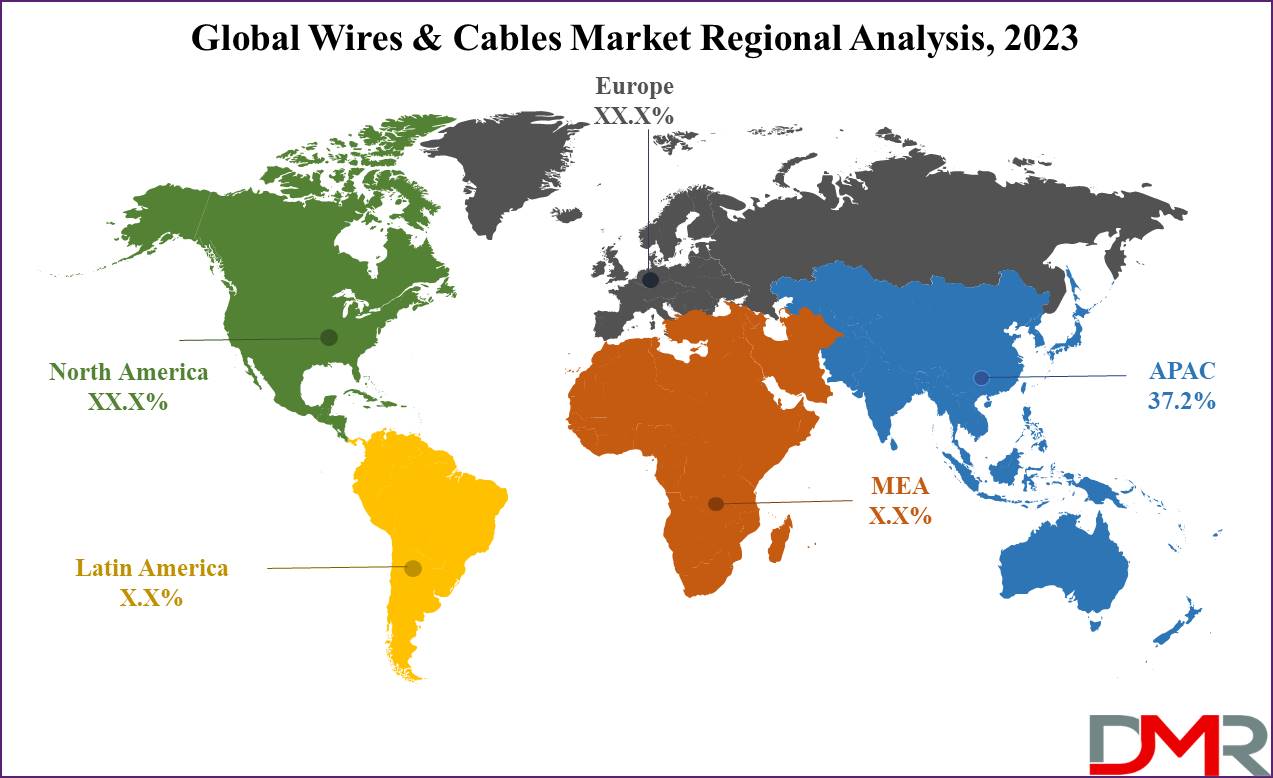

- Regional performance: Asia-Pacific is the largest regional market (~37.2% of revenue) and the primary growth engine, led by China and India and supported by government initiatives (e.g., Make in India) and heavy infrastructure spending.

- Growth drivers & opportunities: Major drivers include investments in renewable energy, smart grids, urbanization, large infrastructure projects, and rising telecom/fiber deployments. Emerging opportunities: fiber optics, EV charging networks, lightweight and recyclable cable technologies.

Use Cases

- Renewable Energy Expansion: High-voltage and medium-voltage cables are critical in connecting wind farms, solar parks, and hydropower plants to national grids, supporting global renewable integration and energy transition.

- Smart Grid & Urban Infrastructure: Low-voltage and underground cables enable advanced smart grid networks, smart metering, and urban electrification projects, ensuring efficient electricity distribution and reduced transmission losses.

- Telecommunications & Data Transmission: Fiber optic cables power telecom backbones, internet infrastructure, and 5G rollouts, offering ultra-high bandwidth and low latency for digital connectivity.

- Electric Vehicle Ecosystem: Specialized charging cables and high-capacity conductors support EV charging infrastructure, including fast-charging stations, synchronized charging networks, and smart mobility solutions.

- Building & Industrial Applications: Copper and aluminum cables are widely used in residential, commercial, and industrial construction projects for wiring, HVAC systems, elevators, and fire-safe installations, ensuring compliance with safety standards.

Market Dynamic

Industrialization has played a major role in enhancing productivity, advancing

Healthcare IT Solutions, and growing overall living standards through the production of high-quality goods. Furthermore, the market is anticipated for additional growth owing to increased investments in smart metering & the modernization of electricity transmission systems. The accessibility & quality of healthcare have enhanced, resulting in lower mortality rates & a growth in birth rates, leading to a population boom & rapid urbanization.

Urban areas have noticed significant development compared to rural regions, with growing industrialization & job opportunities across different economic sectors. The adoption of smart grid technologies has encouraged investments in new underground & submarine cables, addressing the growing need for grid interconnections. The growth of the market is anticipated due to the expansion of offshore wind turbines, the execution of high-voltage direct lines, & the expansion of grid interconnections.

However, the installation of fiber optic cables creates operational challenges, including the need for excavation or conduit installation, specialized equipment, skilled technicians, and significant costs. These complications can hamper the extensive adoption of fiber optic technology despite its benefits, impacting different sectors' growth & implementation, which may further impact on expansion of the global wire & cables market over the cable period.

Research Scope and Analysis

By Voltage

The largest share of revenue in the market in 2023 is attributed to the low-voltage segment. This is mainly due to the extensive usage of low-voltage cables in numerous applications like building wires, LAN cables, appliance wires, distribution networks, & others. These cables play a major role in supporting the efficiency of smart grids, ensuring a more reliable supply of electricity to end-users. Globally, the energy and power sector is undergoing rapid changes, with both developed and developing countries witnessing a substantial surge in electricity demand. Many of these regions are also transitioning towards the integration of large-scale renewable energy sources and alternative solutions like

E-fuels.

Moreover, High voltage wires and cables, designed for transmitting electricity at levels exceeding 1,000 volts, come equipped with protective coatings like paper and oil to prevent direct contact with individuals or other materials. The quality & performance of high-voltage cables are contingent on the type of insulation materials used. The significant demand for these cables across different end-user sectors, including power distribution, oil & gas, telecom, aerospace, & defense, stands out as a major factor driving the expected growth of the high-voltage cable market in the foreseeable future.

By Installation

In 2023, the segment with the largest share of revenue is the overhead installations. This method of installing wires & cables is the most widely used approach globally. Overhead installations are considered the most straightforward & affordable means of installation. They are mainly favored in countries with lower population densities. However, in regions subjected to natural disasters like earthquakes & floods, there is a preference for underground cable installations due to their added resilience.

Further, the underground installation segment is set to notice rapid growth in the forecast period. Underground cable installations offer various advantages, like lower maintenance costs & reduced transmission losses, making them well-suited for enhancing power loads efficiently. Increasing demand across different sectors, including commercial, residential, automotive, and telecom, along with the energy & power industries, is driving the growth & modernization of infrastructure, consequently fueling the need for wire & cable products. Moreover, developing countries like India, China, Vietnam, & others are allocating a good portion of their GDP towards infrastructure development.

By End User

The energy & power sector dominates the overall revenue share in 2023, driven by technological upgrades such as transitioning to high-voltage transmission lines & innovations like synchronized electric vehicle charging. The growth in renewable energy generation has encouraged countries to interconnect their transmission systems, enabling the efficient transfer of electricity. This expanding renewable energy capacity & increased electricity trading are boosting the construction of high-capacity interconnection lines, thereby driving the wires & cables market.

Moreover, the building & construction sector is also set to experience high growth in the coming years, driven by both the renovation of aging structures & the construction of new buildings across the globe. Developing regions in the Middle East, Africa, South America, & Asia Pacific are constantly investing in infrastructure projects, like rail signaling, rail tunneling, and expanding power generation & distribution networks. This growth is further fueled by factors such as recent infrastructure development, strong economic growth in emerging markets, & growing internet accessibility, all contributing to the growth of the wire & cable market.

The Global Wires & Cables Market is segmented on the basis of the following

By Voltage

- High Voltage

- Medium Voltage

- Extra High Voltage

- Low Voltage

By Installation

By End User

- Oil & Gas

- Aerospace & Defense

- Building & Construction

- Energy & Power

- IT & Telecom

- Others

Regional Analysis

The Asia Pacific region has firmly secured a significant market share, contributing 37.2% of the total revenue in the Global Wires & Cables Market, and is anticipated for more growth in the forecasted period, mainly driven by the growing demand for lighting, power, & communication services. Further, government initiatives like "Make in India" & "Go Green" were expected to play crucial roles in the Indian market.

Moreover, according to the Indian Electrical Equipment Industry Mission Plan 2012-2022, the Indian government set ambitious goals to establish the country as a major producer of electrical equipment, with an aim of producing USD 100 billion, achieved by balancing exports & imports. These initiatives have already grown the demand for cables in recent times & are expected to continue driving growth in the forecasted period as well.

Additionally, the rising importance of Healthcare Quality Management systems and digital infrastructure across the region is indirectly supporting demand for reliable telecom and power connectivity, further fueling the expansion of the wires & cables industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The wire & cable market is characterized by fierce competition, with various key players competing for prominence. These companies are vigorously expanding their market presence through strategic partnerships & investments in innovative product offerings, thereby gaining a competitive advantage.

For instance, in May 2023, LibanCables, a subsidiary of Nexans, announced an extension of its solar power system at its Nahr Ibrahim industrial plant, enhancing its peak output capacity to 1.2 MW. Notably, this expansion includes an advanced 500kW containerized battery solution. This initiative is anticipated to result in a significant reduction of 1,500 tons of greenhouse gas emissions annually, same as that of the weight of 750 cars. This accomplishment is made possible by replacing two out of the six electric generators at the facility with photovoltaic panels.

Some of the prominent players in the Global Wires & Cables Market are

- Prysmian Spa

- Fujikura Ltd

- Nexans

- Belden Inc

- NKT A/S

- Sumitomo Corp

- Leoni AG

- Cable & System Ltd

- Southwire Company LLC

- Furukawa Electric Co Ltd

- Other Key Players

Recent Developments

- September 2025: Vanco International unveiled its new SCAT6A Slim CAT6A Patch Cable series. These ultra-slim 28 AWG stranded UTP cables have a compact 3.5 mm diameter, support 1 GHz performance, and are ideal for high-density rack and tight installations, adding flexibility and tidiness to AV setups.

- September 2025: Sterlite Technologies Limited (STL) introduced the world's slimmest IBR cable with 864 F for hyperscalers in the U.S., enhancing their portfolio of high-density, space-efficient connectivity solutions.

- August 2025: Amphenol Corporation reached an agreement to acquire CommScope’s Connectivity and Cable Solutions (CCS) business for approximately $10.5 billion in cash, marking a significant consolidation in the cable and connectivity space.

- June 2025: Nexans completed its acquisition of Cables RCT (a Spain-based low-voltage, fire-safe cable specialist). This strengthens Nexans’ Iberian presence, adds about 25% production capacity, and aligns with its electrification strategy.

- September 2025: ILJIN Electronics India, a subsidiary of Amber Group, secured ₹1,200 crore in strategic funding from ChrysCapital and InCred Growth Partners Fund I, aiming to bolster its expansion within the electronics and cable materials sector.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 221.7 Bn |

| Forecast Value (2033) |

USD 325.7 Bn |

| CAGR (2024-2033) |

4.4% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Voltage (High Voltage, Medium Voltage, Extra High Voltage, and Low Voltage), By Installation (Underground and Overhead), By End User (Oil & Gas, Aerospace & Defense, Building & Construction, Energy & Power, IT & Telecom and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Prysmian Spa, Fujikura Ltd, Nexans, Belden Inc, NKT A/S, Sumitomo Corp, Leoni AG, Cable & System Ltd, Southwire Company LLC, Furukawa Electric Co Ltd, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global Wires & Cables Market is estimated to reach USD 221.7 billion in 2023, which is further expected to reach USD 325.7 billion by 2032.

Asia Pacific dominates the Global Wires & Cables Market with a share of 37.2% in 2023.

Some of the major key players in the Global Wires & Cables Market are NKT A/S, Nexans, Leoni AG, and many others.

The market is growing at a CAGR of 4.4 percent over the forecasted period.