The global 5G Non-Terrestrial Networks market is expected to grow significantly due to the development of satellite and HAPS technologies. Because the 5G NTN can ensure global 5G coverage, even in the deepest and most underserved regions, which would be impossible with traditional terrestrial-based solutions alone, it has emerged as one of the fastest-expanding markets.

Satellite-based 5G systems form the backbone of such seamless connectivity and hence hold the key to market growth. The global 5G NTN market size is projected to be driven essentially during the forecast period by integrating 5G NTN solutions into terrestrial 5G infrastructure.

The adoption of 5G NTN technology presents new ways through which industries such as telecommunications, aerospace, defense, and maritime can improve communication. With the surging demand for high-speed connectivity, investment in infrastructure for 5G NTN has been on an upward swing. Market players, ranging from satellite providers to telecom operators and technology companies, are working toward enhancing their solutions and deploying them to leverage such increasing growth.

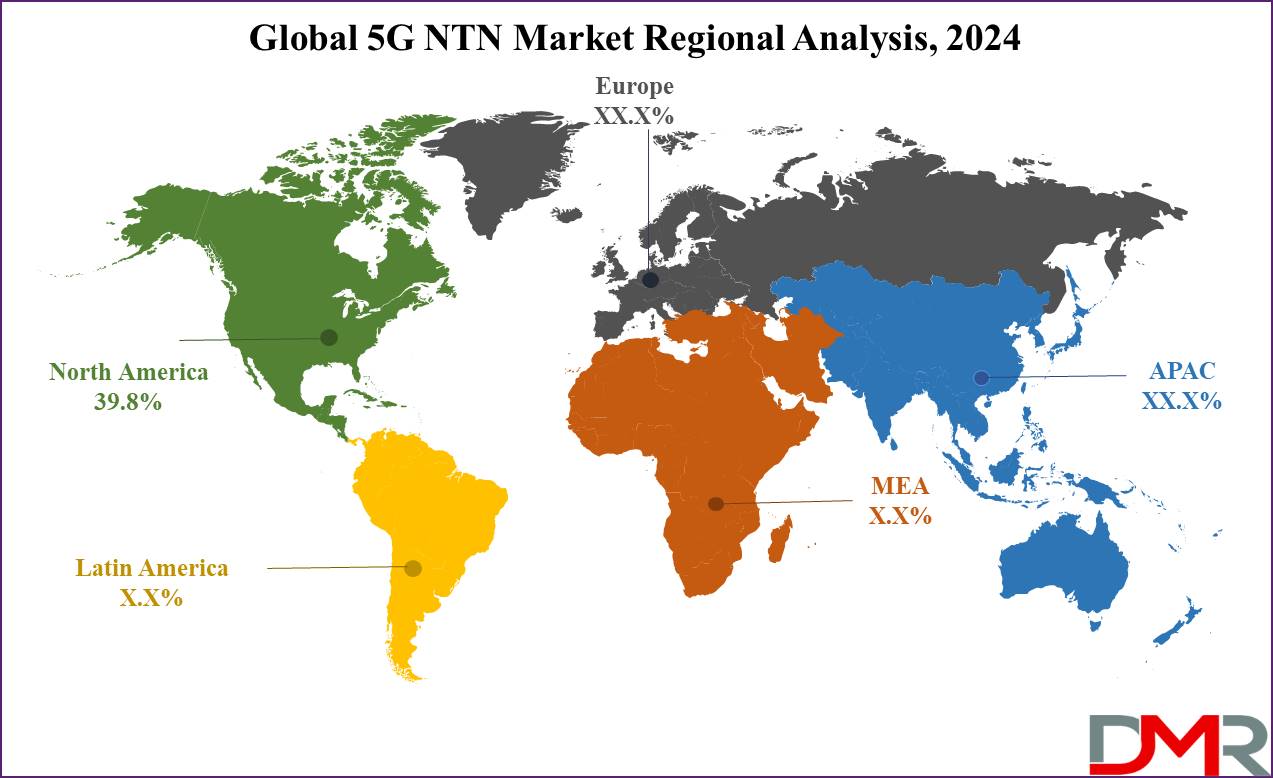

The key regions expected to contribute to substantial market shares are North America, Europe, and Asia-Pacific, with North America expected to bear the leading share due to early adoption and strong investment in 5G NTN technology. Strong demand for enhanced mobile broadband services and mission-critical communications has given a boost to the market growth.

Other trends in the global 5G NTN market also comprise increasingly integrating Artificial Intelligence AI and

Machine Learning ML for performance optimization of 5G NTN networks; hence, it has become a key growth area for the future.

The 5G NTN (Non-Terrestrial Networks) market is rapidly growing as telecom operators and service providers strive to enhance global connectivity, particularly in remote regions. Recent advances in satellite communication technology such as low Earth orbit (LEO) satellites are contributing significantly to this market growth by offering low-latency internet access with fast download speeds.

5G NTN solutions are driven by an increasing need for connectivity across various regions, including underserved and rural locations. Industries like automotive, aerospace and IoT are exploring NTN solutions as part of their digital transformation strategies and to increase communication capabilities.

Recent developments in 5G NTN highlight significant investments and partnerships between key players, such as satellite operators and telecom giants. Working alongside tech companies specializing in AI, edge computing and cloud infrastructure has greatly advanced innovation for remote sensing, data collection and real-time analytics applications.

Opportunities in the 5G NTN market are extensive, particularly when providing global 5G coverage in areas with limited terrestrial network infrastructure. As satellite constellations expand and 5G infrastructure evolves, service providers, enterprises, and governments may find ample opportunity for adopting NTN solutions for applications including telecom, logistics, smart cities and beyond.

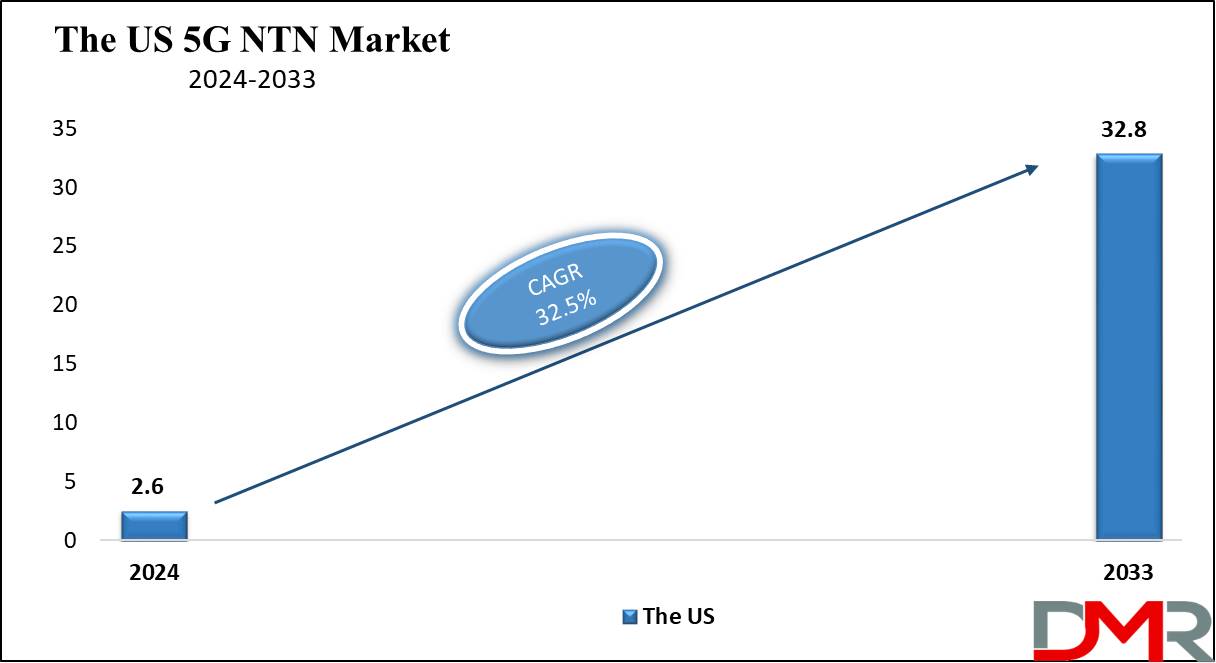

The US 5G NTN Market

The

US 5G NTN Market is set to attain a

value of USD 2.6 billion in the year 2024. Beyond that point, the market is expected to see further growth in the future, considering it retains a

value of USD 32.8 billion in 2033, at a

CAGR of 32.5%.

The U.S. 5G NTN market is poised to dominate the global landscape as the region has already been an early adopter of 5G technologies, coupled with serious investments in satellite-based 5G infrastructure.

The government of the United States has made deployment of the non-terrestrial network a priority, also with major U.S. companies in the 5G NTN business, to extend nationwide coverage to unreachable and underserved areas of the country.

This is part of the bigger picture of making sure the United States remains competitive in key technologies on the global scene. Because of the government's initiatives and investment by the private sector, the size of the U.S. market for 5G NTN is likely to record considerable growth during the forecast period.

It is marked by intense involvement, where key players in the 5G NTN industry are in product development. Key players develop end-to-end 5G NTN solutions to enhance the communication infrastructure of various industries such as defense, space, and telecommunications. US aerospace and defense industries will specifically benefit from the 5G NTN technologies because 5G NTN provides reliable and low-latency connectivity for mission-critical operations.

The U.S. 5G NTN market is also likely to grow in the eMBB application since the need for high-speed, reliable connectivity is pretty high. Strong regulatory support for the market is also an added accelerant in the growth of the 5G NTN market. North America, especially the U.S., is expected to retain its dominance in the global share of 5G NTN.

Key Takeaways

- Global Market Value: The global 5G NTN market size is estimated to have a value of USD 7.8 billion in 2024 and is expected to reach USD 114.0 billion by the end of 2033.

- The US Market Value: The US 5G NTN Market is projected to be valued at USD 2.6 billion in 2024 which is further expected to reach USD 32.8 billion by the end of 2033 at a CAGR of 32.5%.

- Regional Analysis: North America is expected to have the largest market share in the Global 5G NTN Market with a share of about 39.8% in 2024.

- By Component Segment Analysis: Hardware is projected to dominate the component segment as it holds 51.9% of market share in this market by the end of 2024.

- By Platform Segment Analysis: UAS Platform (Unmanned Aerial Systems) is anticipated to command this segment with 37.1% of the market share in 2024.

- Key Players: Some of the major key players in the Global 5G NTN Market are SpaceX (Starlink), SES S.A., OneWeb, Telesat, AST SpaceMobile, and many others.

- Global Growth Rate: The market is growing at a CAGR of 32.5 percent over the forecasted period.

Use Cases

- Enhanced Mobile Broadband (eMBB): eMBB applications, such as high-speed data transfer are very central to 5G non-terrestrial networks that provide seamless connectivity in underserved and remote areas where traditional networks cannot reach.

- Internet of Things (IoT): IoT devices are supported by 5G NTN when terrestrial networks are not available, hence it has given rise to very efficient industrial operations regarding agriculture, mining, and others with real-time monitoring and data transmission.

- Aerospace and Defense: 5G NTN provides reliable, secure communication in actual missions, thus facilitating data on a real-time basis over dispersed locations in missions that are of critical importance and ensuring the continuance of global defense coordination.

- Disaster Management: Non-terrestrial 5G networks guarantee the continuity of critical connectivity during natural disasters, due to which terrestrial networks are destroyed. Hence, they enable rescue operations, emergency communication, and data transmission from affected areas.

Market Dynamic

Trends

Rising Integration of AI and IoT with 5G NTN Solutions

One of the considerable trends in the market of 5G NTN is the further and deeper integration of 5G non-terrestrial networks with AI and IoT.

Artificial Intelligence helps optimize performance through predictive analytics, enabling dynamic resource allocation. This empowers further automation in areas such as satellite management, drone control, and even predictive maintenance.

From smart cities to autonomous vehicles, IoT devices highly rely on constant and low-latency connections, something provided by 5G NTN systems. The combination of AI with IoT is now in the process of revolutionizing how industries from manufacturing and agriculture to transportation are leveraging 5G NTN into real-time collection and analysis for greater efficiency and innovation.

Increased Demand for Satellite-Based 5G Solutions

Another strong trend is the rapidly extended dependency on satellite-based 5G solutions, especially to meet the growing demand for global coverage. Terrestrial networks go to their limits when it comes to covering remote, rural, and even oceanic areas. In other words, because major industries intend to expand their connectivity globally, the dependencies on satellite-based networks are rising.

This trend opens great perspectives for companies operating within the industries of telecommunications, defense, and maritime transport. Companies are planning to invest in Low Earth Orbit satellite constellations to expand 5G coverage around the world. This trend is likely to catalyze long-term growth in the 5G NTN market while triggering new use cases across industries, including disaster management and global transportation networks.

Growth Drivers

Increasing Investments in 5G NTN Infrastructure

One of the main factors driving the growth of the 5G NTN market is heavy investments being made in developing the infrastructure of 5G NTN. Significant government and private investments are being made throughout the world in satellite-based networks, high-altitude platforms, and their supporting ground stations. In this respect, the region of North America is particularly on the frontline, as the US government finances the construction of robust communication systems for both the civilian and defense sectors.

Satellite constellations launched by private players like SpaceX and Amazon's Project Kuiper are extending 5G connectivity to reach remote areas. Such investments are likely to drive up the global market size of 5G NTN appreciably during the forecast period.

Adoption of 5G for Critical Applications in Defense and Aerospace

The adoption of 5G NTN in mission-critical sectors such as defense and aerospace is another strong driver for market growth. These sectors, in particular, require strong, low-latency communication networks that must be both reliable and secure.

Non-terrestrial networks, especially satellite-based systems, can provide global coverage that will enable real-time communication related to military operations, surveillance missions, and emergency responses.

The rise in geopolitical conflicts and demand for national security is driving various governments of major economies to integrate 5G NTN technology into their defense strategies or plans. This demand acts as a driver, accelerating growth in satellite communication systems, thereby acting as a contributor to the continuous growth of the 5G NTN market.

Growth Opportunities

Expansion of 5G NTN in Remote and Rural Areas

The greatest growth opportunities for the 5G NTN market will be brought forth by extending 5G connectivity to remote, rural, and less privileged areas.

Traditional terrestrial networks have always found it extremely challenging to give good coverage to such geographies due to the high costs associated with infrastructure deployment. However, 5G NTN solutions, especially those leveraging satellite technology, provide an alternative worth availing.

It can deliver high-speed internet services to rural communities, ships at sea, aircraft, and remote industrial operations. These immediate market opportunities only heighten the appeal of these networks in closing the digital gap existing today between governments and telecom operators, as well as in tapping markets hitherto unreachable.

Emerging Applications in Autonomous Vehicles and Drones

Another key opportunity for the 5G NTN market arises from the fact that the development of

autonomous vehicle and drone technologies will be dependent upon uninterrupted and reliable low-latency communication networks, further supported by the 5G NTN systems.

This indicates that such satellite-based 5G networks are capable of ensuring that even autonomous cars and drones are kept connected, even in remote areas where terrestrial networks are lacking.

The demand for 5G NTN solutions will see an upward surge, especially in industries such as logistics, transportation, and agriculture that have recently utilized autonomous vehicles. Drones will also see an equal growth in adoption. This may drive in new revenue streams for companies dealing in 5G NTN, especially where the interest is advanced in the application of related technologies in smart cities,

precision farming, and the use of automated delivery systems.

Restraints

High Costs of Infrastructure Deployment and Maintenance

One of the major restraints affecting the growth of the 5G NTN market would be the high cost of deploying and maintaining a non-terrestrial network infrastructure.

A large amount of financial investment will be required to establish satellite constellations, high-altitude platform systems, and ground stations that would call for government subsidies or public-private partnerships.

In addition, operational expenses involving these systems are continuous, especially satellites, which involve continuous monitoring, upgrades, and possible replacements. The high costs for 5G NTN development create a barrier to extension and full diffusion in the market both for smaller companies and for developing regions.

Regulatory and Spectrum Allocation Challenges

Regulatory issues and spectrum allocation are a big concern for the 5G NTN market. Non-terrestrial networks share their frequency bands officially with terrestrial networks therefore, they always have to maintain decorum to avoid interference. The allocation process of spectrum for 5G NTN may be quite complicated and is taken under the rule of various regulators, which may also vary likewise in different regions.

Again, some of the factors that may further delay this market expansion include ensuring international regulations about deploying satellite-based 5G systems. These regulatory challenges in integrating policies by governments to include non-terrestrial networks will also impede the deployment of the 5G NTN solutions, especially in those areas.

Research Scope and Analysis

By Component

In the context of components, hardware is expected to dominate the global 5G NTN market as it holds 51.9% of the market share in 2024. In the global 5G NTN market, hardware components play a vital role in building and maintaining the infrastructure that will support non-terrestrial networks. Major hardware components include satellites, HAPS, antennas, and ground stations that are part of the 5G NTN solution backbone.

The implementation of satellite-based 5G networks constitutes an indispensable deployment of advanced hardware for providing seamless, high-speed connectivity, particularly across regions where terrestrial infrastructure is especially poor or lacking.

Increasing investments in the infrastructure of 5G NTN are driving demand globally, from governments to private companies, with much emphasis on expanding the satellite capacity and upgrading communications systems. These investments are very strong in regions such as North America and Europe, which are trying to push forward advanced 5G NTN technologies with a view toward global coverage.

The hardware also contributes to ensuring the integration of a non-terrestrial network through terrestrial 5G infrastructure. Ground-based 5G systems need to be connected without skips in the case of satellite-based networks with mission-critical applications that involve complex hardware systems, including aerospace, defense, and emergency services.

Thus, the hardware segment possesses a considerable market share part in the 5G NTN market size and is expected to be dominant during the forecast period owing to the ever-growing demand for high-performance robust hardware.

By Platform

UAS platform (Unmanned Aerial Systems) is projected to dominate the global 5G NTN market as it is anticipated to command 37.1% of the market share in 2024. Unmanned Aerial Systems (UASs) dominate the 5G NTN market due to their versatility and ability to meet diverse communication requirements across industries.

UAS platforms provide significant advantages when providing 5G connectivity in remote or hard-to-reach locations, unlike satellites which require complex launches at significant expense. They can be deployed quickly with greater flexibility ideal for applications like disaster recovery, defense monitoring, or industrial monitoring.

One key advantage of UAS platforms equipped with 5G NTN technology is their on-demand deployment capability, making them invaluable tools in industries requiring temporary networks such as military operations, emergency response teams, or logistics services that require temporary networks or mobile coverage at different points in time or locations. UAS platforms may even supplement terrestrial networks by filling coverage gaps and strengthening resilience.

Technological advances in UAS design and capabilities are also driving their adoption within the 5G NTN industry, particularly high-altitude UAS platforms such as drones or balloons. By offering wide area coverage without extensive ground infrastructure requirements, such UAS platforms should play an instrumental role in driving both market size and share expansion for 5G NTN solutions during their forecasted lifespans.

By Location

Urban areas are projected to dominate the location segment and dominate the 5G NTN market. The 5G NTN market is dominated by an urban area due to the high demand for high-speed, reliable connectivity. In the case of densely populated areas, the requirement for enhanced mobile broadband services, low-latency applications, and seamless coverage is remarkably very high.

This continuous growth in urban populations entails extreme pressure on traditional terrestrial networks, and non-terrestrial networks remain a crucial solution to extending 5G coverage to ensure network performance.

This is further supported by the high rate of adoption of 5G-enabled devices in urban locations, such as in various forms like smartphones, smart city infrastructure, and autonomous vehicles. Non-terrestrial networks will be highly instrumental in complementing the existing terrestrial infrastructure by guaranteeing connectivity at places featuring very high network traffic, such as city centers, business districts, and public spaces.

The combination of terrestrial with non-terrestrial networks will play a vital role in satisfying the increasing demand from metropolitan environments for data-intensive applications, such as AR/VR and video streaming. It is also the investment in various smart city projects across all major global urban-metropolitan centers that will drive the demand for 5G NTN solutions.

Some of the major smart city projects include uninterruptedly connected smart grids, smart transportation systems, and surveillance networks. The urban areas will therefore remain dominant in contributing to the size of the 5G NTN market, while the non-terrestrial networks prove highly essential for handling the rising demands in infrastructure.

By Application

Enhance Mobile Broadband (eMBB) has emerged as the clear frontrunner in the global 5G NTN market due to rising demands for high-speed, reliable internet services in both urban and remote environments. eMBB's seamless, high data rate connection is essential for streaming videos or real-time applications such as video conferencing are making it central to the 5G NTN ecosystem.

The adoption of 5G non-terrestrial networks allows services like this one to extend into locations traditional terrestrial networks cannot reach such as rural regions, mountainous terrain, and even on airplanes and ships.

One key reason behind eMBB's dominance lies in its capacity to support data-heavy applications in sectors like entertainment, education, and remote work, which have seen unprecedented surges in usage recently. 5G networks combined with terrestrial infrastructure enable continuous delivery of high-speed broadband access in high-demand areas without interruption to services or service disruptions resulting from overload.

As more devices become 5G enabled, demand for eMBB services increases, particularly within densely populated urban centers. It plays an essential role in meeting data consumption demands as well as creating infrastructure to support future innovations like AR/VR experiences, therefore it should retain its leadership status among 5G NTN market applications segments.

By End User

The aerospace and defense sector dominates the global 5G NTN market as it is projected to hold the highest market share by the end of 2024. Aerospace and defense sectors dominate the 5G NTN market due to their unique needs for secure, global connectivity. They require low-latency networks with high bandwidth capable of supporting mission-critical operations making non-terrestrial networks such as satellite-based 5G NTN solutions an essential element of their communication infrastructure.

Satellite networks allow these sectors to maintain seamless connectivity in areas terrestrial networks cannot reach. Aerospace and defense industries dominate the 5G NTN market due to an ever-increasing reliance on advanced technologies like autonomous drones, real-time surveillance, and unmanned aerial vehicles (UAVs), all requiring robust communication networks for smooth functioning.

5G NTN networks enable real-time data transmission for military operations ensuring command centers stay connected regardless of physical distance and ensuring real-time command of field units regardless of time, space, and location differences.

Government and defense agencies are investing heavily in non-terrestrial networks as an initiative to increase national security and defense capabilities. With its secure nature providing extra layer protection for sensitive communications, satellite 5G networks have proven popular within aerospace and defense sectors, thus leading to their adoption over the forecast period. Hence, aerospace & defense industries will likely remain dominant end-user segments of the 5G NTN market over this time frame.

The Global 5G NTN Market Report is segmented on the basis of the following

By Component

- Hardware

- Antennas

- Modems

- Transceivers

- Ground Segment Equipment

- Gateways

- Software

- Network Management Software

- Virtualization Solutions

- Radio Access Network (RAN) Software

- Traffic Management

- Orchestration Tools

- Services

- Consulting Services

- Connectivity Services

- Integration & Deployment Services

- Managed Services

- Maintenance and Support Services

- System Optimization Services

By Platform

- UAS Platform (Unmanned Aerial Systems)

- LEO Satellite (Low Earth Orbit)

- MEO Satellite (Medium Earth Orbit)

- GEO Satellite (Geosynchronous Equatorial Orbit)

- HAPS (High Altitude Platform Systems)

- UAV (Unmanned Aerial Vehicles)

By Location

- Urban

- Rural

- Remote

- Isolated

By Application

- Enhanced Mobile Broadband (EMBB)

- Ultra-Reliable and Low Latency Communications (URLCC)

- Massive Machine-Type Communications (MMTC)

- Broadcast & Multicast Services

By End-user

- Maritime

- Offshore Operations

- Shipping and Logistics

- Fishing Industry

- Aerospace & Defense

- Government

- Public Safety & Emergency Response

- Surveillance & Border Control

- Disaster Recovery

- Mining

- Remote Monitoring & Automation

- Safety Systems

- Exploration and Operations

- Agriculture

- Precision Farming

- Remote Sensing & Data Collection

- Oil & Gas

- Pipeline Monitoring

- Exploration and Production

- Energy & Utilities

- Grid Monitoring

- Renewable Energy Integration

- Others

Regional Analysis

North America is projected to dominate the global 5G 5G NTN market as it is anticipated to command

39.8% of the market share by the end of 2024. Its dominance can be attributed to several key factors that include early adoption, strong investment in the sector, and a robust regulatory framework that supports the deployment of non-terrestrial networks.

Especially in the US, the region has been at the forefront of the development of 5G. The government and the private sector in this region have made massive investments in improving the level of national connectivity.

Those investments have translated into the ramping up of 5G deployment over satellite networks, which have become utterly important in extending the reach of 5G into the countryside and out-areas that traditional terrestrial-based communications fail to reach.

North America dominates the 5G NTN market due to a greater focus on innovation and technological advancements. Key participants in the 5G NTN ecosystem-satellite operators, telecommunications companies, and technology companies headquartered in North America spur advanced development activities for the solution development of 5G NTN.

These companies participate in launching new satellites, developing HAPS platforms, and integrating AI and machine learning into 5G NTN networks, further strengthening the leading position of the region. In addition, such factors contribute to North America's leading a major share in the 5G NTN market, including aerospace and defense verticals.

This is because non-terrestrial networks ensure secured, low-latency, and high-bandwidth communication highly needed in such industries. The United States government has strategically put efforts into national security strengthening, and building up its powerful communication infrastructure. North America is thus expected to continue domination in the global 5G NTN market share during the forecast period.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The 5G NTN market is highly competitive, with its development and market growth being essentially driven by a few key players. Market vendors include major companies like Qualcomm Technologies Inc., Thales Group, SES S.A., and SpaceX, among others.

These companies are working to further develop and deploy advanced satellite-based 5G networking capable of meeting the growing demand for global connectivity. The market participants often enter into strategic partnerships, mergers, and acquisitions to strengthen the positions of their firms for expanding 5G NTN offerings.

More importantly, Qualcomm Technologies Inc. is a leader in solutions regarding 5G NTN and has to play a very critical role in the development of hardware and software required to support the operability of non-terrestrial networks effectively. Thales Group is another important key player actively involved in the defense and aerospace sector and provides 5G NTN solutions for mission-critical operations.

Add to those other players like SES S.A., a satellite service provider, and SpaceX, which are also building new capabilities and actively expanding their systems to support 5G connectivity with satellite networks. These new companies are launching new satellites and developing high-altitude platform systems to ensure good coverage, even in the most remote areas.

The competitors are into rapid innovation, integrating AI, machine learning, and advanced communication technologies into their respective 5G NTN solutions. This would further heighten competitive rivalry between these players as the market advances.

Some of the prominent players in the Global 5G NTN Market are

- SpaceX (Starlink)

- SES S.A.

- OneWeb

- Telesat

- AST SpaceMobile

- Lockheed Martin

- Huawei

- Ericsson

- Nokia

- Thales Alenia Space

- Other Key Players

Recent Developments

- August 2024: SpaceX successfully launched its 50th batch of Starlink satellites, which will be integrated with 5G NTN technology to enhance global connectivity, particularly in underserved regions.

- June 2024: Qualcomm Technologies Inc. announced the development of its next-generation 5G NTN chipset designed for use in satellites and high-altitude platforms. This new chipset is expected to enhance satellite-based 5G performance, reducing latency and increasing data transfer speeds.

- April 2024: Thales Group partnered with SES S.A. to launch a satellite-based 5G NTN network tailored for defense applications. This new network aims to provide secure, reliable communication solutions for military operations in remote and conflict-prone regions.

- February 2024: The U.S. Federal Communications Commission (FCC) approved new spectrum allocations specifically for 5G NTN applications, opening the door for greater innovation in non-terrestrial network deployments.

- December 2023: Amazon’s Project Kuiper announced the successful deployment of its first batch of Low Earth Orbit (LEO) satellites equipped with 5G NTN technology. These satellites will be used to provide high-speed broadband services to remote regions globally, with a particular focus on developing markets in Africa and South America.

- October 2023: Northrop Grumman completed the testing of its high-altitude platform system (HAPS), designed to provide extended 5G NTN coverage to areas lacking terrestrial networks. The HAPS is expected to play a crucial role in connecting remote locations and supporting defense applications in the 5G NTN market.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 7.8 Bn |

| Forecast Value (2033) |

USD 114.0 Bn |

| CAGR (2024-2033) |

34.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware, Software, and Services) By Platform (UAS Platform (Unmanned Aerial Systems), LEO Satellite (Low Earth Orbit), MEO Satellite (Medium Earth Orbit), GEO Satellite (Geosynchronous Equatorial Orbit), HAPS (High Altitude Platform Systems), and UAV (Unmanned Aerial Vehicles)), By Location (Urban, Rural, Remote, and Isolated), By Application (Enhanced Mobile Broadband (EMBB), Ultra-Reliable and Low Latency Communications (URLCC), Massive Machine-Type Communications (MMTC), and Broadcast & Multicast Services), By End-user (Maritime, Aerospace & Defense, Government, Mining, Agriculture, Oil & Gas, Energy & Utilities, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

SpaceX (Starlink), SES S.A., OneWeb, Telesat, AST SpaceMobile, Lockheed Martin, Huawei, Ericsson, Nokia, Thales Alenia Space, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |