This growth is majorly driven by changes in habits of eating & the increasing pace of modern life, which has led to a surge in the demand for packaged food products, significantly impacting this sector. Additionally, food packaging offers various advantages, such as prolonged & durable life, superior blockade properties, & enhanced safety, all of which contribute to the industry's expansion. Furthermore, the adoption of high-performing items & the presence of several compositions of material in the market are anticipated to further drive the growth in the Global Food Packaging Market.

The expansion in the United States food packaging industry can be accredited to the increasing preference for single-serve packs & the rising urban population, resulting in higher consumption of packaged food. Moreover, the industry's growth is further fueled by the ongoing infrastructural advancements in recycling glass, metals, and plastics. These factors collectively contribute to the positive trajectory of the food packaging sector in the United States. Government agencies, such as the U.S. FDA and the European Commission, play a vital role in regulating the food packaging industry. They impose strict guidelines on the types of materials and packaging used for food products. The industry is currently undergoing a shift towards adopting sustainable packaging materials like bio-based plastics, which is projected to further drive its growth.

Market Dynamic

The surge in evolving lifestyles plays a pivotal role in propelling the food packaging industry. With a growing number of individuals having fast-paced routines, the need for packaged & convenient food options is on the rise. Consequently, there is an increased demand for food packaging solutions that not only protect the quality & freshness of food but also provide ease & portability for consumers. Furthermore, the rising awareness of

health & environmental concerns among consumers drives the push for sustainable & environment-friendly food packaging substitutes.

Moreover, the technological enhancement within the food packaging sector forms another significant catalyst for its market growth. Through technology, innovative packaging solutions have emerged, revolutionizing the preservation of food quality & freshness, offering convenience, and enhancing the safety & portability of food for customers. For Example, the adoption of modified atmosphere packaging technology involves replacing the air inside the packaging with a specific gas content, thereby enhancing the durability of food products.

Additionally, the emergence of smart packaging technologies, like temperature sensors & indicators, allows continuous monitoring of the food's condition, ensuring its safety and freshness throughout its shelf life. These groundbreaking technological strides have substantially boosted the functionality and efficacy of food packaging, leading to a surge in demand for such cutting-edge products. As a result, these factors related to food packaging have significantly contributed to a remarkable Compound Annual Growth Rate (CAGR) in the global food packaging market in recent years.

Various constraints working for this market are the changing cost of raw materials like polypropylene for plastic manufacturing. Moreover, government policies over these resources are also responsible for the price hike. Another factor affecting this market is the availability of skilled workers. The fast-paced evolution of technologies demands a workforce d with high-level skills to handle them effectively. The manufacturing of packaging materials demands exceptionally knowledgeable & experienced workers. As a consequence, the costly manufacturing processes & the expense of skilled manpower together resulted in the increased prices of packaging materials. Consequently, these materials are majorly available in high-economic regions where consumers can afford premium-quality packaged food products.

Research Scope and Analysis

By Material

The plastics segment holds a dominant position within this segment. The rapid growth of plastic food packaging is accredited to its wide usage in various applications, majorly due to its cost-effectiveness. The increasing use of plastic films in food packaging is expected to positively impact the industry. The properties provided by plastic packaging, including enhanced sealing capability & moisture barrier, are anticipated to drive the demand further.

Paper & paper-based sectors constitute a significant portion of the market share (in 2023). The surge in this segment is primarily fueled by the widespread adoption of paper packaging as an environment-friendly substitute when compared to non-biodegradable packing options. Paper packaging holds a competitive edge over plastic and metal alternatives due to its new design innovations, sustainable attributes, & ease of printability. These factors collectively drive the popularity & growth of paper-based packaging in the market.

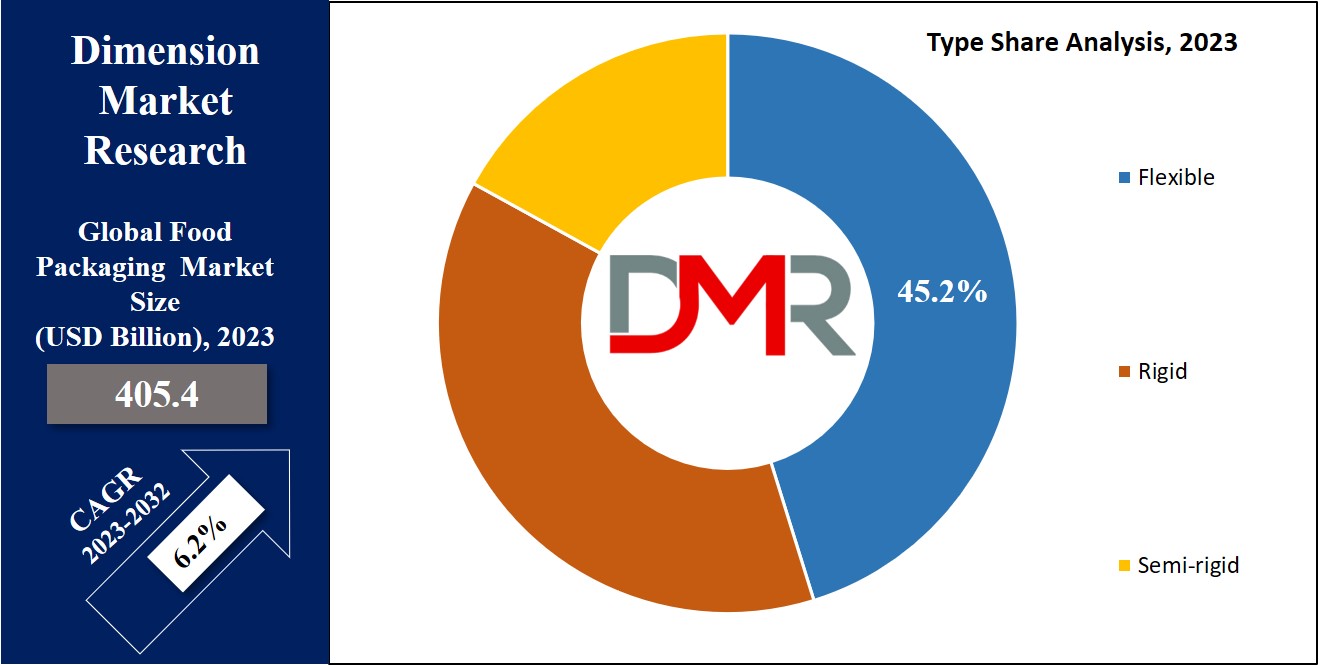

By Type

The Food packaging industry saw flexible packaging emerge as the dominant player, holding a substantial market share. The rapid growth of flexible packaging is due to its ability to provide thin, lightweight, & compact solutions for packaging needs. As the demand shifts from rigid to flexible packaging solutions, this segment is anticipated to experience further growth. Retortable packaging, offering superior performance and convenience, is projected to drive the highest demand by 2032.

Rigid packaging remains widely used due to its excellent barrier properties against oxygen, light, and moisture, ensuring

food safety and preventing contamination.

The steady increase in demand for fresh food products, such as fruits and vegetables, as well as protein-rich fish and meat, is observed in countries like Canada, China, and India, driven by growing health awareness among the population. This has led to extensive usage of rigid packaging for these products, contributing to the growth of the segment. Semi-rigid packaging finds applications in dairy products, fresh sandwich packs, bakery, and confectionery items. As the consumption of milk, dairy products, and bakery and confectionery products rises, the demand for semi-rigid packaging is also expected to increase accordingly.

By Application

The Bakery and confectionery Product Segment dominates the application segment, contributing the maximum share. These products are typically packaged with high moisture barrier materials to extend their shelf life. Flexible packaging is widely preferred for bakery and confectionery applications due to its cost-effectiveness compared to tins and paper cartons, as well as its printability and lightweight nature. The visually appealing packaging of confectionery products is expected to further drive industry growth.

The global presence of strict vegetarians (vegan) has opened a pandora of options for companies to cater to the market operating in the plant-dependent packaged

food industry. During the forecast period, there is expected to be a notable increase in the demand for precooked (or ready-to-eat) meals. The rising awareness of health and wellness is expected to drive the fruits and vegetables demand, consequently boosting the need for suitable packaging solutions.

Furthermore, the growing disposable income among consumers has resulted in an increased demand for fresh products. The rising preference for environmentally friendly packaging solutions that are cost-effective & easy to handle is also fueling the growth in the market. The market is further driven by the upcoming online seafood & meat brands, like, Wegmans Food Markets, & Angus Meats, which cater to marinated product sales. Additionally, government initiatives aimed at promoting good habits for eating, are anticipated to boost the demand for sterilized packages of products like poultry, meat & seafood, thereby contributing to the growth of the market.

The Global Food Packaging Market Report is segmented on the basis of the following

By Material

- Plastics

- Paper & Paper-Based

- Glass

- Metals

- Others

By Type

- Rigid

- Semi-rigid

- Flexible

By Application

- Fruits & Vegetables

- Bakery & Confectionery

- Dairy Products

- Meat, Poultry, & Seafood

- Sauces, Dressings, & Condiments

- Others

Regional Analysis

The Asia-Pacific (APAC) region holds the dominance in the Global Food Packaging Market with a maximum share of 39.8%. The growing food packaging sector in this region is expected to be fueled by several factors, including the rise in disposable income, an increasing population, & a rising demand for packaged food in developing and developed countries, such as India, China, & Japan. China stands out as the largest user in the region due to its vast population and continuously expanding economy.

The food packaging industry in China is projected to witness significant growth, driven by the expanding middle class & their increasing purchasing power. On the other hand, India is witnessing the fastest growth in this market, majorly due to the growing utilization of retail chains. In North America, the flourishing retail industry and the significant consumption of packaged food by consumers are driving the demand for packaging solutions. Moreover, the region's advantage lies in the presence of numerous manufacturers.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Companies are actively pursuing increased market share and revenue growth by offering extensive customization options for their products. Moreover, they are adapting to changing government standards by transitioning from conventional materials to biodegradable alternatives. Many companies are vertically integrated, involving themselves in various stages of the value chain and employing captive consumption of raw materials to streamline production costs.

In recent times, the global market has witnessed the introduction of various packaging technologies, thanks to continuous investments in research and development by leading packaging companies. Some of the commonly used packaging technologies include child-proof and elderly-friendly packaging, retort packaging, modified atmosphere packaging (MAP), and temperature-controlled packaging. These innovative approaches are driving advancements in the packaging industry.

Some of the prominent players in the Global Food Packaging Market are

- Mondi Group

- Berry Global Inc.

- Stora Enso

- Plastipak

- DS Smith

- Coveris Group

- Amcor plc

- Constantia Flexibles

- ExxonMobil Chemical

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Food Packaging Market

The Global Food Industry, being recognized as an essential service by governments worldwide, has experienced a relatively lower impact from COVID-19 compared to other manufacturing sectors. In particular, flexible packaging companies catering to packaged food sectors have shown resilience and therefore sustained during the ongoing pandemic. This growth can be attributed to shifting consumer preferences, government measures, and stockpiling practices that have fueled the demand for packaged food.

The COVID-19 crisis has prompted changes in consumer preferences, especially in developing economies like India, where there has been a notable shift from unpacked food to packed food due to heightened concerns about food safety during the pandemic. Additionally, the rise in e-commerce retail during the outbreak has played an important role in bolstering domestic packaged food sales and driving demand for flexible packaging in the packaged food segment. However, the global market has faced challenges due to trade restrictions and supply chain disruptions caused by the pandemic. Despite these obstacles, packaging suppliers have implemented mitigation strategies, and regional government relief packages have been instrumental in supporting economic recovery, thereby contributing to the growth of the food packaging market.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 405.4 Bn |

| Forecast Value (2032) |

USD 698.6 Bn |

| CAGR (2023-2032) |

6.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material (Plastics, Paper & Paper-Based, Glass,

Metals, Others), By Type (Rigid, Semi-Rigid, and

Flexible), By Application (Fruits & vegetables, Bakery

& Confectionery, Dairy Products, Meat, Poultry, &

Seafood, Sauces, Dressings, and Condiments, Others). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Mondi Group, Berry Global Inc., Stora Enso, Plastipak,

DS Smith, Coveris Group, Amcor plc, Constantia

Flexibles, ExxonMobil Chemical, and Other Key

Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |