. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

AI in retail includes using automation, data, & technologies like

machine learning (ML) to create highly personalized shopping experiences for customers, which can occur both in physical brick-and-mortar stores & on digital shopping platforms.

Moreover, on a website, AI-powered chatbots or virtual assistants can provide shoppers with customized recommendations or adjust pricing in real-time based on the shopper's browsing history, past purchases, & other relevant data.

In physical stores, AI can be applied by collecting data from sources such as customer interactions on mobile devices & sensors within the store. Retailers can even use AI to optimize the store's layout by training algorithms with sales data & other pertinent information, which enables them to make predictions, like the likelihood of a customer purchasing two items if they are displayed together in the store.

The global AI in Retail market is experiencing rapid innovation, dramatically changing operations and customer experiences. Retailers are using predictive analytics with AI-powered predictive tools like virtual fitting rooms to streamline inventory management and optimize supply chains while real-time demand forecasting and reduced stockouts are possible. Automation helps warehouse efficiency while personalization tools deliver personalized shopping experiences, further strengthening customer loyalty through virtual fitting rooms and automated recommendations.

Recent events demonstrate the implementation of advanced technologies, including autonomous stores and dynamic pricing algorithms. Amazon Go is an example of such stores; checkout procedures have been eliminated completely to improve convenience for shoppers. Furthermore, AI-powered marketing strategies are driving engagement through personalized campaigns while dynamic pricing algorithms maximize profitability by adapting rates based on demand and customer profiles.

Emerging opportunities in retail include using generative AI to provide more refined customer interactions and decision-making processes. Advancements like chatbots, virtual assistants and AR-based experiences are revolutionizing retail engagement - these advances, combined with ethical AI use and data security measures help position this sector for continued expansion while meeting challenges like consumer privacy concerns.

Market Dynamic

Artificial Intelligence (AI) is playing a major role in the retail sector, allowing businesses to make quicker decisions in areas like product management, marketing, e-commerce, & other aspects of their operations. AI helps bridge the gap between collecting insights & implementing them efficiently. Additionally, AI-powered chatbots are becoming increasingly popular in the retail industry due to their effectiveness in providing customized & enhanced customer service, leading to higher customer satisfaction.

Further, innovations in retail technology, like computer vision, are gaining momentum, particularly in physical stores. Computer vision is a specialized form of AI that can understand & interpret visual data. This advancement holds great potential for transforming several aspects of retail, including inventory management, predicting customer demand, enhancing the overall shopping experience, and more.

Research Scope and Analysis

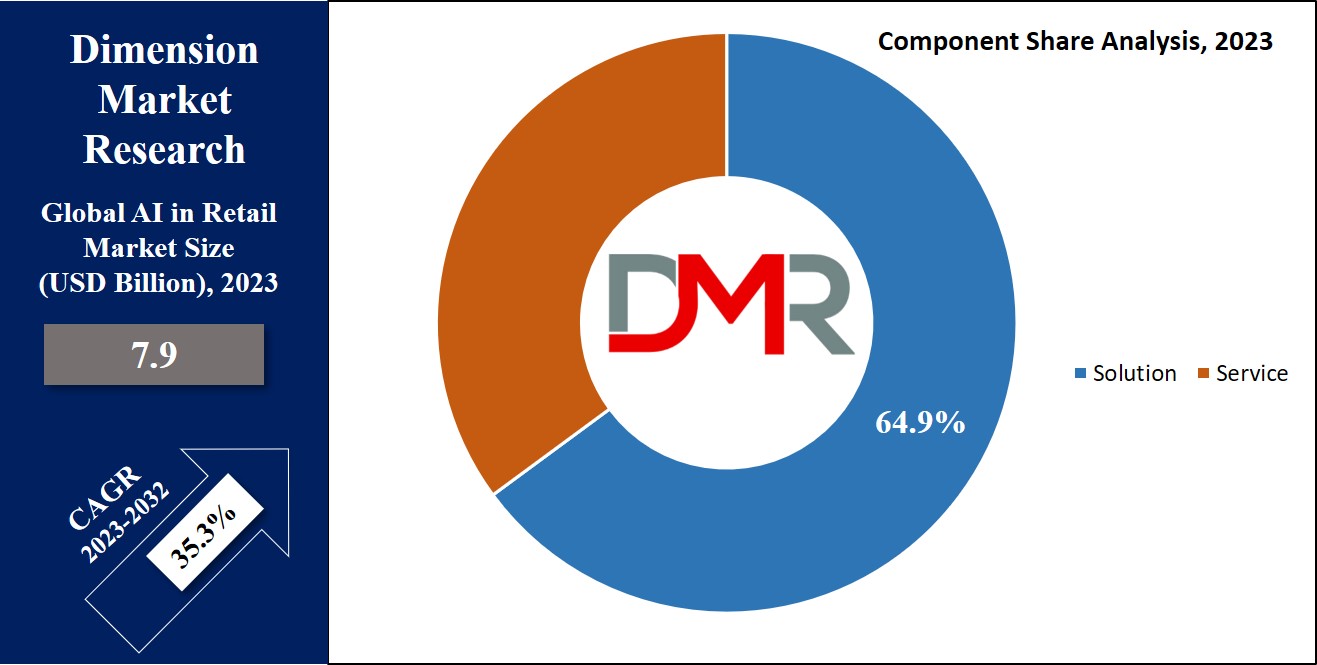

By Component

As components, the global AI in retail is segmented into two divisions solutions & services. In 2023, the solution as a component claims a significant revenue share, as the increase in complexities associated with managing different retail operations is promoting the adoption of innovative & automated technologies within the retail sector. AI-powered technologies are being instrumental in enhancing warehouse management, optimizing supply chain logistics & operations, and enhancing the overall consumer experience. Moreover, the introduction of software solutions like IBM Watson, Google Cloud AI Platform, Salesforce Einstein, & Content DNA Platform has significantly contributed to the dominance of this segment.

Further, the services segment is also positioned for significant growth during the forecasted period, as the demand for AI services in the retail sector is anticipated to grow driven by a high requirement for managed services focused on enhancing efficiency, productivity, & accuracy to optimize business processes. The quick adoption of AI solutions is consequently boosting the need for services, facilitating the creation of intelligent functions, enriching consumer experiences, unlocking revenue growth potential, encouraging rapid innovation, & reducing the likelihood of human error.

By Technology

Machine learning (ML) as a technology is the major driving factor for the growth of global AI in the retail market as it leverages data rapidly & deeply, making it well-suited for providing customized consumer experiences. It assists retail organizations in optimizing their supply chain systems & improving demand forecasts to support inventory efficiency.

Also, during the forecasted period, it is anticipated a rapid growth in the

natural language processing (NLP) segment. The growth in data analysis & the rise in AI-driven chatbot adoption support fueling the advancements in NLP. NLP-powered chatbots, covering mobile interfaces & touchscreen interactions, are secured to enhance interactive customer experiences. Additionally, NLP finds value in sentiment analysis, allowing the evaluation of call center interactions, customer messages, social media posts, & online reviews.

Moreover, the image and video analytics segment is positioned for high growth during the forecast period. The growth of retail video analytics is rooted in the rising popularity of business intelligence tools for garnering insights into in-store promotional strategies, queue data, & bettering the security of malls & chain stores.

By Sales Channel

In 2023, Omnichannel emerges as the leading segment of the market by accounting for the significant revenue share of the market. The growth and domination of omni-channel can be said owing to the extensive growth of digitization around all developed & developing nations. Moreover, the trend of headless commerce is allowing retailers to offer payment gateways & products through a wide range of platforms including smartwatches, kiosk screens, progressive web apps, & mobile apps. The implication of omni-channel experiences is set to grow due to the digitized supply chain landscape along with a focus on delivering a seamless & integrated customer journey.

Further, pure-play online retailers are also anticipated to notice high growth, driven by the growing popularity of virtual & online shopping experiences. The growth of IoT, AI, & social media is anticipated to give favorable momentum to global market growth. Due to these trends, various retail vendors are improving their online customer service capabilities by opting for artificial intelligence solutions.

By Application

The Customer Relationship Management or CRM segment commands a significant market share of the overall global market for AI in retail in 2023 and this segment is further anticipated to gain dominance during the forecasted period owing to the strong need for maintaining customer retention & enhancing customer service. AI-powered tools like search engines, chatbots, virtual assistants, & other solutions are proving crucial for retail vendors in creating loyalty & encouraging strong customer relationships. Furthermore, CRM applications have the potential to improve social media integration, facilitate seamless communication, & streamline data collection for retail businesses.

Also, the supply chain & logistics segment holds a significant share of revenue in the market, as the key companies are integrating AI applications within their business processes to improve operational precision & efficiency.

The AI in Retail Market Report is segmented on the basis of the following:

By Component

By Technology

- Machine Learning

- Natural Language Processing

- Chatbots

- Image and Video Analytics

By Sales Channel

- Omnichannel

- Brick and Mortar

- Pure-play Online Retailers

By Application

- Customer Relationship Management

- Supply Chain and Logistics

- Inventory Management

- Product Optimization

- In-Store Navigation

- Payment and Pricing Analytics

- Virtual Assistant

- Others

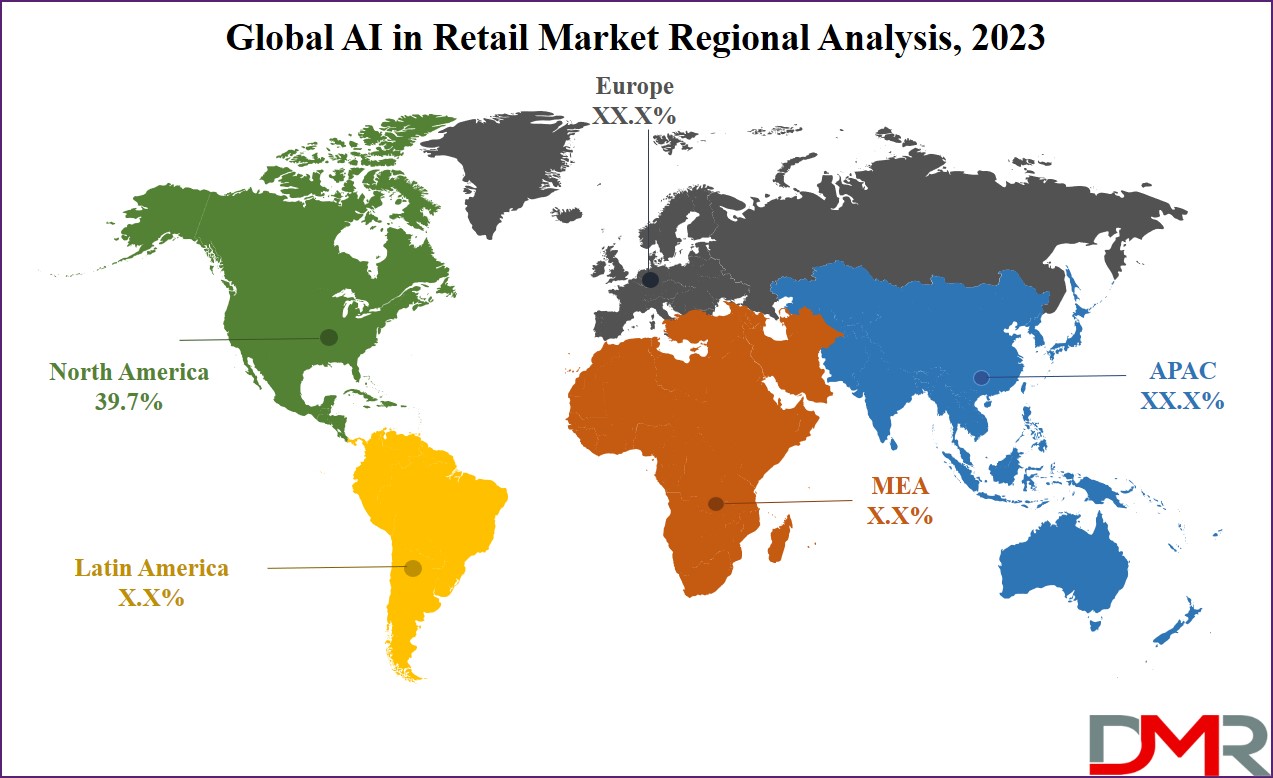

Regional Analysis

North America dominates with a significant share revenue share of

39.7% in the year 2023. The region's growth prospects remain strong, with large investments directed toward AI projects and associated R&D endeavors. Additionally, retail organizations within the region are strategically aiming to harness available customer inclination data to better the efficiency of customer service offerings.

Further, the Asia Pacific region is also anticipated to show substantial growth throughout the forecasted period, which can be said due to technological advancement in countries like China, Japan, & India. The extensive use of smart devices & the integration of 5G technology within the retail sector are the major forces fueling the growth of the AI in retail market across this region.

Also, European retail companies are integrating AI to better their customer experiences, optimize supply chains, & streamline operations. Increase in adoption of AI technologies, emphasis on data-driven decision-making, & digital transformation initiatives.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

AI in the retail market is experiencing strong competition, with a few key global players commanding a significant market share. These key players prioritize innovation through the introduction of advanced products to create opportunities for better profitability by cultivating stronger customer relationships.

Like, in January 2023, Google Cloud unveiled a suite of four innovative AI technologies focused on assisting retailers in revolutionizing their in-store shelf auditing processes & enhancing the online shopping experience for their customers. One of these solutions is a new AI tool for shelf auditing, which is built on the foundation of Google Cloud's Vertex AI Vision.

This tool taps into Google's broad knowledge repository including information about individuals, locations, & products. It contains retailers with the capability to identify a wide range of products, making sure that their in-store shelves are ideally stocked & organized. Furthermore, as part of the updates to its Discovery AI solutions, the company has introduced a new personalization AI feature & an AI-driven browsing feature. These advancements empower retailers to grow their digital storefronts, providing customers with more engaging & user-friendly online shopping experiences.

Some of the prominent players in the Global AI in Retail Market are:

- NVIDIA Corporation

- Microsoft Corporation

- Google LLC

- IBM Corporation

- SAP SE

- Oracle Corporation

- Sentient Technologies

- Intel Corporation

- Salesforce, Inc.

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global AI In Retail Market:

The COVID-19 pandemic & the following recession impacted the adoption of AI in the global retail market. With consumers switching to online shopping, AI-driven chatbots, virtual assistants, & recommendation systems became essential for maintaining customer service & improving personalization. Additionally, AI-powered demand forecasting & inventory management systems assisted retailers in navigating supply chain disruptions, while data-driven insights empowered them to make informed decisions despite economic challenges, reshaping the retail landscape.

| Report Characteristics |

| Market Size (2023) |

USD 7.9 Bn |

| Forecast Value (2032) |

USD 120.2 Bn |

| CAGR (2023-2032) |

35.3% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solutions and Services), By

Technology (Machine learning, Natural Language

Processing, Chatbots, Image, and Video Analytics), By

Sales Channel (Omnichannel, Brick and Mortar, and

Pure-play Online Retailers), By Application (Customer

Relationship Management, Supply Chains and

Logistics, Inventory Management, Product

Optimization, In-store Navigation, Payment and

Pricing Analytics, Virtual Assistant, and others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

NVIDIA Corporation, Microsoft Corporation, Google

LLC, IBM Corporation, SAP SE, Oracle Corporation,

Sentient Technologies, Intel Corporation, SAP SE, and

Salesforce, Inc. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |