The AI Security Camera Market is growing rapidly due to the rise in demand for improving surveillance capability with AI-infused camera technology. Such AI-enabled cameras will be able to provide real-time monitoring, high-level video analytics, and whatnot facial recognition, object detection, and behavior analysis. These, in turn, improve situational awareness, automate threat detection, and reduce manual interventions.

Additionally, cases of theft, burglaries, and terrorist activities have been on the rise, which, in turn, has raised the need for surveillance, hence driving the demand for these solutions in the market. Apart from this, the integration of deep learning algorithms and

cloud computing has been some of the technological advancements that have helped in the expansion of the market. These innovations enable smarter, more efficient data processing and storage that enhance the overall performance of security systems.

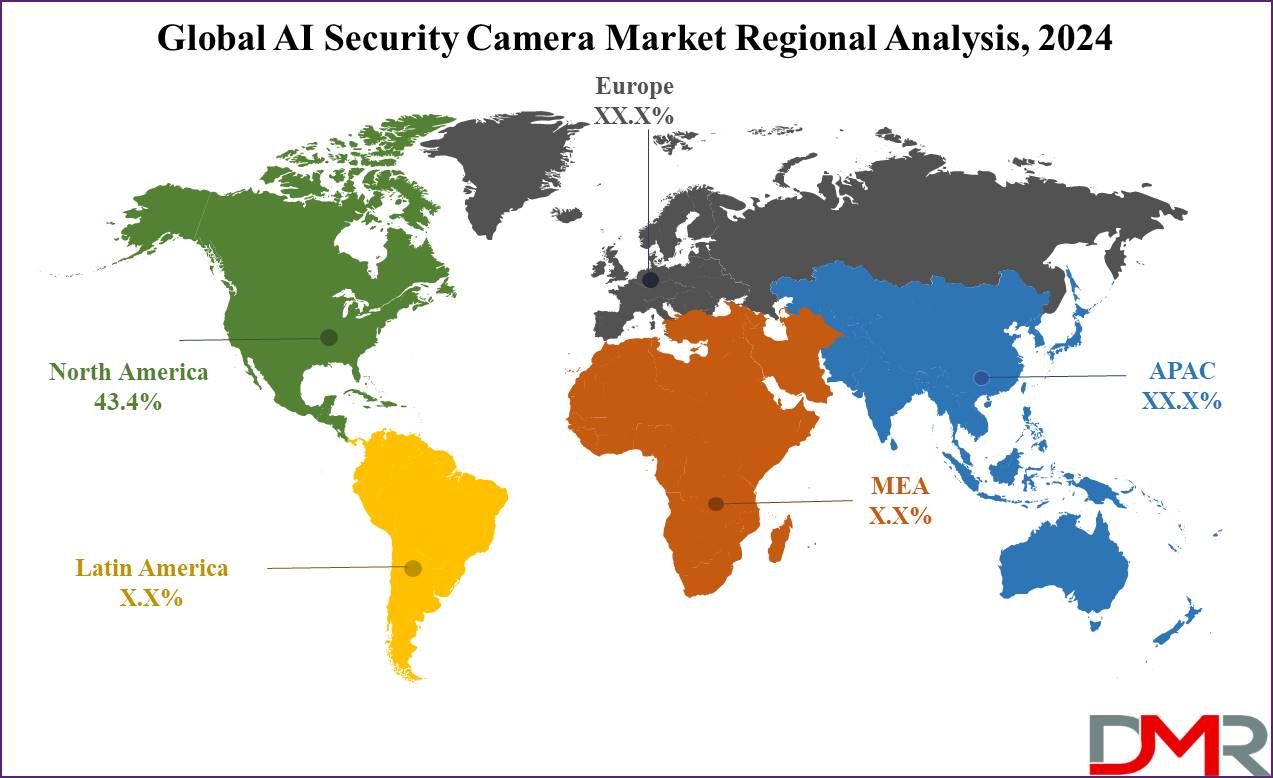

Major regions that drive the growth of the market are Asia-Pacific, North America, and Europe among these, North America leads owing to its high-tech infrastructure and investment in smart city projects. Meanwhile, some of the critical factors accelerating market development include the proliferation of IoT devices, urbanization, and government regulations encouraging surveillance.

The AI security camera market is rapidly growing with the integration of

machine learning and computer vision technologies, enabling cameras not only to capture images but also analyze real-time data to enhance security capabilities. This trend is only expected to accelerate as both public and private sectors prioritize advanced surveillance solutions for safety and protection.

AI-powered security cameras are increasingly in demand due to growing concerns for public events and urban spaces, commercial buildings, and public events. AI security cameras provide real-time threat detection, facial recognition and anomaly identification that improve response times while decreasing human error in monitoring processes. Furthermore, smart homes are driving market expansion.

Recent news stories highlight the increasing investments made in AI security cameras by both tech firms and traditional security firms, including partnerships between AI startups and major security players that promote product innovation. Furthermore, regulatory changes and an increase in demand for privacy protection is driving manufacturers to create more secure systems compliant with regulations.

AI security cameras offer significant opportunities, particularly in emerging markets where infrastructure development and urbanization are creating a greater need for advanced surveillance systems. These Smart CCTV cameras with AI analytics are not only transforming public safety but also enabling businesses to optimize operations.

AI-powered surveillance could revolutionize sectors like retail, transportation, healthcare, and hospitality by providing real-time monitoring, enhancing customer experiences, streamlining operations, and establishing more effective safety protocols. This integration of AI-driven video analytics ensures higher efficiency, predictive insights, and proactive threat detection, making it a crucial investment for enterprises and governments worldwide.

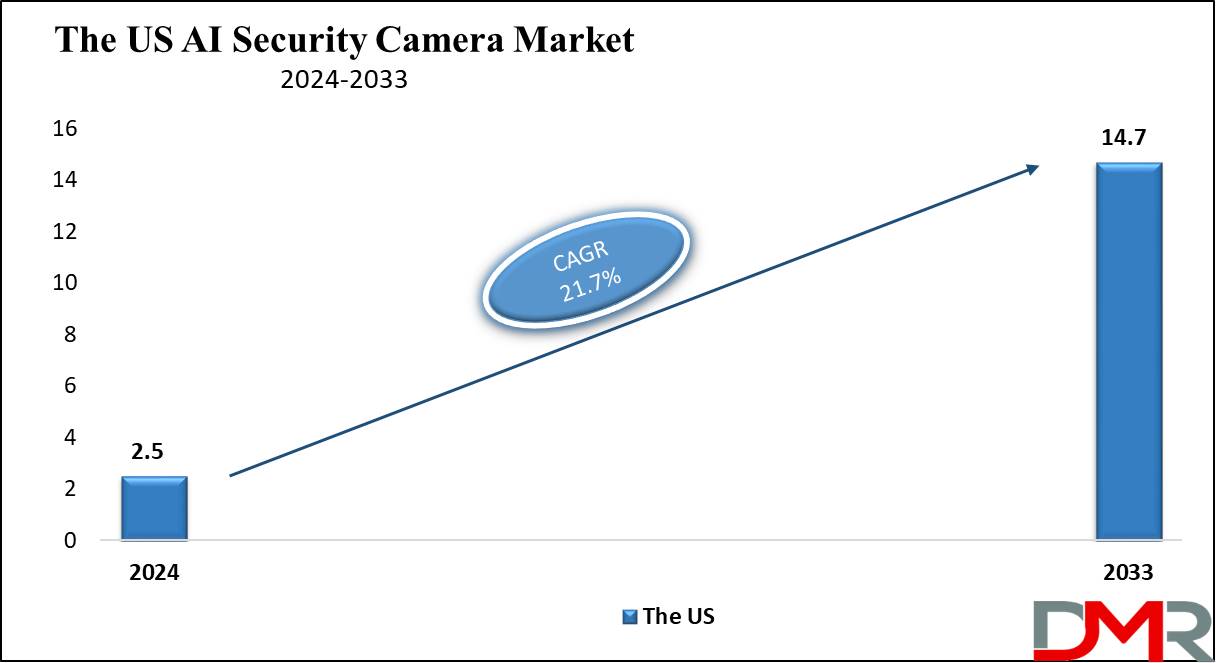

The US AI Security Camera Market

The

US AI Security Camera Market is projected to be

valued at USD 2.5 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 14.7 billion in 2033 at a

CAGR of 21.7%.

The key drivers driving the growth of the U.S. AI Security Camera Market are rapid demand surges for advanced surveillance technologies across smart city projects and critical infrastructure protection. The trends believed to shape the adoption of AI-powered security cameras include rising adoption in retail, healthcare, and law enforcement applications because cameras are often deployed around core operational insights such as foot traffic monitoring or employee performance.

Another significant recent development in this market is the increased integration with the cloud service, which enables it to scale, handle big data, and do real-time processing, thereby reducing the need for on-premise hardware.

The result is faster deployment along with flexible systems. And finally,

edge computing is also gaining traction whereby an AI security camera can process data right at the source for reduced latency and better performance.

Applications of facial recognition also continue to grow in the U.S. market-especially within airports, schools, and large events to help improve public safety. Regulatory constraints, like privacy and data protection, present a stumbling restraint toward large-scale adoption of this technology.

Partnerships between AI companies and security camera manufacturers spur innovation, while governments' plans to increase public surveillance at a rapid rate further drive the growth of AI-enabled cameras across urban centers. The combination of technological advancements with government backing positioned the U.S. as a leading market for AI security cameras.

Key Takeaways

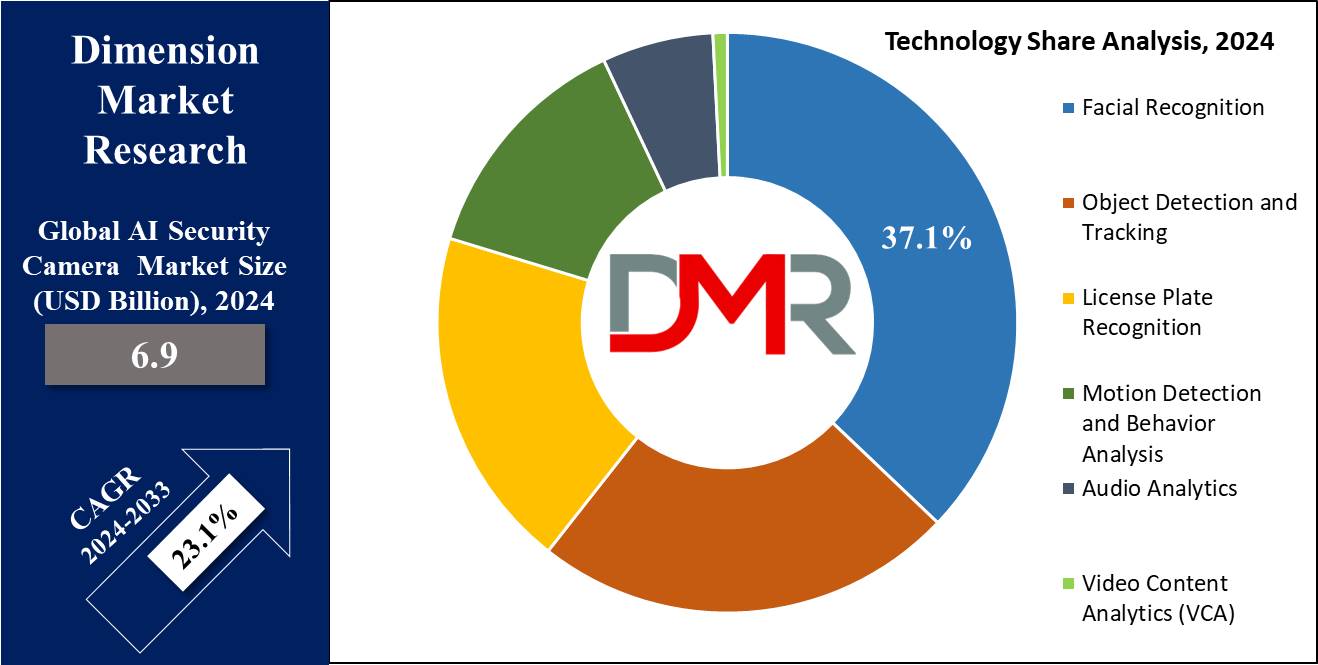

- Global Value: The global AI security camera market size is estimated to have a value of USD 6.9 billion in 2024 and is expected to reach USD 47.3 billion by the end of 2033.

- The US Market Value: The US AI security camera market is projected to be valued at USD 2.5 billion in 2024 which is further expected to reach USD 14.7 billion in 2033 at a CAGR of 21.7%.

- Regional Analysis: North America is expected to have the largest market share in this market with a market share of about 43.4% in 2024.

- By Component Segment Insights: Hardware is anticipated to dominate the global AI security camera market with 64.3% of market share by the end of 2024.

- By Technology Segment Insights: Facial recognition technology is projected to dominate the technology segment in this market as it hold 37.1% of market share in 2024.

- Key Players: Some of the major key players in the global AI security camera market are Axis Communications, Honeywell International Inc., Bosch Security Systems, and many others.

- Global Growth Rate: The market is growing at a CAGR of 23.1 percent over the forecasted period.

Use Cases

- Retail Analytics: With the help tracking customer movements, it helps retailers improve product placements, smoothing customer services, and even theft prevention by instantly identifying suspicious activities in real-time.

- Smart City Surveillance: AI-powered cameras play a very pivotal role in smart cities in keeping a check on the flow of traffic, quickly detecting accidents, and handling all emergencies concerning public safety. Equipped with artificial intelligence analytics, these cameras assist in facilitating the reduction of crime rates.

- Healthcare Monitoring: AI-enabled cameras installed in healthcare institutes help ensure patient safety by observing strange behaviors by a vulnerable patient population, including those suffering from dementia. The cameras help in identifying falls or unauthorized access to certain restricted places, thus enhancing general security.

- Law Enforcement: AI cameras help in surveillance by law enforcement agencies in high-risk areas, detect criminal activities, and, in investigations, face, and license plate recognition are also facilitated. These cameras can monitor big events to identify threats in real time with much greater public safety.

Market Dynamic

Trends

Integration with AI and IoT

The integration of AI security cameras with IoT devices is one of the trends that is changing the surveillance market. Currently, AI-powered cameras can communicate with other smart devices for automation of actions or control through alarms and lighting up, and this may even reach an access system. In this regard, integration will lead to a more intelligent and responsive environment for surveillance, entailing real-time threat detection and speedier responses in the event of security incidents.

Adoption of Cloud-Based Systems

Cloud-based AI security cameras are gaining widespread recognition due to their flexible and scalable surveillance solutions sans widespread on-premise infrastructure. However, with cloud storage, users can store loads of data with ease and have immediate access to the video feeds from any location, besides being able to apply AI analytics remotely.

This aspect is most used in large enterprises and municipal projects where data has to be centralized and where there is a growing need to reach more points of surveillance remotely. Adoption of the Cloud also enables collaboration across multiple locations with increased security management overall.

Growth Drivers

Rising Demand for Public Safety

The growing concern over public safety in urban areas, driven by the increase in crime rate, terrorist threats, and civil unrest, the question of public safety is a high concern for metropolitan cities; hence, one of the most influencing factors that may drive the AI security camera market.

These

artificial intelligence-driven surveillance systems are being drawn into action by governments and law enforcement departments for monitoring large public areas, end. In essence, response times are much quicker and crime prevention more effective with the use of AI cameras capable of automated alerts and predictive analytics.

Technological Advancements in AI

Continuous developments in AI, especially in deep learning, face identification, and behavioral analysis, are driving the demand side of the AI security camera market.

Key benefits to AI cameras in these development areas are enhanced detection and identification of objects and anomalies, which make their input quite invaluable in many industries like retail, banking, transportation, and also projects on smart cities. Improvements in the accuracy and efficiency of AI-driven analytics reduce the need for human intervention, further increasing demand.

Growth Opportunities

Smart City Projects

The proliferation of smart city projects across the globe creates great opportunities for GDP growth in the AI security camera market. Governments and city planners in recent times have increased investment in AI-driven surveillance systems designed to enhance public safety, traffic management, and emergency response.

AI Security Cameras can find applications in monitoring public areas, detecting traffic violations, and even crowd management at big events. This technology would be increasingly in demand, especially AI-enabled cameras, with the growth in the adoption of more smart technologies across cities worldwide, especially in regions like North America, Europe, and Asia-Pacific.

Healthcare and Retail Sectors

AI security cameras are expected to show reasonable growth in the healthcare and retail sectors. The Care industry uses AI cameras to monitor patient safety, prevent unauthorized access to sensitive areas, and alert nurses to unusual behavior.

For retailers, AI Cameras give meaningful analytics that will help them understand customer behavior within the store, allowing them to optimize store layouts while minimizing theft. With increased dependence on AI-driven surveillance, specific markets are opening up in these sectors where businesses look to further streamline operations and tighten security.

Restraints

Privacy Concerns

Security cameras integrated with AI face a lot of challenges that range from privacy concerns to regulatory scrutiny. The application of facial recognition and other AI technologies within the context raises ethical and legal concerns about data collection, storage, and utilization.

The growing public outcry against the pervasive deployment of surveillance cameras, especially in residential and public areas, has triggered a heightened interest in their activities by regulatory bodies. Data protection laws and regulations in some regions are imposing restrictions on the growth of the market.

High Initial Costs

While AI security cameras boast several advantageous functionalities and efficiencies, their initial costs are one of the key reasons why wider conduction is still at a standstill. Estimated costs of AI-powered cameras, installation, maintenance, and software integration costs may be a bit too expensive for small and medium-sized enterprises.

Apart from that, organizations with limited budgets may find it difficult to justify an investment in AI cameras, which, while offering multiple long-term benefits by reducing operational costs and improving security, can still be seen as costly compared to traditional systems. However, the adoption of Intelligent video monitoring solutions enables businesses to achieve higher efficiency, better threat detection, and long-term savings despite initial expenses.

Research Scope and Analysis

By Component

The hardware is projected to dominate the component segment in the AI security camera market as it holds 64.3% of market share in 2024. AI security cameras greatly rely on consistent and updated physical components to ensure their performance and functionality.

High-resolution sensors, processors, and storage devices are some of the key hardware components involved in capturing, processing, and storing real-time data hence, investment in hardware is crucial to the efficiency of the system as a whole.

High-quality camera lenses, image sensors, and advanced chips integrated into AI security cameras significantly raise the bar about what these cameras are truly capable of in terms of complex tasks such as facial recognition, object detection, and motion tracking.

On the other hand, since AI analytics require large data amounts to be processed at high speed, handling data from transmission and processing either at the edge or in the cloud requires a powerful hardware drive toward demand for more hardware.

Furthermore, with the advanced trend towards high-definition, good-quality video, and real-time surveillance, the trend of hardware upgrades becomes quite indispensable to sustain these trends. Innovations in camera design, including multi-lens systems and panoramic viewing, add to the prominence of hardware in the market.

This would eventually lead to more resilient cameras, adding capabilities such as weather proofing, vandalism, and night vision requiring increasingly complex and reliable hardware. As AI cameras become integral to security systems across the world, the hardware segment remains very critical for the foundation of market growth.

By Type

IP (Internet Protocol) cameras are anticipated to dominate the type segment in the AI security camera market due to their advanced features and versatility. Unlike analog cameras, IP cameras have been capable of transmitting video and audio over a network and offering higher resolution, flexibility, and remote access. Hence, it is ideal for modern security systems where real-time monitoring with integrated data is turning out to be an increasingly essential requirement.

Another reason that further cements the lead of IP cameras in the marketplace is the integration with cloud services and IoT ecosystems. Cameras can be integrated seamlessly into the AI platform, which opens up advanced analytics such as face recognition, behavior analysis, automatic threat detection, and improved efficiency in cameras used in commercial and public surveillance systems.

Furthermore, scalability is one of the most important features of IP cameras, making it easy for organizations to scale up their surveillance networks without a major overhaul of infrastructure.

This flexibility is particularly worth the money for large enterprises and smart city projects, where many cameras are expected to work in a team across different locations. In addition, the increasing focus on high-definition video quality drives the adoption of IP cameras, which typically boast better image resolution compared to analog counterparts.

Their ability to efficiently store and send large volumes of data makes them ideal for use in high-security environments such as airports, government buildings, and critical infrastructure. In conclusion, the better functionality of IP cameras, ease of integration with AI and cloud technologies, and scalability contributed to the dominance of IP cameras in the AI security camera market.

By Technology

Facial recognition technology is anticipated to dominate the technology segment in this market in 2024 due to its potential transformative power in security enhancements with operational efficiency. It enables cameras in security to identify and verify people in real-time by analyzing facial features, hence commanding extensive usage in law enforcement, retail, and transportation.

Apart from these key benefits, one of the similar key benefits for every facial recognition system is the automation capability of identification processes at various touchpoints. Facial recognition controls access only to those authorized, using high-security zones like airports, government buildings, and financial institutions.

This helps in deterring unauthorized access and overall strengthening security measures across the board. In retail, facial recognition is used for customer analytics, which is helpful to businesses in providing personalized experiences by identifying repeat visitors and offering them tailored services. It finds its application in the tracking of suspects by law enforcement agencies in solving crime cases and carrying out extensive surveillance during events involving big public gatherings.

This is further integrated with AI, enabling the technology to continuously improve its accuracy even in harsh conditions, such as low lighting and partially occluded faces. Besides, increasing investment in smart cities and public safety has accelerated the adoption of facial recognition in public spaces, hence dominating the AI security camera market.

By Resolution

HD, with its 720p resolution, is projected to dominate this segment in the AI security camera market because it balances video quality with cost-effectiveness. HD cameras have clear and detailed video footage sufficient for most applications of surveillance, let alone facial recognition, motion detection, and object tracking.

The resolution of 720p gives a sharp image with good surveillance without consuming much bandwidth or storage requirements, hence making it an added feature in many user choices of cameras. Not only that, but HD cameras have also proven to be more cost-effective compared to the higher-resolution alternatives at Full HD (1080p) and 4K, allowing it to be in the reach of more and more small businesses and residential customers.

This cost-effectiveness does not compromise on any essential features of night vision, wide-angle viewing, or even remote access, salient features that are so intrinsic to modern surveillance.

At 720p resolution, most applications involving entry point monitoring, parking lots, and retail spaces are adequately catered for in terms of viewing the identifications of people and vehicles resulting in activities without overstressing storage capacities or network infrastructure.

This becomes an attractive option for most users in search of reliable surveillance without the associated higher costs of ultra-high-definition systems.

These factors include wide compatibility with most surveillance infrastructures and how easily they could be integrated into various new and upgraded security systems. This flexibility has entrenched HD cameras at 720p resolution as the leading resolution segment in the AI security camera marketplace.

By Connectivity

Wireless connectivity is forecasted to dominate the AI security camera market due to a wireless property that provides extensive flexibility, ease of installation, and adaptability for all kinds of environments, wireless dominates in the AI security camera market.

In addition, wireless AI cameras do not require cumbersome wiring and are thus easier and quicker to install, especially for locations where laying cables may be impractical or unaffordable. This is very helpful in outdoor or extended areas, such as wide commercial buildings, parking lots, and public areas where the traditional wired solutions are almost impracticable.

Because of this, wireless systems are also favored since it is easy to scale up without added cabling constraints. This way, business organizations can extend their related surveillance coverage with less hassle and infrastructural changes.

These cameras can come with either Wi-Fi or cellular and allow the user, through a computer or smartphone, to access and monitor them from any location in real-time, which has become of great significance in today's connected world.

Over the last couple of years, there has been considerable improvement in Artificial Intelligence-powered cameras, with the development of 5G and Wi-Fi increasing the capacity for wireless transmission manyfold.

These provide higher data transfer rates, qualitative video streaming, real-time analytics, lower latency, and better performance. Further, at lower installation and maintenance costs for wireless systems, these are easily integrated into other IoT devices.

By Deployment

Cloud-based deployment is anticipated to dominate the AI security camera market as it holds the highest market share in 2024 due to the high scalability, cost-effectiveness, and ease of access making cloud-based deployment dominant in the AI security camera market. While on-premise systems involve huge infrastructure investments, cloud-based solutions offer subscription-based models that are flexible and thus quite affordable for business firms of all sizes.

The cloud-based deployment model will thus provide benefits to organizations in expanding their surveillance system according to their needs without incurring the high upfront costs associated with hardware or storage. Perhaps one of the main advantages of cloud-based AI security cameras is the ability to access video feeds and analytics from anywhere and at any time.

Users can view multiple sites in real-time, even on mobile phones, adding more flexibility and control. In multi-site companies, this feature proves most valuable, especially where surveillance data is under central management, such as retail chains.

Also, cloud-based AI cameras constantly get software updates, enabling the system to be at the very edge of activities in AI and security protocols. There is, therefore, no need for expensive upgrades and/or maintenance, as is often the case with traditional on-premise systems.

Additionally, cloud solutions ensure data security by providing advanced encryption and backup features, hence instilling confidence among users that misfortune may befall them in the form of loss or breach of data. Besides being scalable and accessible remotely, security has made the cloud-based deployment segment a preferable choice in the AI security camera market for big enterprises and government institutions.

By Application

Surveillance and monitoring are anticipated to dominate the application segment in the AI security camera market in 2024. The application segment leads the AI security camera market due to growth in demand for real-time threat detection, deterrence of crimes, and situational awareness across various sectors.

Enhanced cameras with advanced capabilities like motion detection, facial recognition, and behavior analysis will be very effective for continuous monitoring of public and private spaces.

Artificial Intelligence security cameras have been deployed amongst the public across cities for safety reasons, monitoring high-traffic spots, and even to identify suspicious behavior or threats. Due to these many crime prevention, crowd management, and traffic congestion enforcement agencies use these cameras and significantly widen the scope for AI-enabled surveillance solutions.

Furthermore, many smart city initiatives have been driving up the demand for AI cameras amid the need for a smarter approach to ensuring safety in urban areas and optimizing resources.

Commercial spaces, such as retail outlets, banks, and office complexes, deploy surveillance that has immense importance in terms of avoiding theft, ensuring the safety of employees, and monitoring operations day to day. AI cameras with real-time analytics help businesses decrease loss by identifying potential suspicious behavior and creating automated alerts.

The advanced capability of AI cameras means they operate without human intervention continuously must-have when it comes to 24/7 monitoring in airports, government facilities, and industrial sites. Further, the development in

video analytics enables these systems to identify prospective threats much before they scale and thus ensures their lead in the surveillance and monitoring application segment.

By End User

The commercial sector leads the end-user segment of the AI security camera market because of the rising demand for the deployment of advanced surveillance systems in numerous industries, including retail, banking, healthcare, and hospitality.

In these industries, there are many security concerns associated with various issues, such as theft, fraud, and safety problems, which bring AI-enabled cameras equipped with features like facial recognition, behavioral analysis, and real-time alerts into action Of course, AI security cameras also play a huge role in retail environments for monitoring customer behavior to prevent shoplifting and analyze foot traffic. Such cameras also give valuable insights into consumer preferences and store layouts that are of immense importance in operational efficiency.

Banking and other financial activities also rely greatly on AI cameras for securing various surveillance against the theft of precious property and fraud. The high-resolution video and AI-driven analytics within these cameras can detect suspicious activities, monitor various transactions, and improve security protocols at ATMs and bank branches.

AI-powered security cameras ensure that patients are cared for safely while keeping tabs on staff members' activities and unauthorized access to healthcare facilities. These therefore help track movements in real time and provide anomaly detection, which especially comes in handy in an environment where there needs to be a high level of patient and staff security.

Also, AI cameras are important in the hospitality industry to ensure guest safety and monitor entrances for threats and risks in real time. This added to the rising usage of AI security systems at the commercial level makes this sector the dominant end user.

The AI Security Camera Market Report is segmented on the basis of the following

By Component

- Hardware

- Camera

- Storage Devices

- Processors

- Sensors

- Communication Modules

- Software

- Video Analytics Software

- AI-based Recognition

- Cloud-based AI Systems

- Edge AI Algorithms

- AI-Integrated Operating Systems

- Services

- Installation and Integration

- Maintenance and Support

- Managed Services

- AI Model Training Services

By Type

- IP Cameras

- Analog Cameras

- Thermal Cameras

- Multi-Sensor Cameras

- Pan-Tilt-Zoom (PTZ) Cameras

- Body-Worn Cameras

By Technology

- Facial Recognition

- Object Detection and Tracking

- License Plate Recognition

- Motion Detection and Behavior Analysis

- Audio Analytics

- Video Content Analytics (VCA)

By Resolution

- HD (720p)

- Full HD (1080p)

- 4K/Ultra HD

- 8K and Above

By Connectivity

- Wired

- Wireless

- Bluetooth

- Wi-Fi

- Cellular (4G/5G)

By Deployment Mode

- Cloud-based

- On-Premise

- Hybrid

By Application

- Surveillance and Monitoring

- City Surveillance

- Commercial Buildings

- Industrial Facilities

- Public Spaces

- Law Enforcement and Border Control

- Access Control

- Automated Entry Systems

- AI-based Access Management

- Retail Analytics

- Customer Behavior Analysis

- Store Layout Optimization

- Loss Prevention

- Traffic Monitoring

- Smart Traffic Management

- License Plate Recognition

- Home Security

- Smart Home Integration

- Personal Safety

By End User

- Residential

- Commercial

- Retail

- Banking and Financial Services (BFSI)

- Hospitality

- Healthcare

- Educational Institutes

- Data Centers

- Corporate Offices

- Government

- Law Enforcement

- Defense and Military

- Traffic and City Surveillance

- Industrial

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Oil & Gas

Regional Analysis

North America is anticipated to dominate the global AI security camera market as it will

hold 43.4% of the total market share by the end of 2024. The commercial sector leads the end-user segment of the AI Security Camera Market because of the rising demand for the deployment of advanced surveillance systems in numerous industries, including retail, banking, healthcare, and hospitality.

In these industries, there are many security concerns associated with various issues, such as theft, fraud, and safety problems, which bring AI-enabled cameras equipped with features like facial recognition, behavioral analysis, and real-time alerts into action.

Of course, AI security cameras also play a huge role in retail environments for monitoring customer behavior to prevent shoplifting and analyze foot traffic. Such cameras also give valuable insights into consumer preferences and store layouts that are of immense importance in operational efficiency.

Banking and other financial activities also rely greatly on AI cameras for securing various surveillance against the theft of precious property and fraud. The high-resolution video and AI-driven analytics within these cameras can detect suspicious activities, monitor various transactions, and improve security protocols at ATMs and bank branches.

AI-powered security cameras ensure that patients are cared for safely while keeping tabs on staff members' activities and unauthorized access to healthcare facilities. These therefore help track movements in real time and provide

anomaly detection, which especially comes in handy in an environment where there needs to be a high level of patient and staff security.

Last but not least, AI cameras are important in the hospitality industry to ensure guest safety and monitor entrances for threats and risks in real time. This added to the rising usage of AI security systems at the commercial level, and together with the desire for data-driven insights, an elevated level of protection creates the grounds that make this sector the dominant end user.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The security camera market for AI is very competitive, with various key players competing through the use of innovative products and strategic partnerships. Key players in the market include Hikvision, Dahua Technology, Axis Communications, Hanwha Techwin, and Bosch Security Systems-a trifecta of majors that offer a suite of AI-enabled security solutions.

Hikvision and Dahua Technology are the largest in this industry, with an extensive portfolio of AI-enhanced cameras based on high-level technologies for video analytics, facial recognition, and object detection. These companies focus on integrating AI with edge computing to enhance performance and scalability for applications related to public safety to commercial.

Axis Communications and Bosch Security Systems manufacture high-quality, robust cameras that come with AI-driven analytics, intended for enterprise and industrial applications. The pathway of technology leadership for them is cybersecurity, powerful encryption, and privacy features that respond to the growing concern over data protection.

Other smaller players and AI startups, such as Anyvision and Avigilon, focus on niche markets, like facial recognition and behavior analysis, which help them be at the helm of the wave. Companies like these are very often dealing with larger manufacturers to embed AI technology into current camera systems that push the boundaries of innovation in regard to surveillance and monitoring.

Some of the prominent players in the Global AI Security Camera Market are

- Hikvision

- Dahua Technology

- Axis Communications

- Honeywell International Inc.

- Bosch Security Systems

- Avigilon (a Motorola Solutions company)

- Hanwha Techwin

- Panasonic i-PRO Sensing Solutions

- Cisco Systems

- Pelco (a Motorola Solutions company)

- FLIR Systems

- VIVOTEK Inc.

- CP PLUS

- Other Key Players

Recent Developments

- August 2024: Hikvision launched its latest AI-powered PTZ (pan-tilt-zoom) camera, featuring advanced facial recognition technology and real-time behavioral analysis for public surveillance. This camera is designed for large-scale surveillance in urban areas, airports, and public transportation hubs, where quick and accurate identification of individuals is crucial.

- May 2024: Axis Communications announced a strategic partnership with Microsoft Azure to offer cloud-integrated AI security solutions. This partnership aims to provide scalable and secure surveillance systems for businesses and municipalities. The cloud-based solution allows users to access real-time video analytics from multiple locations and offers AI-powered insights such as object detection, facial recognition, and motion tracking.

- January 2024: Dahua Technology introduced a new AI camera series equipped with edge computing capabilities, designed specifically for smart city and industrial applications. These cameras are capable of processing data at the source, reducing latency and bandwidth usage while providing real-time analytics for traffic monitoring, and public safety.

- November 2023: Avigilon, a subsidiary of Motorola Solutions, released an AI-based video management platform that integrates with existing security camera systems. The platform features advanced facial recognition and real-time alert capabilities, allowing users to enhance their current surveillance systems with AI-driven insights.

- July 2023: Hanwha Techwin unveiled its AI-enabled dome camera with deep learning analytics, targeting retail and healthcare sectors. This camera is designed to offer real-time customer behavior analysis, such as foot traffic patterns and dwell time, helping retailers optimize store layouts and marketing strategies.

- March 2023: Bosch Security Systems introduced a new AI-powered surveillance solution with enhanced cybersecurity features. This product is designed for critical infrastructure and high security environments, such as government buildings, power plants, and financial institutions.