Market Overview

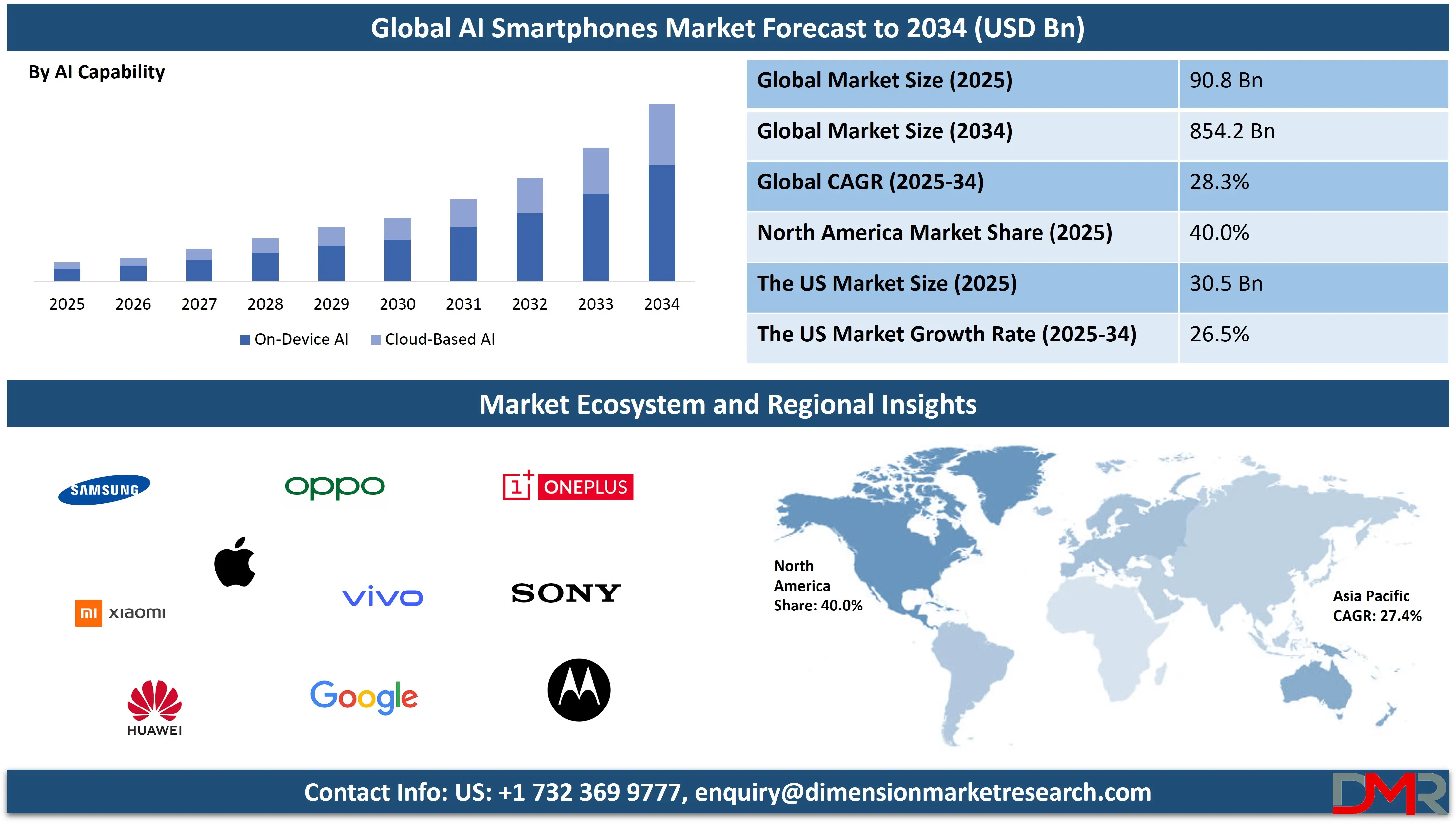

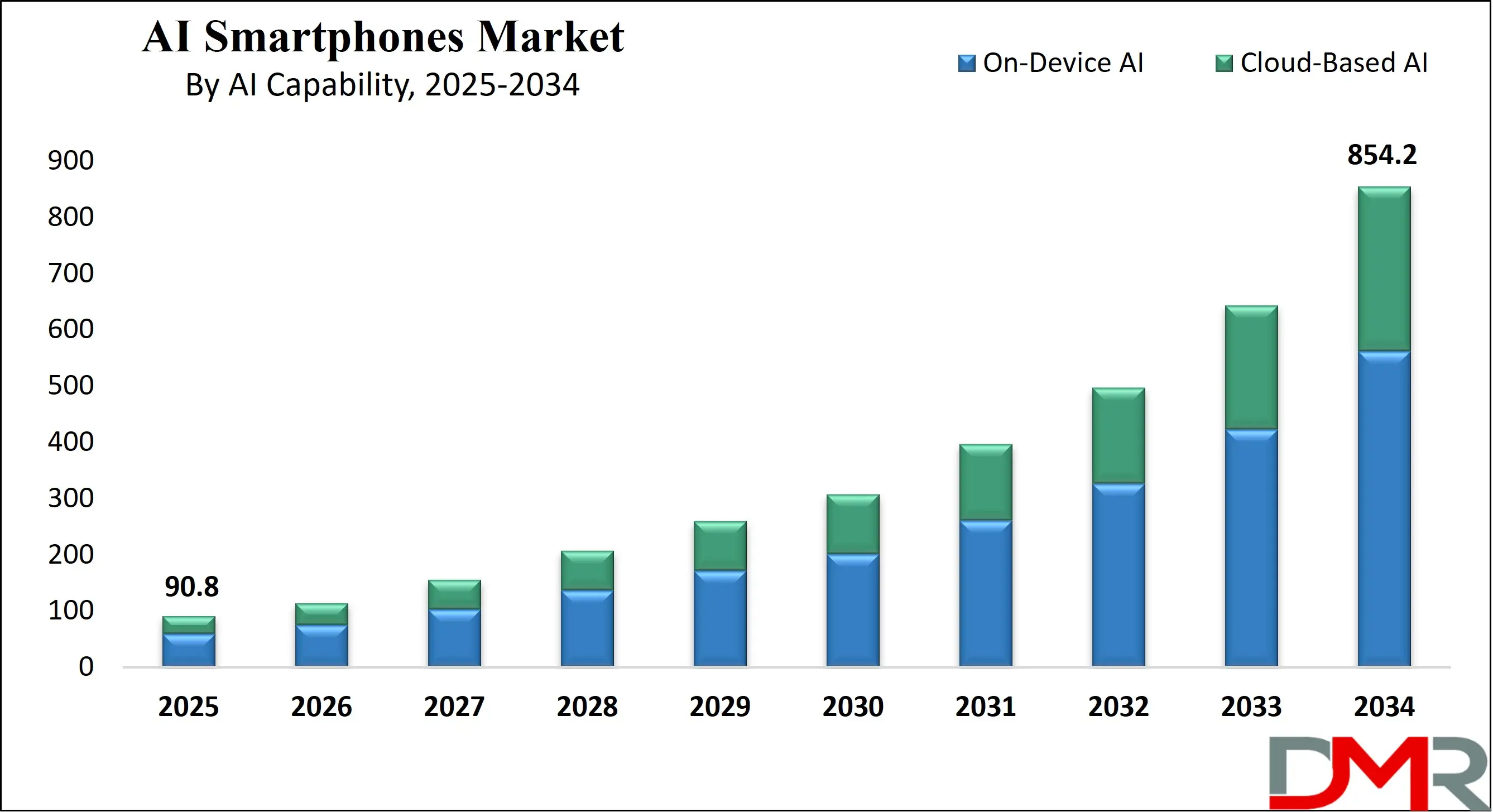

The Global AI Smartphones Market size is projected to grow from

USD 90.8 billion in 2025 to

USD 854.2 billion by 2034, advancing at a robust

CAGR of 28.3%, driven by the integration of AI-driven features such as machine learning, voice assistants, and enhanced photography.

AI smartphones represent the evolution of mobile technology, incorporating advanced

artificial intelligence capabilities to enhance user experiences significantly. These devices use

machine learning, computer vision, and

natural language processing to offer more personalized, efficient, and seamless interactions. AI is embedded across various functionalities, from intelligent voice assistants and AI-driven photography to facial recognition and context-aware optimizations. For instance, the camera systems can automatically adjust settings for the best possible shot, while virtual assistants can understand and predict user needs, adapting over time. With continuous learning, AI smartphones offer smarter battery management, security features, and even real-time language translation, redefining how users interact with their devices and making them indispensable in daily life.

The global AI smartphone market is rapidly transforming as consumers demand more intelligent, feature-rich devices. Technological advancements in AI have driven smartphone manufacturers to integrate deep learning models, enabling faster and more responsive devices. AI-powered features such as enhanced photography, voice recognition, and adaptive user interfaces are becoming standard in high-end and mid-range smartphones alike.

These AI systems work locally on the device, providing users with faster processing times and better privacy by avoiding the need for cloud-based computing. Moreover, as smartphones become more efficient in managing data and resources, AI ensures that devices learn from user behavior, improving performance, battery life, and usability over time, which enhances the overall user experience.

Looking to the future, AI smartphones are expected to continue their growth trajectory, benefiting from the integration of cutting-edge technologies like 5G and edge computing. The growing ability of smartphones to perform AI tasks directly on the device will enable more advanced functionalities, such as more accurate augmented reality applications, smarter health monitoring, and enhanced security features like fraud detection and biometric authentication. As AI becomes more embedded in daily life, smartphones will serve not just as communication tools but as proactive assistants that understand and anticipate the needs of their users. This ongoing innovation is set to shape the next generation of mobile devices, where personalization, efficiency, and security are paramount.

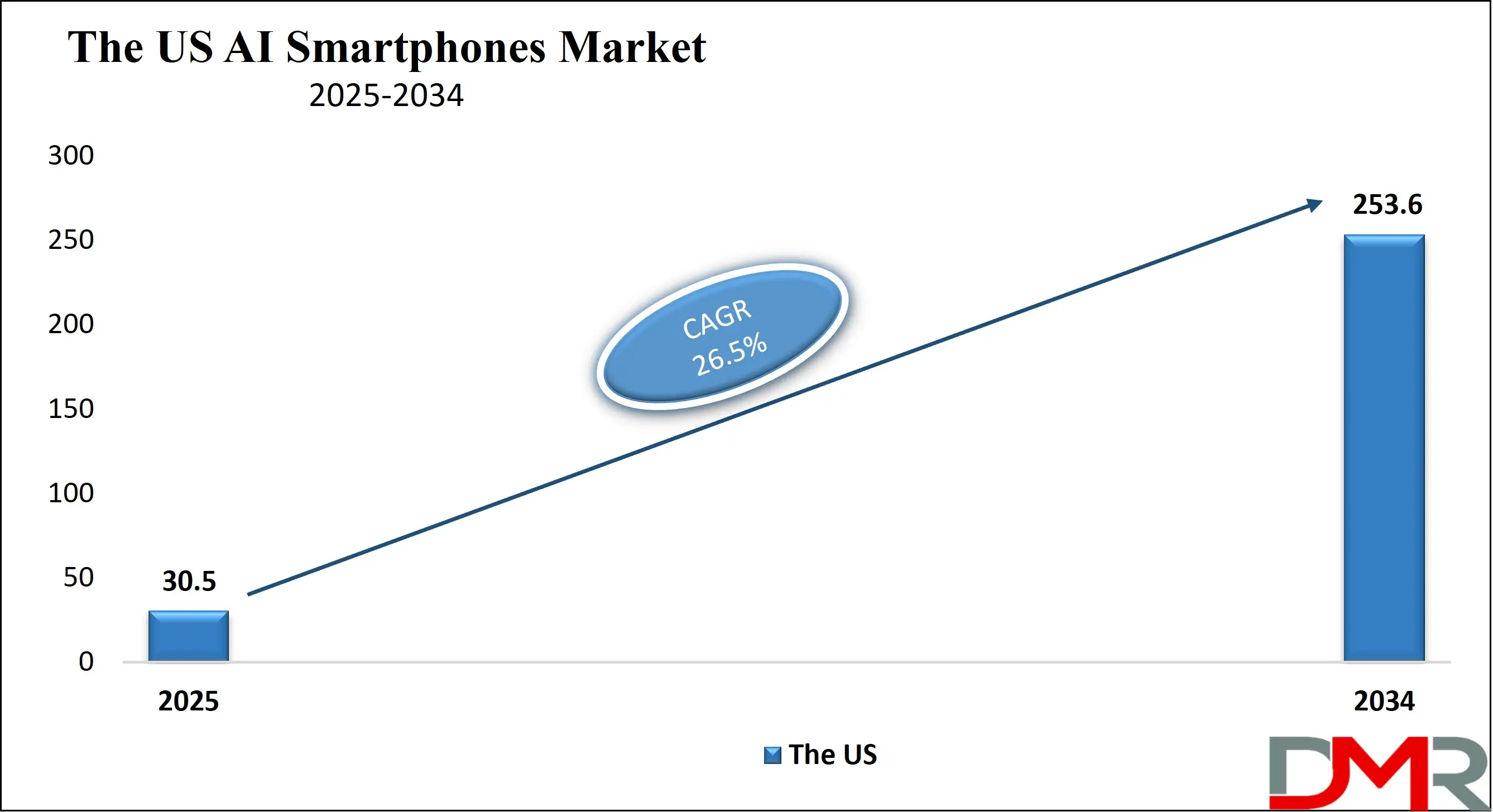

The US AI Smartphones Market

The U.S. AI Smartphones market size is projected to be valued at USD 30.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 253.6 billion in 2034 at a CAGR of 26.5%.

The U.S. AI smartphone market is witnessing rapid growth, driven by the growing demand for advanced mobile devices that offer enhanced user experiences through artificial intelligence. With the rise of AI-powered functionalities such as voice assistants, intelligent photography, real-time translation, and context-aware optimizations, U.S. consumers are becoming more accustomed to smartphones that can anticipate and adapt to their needs.

As leading manufacturers continue to integrate machine learning, natural language processing, and computer vision into their devices, the U.S. market is seeing significant innovation, particularly in premium smartphones. The focus on personalized user experiences and efficient performance management is positioning AI smartphones as a core element in the future of mobile technology.

The demand for AI smartphones in the U.S. is also being fueled by the growing integration of 5G networks and edge computing, which enable faster and more responsive AI capabilities. On-device AI processing is becoming a key feature, ensuring that users can benefit from seamless performance without compromising privacy. As U.S. consumers continue to prioritize smarter devices that enhance convenience, security, and productivity, the market is expected to see sustained growth. From improved battery optimization to AI-powered security measures such as biometric authentication, U.S. smartphone manufacturers are continuously evolving their offerings to stay competitive, ultimately shaping the future of mobile technology in the region.

The European AI Smartphones Market

In 2025, the European AI smartphones market is anticipated to reach a valuation of USD 22.7 billion, driven by the region's growing demand for advanced mobile technology and AI capabilities. Europe's robust technological infrastructure, combined with high consumer spending power, supports the widespread adoption of AI-powered smartphones, particularly in developed countries such as Germany, the UK, and France.

Consumers in these markets are prioritizing devices that offer AI-enhanced functionalities such as real-time language translation, intelligent camera systems, and personalized voice assistants. Additionally, the region's strong regulatory framework surrounding data privacy and security is encouraging manufacturers to invest in AI technologies that prioritize user privacy, further boosting consumer trust and market demand. As AI smartphones continue to penetrate everyday consumer and business use, the European market is expected to maintain its steady growth trajectory.

With a CAGR of 23.5%, the European market is set to experience accelerated growth, driven by both consumer adoption and the proliferation of 5G networks that support faster and more reliable AI-driven experiences. The adoption of AI in sectors like healthcare, automotive, and retail, where mobile technology is integrated for data processing and enhanced user experiences, will further contribute to this growth.

Additionally, the presence of leading mobile manufacturers, such as Samsung, Apple, and Huawei, as well as emerging regional players, will keep the competitive environment dynamic, ensuring continuous innovation in AI smartphone features. The region's growing focus on sustainability, integrated with growing demand for smart devices, positions Europe as a key player in the global AI smartphone landscape, reinforcing its high growth potential in the coming years.

The Japanese AI Smartphones Market

In 2025, Japan's AI smartphone market is projected to reach USD 5.1 billion, driven by a strong demand for advanced mobile technology and AI-driven features among tech-savvy consumers. Japan, known for its early adoption of innovative technologies, is embracing AI-powered smartphones for their enhanced capabilities, such as voice assistants, intelligent camera systems, and real-time language translation.

The country's highly developed infrastructure and high consumer expectations for cutting-edge technology make AI smartphones an appealing choice for a wide range of applications, from entertainment and gaming to professional and personal productivity. Japanese consumers' affinity for high-quality, well-designed smartphones further supports the growth of the market, as manufacturers continue to release models with sophisticated AI functionalities designed to local preferences.

With a CAGR of 20.8%, Japan's AI smartphones market is expected to witness consistent growth in the coming years, driven by the ongoing evolution of mobile technologies and the rising popularity of 5G networks. The country's large base of mobile users, integrated with a well-established ecosystem of smartphone manufacturers like Sony, Sharp, and other domestic brands, plays a crucial role in the market's development.

Additionally, AI capabilities are being integrated into Japan's business sectors, such as healthcare, robotics, and automotive, where mobile devices are becoming essential tools for both professional use and personal applications. As AI technologies become more deeply embedded in Japan's smartphone offerings, the market's rapid growth is expected to continue, fueled by innovations that enhance user experiences, security, and connectivity.

Global AI Smartphones Market: Key Takeaways

- Market Value: The global AI smartphones market size is expected to reach a value of USD 854.2 billion by 2034 from a base value of USD 90.8 billion in 2025 at a CAGR of 28.3%.

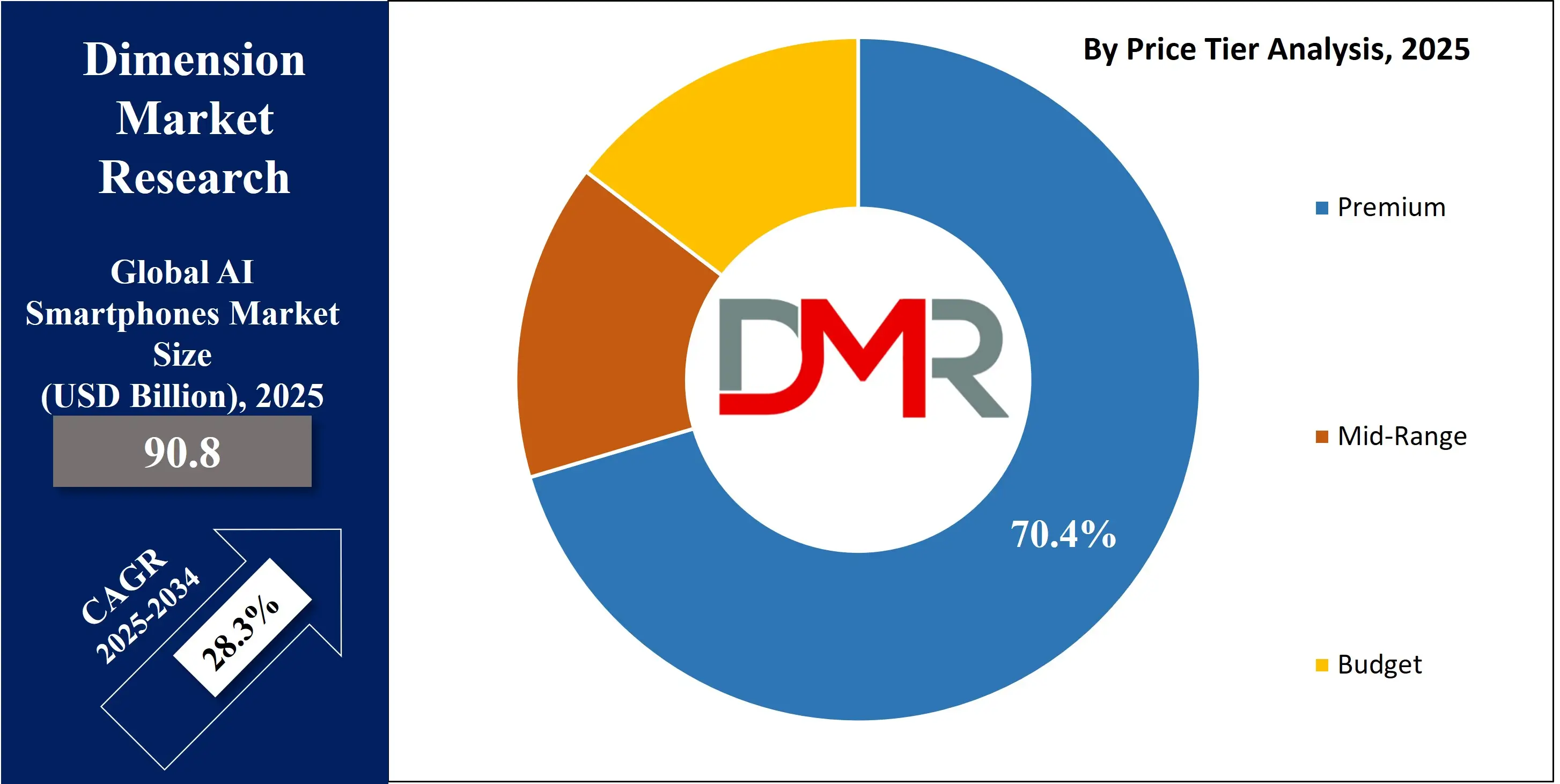

- By Price Tier Segment Analysis: Premium smartphones are expected to maintain their dominance in the price tier segment, capturing 70.4% of the total market share in 2025.

- By AI Capability Segment Analysis: On-Device AI is poised to consolidate its dominance in the AI capability segment, capturing 65.7% of the total market share in 2025.

- By Distribution Channel Segment Analysis: The Offline Retail channel is expected to maintain its dominance in the distribution channel segment, capturing 77.3% of the market share in 2025.

- By Application Segment Analysis: Personal Users are expected to maintain their dominance in the application type segment, capturing 47.1% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global AI smartphones market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global AI smartphones market are Samsung, Apple, Xiaomi, Huawei, OPPO, Vivo, Google, OnePlus, Sony, Motorola, Realme, Honor, Asus, Lenovo, ZTE, Nokia (HMD Global), Meizu, Tecno, Infinix, Lava, and Other Key Players.

Global AI Smartphones Market: Use Cases

- AI-Powered Photography and Video Enhancement: AI smartphones are revolutionizing mobile photography by leveraging computer vision and machine learning to deliver professional-grade images and videos. Advanced camera systems use scene recognition, object detection, and real-time image optimization to adjust lighting, exposure, and color balance automatically. Features such as portrait mode, night photography, and motion tracking are significantly enhanced through AI algorithms, making it easier for users to capture high-quality content in diverse settings. Brands like Apple, Samsung, and Google use neural image processing engines to optimize visuals, giving users an intuitive and automated photography experience.

- Intelligent Virtual Assistants and Natural Language Processing: AI smartphones are equipped with intelligent virtual assistants such as Google Assistant, Siri, and Bixby, enabling voice-controlled operations and contextual assistance. These assistants rely on natural language processing (NLP) and deep learning to understand user intent, provide real-time responses, and perform tasks like setting reminders, sending texts, or searching the web. As NLP models become more advanced, smartphones are becoming better at handling conversational AI, language translation, and even sentiment recognition. This use case highlights the importance of AI in delivering seamless, voice-first user interactions and hands-free productivity.

- On-Device AI for Battery and Performance Optimization: Modern AI smartphones utilize on-device AI to manage system resources efficiently, improving battery life and overall performance. Machine learning models analyze user behavior patterns, such as app usage, screen time, and charging cycles, to dynamically adjust power allocation and background processes. This allows smartphones to intelligently throttle CPU usage, close unused apps, and recommend battery-saving actions in real time. With the integration of edge computing, on-device AI processing reduces latency and enhances privacy, ensuring user data remains secure while delivering faster response times and energy-efficient operations.

- Enhanced Security Through AI-Based Biometrics: Security is a critical application of AI in smartphones, particularly through the use of biometric authentication methods like facial recognition and fingerprint scanning. AI algorithms improve the accuracy, speed, and spoof-resistance of these technologies by continuously learning and adapting to the user’s biometric data. Facial recognition systems, for instance, can distinguish between a live user and a photo using depth mapping and infrared sensors. Moreover, AI is also used to detect fraudulent activities, monitor device access patterns, and implement predictive threat analysis, offering a proactive approach to mobile cybersecurity.

Global AI Smartphones Market: Stats & Facts

- 🇮🇳 India – Government of India

- Digital Literacy Initiative: The Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) aimed to digitally empower 6 crore rural households by March 2020, enhancing access to digital services, including AI-powered applications.

- AI Integration in Governance: The Ministry of Corporate Affairs introduced MCA21 V3.0, utilizing AI to streamline corporate law processes and enhance policy decision-making efficiency.

- AI in Public Safety: Under the Safe City initiative, 1,000 AI-enabled cameras with facial recognition were installed in Lucknow, integrating with the National Automated Fingerprint Identification System to enhance public safety.

- Defense AI Investments: The Indian Ministry of Defence allocated ₹1,000 crore annually until 2026 for AI-related projects, including the development of AI-specific applications by the Indian Army, Navy, and Air Force.

- AI Research Infrastructure: The establishment of the Centre for Machine Intelligence and Data Science at IIT Bombay and the creation of three AI Centers of Excellence in sustainable cities, agriculture, and health, supported by a ₹50,000 crore budget over five years, underscores India's commitment to AI research.

- Digital India Initiative: The Digital India program, including the Pradhan Mantri Gramin Digital Saksharta Abhiyan, aims to enhance digital literacy and accessibility, facilitating the adoption of AI technologies across the country.

- 🇮🇳 India – Telecom Review Asia Pacific

- 5G Adoption Projections: According to the GSMA’s Mobile Economy China 2024 report, China is expected to reach a 5G adoption rate of 90% by 2030, positioning it as a global leader in mobile connectivity.

- 🇨🇳 China – Government of the People's Republic of China

- 5G and AI Integration: China’s 5G commercialization has directly generated approximately CNY 5.6 trillion (around USD 787.53 billion) in economic output over the past five years, significantly enhancing the infrastructure for AI-powered applications.

- AI Industrial Investment: The State Council budgeted USD 2.1 billion for an AI industrial park in Mentougou district, aiming to foster AI development and integration into various sectors.

- AI Ethics Guidelines: China’s Ministry of Science and Technology published the 'New Generation of Artificial Intelligence Ethics Code,' focusing on user protection, data privacy, and security in AI applications.

- AI in Surveillance: AI-powered facial recognition systems are employed in China’s smart city initiatives for mass surveillance, integrating with national security frameworks.

- AI Roadmap: The Chinese State Council's 2017 plan outlines a three-step roadmap to make China a world leader in AI by 2030, with breakthroughs expected by 2025.

- AI Device Investment: Honor announced a USD 10 billion investment over five years to develop AI for its devices, including smartphones, PCs, tablets, and wearables, with support from the Shenzhen local government.

- 🇺🇸 United States – Government of the United States

- AI Application Bans: In February 2025, Texas became the first U.S. state to ban the Chinese AI app DeepSeek and social media apps RedNote and Lemon8 from government-issued devices due to security concerns.

- AI Demand in Semiconductor Industry: TSMC anticipates that rising AI-powered features in smartphones will drive future demand, with AI and 5G applications significantly boosting revenue.

Global AI Smartphones Market: Market Dynamics

Global AI Smartphones Market: Driving Factors

Rising Integration of On-Device AI and Edge ComputingThe shift toward on-device AI processing is significantly driving market growth by reducing dependence on cloud computing and enhancing real-time performance.

Edge computing allows AI tasks, such as facial recognition, voice commands, and smart camera functions, to be processed directly on the smartphone, improving speed, privacy, and battery efficiency. As chipmakers continue to optimize neural processing units (NPUs) for mobile devices, AI smartphones are becoming more powerful and efficient, enabling seamless multitasking and intelligent automation for end users.

Growing Demand for Personalized User Experiences

Consumer expectations have evolved to demand highly personalized digital experiences. AI smartphones cater to this demand by learning from user behavior and adapting interfaces, app suggestions, and notification settings accordingly. With machine learning algorithms embedded into mobile operating systems, these devices offer real-time content curation, predictive text input, and contextual recommendations, boosting user satisfaction and engagement. This emphasis on AI-driven customization is pushing smartphone makers to differentiate their offerings in a competitive market.

Global AI Smartphones Market: Restraints

High Cost of AI-Integrated Smartphones

Despite the widespread appeal, AI smartphones often carry a premium price tag due to the sophisticated hardware required to support AI capabilities, such as dedicated AI chips and high-performance GPUs. This cost barrier limits adoption, especially in developing markets where consumers are more price-sensitive. As mid-range devices begin to incorporate more AI functions, affordability remains a significant hurdle to achieving widespread penetration of advanced AI features across all consumer segments.

Data Privacy and Ethical Concerns

The integration of AI in smartphones raises concerns regarding data privacy, surveillance, and algorithmic bias. Since many AI functions rely on personal data, such as location, voice, biometric identifiers, and usage patterns, there is growing scrutiny over how this data is collected, processed, and stored. Misuse or inadequate protection of sensitive user information can lead to consumer distrust, regulatory intervention, and legal complications, potentially hindering market growth.

Global AI Smartphones Market: Opportunities

Expansion into Emerging Markets with Affordable AI Devices

As AI hardware becomes more cost-effective, there is a significant opportunity to penetrate emerging markets with affordable smartphones that still offer intelligent features. Companies focusing on AI-lite models can capitalize on the growing demand for smarter yet budget-friendly devices. Brands such as Realme, Tecno, and Xiaomi are well-positioned to scale AI smartphone adoption in regions like Southeast Asia, Africa, and Latin America, where mobile-first consumers are seeking enhanced functionality without premium pricing.

Integration of AI in Health and Wellness ApplicationsAI smartphones are evolving into personal health assistants by incorporating machine learning algorithms that monitor physical activity, detect anomalies in user behavior, and integrate with wearable devices. Features such as AI-driven sleep tracking, heart rate monitoring, and mental wellness apps are gaining traction, especially post-pandemic. This opens new avenues for AI smartphones to play a central role in

digital health ecosystems, partnering with

telehealth platforms and IoT-enabled medical devices.

Global AI Smartphones Market: Trends

Advancements in AI-Driven Multimodal InterfacesA major trend in the AI smartphone market is the rise of multimodal interaction, where users can communicate with their devices using voice, gestures, and visual inputs simultaneously. With improvements in natural language understanding, computer vision, and contextual awareness, smartphones are now capable of offering more intuitive and human-like interactions. This trend is transforming accessibility, gaming, and productivity by making devices more adaptive and responsive to real-world stimuli.

Emphasis on AI for Mobile Security and Fraud Detection

Smartphone security is leveraging AI to counter cyber threats in real time. From AI-enhanced facial recognition that adapts to changes in user appearance to real-time fraud detection algorithms that monitor unusual login behavior, AI is becoming a frontline defense mechanism. Additionally, smartphones are beginning to use behavioral biometrics and anomaly detection to prevent unauthorized access, especially in mobile banking and fintech applications, signaling a shift toward proactive, AI-driven mobile security protocols.

Global AI Smartphones Market: Research Scope and Analysis

By Price Tier Analysis

In the AI smartphones market, premium smartphones are expected to maintain their dominance in the price tier segment, capturing 70.4% of the total market share in 2025. This stronghold is largely attributed to their ability to support advanced AI functionalities such as on-device machine learning, real-time language translation, high-precision facial recognition, and ultra-intelligent camera systems.

These devices typically come equipped with high-end chipsets featuring dedicated neural processing units (NPUs), enabling faster and more efficient AI performance without relying on cloud computing. Tech-savvy consumers and professionals are drawn to the seamless experiences, superior build quality, and ecosystem integration offered by flagship models from Apple, Samsung, and Google, further reinforcing premium devices' leadership in the global AI smartphone landscape.

In contrast, the mid-range segment (USD 300–USD 600) is carving out a critical role in expanding AI smartphone adoption across emerging and price-sensitive markets. While these smartphones may not offer the full suite of AI capabilities seen in premium models, they still pack essential features like AI-enhanced photography, adaptive battery optimization, and voice-based virtual assistants. Brands such as OnePlus, Xiaomi, and Vivo are strategically positioning themselves in this space by delivering devices that balance performance and affordability.

This segment plays a vital role in driving mass adoption of AI technology in smartphones, particularly in regions like Southeast Asia, India, and parts of Africa and Latin America, where consumers seek innovation without the premium price tag. As AI technology becomes more scalable and cost-efficient, the mid-range tier is expected to experience substantial growth, bridging the gap between basic smartphones and high-end AI-powered flagships.

By AI Capability Analysis

In the AI capability segment of the global AI smartphones market, on-device AI is poised to consolidate its dominance by capturing 65.7% of the total market share in 2025, underscoring a major shift toward localized, efficient, and privacy-centric computing. On-device AI refers to the ability of a smartphone to process machine learning tasks directly within the hardware, typically using dedicated components like neural processing units (NPUs) or AI accelerators, without needing to access cloud servers. This approach drastically reduces latency, enhances user privacy, and enables real-time responsiveness in features like facial recognition, predictive text, smart photography, and context-aware voice commands.

Major OEMs such as Apple, Samsung, and Google are at the forefront of embedding advanced AI chipsets that allow AI to run natively, even without an internet connection. As users value fast, secure, and seamless mobile experiences, on-device AI is becoming the gold standard for intelligent smartphones, enabling them to learn from user behavior, optimize battery life, and provide instant functionality with high reliability.

Conversely, cloud-based AI remains an essential component of the AI smartphones ecosystem, especially in lower-tier devices or in use cases requiring heavy computational power and large datasets. Cloud-based AI refers to the use of remote servers to perform complex AI tasks such as real-time translation across multiple languages, deep data analytics, and advanced speech synthesis. While it requires internet connectivity, it enables smartphones without dedicated AI hardware to still offer intelligent features by offloading the processing load to powerful cloud infrastructures.

This model benefits from scalability, continuous updates, and access to vast computational resources, which is why it's commonly utilized by digital assistants like Alexa and Google Assistant. Cloud AI is particularly valuable for delivering uniform AI experiences across devices and ensuring rapid deployment of new capabilities. However, limitations related to connectivity, latency, and data privacy continue to drive the industry toward a hybrid model, where cloud-based AI complements on-device intelligence for more robust and flexible performance across user segments.

By Distribution Channel Analysis

In the distribution channel segment of the global AI smartphones market, offline retail is expected to retain its dominance, accounting for 77.3% of the market share in 2025, due to its deep-rooted presence and high consumer trust across both developed and emerging regions. Brick-and-mortar retail stores, including brand-exclusive outlets, electronics chains, and mobile network operator stores, offer a tactile shopping experience that allows consumers to physically interact with devices before purchase. This hands-on engagement is especially valuable for AI smartphones, where features like facial recognition speed, camera intelligence, and voice assistant responsiveness are better appreciated in person.

Moreover, offline retail provides personalized assistance, guided demos, and after-sales support that many consumers, particularly in rural and semi-urban areas, still prefer. Retailers also play a vital role in educating customers about complex AI features, driving awareness and purchase decisions. With global smartphone brands continuing to invest in physical store expansion and retail partnerships, the offline channel remains a cornerstone for high-volume sales and brand visibility.

In contrast, online platforms are rapidly growing as a complementary distribution channel in the AI smartphones market, driven by digital transformation and evolving consumer preferences for convenience, variety, and competitive pricing. E-commerce giants like Amazon, Flipkart, JD.com, and regional platforms such as Noon and Lazada have significantly widened access to AI-enabled smartphones, even in remote geographies. These platforms benefit from advanced product filtering, AI-driven recommendation engines, and influencer-driven marketing to guide users toward suitable devices based on usage behavior, preferences, and price range.

Online sales channels are especially popular during product launches, flash sales, and promotional events, where exclusive models or early access incentives are offered. Additionally, integration of virtual try-ons, 360-degree product views, and detailed AI feature breakdowns helps bridge the experience gap traditionally associated with digital shopping. While the online channel may not match the dominance of offline retail yet, its share continues to rise steadily, particularly among tech-savvy urban consumers and younger demographics seeking a seamless, information-rich purchasing experience.

By Application Analysis

In the application type segment of the global AI smartphones market, personal users are expected to maintain their dominance, capturing 47.1% of the market share in 2025, as individual consumers continue to drive the demand for smarter, more intuitive mobile experiences. Personal users are reliant on AI-powered smartphones for everyday tasks such as voice commands, smart photography, personalized content curation, and health monitoring. These devices are integrated into daily life through features like virtual assistants, biometric security, real-time translation, and adaptive battery management, offering a seamless digital lifestyle designed to individual habits and preferences.

The rise of digital natives, social media influencers, and remote work culture has further accelerated this trend, as consumers demand performance-rich, AI-integrated devices that serve as their primary tools for communication, content creation, and personal productivity. Additionally, brand loyalty and rapid upgrade cycles in the personal segment ensure steady growth, as users look for the latest in mobile AI innovations with every new release.

Meanwhile, commercial use of AI smartphones is emerging as a strategic segment, gaining traction across industries that are leveraging mobile AI capabilities to boost productivity, efficiency, and security. Enterprises and field professionals are utilizing AI smartphones for business communications, real-time data processing, document scanning, language translation, and secure mobile payments. Sales teams, logistics personnel, healthcare workers, and customer service professionals benefit from AI-driven tools that offer context-aware assistance, voice-to-text transcription, and intelligent scheduling.

Moreover, industries are deploying fleet devices equipped with mobile device management (MDM) software and AI analytics to monitor usage, ensure compliance, and enhance employee performance. Commercial adoption is also being fueled by the integration of AI smartphones into broader digital transformation strategies, especially within SMEs and startups that seek scalable and portable solutions without investing in large IT infrastructures. Though currently a smaller share of the market compared to personal use, the commercial segment is poised for robust growth as AI smartphones evolve into essential tools for mobile workforce enablement and enterprise agility.

The AI Smartphones Market Report is segmented on the basis of the following

By Price Tier

- Premium (> USD 600)

- Mid-Range (USD 300-USD 600)

- Budget (< USD 300)

By AI Capability

- On-Device AI

- Cloud-Based AI

By Distribution Channel

- Offline Retail

- Online Platforms

By Application

- Personal Use

- Commercial Use

- Healthcare and Education

Global AI Smartphones Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global AI smartphones market in 2025, capturing 40.0% of the total revenue share, fueled by its advanced digital infrastructure, high consumer spending, and rapid adoption of cutting-edge mobile technologies. The region benefits from the strong presence of key players such as Apple, Google, and Qualcomm, who continuously push innovation in AI chipsets, software integration, and device functionality.

Consumers in the U.S. and Canada are early adopters of intelligent features like voice recognition, real-time translation, smart photography, and privacy-focused on-device AI, supported by widespread 5G connectivity. Additionally, enterprise uptake of AI-powered smartphones for business productivity, mobile security, and field operations further strengthens regional demand. Combined with a robust ecosystem of AI research, regulatory clarity, and cross-industry collaborations, North America remains at the forefront of driving both innovation and large-scale adoption of AI-integrated mobile experiences.

Region with significant growth

Asia Pacific is expected to register the highest CAGR in the global AI smartphones market, driven by rapid digital transformation, growing smartphone penetration, and a tech-savvy population across emerging economies. Countries like China, India, South Korea, and Southeast Asian nations are witnessing accelerated adoption of AI-enabled mobile devices, fueled by competitive pricing, expanding 5G networks, and growing demand for intelligent features such as voice assistants, smart photography, and real-time language translation.

Regional manufacturers like Xiaomi, Vivo, Oppo, and Samsung are heavily investing in integrating AI capabilities into mid- and low-tier smartphones, making advanced functionalities more accessible to the mass market. Additionally, rising internet connectivity, government-led digital initiatives, and a booming youth demographic are creating a fertile ground for sustained growth. With both domestic innovation and international demand converging, Asia Pacific is set to emerge as the fastest-growing region in the AI smartphones landscape through the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global AI Smartphones Market: Competitive Landscape

The global competitive landscape of the AI smartphones market is marked by fierce competition among industry giants like Apple, Samsung, Huawei, Google, and Xiaomi, alongside rising regional players such as Realme and OnePlus. These leading brands differentiate themselves through innovations in AI hardware, such as Neural Processing Units (NPUs), and AI-powered features like intelligent voice assistants, enhanced photography, and adaptive battery management.

Apple and Google dominate the premium segment with their proprietary AI solutions, while Chinese manufacturers, including Huawei and Xiaomi, capture significant market share with affordable AI-enabled devices in emerging markets. Additionally, companies like Qualcomm and MediaTek drive competition by providing advanced AI chipsets, while collaborations with telecom providers and advancements in 5G connectivity enhance AI capabilities. As AI technology evolves, competition intensifies with a focus on improving efficiency, privacy, and security, creating a dynamic and rapidly changing marketplace.

Some of the prominent players in the global AI smartphones are

- Samsung

- Apple

- Xiaomi

- Huawei

- OPPO

- Vivo

- Google

- OnePlus

- Sony

- Motorola

- Realme

- Honor

- Asus

- Lenovo

- ZTE

- Nokia (HMD Global)

- Meizu

- Tecno

- Infinix

- Lava

- Other Key Players

Global AI Smartphones Market: Recent Developments

- April 2025: Samsung unveils its new AI-driven smartphone series, featuring an upgraded Neural Processing Unit (NPU) and enhanced on-device machine learning capabilities for faster real-time performance in imaging, voice recognition, and battery optimization.

- March 2025: Apple releases the latest iPhone series with a dedicated AI chip that optimizes the camera’s computational photography features, providing better image quality and advanced AI-based scene recognition.

- February 2025: Xiaomi launches its flagship AI smartphone equipped with a state-of-the-art AI-powered gaming mode, offering real-time performance enhancements and adaptive cooling for an immersive mobile gaming experience.

- January 2025: Google announces new AI features for its Pixel devices, including more accurate voice assistants and AI-assisted health monitoring tools, using advanced machine learning models for personalized recommendations.

- December 2024: Huawei introduces a series of AI smartphones with integrated 5G capabilities, designed to enhance AI-powered applications such as augmented reality (AR) and real-time translation with cloud processing support.

- November 2024: Qualcomm unveils its latest AI chipset, the Snapdragon X, which offers improvements in power efficiency and AI performance, enabling faster on-device processing for smartphones and expanding capabilities for machine learning tasks.

- October 2024: OPPO releases an AI-powered camera system that leverages deep learning algorithms to enhance image quality in low-light conditions and offers real-time facial recognition and scene adjustment for superior photography.

- September 2024: OnePlus introduces new AI-enhanced features in its Nord series, including real-time AI-driven battery optimization and intelligent resource management, improving the overall performance and longevity of the devices.

- August 2024: Vivo launches a new AI-powered smartphone with a smart assistant that can anticipate user needs based on behavioral data, offering proactive reminders and task suggestions to increase user productivity.

- July 2024: Realme introduces its first AI smartphone featuring on-device AI capabilities, including enhanced security features like real-time facial recognition and a more personalized user experience through advanced machine learning algorithms.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 90.8 Bn |

| Forecast Value (2034) |

USD 854.2 Bn |

| CAGR (2025–2034) |

28.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 30.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Price Tier (Premium > USD 600, Mid-Range USD 300-USD 600, Budget < USD 300), By AI Capability (On-Device AI, Cloud-Based AI), By Distribution Channel (Offline Retail, Online Platforms), By Application (Personal Use, Commercial Use, Healthcare and Education). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Samsung, Apple, Xiaomi, Huawei, OPPO, Vivo, Google, OnePlus, Sony, Motorola, Realme, Honor, Asus, Lenovo, ZTE, Nokia (HMD Global), Meizu, Tecno, Infinix, Lava, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global AI smartphones market size is estimated to have a value of USD 90.8 billion in 2025 and is expected to reach USD 854.2 billion by the end of 2034.

The US AI smartphones market is projected to be valued at USD 30.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 253.6 billion in 2034 at a CAGR of 26.5%.

North America is expected to have the largest market share in the global AI smartphones market, with a share of about 40.0% in 2025.

Some of the major key players in the global AI smartphones market are Samsung, Apple, Xiaomi, Huawei, OPPO, Vivo, Google, OnePlus, Sony, Motorola, Realme, Honor, Asus, Lenovo, ZTE, Nokia (HMD Global), Meizu, Tecno, Infinix, Lava, and Other Key Players.

The market is growing at a CAGR of 28.3 percent over the forecasted period.