Application security involves the implementation of measures and protocols within software applications to protect them from threats and vulnerabilities throughout their lifecycle. It ensures that the application is free from defects & vulnerabilities that could be exploited by attackers to gain unauthorized access, steal data, or disrupt services.

As applications become more central to business operations, ensuring endpoint detection and response (EDR) is integrated into application security practices becomes crucial. This approach helps in identifying threats and vulnerabilities proactively.

An increasing number of cybersecurity breaches targeted at specific business applications, growing adoption of mobile & cloud-based technologies, and stringent compliance and regulatory requirements for application security are fueling market expansion.

Growing concerns related to cloud services and AI for threat detection are also significant contributors. Increasing cybersecurity cases are one of the main factors propelling the growth of application security. Businesses are turning to security as a service to optimize their security posture with AI in cybersecurity solutions.

Key Takeaways

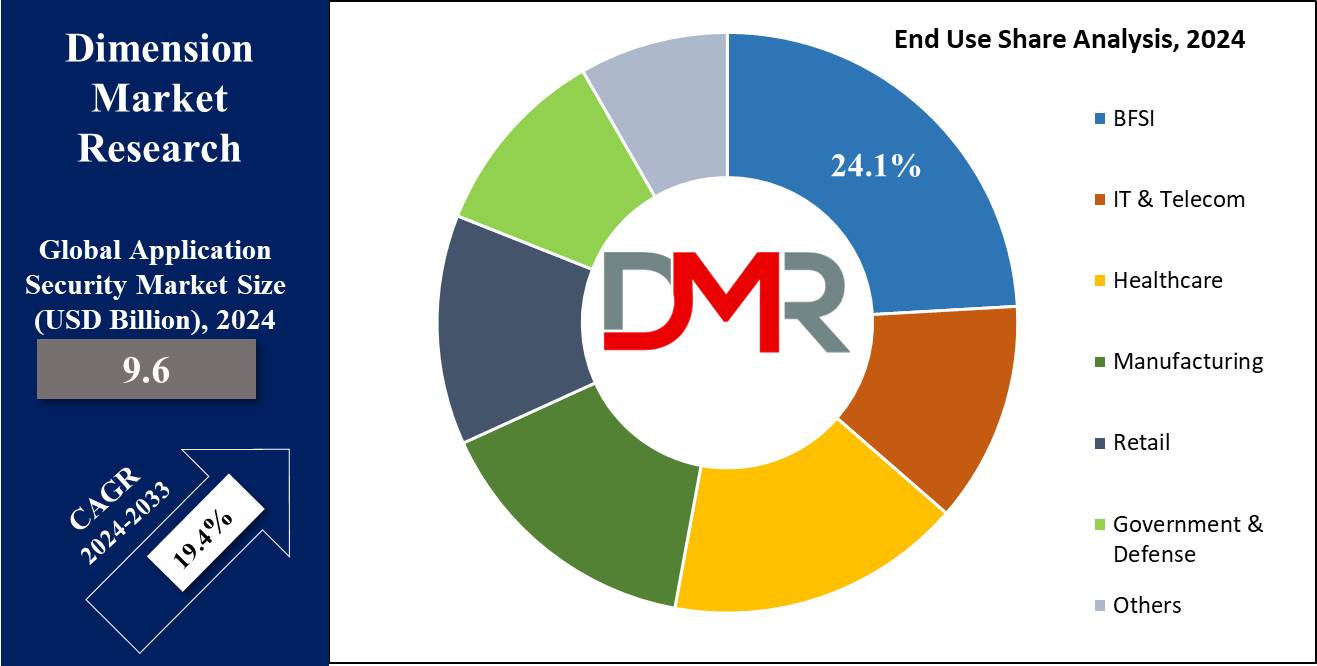

- Market Size: The Global Application Security Market is projected to grow by 36.0 billion, at a CAGR of 19.4 % during the forecasted period.

- Market Definition: Application security is the set of measures and practices to protect software applications from various security threats. This includes securing APIs, ensuring identity & access management, and leveraging security information and event management (SIEM) solutions.

- Component Analysis: By Component, the solution is expected to hold the largest market share of 69.1% in 2024 & is anticipated to dominate throughout the forecasted period.

- Testing Analysis: Based on the testing, Static application security is expected to be a dominant segment in the market with the largest revenue share during the forecasted period.

- Deployment Analysis: On-premise deployment is expected to come out as a dominant force with a higher revenue share in 2024.

- Enterprise Analysis: By Enterprise, large enterprises are expected to lead the application security market with the largest market share in 2024.

- End-User Analysis: BFSI is expected to lead the application security market based on end-use, with a revenue share of 24.1 % in 2024.

- Regional Analysis: North America is expected to hold a 41.7% revenue share in the Global Application Security Market in 2024.

Use Cases

- Web Application: Application security provides safety to rising web-based services and platforms as they offer protection against common threats such as SQL injection, cross-site scripting, and cross-site request forgery.

- Mobile Application Security: This application security helps secure mobile apps, which often handle sensitive user data such as personal information, financial transactions, and location data. It includes static & dynamic analysis tools, runtime application self-protection (RASP), and mobile device management (MDM) systems.

- Cloud Application Security: These are designed to protect applications hosted on cloud platforms such as AWS, Azure, and Google Cloud as they offer a range of security measures, including encryption, identity and access management (IAM), and continuous monitoring to detect and respond to security incidents in real-time.

- API Security: APIs are responsible for enabling different software systems to communicate and share data. Their security is important as it involves protecting them from threats like data breaches, denial-of-service attacks, and unauthorized access.

Market Dynamic

Drivers

Rising cybersecurity threats

The increasing number of cybersecurity breaches, particularly those targeting business-critical applications, is a major driver for market growth. Businesses are investing in managed security services and next-generation firewalls (NGFWs) to protect their applications and sensitive data.

Growing adoption of next-generation application security options

Companies are adopting next-generation application security platforms as they offer complete visibility into services, dependencies, APIs, and data flows. They are introducing new features for organizations like Business Risk Scoring and Bionic Signals to streamline threat identification. They use data from various security tools to inspect vulnerabilities and assess the relative risk of applications. It enables engineering teams to quickly prioritize and address critical threats.

Restraints

Shortage of skilled security professionals

There is a lack of qualified individuals with the necessary skill sets to develop and implement security systems. It can impede the ability of an organization to manage security technologies effectively. It is further accelerated by the constantly evolving threat landscape, which requires continuous learning and upskilling of security professionals.

Complexity in securing modern applications

The complexity of modern application environments, which include containers and multi-cloud setups, poses a significant challenge in ensuring comprehensive security across dynamic application landscapes. Continuous monitoring is important to address this complexity, creating a notable challenge for the growth of application security.

Opportunities

Increasing Use of AI-Driven Solutions

The growing adoption of AI and ML in web and mobile-based security processes shows an opportunity for the application security market. These technologies help strengthen security measures by providing advanced threat detection capabilities and analyzing vast amounts of data to identify patterns indicative of potential attacks. They improve the efficiency of security systems and allow organizations to stay ahead of evolving cyber threats in real time, thereby driving demand for innovative application security solutions.

Use of SaaS application security

Software as a service (SaaS) shows a great opportunity for businesses to access cost-effective & scalable security options. It allows organizations to deploy security measures without the need for significant upfront investments in infrastructure or software licenses. It encourages more businesses, including small and medium-sized enterprises (SMEs), to prioritize application security and adopt robust protection measures.

Trend

Use of DevSecOps

The Application Security market is witnessing a significant trend in the global adoption of DevSecOps practices. It integrates security practices and tools smoothly into the DevOps workflow, which ensures security measures are ingrained in the application development and deployment processes right from the start. They show the importance of taking a proactive and collaborative approach to application security, as it is an indispensable part of the entire software development lifecycle.

Research Scope and Analysis

By Component

Solution is expected to dominate the Application security market with the largest revenue share of 69.1% in 2024, due to increasing demand for mobile and web application security. Higher internet penetration of smart devices and adoption of bring-your-own-device policies within organizations lead to more frequent use of personal devices such as smartphones, smart wearables, laptops, and tablets to access corporate information, which drives the growth of this market.

There is a constant demand for application security solutions to prevent data breaches in mobile applications. It is essential for managing and identifying risks associated with open-source and third-party components during both the development and production stages. They aggregate risk scores from software composition analysis, static analysis, and dynamic analysis, allowing users to filter across multiple security tests.

Meanwhile, service is anticipated to experience the highest revenue share due to increasing demand for organizations to outsource their security needs, due to a shortage of skilled and experienced in-house security professionals, which significantly contributes to the dominance of this segment.

By Testing

Static application security testing is anticipated to dominate the application security market with the largest revenue share in 2024, due to its ability to address and identify vulnerabilities early in the software development life cycle.

They analyze source code, byte code, and binary code without executing the program, which allows developers to detect security issues promptly and resolve them. This early detection and remediation prevent vulnerabilities from reaching the final stage of application, reducing the risk of security breaches and ensuring a more secure software product.

It is important to maintain strong application security, which propels the growth of the SAST segment. Also, Dynamic Application Security Testing (DAST) is expected to experience notable growth due to increasing dependence on web and mobile applications, which are the leading cause of data breaches. They mimic external hacker attacks by functioning without internal knowledge of the application or its source code, targeting exploitable weaknesses.

By Deployment

In terms of deployment, the on-premise is expected to take the lead in the global application security market, commanding the largest share in terms of revenue in 2024. Organizations prefer these deployments as they have complete control over their data.

It allows them to implement necessary procedures and policies to optimize security. It protects certain types of sensitive information according to industry regulations or client contracts. They offer protection against external attacks, as access to critical business information is controlled by the internal security teams.

It ensures full maintenance and oversight of its security, driving the growth of the industry. On the other hand, cloud deployment is predicted to show notable growth due to the increasing adoption of cloud computing by organizations.

It involves security and governance controls designed to protect data across the entire cloud environment. Organizations may significantly reduce their IT operational costs by migrating data and assets from on-premises locations to the cloud.

They are also preferred as they can accommodate unlimited security feeds based on the subscription. It removes the requirement of the internal network as data is transmitted over the internet from the security source to the cloud externally. Data on cloud networks can be reviewed using mobile devices with remote access or on-site monitors, which expands the application security market.

By Enterprise

Large enterprises are anticipated to maintain their market dominance, with the largest revenue share in 2024. They are engaged in many business-critical tasks, like ordering goods and services or processing payments, which makes various applications vulnerable to security threats.

The applications of these businesses are not regularly updating their data which poses a significant risk to their platform. Thus, they are increasingly investing in application security systems, driving the growth of this segment. Also, the small and medium-sized businesses category is predicted to register the fastest annual growth rate during the projection period.

The continuous occurrence of cyberattacks on SMEs is rising, which forces these businesses to invest in application security solutions. They are seeking application security platforms due to the rapid adoption of new technologies and the increase in hybrid work models. Manufacturers are offering comprehensive packages and customized application security solutions for SMEs, fueling the growth of the market.

By End Use

Banking, Finance Services, and Insurance (BFSI) is anticipated to capture the largest revenue share in 2024; they are more prone to application attacks. These banks and financial institutions are responsible for managing and storing large amounts of sensitive consumer financial data, such as account numbers, trading transactions, credit card and debit card details, payment information, and transaction records.

Thus, security solutions are important for identifying and mitigating security vulnerabilities to protect these applications. Many banking operations and financial works increasingly shifting towards digital-centric approaches, which are conducted through mobile or web apps, ensuring a seamless user experience without interruptions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The adoption of security solutions integrated with

machine learning helps identify security gaps and protect against vulnerabilities. It is also helpful in providing effective resolution of customer queries by agents.

Healthcare is the second largest segment anticipated to show growth in the application security market, due to its cybersecurity risks linked to web-based email services, cloud storage, and dentists' computer-aided design (CAD) systems.

The Application Security Market Report is segmented based on the following:

By Component

- Solution

- Web Application Security

- Mobile Application Security

- Services

- Professional Services

- Managed Services

By Testing

- Static Application Security Testing (SAST)

- Dynamic Application Security Testing (DAST)

- Interactive Application Security Testing (IAST)

- Runtime Application Self-Protection (RASP)

By Deployment

By Enterprise

- Large Enterprises

- Small & Medium Enterprises

By End Use

- IT & Telecom

- BFSI

- Healthcare

- Manufacturing

- Retail

- Government & Defense

- Others

Regional Analysis

North America is expected to dominate the global application security market with a

revenue share of 41.7% in 2024, due to the rise in cloud-based security networking and mobile device usage, along with the presence of major companies.

Also, rising security breaches targeting business applications and a projected increase in the number of SMEs in this region propelled the growth of this market. There is a frequent occurrence of hackers accessing enterprise web-based email and other web applications by using stolen credentials.

After North America, the Asia-Pacific is the second-largest region expected to see significant application security market growth. The growing adoption of SaaS-based security solutions and the BYOD trend among businesses in this region boosted the application security market. Further, increasing the use of ML and AI in security to identify threats and vulnerabilities quickly leads to the adoption of application security solutions in the market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The application security market is fiercely competitive, with numerous key players competing for market dominance. Players in the market continually innovate and create cutting-edge security solutions to tackle the increasing challenges and threats in the application security sector. This competitive environment fuels innovation and progress in application security, enabling organizations to safeguard their crucial applications and data against emerging threats.

Key players in the global market, such as Veracode, Qualys, Inc., HCL Technologies Limited, Synopsys, Inc., Open Text (CyberRes), Imperva, and others, are focused on expanding their geographical presence. Major players are introducing specific solutions and new products to attract a vast customer base, improving revenue.

Some of the prominent players in the global application security market are

- CAST Software

- Checkmarx

- Cisco Systems, Inc.

- F5, Inc.

- GitLab

- HCL Technologies Ltd

- International Business Machines Corporation

- MicroFocus

- Onapsis

- Rapid7

- Others

Recent Development

- In March 2024, GitLab Inc., recognized for its AI-driven DevSecOps platform, revealed the acquisition of Oxeye, a cloud-native application security provider. This acquisition aims to enhance GitLab's capabilities in Static Application Security Testing (SAST) and software composition analysis tools.

- In March 2024, StackHawk, a company integrating application security testing into software delivery, announced the availability of StackHawk Pro and StackHawk Enterprise on the Microsoft Azure Marketplace. This marketplace offers applications and services for use on Azure.

- In November 2023, Snyk expanded its offerings by partnering with Amazon Web Services (AWS) to enable global enterprises to implement developer security from code to cloud. Snyk introduced new integrations with AWS services, such as Amazon EventBridge, AWS Security Hub, and AWS CloudTrail Lake, to provide customers with a unified experience and modernize vulnerability management across their codebase.

- In November 2023, Require Security Inc., a cybersecurity company, launched Falcon, a Runtime Application Security Protection application. For companies that depend on open-source libraries, the solution offers the highest level of security, protecting them against potential threats and vulnerabilities.

- In October 2023, Checkmarx Ltd., a cloud-based application security provider announced its Checkmarx Technology Partner program, to provide businesses quick access to various technology partner features that let them expand the AppSec platform. With the launch of its Checkmarx Technology Partner program, the business made it simple for enterprises to add various technology partner capabilities to the AppSec platform.

- In July 2023, New Relic, Inc., a web tracking and analytics company, launched the Interactive Application Security Testing (IAST). In addition to offering guided remediation and advanced detection accuracy, Relic IAST also facilitates visibility and context to security findings.