Biologics, also known as biological medications, are disease-modifying drugs made from living organisms or their components. They contain blood products, vaccines, tissues, & more derived from different sources like animals, humans, & plants. These substances influence essential proteins, modify hormones & cells, and can either boost or suppress the immune system, ultimately impacting natural biological processes.

Biologics are complex, large-molecule drugs derived from living cells, tissues, or organisms, often targeting specific diseases with high efficacy and fewer side effects compared to traditional drugs. They're primarily used in treating chronic and life-threatening conditions like cancer, autoimmune disorders, and rare diseases.

The biologics market is growing rapidly due to increased demand for personalized medicine and advancements in biotechnology. Important conferences include the BIO International Convention, BioProcess International Conference, and World Biosimilar Congress.

Recent industry surveys reveal a strong market focus on biosimilars, cell, and gene therapies, with significant investment in R&D and manufacturing capacity.

According to Allergy, Asthma & Clinical Immunology, in a study of 5,997 patients (58% male, mean age 48.1), 10.7% (642) used biologics. Asthma was more common in biologic users (89.1%) than non-users (35%; P<0.001). Biologic users had fewer diagnostic (but more drug-related) services.

Among 11.6% of sinus surgery patients using biologics, 56.1% started treatment before surgery, and 12.5% began ≤30 days post-surgery. Oral corticosteroid (OCS) use was higher in biologic users (68.8% vs 42.5%; P<0.001).

Asthma raised biologic use odds by 5.46 times; age <65, prior OCS/doxycycline, and comorbidities also increased use.

Recent news highlights include regulatory advancements for biosimilars, partnerships for novel cell and gene therapies, and innovations in manufacturing to reduce costs and improve accessibility.

Key Takeaways

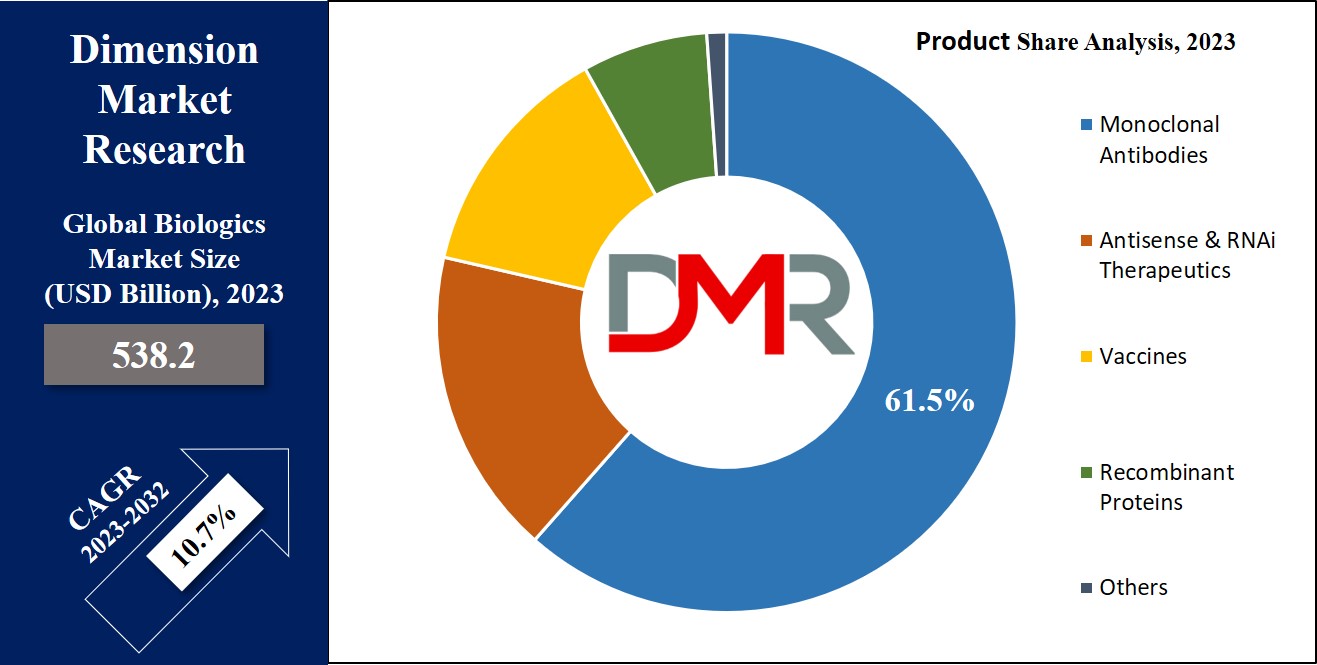

- Market Growth: The global biologics market is projected to grow from USD 538.2 billion in 2023 to USD 1,342.7 billion by 2032, with a strong CAGR of 10.7%.

- Therapy Advancements: Biologics are increasingly favored for treating chronic and life-threatening diseases, offering higher efficacy and fewer side effects compared to traditional drugs.

- Product Trends: Monoclonal antibodies dominate the market, while antisense and RNAi therapeutics are expected to see significant future growth due to their potential in gene-silencing treatments.

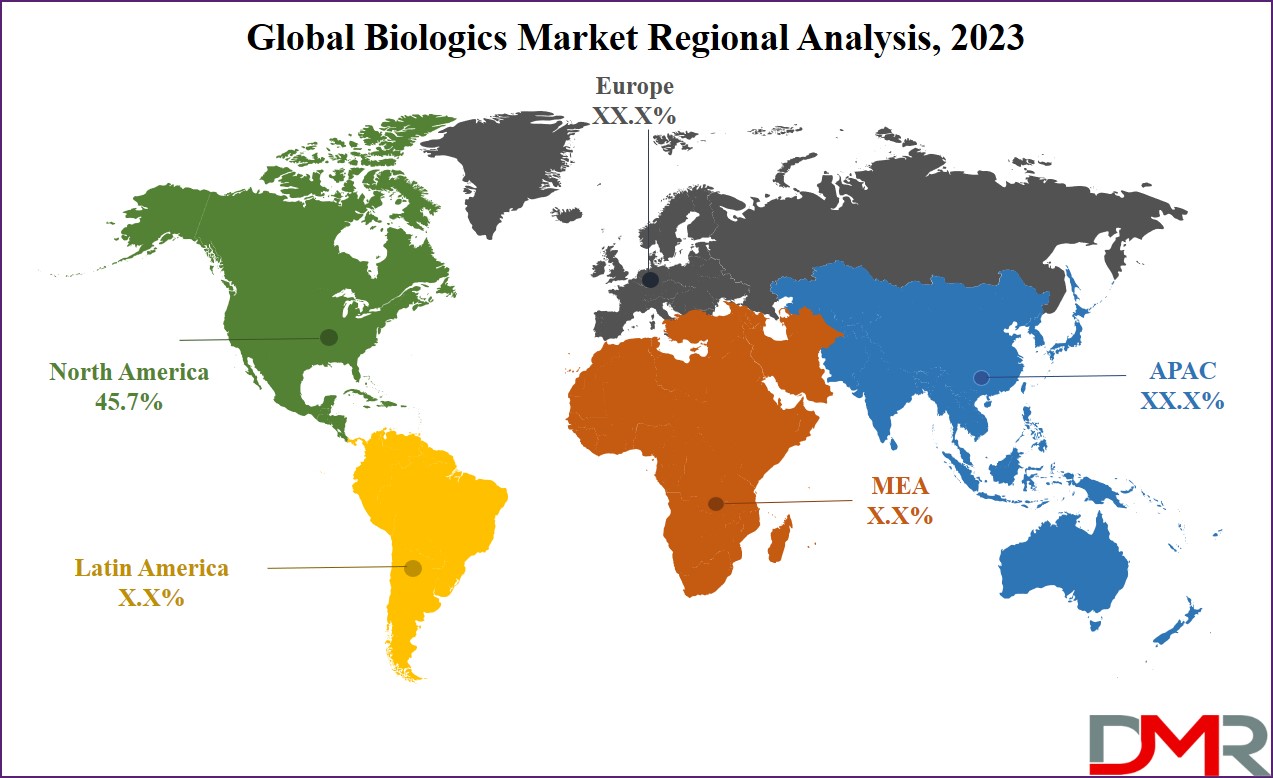

- Regional Leadership: North America led the market in 2023 with a 45.7% revenue share, driven by chronic disease prevalence, advanced infrastructure, and robust investments in research and targeted drug development.

- Manufacturing Shifts: In-house production controls most of the market, but outsourcing to specialized contract organizations is rising for efficiency and access to expert facilities.

- Market Drivers: Growing incidence of chronic diseases and government initiatives to enhance healthcare infrastructure continue to drive market expansion.

- Challenges: High production costs, limited skilled professionals, and inadequate infrastructure—especially around storage and distribution in developing regions—impede market penetration.

Use Cases

- Personalized Medicine: Enables development of biologics that target specific genetic profiles, improving treatment effectiveness for chronic diseases like cancer and autoimmune disorders.

- Rare Disease Therapy: Supports the creation of gene therapies and monoclonal antibodies for rare blood and genetic disorders, offering new hope for previously untreatable conditions.

- Biosimilar Adoption: Drives cost savings and wider access to advanced treatments by promoting biosimilar development and uptake in emerging markets and healthcare systems.

- Contract Manufacturing: Facilitates outsourcing production of complex biologics to specialized CDMOs, allowing pharmaceutical companies to scale efficiently and focus on R&D.

- Innovative Vaccines: Speeds up development and deployment of advanced vaccines—such as viral-vector and recombinant protein types—for widespread infectious disease prevention.

- Oncology Advances: Expands use of monoclonal antibodies and immunotherapies to enhance cancer care, improve survival rates, and reduce side effects compared to traditional treatments.

- Supply Chain Optimization: Highlights the need for robust logistics and cold chain management, reducing spoilage risk and ensuring global distribution of temperature-sensitive biologics.

Market Dynamic

According to the World Health Organization (WHO), about

41 million people lose their lives to chronic diseases annually. The most common among these is cardiovascular disease, causing about

17.9 million lives per year, followed by cancer, diabetes, & respiratory disorders. Together, these four categories are responsible for a

higher 80% of all chronic disease-related deaths.

The prevalence of chronic diseases has driven advancements in advanced diagnostics & treatments. Biologics, which are commonly engineered medicines targeting the immune system to fight inflammation, play a major role in addressing these health challenges. The growth of the biologics market is further influenced by growing healthcare expenditures & government initiatives focused on enhancing healthcare infrastructure.

However, many challenges are there in the biologics market, like the high costs associated with drug development & distribution create obstacles to growth. Also, limited healthcare infrastructure in developing economies, less skilled professionals, & a lack of awareness about biologics in research facilities may restrain and impede market growth. Moreover, the sensitivity of biologics to heat & light necessitates precise refrigeration, which is not consistently available worldwide, further hindering the market's growth.

Research Scope and Analysis

By Source

The global biologics market in terms of source is categorized into microbial, mammalian, and others. In 2023, the microbial source category takes a leading position within the biologics industry, holding a substantial share, which is primarily because a majority of the biologics currently approved have been created & produced using microbial expression systems. In addition, products like platelet-derived growth factor, granulocyte-macrophage colony-stimulating factor, recombinant insulin, & recombinant interferons are all manufactured in microbial expression systems.

Further, the mammalian expression systems segment is anticipated to witness major growth in the forecasted period. These systems are predominantly used for developing

recombinant proteins & viral-vector-based vaccines. The most commonly used mammalian cell lines in this context are CHO & HEK, which are driven by their effectiveness in producing these advanced biological products, marking an encouraging avenue for future growth in the biologics market.

By Product

Regarding the product, the monoclonal antibodies (MABs) category takes a substantial share in 2023, particularly because these drugs find broad application across several therapeutic areas. MABs offer the advantage of precisely targeting diseased cells while saving healthy ones, making them a popular choice in biological therapies, as they have emerged as the prominent category among approved biologic drugs to date.

Also, the antisense and RNAi therapeutics segment is expected to have significant growth in the coming years. These biological products enable accurate and effective gene silencing, resulting in the development and approval of numerous gene-silencing drugs for genetic diseases. This expansion is driven by the potential to address specific genetic conditions, making it a major segment in driving the biologics market's future.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Disease

The

oncology category in the diseases category stands as the driving factor in the biologics industry, holding a significant share in 2023. This is primarily due to the alarming prevalence of cancer, where approximately 2 million new cases and over 600,000 cancer-related deaths were reported in the U.S. in 2022 as per the American Cancer Society. Further, the introduction of biologic treatments, mainly monoclonal antibodies & immunotherapy, has markedly enhanced cancer care, increasing survival rates & lowering the side effects. In addition, biological drugs have left a positive mark on breast cancer treatment, as seen with the successful use of Herceptin.

Moreover, the hematological disorder category is anticipated to experience the most rapid growth in the forecast period, which is driven by the approval of gene therapy for rare blood disorders like hemophilia, which is a significant factor driving the market expansion.

By Manufacturing

The in-house manufacturing segment holds the dominant share of the market in 2023, as manufacturing biological drugs is more complex compared to small molecules, including live micro-organism cultures & strict regulatory compliance. In-house manufacturing gives the advantage of direct control, enabling better day-to-day monitoring of biological drug production.

In addition, the outsourcing segment is expected to grow at a high rate in the coming years, as numerous Contract Development & Manufacturing Organizations (CDMOs) like Lonza, Wuxi Biologics, & Samsung Biologics have established state-of-the-art biologic manufacturing facilities. Collaborating with these CDMOs gives organizations access to manufacturing experts, allowing successful downstream process development & the integration of new technologies. The market's growth is highly influenced by the growth in the number of CDMOs & their expansion in production capacity.

The Biologics Market Report is segmented on the basis of the following

By Source

- Microbial

- Mammalian

- Others

By Product

- Monoclonal Antibodies

- Antisense & RNAi Therapeutics

- Vaccines

- Recombinant Proteins

- Others

By Disease

- Oncology

- Infectious Diseases

- Cardiovascular Disorders

- Immunological Disorders

- Hematological Disorders

- Others

By Manufacturing

Regional Analysis

North America leads the global biologics market with the largest

share of 45.7% in 2023 in terms of market revenue due to various factors, which include a high prevalence of chronic diseases, the presence of key

biopharmaceutical companies, favorable reimbursement policies, & high investments in R&D. The growth in the use of biologic prescriptions & investments in targeted drug development also contribute to market growth. In addition, the approval of innovative biological drugs like antisense & RNAi therapeutics, and gene therapy, is expected to drive further expansion.

Also, the Asia Pacific region is set to experience significant growth during the forecasted period. The growth in the number of diseases like diabetes, cancer, and heart conditions, along with a rise in the elderly population, has led to a rise in demand for biologics. Market leaders are investing in advanced biologic products to meet this need, and the adoption of biosimilars is playing an important role in enhancing the accessibility & affordability of biologic treatments, further fueling market growth in the region.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The biologics market has a decent level of competition with many key players, who are using strategies like launching new products, mergers, acquiring other companies, & forming partnerships to enhance their positions in the market. They also invested a lot of money in R&D biologics as they are quite expensive to make.

Like, in February 2022, the Janssen Pharmaceutical Companies of Johnson & Johnson got the green light from the US Food and Drug Administration (FDA) for a biologic medication called CARVYKTI, which is developed to assist adults with a challenging form of multiple myeloma, known as RRMM (relapsed or refractory multiple myeloma), when they've already tried four or more different treatments, including specific types of drugs like immunomodulatory agents, proteasome inhibitors, and anti-CD38 monoclonal antibodies.

Some of the prominent players in the global Biologics Market are:

- Amgen Inc

- Sanofi

- AbbVie Inc.

- Johnson & Johnson

- Samsung Biologics

- Merck & Co.

- Pfizer Inc.

- Novartis AG

- Bayer AG

- AstraZeneca PLC

- Other Key Players

Recent Developments

- In April 2025, Boehringer Ingelheim and Cue Biopharma partnered to develop CUE-501, a bispecific biologic targeting autoimmune and inflammatory diseases through novel T-cell B-cell approaches.

- In February 2025, Biocon Biologics launched YESINTEK (ustekinumab-kfce), a biosimilar to Stelara®, in the U.S., increasing accessibility to biologic treatments for autoimmune disorders.

- In June 2025, Sanofi acquired Blueprint Medicines for $9.1 billion, gaining access to Ayvakit, a first-in-class tyrosine kinase inhibitor, and a broader rare oncology pipeline.

- In July 2025, Merck announced a $10 billion acquisition of Verona Pharma to strengthen its portfolio in respiratory disorders, focusing on ensifentrine for COPD.

- In February 2025, Biocon Biologics secured strong U.S. market access coverage for Yesintek™, covering over 100 million lives and bolstering its biosimilar reach.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 538.2 Bn |

| Forecast Value (2032) |

USD 1,342.7 Bn |

| CAGR (2023–2032) |

10.7% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Source (Microbial, Mammalian, and Others); By Product (Monoclonal Antibodies, Antisense & RNAi Therapeutics, Vaccines, Recombinant Proteins, and Others); By Disease (Oncology, Infectious Diseases, Cardiovascular Disorders, Immunological Disorders, Hematological Disorders, and Others); By Manufacturing (In-house and Outsourced) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Amgen Inc., Sanofi, AbbVie Inc., Johnson & Johnson, Samsung Biologics, Merck & Co., Pfizer Inc., Novartis AG, Bayer AG, AstraZeneca PLC, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |