Blockchain technology is transforming the Banking, Financial Services, and Insurance (BFSI) sector by improving security, transparency, and operational efficiency. It assists cryptocurrencies and applications like smart contracts, identity management, and fraud prevention.

The global blockchain market in BFSI is increasing significantly due to the adoption of distributed ledger technology, which minimizes fraud, streamlines processes, and lowers operational costs. Key growth drivers include the need for efficient business processes, secure transaction platforms, and regulatory changes favoring

digital ledger technologies.

Blockchain Technology in BFSI Market is experiencing tremendous growth in 2023 due to growing demands for increased security, transparency, and efficiency in financial transactions. Banks and financial institutions are turning increasingly toward blockchain solutions for faster payments, fraud detection/prevention/smart contracts as well as regulatory compliance/risk management improvements across their entire institution portfolios.

Multiple events in 2023 demonstrate the expanding adoption of blockchain within BFSI. Major financial players like JPMorgan, HSBC and Goldman Sachs have increased their blockchain initiatives utilizing distributed ledger technology (DLT) for cross-border payments utilizing DLT solutions such as distributed ledger technology (DLT). Their keen interest demonstrates its immense potential to transform traditional banking systems while driving industry wide innovation.

Asia-Pacific and Latin American emerging markets provide ample opportunities for blockchain solutions, especially with rising digital banking demand and rising cryptocurrency solutions investments by BFSI companies, investing heavily in blockchain to secure cost-efficient operations while regulatory clarity in these regions may further accelerate adoption of this emerging technology.

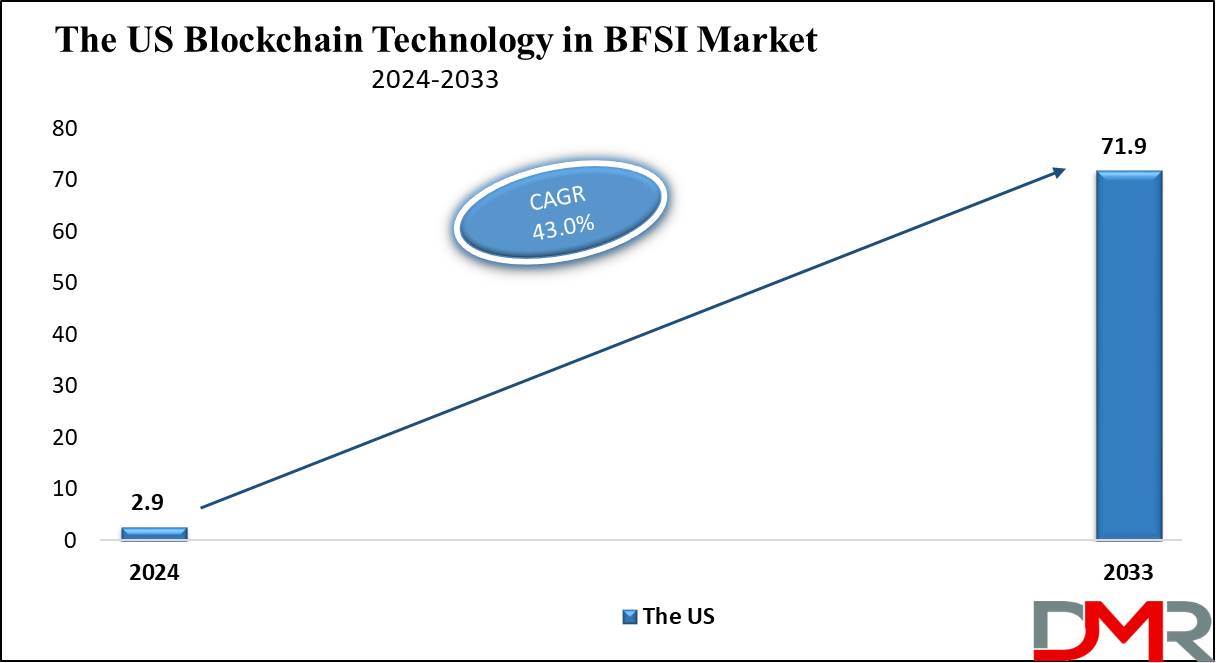

The US Blockchain Technology in BFSI Market

The US Blockchain Technology in BFSI Market is

expected to reach USD 2.9 billion in 2024 at a

CAGR of 43.0% over the forecast period of 2024 to 2033.

The US BFSI market offers major growth opportunities for blockchain technology through better and advanced digital identity management, enhancing the efficiency & security of identity verification processes. In addition, the potential for asset tokenization allows for greater liquidity and accessibility of many assets. The ongoing digital transformation & higher demand for transparent, secure financial transactions further drive the adoption & innovation of blockchain solutions in this sector.

Moreover, in the US, the BFSI market's adoption of blockchain technology is driven by the demand for secure, effective transaction platforms, reducing fraud, & regulatory changes favoring digital ledger technologies. However, regulatory uncertainty & the challenge of integrating blockchain with existing legacy systems create significant restraints, developing hesitation among financial institutions and requiring substantial resources for implementation.

Key Takeaways

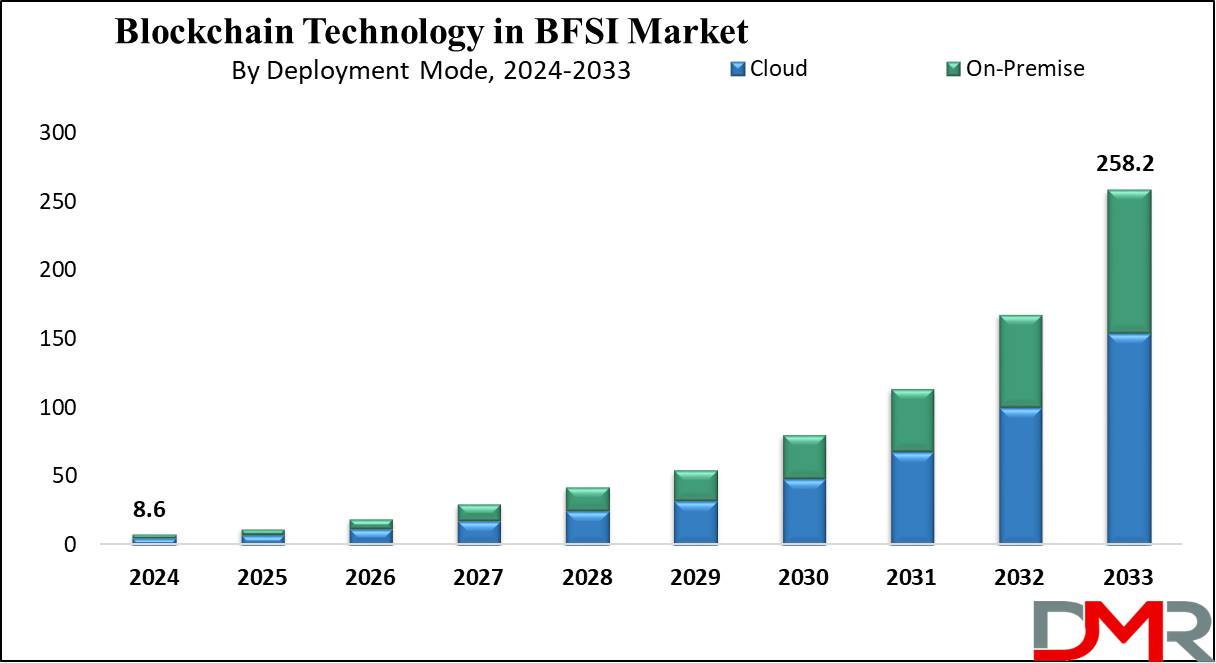

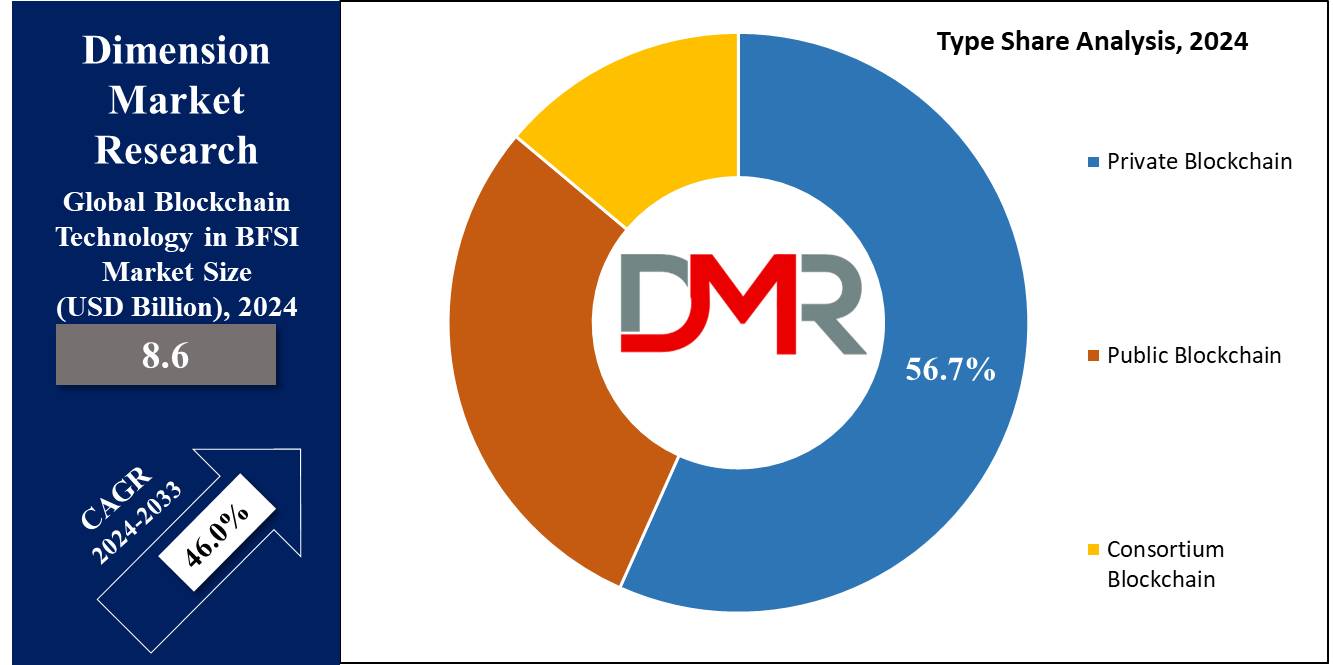

- Market Growth: Blockchain Technology in BFSI Market size is expected to grow by 246.1 billion, at a CAGR of 46.0% during the forecasted period of 2025 to 2033.

- By Type: The private blockchain segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Deployment Mode: The cloud segment is expected to lead the Blockchain Technology in BFSI Market in 2024.

- By End User: The Banking Sector is expected to get the largest revenue share in 2024 in the Blockchain Technology in BFSI market.

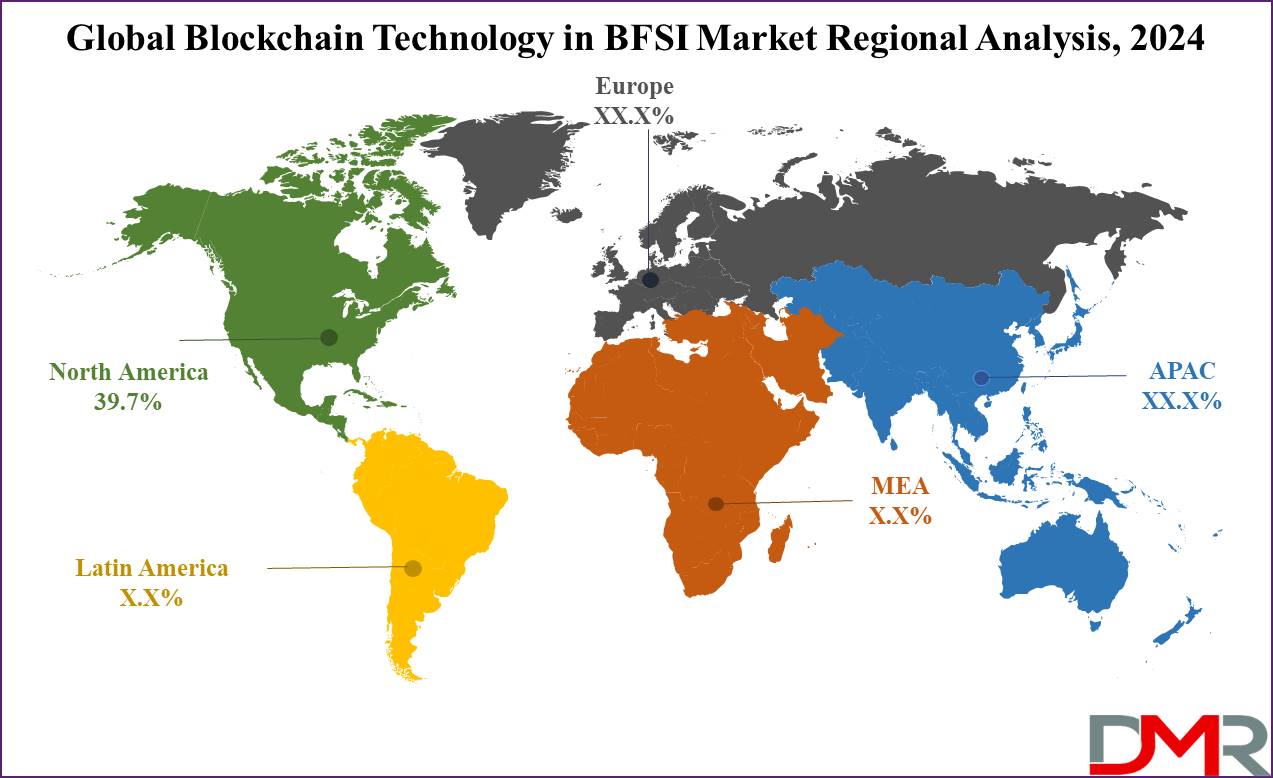

- Regional Insight: North America is expected to hold a 39.7% share of revenue in the Global Blockchain Technology in BFSI Market in 2024.

- Use Cases: Some of the use cases of Blockchain Technology in BFSI include fraud reduction, smart contracts, and more.

Use Cases

- Cross-Border Payments: Blockchain can majorly reduce the cost & time of cross-border transactions by removing intermediaries and providing a secure, transparent ledger for all parties involved.

- Fraud Reduction: The immutable nature of blockchain ensures that once a transaction is recorded, it cannot be altered or deleted, thus minimizing the chances of fraud & improving security in financial transactions.

- Smart Contracts: These self-executing contracts with the terms directly written into code can automate & streamline various processes like loan agreements, insurance claims, and trade settlements, highly efficient and reduces the need for manual intervention.

- Customer KYC/AML: Blockchain can streamline the Know Your Customer (KYC) and Anti-Money Laundering (AML) processes by providing a secure, decentralized database for identity verification, reducing duplication of efforts, and enhancing compliance.

Market Dynamic

Driving Factors

Operational EfficiencyBlockchain's ability to automate processes, minimize intermediaries, and provide live transaction processing creates significant cost savings and better operational efficiency for financial institutions.

Enhanced Security and TransparencyThe decentralized and immutable nature of blockchain improves the

security and transparency of transactions, building trust among users and regulators, and supporting greater adoption of blockchain-based solutions in BFSI.

Restraints

Regulatory UncertaintyThe lack of clear & consistent regulatory frameworks across different jurisdictions creates uncertainty, making financial institutions hesitant to completely adopt blockchain technology.

Scalability and Integration Challenges

Current blockchain networks often face scalability issues, like slower transaction processing times and higher costs as the network grows. In addition, integrating blockchain with existing legacy systems can be complex and resource-intensive.

Opportunities

Digital Identity Management

Blockchain can provide secure, decentralized digital identity solutions, enhancing the efficiency & security of identity verification processes for banking and financial services.

Asset Tokenization

Blockchain allows the tokenization of many assets, including real estate, stocks, and bonds, making them more liquid, accessible, and easier to trade, thereby expanding investment opportunities and improving market efficiency.

Trends

Central Bank Digital Currencies (CBDCs)

Many central banks are exploring or piloting their digital currencies using blockchain technology to improve the efficiency of payment systems, reduce costs, and increase financial inclusion.

Decentralized Finance (DeFi)

The rise of DeFi platforms, which use blockchain to provide financial services like lending, borrowing, and trading without traditional intermediaries, is gaining traction and challenging traditional financial models.

Research Scope and Analysis

By Type

The Private Blockchain segment will dominate the BFSI blockchain technology market in 2024, due to its better security and privacy features, important for financial institutions handling sensitive data & requiring strict access control. Private blockchains process transactions through a limited number of participants, reducing risks from unknown entities that could compromise data integrity.

Further, the BFSI sector prefers private blockchains for their scalability and efficiency. Unlike public blockchains, private blockchains can handle a higher volume of transactions quickly, important for financial operations requiring immediate processing times. Their regulatory compliance & audibility align well with BFSI’s strict regulations, and their ability to provide customized solutions customized to institutional needs further improves their appeal.

Financial institutions use private blockchains to enhance payment systems and secure insurance data transmission, driving higher growth. As blockchain technology evolves, the scalability, privacy, and regulatory compliance of private blockchains will constantly drive their adoption and market leadership.

By Deployment Mode

The Cloud segment is expected to dominate the blockchain technology market in the BFSI sector in 2024, capturing the majority share. The broad adoption of cloud-based blockchain solutions is due to their affordable and scalability. Cloud platforms allow financial institutions to implement blockchain technology without major upfront infrastructure investments, appealing particularly to small & medium-sized enterprises with limited IT resources. The cloud segment's leadership is further strengthened by its flexibility & ease of integration.

Further, financial institutions prefer cloud-based solutions because they integrate smoothly with existing financial applications and systems, which allows banks, insurance companies, and other financial services providers to innovate & adapt quickly to changing market conditions without the limitations of on-premise systems. In addition, cloud deployment provides better disaster recovery and data redundancy, important for maintaining the integrity & availability of financial data.

Efficient data management & recovery during system failures or security breaches ensure continuous operation & build consumer trust. As blockchain technology includes, the cloud segment is expected to maintain its lead, driven by current innovations and its strategic advantages in the BFSI sector.

By Application

The smart contracts segment is expected to hold the biggest share of the blockchain market in 2024, highlighting its vital role in automating & simplifying complex contractual processes. Smart contracts, which are self-executing with the terms embedded in code, provide higher potential in the BFSI sector. It can automate routine & complex tasks, minimize the requirement for intermediaries, & ensure compliance and transparency, which is mainly beneficial in areas like loan processing, insurance claims management & regulatory compliance. The accuracy, efficiency, & affordability of smart contracts drive their adoption, making 30 them a critical application in the financial services blockchain landscape.

Further, the digital currency segment, though smaller than smart contracts, is also vital in the market, as it involves using blockchain to create & manage digital currencies, like cryptocurrencies like Bitcoin & central bank digital currencies (CBDCs). Digital currencies on the blockchain provide benefits like better security, lower transaction costs, & quick settlement times. In addition, blockchain's application in record-keeping is crucial for the BFSI sector. It provides an immutable, secure, and transparent way to maintain records, crucial for financial institutions handling large amounts of sensitive data. Blockchain improves data integrity, decreases fraud risk, and simplifies compliance and auditing, from maintaining customer records to tracking transactions and managing cross-border payments.

By End User

In terms of end users, the Blockchain technology in the BFSI market includes banking, insurance, & non-banking financial companies (NBFCs), with the banking sector expected to account for the largest market share in 2024. Banks are highly adopting blockchain to improve various operations, like compliance management, transaction processing, fraud prevention, & customer identity verification.

The technology's secure, transparent, & effective transactional processes are highly appealing in banking, where trust & security are essential. Additionally, blockchain's potential to minimize operational costs & streamline processes is a major factor driving its adoption. As the financial sector undergoes digital transformation, blockchain's role in banking is expected to grow, embracing new applications & innovations.

Further, insurance, though smaller than banking, is also seeing significant growth due to blockchain's ability to address key industry challenges. Blockchain can make better claims processing, fraud detection, & risk management in insurance. By providing a transparent and immutable record-keeping system, blockchain helps insurers less fraud, automate claims processing with smart contracts, & improve operational efficiency. Also, NBFCs are exploring blockchain to enhance their services. Blockchain technology can improve loan processing, and customer verification, & streamline payments and settlements for NBFCs. The decentralized nature of blockchain provides more efficient and secure transactions, benefiting NBFCs significantly.

The Blockchain Technology in BFSI Market Report is segmented on the basis of the following

By Type

- Public Blockchain

- Private Blockchain

- Consortium Blockchain

By Deployment Mode

By Application

- Smart Contracts

- Security

- Digital Currency

- Trade Finance

- Record Keeping

- GRC Management

- Identity Management & Fraud Detection

By End User

- Banks

- Insurance

- Non-banking Financial Companies (NBFC)

Regional Analysis

North America is expected to dominate blockchain technology in the BFSI market in 2024 with a

share of 39.7%, mainly due to the region's hi-tech technological infrastructure, rapid adoption of blockchain technologies, and the presence of major financial and technological players. The US & Canada are leading in this space, with many initiatives and investments focused on exploring & integrating blockchain in many financial services, as the region's market growth is driven by a combination of technological developments, supportive regulatory frameworks, and a strong aim to innovation in financial services. The higher acceptance of blockchain solutions in banking, insurance, and other financial services in North America shows constant growth for this market segment.

Further, the Asia Pacific region is also rapidly emerging as a major market, driven by the faster digitalization of financial services & supportive government policies, mainly in countries like Japan, China, South Korea, & Singapore. The region's rising fintech sector, along with a large & technologically savvy consumer base, provides a fertile ground for blockchain adoption. Efforts towards improving financial inclusion, enhancing payment infrastructures, & increasing investments in blockchain technology are further driving the market characterized by a strong look on innovation, regulatory compliance, and security.

The European Union's proactive approach to regulating & supporting blockchain technology, along with the presence of various fintech startups and traditional financial institutions keen on blockchain adoption, contributes to the region's market growth. Countries like the UK, Germany, France, and Switzerland are notable contributors, with their efforts centered on using blockchain for more secure, transparent, and efficient financial services.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the blockchain technology market in the BFSI sector is marked by strong innovation & rapid adoption. Financial institutions are mostly collaborating with tech startups & investing in in-house blockchain development to improve their service offerings. The market is highly dynamic, with constant advancements in security, scalability, and regulatory compliance. Companies are aiming to create customized blockchain solutions to address specific financial needs, like fraud prevention, transaction transparency, and operational efficiency, which is driving the evolution and growth of blockchain applications within the BFSI industry.

Some of the prominent players in the Global Blockchain Technology in BFSI Market are

- IBM

- Accenture

- Microsoft

- SAP

- Oracle

- Amazon Web Services

- JP Morgan Chase

- Auxesis Group

- Bitfury Group

- AlphaPoint

- Other Key Players

Recent Developments

- In June 2024, Metallicus, the core developer of Metal Blockchain announced OneAZ Credit Union's enrollment in its Banking Innovation Program, which signifies OneAZ Credit Union's proactive approach to inspecting blockchain technology's potential & harnessing Metallicus' expertise to reduce its technological prowess.

- In February 2024, The Reserve Bank of India (RBI) unveiled a detailed framework for a ‘regulatory sandbox’ that will provide a safe & protected environment for innovative fintech startups to test their product hypothesis before taking it to the market.

- In December 2023, The Indian government announced that the Indian Banks' Digital Infrastructure Corporation (IBDIC) is currently considering implementing block letters of credit (LC) issuance to provide a framework for digital exploration, delivery, and implementation. Solutions for the Indian Financial Services Sector is currently working to adopt the implementation of Domestic Letter of Credit (LC) issuance on blockchain as one of its use cases. It is a group of 18 banks including leading public and private sector banks in India.

- In September 2023, Citi introduced Citi Token Services, which will tokenize clients’ deposits so they can be sent anywhere in the world instantly. With the new service, “if it’s … 5:00 p.m. in the U.S. and 5:00 a.m. in Singapore, but one need to get money there, one can send that immediately, within seconds.

- In June 2023, JPMorgan announced that it will test the use of blockchain technology for the provision of dollar-based settlement services for Indian financial institutions. Dollar payments in India are usually made via the Swift messaging system through Nostro accounts held at US-based banks. However, these payments can only be processed during US office hours & are unavailable over the weekend.

- In April 2023, SEB and Crédit Agricole CIB together launched so|bond, a “sustainable and open” platform for digital bonds built on blockchain technology. Through the platform, issuers in capital markets will be able to issue digital bonds onto a blockchain network, focusing on enhancing efficiency and allowing real-time data synchronization across participants.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 8.6 Bn |

| Forecast Value (2033) |

USD 258.2 Bn |

| CAGR (2024-2033) |

46.0% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 2.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Public Blockchain, Private Blockchain, and Consortium Blockchain), By Deployment Mode (Cloud and On-Premise), By Application (Smart Contracts, Security, Digital Currency, Trade Finance, Record Keeping, GRC Management, Identity Management & Fraud Detection), By End User (Banks, Insurance, and Non-banking Financial Companies (NBFC)) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

IBM, Accenture, Microsoft, SAP, Oracle, Amazon Web Services, JP Morgan Chase, Auxesis Group, Bitfury Group, AlphaPoint, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |